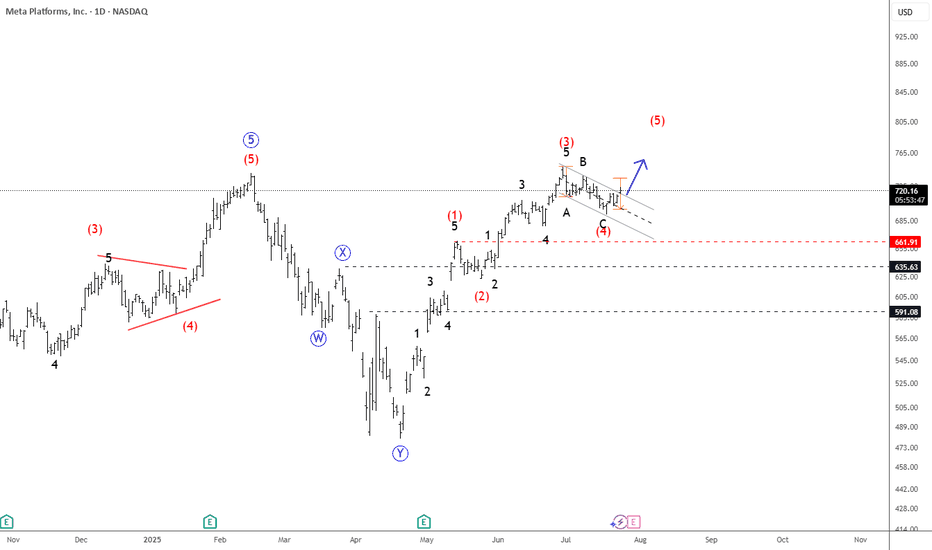

META Slows Down For A Correction Within UptrendMeta has seen a strong recovery recently, but barely retested February highs around 740, from where we can see some nice pullback, but it appears corrective, since it’s unfolding in three waves, and forming a potential bull flag — likely wave 4. A breakout above the downward channel on a daily close could signal the start of wave 5 and a push to new highs.

However, keep a close eye on the 666.1; a break below this level would invalidate the bullish view and suggest a deeper consolidation phase may follow.

Highlights:

Direction: Up (pending breakout)

Structure: Wave 4 bull flag; wave 5 possible soon

Support: 680 / 690

Equity

BAJAJFINSV BUY PROJECTION Bajajfinsv - Buy View

Trade Setup :

Monthly - Strong Support and FIB 0.786

Weekly - Symmetric Triangle Breakout

Day - Higher High Formed (Uptrend)

Entry - Aggressive Trader(Entry Now)

Conservative Trader - 1588 Rs

Target 1 - 1925 Rs

Target 2 - 1971 Rs

Stoploss - 1514 Rs

Expected Return - 20 %

OIL INDIA BUY VIEW OIL INDIA - BUY PROJECTION

Trade Setup :

Fundamental Analysis

Stock PE - 9.22

Industry PE - 20.7

Low Debt

Promoter Holding - 53 %

DII Holdings - 17 %

Regularly Paid Dividend - 2 %

Strong Fundamental - Stock Possible to Doubled - (Current - 474 ) (Target - 948 )

for Long term 5 years Holding ..

Technical Analysis

Monthly - Strong Support & Fib 50 %

Day - Wait For Candle Close in Black Line

Entry - 507 Rs

Target - 740 Rs

Stoploss - 408 Rs

Happy trading .. Thank You ...

SWING IDEA - NEULAND LABNeuland Lab , a niche API manufacturer with strong export presence and leadership in complex molecules, is offering a technically strong swing trade opportunity from key support levels.

Reasons are listed below :

11,500 zone acting as a crucial support area

Formation of a hammer candle on the weekly timeframe, signaling potential reversal

Reversing from the 0.618 Fibonacci retracement zone – the golden pocket

Taking support at the 50-week EMA , holding long-term trend structure

Target - 14900 // 17600

Stoploss - weekly close below 10215

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

Dow Jones Potential DownsidesHey Traders, in the coming week we are monitoring US30 for a selling opportunity around 44,270 zone, US30 is trading in an uptrend and currently seems to be attempting to break it down, if we get dips below the trend we will be looking for a potential retrace towards further downsides.

Trade safe, Joe.

Dow Jones Potential DownsidesHey Traders, in today's trading session we are monitoring US30 for a selling opportunity around 44,450 zone. Dow Jones is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 44,450 support and resistance area.

Trade safe, Joe.

Dow Jones Potential UpsidesHey Traders, in tomorrow's trading session we are monitoring US30 for a buying opportunity around 44,400 zone, Dow Jones is trading in an uptrend and currently is in a correction phase in which it is approaching the trend 44,400 support and resistance area.

