ETH ANALYSIS (12H)This analysis is an update of the analysis you see in the "Related publications" section

Ethereum has finally reached the flip zone.

Pay close attention: Ethereum dominance is sitting on monthly support, which is a level with strong bounce potential.

We have two possible scenarios for Ethereum | either it breaks through the flip zone, or it makes a correction and turns bullish again from around the bottom.

⚠️ What’s clear is that shorting Ethereum is risky and doesn’t make sense!

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

ETH

This Low Cap Alt will 20-50x (CULT DAO)This crypto cycle has been brutal for alts. There have been massive shakeouts over and over, a relentless onslaught of rug pulls and scams, and the "Pump.fun" casino on Solana that’s drained billions of retail liquidity and transferred it to the few.

The few always seem to win, and the many always seem to lose. Today, if you’re reading this, it might all change.

CULT DAO could easily 20-50x from now until October 2025. Let’s take a look at the MACD divergence.

### Technical Divergence

For 750 days, this bullish divergence has been forming on the histogram MACD. Every new low on price has formed a higher low on the MACD.

Let’s take a look at a case study of what happens when we get this form of divergence.

I traded this exact same pattern in 2022 that resulted in a nearly 425% move. The play function doesn’t work because they rebranded, and that ticker is no longer valid, but you can scroll to the bottom in my comments on that TA and see the move. I’ll post it under this as well.

As you can see, we got that 425% move. Currently, CULT DAO is showing exactly the same histogram divergence.

Here are some examples of zigzag impulses on low-cap alts. You tend not to get 5 waves; instead, you get this zigzag pattern. This is what I predict CULT DAO will do since it’s only a 5 million market cap.

We can also see in the chart that the 0.618 time Fibonacci level hits at the end of October 2025, which is exactly where I think the altcoin market will top. Check out previous TA on that.

This is only scratching the surface of what is to come for CULT DAO. I have presented to you the technical reason why a big move is stirring and why, at the apex of these divergences, the stars align, and you have the catalyst present itself, and boom—the explosive move comes all at once, and it will be extremely volatile because of its low market cap.

### Let’s Start with the Tokenomics

Every time someone sells or buys CULT DAO on Uniswap, there is a 0.40% tax that goes to a treasury. The top 50 stakers get to pass proposals that fund projects/investments. The idea is to remove the centralized component of funding a project.

121 projects have been funded over the last three years with 3 million dollars.

- Total CULT Funded: 479,751,081,214 CULT

- Total ETH Funded: 1,573 ETH

- Proposals Funded: 121

- Total USD Funded: $3,289,596

- Total ETH Burned: 303 ETH

Allocating these funds has been a learning process over the last three years, but every failure has been necessary in preparing the DAO for what’s to come next.

### The Big Catalyst

The creator of CULT DAO has been working on a blockchain that will function on a custom gas token—that’s right, and that custom token will be CULT DAO. You heard correctly.

Every transaction, every deployment on the blockchain will require the CULT DAO token as gas to execute. The implications are massive. There are multiple dApps that are currently being constructed on the Modulus blockchain.

A privacy-first zkEVM blockchain like Modulus means a scalable, Ethereum-compatible blockchain that prioritizes user privacy through zero-knowledge proofs, allowing optional private transactions while maintaining decentralization.

Modulus is a privacy-first zkEVM blockchain and is scheduled to release this year between April and August 2025. I hope now you’re starting to see the picture.

### CULT DAO and ETH Liquidity Pools

So, why does the price of CULT go down if there is currently very little volume? Well, CULT DAO and ETH liquidity pools are tied together, so if the ETH price goes down, so does CULT. In turn, if ETH goes up, so does CULT.

You can see that CULT is nearly at a 1:1 ratio with ETH for now, coming in at a 0.91 ratio.

In other words, if my thesis is correct about ETH and it goes to 15,000 dollars, the price of CULT would be as follows:

- ETH at $10,000:

CULT Price: $0.000005008 (4x increase).

Market Cap: $21.38M (4x increase).

- ETH at $15,000:

CULT Price: $0.000007512 (6x increase).

Market Cap: $32.08M (6x increase).

That’s right—if nobody even bought CULT, not one dollar, the base liquidity increase of ETH would bring the market cap to possibly 32 million, in other words, if you were thinking of buying ETH, why don’t you just buy CULT DAO?

You can buy ETH now; from this price, 15,000 is 7x, or you can buy CULT DAO, get 6x plus whatever extra volume is coming in. It seems like a logical play, really.

Everything you’ve seen so far is why I believe this MACD histogram divergence has been forming for 750 days. As I said, the stars will align at the apex, and the explosion will come.

