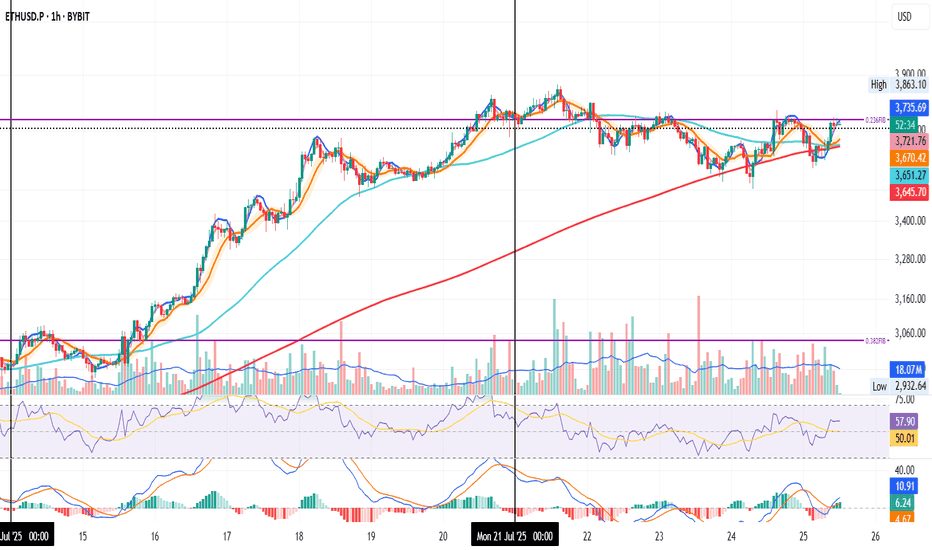

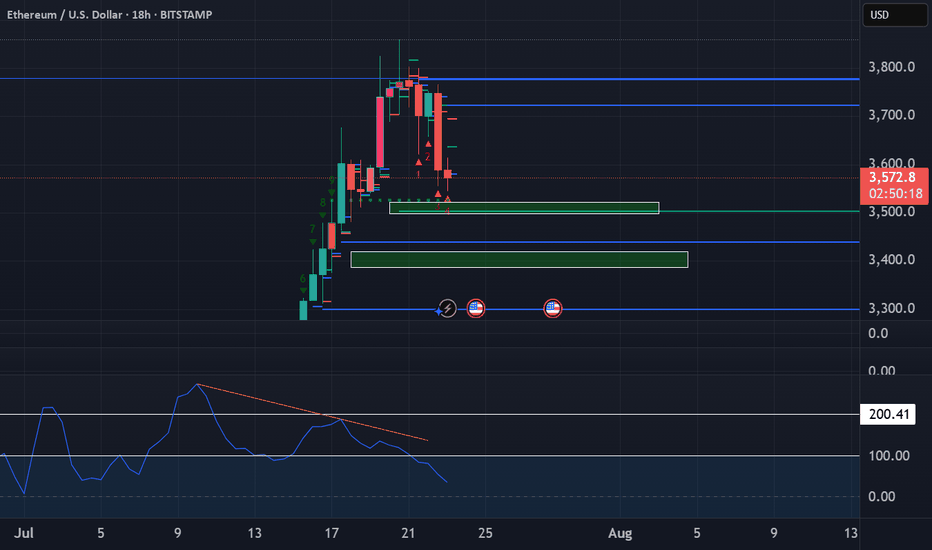

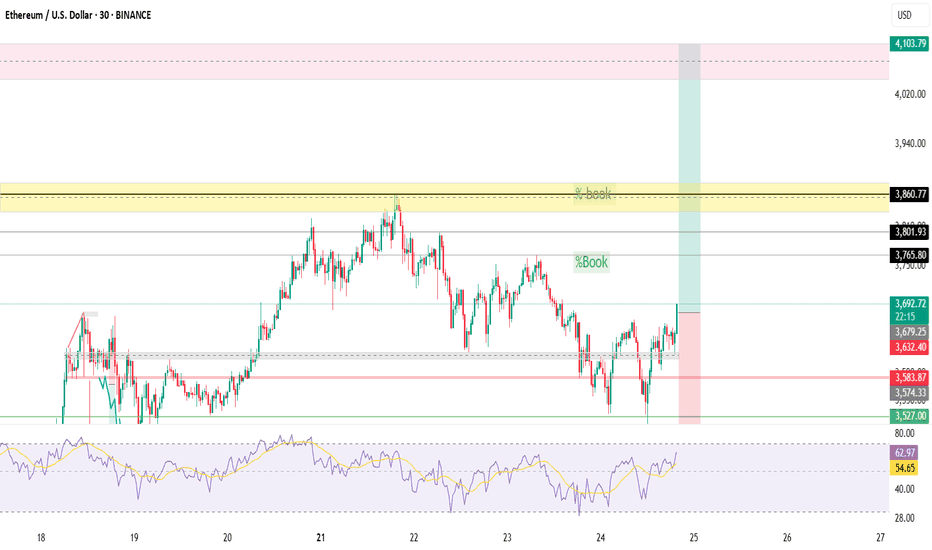

ETH on the 1H

After rejecting the 0.236 Fib level, price found support at the 200MA.

RSI cooled off slightly, giving room for another move before hitting overbought.

MACD just flipped bullish, pushing price higher.

MLR > SMA > BB Center — structure confirms upward momentum.

Now price is back at the Fib level.

It looks fresher than yesterday, but needs clean closes above to build traction for a real breakout.

We’ll be here watching.

Always take profits and manage risk.

Interaction is welcome.

