6/23: Daily Recap, Outlook, and Trading PlanRecap

The market continued to follow the pattern of Mon-Wed weakness, Wednesday tight chop, and Thursday/Friday strength. This week, ES had a 30 point rally off the lows of the day, continuing the trend. However, there is still reason for caution as ES had a rare 3 red days in a row. In this newsletter, we will discuss the setup that produced yesterday's rally off 4393 support and provide the actionable trade plan for Friday.

The Markets Overnight

🌏 Asia: Down

🌍 Europe: Down a lot

🌎 US Index Futures: Down a lot

🛢 Crude Oil: Down

💵 Dollar: Up

🧐 Yields: Down a lot

🔮 Crypto: Up

World Headline

Recession fears to the forefront as global PMI data released overnight and this morning shows sharp economic contraction in the EU, Japan and Australia.

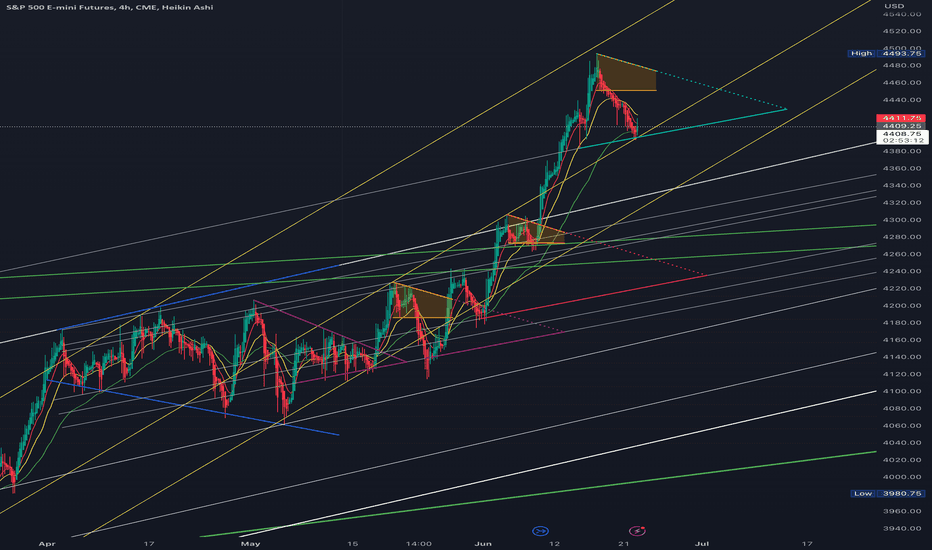

Key Structures

Some of the core big picture structures and levels being watched include the 4375ish level, the main breakout level from June 1st and 2nd, and the large rising uptrend channel in white. The uptrend from March is in play as long as we are above this channel.

Support Levels

4413(major), 4404 (major), 4380-82, 4374 (major), 4363, 4350, 4335-40 (major), 4325, 4317 (major), 4300-05 (major), 4280-85 (major), 4270 (major)

Resistance Levels

4421 (major), 4432, 4445 (major), 4454, 4467 (major), 4481-85 (major), 4492, 4508, 4518-20 (major), 4542 (major), 4550, 4565 (major), 4580 (major)

Trading Plan

For today, the rally continues above 4404, and we sell/short below. Longs are risky after a good rally, so picking spots carefully is essential. The most immediate supports down from here are 4413 and 4404, which is the critical "must hold" support for today. If we go into freefall, the levels marked as major are spots to try knife catches. For the bull case, as long as the 4404 blue uptrend channel holds, the bull case remains in play for Friday. For the bear case, it begins on the failure of 4404.

Wrap Up

In summary, as long as 4404 keeps holding, ES can base under 4421 then try to take a trip to 4432, then 4445. If 4404 fails, we start a sell to 4382, 4374, which is a magnet and major support/spot to try longs.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

Es_f

6/22: Daily Recap, Outlook, and Trading PlanRecap

Yesterday was a high complexity session with hours of total chop around the key 4413 level, which acted as a magnet. ES has now put in 3 red days in a row for the first time since May 4th, and we are yet to see if the Thursday rally will bail out ES.

The Markets Overnight

🌏 Asia: Down but China closed for holiday

🌍 Europe: Down a lot

🌎 US Index Futures: Down a bit

🛢 Crude Oil: Down

💵 Dollar: Up slightly

🧐 Yields: Up

🔮 Crypto: Up

World Headline

Bank of England surprises markets with 50bps rate hike to counter persistent inflation.

Turkey raises their rate by 650bps to 15% from 8.5% reversing their unorthodox policy to battle runaway inflation.

Indian Prime Minister Modi arrives for his first U.S.state visit and will meet top CEOs at a White House state dinner.

Key Structures

Some core big picture structures and levels I am watching include 4432, the most recent breakout level from Thursday June 15th; 4413-4404, a battleground for three days now; 4372, the break-out level from Monday June 12th; and the main breakout zone from June 1st/2nd at 4282-77.

Support Levels

4413 (major), 4404, 4393 (major), 4382, 4372 (major), 4358, 4340-45 (major), 4331, 4317, 4310, 4302, 4282-77 (major), 4265-70 (major)

Resistance Levels

4421, 4432 (major), 4440-44 (major), 4453, 4465-68 (major), 4485 (major), 4502, 4515 (major), 4525, 4538-40 (major), 4558 (major), 4575 (major), 4585, 4600-05 (major), 4627 (major)

Trading Plan

The short-term bull case is extremely vulnerable and it would not shock me if the Thurs/Friday rally streak fails this week or is much more muted. The bear case today begins on the loss of yesterday's low. My very loose lean is as long as this pattern is in tact (with yesterday’s low holding) ES can try another push to 4440ish, then dip. Yesterday’s low fails, we start the move down. I’ll react to whatever price picks.

