ETH/BTC Golden Cross Ignites

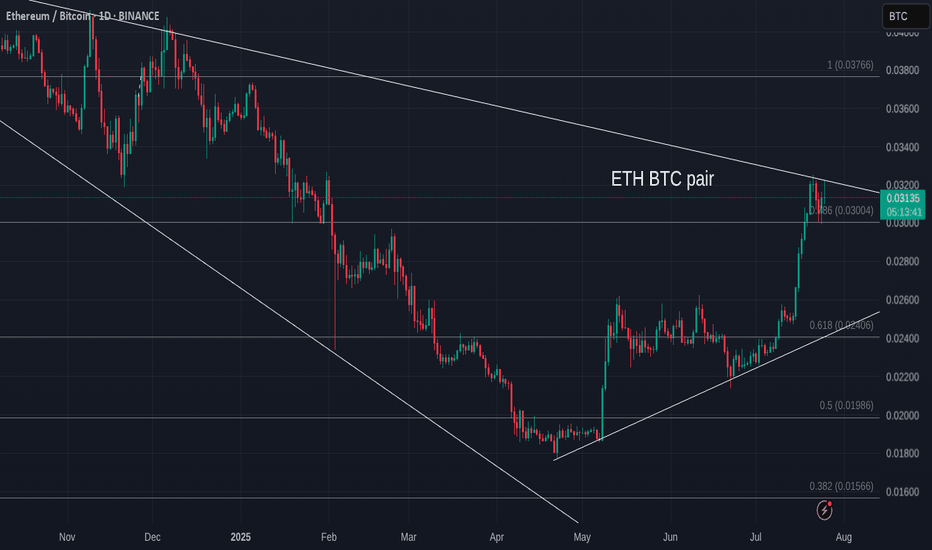

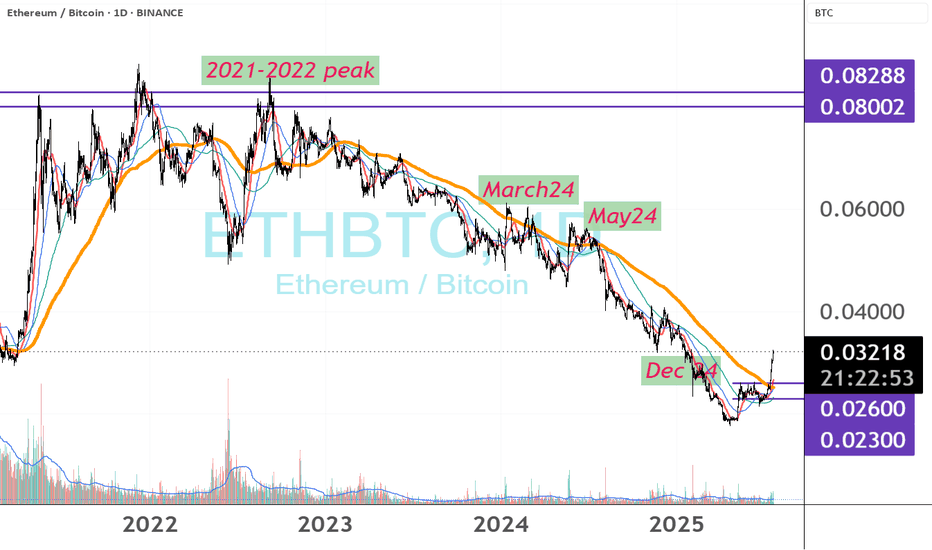

This is ETH/BTC on the daily chart.

The golden cross is now confirmed: 50MA has officially crossed above the 200MA.

Price reacted immediately, jumping straight to the 0.786 Fib level at 0.0347 a key resistance.

This confirms the bullish structure we’ve been tracking:

– Golden cross ✅

– Breakout above 200MA ✅

– Push into major resistance ✅

Now all eyes are on the 0.0347 zone.

If price can flip it into support, momentum could accelerate quickly.

Always take profits and manage risk.

Interaction is welcome.

ETHBTC

ETH/BTC: Golden Cross Reloaded?This is ETH/BTC on the daily chart.

A major event is about to unfold: the golden cross, where the 50MA crosses above the 200MA.

The last time this happened was in early 2020, around the same price zone, right after a bounce off the 2019 low double bottom and a rejection from the 0.5 Fib level, which sits halfway between the 2019 low and the 0.786 Fib.

