🔥 Bitcoin's Moment Of Truth: Will The Bulls Win?Over the course of the last months I've made plenty analyses on the bullish channel that BTC is trading in. As of today, BTC is seemingly making first steps to break out of this channel.

This area will be likely highly contested by bulls and bears. Bears will see a perfect entry for a short, bulls will see a perfect entry to exit (part of) their long position. We're going to need some serious buying volume in order to get through the top resistance of the channel.

In case the bulls will push through, I'd want to see a weekly close above the resistance to confirm the break out. After that, the next major resistance is the all-time high.

Do you think the bulls will win this war? Share your thoughts in the comments 🙏

ETHEREUM-USDT

🔥 Bitcoin Bulls Put Up A Fight: Still Waiting For A DumpYesterday we saw the BTC bulls put up a show with over 5% gains over the course of the day. Personally, I was not expecting such a bullish day to happen anytime soon. Part of the explanation is the oversold RSI on higher time frames for the first time in months, combined with shorts getting liquidated.

For now, I'm still not convinced that the bulls have the overhand in the short-term. A clear rejection from 42,200 indicates that bears are still dominating the short-term. However, if the bulls can pull through we might see a move towards 43,500 or higher.

I stand by my earlier analyses where I discussed my idea of the ETF being a longer-term top. To invalidate that analysis I'd like to see a move above 50k in the next 1-2 months. Personally, I think we're going to see 50k after the halving.

Time will tell.

Bitcoin(BTC): Getting Ready For Another Dump!While Bitcoin had a smaller correction yesterday, it has tested that broken zone as of now (but there has been no significant movement there as of now).

We are still keeping an eye on that potential upper zone to be repaired (which means a breakout from a broken zone).

If everything plays out nicely, we will see a very nice downward movement, for sure!

Swallow Team

After long correction, ETH can bounce of support level to 2345 Hello traders, I want share with you my opinion about Ethereum. Observing the chart, we can see that the price some days ago started to trades inside the range, where it first made a correction to the 2185 support level, which coincided with the buyer zone. After this movement, ETH bounced from this level and rose to the top part of the range, which coincided with the resistance level, but some time later it rebounded and made a correction back to the 2185 support level. Ethereum some time traded near this level and then made a strong upward impulse to 2718 points, thereby breaking the 2425 resistance level and exiting from the range. After this price started to decline in a triangle, where ETH in a short time declined to this level, which coincided with the seller zone. Later price one more time broke this level, thereby exiting from triangle too and decline to support level, and a not long time ago Ethereum bounced and start to move up. In my mind, ETH can make correction to support level again and then continue to grow, therefore I set up my target at the 2345 level. Please share this idea with your friends and click Boost 🚀

HelenP. I Ethereum can fall to trend line and make impulse upHi folks today I'm prepared for you Ethereum analytics. After the price broke some days ago support 2, which is located in the support zone, ETH declined to the trend line. But soon it turned around and made a strong impulse up to support 1, thereby breaking one more time support 2. Later, ETH broke support 1, which coincided with the resistance zone, and rose to 2715 points, after which the price fell to the resistance zone. As well then, the price some time traded near this zone, but a not long time ago it tried to rise higher, but failed and in a short time declined below support 1, breaking this level again. Also soon, the price declined to the trend line, after which it bounced and rose back to the resistance zone, where it continues to trades to this day. For my mind, Ethereum will decline to the trend line and then the price can rebound up higher than it is now one more time. That's why I set my target at the 2575 level. If you like my analytics you may support me with your like/comment ❤️

🔥 Bitcoin's Perfect Storm: Be Watchful Here!As expected, Bitcoin is continueing the bull-trend, fueled by ETF optimism. However, with the whole market turning bullish, I'm taking a step back.

My target for this move from 26k was 48k, as often mentioned in my analyses. It seems a matter of time before 48k will be hit, especially once the ETF actually get approved and traders market buy their way in with >50x leverage.

In my most recent BTC analysis I wrote that I'm edging towards the expectation that the whole ETF approval will be a sell-the-news event. Check it out below.