Wrap Up

Bulls put in a bullish failed breakdown pattern yesterday by losing yesterday's low and reclaiming. It ran to 4430 and failed, which is not good. This is the shot for bulls and failure of a bullish pattern is bearish.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

6/21: Daily Recap, Outlook, and Trading Plan

Recap

Last week's rally saw a timely exit of my remaining runner long from 4405, concluding a 90+ point long. This week began with highly complex, tactical action, and we got a rare short trigger on the fail of 4450, which played out nicely for a good 30+ points.

The Markets Overnight

🌏 Asia: Down

🌍 Europe: Down

🌎 US Index Futures: Down a bit

🛢 Crude Oil: Up slightly

💵 Dollar: Up a bit

🧐 Yields: Up

🔮 Crypto: Up strongly

World Headline

UK inflation data prints much hotter than expected raising expectations the Bank of England will continue to raise rates.

Key Structures

4430: The most recent breakout level from Thursday

4413: A stubborn support all last week

4272-80: The core breakout level from June 1st/2nd

Large white rising channel structure from the March low

Large red channel structure connecting the October low with the March low

Support Levels

4433 (major), 4423, 4413 (major), 4402, 4385 (major), 4374 (major), 4358, 4340 (major), 4329 (major), 4314-17, 4300, 4282, 4265-70 (major), 4257, 4247, 4230 (major)

Resistance Levels

4444, 4455-60 (major), 4468, 4482-85 (major), 4498-4500, 4510 (major), 4518, 4528, 4535-40 (major), 4551, 4565-70 (major), 4584, 4595-4600 (major), 4624 (major)

Trading Plan

Bull Case: Reclaim 4413 — must hold 4402. Range bound between 4413 - 4430.

Bear Case: Watch for a false breakdown of 4404 — on strong conviction/followthrough, it's 4385, 4374.

Wrap Up

ES is likely in for some tactical range building now, but as long as 4430 holds, it is set up to test 4455-60, then 4480s, where another dip is likely before breakout. If we sell today, 4413 must hold, or shorts trigger.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

S&P 500 ETF (SPY) Elliott Wave Sequence Remains BullishShort term, SPY favors higher in impulse Elliott wave sequence started from 5.04.2023 low and expect further strength to continue in wave 3. SPY finished wave 1 at 417.62 high started from 3.13.2023 low. It placed ((i)) at 402.49 high and ((ii)) at 389.33 low as 0.618 Fibonacci retracement. It finished ((iii)) of 1 at 416.06 high and ((iv)) at 403.78 low. Finally, it ended ((v)) at 417.62 high as wave 1. It corrected lower in 2, ended at 403.74 low as 0.382 Fibonacci retracement of wave 1. Above there, it favors higher in wave 3 and expect further strength to continue before correcting in 4. Within wave 3, it placed ((i)) at 420.87 high and ((ii)) at 409.88 low as 0.618 Fibonacci retracement of ((i)).

Above 409.88 low, it favors higher in ((iii)) of 3. It placed (i) at 422.99 high and (ii) at 416.22 low. It finished (iii) at 443.90 high, in which it ended i at 429.67 high, ii at 425.75 low, iii at 439.06 high, iv at 433.59 low and v at 443.90 high as (iii). It proposed ended (iv) at 435.03 low. Within (iv), it placed at 440.01 low, b at 443.25 high and c in zigzag at 435.03 low as 3 swing reaction lower. Above there, it favors higher in (v) to finish ((iii)) of 3. As long as price remain above 409.88 low of ((ii)), it expects at least one more high. Alternate view can be ended ((iii)) at last high and correcting in ((iv)) as double correction, which may extend lower below 435.03. In that case, it can find support at next extreme areas before upside resumes.

6/20: Long Weekend Recap, Outlook, and Trading PlanRecap

The past week saw an impressive rally, with a 100-point squeeze on Thursday leading to a 190-point rally throughout the week. This marks the fourth week where the Thursday or Friday rally tendency has been tracked. As expected, Friday was OPEX day, leading to a messy, rangebound chop.

The Markets Overnight

🌏 Asia: Down

🌍 Europe: Mixed

🌎 US Index Futures: Down a bit

🛢 Crude Oil: Down

💵 Dollar: Up a bit

🧐 Yields: Down slightly

🔮 Crypto: Down slightly

World Headline

Both sides expressed positive sentiments following US Secretary of State Blinken's China trip and meeting with President Xi. However, Chinese stocks are experiencing a decline due to the PBOC implementing monetary easing measures that were more moderate than anticipated.

Key Structures

Some core big-picture structures and levels to watch include 4430, the most recent breakout level from Thursday; 4400, a stubborn support all last week; 4272-80, the core breakout level from June 1st/2nd; and the large white rising channel structure from the March low, with support now at 4260.

Support Levels

4455-50 (major), 4431 (major), 4421, 4400-05 (major), 4381 (major), 4371 (major), 4356, 4340 (major), 4328, 4317, 4294, 4272-80 (major), 4260 (major)

Resistance Levels

4466 (major), 4477, 4484 (major), 4492, 4503 (major), 4515, 4524 (major), 4535 (major), 4550-55 (major), 4570 (major), 4582, 4590-95 (major)

Trading Plan

The plan for the upcoming week is to remain cautious with longs and focus on failed breakdowns. Key supports to watch today include 4450 and 4431, with 4431 being the most recent breakout point that needs to backtest. In the bull case, defend 4450, perhaps with a quick flush to 4430 at the lowest, and then base build between 4450 and 4484. In the bear case, the failure of 4450 begins the short setup, with a move down to 4430 and potentially deeper if it fails.

Wrap Up

After a strong rally, pullback is not surprising, with a potential dip to 4430 on the spike down. The general lean is for ES to defend these levels and base more under 4484 to set up another push to 4505 and 4524 later in the week. Keep an eye on the key support and resistance levels and adjust the trading plan accordingly.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

6/16: Daily Recap, Outlook, and Trading PlanRecap

In the past few weeks, traders have witnessed the power of simple technical analysis in cutting through the noise and negativity, leading to account-changing growth. The market has been on a strong rally, with every intraday dip being bought. Yesterday saw another melt-up, and while a pullback is expected soon, the focus remains on reacting level to level and watching for support failures as a warning that the trend may be changing.

