08/1/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: +440

Sleep: 6 hours

Overall health: Good

VX Algo System Signals from (9:30am to 2pm)

— 9:30 AM Market Structure flipped bearish on VX Algo X3!

— 10:12 AM VXAlgo ES X1 Buy signal

— 10:20 AM VXAlgo NQ X1 Buy Signal

—12:30 PM Market Structure flipped bullish on VX Algo X3!

— 1:00 PM Market Structure flipped bearish on VX Algo X3!

— 1:50 PM VXAlgo ES X1 Buy signal,

— 3:00 PM Market Structure flipped bullish on VX Algo X3!**

What’s are some news or takeaway from today? and What major news or event impacted the market today?

Market range expanded a lot today, we dropped over 100 points today and sometimes i forget to adjust my bracket orders to go for 10 -15 points take profits when the volatility is so high. But overall, it was a good day, I knew to be patient as market was wild and sometimes you want to just snipe a few trades and call it a day before you get caught on the wrong side.

The great thing about big moves is that it will eventually hit a major level and it will react really well, you just have to wait for it.

a great question is will the market recover? Or is going back down to April prices?

News

*STOCKS TUMBLE TO END THE WEEK, VIX SPIKES AS SOFT JOBS DATA STOKE ECONOMIC JITTERS

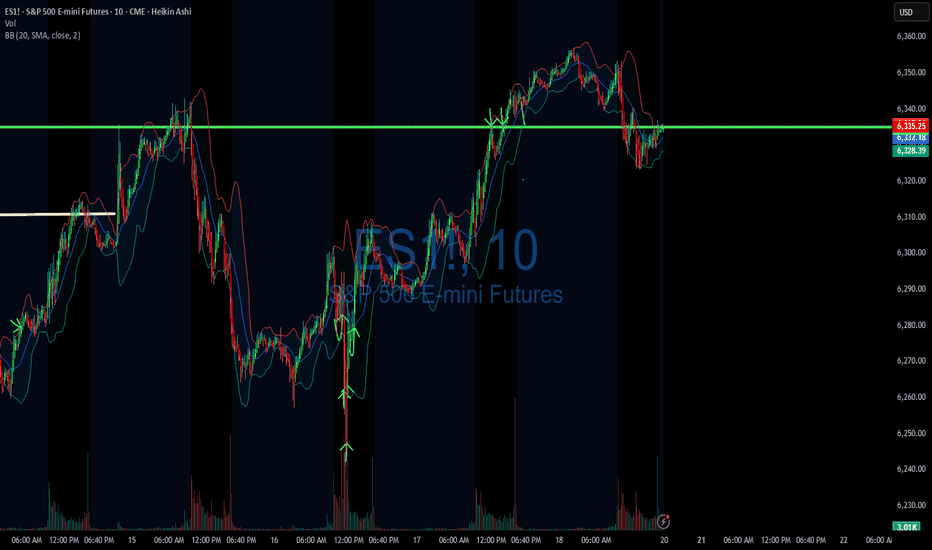

What are the critical support levels to watch?

--> Above 6330= Bullish, Under 6310= Bearish

Es_f

DIYWallSt Trade Journal: $531 Profit & Navigating Volatile Morn**07/21/25 Trade Journal, and ES_F Stock Market analysis **

EOD accountability report: +531.25

Sleep: 6 hours

Overall health: worked on the newsletter last night and didn't get much sleep.

** VX Algo System Signals from (9:30am to 2pm) **

— 9:30 AM VXAlgo NQ X3 Buy

— 9:42 AM Market Structure flipped bullish on VX Algo X3!