In 2025, we’re seeing a strikingly similar pattern:

– Price bounced off the 2019 low

– Got rejected again from the 0.5 level

– And now appears to be gathering strength to flip that level and the 200MA to confirm the Golden Cross

Always take profits and manage risk.

Interaction is welcome.

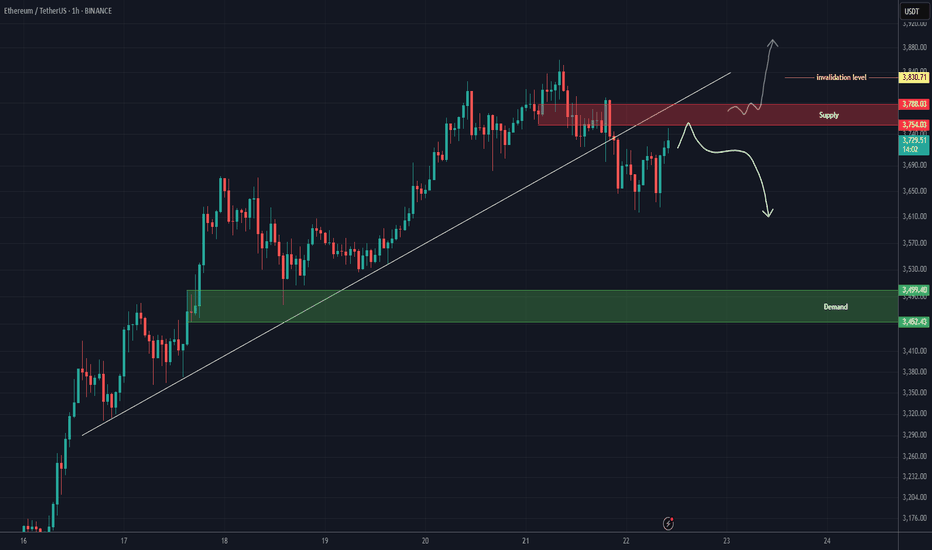

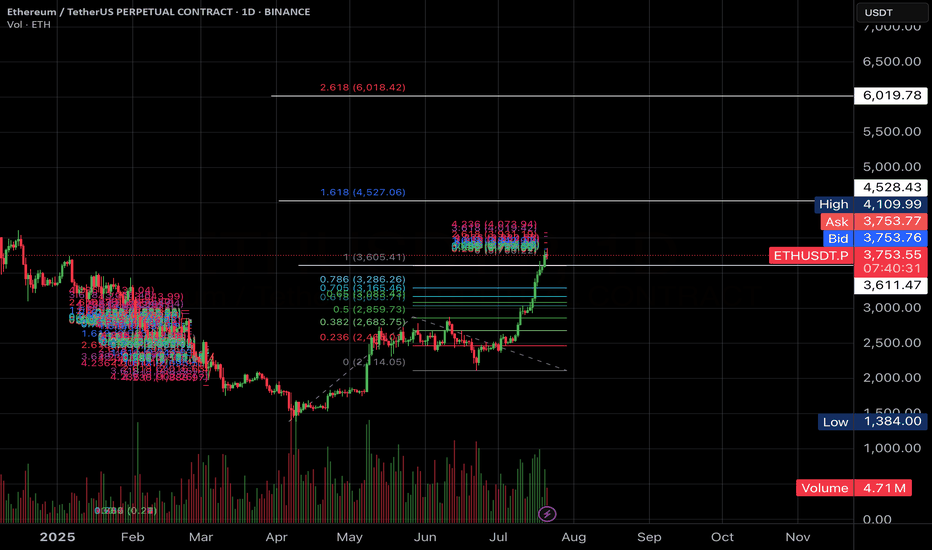

ETH at Critical Resistance + Liquidation Zone | Time to Short?Today I want to analyze Ethereum ( BINANCE:ETHUSDT ) on the 1-hour time frame . Is there a short position opportunity?

Please stay with me.

Ethereum is currently trading near a Heavy Resistance zone($4,390-$3,950) , Cumulative Short Liquidation Leverage($3,983-$3,878) and the $4,000 ( round number ). $4,000 could be a psychological number to sell .

In terms of Elliott Wave theory , Ethereum appears to have completed the main wave 3 at $3,860 and is currently completing the main wave 4 . The main wave 4 could have a Double Three Correction(WXY) or Expanding Flat(ABC/3-3-5) , with the Expanding Flat structure being more likely .