The Markets Overnight

🌏 Asia: Up

🌍 Europe: Up

🌎 US Index Futures: Up slightly

🛢 Crude Oil: Up

💵 Dollar: Up slightly

🧐 Yields: Up

🔮 Crypto: Mixed

World Headline

China rallies on expectation a major stimulus program is imminent.

EU CPI holds steady, inline with expectations.

Quad witching today and US markets closed Monday.

Key Structures

The large white rising channel structure from the March low, with support at 4245 and resistance at 4467.

The core breakout level from June 1st/2nd at 4274-84.

4390-95, which was the Tuesday low, the Wednesday FOMC low, and yesterday's low.

4430, which is the most recent breakout level from Wednesday.

Support Levels

4467 (major)-4462, 4450-53 (major), 4440, 4430-33 (major), 4419, 4413 (major), 4395-4400 (major), 4385, 4368 (major), 4351 (major), 4338-42 (major), 4329, 4318-20 (major)

Resistance Levels

4477 (major), 4484, 4502 (major), 4515 (major), 4524, 4530-35 (major), 4545 (major), 4561, 4571, 4585 (major)

Trading Plan

The next targets in line are 4503 followed by 4515.

The new support levels are established at 4477 and 4467-62.

Bears: 4430 needs to fail at least for any significant pullback.

Wrap Up

Today is OPEX day, which is notoriously difficult for trading. After a strong week of gains, it's important to be cautious with new long positions and to focus on reacting to the market's movements. The easy money has been made, and traders should be prepared for a pullback or extended consolidation phase. The focus remains on reacting level to level and watching for support failures as a warning that the trend may be changing.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

6/15: Daily Recap, Outlook, and Trading PlanRecap

Yesterday's FOMC session contained the typical trap, but ultimately the dip was bought, continuing the impressive uptrend we've seen in recent weeks. The rally demonstrates the power of simple technical analysis and the importance of holding runners. We have had a massive rally, and it would not be surprising to see ES get some complex rangebound trading, which is much needed.

The Markets Overnight

🌏 Asia: Up

🌍 Europe: Down

🌎 US Index Futures: Down

🛢 Crude Oil: Up

💵 Dollar: Unchanged

🧐 Yields: Down

🔮 Crypto: Down

World Headline

FOMC holds rates steady and signals two more hikes this year.

Chinese stocks up as People's Bank of China eases momentary policy.

European Central Bank raises rate 25bps.

Key Structures

The large white rising channel from the March low is the "macro uptrend channel" and controls the broader leg up since the March low. Support is now at 4245, and immediate resistance is at 4462. The 4275-80 yellow trendline represents the breakout of both the February and May 2023 highs. The green channel structure with 4366 resistance is now the most immediate back-test level. The 4385-90 zone remains key support.

Support Levels

4413 (major), 4403, 4385-90 (major), 4366 (major), 4357, 4343-4338 (major), 4327, 4315-17 (major), 4290, 4275-80 (major), 4263, 4245 (major), 4230, 4215-20 (major), 4197, 4175-80, 4166 (major), 4158, 4141, 4123 (major)

Resistance Levels

4422, 4430 (major), 4438, 4445-50 (major), 4462 (major), 4477, 4496, 4505-4510 (major), 4518, 4530-35 (major), 4540, 4570 (major), 4595, 4615, 4635-40 (major)

Trading Plan

Watch for failed breakdowns at 4413, 4404, and 4385-90, which are the immediate supports below. Resistances at 4445-50 and 4462 could provide reaction spots for counter-trend shorting. Bulls remain in control as long as we are above the June 1st breakout level, with a 4413 key mid-pivot. Sells occur under 4385.

Wrap Up

The general likelihood for today is that we base build in the 4390-4430 range, with a 4413 key mid-pivot. This sets up a push up the levels to 4438, 4445-50, 4462. Sells occur under 4385.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

6/14: Daily Recap, Outlook, and Trading PlanRecap

Yesterday's CPI report led to a 40-point upside squeeze after an initial flush. The first move was a trap, followed by a flush down to 4380 support, recovery, and then a squeeze up. Since June 1st, ES has been in a "buy all dips phase" with a 140-point increase. However, FOMC day is today, which may bring more complexity and difficulty for traders.

The Markets Overnight

🌏 Asia: Mixed

🌍 Europe: Up

🌎 US Index Futures: Up slightly

🛢 Crude Oil: Down

💵 Dollar: Down

🧐 Yields: Down

🔮 Crypto: Up a bit

World Headline

FOMC Rate Statement and Jay Powell press conference.

Key Structures

Large white rising channel structure from the March low, with support at 4245 and resistance at 4455

Core breakout level from June 1st/2nd at 4277-82

4385, the most recent breakout level

Support Levels

4408-05 (major), 4385-90 (major), 4367 (major), 4358, 4344 (major), 4338, 4317-23 (major), 4305, 4294 (major), 4276-80 (major), 4264, 4255, 4240-45 (major), 4230, 4215 (major), 4194, 4175-80 (major), 4157, 4142, 4125 (major)

Resistance Levels

4429 (major), 4438-4440, 4458 (major), 4470, 4486, 4503 (major), 4525 (major), 4540-45 (major), 4570 (major), 4591, 4600, 4615, 4640 (major)

Trading Plan

📈 Bulls: 4440, 4458 with 4408 as support

📉 Bears: 4385 triggers downside

Watch for false breakdowns/breakouts:

4440, 4458 next up as long as 4408 keeps holding. 4385=post FOMC sell trigger

If ES can base above 4408, target 4429, 4438, and ultimately 4458

If 4385 fails, consider short at 4382 for a sell to 4366

Wrap Up

FOMC day is today, which may bring more complexity and difficulty for traders. Focus on false breakdowns/breakouts, and watch the key structures and support and resistance levels for potential moves. Be prepared for unpredictable action after the FOMC meeting and adjust trading strategies accordingly.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

SPX Favors Rally With Bullish Momentum & Remain SupportedShort term, SPX favors upside in wave ((iii)) of 3 started from 4048.28 low of 5.04.2023 and expect to remain supported in pullback. It is nesting as the part of impulse Elliott wave structure and favors further upside. It placed 2 of (3) at 3838.24 low and ((i)) of 3 at 4186.92 high. Within wave ((i)), it favored ended (i) at 4039.49 high and (ii) at 3914.24 low as 0.618 Fibonacci retracement. It finished (iii) at 4162.57 high and (iv) at 4049.35 low. Finally, it finished (v) at 4186.92 high as ((i)) of 3. It retraced in ((ii)) at 4048.28 low as 0.382 Fibonacci retracement of ((i)). Above there, it favors higher in ((iii)) of 3 and expect few more highs to finish it before starts ((iv)) pullback.