— 10:40 AM VXAlgo ES X1 Sell Signal

— 12:42 PM VXAlgo ES X1 Buy signal

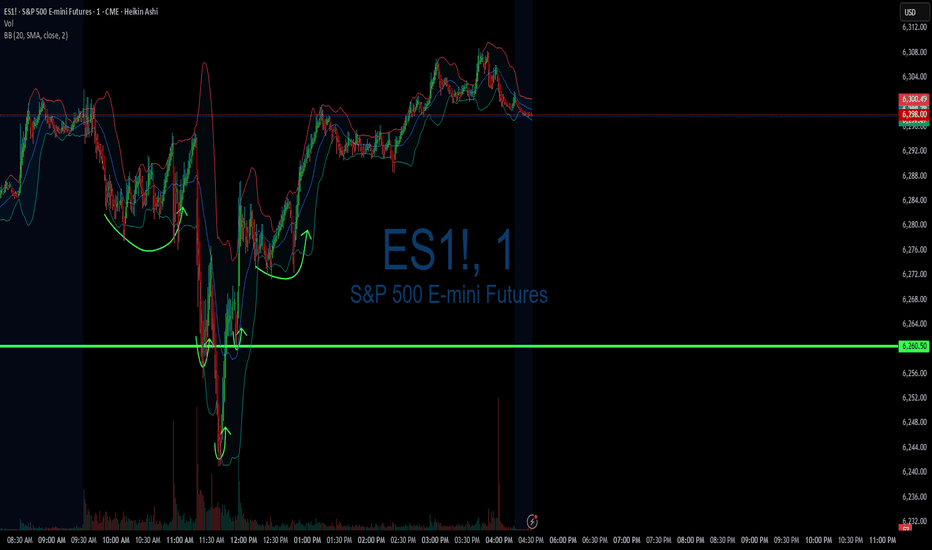

**What’s are some news or takeaway from today? and What major news or event impacted the market today? **

market moved very well this morning after bullish market structure signal, but because it was so violent, it was hard to hold that position for long.

throughout the rest of the day, it moved extremely slow and eventually formed a double top and came all the way down to market opening price lol.

**News**

*FED CHAIR POWELL HIT WITH CRIMINAL REFERRAL BY HOUSE GOP TRUMP ALLY - FOXNEWS

**What are the critical support levels to watch?**

--> Above 6339= Bullish, Under 6320= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

DIYWallSt Trade Journal:$238 Lessons From Monthly Expiration07/18/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +238.75

Sleep: 5. hours

Overall health: Was working late last night and didn't get much sleep.

VX Algo System Signals from (9:30am to 2pm)

— 8:30 AM Market Structure flipped bullish on VX Algo X3!

— 10:30 AM Market Structure flipped bearish on VX Algo X3!

— 11:10 AM VXAlgo ES X1 Buy signal (didn't work that well)

— 12:10 PM VXAlgo NQ X1DD Sell Signal

— 12:19 PM Market Structure flipped bullish on VX Algo X3!

What’s are some news or takeaway from today? and What major news or event impacted the market today?

Today was monthly expiration for options and we got a lot of X7 Sell signals but structure was bullish so I tried to take a long at MOB and got burned. Flipped bearish and started shorting the rest of the day and ended up making money back.

News

*US STOCKS MOVE LOWER AFTER REPORT SAYS TRUMP PUSHES FOR 15-20% MINIMUM TARIFF ON ALL EU GOODS

What are the critical support levels to watch?

--> Above 6335= Bullish, Under 6315= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