Ethereum (Cryptocurrency)

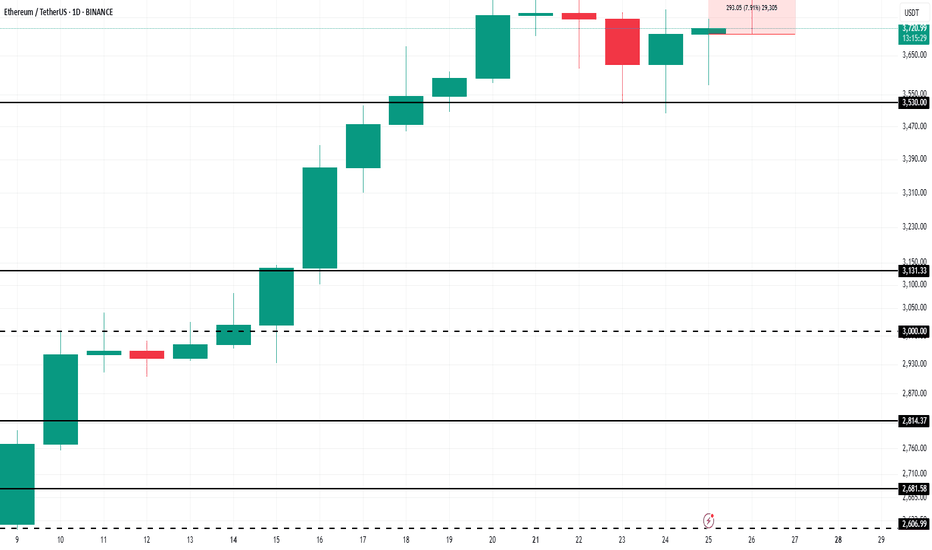

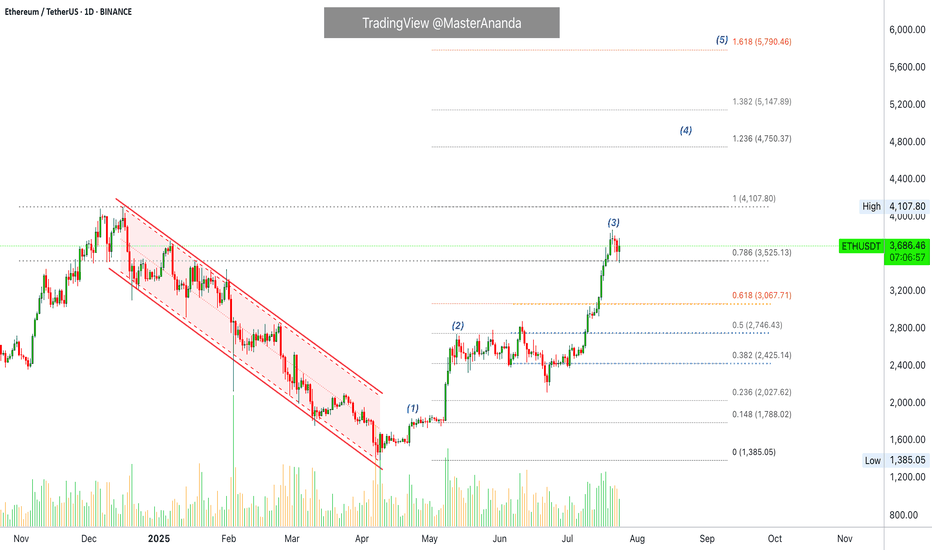

Ethereum’s $4,000 Target Alive as Historic Rally Signs EmergeBINANCE:ETHUSDT is currently trading at $3,680, just 9% away from the critical $4,000 resistance that many investors have been waiting for over the past seven months. The altcoin is expected to continue its upward momentum despite the recent consolidation, with the potential to breach the $4,000 mark soon.

Looking at broader technical indicators, the NUPL (Net Unrealized Profit/Loss) suggests that BINANCE:ETHUSDT is poised for a significant rally . The NUPL indicator, when reaching a threshold of 0.5, traditionally signals a pause in the uptrend, followed by a sharp rally.

$ BINANCE:ETHUSDT is currently nearing this threshold , which, in the past, has marked the beginning of powerful upward price action.

As long as BINANCE:ETHUSDT remains above its key support levels, the price is likely to surge toward $4,000 . If Ethereum can maintain its momentum, a breach of $4,000 could act as a catalyst for further gains.

However, should unforeseen selling pressure arise, $BINANCE:ETHUSDTprice could slip below the $3,530 support level. In such a scenario, Ethereum may fall to $3,131, invalidating the current bullish outlook. The key will be maintaining support and capitalizing on the retail-driven surge.

ETH/BTC vs btc dominanceethereum received a reaction as we expected from the current demand zone in the bitcoin pair, and it seems inevitable that the upward momentum from the current area will continue. on the bitcoin dominance side, the same situation exists, but I think we will witness a bearish absolute process.

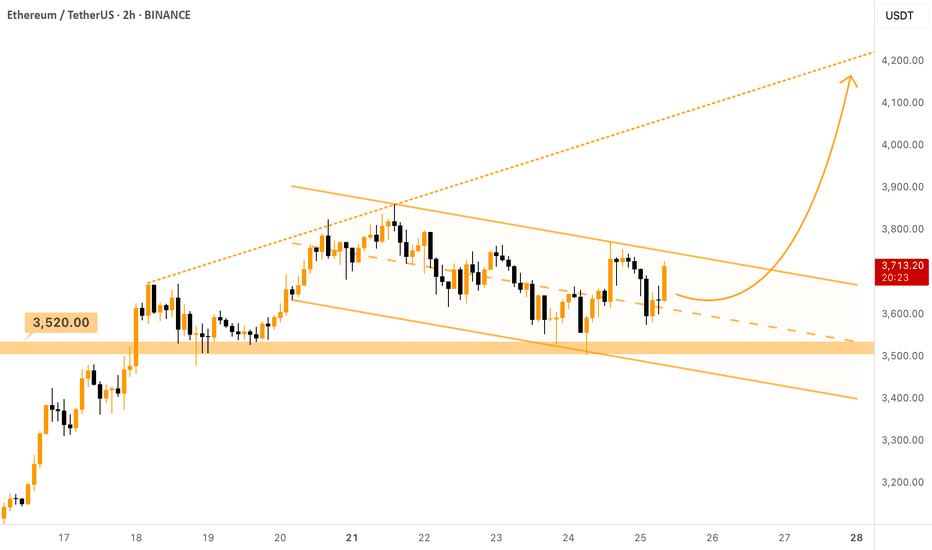

$ETH - Taking Lead Over $BTC (again)Ethereum is strong as ever here. Despite Bitcoin dumped due to the FUD of Galaxy Digital selling CRYPTOCAP:BTC worth of $3.5B, Ethereum managed not stay above the support and even umped!