It placed (i) of ((iii)) at 4212.91 high and (ii) at 4103.98 low. (ii) was corrected 0.618 Fibonacci retracement of (i). Currently, it favors higher in (iii) of ((iii)) as extended Elliott wave sequence. It placed i of (iii) at 4217 high, ii at 4166.15 low. Currently, it favors higher in iii of (iii) and can see further upside to finish it before pullback starts in iv of (iii). It expect few more highs and can extend between 4398 -4614 area to finish ((iii)) before pullback starts in ((iv)) of 3.

6/13: Daily Recap, Outlook, and Trading PlanRecap

The SPX has continued its routine Thursday/Friday rally, with the market rallying 80+ points on Thursday. This trend has been observed for the past 4 weeks, and it is expected that this week may be the last time we see it due to the upcoming CPI and FOMC events. Yesterday was another straightforward trend day, with a classic trend day in play. Today is CPI day, and as long-time readers know, these days can be volatile, unpredictable, and filled with traps.

The Markets Overnight

🌏 Asia: Up

🌍 Europe: Up

🌎 US Index Futures: Up

🛢 Crude Oil: Up strongly

💵 Dollar: Down

🧐 Yields: Down a lot

🔮 Crypto: Up

World Headline

CPI inflation declines, printing inline to lower than expectations.

Key Structures

The 4285-75 zone, representing the February 2023 highs and the May "double top". This is the most recent "breakout zone" and is the zone bulls will want to defend on any sells.

The white rising channel, which has been the core uptrend channel from the March low. Support is now 4230-35, and resistance is 4450.

The 4366-68 level, which is the most recent high we broke out from yesterday and is now support.

Support Levels

4366 (major), 4357, 4345 (major), 4338, 4328, 4314-17 (major), 4298, 4286 (major), 4277, 4263 (major), 4247-50, 4230-35 (major), 4209-11 (major), 4192, 4176 (major), 4165, 4158, 4140-42 (major), 4125, 4115, 4100-05 (major), 4085-90 (major), 4068, 4053 (major)

Resistance Levels

4380-85 (major), 4390, 4405 (major), 4416, 4426-30 (major), 4437, 4452 (major), 4472, 4495-4500 (major), 4515, 4525-30 (major), 4540, 4565-70 (major), 4589, 4613, 4635 (major)

Trading Plan

Bulls: 4416, 4425-30 in play next.

Bears: 4380 fails, we see 4366, then 4344

Since it is CPI day, it is advised to be cautious about bidding levels directly and wait for failed breakdowns for any long entries. 4366 is the first support down, but for CPI, it's safer to wait for it to flush then recover. If the channel fails, it would not be surprising to see ES test 4085, but as always, take it level by level and one intraday trade at a time.

Wrap Up

With the CPI and upcoming FOMC events, the market is expected to be volatile and unpredictable. It is important to size down, not over-trade, and watch for failed breakdowns. Be prepared for anything and trade cautiously during these challenging sessions.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

6/12: Daily Recap, Outlook, and Trading PlanRecap

As mentioned in previous newsletters, we have observed a solid day-of-week tendency in ES, with weakness from Monday to Wednesday, followed by Thursday and Friday squeezes. This pattern has held up for 8 of the last 10 weeks, including last Friday. However, last week we expected this to happen, and with both CPI and FOMC, we anticipate one of the most volatile weeks of 2023.

The Markets Overnight

🌏 Asia: Up

🌍 Europe: Up

🌎 US Index Futures: Up

🛢 Crude Oil: Down a lot

💵 Dollar: Down slightly

🧐 Yields: Down

🔮 Crypto: Down slightly

World Headline

Markets look ahead to tomorrow’s CPI inflation report and Wednesday’s FOMC meeting.

Key Structures

The core setup we have been observing is the failed breakdown, which preceded the 60+ point Thursday/Friday squeeze. This setup is essential to learn, as it precedes almost all major moves.

Support Levels

4344-42 (major), 4338, 4327 (major), 4315-18 (major), 4303, 4290-85 (major), 4265-70 (major), 4258, 4248 (major), 4236 (major)

Resistance Levels

4353-55, 4366-68 (Major), 4380-85 (major), 4391, 4400 (major), 4407, 4415, 4431-33 (major), 4447 (major), 4454, 4464, 4483, 4491 (major)

Trading Plan

📈 Bulls will generally want to hold 4344-42 and base above, with 4327 being the lowest on any spikes down. This will set up a retest of 4366-68. Choppy action is likely today, as always. A 4315 fail would be considered the trigger down to 4285.

📉 A 4315 fail would be considered the trigger down to 4285 for the bears.

Wrap Up

As we approach one of the most volatile weeks of 2023, it is crucial to put away any predicting mindset and fluidly react to the levels and setups. Stay sharp!

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

6/9: Daily Recap, Outlook, and Trading PlanRecap

Yesterday, we were closely watching the rally in the S&P 500 futures with a target of 4304 from the 4268 support level. The market held strong at 4268 and managed to reach 4303, just shy of our target. Throughout the night, the market has been basing around this level, indicating a potential major breakout point.