### Unruggable and No Whales Controlling Supply

As you can see from the bubble map, the largest wallet that is not an exchange has a cluster total of 0.7%. The rest of the clusters you see in the image are basically exchange wallets, which are the red and dark green circles mostly.

Liquidity is also locked for over 200 years.

- Burned Supply = 1.29664T

- Circulating Supply (including staked) = 4.27T

- Staked Supply = 1.07599T

- Remaining Tradable Supply (excluding burned and staked) = 4.27T - 1.29664T - 1.07599T ≈ 1.89737T

So, no whales, and it’s not possible to rug because liquidity is locked.

### Modulus Blockchain Liquidity Injection

The average liquidity injection for DAOs in ZK would be anything from 200,000 to 10 million. Let’s assume it’s a $1M injection that is split 50/50 between CULT and ETH, a common practice for Uniswap-style pools.

- CULT Amount in Pool: At the current price of $0.000001252, $500,000 buys ~399.36B CULT ($500,000 ÷ $0.000001252).

It would increase the price to a 10 million market cap overnight.

### Conclusion

- Liquidity is locked for 200 years

- No whales

- Not possible to rug

- Mainnet launching this year

- ETH pools tied to CULT

- MACD histogram divergence

The target I have for CULT is just based on Fibonacci levels. Honestly, it’s unpredictable what will happen, how high it will go, or the impact the Modulus chain will have. 120 million is my low-end estimate; the macro Fibonacci is much higher.

The last extension puts it at a 1.4 billion market cap and 266x from where we are now.

This is where you want to be for the upcoming alt season—right here, down 98% with this massive divergence and all these factors that come into play. Just the mainnet launch and ETH going to 10,000 basically sends this to a 30-50 million market cap.

Cult DAO and Satoshi Nakamoto share a common ethos of decentralization and anti-centralization. We need to embrace this notion and bring back the power to the many. If CULT DAO hits 1.4 billion dollars, the treasury funds would be in the millions; we fund our own future.

moduluszk.io

cultdao.io

cultdao.io

coinmarketcap.com

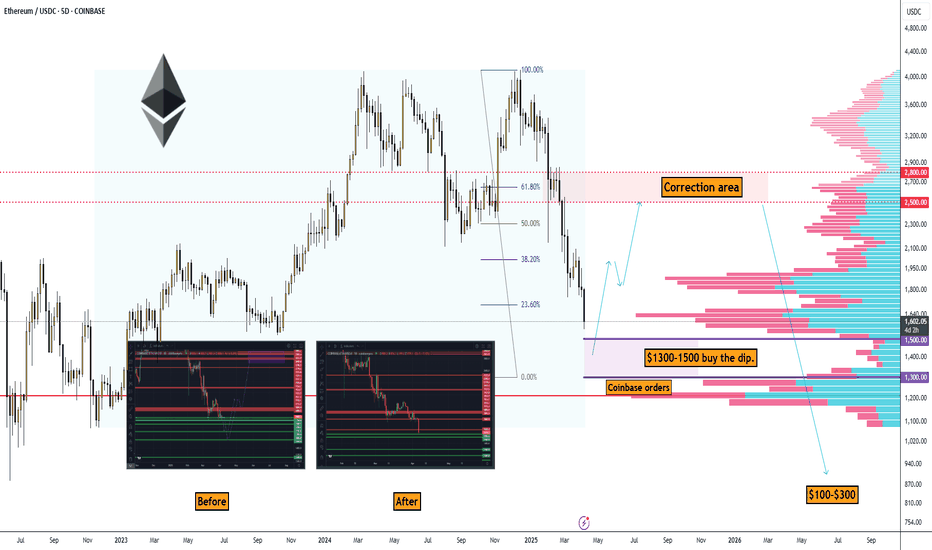

Ethereum: Correction to $1,300–$1,500 and Rise to $2,500–$2,800#Ethereum Price Analysis: Correction to $1,300–$1,500 Before Potential Rise to $2,500–$2,800

Let’s break down why Ethereum (ETH) might correct to the $1,300–$1,500 range and then potentially rise to $2,500–$2,800 (with increased risk beyond that).

Technical Analysis

On the ETH/USDC 5-day timeframe chart from Coinbase, key points confirm a correction to $1,300–$1,500:

1. Correction Target: $1,300–$1,500 ("Coinbase orders")

• Limit orders were placed on Coinbase before the drop.

2. Hyperliquid Liquidation Map

• According to the Hyperliquid Liquidation Map, the liquidation level for long traders is at $1,337.00, within the target zone of $1,300–$1,500.