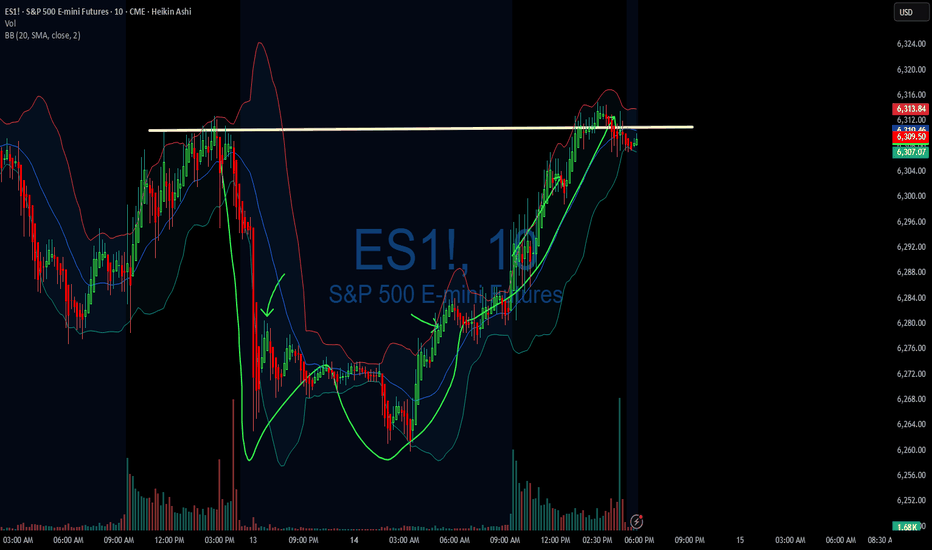

DIYWallSt Trade Journal: How I Navigated Powell Firing Rumors & 07/16/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +428.75

Sleep: 7 hours

Overall health: Good

VX Algo System Signals from (9:30am to 2pm)

— 4:17 AM Market Structure flipped bullish

— 9:50 AM Market Structure flipped bearish

— 12:00 PM VXAlgo NQ X3 Buy Signal

— 1:02 PMMarket Structure flipped bullish

What’s are some news or takeaway from today? and What major news or event impacted the market today?

Today was a crazy trading day with a bunch of wild moves because Trump said they were going to fire Powell and then cancelled the threat.

Overall health and sleep have been good this week and our trading balance is reflecting that.

News

— 10:30 AM *SCOTT BESSENT: “FORMAL PROCESS” TO REPLACE FED CHAIR POWELL UNDERWAY

— 12:11 PM

*TRUMP ASKED IF HE WILL FIRE POWELL: NOT PLANNING ON DOING ANYTHING

What are the critical support levels to watch?

--> Above 6290= Bullish, Under 6280= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

DIYWallSt Trade Journal: Perfect Morning Signals & Rate Cut bets07/15/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +404.50

Sleep: 7 hours

Overall health: Good

VX Algo System Signals from (9:30am to 2pm)

— 8:41 AM Market Structure flipped bullish on VX Algo X3!

— 9:33 AM VXAlgo ES X1 Sell Signal (triple sell)

— 9:40 AM Market Structure flipped bearish on VX Algo X3!

— 1:20 PM VXAlgo ES X1 Buy signal (triple buy)

What’s are some news or takeaway from today? and What major news or event impacted the market today?

We got great signals at the start of the day and that really helped with today's trading. I had some meetings today and stufff to take care of so i decided to lock out the funded account around noon and called a day.

News

— 9:54 AM

*TRADERS STICK TO BETS ON SEPTEMBER FED RATE CUT AFTER INFLATION REPORT

What are the critical support levels to watch?

--> Above 6295= Bullish, Under 6285= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

DIYWallSt Trade Journal:The Importance of Your First Trade **07/14/25 Trade Journal, and ES_F Stock Market analysis **

EOD accountability report: +158.75

Sleep: 7 hours

Overall health: Good

** VX Algo System Signals from (9:30am to 2pm) **

— 8:00 AM Market Structure flipped bullish on VX Algo X3!

— 10:30 AM VXAlgo NQ X1DD Buy Signal

— 11:50 AM VXAlgo ES X1 Sell Signal

— 1:00 PM VXAlgo NQ X1DD Buy Signal

**What’s are some news or takeaway from today? and What major news or event impacted the market today? **

I need to really be careful with my first trade and making sure it is a high probability trade, otherwise a bad early start is likely to ruin my whole day.

News

— 1:42 PM *TRUMP TO UNVEIL $70 BILLION IN AI AND ENERGY INVESTMENTS

— 4:08 PM *S&P 500 ENDS HIGHER AS STOCKS RISE AFTER TRUMP SAYS OPEN TO DEALS ON TARIFFS

**What are the critical support levels to watch?**

--> Above 6295= Bullish, Under 6285= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

DIYWallSt Trade Journal: Missed Entry & Climbing Back From Loss **07/11/25 Trade Journal, and ES_F Stock Market analysis **

EOD accountability report: -46.25

Sleep: 5 hours

Overall health: Good

** VX Algo System Signals from (9:30am to 2pm) 3/3 success**

— 9:41 AM Market Structure flipped bearish on VX Algo X3!