It is currently forming a Descending Channel (bullish pattern) above the $3520 support level. Local setup. Once this channel is broken upwards, we can expect the price to move towards the ascending resistance that was set a week ago, target is $4100 - $4200 .

You can either enter a trade here or wait for the breakout of the descending channel, the second option is safer.

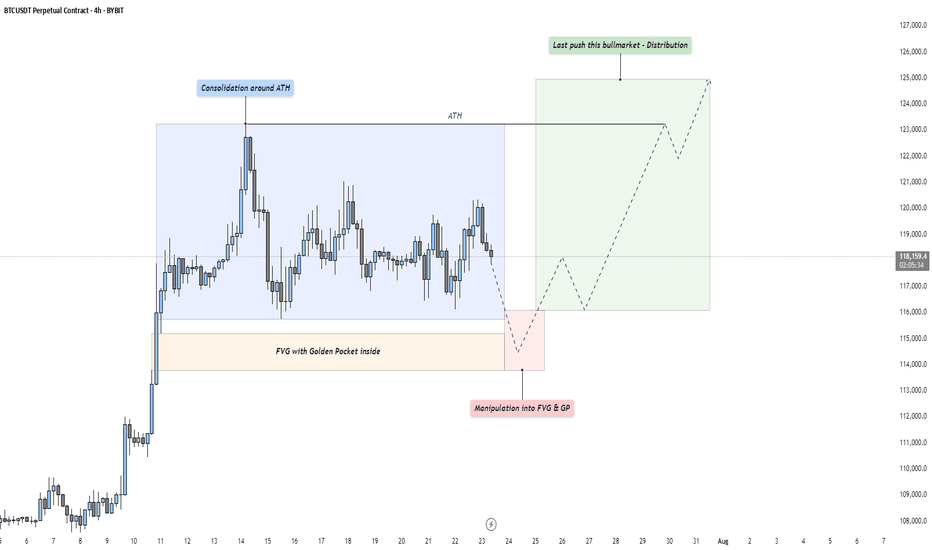

BTC - Last Push: Consolidation, Manipulation & DistributionMarket Context

After a strong upward impulse, Bitcoin has entered a mid-term consolidation phase just below its all-time high. This kind of price action is typical as the market digests recent gains and larger participants prepare for the next move. These pauses in momentum often precede either trend continuation or a reversal — and the structure here suggests we might be witnessing the former, but not without a final shakeout.

Phase 1: Consolidation Around the All-Time High

The first phase is defined by a tight range just beneath the all-time high, where price moves sideways in a balanced struggle between buyers and sellers. This is often where retail participants become overly bullish, anticipating a breakout. However, the lack of a sustained move higher indicates that smart money may be waiting for better entries — or preparing to engineer liquidity to fuel the next move.

Phase 2: Manipulation Into the Fair Value Gap and Golden Pocket

Directly below the range lies a clean Fair Value Gap, with a Golden Pocket retracement nestled inside it. This zone represents a strong area of interest. A sharp move into this area would likely sweep late long positions and trigger stop-losses from range traders — a classic manipulation pattern. This phase serves two purposes: collect liquidity and offer favorable pricing for larger players looking to position themselves before expansion. Watch for signs of absorption or reversal as price enters this zone.

Phase 3: Expansion – The Last Push of the Bull Market?

Following the liquidity sweep and reaction from the Fair Value Gap and Golden Pocket zone, we could see a renewed expansion toward higher highs. This is the phase where volume returns, sentiment shifts, and price accelerates. If this plays out, it could mark the final leg of this bull cycle — potentially driving Bitcoin to new all-time highs with strength.

Execution Thoughts

If you're looking to participate, it's wise to wait for a confirmation signal on a lower timeframe — like the 5-minute or 15-minute chart — once price enters the Fair Value Gap and Golden Pocket zone. Watch for a strong bullish reaction, break of structure, or shift in order flow to signal that buyers are stepping back in.

Final Thoughts

Let the market come to your level and don’t chase moves without context. These three phases — consolidation, manipulation, and expansion — are timeless patterns seen across all markets. Stay patient, stay objective, and react with clarity.

If this breakdown helped you see the setup more clearly, a like would mean a lot — and I’d love to hear your thoughts in the comments! Are you watching the same zone, or do you see something different?

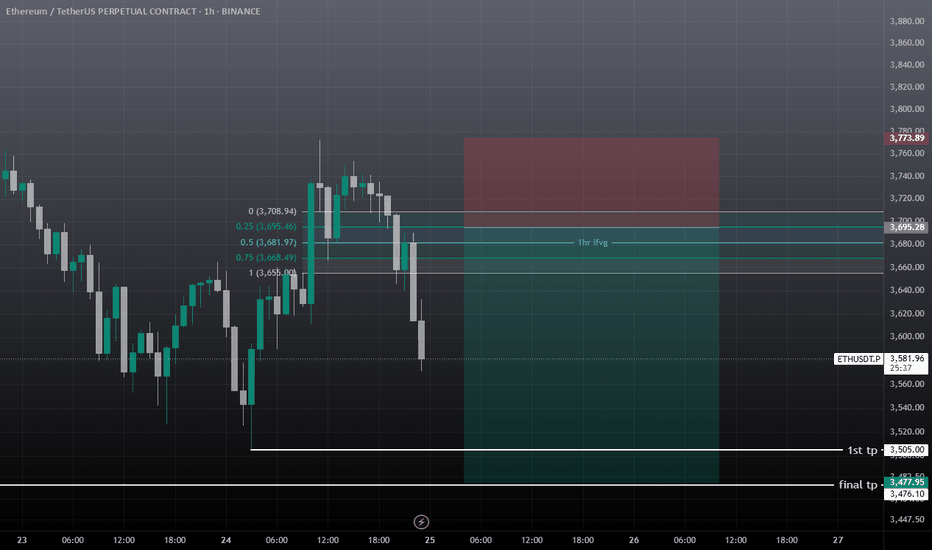

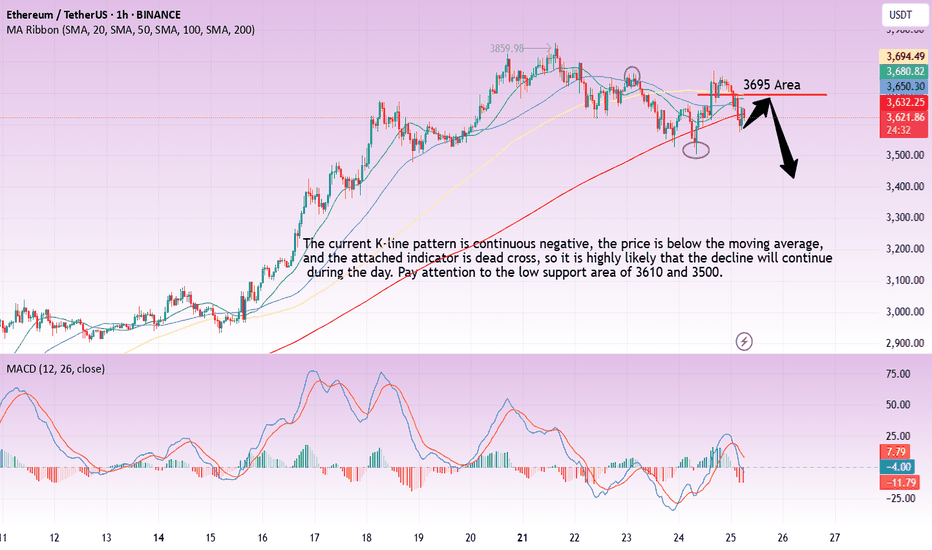

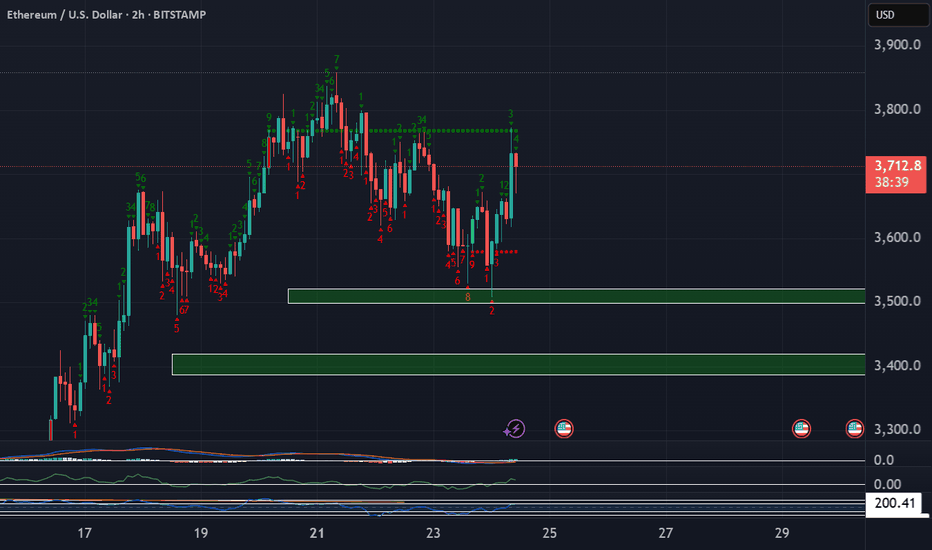

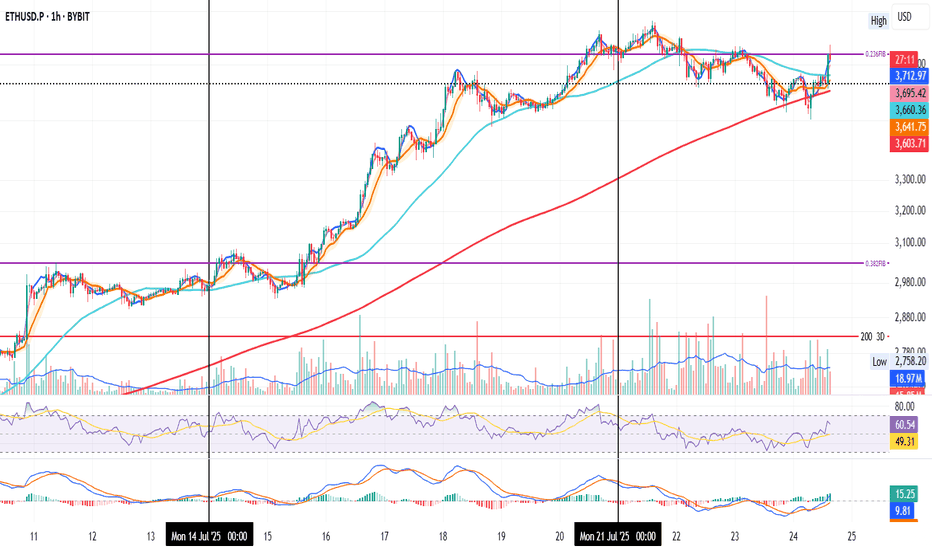

ETH-----Sell around 3690, target 3615 areaTechnical analysis of ETH contract on July 25:

Today, the large-cycle daily level closed with a small positive line yesterday, the K-line pattern was single negative and single positive, the price was at a high level, and the attached indicator was golden cross and running with shrinking volume. From the big trend, the current trend is in a weak trend, the price rebound is not strong and has not continued, the trend is prone to fall under pressure and test the low point downward, so the trend has changed; the short-cycle hourly chart yesterday hit a high in the US market and fell under pressure in the Asian morning. The current K-line pattern is continuous negative, the price is at a low level, and the attached indicator is dead cross running. It is highly likely that the decline will continue during the day. Yesterday's low point of 3500 is the position that needs to be paid attention to today. The current hourly chart resistance is near the 3695 area.

Today's ETH short-term contract trading strategy:

Sell in the 3690 area after the rebound, stop loss in the 3720 area, and target the 3615 area;

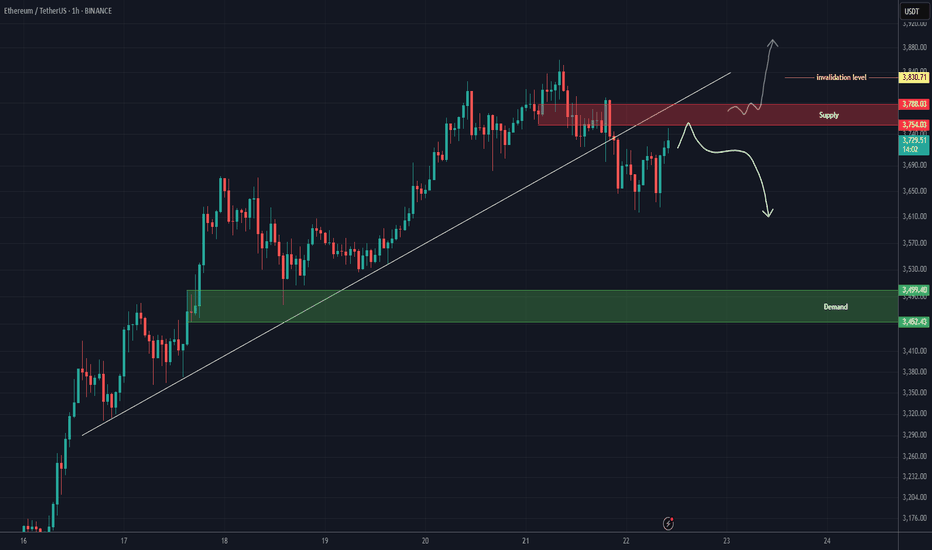

ETH analysis (1H)A trendline has been broken, and a resistance zone has formed on the chart. As long as Ethereum fails to hold above the red zone, the price may experience a drop.

The green box can be considered the target.

If the price stabilizes above the red zone and a daily candle closes above the invalidation level, this analysis will be invalidated.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

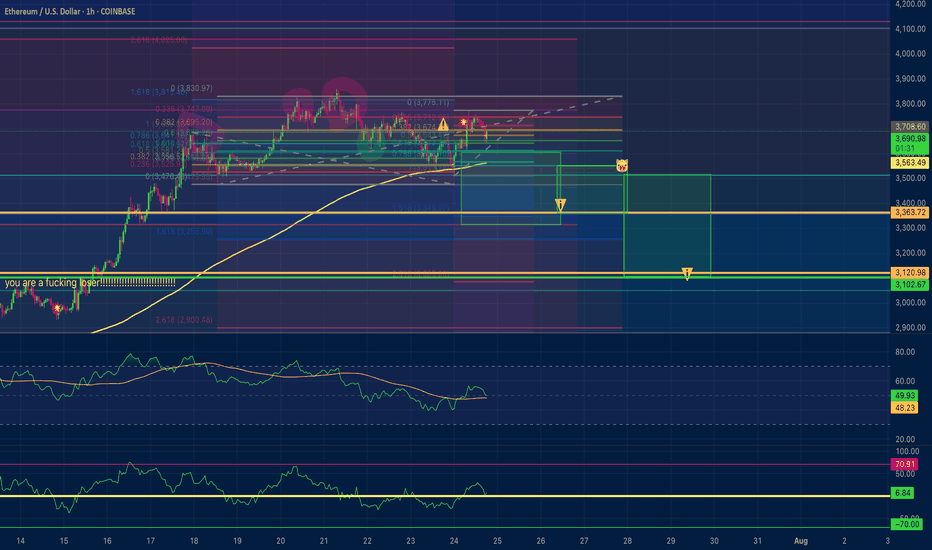

Ethereum Price Target $3,120 by Sunday?Ethereum short position Price Target $3,120 by Sunday ? Negative divergence on the hrly RSI.

Exhausted the 15 minute positive divergence when bouncing off the EMA 200 on the 1 Hour chart. First profit target is $3,350 second is $3,120. I am usually wrong with my estimations... I would recommend the opposite. So go long!

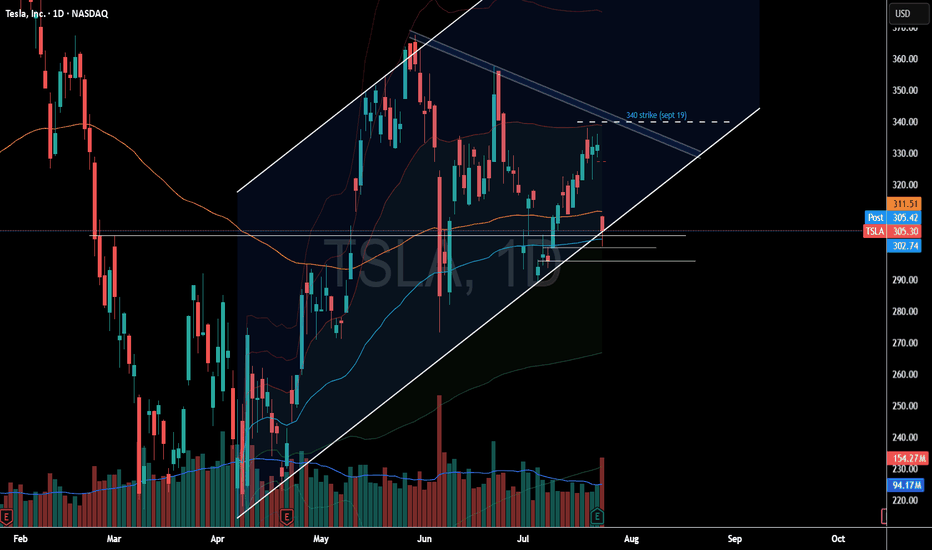

Bitcoin, SPX, Ethereum, Tesla: Whats Next? BTC appears to be showing distribution signs.

I do believe BTC local top is in, but alt coins like Ethereum can still push a bit higher.

Ethereum short around 3900-4000 looks promising

Tesla fell sharply on the back of cash flow burn and expenditures.

Investors are also fearful of sales decline and loss of EV credits.

SPX hit major long term resistance today. Coupling this with a depressed Vix we are likely setting up for a pullback in the market.

Small caps saw distribution today on the back of rising yields. A failed breakout observed on IWM chart.

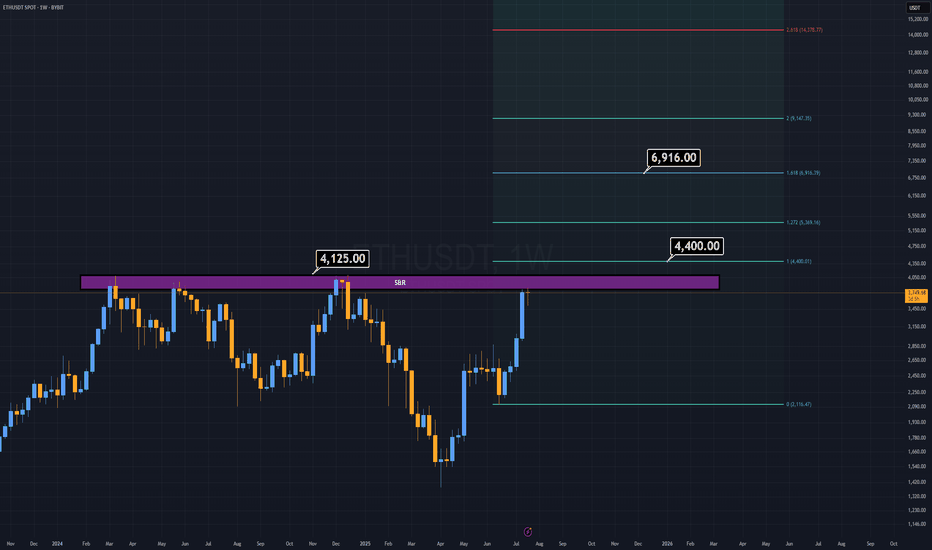

ETH Analysis (1W)Here I am, presenting the asset I personally dislike the most — ETH.

But the chart doesn’t care about feelings. ETH looks ultra bullish, but only if it breaks above the $4,125 level.

Why this level?

The $3,800–$4,100 range has historically acted as a major distribution zone — a place where market participants have consistently taken profit for years.

If this resistance is finally broken, we could see ETH rally toward $6,900 as a minimum target.

This level is based on the breakout projection of the long-standing macro structure.

Honestly, the target looks even better than the asset itself :)

Good Luck.

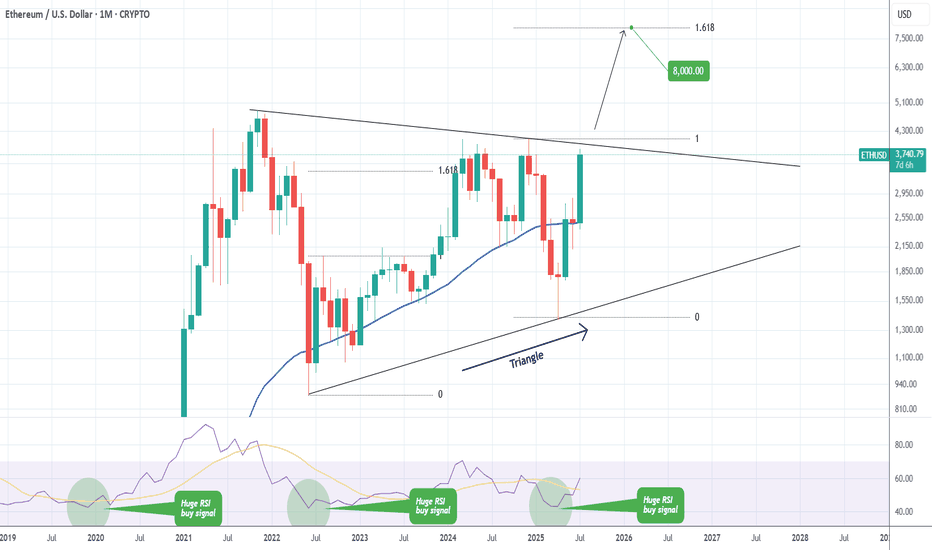

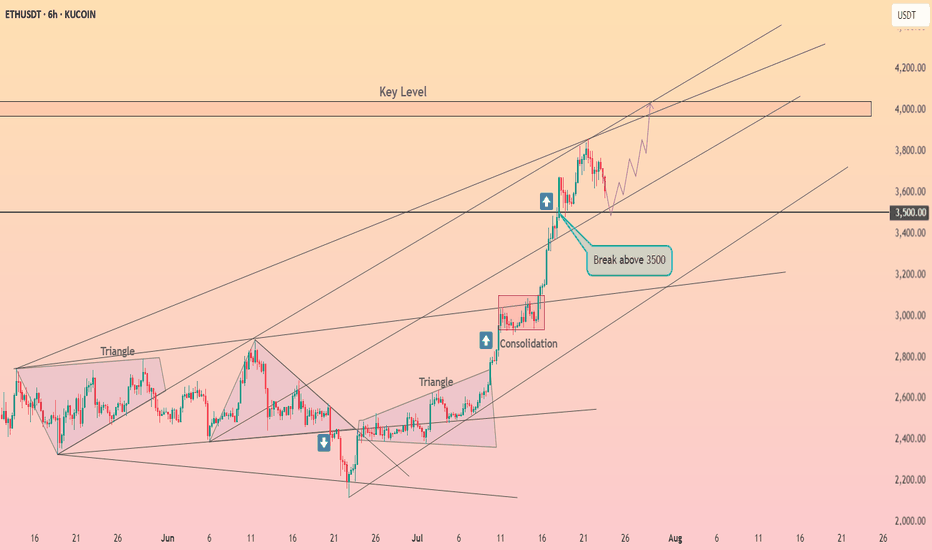

ETHEREUM Massive Triangle break-out ahead??Ethereum (ETHUSD) has been trading within a 4-year Triangle for the entirety of this Cycle. The recent post April rally has been the most aggressive since the parabolic rally that led to the Top of the previous Cycle.

The price is now almost on the top (Lower Highs trend-line) of the Triangle. A break above it, can initiate an aggressive Bullish Leg towards the 1.618 Fibonacci extension ($8000), which was the level that was marginally exceeded during ETH's first rally of this Cycle.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Ethereum vs SolanaIn 2025, the competition between Ethereum and Solana is no longer just a rivalry — it’s a pivotal chapter in blockchain evolution.

We are witnessing a clash of two philosophies:

Ethereum — maturity, security, and deep ecosystem

vs.

Solana — speed, efficiency, and adaptability.

📈 Price Resilience vs. Market Legacy

While Ethereum still holds the crown in market cap and institutional trust, Solana is rewriting the rules with superior transaction speed and cost-effectiveness.

The question is no longer "Who is better?"

It’s "Who is evolving faster?"

⚡ Key Drivers Shaping the Ethereum-Solana Rivalry

1️⃣ Scalability vs. Stability

Solana leads with up to 65,000 TPS, attracting high-frequency traders, NFT creators, and DeFi innovators.

Ethereum, relying on its Layer-2 solutions, tries to balance security with scalability.

2️⃣ Institutional Shifts

Funds like Galaxy Digital and Ark Invest are reallocating capital towards Solana, betting on efficiency and growth.

Ethereum, meanwhile, is waiting on ETF approvals to regain momentum.

3️⃣ Technological Innovation

Ethereum focuses on sharding and Layer-2 expansion.

Solana pushes aggressive ecosystem growth but pays the price with occasional network instability.

📊 Market Performance Snapshot — 2025

Ethereum: ▼ 56% YTD | ~$1,600

Solana: ▼ 40% YTD | ~$135

Solana’s DEX market share jumped to 39.6% in Q1, driven by meme coins and retail traders.

Ethereum’s dominance continues to erode under macro pressures and rising competition.

But don’t be fooled — Ethereum's foundation remains strong. Institutional adoption and infrastructure upgrades still offer potential for a rebound.

📉 ETH/BTC Looks Like a Meme

ETH/BTC:

SOL/BTC: Potential -50% in next 160 weeks ➡️

ETH/SOL:

⚡ Where Did the Liquidity Go?

The real question isn’t why ETH is dropping —

It’s why no one cares.

Layer 2 solutions — Arbitrum, Optimism, Base — have drained liquidity from Ethereum’s mainnet.

DeFi activity? → Migrated to L2

Users? → Choosing lower fees and speed

Ethereum L1? → A blockchain for whales and archives

No liquidity = No rally

No narrative = No attention

Funds are betting on Solana and L2, not Ethereum’s base layer.

🎯 When Could ETH Take Off?

Only if we see:

A strong “Liquidity Returns to L1” narrative (RWA could be a trigger)

Spot ETH ETFs launching with institutional accumulation

A new DeFi wave on L1 (unlikely with current gas fees)

Or simply — when the market decides to pump forgotten assets

For now, Ethereum is about patience.

Smart money is flowing into L2, Solana, and high-risk narratives.

🕒 But Time Will Tell...

Today, we debate ETH vs. SOL.

Tomorrow — the bull market ends, and we’ll be discussing entirely different narratives.

Are you SOL or ETH?

As always, stay one step ahead.

Best regards,

EXCAVO

______________________________

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETHEREUM: THE NEW BOND OF THE DIGITAL WORLDPrice isn’t the goal. Price is the side effect.

Meanwhile, BlackRock - a black hole with a trust-backed logo - just absorbed 42,000 ETH more.

Yesterday, you may have read this "regular" headline:

BlackRock increases its Ethereum exposure to $4 billion, adding $109.5 million via ETFs.

But here’s what you missed: there are no random numbers on the market.

When a player like this moves - it’s not hype. It’s a blueprint for the future.

Ethereum is no longer an altcoin.

It’s no longer speculation. It’s a financial infrastructure, already recognized by law, exchanges, and institutions.

What does this mean?

💡 Ethereum is now a digital bond - with yield flowing from blocks.

Profit is no longer built on promises, but on the structure of the chain itself.

Trust lies not in faces, but in code.

Growth is not artificial — it’s architectural.

And here’s why this is terrifyingly beautiful:

While you sleep, they are building an era.

Each ETF purchase removes ETH from circulation - permanently. Because:

✅ This ETH is gone from the open market

✅ It won’t be panic-sold

✅ It becomes income-bearing collateral, not a speculative asset

Still waiting for an entry signal?

The big players are already in.

This is no longer crypto - this is cash flow infrastructure, embedded into the digital economy.

And when pension funds, insurers, and sovereign investors move into Ethereum - they will come via ETFs.

Not because it’s trendy, but because it’s regulated, stable, and profitable.

📉 When institutional demand meets vanishing supply - the price won’t simply rise. It will explode, not as growth, but as a structural liquidity shift.

Ethereum is:

💸 Staking = passive yield

🔗 Backbone of DeFi

🖼 Fuel for NFTs

⚙️ Millions of transactions per second

⚖️ A regulated ETF asset

This is the new digital bond system, where the bet isn’t on the dollar - it’s on ETH as an income-producing asset.

💥 While you're reading this, the game is already on.

ETFs are rewriting the rules of time-ownership.

No hype. Just filings. Just intention.

Best regards EXCAVO

Ethereum Long These zones are significant because they represent areas where large institutions and professional traders are likely to be active, potentially causing strong price movements when those orders are triggered. We want to enter trades that have minimal drawdown to maximize our buying power.

Huge Bear Trap next in line??Ethereum Exit Queue: 518,180 ETH

Half a million ETH is currently queued for unstaking on Ethereum...

Keep in mind, August 1st, Trump's Reciprocal Tariffs get in effect

Everyone's talking about BTC's new ATH, ETH's rally, XRP new ATH, but no one is talking about August 1st...

Manipulation is taking place. Stay safe, because a huge bear trap might be next in line (BTC back to 90K)

*NOT INVESTMENT ADVICE*

#crypto #ethereum #eth #btc #bitcoin #trading #xrp #trump #tariff #finance #economy

Why Ethereum Will Continue Growing · Trading Above ResistanceEthereum started its latest bullish on the 9th of April. Each advance has been preceded by a period of consolidation.

ETHUSDT (Ether) recovered from its bottom range 23-April, immediately it went sideways for 14 days before moving forward (1). As soon as Ethereum reached $2,700, we have the same pattern but extended, more sideways before moving forward. See this as (2) on the chart. This time the consolidation period lasted 57 days.

The last advance was even stronger (3), Ethereum peaked at $3,860 and we can expect another sideways period, a pause, repeating the same pattern as before. Now, there is an interesting part. The first is a prediction: This consolidation period wont be as long as the second one. The second is related to resistance and support. Notice how ETHUSDT peaked above 0.786 Fib. and this level is being tested as support. The fact that bullish action managed to conquer this level and stop above it, not below, favors the bulls. This means that the market is strong and set to continue growing. There is no significant bearish volume on the red days and the action is neutral so we can expect an advance; the next high will be a new all-time high. We will name it (4) on the chart.

This price pattern should repeat giving us additional growth. After a new all-time high, there will be resistance shy of 6K. And then we expect higher prices with Ethereum peaking around $8,500. Depending on how this level is handled, we can look for $10,000 or even $11,000.

Right now the chart is bullish and points higher.

Continue to hold long-term. It is still too early to fold; it is too early to sell. We are going higher.

Thank you for reading.

Namaste.

ETH 1H — Decision Point Ahead

ETH just confirmed a bullish RSI divergence, with price finding support at the 200MA.

MACD supports the move, and the trend structure is clean: MLR > SMA > BB Center.

Now, price is hovering at the 0.236 Fib level.

A few strong closes above it could open the door for more upside.

If rejected, we might revisit the 200MA for another test.

Either way — we’ll find out soon.

Always take profits and manage risk.

Interaction is welcome.

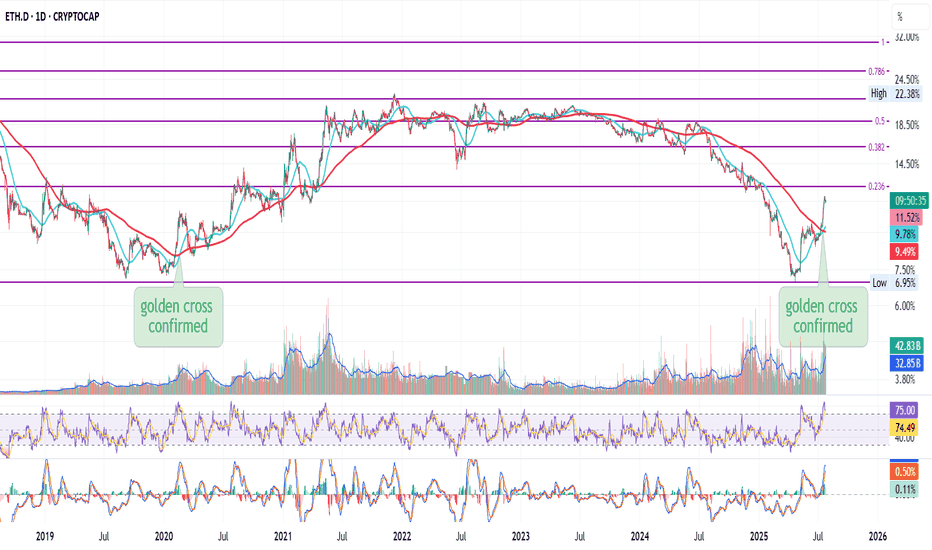

ETH Dominance – Golden Cross, New Era?This is ETH Dominance on the Daily chart.

A golden cross just printed, and the last time we saw this, at similar levels, was February 2020. Back then, dominance climbed steadily, bouncing off the 200MA repeatedly.

Today, price is approaching the 0.236 Fib level, which could act as short-term resistance and send us back to retest the 200MA as support.

But unlike 2020, everything has changed:

– ETH is getting institutional support via ETF flows

– The SEC confirmed ETH is not a security

– The RWA narrative is gaining serious traction

That’s why this golden cross could mean more than just a signal, it may be the start of a much stronger structural uptrend.

My humble guess?

ETH Dominance continues climbing with the 200MA as support.

It won’t be a smooth ride, but the direction might be set.

Always take profits and manage risk.

Interaction is welcome.