Ethereum Surges Past Resistance as Trump Halts Tariff Plans..!🚨 **Market Update** 🚨

President Donald Trump has announced a 90-day pause on the full effect of new tariffs for certain countries, and the markets are reacting strongly! 📈 Both the stock and crypto markets are surging as a result.

Right now, Ethereum is testing the $1600 resistance level on the 1-hour timeframe. 💥 Our trading strategy is to let it break the resistance and sustain above it, then look for a solid entry on the pullback.

Stay tuned and trade wisely! 🚀💰

Ethereumforecast

Ethereum - Short Term Sell Trade Update!!!Hi Traders, on April 8th I shared this idea "Ethereum - Expecting Retraces Before Prior Continuation Lower"

I expected retraces and further continuation lower until the two Fibonacci resistance zones hold. You can read the full post using the link above.

The bearish move delivered, as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Ethereum (ETH) Forecast with NEoWave1M Cash Data Chart

Based on the price size of wave-B, it appears that a flat pattern with a regular wave-B is forming. In this pattern, wave -C typically retraces the entirety of wave -B, though a flat with a C-failure may occur at times.

Our primary scenario suggests that wave -C could conclude within the 1000–1200 range, indicating a flat with a C -failure. However, if the price breaks strongly through the 1000–1200 range and consolidates below this level, wave-C might extend to the 700–807 range.

Just In: $CORE Surges 15% Becoming The Top Performing AltcoinAlbeit the bloodbath besieging the crypto market, one asset stood tall defying market odds surging 15% today with about 86.58% increase in 24 hours volume. "CORE" or Satoshi Core is a L1 blockchain that is compatible with Ethereum Virtual Machine (EVM), therefore it can run Ethereum smart contracts and decentralized applications (dApps).

With increased volatility today, MIL:CORE stood different surging 15%. The asset still has room for a continuation trend as hinted by the RSI at 59.

In the case of cool-off, the 38.2% Fibonacci retracement level is a suitable point for consolidation further selling pressure could push it lower to the 1-month low axis. Similarly, should MIL:CORE break above the 1-month high pivot, the $1 resistant will be feasible, therefore, attainable.

Core Price Live Data

The live Core price today is $0.476759 USD with a 24-hour trading volume of $71,813,902 USD. Core is up 13.98% in the last 24 hours, with a live market cap of $476,107,555 USD. It has a circulating supply of 998,633,921 CORE coins and a max. supply of 2,100,000,000 CORE coins.

$ETH why is it cancelled? Things you porobably need to know.There are several reasons why CRYPTOCAP:ETH is being sidelined—some obvious, others you may not have considered. Here's my analysis.

Let’s be clear: something is wrong in this cycle, and the ETF providers are at the heart of the problem.

The famous line, *"there is no second best"*, rings true—because they ensure no one overshadows their main asset: $BTC.

They’ve already tried to destroy crypto outright—really hard—and failed. The elites are 100% devoted to the USD; it’s their lifeblood. Crypto, especially stablecoins like USDT or USDC, became a competitor, and they did everything possible to wreck the market. When direct attacks didn’t work, they turned to a new strategy: controlling it from the inside.

They embraced crypto, and now they’re making billions off crypto enthusiasts who mistakenly believe these players are here for their benefit. This won’t last forever, but that’s a topic for another day.

Now, let’s address why Ethereum is underperforming—and why it’s likely to continue.

### 1. **Corruption in the Proof-of-Stake System**

All PoS systems rely on staking: the more you stake, the more rewards you earn. Typical staking rewards in crypto average about 10% APR, significantly higher than traditional bank interest rates.

But here’s the catch: these rewards are minted, creating inflation because more coins are constantly being dumped into the market. This results in a class of "retired" investors who stake massive amounts, live off their staking rewards, and sell them without ever touching their capital. This creates constant sell pressure on PoS coins.

The Ethereum Foundation controls how much staking is rewarded. Because it’s run by the same people staking, their vested interest is to keep APRs high, even though this fuels inflation. Ironically, Ethereum’s inflation rivals the USD—a troubling reality for a crypto meant to outperform traditional finance.

### 2. **Ethereum’s Ripple Effect on the Market**

Most altcoins rely on Solidity smart contracts, meaning Ethereum’s performance directly impacts the broader altcoin market. When Ethereum underperforms, it drags down Layer 2 solutions, DeFi projects, and the entire altcoin ecosystem.

Knowing this, why did ETF providers rush to approve ETH ETFs? Simple: *“There is no second best.”*

By taming Ethereum, ETF providers manipulate the market to keep Bitcoin afloat, cancel bear markets, and kill any chance of an altseason. On-chain data shows their strategy: when they buy Bitcoin, they sell Ethereum. This frustrates altcoin holders, pushing them to dump their bags and pivot toward—guess what—Bitcoin.

### 3. **The ETF Trojan Horse**

Ethereum, with its corrupt foundation, is the perfect tool for entities like BlackRock to maintain Bitcoin dominance. By doing so, they effectively prevent bear markets and suppress altseasons.

But this strategy has an endpoint. ETFs will milk the crypto space for as much profit as possible. Once they’ve extracted enough, they’ll dump their holdings, funneling all that capital back into USD. This has been their plan all along.

When that happens, the crypto market—including Bitcoin—will crash. Ethereum’s role has essentially been to funnel cash into Bitcoin, making it easier for institutions to accumulate wealth before transferring it all back into USD.

---

In short, Ethereum is being used as a tool in the ETF providers' larger scheme. It’s not about creating a thriving ecosystem but about maintaining dominance, controlling markets, and ultimately cashing out into the USD.

Ethereum - Expecting Retraces Before Prior Continuation LowerH1 - Bearish trend pattern in the form of lower highs, lower lows structure.

Strong bearish momentum

Lower lows on the moving averages of the MACD indicator.

Expecting retraces and further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

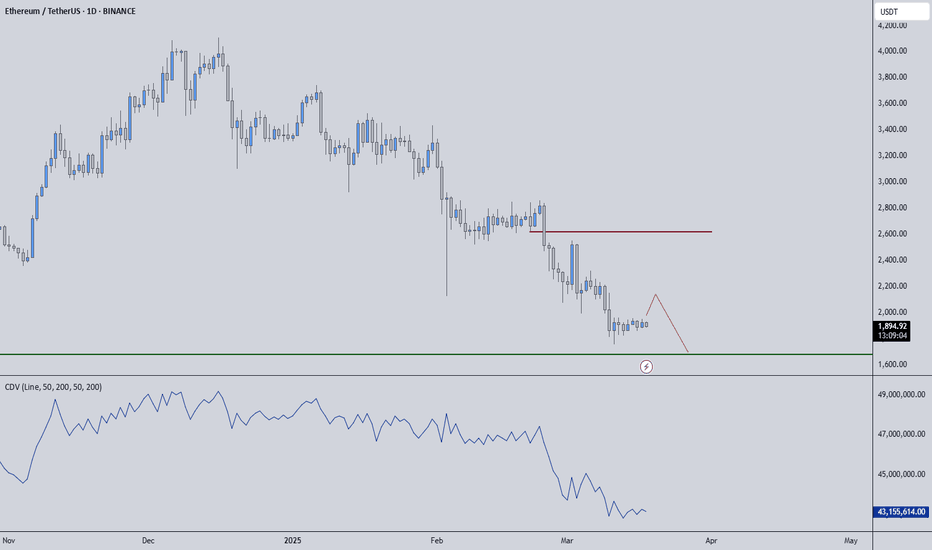

ETHUSDT – Eyes on the Green Line!ETHUSDT – Eyes on the Green Line!

“Momentum is building, and all signs point to the next key level—the green line is in play!”

🔥 Key Insights:

✅ Trend Remains Strong – No reason to fade the move.

✅ Green Line = Next Target – That’s where liquidity & reactions will matter.

✅ Pullbacks = Buying Opportunities – No FOMO, we wait for strategic entries.

💡 The Smart Plan:

Look for Dips to Load Up – Volume & CDV should confirm strength.

LTF Breakouts = Strong Entry Signals – Follow structure, not emotions.

Green Line = First Major Resistance – Expect reactions, manage risk accordingly.

“If momentum holds, Ethereum is headed straight for the green line—watch closely!” 🚀🔥

A tiny part of my runners;

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

ETHEREUM REVERSAL INCOMING !!!!Ethereum formed major bat harmonic pattern and now approaching to it's Potential Reversal Zone. Also with that, it's approaching to it's range low. We can expect sweep of range low, although 1400-1200$ region is strong PRZ after that targets would be straight towards 4500-5000$

Breaking: $PORK Approaching Key Fibonacci Levels for a Breakout PepeFork ($PORK) a memecoin created as a parody to the original CRYPTOCAP:PEPE coin is set to go parabolic amidst breaking out from the 61.5% Fibonacci retracement point, a level holding ground as the support pivot for $PORK.

The asset is trading with moderate momentum as hinted by the RSI at 43. $PORK is nearly approaching the 61.5% Fibonacci point and a bounced from that level would spark a bullish campaign for PepeFork ($PORK).

PepeFork Price Live Data

The live PepeFork price today is $4.75e-8 USD with a 24-hour trading volume of $2,431,278 USD. PepeFork is down 5.17% in the last 24 hours, with a live market cap of $18,706,640 USD. It has a circulating supply of 393,690,000,000,000 PORK coins and a max. supply of 420,690,000,000,000 PORK coins.

Ethereum Is About To Make Move !!!As Per current price action on Ethereum, Two Harmonic Patterns, Bat & Alt. Bat are forming on Ethereum, and right now price is at PRZ of both patterns. If price reclaims range low, then we may probably will see ethereum exploding upto mid range range high and even further beyond forming new ATH.

Why is Eth Falling? ETH/BTC Ratio Hits All-Time Low Since 2020Why is Ethereum Falling? ETH/BTC Ratio Hits All-Time Low Since 2020

The cryptocurrency market is a volatile landscape, constantly shifting and evolving. Recent data has revealed a significant development: the Ethereum to Bitcoin (ETH/BTC) ratio has plummeted to an all-time low since 2020. This stark decline, currently resting at a mere 0.02 has ignited a wave of speculation and concern within the crypto community, raising questions about Ethereum's current standing and future trajectory.

The ETH/BTC ratio serves as a crucial metric for comparing the relative performance of Ethereum against Bitcoin. When the ratio falls, it indicates that Bitcoin is outperforming Ethereum, and conversely, a rising ratio suggests Ethereum's ascendancy. The current dramatic drop highlights a significant divergence in the fortunes of these two leading cryptocurrencies.

The backdrop to this decline is multifaceted. Bitcoin, often seen as the “digital gold” of the crypto world, has exhibited remarkable resilience and strengthened its position. This consolidation is likely driven by several factors, including increased institutional adoption, regulatory clarity in some jurisdictions, and its established reputation as a store of value. These factors have contributed to a sense of stability and confidence in Bitcoin, attracting capital and bolstering its market position.

Ethereum, on the other hand, has faced challenges in maintaining its momentum. While it remains the leading platform for smart contracts and decentralized applications (dApps), it has struggled to keep pace with Bitcoin's surge. Several factors contribute to this relative underperformance.

Firstly, regulatory uncertainty surrounding Ethereum and its classification has cast a shadow over its future prospects. The evolving regulatory landscape, particularly in major economies like the United States, has created a sense of unease among investors. The lack of clear guidelines and the potential for stricter regulations have dampened enthusiasm and limited institutional investment.

Secondly, Ethereum has faced competition from emerging layer-1 blockchains that offer faster transaction speeds and lower fees. These “Ethereum killers,” as they are sometimes called, have attracted developers and users seeking alternatives to Ethereum's perceived limitations. While Ethereum has undergone significant upgrades, such as the transition to proof-of-stake (The Merge), the benefits have not yet translated into a sustained surge in its relative value.

Thirdly, the overall market sentiment has played a role. Bitcoin's narrative as a safe haven and store of value has resonated strongly during periods of economic uncertainty. In contrast, Ethereum, with its focus on innovation and development, is perceived as a riskier asset. When market volatility increases, investors often gravitate towards the perceived safety of Bitcoin.

The decline in the ETH/BTC ratio raises several critical questions. Is Ethereum in trouble? Is this a temporary setback or a sign of a more fundamental shift in the crypto landscape?

While the current situation is concerning, it is essential to consider the long-term potential of Ethereum. Its robust ecosystem, driven by a vibrant community of developers and innovators, remains a significant asset. Ethereum's role in powering decentralized finance (DeFi), non-fungible tokens (NFTs), and other emerging technologies positions it as a crucial player in the future of the internet.

Furthermore, Ethereum's ongoing development efforts, including layer-2 scaling solutions and future upgrades, aim to address its scalability and efficiency challenges. These improvements could potentially revitalize Ethereum's performance and restore its competitive edge.

However, the current market dynamics suggest that Ethereum faces an uphill battle. To regain its footing, it needs to overcome regulatory hurdles, address its scalability issues, and effectively communicate its value proposition to a broader audience.

The cryptocurrency market is notoriously unpredictable, and past performance is not indicative of future results. The ETH/BTC ratio could rebound, or it could continue its downward trajectory. The outcome will depend on a complex interplay of factors, including regulatory developments, technological advancements, and market sentiment.

In the meantime, the low ETH/BTC ratio serves as a stark reminder of the dynamic nature of the cryptocurrency market. It underscores the importance of diversification and the need for investors to consider the risks and potential rewards of each asset carefully.

The current situation also highlights the need for Ethereum developers and community members to focus on the core values of the project, and to continue to innovate and improve the technology. Ultimately, the success of Ethereum will depend on its ability to adapt to the changing landscape and deliver on its promise of a decentralized and equitable future.

In conclusion, while the record low ETH/BTC ratio raises concerns about Ethereum's current standing, it is premature to declare its demise. The cryptocurrency market is constantly evolving, and Ethereum's long-term potential remains significant. However, the current challenges demand a proactive and strategic approach to ensure its continued relevance and success in the years to come.

Ethereum Not Dead- i know some peoples think ETH will go to 250$ or 500$, so wait for it...

- I've always maintained that I'm not a fan of ETH because of its scalability limitations and centralization, for that reason ETH needs some messy L1...L2...etc..

- That said, my opinion doesn’t matter much, ETH is here to stay. The Ethereum ecosystem hosts thousands of projects; I’d say it’s too big to fail.

- i used Bitstamp exchange to look further back in the chart's history.

- i simplified this monthly chart so much that even a 10 year old kid could understand it, just check the RSI low levels and compare it with previous years. Again, check the max RSI level for the previous ATHs.

- i won't discuss where to buy because, whether you get ETH at $1,800 or $1,500, the bull run for ETH and Altcoins hasn't started yet.

Happy Tr4Ding !

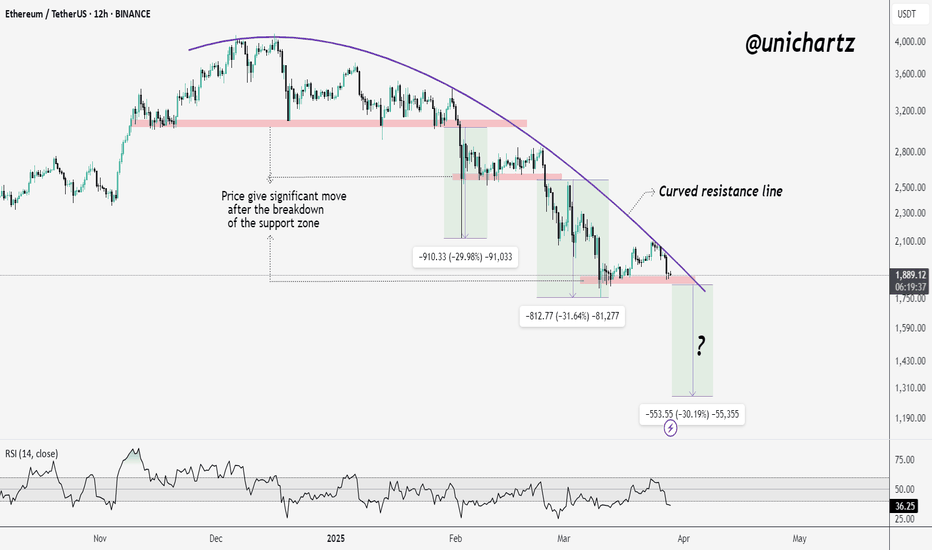

Will Ethereum Survive This Critical Level?Ethereum (ETH/USDT) on the 12-hour timeframe is currently displaying a strong downtrend structure, highlighted by a well-defined rounded top pattern and a descending arc acting as dynamic resistance. Since reaching its peak above $4,000, ETH has consistently printed lower highs and lower lows, respecting this curved resistance line.

The price is currently trading around $1,887, testing a significant horizontal support zone near $1,880–$1,900. This level has held multiple times in the past and now serves as a crucial line in the sand for bulls. If this support fails to hold, Ethereum could see further downside toward the next demand zones around $1,700 or even $1,600.

The RSI indicator stands at 36.11, which suggests that momentum is weak and the asset is nearing oversold territory. While this can often lead to short-term relief bounces, the overall trend remains bearish unless ETH breaks above the descending arc and reclaims key resistance levels near $2,050. A bullish scenario would require strong buying volume and a structure shift to higher highs

ETH Chart - SECRET in the INVERTETH is losing ground quickly after a nasty bearish pattern formed in the weekly.

The bearish M-pattern we're currently observing in the macro timeframe:

We know this is a bearish patter, not only because we've seen it many times before but also because it is the opposite of the W-Bottom. (we can actually confirm this by flipping the chart):

In this case, the bullish confirmation would have been a support retest of the neckline:

And so, if we flip it again back to the original view - the opposite can be true. As we get rejected on the resistance line, an even lower price is likely:

____________________

BINANCE:ETHUSDT

Ethereum ETH Will Crash After Small PumpHello, Skyrexians!

Recently we have already told that potentially BINANCE:ETHUSDT has been finished the correction and is ready to reach $7-10k, but today we recalculated waves and can tell that one more leg down will happen with the high probability.

Let's take a look at the daily chart. Minimum Awesome Oscillator wave tells us that recent dump was only wave 3. Now asset is in wave 4. When AO crosses zero line it means that the min requirement for the wave 4 has been complete. At this point price shall reach the target area at 0.38-0.5 Fibonacci approximately at $2600. There we have to be very careful and if will see the bearish divergent bar the wave 5 will come. The target is $1600.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

ETHUSD – Bullish Quasimodo + iH&S Breakout | Upside Targets!Ethereum (ETHUSD) has completed a textbook bullish Quasimodo pattern in confluence with an Inverse Head & Shoulders (iH&S) on the 15-minute timeframe. Price has broken out with strong bullish momentum, and the structure suggests more upside ahead.

📊 Technical Breakdown

1. Quasimodo Pattern

A well-defined Quasimodo reversal formed at the swing low, providing early signs of a bullish trend shift.

This pattern combines a higher low and reclaimed structure—offering an excellent base for trend continuation.

2. Inverse Head & Shoulders

Left Shoulder, Head, and Right Shoulder clearly structured with neckline breakout confirmed.

Breakout above neckline resulted in a 5.38% rally into minor resistance.

3. Bull Flag Formation

A short consolidation just below the recent highs resembles a bull flag, typically a continuation signal.

Breakout from the flag would trigger the next leg toward the final target.

🎯 Targets

Minimum Target: 2,121.41 — aligns with neckline projection.

Final Target: 2,229.90 — 6.27% projected move based on iH&S measured move.

📌 Trade Idea

Entry Zone: On bull flag breakout above 2,093

Stop Loss: Below 2,060 (flag low support)

TP1: 2,121

TP2: 2,229

🔎 Key Confluences

Pattern Breakouts ✅

Strong Momentum ✅

Clean Structure & Price Geometry ✅

ETH bulls have reclaimed short-term control. If momentum sustains, the upside targets are well within reach.

Breaking: SPX6900 ($SPX) Surged 21% Today The price of SPX6900 ( SP:SPX ) surged Nearly 25% today amidst breakout of a falling wedge.

Created on the Ethereum blockchain, SPX6900 is an advanced blockchain cryptography token coin capable of limitless possibilities and scientific utilization. With a growing momentum and hardworking community the coin seems to be a contender in the incoming bullrun speculated by traders.

As of the time of writing, SP:SPX is up 16.35% trading in tandem with the 1-month high axis. a break above that point could signal a trend continuation to the $0.70 - $0.80 pivot.

Similarly, should SP:SPX cool-off, immediate consolidation point resides in the 38.2% Fibonacci retracement point.

SPX6900 Price Live Data

The live SPX6900 price today is $0.616856 USD with a 24-hour trading volume of $45,031,583 USD. SPX6900 is up 21.61% in the last 24 hours, with a live market cap of $574,288,459 USD. It has a circulating supply of 930,993,090 SPX coins and a max. supply of 1,000,000,000 SPX coins.

$LEASH Set For A Surge Amidst Breaking Out of a Falling Wedge The Price of Doge Killer ($LEASH) is set for a massive surge amidst breaking out of a falling wedge pattern. A pattern formed on the start of January, 2025 that saw $LEASH lose about 33% of value albeit the general crypto landscape was bearish for over 3 weeks now.

We saw CRYPTOCAP:BTC swinging in the $80,000 - $86,000 axis, with CRYPTOCAP:ETH also swinging in the $1900- $2100 pivot. Additionally, should Doge Killer ($LEASH) token break the 1-month high pivot, a bullish continuation move is inevitable.

What Is Doge Killer (LEASH)?

Doge Killer (LEASH) is a token in the Shiba Inu (SHIB) ecosystem. Shiba Inu is commonly referred to as the “Dogecoin (DOGE) killer” because of its enormous popularity. SHIB grew to become the second-largest canine-inspired coin in the crypto space and aims to be the Ethereum (ETH)-based counterpart to Dogecoin’s Scrypt-based mining algorithm. Besides LEASH, there is also Bone ShibaSwap (BONE), another dog coin that is part of the Shiba universe, which can be traded on its own ShibaSwap decentralized exchange (DEX).

Doge Killer Price Live Data

The live Doge Killer price today is $173.74 USD with a 24-hour trading volume of $1,646,362 USD. Doge Killer is up 12.37% in the last 24 hours, with a live market cap of $18,485,943 USD. It has a circulating supply of 106,399 LEASH coins and the max. supply is not available.

Ethereum’s Trendline Support Holds Strong! Time to Long?CRYPTOCAP:ETH is currently testing a key support trendline, which has historically provided strong buying interest. This level has acted as a critical zone for bullish rebounds in previous market cycles.

The 100 EMA (Exponential Moving Average) is positioned above the price, indicating potential resistance on any recovery attempts. If ETH maintains support at this trendline, it could trigger a bounce towards the ATH resistance zone around $4,400.

DYOR, NFA

Please hit the like button and leave a comment!

Breaking: Ethereum Is Good Coin ($EBULL) Surged 66% TodayThe Ethereum is Good coin ($EBULL) a token used as Ethereum's mascot saw a noteworthy uptick in price surging 66% today a move we believe to have been related to the rise in the Ethereum price to reclaim the $2k pivot point.

The $EBULL token recently in the start of year underwent a Community Take Over (CTO) as the community took to their hands to make the project a worthwhile project under the Ethereum network. With backings from Vitalik Buterin and notable crypto exchanges like Poloniex, the $EBULL coin stands to be a coin or token worth hording in your wallet.

Technical Outlook

As of the time of writing, the $EBULL is up 35% trading with a bullish RSI of 71. The surge today was as a result of a breakout from a falling wedge pattern that saw $EBULL tanked to $968k in market cap from a high of $3.4 million just months ago.

$EBULL might encounter a reprieve in the $0.00011 support point before picking momentum up towards recent highs.

ETHEREUM IS GOOD Price Live Data

The live ETHEREUM IS GOOD price today is $0.000122 USD with a 24-hour trading volume of $103,532 USD. ETHEREUM IS GOOD is up 30.72% in the last 24 hours, with a live market cap of $1,215,331 USD. It has a circulating supply of 10,000,000,000 EBULL coins and a max. supply of 10,000,000,000 EBULL coins.