• A price drop to this level could trigger a cascade of liquidations, and market makers might accumulate positions at the lowest prices, specifically in the liquidation area.

3. Elliott Waves

• We’re completing the 5th wave and starting to form a reversal. This event will roughly coincide with the S&P 500’s reversal.

What Event Could Trigger the Correction?

• An expected Bitcoin correction to $70,000–$76,000 could trigger Ethereum’s drop, as the altcoin market historically follows BTC.

• I’ve previously shared this Bitcoin idea; we’re waiting for it.

Potential Targets for Ethereum Before a Global Downturn

Look for an exit point in this area: $2,500.00–$2,800.00

➖ This is approximately the 61.8% Fibonacci level

➖ A significant area according to the Volume Profile

➖ Large sell orders on Binance at $2,500, $2,800, and $3,000

➖ On Coinbase, they’re getting smarter and splitting orders into 500–600 ETH.

➡️ In Summary for Ethereum

This makes the $1,300–$1,500 range attractive for buying the dip.

Ethereum Bear Market Over! $10,000 Before 2026 Confirmed!People were badmouthing Ethereum but look what is happening, more than 20% growth in a single day. Awesome right? But this is only the start, the last high will be reached and conquered easily, that I know for certain for sure it is true just watch.

In a previous analysis I mentioned that ETHUSDT was trading within a tight range support buy-zone, marked blue on this chart. This is also a higher low and consolidation was happening before what happened today. Bullish action confirmed. Real bullish action I should say because this action is coupled with really high volume. Confirming a very strong high in the coming weeks and days.

Here is what will happen, Ethereum will grow daily non-stop for months. Now, saying it (reading it) is one thing, experiencing will be something completely different, the market will become euphoric as everything grows.

Hundreds of billions worth of USD will be injected into the market, we already have 30 billions that came in recently but only some 10-15 billions are already in-play. This means that the whales still have 15 billion USD ready to buy, and they will continue to buy long-term. As this capital dries up, more and more players will get involved. Notice how the sentiment is still low. People know we are bullish but that is only the usual market participants, those that are part of the industry, the rest, the mass, they are not in yet. When the masses wake up, that will be very close to the top of the first bullish wave. 250 B$ coming in will change not only the Cryptocurrency market forever but also the global financial landscape.

Ethereum breaking bullish is just step one, there is more to come. Prepare for Ethereum to trade at around $10,000 before this year ends. Would you like to bet? I don't think so, we already won because we've been bullish since before 7-April, now it is time to enjoy the ride nothing more.

Adapt and change. The market always fluctuates from bullish to bearish, from bearish to sideways, from sideways to bullish and bullish the market will stay long-term.

Thank you for reading.

"Buy like it's the end of the world. —Master Ananda"

You can't go wrong when prices are low.

Thanks a lot for your continued support.

Namaste.

ETH is fighting in a strong resistance zone!Hello everyone, I invite you to review the current situation on ETH. When we enter the one-day interval, we can see how the ETH price came out on top from a strong downward trend.

Here we can see how the current bounce brought the movement closer to a very strong resistance zone from $ 2,090 to $ 2,310, in which we can currently observe a fight for further upward movement. Only when the price comes out on top, it can go towards resistance at $ 2,740, and then move towards strong resistance at $ 3,070.

Looking the other way, we can see that when the trend reverses, we first have support at $ 1,837, then a very strong support zone from $ 1,610 to $ 1,404 is visible, however, if this zone is broken, we can see a quick decline to the support area at $ 1,071.

On the RSI indicator we can see how strong the ETH price movement is visible intensively on the indicator and here we can see how we are approaching the upper limit, which could potentially slow down the movement or give a temporary relief.

If Ethereum behaves like $BTCIf Ethereum behaves like CRYPTOCAP:BTC , which after breaking through the downward channel continued to grow without a rollback, then soon we will see our Favorite Ether at $2500.

The altcoin season will come after the growth of Ether, but there will not be enough Liquidity for everyone!

Projects that are alive, working, and earning will grow.

Projects should have realized - It's time to take responsibility and independently ensure the Liquidity of their Tokens at the expense of income from the Business Model, and not live at the expense of VCs with a printing press.

#RateXAI #RAA token

ETH - Is $3,000 next?Today marked a significant milestone for Ethereum as it successfully rolled out its much-anticipated Pectra upgrade. The update, which introduces a number of technical enhancements aimed at improving scalability, security, and developer experience, has already had a noticeable impact on market sentiment. In the hours following the upgrade, Ethereum (ETH) surged more than 13%, breaking through key resistance levels and igniting fresh bullish momentum.

