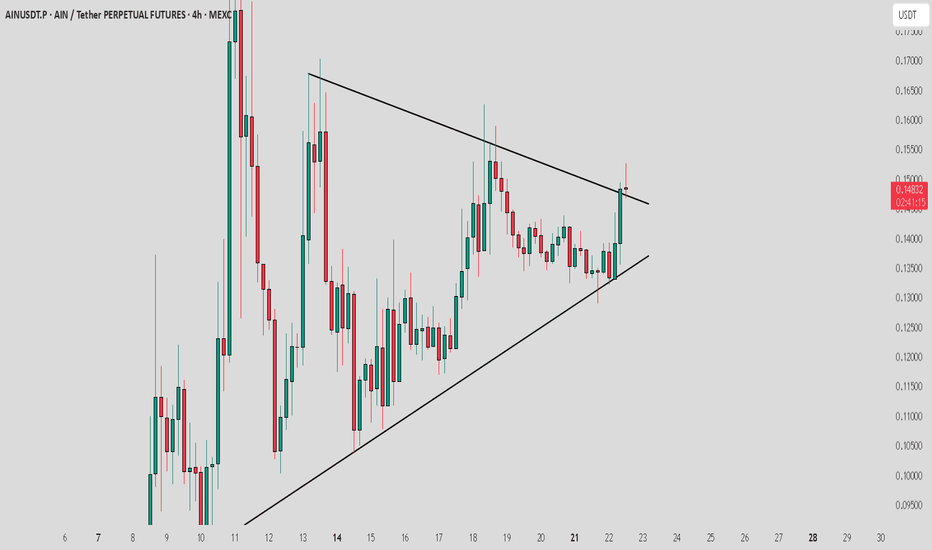

AIN / USDT retesting Trendline..Should enter now ? details belowAIN/USDT broke out from trendline resistance and is now retesting the breakout zone. For a safer entry, wait for a clear bullish candle on the 1H timeframe with strong volume. Without confirmation, there's a high chance the retest could fail.

Pro Tips:

– Always wait for confirmation before entering on retests

– Use tight stop-loss below the breakout zone

– Avoid chasing entries if volume is weak

Entrysetup

$1,000+ Profit on NQ with this one tradeGive this post a like and if we get it to 100 likes I will post on my YT the entry to this trade as well as an explanation as to why I entered here.

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

PLR (Path of Least Resistance) Strategy Explanation - $SHOPHi guys this is a follow up to a post I have just published about my trading idea on shorting NYSE:SHOP ,

It really doesn't matter if you want to short the market or long the market as it works either way, but for the sake of the example I'll take a 6 months period from the Shopify chart following earnings to better explain you my strategy...

This right here is the NYSE:SHOP chart from approx. Jan/2024 to end of Aug/2024,

2 Earnings have been announced, both having great positive surprises, but regardless of the positive surprise (typically bullish indicator), the stock fell of 45%+.

Let's add the earnings dates to the chart so that you can better visualize them:

What you care about in this image is the earnings dates lined out, as you can see the surprise was positive yet both fell more than 10% in just a day, that I will take as the upcoming trend for at least the time being, till the next earning is announced (so, if for example the 13/Feb earning ended up being bearish, my overview on the market till at least the next earning on 8/May, will be bearish, so all of the trades I will take will be shorts).

Now I will line out the trend and the BoSs (breaks of structure) just to better visualize the trend:

As you can see the Earning date candles signed the beginning of a down trend twice, pre-announced by the Earning candle itself.

The entry strategy is now simple, the idea behind it is to "follow the path of least resistance".. by that I mean that, if your bias is bullish, who enter on candles that are of the opposite direction to the one you are heading to? - Sure you might say that it is to get better entries as ofc, on a short bias, higher sale points = better profits, but the goal here is not maximizing profits, but raising the odds exponentially so that you can take surer trades.

I've tested this strategy from Feb/2021 and so far the win rate is 95.6% (123 out of 136 trades profited .

The way the entries are spread is this:

Basically every time a bearish candle - that closes lower than the previous bearish candle did - is created, a short position of 1% of total equity is generated.

The period begins from the beginning of the current earnings season, and closes the day before the next earnings season as it works within a 3 months frame.

