BTC/USD monthly chart - the bottom is in!?BTC/USD looks to be potentially exiting the bear market. X marks the spot. This move could still take several weeks to months. Keep in mind that any monthly close outside of the range would be very bearish.

Blue triangle indicates the current range.

Green box is buy.

Red box is sell.

Blue line indicates major resistance.

This is a log chart.

Entry

LTCs retracement before another move upLTC had a well respected resistance at 45 EUR, and it managed to brake above it!

Right now I have outlined a channel (Light blue trend lines) in which LTC is moving in for the past 44 days.

Right now LTC has made a Double Top pattern. That could lead LTC to retrace back to the support at 45 EUR.

I am looking forward for an Entry at the 45 EUR zone ( Green circle ) . Just need a comfirmation for the Entry.

ECA Entry pointsNYSE:ECA

Retracement lines indicating what area's will be a good buy point. Most likely around 50%

Could be 33% if it consolidates there for awhile.

Wouldn't recommend buying at 66%.

Sell safely at $7.00.

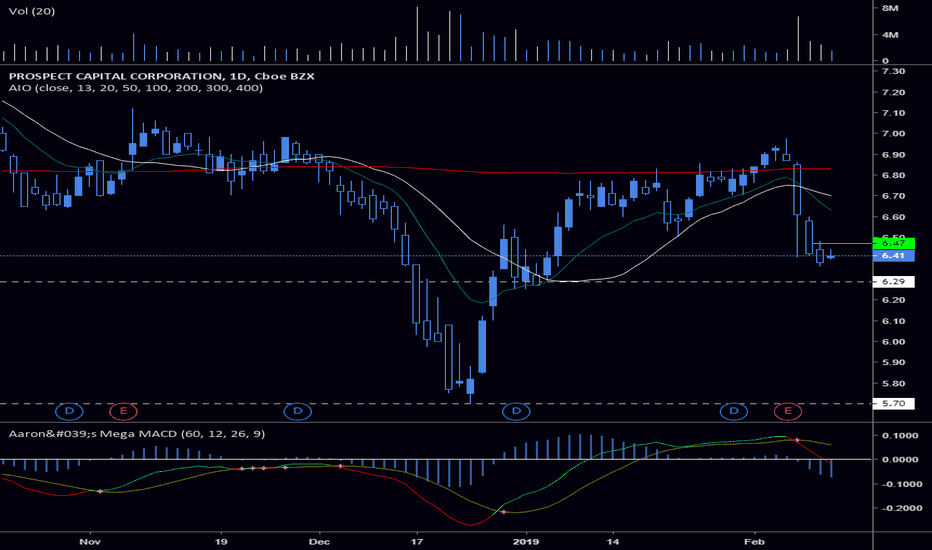

$PSEC long term dividend. This is one of my dividend holdings that I picked up on Friday (1,000 shares). It pays an 11% annual dividend, but also enjoys movements of quick bearish drops and equally quick recoveries.

Full details of this play at https://wingtrades.com!

My entry of 1,000 shares was at $6.47 on Friday, February 8, 2019.

ETC BTC XBT Long Entry Setup at .001 - .0011 ETCXBTKnowing BTC is finishing its move into the final leg E-wave of its bear flag continuation pattern, when BTC moves down to its previous yearly low around 3250ish/ ETC will also move to its yearly low- however will be in a great position to make a major move upwards.

Entry Long Limit order at these positions: .001/.00105/ .0011

SL: none/ only commit 5-20% to these positions/ If the price continues to drops then apply higher leverage and at to position up to .00089.

T1: .0014

T2: .0015

Tilray nearing full retracement - daily MACD - CCI watch Tilray is currently $71.74/share and falling in this weeks sell off and good chance to drop near full retracement to $65-66 range. Great time to buy half and have standing order 8% below this for full retracement, or just wait.

$65.50 target with MACD cross-over on 12/26 and CCI about to cross positive.

BTC/USD - Bearish Divergence and OversoldBTC has seen a 12.5% move down over the last 4 days ranging from $4000, to $3600. RSI entered oversold region on the 9th of Jan and a small bear flag looks to be forming on the 4hour.