From a technical standpoint, ETH is currently breaking out of a descending wedge pattern, a structure often seen as a bullish reversal signal. The price action has decisively pushed through the wedge’s upper boundary, signaling a potential end to the recent downtrend. Additionally, ETH is now testing a significant resistance zone, often referred to as the "resistance box," which has historically served as a key battleground between bulls and bears.

Should Ethereum manage to secure a clean breakout above this resistance area with strong volume. The next major upside target lies around the $3,000 level, a psychologically and technically important price point. This move could mark the beginning of a larger bullish cycle if market conditions remain favorable and momentum continues to build.

With the broader crypto market showing signs of recovery and Ethereum's fundamentals strengthening post-upgrade, traders and investors alike will be closely watching to see whether ETH can sustain its breakout and confirm this bullish trend.

-------------------------------

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

ETH/USDT – Ascending channel. Breakdown below support?Ethereum - is a smart contract platform that allows developers to build decentralized applications (DApps) on its blockchain.

CoinMarketCap : #2

↗️ Ethereum is moving within an ascending channel, and the bullish trend remains intact.

Inside the channel, there are two triangles.

The first triangle, with a base of 88%, has played out—its third wave broke through the triangle.

Liquidity grabs and shakeouts before the growth in the inner channel zones are marked with yellow circles.

Currently, we see a mirrored situation with a new triangle, this time with a 156% base. However, if this pattern plays out, it will break the ascending channel.

At the moment, the price has been dragged below the channel support, and there is a lot of negative sentiment in the news and opinions. Few believe in an upward move, and many have been liquidated. To me, this looks like a strong trigger.

⤵️The bearish scenario implies a -61% drop. (A less likely scenario.)

I've marked everything on the chart—consider this in your trading strategy. Remember, there's a lot of negativity around Ethereum, just like with all altcoins...

I also believe that on the monthly chart, it will end up being just a wick of the candle.

SHITCOIN index to 11X - No crying in the CASINO!I see grown men on my timeline expressing despair, claiming that altcoins are finished!

Come on, get a grip!

Volatility is simply the cost of chasing the highest potential returns in the most speculative market the world has ever seen.

Yet, many are unwilling to wait just one more year.

They’re turning into Bitcoin maximalists, hesitant to promote their favourite coins and reluctant to introduce friends and family to their preferred ecosystems.

This is just ridiculous.

Take a look at that chart.

I mean really study it.

It shows a stunning continuation pattern of an inverse head and shoulder.

Is that bearish or bullish?

You decide.

Embrace the cost of those future returns.

The Others index going to Trillions of dollars.

Means many millionaires will be freshly minted.

From memes to mansions.

Crypto update for 2025.05.08A quick little technical crypto update for 2025.05.08.

Let us know what you think.

CRYPTO:BTCUSD

CRYPTO:BCHUSD

CRYPTO:ETHUSD

CRYPTO:XRPUSD

CRYPTO:DOGEUSD

CRYPTO:DOTUSD

CRYPTO:TRXUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Ethereum ETH price analysisThe #Ethereum network has successfully activated the #Pectra update, one of the factors that JPMorgan previously called a bullish driver for CRYPTOCAP:ETH

The update contains 11 improvements, including: support for smart contracts in wallets (simplified use and recovery, payment of fees in different tokens), an increase in the staking limit to 2048 ETH, optimization of validators and management of withdrawals through smart contracts.

All of this should make #Ethereum more convenient, scalable, and accessible.

📊 If we look at the OKX:ETHUSDT chart, I want to believe that the price will not go below $1500-1600 and this will be the “last carriage” buying zone

📈 And then - a smooth “acceleration of a heavy locomotive”, which, let's hope, will reach the $3800 “station” already in 2025.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Bitcoin (BTCUSD) – Bullish Continuation SetupBitcoin is showing strong bullish structure on the daily timeframe, having broken out of a key range and now approaching a potential retest zone.

Price is currently hovering around 96,990, and we’re anticipating a possible retracement into the demand zone between 91,856 – 88,533. This area aligns with a previous consolidation and breakout range, offering a high-probability buy zone if price reacts with bullish intent.

📌 Key Technical Highlights:

Break of structure confirms bullish bias

Demand zone identified between 91.8K – 88.5K

Anticipating a retracement for continuation

Bullish targets toward 100K+

We’ll be watching lower timeframes for confirmation (engulfing candles, bullish BOS, or SFPs) before entering long.

ETH Summer BearishA potential path for ETH before resuming a bullish major trend, is drawn with a purple arrow.

I don't think the FED will cut rates today. In fact, maybe in September. Maybe. If the FED cut rates, then the target scenario (green box in the chart) would not play out, we would shift to a bullish movement. I wish for that, but I don't think is near yet.