— 10:15 AM VXAlgo ES X7 Buy signal,

— 10:23 AM Structure flipped bullish

— 11:30 AM VXAlgo ES X3DD Sell Signal

**What’s are some news or takeaway from today? and What major news or event impacted the market today? **

I was a little busy this morning and missed the chance to short the market at MOB with Bearish market structure at 9:30, so I had to wait for the next chance but when i shorted the MOB on the move up, the X7 buy signal came out and pushed market structure bullish.

Ultimately If i had a better entry on my short, I would have been okay, but since i shorted early, i got stopped at at 6306 and it ended up dropping right after that. So the day actually started pretty bad and i was -300 from there and was just trying to climb back and forth the next few hours.

News

*LATEST TARIFF THREATS COULD DELAY RATE CUTS, CHICAGO FED’S GOOLSBEE SAYS - WSJ

**What are the critical support levels to watch?**

--> Above 6290= Bullish, Under 6280= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

DIYWallSt Trade Journal: Starting Down $400 & Patience Pays Off 07/09/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: -271

Sleep: 4.5 hours

Overall health: Good

VX Algo System Signals from (9:30am to 2pm) 4/4 success

10:00 AM VXAlgo ES X1 Sell Signal

10:36 AM VXAlgo ES X3 Sell Signal

11:00 AM Market Structure flipped bearish on VX Algo X3!

1:33 PM Market Structure flipped bullish on VX Algo X3!

What’s are some news or takeaway from today? and What major news or event impacted the market today?

I took some short positions overnight and got caught in the big push up this morning and started the day with -400, I was very tempted to go big and tried to trade it back but decided it was better off just to wait for a better day to recover the account instead.

Consider yesterday was a big manipulation day and today was another one but squeezing to the upside for a rug pull downwards.

News

*(US) FOMC JUN MINUTES: COUPLE OF PARTICIPANTS NOTED THEY WOULD BE OPEN TO CONSIDERING A RATE CUT AS SOON AS THE JULY MEETING IF DATA EVOLVE AS THEY EXPECTED (Bowman and Waller have said as much since the FOMC meeting)

What are the critical support levels to watch?

--> Above 6290= Bullish, Under 6280= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

07/08/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: +220

Sleep: 7 hours

Overall health: Good

VX Algo System Signals from (9:30am to 2pm) 4/4 success

— 9:30 AM Market Structure flipped bullish on VX Algo X3! :check:

— 10:30 AM VXAlgo NQ X1 Buy Signal :check:

— 12:24 PM Market Structure flipped bullish on VX Algo X3! :check:

— 1:30 PM Market Structure flipped bearish on VX Algo X3! :check:

What’s are some news or takeaway from today? and What major news or event impacted the market today?

After taking losses, I usually set a lock out on my account after $200 profit to build back small wins and confidence. so luckily I was locked out pretty early today and avoided most of the market whipsaw. But on days like these, if you don't walk away after you make money, you could eventually get triggered and tilted by the whipsaw. a lot of orb traders probably died today.

News

*HOWARD LUTNICK ON TARIFFS: EXPECT ANOTHER 15-20 LETTERS TO GO OUT OVER THE NEXT 2 DAYS- CNB

*Trump announces 50% tariff on copper imports, threatens 200% tariff on pharmaceuticals and maybe chips

What are the critical support levels to watch?

--> Above 6280= Bullish, Under 6260= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

DIYWallSt Trade Journal: Why Price Action Beats News **07/02/25 Trade Journal, and ES_F Stock Market analysis **

EOD accountability report: +763

Sleep: 4.5 hours

Overall health: sleep deprived

** VX Algo System Signals from (9:30am to 2pm) 4/4 success**

— 9:57 AM Market Structure flipped bullish on VX Algo X3! :check:

— 10:30 AM Market Structure flipped bullish on VX Algo X3! :check:

— 11:10 AM VXAlgo ES X1 Sell Signal :x:

**What’s are some news or takeaway from today? and What major news or event impacted the market today? **

You can't trade on news, the only thing that matters in day trading is price action.