The Markets Overnight

🌏 Asia: Up

🌍 Europe: Down

🌎 US Index Futures: Mostly up

🛢 Crude Oil: Down slightly

💵 Dollar: Up slightly

🧐 Yields: Up

🔮 Crypto: Up

World Headline

The bear market ends as the S&P500 gains 20% from the October low.

Key Structures

Major breakout point at 4303

Support Levels

4288, 4283

Resistance Levels

4312, 4320

Trading Plan

📈 Bulls 4303

Our plan for today is to closely monitor the 4288 and 4283 support levels. As long as 4283 holds, we can expect a break in play towards 4312 and potentially 4320 or higher.

📉 Bears 4283

4283 fails to hold, we may see a retest of the 4271 level.

Wrap Up

In conclusion, the market is currently at a critical juncture with a potential major breakout point around 4303. Keep a close eye on the support levels and adjust your trading plan accordingly. As always, trade with caution and stay disciplined.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

6/8: Daily Recap, Outlook, and Trading PlanRecap

In the past few days, we have seen a pattern of weakness from Monday to Wednesday and massive strength on Thursday and Friday. This cycle has played out for 7 of the last 9 weeks. If this pattern persists for another week, this week will be the last as next week is both CPI and FOMC, which should be one of the most volatile, complex weeks of 2023 and will see 50+ point setups for both bulls and bears.

The Markets Overnight

🌏 Asia: Mixed

🌍 Europe: Up slightly

🌎 US Index Futures: Up a bit

🛢 Crude Oil: Down

💵 Dollar: Up

🧐 Yields: Up a bit

🔮 Crypto: Up

🌏 World Headline

The Bank of Canada's sudden rate hike unsettles the markets and raises the likelihood that rates will be raised at the FOMC meeting next week due to strong consumer spending and persistent inflation.

Key Structures

The 4243 level

The blue broadening formation

Resistance is now 4317-23, and support today will be 4250-55

If this pattern breaks out, the next magnet becomes 4343

Support Levels

4268, 4251-56 (major), 4243 (major), 4235, 4222 (major), 4213, 4200-05 (major), 4191 (major), 4182, 4175, 4167 (major)

Resistance Levels

4278-80 (major), 4288, 4304 (major), 4308, 4317 (major), 4325 (major), 4332, 4343 (major), 4356 (major), 4367, 4373, 4387 (major), 4395-4400 (major), 4411

📖 Trading Plan

📈 Bulls 4268 is support

Reclaim 4280 and consider longs at 4283. Level to level profit taking as always, but this could eventually make its way back to 4303, dip again, base more, then try a break up.

📉 Bears begin on the fail of 4268

Under 4280 bulls should be on guard. 4268 fail from here would then trigger downside to 4255.

Wrap Up

In summary, we are closing right at a decision point here, so it difficult to provide any lean. One could argue that we can sell down to perhaps 4255, 4243, then try a bounce out. If 4280 reclaims, we head up directly. Have a great trading day!

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

6/7: Daily Recap, Outlook, and Trading PlanRecap

In yesterday’s trading session, we saw the ES continue its choppy mode after hitting the 4280 target last week. The market has followed a pattern of Thursday/Friday rallies followed by Monday/Tuesday chop for the past three weeks. We had a 20-point rally off the 4267 buy zone and spent much of the day chopping under 4290. With another significant late-week squeeze potentially incoming, focusing on catching one or two level-to-level pieces of the action each day is essential and avoiding introducing bias into intraday trading.

The Markets Overnight

🌏 Asia: Mixed

🌍 Europe: Near unchanged

🌎 US Index Futures: Up a bit

🛢 Crude Oil: Up

💵 Dollar: Down a bit

🧐 Yields: Up slightly

🔮 Crypto: Down

Key Structures

Last Friday's breakout origin point at 4243, which serves as a significant level for bulls to maintain control.

The blue broadening formation, which has been the core macro structure guiding the market for the past 2+ months.

4317 resistance and 4261 support.

Support Levels

4284, 4274-76 (major), 4261 (major), 4243-47 (major), 4227 (major), 4221 (major), 4213, 4204, 4194-4198 (major), 4188 (major), 4177 (major), 4166 (major), 4155, 4137, 4120 (major), 4094-4100 (major)

Resistance Levels

4288 (major), 4303, 4315-17 (major), 4329 (major), 4340, 4353 (major), 4361, 4367 (major), 4382-86 (major), 4395, 4400 (major)

Trading Plan

📈 Bulls 4288-4284 is support. Next minor up is 4315, then 4317

📉 Bears begin on the fail of 4284. Next minor down is 4274 and 4261

Wrap Up

In summary, the market is still in chop mode, and everything between 4275-4290 is noise. As long as 4275 holds, we can push to 4303, 4315-17, and potentially higher. A sell-off may occur if 4272-75 fails. Stay focused on catching one or two level-to-level pieces of the action each day and avoid introducing bias into intraday trading.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

6/6: Daily Recap, Outlook, and Trading PlanRecap

In the past few days, we've seen an extraordinary 110-point long and one of the more significant trades of the year. We are now up 120+ points in two days, and the pullback risk is high. Yesterday's action was highly trappy and complex, fitting the description of a post-trend period. We are now in a strong uptrend, which will remain the case for the foreseeable future.

The Markets Overnight

🌏 Asia: Mostly down

🌍 Europe: Down slightly

🌎 US Index Futures: Down slightly

🛢 Crude Oil: Down

💵 Dollar: Up

🧐 Yields: Up a bit

🔮 Crypto: Down

Key Structures

The 4243-37 area is the first and foremost zone to watch, acting as a loose support zone.

The blue broadening formation pattern has now broken out and is currently acting as support in the 4280-90 range.

The new pink triangle pattern would be one to watch, but support must fail at 4200 for bears to take control.

Support Levels

4278-80 (major)

4267 (major)

4254

4243-37 (major)

4222 (major)

4213

4204

4190-95 (major)

4176

4171 (major)

4161

4154 (major)

Resistance Levels

4288 (major)

4307

4317 (major)

4326 (major)

4337

4347-52 (major)

4358

4366

4380-85 (major)

4400-4405 (major)

Trading Plan

📈 4267, and 4245-37 are support zones.