Each entry HAS to be the lowest bearish candle of the period, example:

Only these candles marked in blue count as entries for short positions as their close is lower of more than 0.5% than the previous one,

The pink ones are higher than the lowest up to that point, so they do not count as entries as they are technically part of a pullback that is moving in the opposite direction where you are heading.

So, going back to the entries, we enter on the close of the lowest bearish candle close up to that point.

For safety, we trail the stop loss to the previous high, this is where well defined trend lines come handy:

The thick black line is the trend line, and as new lows are broken, I mark those as BoS (break of structure) and until a new one is created, the SL will go to the previous high, and so it goes.

(viceversa for buys).

We then proceed to target the FVGs left behind by previous quarters:

As you can see there are massive gaps in the chart that we will target and identify as FVGs (Fair Value Gaps) and set the TP at the close (lowest point) of the fair value gap.

Now comes in your exit strategy...

There really are 3 ways that you can tackle this:

1- You set up TP to the lowest FVG of the series (if there are multiple like in this case)

2- You set up TP to the first FVG still open during the quarter following the Earnings Period

3- You tackle both TPs and take each FVG as a partial close to the position (example: if there are 2 FVGs you take out 50% of the position on the first and 50% on the last).

But what to do if your positions didn't reach TP (FVG close) before the next Earning or there is no FVG to begin with???

- In the case the TP you have marked out at the close of the FVG didn't reach, you'll proceed to close the position 1 day before the next Earnings is coming, unless your conviction that the FVG will fill in is so high, then you can let those run at your own risk:

- In the case in which a FVG is not present then you'll target the previous High (in case of a buy) or Low (in case of a sell) as your TP, utilize the previous low (in case of buy) or previous high (in case of sell) as SL and just let it run:

as you can see the 4 trades were all profitable, made little money but sure money in just 15 days

Unless I forget anything, this right here, is my strategy.

Simple, straight forward, high success rate and doesn't leave anything up to the case.

If you have any questions PLEASE leave a comment below and I'll do my best to reply in time ;)

Fantom (FTM): Bullish Setup with Strong Support Levels!Looking at Fantom on the daily timeframe, we see a promising setup following the completion of Waves 3 and 4. Wave 4 ended around $0.567, and since then, we have observed a consistent formation of higher lows. This pattern suggests a continuation of the upward trend.

The recent rise has left behind a breakout gap. Our plan is to see this gap touched or closed, and subsequently, we aim to use the underlying demand zone for Dollar-Cost Averaging (DCA) if further pullbacks occur. Within this area, we have two significant supports: the Point of Control (POC) and the High-Volume Node Edge. These levels should provide enough support to prevent the price from falling below this range.

Our target is set at a minimum of $1.22, though it could go higher, considering this is likely Wave 5. This target aligns with the expected continuation of the bullish trend as indicated by the Elliott Wave theory.

It is relatively easy to see that there are many liquidation levels above the current price for FTM. Significant liquidations have already been taken out, particularly just shortly after the ETF approval when many overleveraged positions were liquidated. Currently, there aren't many liquidation levels below the current price.

Therefore, we believe this might be a good time to dip again to clear out any remaining liquidation levels. After that, we expect to absorb the remaining short positions and push upwards. There is significant room to move higher, reaching our first target and potentially taking out more liquidations along the way.

Focusing on Fantom (FTM) on the quarterly VWAP chart, the 2024 Q1 VWAP has acted as a significant resistance level, respected four times. This consistent resistance often becomes a powerful support once broken, marking the start of a bullish phase. We anticipate the 2024 Q1 VWAP will transition from resistance to support, signaling strength and potential upward momentum. Additionally, the 2024 Q2 VWAP is providing strong support, reinforcing our bullish outlook and underpinning the price action.

With the combined support from the 2024 Q2 VWAP and the potential flip of the 2024 Q1 VWAP, Fantom is poised to gain momentum. We expect this to drive the price upward, leading to a retest of the 2024 Q1 VWAP soon. In summary, the interaction between these VWAP levels is pivotal. The 2024 Q1 VWAP is likely to become new support, bolstered by the 2024 Q2 VWAP. This setup suggests Fantom could move higher in the near future, retesting and possibly surpassing previous resistance levels.

We also need to consider the monthly VWAP chart for Fantom (FTM). Resistance was encountered between $0.915 and $0.925, defined by the Previous Monthly VAH and the March VWAP.