Bad news can still make the market go up.

News

The U.S. economy lost 33,000 jobs in June, as per ADP, badly missing forecasts for a gain of 99,000.

MICROSOFT TO LAY OFF AS MANY AS 9,000 EMPLOYEES

Tesla’s NASDAQ:TSLA Q2 deliveries miss consensus expectations

**What are the critical support levels to watch?**

--> Above 6250= Bullish, Under 6240= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

DIYWallSt Trade Journal: Why Traders Are Rotating from Nasdaq to**07/01/25 Trade Journal, and ES_F Stock Market analysis **

EOD accountability report: +1160

Sleep: 5 hours

Overall health: Need to catch up on sleep again

** VX Algo System Signals from (9:30am to 2pm) 4/4 success**

9:39 AM Market Structure flipped bullish on VX Algo X3! :check:

11:00 AM Market Structure flipped bearish on VX Algo X3 :check:

11:24 AM VXAlgo ES X1 Buy signal :check:

12:00 PM Market Structure flipped bullish on VX Algo X3! :check:

**What’s are some news or takeaway from today? and What major news or event impacted the market today? **

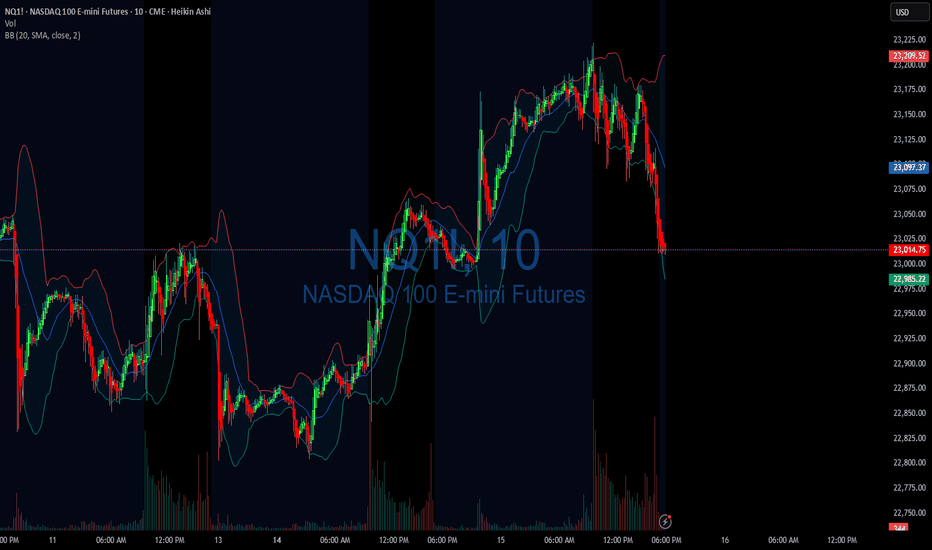

RTY and YM leading the way today

NQ lagging

Why is this?

The answer is, Simple Supply and Demand theory.

Money has to come from somewhere.

If Money is going to YM and RTY,

Money has to leave from NQ or ES or both.

There is not an infinite amount of money, So if one index is outperforming like crazy over the other. It must be draining from it

Why would it drain from NQ? Easy

Because NQ and ES already hit ATH,

YM and RTY has not hit ATH yet.

So people are selling NQ and buying YM because it is on Discount

News

N/A

**What are the critical support levels to watch?**

--> Above 6235= Bullish, Under 6210= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

06/30/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +212

Sleep: 7 hours

Overall health: Good, caught up on workout and sleep over the weekend.