I expect we'll seen another leg down to new yearly lows around $2800 over the coming weeks, I will be staggering my long entries within the green boxes. If we see momentum switch bullish again I will be looking to enter into a short term long around $3920 and will most likely hedge with a TRX short. Clear rounding and staggered bullish divergence on the chart could align nicely with lack of oversold momentum which could propel price levels higher over the coming days if $3500 region fails to break to the downside.

BTC Entry Completely nailed the short these past few days. You can look back at previous posts or on my twitter to see the short calls with stop loss and targets. Today I think we bounce and run into resistance somewhere in or around my gray box. Closes below there are bad and have me thinking short with a final target of blue box. S curve shows how I think PA will play out. I may look to scale in on a short depending on what price is telling me. I really like a long from blue box for a solid bounce. Still think we see new lows this year.

BTC Long Idea (With Stop Loss and Take Profit LevelsAll the extension and retracments of the elliott waves are based on fib numbers and patterns.

As ususal the chart speaks for itself as long as you know how to read sub waves and understand elliott waves and patterns.

This will likely play out if we do not go below the stop loss, but the time frame will likely take longer, I just shortened it so it could fit on the screen.

This is not finacial advise.

Long BTC (Good RR)We have completed the ABC for the first sub wave of btc , if you were waiting for a good entry point for a btc long now is a great time.

If we retrace more than 100% than exit your long (Stop Loss 3500) and then if you are long a good target would be at the 1.618 range (Target 5,000) over a longer time frame this should hit in about 2 weeks.

Happy holidays

Tron – Panic?Hello everyone,

trx has pushed through 0.021! But has directly lost confidence…

Don’t panic, because there are two scenarios that are most likely now:

Down to complete wave 2 (green line) at around 0.015 – chance 60%

Down to complete wave 4 (dark green in square brackets) – chance 20% (please keep in mind, that if 0.017 will fall, this scenario is invalidated!)

Other possibilities:

Down to around 0.012 to complete wave 2 there – chance 10%

UNDER 0.011 trx is going to hell! – chance 10%

Please leave a comment or a message, if you have any questions!

Take care

tgo

Ripple – 0.36=up / 0.27=downHello everyone,

In my last analysis I wrote: “Please keep in mind, that xrp could easily fall down to 0.04, if we will not fight the actual level down strongly!” The level which I am speaking of is 0.36/0.37. xrp failed there, so we have to keep in mind two scenarios:

Scenario 1 – blue lines, chance 70%

xrp is building a 1-2 setup. Now on its way down to complete wave 2 (dark green in square brackets) in between my green trading box. Ideally at 0.32/0.30. If so, we have very good chances to finally break through 0.36/0.37!

Scenario 2 – red line, chance 30%

xrp fails completely at 0.27. If so, we have to face courses around maybe even 0.04!

Please leave a comment or a message, if you have any questions!

Take care

tgo

Bitcoin – Turning point!?Hello everyone,

now it’s a perfect point to turn the direction up! But, as I wrote in my last analysis: “we are not safe until breaking through the blue line ($6.242), so be careful! There’s a possibility left that btc is building only a wave 4 up to complete the correction pattern at $1.800 or deeper at $800. But I think it’s more likey that btc has built the bottom already!

Merry Christmas!

Please leave a comment or a message, if you have any questions!

Take care

tgo

Ethereum – Turning point reached?Hello everyone,

as planned, ETH has turned its direction exactly at the predicted point ($83). So let’s start the party! WAIT! Be careful, because the minimal requirement to declare the low at $83 is a stable uptrend through the first important level: $188! Please keep that in mind, when trading ETH now!

If ETH goes up, we will see courses around $800!

Merry Christmas!

If you have any questions or other ideas, please contact me.

Take care,

tgo

Tron – This is it!?Hello everyone,

in my last analysis I wrote, that the minimal requirement for a low in this market is pushing through 0.021! This is absolutely right, so please keep that in mind, when trading trx now.

But I think it’s very likely that we will see an uptrend now!

Merry Christmas!

Please leave a comment or a message, if you have any questions!

Take care

tgo

Ripple – 0.36/0.37 again!Hello everyone,

xrp seems to love this level mostly, so if xrp will finally hunt it down, we have a very good chance for an uptrend to new highs.

Please keep in mind, that xrp could easily fall down to 0.04, if we will not fight the actual level down strongly!

Merry Christmas!

Please leave a comment or a message, if you have any questions!

Take care

tgo