Currently, the May VWAP is holding, along with the Previous Monthly VWAP. However, we might fall below this level, where the Previous Monthly VAHL and May VAL should provide support. This alignment offers solid support and aligns with market structure and Elliott Wave principles.

Maintaining these levels is crucial for sustaining the bullish outlook and allowing the market to stabilize before moving higher. Holding the May VWAP and the Previous Monthly VWAP shows Fantom's resilience, potentially facilitating upward movement. If a dip occurs, support at the Previous Monthly VAL and May VAL should stabilize the price and provide a foundation for the next bullish phase.

Bitcoin Analysis #1: Simple Plan & Strategy During the Bull RunWe can clearly observe that we are once again in an uptrend, which is certainly encouraging news. This resurgence makes a break below the current low of November 2022 at 15k seem unlikely.

Thus, we find ourselves in a new bullish cycle, with a potential target of at least 100k. Personally, I believe that aiming for 150k to 250k in this cycle is quite plausible. This signifies numerous new opportunities in the realm of Bitcoin and cryptocurrency.

Many altcoins are currently trading at lower levels, presenting a favorable opportunity to invest in the cryptocurrency market.

Although, it's important to adhere to rule number one: avoid succumbing to hype and exercise patience . It's crucial to wait for an opportune entry point, ideally during a dip with a confirmed reversal pattern, or a breakout from a trading pattern within a favorable price zone. This is the essence of prudent trading.

However, reaching the 100k mark won't occur immediately, especially without a significant pullback. Presently, it's ill-advised to enter the market, as mentioned earlier. In both investing and trading, patience is key, and it's better to miss out on an opportunity than to enter into a risky one . For me, now is the time to secure profits and reassess the market for a better entry point. The zone between 59k to 82k presents an opportune window to take profits, particularly if there are signs of a reversal pattern or divergence. Alternatively, one can progressively secure profits within this range and wait for a re-entry opportunity between 40k to 23k. Subsequently, it's prudent to await entry confirmation, such as a reversal divergence or another preferred indicator. Alternatively, one can gradually enter the market with buy limits at various levels between 40k to 23k.

Regarding shorting, it's advisable to wait for a break above the previous all-time high. An entry for a short position can be planned between 70k to 82k, contingent upon identifying a suitable trading pattern. Profit-taking can occur at 50k, with the majority or all of the profits being realized at 40k. While it may be tempting to hold onto positions for potentially higher gains, it's essential to prioritize safety . At least 50% of profits should be secured at 50k and 40k levels.

For me, a break below 18k confirmed with a weekly close below signals a significant shift. However, this doesn't necessarily imply selling Bitcoin outright. Instead, it suggests that new all-time highs may not be imminent , and we could potentially be entering a new downtrend. Nevertheless, Bitcoin remains a stable asset, providing the option to either hold or await a pullback to exit positions. This exemplifies the approach of smart trading.

I'm back on TradingView, and I appreciate your support by liking my post. With your encouragement , I'll continue to provide more frequent updates on major trading pairs , perhaps even on a weekly or monthly basis. This post was crafted diligently by myself, taking over an hour to compose. I only utilize tools for text correction, not for generating content. Therefore, if you'd like to see more updates, please follow me. Thank you sincerely for your support.

AJG: Entry, Volume, Target, StopEntry: with price above 219.23

Volume: with volume greater than 955k

Target: 243.31 area (this is an area, no guarantee it reaches this price, but you should be selling on the way up)

Stop: Depending on your risk tolerance; Based on an entry of 219.24, 207.22 gets you 2/1 Reward to Risk Ratio.

This LONG swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not take this trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.

BRK.B Entry, Volume, Target, StopEntry: with price above 364.63

Volume: with volume greater than 5.4M

Target: 382.41 area (this is an area, no guarantee it reaches this price, but you should be selling on the way up)

Stop: Depending on your risk tolerance; Based on an entry of 364.64, 355.75 gets you 2/1 Reward to Risk Ratio.

This LONG swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not take this trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.