As BTC moves up, it's going to hit 2 major resistances at the same time.

1: 48.000, which is the main resistance before the ATH.

2: The top of the bullish symmetrical channel.

I would not be buying at this point.

Nevertheless, I'm happy to be proven wrong. Once we confidently break through 50.000 I will switch back to a more bullish oriented market view. For now, I'm sitting on my hands.

🔥 Ethereum's Next Bull-Market Top PredictionIn this analysis I'm going to make an educated guess at ETH's next bull-market top. I'm going to make the assumption that ETH will continue to trade within this rising wedge pattern. Naturally, this prediction will be invalidated once ETH deviates from this pattern.

First of all, the time at which ETH will presumably top will be around the same time that BTC will. Following my very popular BTC top forecast from a while ago, this will be somewhere in October of 2025.

Assuming that ETH will hit the top resistance around that time, a value around 16,000$ is to be expected at that point in time.

Seeing that Q4 of 2025 coincides perfectly with the later stages of the rising wedge, a bearish break out through the wedge's support is to be expected soon after, which will likely kick-off a new bear market.

What's your top prediction? Share your thoughts in the comments 🙏

🔥 Ethereum Highest Value In 1.5 YEARS: Bull-Market Started?Ethereum has managed to break through the main bearish resistance line that has been keeping the price in check for well over a year. With this break out, ETH has broken of the 1.5 years of accumulation and has arguably started a new bull-run.

I'm looking for a longer-term move all the way towards the 3600$ area. This can take a while, so don't see this as a short-term trade.

Now that ETH has also left bearish territory, things are looking very good for crypto.

🔥 Ethereum MASSIVE Bullish Triangle Nearly Broke Out 🚨As seen on the chart, ETH has been trading inside a bullish triangle pattern for over 1.5 years.

In my eyes, a break out from this pattern might result in big gains for ETH, since it will burst through an area full of short-trade stop-losses which will be forced to buy back their positions.

Consequentially, a break out will trigger a long-term trade that I've been looking at for some time. With a stop below the recent swing low and a target around the current ATH, we can construct a very decent long-term trade for this big token.

🔥 Ethereum PERFECT Bull-Flag Break OutIn my most recent ETH analysis I wrote that ETH was likely forming a bull-flag pattern and was going to break out in the near future.

And here we are. A break out, followed by a retest of the top resistance, which is exactly what bulls want to see.

Our entry has been hit and stop moved just below the retested resistance. This constructs a very decent trade with a risk-reward well over 12.

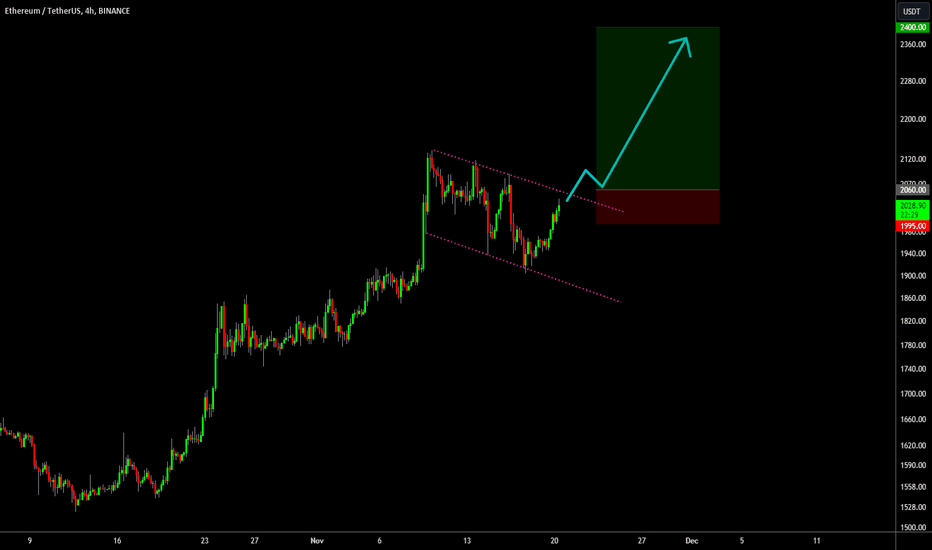

🔥 Ethereum Bull-Flag: Patience For Break OutETH has been consolidating for nearly 10 days now, after a huge move from the 1500's to 2100$.