💪 Bulls must defend the 4243 zone to keep the direct breakout from last week in play.

📉 Bears' case begins on the fail of 4267. Watch for possible short-side reactions at 4317 major resistance.

Wrap Up

We are in a post-rally chop phase, and our focus should be on reacting to the plan outlined above. As long as 4278-80 holds (4267 on any quick flushes down), we can retest 4307, 4317, and then perhaps try another dip. A failure at 4278 is the first warning for bulls, with a 4267 fail triggering a sell down to 4243.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

6/5: Daily Recap, Outlook, and Trading PlanRecap

In this week's newsletter, we go over the recent market parabolic squeeze and how a classic failed breakdown setup caused it. With a move of 100 points, this produced one of the best trades of 2023. We also stress the significance of runners in catching these explosive moves and how they lessen FOMO and the need to chase/over-trade. The purple triangle, which served as the foundation for the initial rally to 4240, has been essential in determining the market's course.

The Markets Overnight

🌏 Asia: Mostly up

🌍 Europe: Up a bit

🌎 US Index Futures: Mixed

🛢 Crude Oil: Up strongly

💵 Dollar: Up

🧐 Yields: Up

🔮 Crypto: Down

Key Structures

The purple triangle was the foundation for the initial rally to 4240 and has been essential in determining the market's course. The blue broadening formation has also been an important target for price action.

Support Levels

Significant levels of support include 4281-85, 4262, 4241-37, 4187-4192, and 4176.

Resistance Levels

Significant levels of resistance include 4304–4306, 4315, 4350, 4366, and 4382.

Trading Plan

Exercise caution when trading in stretched positions and put more emphasis on being responsive than proactive. At support levels, keep an eye out for potential long entries, but be cautious of rug pull risks. At levels of significant resistance, take into account short entries, but be aware that counter-trending entails greater risks.

💪 4282 - 4285 is support

📈 Next minor is 4304, then 4315

📉 Pullback if 4280 fails, then 4262

Wrap Up

Following a significant rally, it's crucial to approach the market cautiously and concentrate on responding to price action rather than attempting to predict the next move. However, it's important to be aware of the risks associated with trading in these extended market conditions. Key support and resistance levels offer potential entry points for both long and short trades.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

6/2: Daily Recap, Outlook, and Trading PlanRecap

Yesterday's newsletter highlighted the ES' tendency to show early-week weakness followed by strong action on Thursdays and Fridays, a pattern that has become increasingly noticeable over the past eight weeks. This trend was validated by yesterday's market activity, which featured a substantial rally after a significant triangle pattern breakout last week, a back-test this week, and then the rally.

The Markets Overnight

🌏 Asia: Up strongly

🌍 Europe: Up strongly

🌎 US Index Futures: Up strongly

🛢 Crude Oil: Up strongly

💵 Dollar: Unchanged

🧐 Yields: Down

🔮 Crypto: Up

Key Structures

Two crucial structures to watch are the large blue broadening formation, with resistance currently at 4280, and the purple triangle, which has been back-tested throughout the week. The recent market activity, which consisted of a pattern breakout, back-test, and subsequent rally, is an excellent example of technical analysis and might mark the beginning of a new leg up to higher levels.

Support Levels

4221 (major), 4211 (major), 4205, 4193-89 (major), 4179 (major), 4162-66, 4149 (major), 4137, 4130 (major), 4124, 4118-20 (major), 4110, 4093-96 (major), 4086, and 4075-70 (major).

Resistance Levels

4232, 4240-43 (major), 4250-53, 4260 (major), 4273, 4282-85 (major), 4291, 4300 (major), 4315-20 (major), and 4328. The breakout point remains at the 4240-43 level, with potential shorting areas at 4260 and 4280-85.

Trading Plan

For today's trading plan, consider defending the 4221 and 4212 levels on dips, with the bull case targeting 4260 and then 4282-85. If the 4205 level is lost, this could indicate a return to choppy market conditions. For the bear case, a loss of 4205 would be the first warning, with potential short opportunities at 4203 or 4221.

💪 4240 - 43 is support

📈 Next minor is 4260, then 4267

📉 Pullback if 4240 fails is 4232, then 4221

Wrap Up

In conclusion, the market may be ready for an upward surge, focusing on basing above 4221 or 4212, and then setting up a breakout leg targeting 4260 and 4280-85. If the 4200 level is lost, we could see a return to choppy conditions. Keep an eye on the key structures and support and resistance levels to guide your trading decisions today.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

6/1: Daily Recap, Outlook, and Trading PlanRecap

Over the past few weeks, a pattern has emerged where Thursdays and Fridays see a violent squeeze, followed by a "hangover" state in the first few days of the next week. Both last week and this week so far have followed this pattern. We are currently in the sub-4200 congestion zone after yesterday's dip, having retraced about 60% of last week's rally.

The Markets

🌏 Asia: Mixed

🌍 Europe: Up

🌎 US Index Futures: Up slightly

🛢 Crude Oil: Up slightly

💵 Dollar: Down

🧐 Yields: Down

🔮 Crypto: Down a bit

Trading Plan

💪 4193 - 4185 is support

📈 Next minor is 4212, then 4221

📉 Pullback if 4185 fails is 4167, then 4145

Key Structures

The purple triangle backtest has a support level of 4147 and a resistance level of 4190. Resistance is now around 4221 on the small white channel. A new leg up to break the weekly high would begin if this area could be reclaimed.

Support Levels

4193 (major), 4185-88, 4176, 4167-70, 4160, 4146, 4137, 4125-28, 4112-15, 4099 (major), 4084, 4070-75, 4062, 4048 (major), 4036, 4030 (major)

Resistance Levels

4200-05 (major), 4213, 4221, 4230, 4240-43 (major), 4247, 4263, 4274

Trading Plan

Expect a more complex trading session today, with possibilities for both long and short setups. The 4190 triangle level was reclaimed at around 4194, offering some long exposure opportunities. However, trading in the 4185-90 zone requires skill and a strong real-time sense of action due to its messy and well-tested nature. An alternative is to test around 4185, then spike back up to 4192 for an entry. Potential knife catch long locations include the 4160 and 4146 levels if there is a leg down.