Trade safe, Joe.

SWING IDEA - AKZO NOBEL INDIA Akzo Nobel India , a subsidiary of the global paints and coatings giant AkzoNobel N.V., is a leading player in India’s decorative and industrial paints market. Known for its premium brand Dulux , the company has strong brand recall, a wide distribution network, and consistent profitability.A strong brand, steady margins, and a bullish chart make this a candidate to watch for a short- to medium-term swing trade.

Reasons are listed below :

Bullish engulfing candle spotted on the weekly timeframe, signaling a potential trend reversal.

Accompanied by the highest-ever volume spike, adding strong conviction to the move.

Price is bouncing off the golden Fibonacci support (0.618), a classic retracement zone where strong reversals often occur.

The level of 3100 acted as a solid support.

The stock is trading above its 50 & 200 EMA on the weekly chart — a sign of long-term strength.

Target - 3812 // 4520

Stoploss - weekly close below 3000

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

S&P 500 Outlook. Best Quarter Since 2023… But What Next?The S&P 500 just logged its best quarterly performance since Q4 2023 , surging on optimism around global trade negotiations and growing expectations that the Fed may begin cutting rates as early as September. US futures are green this morning, thanks to developments like Canada backing off digital taxes, ongoing dialogues with China ahead of the July 9 deadline, and risk-on sentiment is pushing yields and the dollar lower.

But as traders, we need to ask:

Are we witnessing a genuine economic inflection point? Or is this just a liquidity-driven rally that’s pricing in a best-case scenario?

Technical View

Support Zone: 6,150 was just broken through. And 6000, the round number level, coinciding with the 20-day EMA and previous swing level.

Resistance Levels: 6,235 is the next critical ceiling, a clean breakout could see price reach the extension level of 6,415.

Momentum Indicators: RSI remains elevated and is creeping toward the overbought. While momentum is strong, watch out for the possible development of a divergence.

Possible Scenarios

The 'Soft Landing’ Is Now the Base Case

Markets are trading as if the Fed has successfully engineered a soft landing. But that’s now fully priced in, and historically, the most dangerous trades are the ones everyone agrees on. If trade talks stall, inflation re-accelerates, or earnings disappoint, the reversal could be brutal and fast.

Risk-on Sentiment Without Volume Is a Yellow Flag

Despite the price strength, volume has been tapering off. The S&P’s recent leg up occurred on lighter-than-average participation, suggesting institutions may be watching, not chasing. That’s often the case in low-volatility summers, but it also implies that any negative catalyst could cause outsized downside moves.

Macro-Fundamentals May Not Justify Valuation Expansion

Yes, inflation is slowing, and the Fed might cut. But if they do, it’s likely because growth is weakening, not because the economy is roaring. So the very condition that triggers rate cuts could also cap earnings growth!

Projection

Bullish Scenario: A confirmed breakout above 6,280 could carry us toward 6,400–6,500 by mid-Q3, especially if the trade deals progress, July inflation comes in soft, and the Fed signals accommodation.

Bearish Risk: If price fails to hold above 6,120, especially if trade optimism fades, or inflation growth spikes or Fed rhetoric shifts hawkish again, this could then open a quick pullback toward 6,000 or lower, which also aligns with the 50-day SMA.

Key Events to Watch

July 9 Trade Talks Deadline: Any sign of stalling could bring volatility back fast.

June CPI Print (July 10): Crucial for confirming the Fed's next move.

Earnings Season Kickoff (mid-July): Tech-heavy expectations may not be easy to beat after such a strong run.

Conclusion

A record-setting quarter is impressive but not necessarily predictive. This quarter’s rally has been built more on relief and expectations than hard data. When expectations (not earnings) are doing the heavy lifting, any misstep from central banks or geopolitics could unravel gains rapidly.

A rate cut might be delayed, or inflation re-accelerates, or trade talks stall; any of these could leave equities hanging. Remember: the higher the climb without real earnings growth, the harder the fall when sentiment shifts. It's not just about the chart. It is about the narrative behind the price.

What’s your bias for Q3?

Are you buying this breakout or fading the optimism? Drop your thoughts below.

$DXY Repeating 2016 Post-Election I have highlighted the 2016 to 2020 Presidential Elections time period and then pasted that timeframe onto the 2024 election and found that the pattern is going along very similarly to Trump 1.0.

If we assume that the future unfolds the same as last time, which is low probability, of course, then the future will unfold as shown in the yellow bars going into the future, as shown.

Initially in 2016 post election there was a 7% rally in the U.S. Dollar Index and then a 15% retreat for the following year. So far in 2025 we have seen the same rally and a similar decline, but only faster this time.

It would appear as thought the bulk majority of the declines in the TVC:DXY are over at this time with perhaps 4% further downside over the balance of the year.