With the market rallying over the last couple of days, I see a decent probability for ETH to break out of this bull-flag and continue the rise up. Bull-flags are bullish continuation patterns, to bullish price action is the most likely result from this pattern.

Target at 2400$ for the coming weeks.

🔥 The Last Hurdle Before The Bull-Market: EthereumLike most alts, ETH has been seeing very decent gains over the last few weeks. However, ETH has not yet broken out of the bear market range, which is well defined below the purple resistance area.

This resistance area ranges from $2000-$2150. If ETH does not manage to break through this resistance, we can't call the bear market over. On the contrary, if this resistance manages to hold there's a potential for the entire crypto market to fall.

Since the market has shown exceptional strength lately, there's a potential that ETH will break through this resistance. If it does, there's little holding back crypto from starting a new long-term bullish trend.

Keep your eyes focused on this range, since it might prove to be an important one in the near future.

🔥 Ethereum On Key Resistance: Bears Are Watching 🚨In my most recent ETH analysis I took a look at the long-term rising wedge pattern that has been playing out on the ETH chart since early 2017.

I noted that the break out occurred, and could potentially lead to more selling. However, now that I switched to a bullish view of the market (because of the BTC break out), I think it's likely that ETH will go up as well.

However, bears are closely watching this resistance (previous support). If the ETH bears want to push through, now is the time. Once we're above this resistance, we're likely back in full bullish territory.

Bitcoin needs to push through in order for ETH to go up as well. Watch this resistance closely, since I'm expecting a break out rather soon.

🔥 Crypto Will Be Fine - Comparing All Cycles!In this analysis I want to take a look at a very simple, but important chart. We're going to compare previous bull- and bear markets and look at the years after the bear market.

The result is simple, Bitcoin has always recovered and always pumped again after every bear market. In many previous analyses I've noted that 15.500 was the bear market low, so this analysis will most likely hold up.

The future looks bright!

🔥 Ethereum Officially BEARISH: Will The Rest Follow?Ethereum has officially fallen through the last remaining bullish trend line left on the chart. This trend line has emerged at the depth of the June 2022 sell-off, so it's well over a year old and must carry some weight.

In my view, this is the start of a longer bearish period for ETH, potentially even to retest the June 2022 lows around 900$. Wait for the price to break below 1510$.

This bearish move is in line with my overall bearish view on the markets. Pre-halving years are usually half bullish and half bearish, which would indicate that it's the turn of the bears by now.

🔥 WARNING: Ethereum 6-Year Rising Wedge Break Out ConfirmedAs of last week, Ethereum has broken out of a rising wedge pattern which has been formed at the start of 2017, making it the longest pattern that exists on the ETH chart in recent memory.

Seeing that rising wedges are classically bearish reversal patterns, the risk is definitely to the downside. There's a risk that ETH will see more bearish pressure over the next few months.

If BTC were to make a double bottom like last cycle, I assume that ETH will make a lower-low in the yellow area.

Personally, I'm keeping some cash on hand for this very bearish scenario. Will you? Share your thoughts in the comments.

🔥 My BEST-CASE Scenario For Bitcoin's 2025 TopOver the last two bull-runs, Bitcoin has been trading in a relatively predictable pattern. In this analysis I want to take a closer look at this pattern and discuss my BEST-CASE scenario for the next bull-run.

* BTC has been trading within the bullish channel Since July 2017 (more than 6 years). Every time the support was touched it produced a local low, every time the resistance was touched it produced a local top.

* Bitcoin topped (green) between 74 and 78 weeks after the halving (yellow) took place.

Knowing this, we can predict the next Bitcoin top with relative certainty. Naturally, assuming that this pattern will continue to hold.

* The next BTC top will be somewhere between 15 Sept 2025 and 13 Oct 2025, 74 and 78 weeks after the next halving.