Wrap Up

Yesterday's session was complex and future sessions are likely to follow suit. After the easy trend last week, it's time to be strategic. Focus on reacting, with a loose lean as follows: as long as 4193-85 holds, a push back to 4213 and 4221, followed by another dip, is possible. If 4185 fails, a correction may be needed, possibly down to 4160.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

5/31: Daily Recap, Outlook, and Trading PlanRecap

ES has been in a broad dip-buy regime since October. Today marked the first post-rally pullback, and the ES had a very choppy/corrective session. We are in a confusing post-rally consolidation phase, with a new consolidation range between 4206 and 4243.

The Markets Overnight

🌏 Asia: Down

🌍 Europe: Down

🌎 US Index Futures: Down

🛢 Crude Oil: Down a lot

💵 Dollar: Up a bit

🧐 Yields: Down

🔮 Crypto: Down

Key Structures

The purple triangle is one of the key structures I'm keeping an eye on, with a clear support line extending from May 10 through May 24. Support is currently at 4145. The sizable blue broadening formation is also a key structure to watch. Generally, these patterns tend to "fill out” over time, so when support of this pattern tests, resistance tends to become a magnet.

Support Levels

First support down is at 4212, followed by 4206 and major support at 4193-89. Further support levels include 4165, 4145, and 4113-4116.

Resistance Levels

Major resistance levels include 4221-24, 4243, 4273-77 (blue broadening formation resistance), and 4292. Additional resistance exists at 4313 and 4342.

Trading Plan

Consider going long at 4213, provided it holds above 4212. Initially, aim for 4243, but be cautious chasing in a choppy range. If the 4221-24 level is reclaimed, it would be bullish. However, if 4213 fails, it could signal a bearish case. If we drop below 4213, only consider going short if there's a significant bounce and hours of acceptance at given levels.

Wrap Up

Following the recent rally, we are now in a period of choppy consolidation. Ideally, we can hold 4213, potentially backtest 4194-89, and continue the basing process by bouncing to 4243. If 4194-89 fails, we may start our journey back to triangle support, which would be a warning for bulls. Remember to stick to the three fundamental principles: do not overtrade, manage trades using a standard procedure, and pay attention to failed breakdowns and breakouts when looking for entry points.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

5/27: Weekend Recap, Outlook, and Trading PlanRecap

After shaving 100 points off the weekly low, we are currently monitoring several structures. A "triangles within triangles" pattern is emerging, with a larger triangle appearing (shown in purple). Although this technically broke out yesterday, factors like stretched-out RSI and the upcoming long weekend make us suspect ES still has work to do.

After witnessing a significant and straightforward move, it is now time to react and monitor further price movement. The plan and lean will be detailed at the very end.

Stock Market Performance

The U.S. stock market saw modest gains in April. The S&P 500 rose 1.4% during this period, thanks in part to signs that inflation is cooling off, indicating that the current interest rate hike cycle might be ending. Investors are optimistic that the market can continue its bullish momentum into May, despite historically being one of the worst months for the S&P 500.

Recession Risks

There is a rising risk of a recession, due in part to slowing economic growth. The U.S. GDP grew by just 1.1% in the first quarter, well below the expected 2% growth. This has led some investors and experts to believe that a recession in 2023 is unavoidable.

Inflation and Federal Reserve Actions

The inflation rate, as measured by the Consumer Price Index, was 5% year-over-year in March, down from peak levels of 9.1% in June 2022 but still above the Federal Reserve's 2% long-term target. The Federal Reserve has been hiking interest rates to combat inflation. The market is currently pricing in an 85% chance that the Fed will raise rates in May, with a potential rate hike in June still on the table. The Fed's actions in the coming months will be crucial in determining whether the economy can avoid a recession.

Economic Indicators

The U.S. housing market has softened, and manufacturing activity has dropped. The U.S. Treasury yield curve has been inverted since mid-2022, which is often a sign of an impending recession. However, the labor market remains resilient, with the economy adding 253,000 jobs in April, and the unemployment rate remaining low at 3.4%.

Support Levels

Support is currently in the mid-4140s.

4213, 4205 (major), 4187-94 (major zone), 4176, 4165 (major), 4155, 4143 (major), 4137, 4123 (major), 4109 (major), 4099, 4081 (major), and 4072 (major).

Resistance Levels

4221 (major), 4228, 4235, 4242 (major), 4254, 4260 (major), 4267, 4274 (major), 4283, 4295, 4306, and 4312 (major).

Trading Plan

The presented levels are valid for both Tuesday and Monday's short futures trading day but may be slightly less accurate. We will be taking it easy on Monday and Tuesday while waiting for price discovery. The general consensus is that we can hold 4220 at this point, possibly backtest 4205 and 4193, then defend and establish a base before another rally. If 4193 fails, we will see a further dip.

Wrap Up

In this newsletter, we discussed the possibility of finally breaking through the 4200s area, our method for trailing stops, and our trade plan for the upcoming week. Our general sentiment is that we can now hold 4220, possibly backtest 4205 and 4193, then defend and create a base before another rally. A further dip is expected if 4193 fails.

5/26: Market Recap, Outlook, and Trading PlanToday's Recap

This week, we experienced a nice 130-point decline, creating a unique short opportunity. The market overreacted, but since October, dips have been consistently bought. We repeatedly held 4123-16, climbed back to 4165-75, and then experienced a tradeable dip to open today's session. In this newsletter, we will discuss the setup that got us long for today's rally, the reason for it, and provide the workable trade plan for today.

Debt Ceiling Crisis

With the debt ceiling as the main risk, Friday is coming up before a 3-day weekend. We'll trade sparingly or perhaps not at all tomorrow as a result (holding our runner). Our objective will be to preserve this week's profit rather than increase it.