That being said, the current potential risk, I calculated it to -30% from current levels. Exact prices are impossible to predict, rather I focus on target areas.

DISCLAIMER:

Do Your Own Research, don't use mine to invest! This is not a financial advice, it is only a mere opinion of mine. I own several cryptocurrencies, including ETH.

ETH (Ethereum)–High-Risk, High-Reward Setup Near Fair Value GapEthereum is showing early bullish signals within a broader downtrend, and a pullback toward the $1,700 zone—where it meets the underside fair value gap and 21-day moving average—may set the stage for a higher low and potential trend reversal.

🔹 Entry Zone:

$1,700

🎯 Take Profit Levels:

🥇 $2,000

🥈 $2,200

🥉 $2,400

🛑 Stop Loss:

$1,550 (below structure and invalidation point)

ETH/USDT – Weekly Chart AnalysisETH/USDT Unique Technical Structure: Large Accumulation + Recovery Setup

This chart shows Ethereum’s price action over the past few years, highlighting key support and resistance areas. A strong visual signal (blue arrow) indicates bullish potential.

Chart Pattern Implications:

The pattern on this chart is not a classical shape (e.g., cup and handle), but it does show a Wyckoff-style accumulation phase followed by a failed breakout and reaccumulation:

Strong base formed between $1,000-$1,400

A series of lower highs and a range-bound structure after the 2022 peak

The bullish projection illustrated by the arrows shows a potential recovery towards the ATH again

This setup suggests that Ethereum is at a critical juncture – either:

It retests current support and begins a new uptrend.

Or it risks another test of the $1,400-$1,050 range before a breakout.

Risk-Reward: Current levels ($1,796) offer attractive long-term entries if you’re bullish.

Caution Zone: If ETH breaks below $1,400 with volume, $1,050 becomes the next key defense.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

ETHEREUM: Will Go Up! Long!

My dear friends,

Today we will analyse ETHEREUM together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1801$ Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 1810$ Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

AI Prediction ETH/USD for 24 hour! Intraday trading!May 5, 2025 6:36 pm. ETH/USD. ETH/USD Trading Plan

Long Scenario

- Entry: $1,815 (confirmed by Supertrend long + RSI rising above 40).

- Stop-Loss (SL): $1,790 (below $1,800 support).

- Take-Profit (TP): $1,840 (below $1,850 resistance).

- Trailing Stop: 13 points (2x ATR).

Short Scenario

- Entry: $1,795 (confirmed by breakdown below $1,800 + MACD bearish crossover).

- Stop-Loss (SL): $1,820 (above $1,810–$1,820 resistance).

- Take-Profit (TP): $1,750 (above $1,780 support).

- Trailing Stop: 13 points (2x ATR).

BTC (Post Weekly Close Update)BTC has seen a weekly close above the 93700 support, suggesting bullish strength and likely continuation if this level holds on the weekly. We remain bullish as long as 93700 is maintained; a drop below it would be the first SOW on the HTF, potentially targeting 89K–90K, and possibly 1D OB at 83K–85K. Technically, this remains a LH until the 99500 SH is convincingly reclaimed, ideally on a weekly close.

On the daily, however, we’ve observed the first SOW, closing below the SH at 95K after a rejection from the 1D supply zone, refined into MTF HOBs, where whales initially sold off aggressively. This isn’t alarming, but it warrants attention. With the SPX at resistance, the DXY at support, USDT.D closing the weekly well above the SL at 5.03, and TOTAL at resistance, these are signs of caution, in my view, despite the series of bullish news we’ve seen. That said, with the HTF remaining bullish, we’ll focus on exploiting LTF and MTF moves. The FOMC meeting on Wednesday could certainly bring volatility in the markets, particularly as BVOL24H and BVOL7D, as mentioned in the last update, are at support.👀

To further examine the weakness, note the contrast between the two horizontal ranges (grey boxes). The first range saw a BO followed by impulsive PA, smashing through the 90K key level. In contrast, the second range produced a BO but encountered an HTF supply, resulting in a notably weaker bounce compared to the first BO from the lower range. This could potentially manifest as a deviation if the price closes below the RL, making the 8D HOB at 89K–90K our next target.

On the LTF/ MTF, we’ve also seen a break below the TL, with the other resistance TL being respected, indicating further weakness. Although we haven’t yet seen HTF weakness, I believe a scalp-sized short from the 11H OB, refined into a 2H HOB at 95500 SH, makes sense with a tight invalidation, or from the MTF level around 97500, if provided. If the daily closes above 95500 again, I might consider a scalp long into the 1D supply for a potential DT or even the 100K psychological level.