One of the reasons why shorting Ethereum could be better than shorting Bitcoin right now is that ETHBTC ( BINANCE:ETHBTC ) is currently trading above the ascending channel and is likely to correct to Fibonacci levels .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect Ethereum to drop to at least the Potential Reversal Zone(PRZ) and attack the Support lines ( Second target ) .

Cumulative Long Liquidation Leverage: $3,591-$3,543

CME Gap: $3,461-$3,417

Note: Stop Loss: $4,023

Please respect each other's ideas and express them politely if you agree or disagree.

Ethereum Analyze (ETHUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

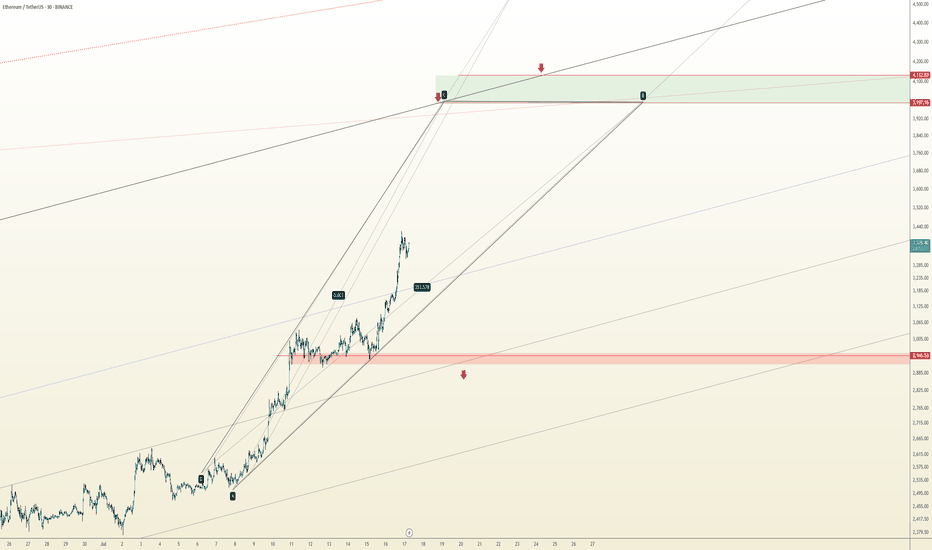

The Loudmouth Pattern: It Yells, We Trade!

On the 30-minute chart, ETH is forming a classic Broadening Formation – or as some traders like to call it, “The Big Mouth Pattern” 😄. It’s noisy, unpredictable at first glance, but when it speaks, you’d better listen.

Right now, price is moving through the bullish leg of this setup, and if momentum holds, we’re eyeing the $4,000 psychological level, followed by the $4,120 – $4,170 supply zone.

🔹 Bullish Scenario (our expected outlook):

🎯 Target 1: $4,000

🟩 Main Resistance: $4,120 – $4,170

❌ Invalidation: Confirmed close below $2,946

If price breaks and holds below that red support zone, this setup gets thrown out the window.

📊 Risk Management:

Scale in on pullbacks – if structure remains valid

No chasing without confirmation

Keep risk under 1% of total capital

📈 The market’s big mouth is open – and until it closes below $2,946, we’re listening for bullish signals. 🤑