The Dollar Index has been useful for predicting changes in the earnings estimates for the S&P500 in the USA due to the high percentage of earnings coming back to the US for quarterly reporting. I have posted a few charts in the past which have been helpful at determining the risk in the stock market.

The behavior of the global central banks has certainly had its impact on monetary aggregates and inflation. The policy response since the Covid Pandemic has been for maximum liquidity and maximum Government spending to keep the global economy afloat. The post-Covid response is now coming to a head along with new policy directives to cut wasteful Government spending and to reduce inflation (caused the Gov't spending).

Global investors have flocked to the US for access to high technology stocks and have driven up the value of US assets to extreme levels compared to other markets. This adjustment phase where investors remove money from overvalued, or highly valued, US assets back to other markets has created a wave of selling in the US Dollar and US listed equities.

What does the future hold? We never know but we sure can learn from what happened in the past by looking at charts just like this one to see what may happen. Looks like a bounce in the TVC:DXY from here, followed by a new low and then a rebound into the next few years.

All the best,

Tim

April 22, 2025 1:16PM EST TVC:DXY 98.78 last

NASDAQ Breakout and Potential RetraceHey Traders, in tomorrow's trading session we are monitoring NAS100 for a selling opportunity around 21,700 zone, NASDAQ was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 21,700 support and resistance zone.

Trade safe, Joe.

S&P500 is Nearing an Important Support of 5,960!!!Hey Traders, in today's trading session we are monitoring US500 for a buying opportunity around 5,960 zone, US500 is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 5,960 support and resistance area.

Trade safe, Joe.

S&P 500 Index (SPX) Weekly TF – 2025

Chart Context:

Tools Used: 3 Fibonacci Tools:

1. One **Fibonacci retracement** (from ATH to bottom)

2. Two **Trend-Based Fibonacci Extensions**

* Key Levels and Zones:

* **Support Zone** (Fib Confluence): \~4,820–5,100

* **Support Area (shallow pullback)**: \~5,500–5,600

* **Resistance & TP Zones:**

* TP1: **6,450** (Fib confluence & -61.8%)

* TP2: **6,840** (-27%)

* TP3: **7,450–7,760** (Major Confluence)

Technical Observations:

* SPX is approaching a **critical resistance** near previous ATH (\~6,128) with projected upward trajectory.

* The **green dashed path** suggests a rally continuation from current \~6,000 levels to TP1 (\~6,450), TP2 (\~6,840), and eventually TP3 (\~7,450–7,760), IF no major macro shock hits.

* The **purple dotted path** suggests a potential retracement first to \~5,600 (shallow correction) or deeper into \~5,120 or even 4,820 zone before continuing the bullish rally.

* The major support zone around **4,820–5,120** includes key Fib retracement levels (38.2% and 61.8%) from both extensions and historical breakout levels.

Fundamental Context:

* US economy shows **resilience** amid soft-landing narrative, though inflation remains sticky.

* The **Federal Reserve** is expected to cut rates in **Q3–Q4 2025**, boosting equity valuations.

* Liquidity expansion and dovish outlook support risk assets, including **equities and crypto**.

* However, **AI-driven tech rally** may be overstretched; a correction could follow earnings disappointments or macro surprises (e.g., jobs or CPI shocks).

Narrative Bias & Scenarios:

**Scenario 1 – Correction Before Rally (Purple Path)**

* If SPX faces macro pushback (e.g., high CPI, hawkish Fed), expect retracement to:

* 5,600 = Fib -23.6% zone

* 5,120–4,820 = Major Fib Confluence Zone

* These would act as **accumulation zones**, setting up next leg up toward TP1 and beyond.

* **Effect on Gold**: May rise temporarily due to risk-off move.

* **Effect on Crypto**: Could stall or correct, especially altcoins.

**Scenario 2 – Straight Rally (Green Path)**

* If Fed confirms cuts and macro remains soft:

* SPX breaks ATH (\~6,128)

* Hits TP1 (\~6,450), TP2 (\~6,840)

* Eventually reaches confluence at **TP3 (7,450–7,760)**

* **Effect on Gold**: May struggle; investor preference for equities.

* **Effect on Crypto**: Strong risk-on appetite, altseason continuation.

Indicators Used:

* 3 Fibonacci levels (retracement + 2 extensions)

* Trendlines (macro and local)

* Confluence mapping

Philosophical/Narrative Layer:

This phase of the market resembles a test of collective confidence. Equity markets nearing ATHs while monetary easing begins reflect a fragile optimism. The Fibonacci levels act as narrative checkpoints — psychological as much as mathematical. Will we rally on faith or fall for rebalancing?