* The next BTC top will touch the top resistance of the channel somewhere between 300,000 and 320,000.

An argument can be made that Bitcoin is experiencing diminishing returns over the years, invalidating this analysis. However, the move from (roughly) 3k > 69k is bigger than the move from 15.5k > 320k. The returns are not diminishing as fast as before, but it's still diminished.

Personally, I don't think this outcome is likely. Market conditions have deteriorated significantly with rising interest rates and inflation. Hence I call this my "best-case" scenario. I'd be surprised if the next bull-run will bring us above 150k, but time will tell.

Where and when do you think Bitcoin will top? Share your analyses below.🙏

🔥 Ethereum Head & Shoulders Break Out! Sell-Off IncomingIf you enjoy this analysis, please like and follow.

Just like BTC, ETH has been trading relatively bullish since 2023. However, ETH failed to make new highs in July, unlike BTC, which makes is arguably a lot weaker.

With ETH being the king of the alts, this bearish pattern might signal more pain coming for the altcoins.

I'm anticipating a move towards the November 2022 lows, around 1080. With a stop just above the mosst recent swing high we can construct a very decent short trade with great risk-reward.

Are you bearish on ETH? Share your thoughts🙏

🔥 Bitcoin: Time's Running Out For The BullsIf you enjoy this analysis, please give it a like and a follow.

In this analysis I want to take a look at Bitcoin's chart over the last ~2 years. Note that the top purple resistance of the channel is a direct copy of the bottom support.

Time is running out for the bulls. BTC is just a couple of days away from potentially breaking below the yellow bullish support line which has been providing bullish guidance for all of 2023. Furthermore, the bulls seem to be having a lot of troubles breaking through the top purple resistance.

With the stock market falling, things are starting to look a little bleak for Bitcoin. Then again, we're still above the yellow support, to bulls are technically still in control.

But for how long?

Do you think a dump is imminent? Or are we going back up? Share your thoughts below🙏

🔥 Ethereum Looks Ready To Dump: Bearish Head & ShouldersIf you enjoy this analysis, please give it a like and a follow.

ETH has been trading practically flat since the start of April, well over 4 months at this point. Similar to Bitcoin, ETH is trading alongside a strong diagonal support, keeping the bulls in power.

Looking at the chart, we can spot a classical Head & Shoulders pattern, which often signals an incoming dump. Wait for the price to close the daily (or higher timeframe) candle below the diagonal support (neckline) before considering an entry.

In case of a dump, consider to put your targets around 1620, 1370 or 1150.

🔥 History Predicts BAD Months Ahead For Bitcoin 🚨If you like this analysis, please like and follow to support my work.

In this analysis we're going to take a look at the performance of Bitcoin during the pre-halving year. Specifically, the third quarter (July - September).

As seen on the chart, Bitcoin's performance has ALWAYS been bad in the third quarter. During all three pre-halving years the price dropped over 20% at some point. As of today, BTC is down a little over 4%. A 20% drop from the monthly open would bring Bitcoin back at 25.000$.

Not saying that BTC will fall that much, but that's what historically happened.

What is your view on the third quarter? Going up, going down? Share your thoughts below.

🔥 Bitcoin Break Out! New Yearly Highs Finally Confirmed🚨Over the last few weeks I've made several analyses on BTC where I argued that a break out through 31k was just a matter of time. My previous one below.

With the help of the EU approving a Bitcoin spot ETF and XRP not being a security, alts started pumping and Bitcoin followed suit.

I think that this is the start of a new bullish phase. My target for the 2023 highs are around 39k, which is also the target of this trade.

See below for my view for 2023 overall.

🔥 Bitcoin Finally Breaking Out? Part 2Last week I made an analysis on Bitcoin where I wrote that I was expecting a break out from the range. However, BTC reversed sharply after hitting the ~31.5k resistance. No entry has been made in the previous analysis because we didn't close above the yellow area.

As of now, BTC is seeing another strong influx of buyers. Again, I'm looking at the same structure and hoping for a bullish break out. Close above 31.5k to trigger the signal.

39k is the target because it's around the middle of my Elliot Waves analysis range, see below.