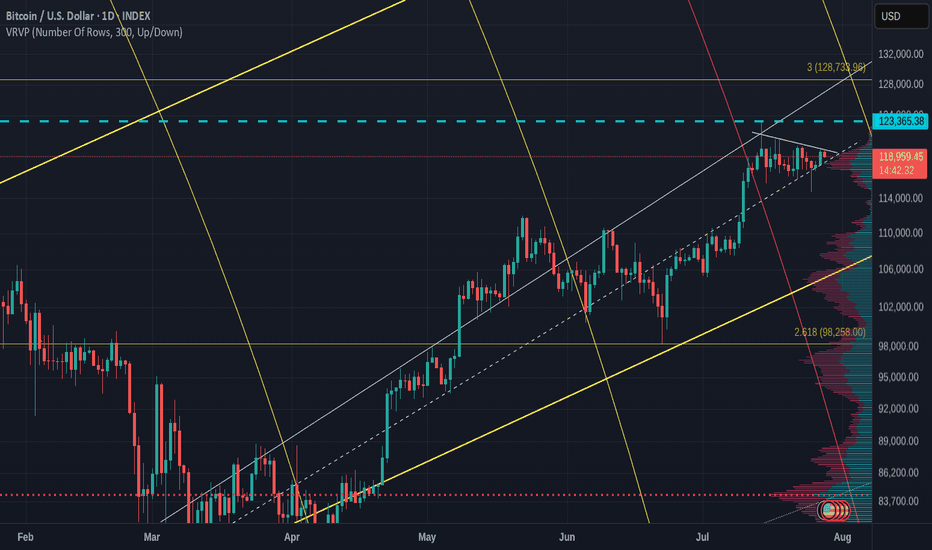

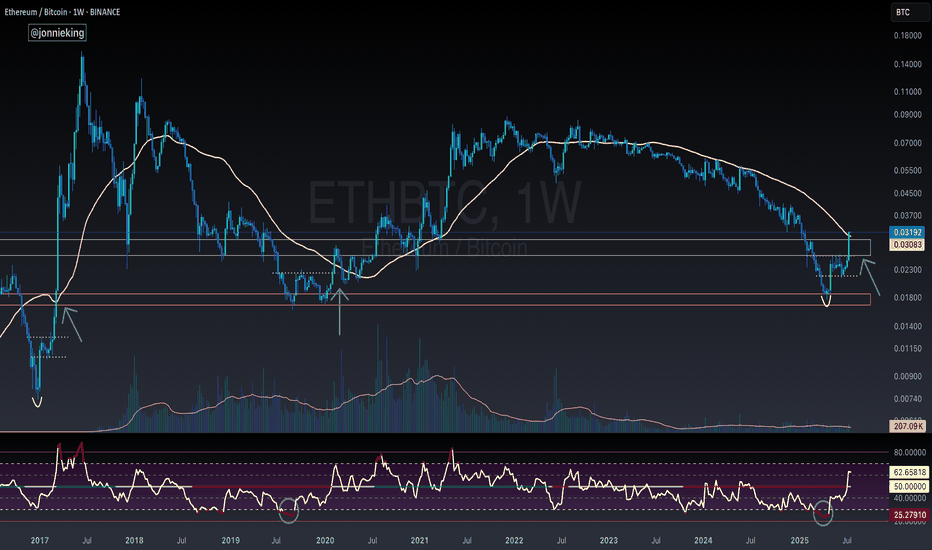

Bitcoin Versus ETH daily charts- one is VERY BULLISH

No Guesses which one.

Bitcoin printing a Bullish pennant on the daily with the Apex late this Wednesday, After the FED tell us what they are doing with interest rates

PA always reacts before the Apex.

ETh on the other hand, is under a Huge area of long therm resistance and running out of steam

If we zoom out to the weekly, we can see how long this line has rejected PA

My money remains in Bitcoin, whihc has also made gains over the weekend.

And is highly likley to remain there

ETH/USDT (Monthly) – Symmetrical Triangle BreakoutPattern & Technical Setup

Ethereum (ETH/USDT) is showing a textbook symmetrical triangle pattern on the monthly chart. The pattern has been developing since the 2021 high, with lower highs converging with higher lows.

The current candle has broken out above the triangle’s upper trendline, suggesting a potential bullish continuation. This breakout is significant given the long consolidation period and strong volume profile near the breakout zone.

Trade Plan

• Entry: Around $4000 on confirmed monthly close above triangle.

• Stop Loss: Below $3,500 (safe side under breakout + previous support).

• Profit Targets:

$4,800 (measured move target based on triangle height)

⸻

Risk & Reward

• Risk: ~17% downside (stop at $2,950)

• Reward: ~253% upside to $4,800

• R/R Ratio: ~14:1 (favorable for swing trade)

Ethereum Bitcoin pair bottom confirmed!As confirmed by CRYPTOCAP:ETH \ CRYPTOCAP:BTC momentum, we can say that a local bottom was seen at 2019 accumulation levels. With a major reversal from the current region, we can see major movements across Altcoins, with Ethereum being an undeniable leading force and leader for altcoins.

ETH Versus BTC - Daily Update - Bitcoin still winning

As mentioned yesterday, ETH has hit long term resistance and got rejected....and it is happening again

ETH seems unable to find the moemntum just yet.

The MACD Daily is still turning Bearish

The Daily RSI is also up high and likely to fall

The weekly RSI is also high though the Weekly MACD has still yet to rise above Neutral

All in All, for me, it is NOT the time....Though we can see that ALTS are running Hot though not a full ALT season as we have seen in the past.

It is fragile...please remain CAUTIOUS

ETH/BTC vs btc dominanceethereum received a reaction as we expected from the current demand zone in the bitcoin pair, and it seems inevitable that the upward momentum from the current area will continue. on the bitcoin dominance side, the same situation exists, but I think we will witness a bearish absolute process.