Bias & Strategy Implication:

Bias: Bullish with caution

* Strategy:

* Await **confirmation breakout >6,128** for fresh long entries

* Accumulate on dips in the **5,100–5,500** zone if correction unfolds

* Use **TP1, TP2, TP3** as staged exits

Related Reference Charts:

* BTC.D Analysis – Bearish Bias:

* TOTAL:Bullish Bias

*TOTAL3 – Bullish Bias:

* US10Y Yield – Falling Bias Impact:https://www.tradingview.com/chart/US10Y/45w6qkWl-US10Y-10-Year-Treasury-Yield-Weekly-TF-2025/

OptionsMastery: Looking for a breakout on HOOD!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

OptionsMastery: Break and Retest on GE.🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

OptionsMastery: 2 types of traders scenarios! 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Break and retest of ATH's?OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Tariffs, and Tumult: Wall Street Waits on Super WednesdayHello everyone, it’s April 30, 2025. The TVC:DJI just closed its sixth consecutive green session, with markets clinging to hope as rumors swirl of a first tariff deal—possibly with India—though nothing is confirmed. That tiny breadcrumb of optimism was enough to boost sentiment late in yesterday’s session, even if volatility is dipping below 25% and investor enthusiasm seems to be fading in lockstep.

U.S. macro data continues to paint a picture of “not great, but not terrible.” Consumer confidence and job openings (JOLTS) came in below expectations but not disastrously so, prompting markets to collectively shrug and declare everything “less worse than feared.” It’s a strategy now: ignore bad data as long as it isn’t apocalyptic.

As earnings roll in, companies are split between those who pretend the tariff storm is “manageable” (hello, NASDAQ:COKE ) and those flying blind through economic fog ( NYSE:UPS , Snap, and Super Micro—who might be losing a major client named Nvidia). The overall takeaway? Visibility is garbage, and most companies are bracing rather than building.

All eyes are now on today’s so-called Super Wednesday, packed with economic data (U.S. GDP, PCE, ADP jobs, Chicago PMI) and mega-earnings from NASDAQ:MSFT and NASDAQ:META . But as usual, expectations may outpace reality. Markets often dream of clarity and wake up to more noise.

Meanwhile, China flashed its first big red light: a manufacturing PMI of 49, signaling contraction—the lowest in two years. No shock, considering their ongoing trade war with the U.S., which seems to be giving the global economy the flu.

On the political front, Trump celebrated his 100 days in office with a campaign-style detour to Detroit, throwing shade at Fed Chair Jerome Powell while declaring the economy in perfect health (despite the worst market performance since Nixon’s early days). He promised tax cuts, again, while doubling down on trade threats. Powell, of course, is just trying to survive the week.

Oil briefly dipped under $60 as markets considered the broader implications of economic warfare, gold sits at $3,311, and Bitcoin hovers around $95,000—looking resilient despite the madness.

As for corporate earnings, Starbucks missed on sales due to weak U.S. demand, Pfizer beat on EPS but saw revenue fall, and Visa continues to rake in profits as Americans keep spending like inflation isn’t real. Novartis crushed it but got no love from the market because apparently, +22% net income just isn’t sexy enough.

In short: chaos remains king. Markets seem oddly calm on the surface, but under the hood, it’s still all about tariffs, Trump tweets, and the fantasy that maybe—just maybe—some clarity will come today. Don’t hold your breath.

Enjoy the ride, and see you tomorrow for more market mayhem.

KFin Technologies LtdCompany Snapshot:

Sector: Financial Services (Mutual Fund Services, RTA)

Market Cap: ₹21,000 Cr

Current Price: ₹1,239.20

Debt-to-Equity: 0.06 (very low)

ROE: 39% | ROCE: 49%

Financial Highlights:

Revenue Growth (3Y CAGR): ~22%

Profit Growth (3Y CAGR): ~32%

EBITDA Margin: ~48%

P/E Ratio: ~35x (TTM)

Industry Avg P/E: ~30-32x

Recent Price Action:

Stock broke out sharply in April 2025.

Support: ₹1,180 | Resistance: ₹1,300

RSI near 70 (mildly overbought, but momentum strong).

Key Strengths:

Dominant RTA player with 70%+ MF asset share.

Consistent cash flows and expanding international footprint.

High operating leverage driving margin expansion.

Key Risks:

Regulatory changes (SEBI reforms) could pressure fees.

High client concentration risk with top AMCs.

Valuation & Recommendation:

DCF Estimated Fair Value: ₹1,280–₹1,350

Recommendation: BUY on Dips / Accumulate

12-month Target Price: ₹1,320

Investment Horizon: 1–2 years

📈 Verdict: Strong business fundamentals, steady growth, and low debt make KFin Technologies attractive for long-term investors. Minor corrections can offer better entry points.

For Education Purposes only