** VX Algo System Signals from (9:30am to 2pm) 2/4 success**

— 12:20 PM VXAlgo NQ X1 Sell Signal :x:

— 12:30 PM Market Structure flipped bullish on VX Algo X3!:check:

— 1:55 PM VXAlgo NQ X1 Buy Signal :x:

— 2:00 PM Market Structure flipped bearish on VX Algo X3! :check:

**What’s are some news or takeaway from today?

and What major news or event impacted the market today?

**

The X1 Signals today has been happening after market structure signals and usally that means MM is going to change the direction to the opposite way to scam us. Based on that, I decided to lock out my account after making $200 today so i don't get caught in the scam.

News

EU TO ACCEPT TRUMP’S UNIVERSAL TARIFF BUT SEEKS KEY EXEMPTIONS — 2:07 PM

What are the critical support levels to watch?

--> Above 6240= Bullish, Under 6210= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

06/27/25 Trade Journal, and ES_F Stock Market analysis 06/27/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +915

Sleep: 6 hours

Overall health: edgy from sleep

** VX Algo System Signals from (9:30am to 2pm) 3/4 success**

9:37 AM VXAlgo ES X1 Buy signal :check:

9:55 AM Market Structure flipped bullish on VX Algo X3! :check:

10:31 AM VXAlgo ES X1 Sell Signal (double sell) iffy

1:43 PM Market Structure flipped bearish on VX Algo X3! :check:

**What’s are some news or takeaway from today?

and What major news or event impacted the market today?

**

Early on in the market, I noticed that there was heavy manipulate by the MM with violent buy and sell. This somewhat warns that today's market could be tough to trade and you have to be very patient.

News

PRES TRUMP: ENDING ALL TRADE TALKS WITH CANADA; WILL TELL CANADA ITS TARIFF LEVEL IN COMING DAYS - around 1 :40pm est

What are the critical support levels to watch?

--> Above 6200= Bullish, Under 6185= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

06/26/25 Trade Journal, and ES_F Stock Market analysis 06/26/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +731.25

Sleep: 5 hours

Overall health: meh

** VX Algo System Signals from (9:30am to 2pm) 3/3 success**

— 9:38 AM Market Structure flipped bullish on VX Algo X3

— 10:30 AM Market Structure flipped bullish on VX Algo X3!

— 11:27 AM VXAlgo ES X1 Sell Signal

What’s are some news or takeaway from today?

and What major news or event impacted the market today?

today was another interesting day, i am noticing that when market structure changes 2x in the same direction, it is usally pretty effective and scammy at the same time

News

*NVIDIA NASDAQ:NVDA SHARES HIT A NEW HIGH TO RECLAIM WORLD'S LARGEST STOCK TITLE - market is being carried by the momentum of mag 7

What are the critical support levels to watch?

--> Above 6175 = Bullish, Under 6155= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

SPX Rug📊 Chart Analysis: ES1! (S&P 500 E-mini Futures, 1H) – Impending Breakdown via iFVG and Rising Wedge Top

This chart represents a technical analysis setup for ES1! (S&P 500 E-mini Futures) on the 1-hour timeframe. Here’s a contextual breakdown pointing toward a potential “rug pull” scenario by the end of the week, driven by an internal Fair Value Gap (iFVG) rejection and wedge resistance structure:

⸻

🔺 Structure Overview: Rising Wedge and Distribution Top

• The price action is following a rising wedge, which is typically a bearish reversal pattern, especially when occurring after a strong impulse move.

• The wedge’s upper trendline has just been tagged or slightly breached, with price showing early signs of rejection (small-bodied candles, wicks).

• A parabolic curve is drawn projecting a rounded top, suggesting buyers may be exhausting into resistance.

⸻

🧩 Internal Fair Value Gap (iFVG) in Focus

• The shaded gray area below current price action marks an iFVG (Internal Fair Value Gap) – a low-volume inefficiency formed during the recent bullish rally.

• iFVGs often act as magnetic zones, pulling price back to “rebalance” before continuation or reversal.

• Price has not yet filled this inefficiency completely, indicating a likely retracement target.