ETH analysis (1H)A trendline has been broken, and a resistance zone has formed on the chart. As long as Ethereum fails to hold above the red zone, the price may experience a drop.

The green box can be considered the target.

If the price stabilizes above the red zone and a daily candle closes above the invalidation level, this analysis will be invalidated.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Ethereum vs SolanaIn 2025, the competition between Ethereum and Solana is no longer just a rivalry — it’s a pivotal chapter in blockchain evolution.

We are witnessing a clash of two philosophies:

Ethereum — maturity, security, and deep ecosystem

vs.

Solana — speed, efficiency, and adaptability.

📈 Price Resilience vs. Market Legacy

While Ethereum still holds the crown in market cap and institutional trust, Solana is rewriting the rules with superior transaction speed and cost-effectiveness.

The question is no longer "Who is better?"

It’s "Who is evolving faster?"

⚡ Key Drivers Shaping the Ethereum-Solana Rivalry

1️⃣ Scalability vs. Stability

Solana leads with up to 65,000 TPS, attracting high-frequency traders, NFT creators, and DeFi innovators.

Ethereum, relying on its Layer-2 solutions, tries to balance security with scalability.

2️⃣ Institutional Shifts

Funds like Galaxy Digital and Ark Invest are reallocating capital towards Solana, betting on efficiency and growth.

Ethereum, meanwhile, is waiting on ETF approvals to regain momentum.

3️⃣ Technological Innovation

Ethereum focuses on sharding and Layer-2 expansion.

Solana pushes aggressive ecosystem growth but pays the price with occasional network instability.

📊 Market Performance Snapshot — 2025

Ethereum: ▼ 56% YTD | ~$1,600

Solana: ▼ 40% YTD | ~$135

Solana’s DEX market share jumped to 39.6% in Q1, driven by meme coins and retail traders.

Ethereum’s dominance continues to erode under macro pressures and rising competition.

But don’t be fooled — Ethereum's foundation remains strong. Institutional adoption and infrastructure upgrades still offer potential for a rebound.

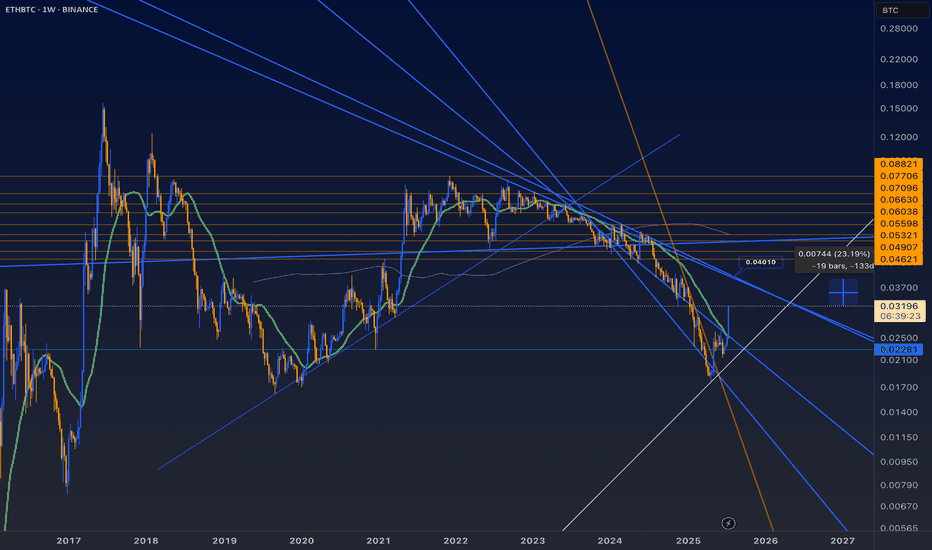

📉 ETH/BTC Looks Like a Meme

ETH/BTC:

SOL/BTC: Potential -50% in next 160 weeks ➡️

ETH/SOL:

⚡ Where Did the Liquidity Go?

The real question isn’t why ETH is dropping —

It’s why no one cares.

Layer 2 solutions — Arbitrum, Optimism, Base — have drained liquidity from Ethereum’s mainnet.

DeFi activity? → Migrated to L2

Users? → Choosing lower fees and speed

Ethereum L1? → A blockchain for whales and archives

No liquidity = No rally

No narrative = No attention

Funds are betting on Solana and L2, not Ethereum’s base layer.