Dollar/Yen Early 15minute Entry from a Daily setupI decided to go as low as the 5minute timeframe for an entry into this Bullish Pair. As I noticed price respecting structure creating higher highs and higher lows on the 1hour, 30min and the 15 minute time frame, I felt very confident going Long upon a retest of any support along with a reversal candlestick. After a 30 min higher high and a retest on the buy side of a strong correction trendline, I decided to go Bullish immediately. This entry is very tight considering the fact that this is a DAILY setup. My target projection is -27%. @ 138.700 of a Daily 78.6 retracement. My stop loss is beneath the prior 1H low as I notice price respecting structure @ 134.357. Risk to reward was excellent at 13.7

BTCUSDT local workAfter consolidation, we got a deviation at the upper border of range. There is a huge amount of liquidity at the lower boundary, which should be removed.

You can look to enter a position after a confirmation or the start of a downward OF on the MTF. Targets are indicated with red levels.

Open your positions after conformation of LTF (5m or 1m TF)

Sell Entry example - Supply and DemandHere is a sell entry example i have put together to show you what i look for in the market when looking for a continuation entry

After an impulsive move in either direction we would expect to see a correction, then another impulsive move. The initial impulse move shows us that a lot of volume has entered the market and for this example that the sellers are in control. When this happens we want to capitalise on the next move down and the best way to do this is to be patient and wait on a correction forming so we can get a good high probability entry.

This can be applied to all time frames as well as buy or sell

Emini S&P 500 (ESH2022) *Entry*Lows Were Swept from the previous *Prediction* Analysis and as I anticipated. There was a swing high that was formed at around 9:00 am LA Time which got broken causing an ICT Market shift Model where I took an Entry at the lowest Fair Value Gap and Stop loss Just below the candle. I will be Targeting the Redlivered Rebalance and will keep you updated...

I will be following These Rules.

Trading Rules for ESH2022:

Take 50% partials at 1R

Move SL to Entry at 1.5R

At 1-3 RR Close 90%

Let Rest run to TP or Break even

Gold 4-Hour Channel Breakout Hits TargetOur 4-Hour channel Breakout from a few days ago has reached its target.

The target was the bottom of the beginning of the channel.

However, we had no retrace to the neck zone, so we had no entry.

I am a breakout and retrace trader, and if I see no retrace to the point of interest, I will not take a position.

My thoughts on Gold now is that if support does hold around the 1782 mark, we should begin ranging in short to mid-term between support and 1810.

Let’s watch and see what it does. I will be watching as always, and should a setup present itself; I will be posting it. Happy Monday!

SLV - Safe to re-enter the fraySLV weekly chart showing a prominent double bottom with the Sept low and Dec retest holding nicely. With the long term trend line lending support, it appears safe to renter the slippery silver paper waters once again.

SLV will likely try to play catch-up to COPX (also shown) which has gained +20% since Dec 20th. I doubt SLV will post those high % gains but a 10% pop seems highly doable by months end or early Feb.

Weekly RSI and Stoch are trending upwards with plenty room to run from here. In the shorter time frames (4 hour chart - not shown) the RSI and Stoch appear over-bought on SLV and with 4 up days in row including a gap up today - will look for an entry price on a modest pull back/gap fill into Friday of this week.

Max pain sitting at $21 this Friday

maximum-pain.com

Not financial advice.

CANADIAN DOLLAR STRONGER ON OIL Here I see a nice technical look entry if engage RR could be 5:1 !

CADJPY Broke the downtrend of various days we could see December 9th high’s or do a new ATH for the end of the year.

Canadian dollar is doing great on this pandemic since dollar is guided by Oil and gold.

The best play here would be to buy it against the Yen since it’s been weak sessions after session against the USD.

HNT 55% SWING TRADEBullish falling wedge formation on HNT, Stoch RSI oversold with BTC pair bouncing from support.

Entry: Around bottom of wedge

Target: $59.27 (ATH) - $61.83 (2.618 fib extension level)

SL: Under previous wick (~$35.56)

*Aiming for 55% swing trade with 7.5% risk

Happy trading! :)

TIE on the ASX is set to run higherTIE looks good on the weekly charts as buyers soak up the minor pullback above the EMAs. Expecting to see the pullback hold as a higher low and drag in more buyers in coming sessions. Watch the video for a more detailed breakdown of the price action.

Remember to take a look at www.tradethestructure.com

Are we seeing a major top in Crypto or just another Dip to Buy?!Major Cryptos were under pressure in the US session as prices fell across the board. Many are extended and will need to flush buyers out to reset if there is going to be another leg higher. I take a look at majors like BTC, ETH, XRP, EOS, BNB, ADA and LTC.

Enjoy the Video and check out Trade The Structure profile and website.