⸻

📉 Projected Breakdown Path

The curve implies a rounded top formation, with the following potential sequence:

1. Minor liquidity grab just above the wedge resistance.

2. Failure to hold above resistance confirms a deviation and traps late longs.

3. Sharp drop into the iFVG zone (gray block).

4. If iFVG support fails, acceleration toward the lower wedge trendline could follow — a true rug pull scenario.

⸻

🔻 Bearish Confluence Factors

• Volume divergence or lack of sustained momentum at highs (not visible here, but implied).

• The steepness of the rally suggests FOMO-driven buying, often vulnerable to reversal.

• The price has extended significantly from the last consolidation base, creating air pockets below.

• Candle structure shows upper wicks and rejection tails, signaling supply.

⸻

🗓️ Timing Bias – Into Week’s End

• Given the tightness of the wedge and proximity to iFVG + overhead resistance, any retracement could be swift and violent, particularly if driven by macro catalyst or profit-taking.

• Expectation would be a breakdown into Thursday or Friday, aligning with common volatility windows (e.g., weekly options expiry).

⸻

🔚 Summary

• Bias: Bearish (short-term)

• Trigger: Rejection of wedge high / deviation above resistance

• Targets:

• Primary: Fill of iFVG (gray zone)

• Secondary: Breakdown to lower wedge support

• Invalidation: Sustained acceptance above wedge trendline with bullish continuation

06/24/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: -717.50

Sleep: 4.5 hours - heat waves in nyc

Overall health: meh

** VX Algo System Signals from (9:30am to 2pm)** 4/4

9:40 AM Market Structure flipped bullish on VX Algo X3! 5 pts

9:42 AM VXAlgo NQ X3 Buy Signal (failed)

11:00 AM Market Structure flipped bullish on VX Algo X3! 20pt

11:58 AM VXAlgo NQ X1 Sell Signal (failed)

What’s one key lesson or takeaway from today?

and What major news or event impacted the market today?

There are days that the algo will lose but you just gotta trust the process and execute accordingly with a stoploss.

What are the critical support levels to watch?

--> Above 6130 = Bullish, Under 6125= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

06/23/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: +1128.75

Sleep: 7.5 hours

Overall health: good

VX Algo System Signals from (9:30am to 2pm) 4/4

10:40 AM VXAlgo NQ X1 Sell Signal (double signal):check: 10 pt move

12:00 PM Market Structure flipped bearish on VX Algo X3! :check: 35 pt move

12:43 PM VXAlgo ES X1 Buy signal (triple signal) :check: 20 pt move

1:34 PM Market Structure flipped bullish on VX Algo X3! :check: 23 pt move

What’s one key lesson or takeaway from today?

and What major news or event impacted the market today?

Oil is trading as if the Israel/US-Iran war is over and market can be irrational lol

What are the critical support levels to watch?

--> Above 6060 = Bullish, Under 6050= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

06/20/25 Trade Journal, and ES_F Stock Market analysis06/20/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +1437.50

Sleep: 6 hours

Overall health: hanging in there

** VX Algo System Signals from (9:30am to 2pm)**

— 6/20/2025 9:30 AM VXAlgo ES X1 Sell Signal (double sell) :check:

— 6/20/2025 10:30 AM Market Structure flipped bearish on VX Algo X3! :check:

— 6/20/2025 11:14 AM VXAlgo ES X1 Buy signal (triple buy) :check:

What’s one key lesson or takeaway from today?

and What major news or event impacted the market today?

Fed's Barkin: There is nothing urgent in the data warranting a rate cut at this point.

What are the critical support levels to watch?

--> Above 6015 = Bullish, Under 6005= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

06/18/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +521.25

Sleep: 5 hours (bad sleep)

Overall health: My Ultrahuman Ring is saying I might be getting sick. 9 need to recover sleep and take care of body today and tmr. I think my lack of exercise this week is catching up to me.

**What was my initial plan? **

Looking at things premarket, things looked a bit weak as it was about sell off in the morning with bearish structure and DHC. Went in for a short at 1 min MOB but it didn't react and just broke thru, so flipped to bullish side and took it to the next resistance.

overall plan for the day was to look for chop zones to scalp b4 fomc, but that actually didnt happen until after fomc.