🎯 When Could ETH Take Off?

Only if we see:

A strong “Liquidity Returns to L1” narrative (RWA could be a trigger)

Spot ETH ETFs launching with institutional accumulation

A new DeFi wave on L1 (unlikely with current gas fees)

Or simply — when the market decides to pump forgotten assets

For now, Ethereum is about patience.

Smart money is flowing into L2, Solana, and high-risk narratives.

🕒 But Time Will Tell...

Today, we debate ETH vs. SOL.

Tomorrow — the bull market ends, and we’ll be discussing entirely different narratives.

Are you SOL or ETH?

As always, stay one step ahead.

Best regards,

EXCAVO

______________________________

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETHEREUM: THE NEW BOND OF THE DIGITAL WORLDPrice isn’t the goal. Price is the side effect.

Meanwhile, BlackRock - a black hole with a trust-backed logo - just absorbed 42,000 ETH more.

Yesterday, you may have read this "regular" headline:

BlackRock increases its Ethereum exposure to $4 billion, adding $109.5 million via ETFs.

But here’s what you missed: there are no random numbers on the market.

When a player like this moves - it’s not hype. It’s a blueprint for the future.

Ethereum is no longer an altcoin.

It’s no longer speculation. It’s a financial infrastructure, already recognized by law, exchanges, and institutions.

What does this mean?

💡 Ethereum is now a digital bond - with yield flowing from blocks.

Profit is no longer built on promises, but on the structure of the chain itself.

Trust lies not in faces, but in code.

Growth is not artificial — it’s architectural.

And here’s why this is terrifyingly beautiful:

While you sleep, they are building an era.

Each ETF purchase removes ETH from circulation - permanently. Because:

✅ This ETH is gone from the open market

✅ It won’t be panic-sold

✅ It becomes income-bearing collateral, not a speculative asset

Still waiting for an entry signal?

The big players are already in.

This is no longer crypto - this is cash flow infrastructure, embedded into the digital economy.

And when pension funds, insurers, and sovereign investors move into Ethereum - they will come via ETFs.

Not because it’s trendy, but because it’s regulated, stable, and profitable.

📉 When institutional demand meets vanishing supply - the price won’t simply rise. It will explode, not as growth, but as a structural liquidity shift.

Ethereum is:

💸 Staking = passive yield

🔗 Backbone of DeFi

🖼 Fuel for NFTs

⚙️ Millions of transactions per second

⚖️ A regulated ETF asset

This is the new digital bond system, where the bet isn’t on the dollar - it’s on ETH as an income-producing asset.

💥 While you're reading this, the game is already on.

ETFs are rewriting the rules of time-ownership.

No hype. Just filings. Just intention.

Best regards EXCAVO

ETHBTC , what if?ETH/BTC has just pushed above 0.026 on the 200‑day MA, indicating ETH’s relative strength against BTC, despite ETH still trading under $4,000.

Unlike the $4,000 rallies in March, May and December 2024—when ETH/BTC never truly broke out—this move shows genuine outperformance.

If Bitcoin holds at about $120K, revisiting the 2021–22 ETH/BTC high would put ETH near $9.6K.

Historical peaks for reference:

2018: ETH/BTC ≈ 0.12 → ETH ≈ $14,400

2017: ETH/BTC ≈ 0.15 → ETH ≈ $18,000

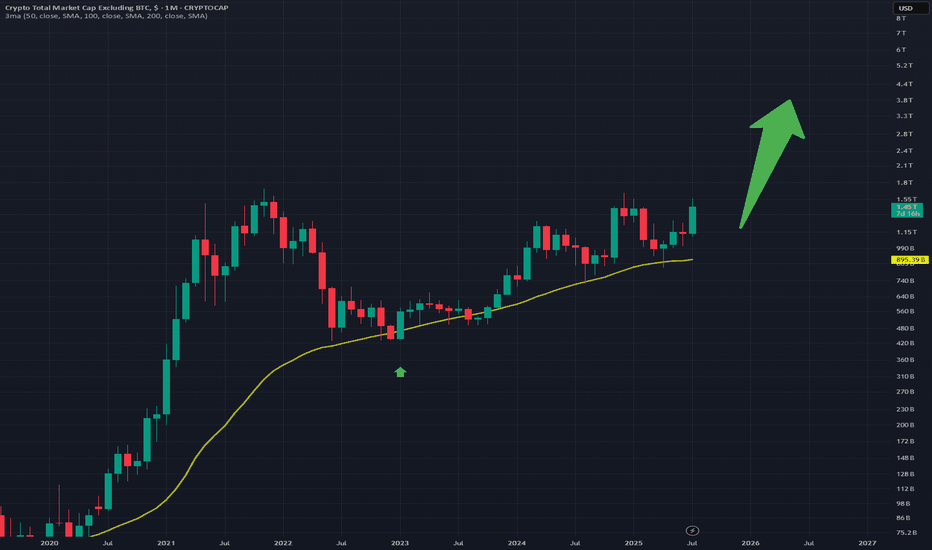

$ETH Closes Above the 50WMA - Alt Season Signal ALT SEASON ALERT 🚨

CRYPTOCAP:ETH Closed the Week ABOVE the 50WMA

Historically this has signaled the start of ALT SEASON.

*NOTE* 2020 had the pandemic hiccup.

This bottoming pattern looks very similar to the 2017 explosion.

Also the RSI matches the 2019 bottom.

Dare I call it yet bros? 🤓

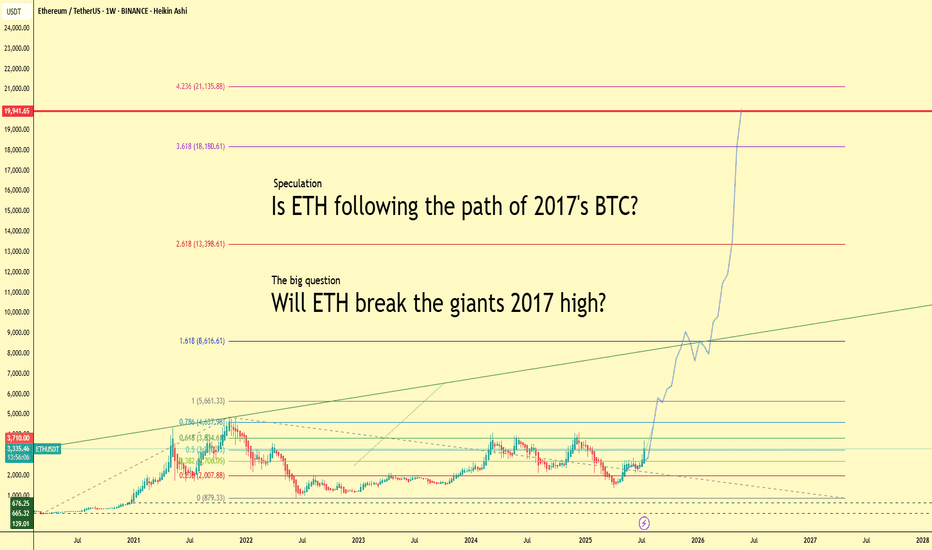

Will ETH Follow BTC’s 2017 Path? $20K in Sight?Ethereum is heating up — up more than 20% this week and currently trading above $3,300. But what if we told you this might just be the beginning?

This chart explores a bold yet exciting speculation:

👉 Is ETH repeating Bitcoin’s legendary 2017 run?

Back then, BTC went from obscurity to global headlines, smashing through $1k, then $5k, then $10k… and eventually peaking just below $20,000. Ethereum might just be lining up for a similar parabolic path.

🚀 Fibonacci Levels Say: Sky’s the Limit

The chart projects Fibonacci extensions up to:

1.618 = $8,600

2.618 = $13,400

3.618 = $18,180

4.236 = $21,135

Notice the key level: $19,941. That’s the legendary BTC high of 2017. Will ETH match or even surpass that milestone?

🧠 The Big Question:

Can ETH become the new “giant”?

While Bitcoin still leads the narrative, Ethereum’s ecosystem, real-world adoption, and institutional attention have never been stronger.

💬 Let’s Talk

Do you believe Ethereum is set to break $20K this cycle? Or is this just hopium and lines? Share your thoughts and let's compare notes.

#Ethereum #ETHUSDT #Crypto #Altseason #BTC2017 #Fibonacci #Bullrun #ETHBreakout #Parabola #CryptoSpeculation

Is Your Altcoin on the Chopping Block?-Update: Originally posted on July 8, 2025… but swiftly vanished into the void by a moderator (rookie mistake—I neglected the sacred posting rules). Turns out, publishing has rules… that I did not interpret accurately?

To my loyal circle of 5 followers: if this feels like déjà vu, my sincerest apologies for the rerun. But with the winds shifting and the drums beating for alts season, I figured it was worth a resurrection.

Let the thrills—and the calls—begin. 🎭📈

Whenever you see “-Update:” that’s the latest as of today — 07/18/25.

Is Your Altcoin on the Chopping Block? 🪓

Brace yourself—this might sting.

Odds are, your favorite altcoin is walking a tightrope. And while I’m not here to spread doom, I am here to give you a wake-up call. Don’t shoot the messenger.

TradingView recently dropped a chart that cuts through the noise: Total3ESBTC.

It’s a ratio of the Total Crypto Market Cap (minus BTC, ETH, and stablecoins) to Bitcoin.

Translation?

👉 A clear, undistorted look at how the altcoin market is actually doing—without ETH clouding the view or stablecoins muddying the waters.

Think of it like night-vision goggles for spotting altcoin strength—or weakness—in the shadows of BTC dominance.

Perfect tool to sniff out market rotation—that sweet spot where Bitcoin hands the baton to alts or rips it back.

So why should you care?

Because the writing's on the wall... and most altcoins might not survive what's coming.

Let’s break it down:

ZOOMED OUT – MONTHLY VIEW 🔭

Before every major altcoin run, there’s always a major low.

You’ll notice three big ones:

🔴 March 2017 (Pink Line)

🟣 Dec 2017 (Purple Line)

🟢 Jan 2021 (Green Line)

Yes, some individual alts have pumped. A few even went full parabolic.

But if altcoins as a whole were ready to fly? They would've taken off already.

-Update: Yes, they finally did it this week… but hold that excitement—there’s more to the story.

Instead, the altcoin ratio broke a critical support (White Line) back in May... and even closed below it. That’s not bullish—it’s a red flag flapping in the wind.

– Update: We just sliced through that white line, but for most alt’s to stay strong, we need a monthly close above it.

Strangely enough (or coincidental, if you believe in coincidences) ...

🗓️ All the major altcoin market highs happened in MAY.

Not once. Not twice. Every. Single. Time.

🔴 May 2017

🟣 May 2018

🟢 May 2021

Call it coincidence. Call it cycle magic.

Maybe it’s a message from the crypto gods—and they don’t whisper for no reason.

So if we just had another May, and the ratio is still sliding with no reversal in sight… ask yourself:

Was that the high?

Or are we still heading toward the low that resets the board?

Here’s the hard pill 💊

If altcoins are ever going to go up again, odds are they’ll need to hit one of these historical lows first.

That’s not a prediction. It’s just how the markets have moved before major alt run.

📉 That means more pain ahead.

We’re talking potential drops of:

🔻 -32% to revisit Dec '17 levels

🔻 -51% to retest Jan '21 lows

🔻 -85% if we go full wipeout to March '17

Harsh? Yeah.

But better you hear it now than wonder “what happened?” when the floor caves in.

The worst part?

Most won’t believe this until it’s already too late.

-Update: Those lows haven’t been tested yet—might be wise to hold off on loading your bags to the brim. Patience pays.

Now here’s the uncomfortable twist:

There’s a legit case to be made that we may never see another “real” alt season again.

Why?

🪙 Liquidity is being siphoned by stablecoins

📈 Speculation is migrating to AI stocks

⚠️ Risk appetite is narrowing

Altcoins used to be the Wild West. Now? They’re the illiquid backyard of a global casino.

BUT… Let’s put on our degen-tinted glasses for a second.

Suppose the Fed hits the panic button:

🛩️ Rates cut

💸 QE returns

🚁 Helicopter money rains from the sky (not that they’d ever do that… right?)

– Update: Crypto Week is announced and broadcasted to the herd.

What happens then?

That’s when this chart—this ugly, broken, bleeding chart—might finally spring back to life.

– Update: Clearing those lows would’ve made this week feel a lot more convincing. But if you’re looking for signs of life—ETH/BTC chart might just be lighting the way. 🚀

Stay Sharp! 🐋R hUNTING!

THIS IS NOT FINANCIAL ADVICE. FOR EDUTAINMENT PUPOSES ONLY.

ETH/BTC - Finally Trend is reversing - After a long time we are finally seeing a change in the trend of ETH/BTC pair.

- Compared to BTC, ETH was underperforming for last couple of years and we are seeing some strength in ETH

- If this trend continue we can finally see some new ATH on ETH

Entry: 0.02633

StopLoss: 0.02125

TP1: 0.02825

TP2: 0.03168

TP3: 0.03592

Don't forget to keep stop loss. Stay tuned for more updates

Cheers

GreenCrypto