Bond Yield Rates

No significant updates on bond yield rates today.

Key Structures

The blue triangle: Over the course of ten days, we constructed a classic triangle pattern that, on May 17, broke out, setting us up for a squeeze of more than 100 points. We roughly received the backtest yesterday and then rallied in response to it. Above that triangle, the breakout from last week is still in effect, while below it, the breakout failed. The upside is still present right now. That support is at 4118 right now.

The yellow rising channel: Yesterday, we dissected it; today, we backtested it. Right now, there is 4175 resistance. Reclaiming it is extremely bullish and strong proof that a bottom has been formed (once inside it, the uptrend is reinstated).

White downtrend channel: 4205 is currently the resistance, and this is a magnet.

The Yellow Uptrend Channel

Currently consolidating under this major zone and accepting it, we are not yet back in this range.

Support Levels

4155-58, 4147 (major), 4134-38 (major), 4118-23, 4105 (major), 4099, 4085, 4074-76 (major), 4061, 4052 (major), 4040, 4020-25 (major), 4013, 4000-4005 (major), 3980 (major).

Resistance Levels

4167, 4172-75 (major), 4181, 4191-93 (major), 4200-05 (major), 4215, 4222-25 (major), 4238, 4242 (major), 4250, 4256, 4270-75 (major).

Trading Plan

We view the range 4175–4135 as a new chop zone; trade with caution in it as the action will be chaotic and tactical. To add longs, we will be keeping an eye out for failed breakdowns. One could bid on 4147 or wait for a flush to 4134-38 before reclaiming it in an effort to try and scalp some points in this range. 4147 is the first strong support down. In the same manner as yesterday, 4134-38 will need to provide support for tomorrow; alternatively, one may choose to wait for a failed breakdown. Only the levels above marked as major are the places we'd try knife catches if that doesn't work

Wrap Up

Many traders choose to take the Friday before a three-day weekend off. We won't put this week's profits in danger; instead, we'll be concerned with protecting our profits. But now, the chop zone is 4135–4175. Our general inclination is to fill this out (ideally, bulls want to hold above that 4147 zone), then try the push higher to 4190+. The warning shot for the bear case is 4135 fail.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

5/25: Market Recap, Outlook, and Trading PlanSPDR S&P 500 FUTURES ESM2023 & SPY ETF - Market Update - 5/25/23

Today's Recap

This week has been a mirror image of last week, with the ES building a smaller triangle and breaking down, triggering a nearly 100-point sell. Although this seems dramatic, similar dips have occurred in the past month and have been bought. The question now is whether this dip will also be bought.

Debt Ceiling Crisis

The current market environment is complex and headline-driven, with the debt ceiling debate making the next few days of trading potentially difficult. Traders need to be flexible and prepared to react to price movements, rather than trying to predict or forecast the market.

Bond Yield Rates

Bond yields have been fluctuating due to the uncertainty surrounding the debt ceiling crisis. This has led to increased volatility in the market, making it more challenging for traders to navigate.

Key Structures

The latest rally of this bull leg started because we broke out a triangle structure shown in blue below. It is currently at 4123-4116 and represents an important back-test, which we managed to defend.

The yellow rising channel connecting the May lows. This broke down yesterday. As always, when price breaks down any sort of significant level that level needs to be recovered in order to “end” the immediate move (down). Currently, this is 4165-75 and I would say a “bottom is in” when that is recovered.

While this is very far away - note the lowest white trendline. This connects the October low with the March low and is currently 3980. I consider this the driving trendline controlling the multi-month bull market we are currently in. We remain in a clear uptrend by every definable measure.

The Flat Bottom

You can see the flat bottom pattern failed to hold and triggered the sell-off at 4190.

The Yellow Uptrend Channel

The yellow uptrend channel, which connects the May lows, broke down yesterday. In order to end the immediate move down, the level of 4165-75 needs to be recovered.

Supports and resistances are listed, and I discuss potential bids and trade scenarios for both bull and bear cases. In summary, 4195-4220 is chop, and there is a heavy headline risk due to the debt ceiling.

Bulls control above the structure

Bears control below the structure

The back-test level is now 4140-42.

Support Levels

The bull case would look something like yesterday lows continue holding, and from there we push up the levels to 4147, 4156, then 4166-75 where ES can try another sell.

4123, 4116 (major), 4100-05 (major), 4087, 4075 (major), 4061, 4053 (major), 4040, 4020-25 (major), 4013, 4000 (major), 3977-83 (major).

Resistance Levels

Starts on the failure of yesterday’s low. Ideally, one more bounce attempt at 4116-23 before trying a short. After this bounce though, consider a short 4115 or so for a move to 4100-05 where gains should be locked in.

4135 (major), 4147, 4157, 4166 (major), 4175 (major), 4191-95 (major), 4204 (major), 4212, 4221 (major), 4235, 4242-45 (major), 4253, 4259, 4270-75 (major).

Trading Plan

If buying big red candles, these are “knife catch trades”. Size them down. 4123-4116 is major support still, one could bid it direct again or wait for a decisive failed breakdown. In terms of spots to try knife catches, 4100-05 and 4075 would be possible regions.

Wrap Up

In conclusion, the market is currently in a complex and headline-driven environment due to the debt ceiling crisis. Traders need to be flexible and prepared to react to price movements, rather than trying to predict or forecast the market. Keep an eye on key structures, support and resistance levels, and have a solid trading plan in place to navigate the market successfully.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decisions.

SP500 Makes "Failure" Break Higher; Now Short-term Weakness SP500 is making a sharp reversal, so it appears it was failure break higher after that overcrowded trade when everyone expected 4200 to be a major breakout point for the bull run. We also see USD still in bullish mode which can extend gains much higher now if stocks will be in risk-off mode. Looking at the SP500 price action, we see price falling below the trendline support so it seems that five wave rise from the March low is finished and that minimum three wave drop is in play. Big important level can be 4060/4070 which has been retested a few times in the last two months. Below that we have 4k, near 61.8% Fib.