** VX Algo System Signals from (9:30am to 2pm)** 4/5

— 9:50 AM Market Structure flipped bullish on VX Algo X3! :check:

— 10:52 AM VXAlgo ES X1 Sell Signal :check:

— 12:10 PM VXAlgo ES X1 Buy signal (Double signal) :x:

— 12:11 PM Market Structure flipped bearish on VX Algo X3! :check:

— 1:40 PM VXAlgo ES X1 Buy signal (Double signal) :check:

Next day plan--> Above 6015 = Bullish, Under 6005= Bearish

06/17/25 Trade Journal, and ES_F Stock Market analysisEOD accountability report: +1,337.50

Sleep: 9 hours

Overall health: Good, was averaging 40k steps the week before, now around 20k avg,

need to get it up to 25k steps min per week.

**What was my initial plan? **

Went into the market pretty neutral today with the mindset that it should be the calm before storm (fomc tomorrow), There was a string defense of 1 min MOB in the morning and that gave me the belief that early part of the day was going to be bullish so i took a few stabs at support and made my money.

** VX Algo System Signals from (9:30am to 2pm)** 4/4

— 9:34 AM Market Structure flipped bullish on VX Algo X3! :check:

— 10:30 AM VXAlgo ES X1 Sell Signal (double signal) :check:

— 11:36 AM VXAlgo ES X3 Sell Signal (double signal) :check:

— 1:00 PM Market Structure flipped bearish on VX Algo X3! :check:

Next day plan--> Above 6015 = Bullish, Under 6005= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

06/16/25 Trade Journal, and ES_F Stock Market analysisEOD accountability report: +450

Sleep: 7 hours

Overall health: Good

What was my initial plan? I knew today was contract rollovers and decided not to trade it, but after noticing that the x1 signals were working pretty good today, i decided to take some plays at the soft support and resistances.

**Daily Trade recap based on VX Algo System from (9:30am to 2pm)**

Lot of X7 buy signals (usual signal that market is bullish)

— 10:40 AM VXAlgo ES X1 Sell Signal (triple signal)

— 11:56 AM VXAlgo ES X3 Sell Signal

— 12:30 PM Market Structure flipped bearish on VX Algo X3!

— 1:20 PM VXAlgo ES X1 Buy signal

Next day plan--> Above 6010 = Bullish, Under 5965= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

06/13/25 Trade Journal, and ES_F Stock Market analysisEOD accountability report: +3825

Sleep: 5.5 hours (sleep is declining, will spend the weekend catching up)

Overall health: Good

What was my initial plan? I wanted to short 6016-6020 area in the morning but we didn't open up to that, so i just sat on sideline until we hit the 6025 , took a big short there and paid off really well.

Daily Trade recap based on VX Algo System from (9:30am to 2pm)

— 9:30 AM Market Structure flipped bearish on VX Algo X3!

— 10:30 AM Market Structure flipped bearish on VX Algo X3!

— 10:40 AM VXAlgo YM X1 Buy Signal

— 11:30 AM Market Structure flipped bullish on VX Algo X3!

— 12:21 PM VXAlgo ES X1 Sell Signal (double signal)

— 1:12 PM VXAlgo NQ X3 Sell Signal

— 1:30 PM Market Structure flipped bearish on VX Algo X3!

Next day plan--> Above 6010 = Bullish, Under 5965= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

06/12/25 Trade Journal, and ES_F Stock Market analysisEOD accountability report: +437.50

Sleep: 6.5 hours

Overall health: Good

What was my initial plan?

market pumped heavily due to ppi data so I decided today was another oe of those days where you wait on the sideline for a better move.

1. until major levels are hit.

2. or a signal occur.

**Daily Trade recap based on VX Algo System from (9:30am to 2pm)**

10:57 AM VXAlgo ES X1 Sell Signal

2:00 PM VXAlgo NQ X3 Sell Signal

Next day plan--> Above 6010 = Bullish, Under 5950= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts