JUST IN: Ethereum ($ETH) reclaims $2,000The price of the first altcoin (I.e alternative coins) Ethereum ( CRYPTOCAP:ETH ) surged 5% to $2030 price levels reclaiminng the $2k price point. Albeit the general crypto landscape is facing consolidation CRYPTOCAP:ETH seems to break the nuance. This move by Ethereum is tandem with the incoming Ethereum upgrades called "Pectra Upgrade""

The Pectra upgrade is bringing faster transactions, lower fees, & better staking to ETH! With account abstraction (EIP-7702) & higher staking limits (EIP-7251), Ethereum is stepping up its game against Solana!

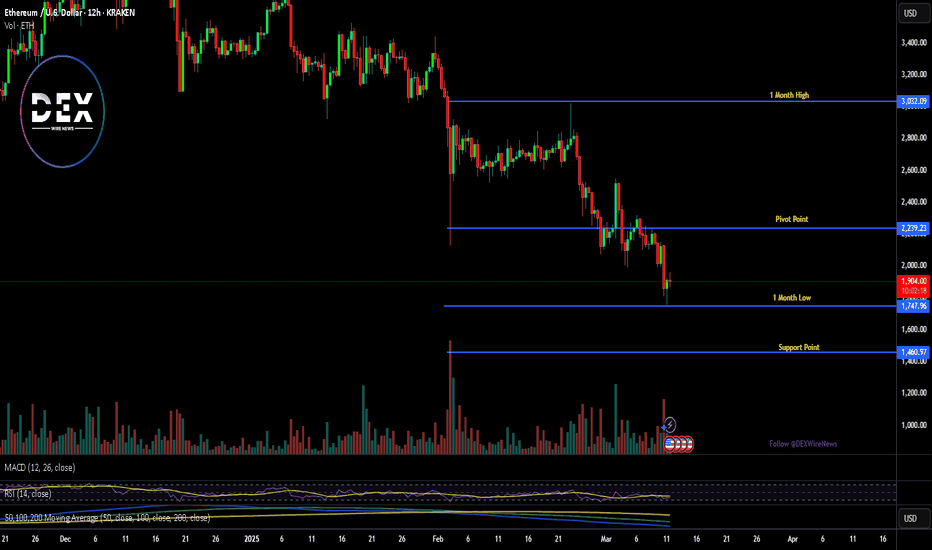

Technical Outlook

As of the time of writing, CRYPTOCAP:ETH is up 5.12% with a bullish Relative strength index (RSI) of 69 hinting at a continuous rising trend. The 38.2% Fibonacci retracement level is serving as pivot point a move to the $2300 zone would catalyse a bullish spree for Ethereum.

Ethereum Price Live Data

The live Ethereum price today is $2,027.90 USD with a 24-hour trading volume of $13,340,876,260 USD. Ethereum is up 7.20% in the last 24 hours. The current CoinMarketCap ranking is #2, with a live market cap of $244,618,878,972 USD. It has a circulating supply of 120,626,703 ETH coins and the max. supply is not available as per data from CMC.

Ethereumforecast

Bullish ETH theories I think this could be a possible scenario for ETH's next breakout. I think it's possible because of the ETH ETFs that will most likely gain some traction over time, and retail will have to play "catch up" due to the price consolidation over these past years. The winds will turn, and I think everything will play out quite quickly when it happens.

I also think the FED will announce the end of QT today at the FOMC, which COULD trigger the next ETH bull run.

Looking at the ETH/BTC chart, I think this will trigger the next leg up and complete the pattern when looking at the weekly chart, testing the previous highs.

When I look at ETH relative to SOL/USD, it also looks bullish in the short term. I think this is quite reliable, but we will see over time. Although I think ETH will outperform both BTC and SOL and play catch-up with them both.

Conclusion: I have deployed most of my crypto portfolio to ETH now, believing ETH will give me the most beta in this bull run over the coming months. I know the sentiment looks quite bad at the moment for ETH, but I believe there is a saying: "Buy when others are fearful, sell when everybody is greedy." I think this is quite similar to value investing, and I believe there is a lot of value in BTC, ETH, and SOL.

Good luck! And share your thoughts, I like to discuss things like this. =)

The current ETH chart, incorporating my 'flash-crash' thesisThis chart illustrates the current ETH pattern, with my 'April flash crash thesis.'

I believe we will see another thrust lower into the marked lower ranges before a spring into the fifth wave. However, the fifth wave will be a "false breakout," as a flash crash in mid to late April is likely to occur, intentionally designed to sweep liquidity by liquidating overleveraged positions and triggering stop losses—only for the market to recover shortly thereafter and continue its breakout to the upside. This breakout will likely push beyond the pattern and take out the "Trump Election Pump" highs.

There could be some opportunities in the next 4 to 6 weeks, but with opportunity comes risk. Always use a proper risk management strategy suited to your skill level and wallet size.

Good luck, and always use a stop loss!

Ethereum's Current Consolidation: Will It Move Up or Down...?BINANCE:ETHUSDT Ethereum Consolidating Between $1820 and $1950: Will It Break Upside or Downside..?

Ethereum has been trading in a consolidation range between the $1820 and $1950 levels since last week. As the price oscillates within this range, market participants eagerly await a breakout in either direction. The big question is: will Ethereum break upwards or downwards? Let's analyze two potential scenarios based on key price levels and liquidation points.

Scenario 1: Upside Breakout and Potential Rally

One key level to watch is the $1950 resistance. Ethereum has struggled to break past this level, but if the price manages to break above and sustain above $1950, there is a significant upside potential.

Why? At the $1994 level, there is approximately $1.16 billion in liquidations waiting to happen. If Ethereum pushes past the $1950 resistance and approaches this $1994 mark, the surge of liquidations could provide the momentum for a continued rally.

In this scenario, a good strategy would be to wait for a retest of the $1950 level as support, confirming the breakout. If the price holds above this level, it may be a good time to enter a long position, riding the potential bullish move.

Scenario 2: Downside Breakout and Further Decline

On the other hand, if Ethereum fails to hold above the $1820 support and breaks below this level, a downside move could be on the horizon. The next significant support lies around the $1785 level, where around $900 million in liquidations are waiting.

A break below $1820 could trigger a sharp decline toward this liquidation point at $1785. In this case, entering a short position after a retest of the $1820 resistance-turned-support could offer a solid opportunity for traders looking to capitalize on the downtrend.

Conclusion

Ethereum’s consolidation between the $1820 and $1950 levels presents two distinct scenarios. If the price breaks above $1950 and sustains that level, there is upside potential, with liquidation at $1994 offering a bullish catalyst. However, a break below $1820 could open the door for further downside, with liquidations at $1785 triggering a possible downtrend.

Traders should keep a close eye on these levels for confirmation and act accordingly based on the direction Ethereum takes in the coming days.

Breaking: $PIKACH Set for a Comeback Built on the Ethereum blockchain, while simply paying homage to an adorable creature we all love and parody- the Pokémon or its creation Pikachu, $PIKACH is set to soar amidst a bounced from the 38.2% Fibonacci retracement that is presently acting as a support point.

A breakout above the 1-month high could catalyse a bullish move with 30% gains in sight.

With the Relative Strength Index (RSI) at 56 this metric validates the bullish thesis on $PIKACH.

Pikaboss Price Live Data

The live Pikaboss price today is $5.40e-8 USD with a 24-hour trading volume of $24,671.20 USD. Pikaboss is down 2.77% in the last 24 hours, with a live market cap of $22,726,087 USD. It has a circulating supply of 420,690,000,000,000 PIKA coins and a max. supply of 420,690,000,000,000 PIKA coins.

Breaking: Ethereum Dips 9% Today losing the $2k Price LevelEthereum today saw a noteworthy downtick with the asset dipping below the $2000 pivot zone. currently trading around the $1900 - $1700 price zones.

Ethereum is currently oversold as depicted by the Relative Strength Index (RSI) at 36. The 1-month low is acting as support point for Ethereum. Should selling pressure continue, CRYPTOCAP:ETH might tanked to $1000- 1400 price levels.

However, in the case of a price reversal, a break above the 65% Fibonacci retracement level could placed CRYPTOCAP:ETH on the cusp of a bullish spree.

Despite the bloodbath facing Ethereum albeit the general crypto landscape facing same, data from DefiLlama hints at a growing Defi landscape in the Ethereum blockchain with about $45.43 billion locked in Total Value Lock (TVL) and the volume growing in tandem with the TVL locked.

Presently up 2% trading at $1905 price point all eyes are set on the major pivots we mentioned above.

Ethereum at Critical Levels – Breakout or Breakdown for ETH?Ethereum (ETH) is looking heavily overextended right now 📊, with price action pressing into key support zones on the daily and weekly charts ⏳. The market is at a critical juncture, and a sharp pullback 📉 could be on the cards.

This could present a short-term counter-trend buying opportunity on the lower timeframes 💰, but if ETH pushes higher, it may offer a prime short setup 🎯.

⚠️ Not financial advice – trade smart and manage risk accordingly! 🚀

ETH → Gearing Up for $10,000!? Or $1,200? Let's Answer.Ethereum finally fell into my buy zone this past week and I was able to buy with an average price of $2,185.18. This is a target I've been watching for months in anticipation. The best part is that it may go lower!

How do we trade this? 🤔

ETH has landed on a key support area of $2,100 and is now flirting with falling to the .236 Fib level at $1,800. A final target would be around $1,500 which brings us back into the bear market range. ETH formed a triple top over the course of 2024 and as expected, it pulled back hard with the alt market.

Bitcoin Dominance has been in a bull trend since the last cycle and hasn't shown any signs of weakness yet. Currently at 62%, it could jump up to 70% easily. Until it drops, ETH and the alts are going to remain bleeding out.

I'm targeting the previous all-time high for a first profit target, around $4,800. Whether I take profits at that level depends on the price action leading up to it. If we get a strong push with strong candle closes leading up to that price, I'll likely hang on. Otherwise, I may take 25% of my position off the table and look for a potential re-entry.

Final target price is $6,750, just below the 1.618 Fib level. This level also corresponds with a measured move target if the price attempts $4,000, pulls back to the 3-Year Support, then moves up again. I believe $10,000 ETH is absolutely possible for this run, but given how slumpy the alt market is, I don't see that probability being as high as the previous high of $7,000. This is why I'm taking my profits before that 1.618 Fib level is hit.

💡 Trade Idea 💡

Long Entry: $2,185.18

🟥 Stop Loss: $700

✅ Take Profit #1: $4,800

✅ Take Profit #2: $6,750

⚖️ Risk/Reward Ratio: 1:3

🔑 Key Takeaways 🔑

1. 2024 Triple top led to a retrace down to the 2023 range.

2. First buy at $2,185.18, potential buy at $1,800 and $1,500

3. Stop loss at $700 below the 2022 bear market low

4. Holding the position until the previous all-time high around $4,850 where the first take profit waits. $6,750 is the second take profit just before the 1.618 fib level

5. Weekly RSI is near 34.00 and below the Moving Average. This is a good level to buy.

💰 Trading Tip 💰

Ascending Wedges signal an increased probability of a bear breakout. Combined with three pushes up in a bull trend and strong sell bars (candles with large wicks on their tops), creates conditions where a counter-trend trade is reasonable.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and Follow to learn more about:

1. Reading Price Action

2. Chart Analysis

3. Trade Management

4. Trading Psychology

ETH: Can Ethereum Rally Once More in this Cycle?ETH: The white scenario still permits a move to all-time highs, but a drop below $1,790 would make another all-time high in this cycle less likely, as the pullback would be too deep for wave (4). In that case, I will monitor the lower support region between $1,436 and $1,254 for a potential reaction, should the yellow scenario materialize. However, this remains a low-probability outcome, and I would expect the blue scenario to unfold if the price decisively breaks below $1,790.

For now, the local trend remains to the downside, and we need to see a clear reaction at support before considering the start of the next upward move. We remain vigilant for any signs of a shift in momentum that could indicate the beginning of a reversal.

Ethereum ETH Is About To ReverseHello, Skyrexians!

Recently we have already made the analysis that BINANCE:ETHUSDT is printing the wave C inside the global wave 2 in this bull run. Today we will consider the wave C in details. As you know it shall consists of 5 waves and currently we can see the clear picture that dump can be over or almost over.

Let's take a look at 12 hours time frame. We can see that each Elliott Wave has reached the normal target. Wave 2 finished at 0.61 Fibonacci. The wave 3 reached exactly 1.61 level. Wave 4 finished inside the 0.5 zone. It gives us confidence that wave 5 will be the same length as the wave 1 and will be finished approximately at $1900. We have already almost seen this price. Moreover, price formed the green dot on Bullish/Bearish Reversal Bar Indicator and the divergence with AO. So, this trend could be over already or be very exhausted. The next move is the global wave 3. Target is unchanged: $7k realistic, $10k optimistic.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Ethereum Holds Key Support at Weekly Trendline: What's Next...?Ethereum Holds Key Support at $2,100: Could a Rally to $4,000 Be Coming? Altcoin Season and Trump’s Crypto Summit as Potential Catalysts

Ethereum is currently finding support at a critical juncture, with the price holding steady at the weekly uptrend line and an important support level around the $2,100 mark. Historically, every time Ethereum has tested this support zone, it has bounced significantly, often making strong moves toward the $4,000 level. The question now is whether history will repeat itself.

At this point, Ethereum’s ability to maintain this support level is crucial. With the market in a generally cautious state, Ethereum's resilience at this key level could signal the potential for a powerful rally in the near future. The broader crypto market is also awaiting the highly anticipated "altcoin season," where altcoins—especially Ethereum—could see a surge in demand, potentially driving prices higher.

Adding to the excitement, former U.S. President Donald Trump is set to host a crypto summit at the White House on March 7. This event could serve as a major catalyst for the next crypto rally, especially if significant regulatory or institutional insights emerge. The combination of Ethereum holding its critical support, the potential for altcoin season, and the White House summit could create the perfect storm for a significant price movement in Ethereum.

As Ethereum continues to hover around the $2,100 mark, traders and investors are closely watching for any signs of a breakout. If the rally to $4,000 materializes, it could set the stage for further gains, with the broader crypto market potentially following suit. The next few weeks could prove to be pivotal for Ethereum and the cryptocurrency space as a whole.

Ethereum’s Dip: A Golden Buying Opportunity?Ethereum has been a disappointment for traders.

Many were expecting a new all-time high, but so far, Ethereum has failed to deliver.

However, for speculators like me, this type of market movement presents an ideal trading opportunity.

Recently, ETH reached a key confluence support zone around the psychologically significant $2,000 level, reinforced by multiple technical factors. This setup suggests a strong potential for a reversal.

What’s Next?

✅ The $2,000 support zone remains critical, and I expect it to hold, leading to an upside move.

✅ While not aiming for extreme highs, I’m looking to buy dips near $2,200 with a target around $2,800.

ETH | ByBit HACK causes MASSIVE SELL-OFFBybit got hit with a serious security breach.

$1.4 billion was hacked in Ethereum, which is a huge amount of ETH. 2 Apparently the trouble started with their cold wallet, where they keep a lot of their crypto offline. The investigation points to the North Korean Lazarus Group as the likely culprits, and it seems the attack originated from some malicious code within their wallet provider, Safe Wallet.

Currently there's a big push to track down the stolen funds, and Bybit's even offering a bounty, but it's unlikely the funds will be recovered. It's important to understand that this wasn't necessarily a fault of Bybit's own security, but rather a problem with the wallet provider they were using.

Bybit has reassured users that withdrawals remain unaffected and other cold wallets are secure. While investigations into the incident continue, early speculation about Bybit buying back ETH to cover losses, which briefly boosted ETH's price, was dispelled by CEO Ben Zhou. He clarified that a bridge loan covered 80% of the stolen ETH, and there are no plans for spot market purchases. The hackers now holds a substantial amount of ETH across multiple wallets, raising concerns about potential drops should they decide to sell, but this may occur gradually over many months or even years (since they didn't buy it / it will not matter at what price it is sold).

This hack coincides with ETHDenver, a major Ethereum event typically associated with bullish market conditions and optimism. But overall, the outlook for Ethereum isn't looking as bright as it usually would be and this may lead to a further sell-off once more people catch on.

_________________

BINANCE:ETHUSDT

Ethereum — 2025. The Lord Giveth and Taketh Away (Caution! 18+)Donald Trump's recent policies and statements have generated significant negative sentiment towards Ethereum and the broader cryptocurrency market. As he resumes the presidency, his administration's approach to cryptocurrencies is expected to be more regulatory and cautious, which could impact Ethereum investors.

Historical Context of Trump's Views on Cryptocurrency

Trump has a mixed history with cryptocurrencies, as we mentioned in earlier published ideas. Initially, he labeled them a "scam", "based on thin air" as well as "threat to the U.S. dollar" and expressed skepticism about their value, stating that they are not real money and are highly volatile. However, in recent months, he has shifted his stance somewhat, reportedly owning between $1 million and $5 million in Ethereum as of August 2024. Despite this personal investment, his public comments continue to reflect a critical view of the crypto market.

Impact of Recent Tariffs on Ethereum

The most immediate cause of concern for Ethereum investors has been Trump's announcement of new tariffs on imports from Canada, Mexico, and China. This decision triggered a significant sell-off in the cryptocurrency market, with Ethereum experiencing a drastic price drop of over 26% in just one day. The overall cryptocurrency market lost nearly half a trillion dollars in value following these announcements, highlighting the interconnectedness of global trade policies and digital asset valuations.

The tariffs have led to increased uncertainty among investors, prompting many to liquidate their positions in riskier assets like Ethereum. This reaction is indicative of a broader trend where geopolitical tensions and economic policies directly influence cryptocurrency prices. Analysts noted that such trade policies could lead to inflationary pressures and a stronger dollar, making cryptocurrencies less attractive to international buyers.

Future Outlook for Ethereum Under Trump's Administration

Looking ahead, Trump's administration is likely to focus on stricter regulations for cryptocurrencies. This could manifest in enhanced oversight that may slow down the adoption of Ethereum by businesses and individuals. However, there is also potential for increased legitimacy if clear regulations are established.

Moreover, Trump's interest in Central Bank Digital Currencies (CBDCs) might further complicate the landscape for Ethereum. As the U.S. explores its digital dollar initiative, Ethereum's decentralized finance (DeFi) ecosystem could face stiff competition from state-backed digital currencies.

Technical challenge

The main technical graph for Ethereum BITSTAMP:ETHUSD indicates on Bearish trend in development, since mid-December 2024, with acceleration occurred a day before Mr. Trump entered the White House.

Key support considered as 100-week SMA (near $2550 in this time) and $2200 flat multi bottom, that helps so far; otherwise (in case of breakthrough) we believe it could lead the Ethereum price much lower, as it described on the chart.

Conclusion

In summary, while Trump’s personal investment in Ethereum marks a notable shift from his previous criticisms, his administration's policies—especially regarding tariffs—have created a challenging environment for Ethereum investors. The combination of regulatory uncertainty and macroeconomic factors will likely continue to influence Ethereum's market performance in the near future.

Ethereum Analysis Ethereum Analysis

Ethereum is currently exhibiting a pattern similar to the one observed in Shiba Inu, with a clear downtrend that has led to the breakdown of a key support level. As of now, it seems to be retesting this broken support, though confirmation will only be possible once the current candle closes.

In my opinion, patience is critical in this scenario, and it would be wise to wait for the candle to close before considering any short positions. The broader trend still appears to be bearish, suggesting that Ethereum may not have exhausted its downward momentum just yet. However, market dynamics can shift rapidly, and it is important to remain vigilant and adapt to new information as it unfolds.

I would appreciate your thoughts on Ethereum's current price action and whether you agree with the assessment of a potential continuation of the downtrend. As always, thorough analysis, risk management, and due diligence are essential before making any trading decisions.

Cheers!

Public trade #22 - #ETH price analysis ( Ethereum )💰 In continuation of our global idea for #Ethereum

03/02/25 for the first time liquidations on CRYPTOCAP:ETH exceeded liquidations on CRYPTOCAP:BTC

There are already a lot of “investigations” from Twitterers and not only how manipulative the market drain was on “red-black” Monday, but these are the realities of an unregulated market and “crazy” participants at all levels and ranks!)

They achieved their goal of wresting assets, including CRYPTOCAP:ETH , from weak hands and accumulating them in strong hands for future achievements.

In particular, the Trump family foundation owns $400m+ of #ETH, half of which was bought back at the recent notorious drop.

Well, we need to be in the trend and also bribe #ETH into our investment portfolio and crypto trading

🟢 Desirable OKX:ETHUSDT purchase zone - $2441-$2551

1️⃣ TP1 - $3800-3900

2️⃣ TP2 - $5900-6000

⌛️ And then: we'll see...

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Ethereum in the Golden Zone: Bounce or Breakdown?Ethereum (ETH/USDT) Weekly Analysis:

Trendline Support:

The price has repeatedly found strong support along the upward-sloping trendline, maintaining a bullish market structure.

Key Zones:

Support Zone: The critical support lies between $2,200 and $2,400, aligning with the golden Fibonacci retracement zone (0.618 - 0.786), making it a significant area for potential accumulation.

Resistance Zone : The major resistance lies between $3,900 and $4,100, where the price has previously faced selling pressure.

Outlook:

Bullish Scenario: A bounce from the support zone and trendline could lead to a retest of the resistance at $3,900–$4,100.

Bearish Scenario: A break below the trendline and $2,200 could signal a deeper correction.

Please do Like, comment and follow for more insights.

Ethereum's Downtrend: Flag and Pole Pattern Set for Breakout...Ethereum is currently on a downtrend from the 4100 resistance level, forming a flag and pole pattern. The next strong support level is at 2800, where we could see a positive move arise from either a breakout of the trendline, support at the 2800 level, or both co-occurring. It's important to patiently wait for a signal before making any decisions.