Etheurshort

ETHEUR bearish short-term scenarioHello traders,

Two triangles have been forming recently: the first one since March 8th around 1400 EUR, and the second one since March 9. The former is a symmetrical triangle, while the latter is a flat bottom triangle. As chart displays, the former is not that clear, while the flat bottomed (drawn in blue) is more evident.

In terms of pricing, considering the height of this flat-bottomed triangle, prices could potentially dip up to 1380 EUR, which coincides with the resistance configured by the inverted head & shoulders pattern, formed and fulfilled on late February. However, one should also consider 1420 EUR as a consolidated resistance in the case the pattern that goes from February 23 to March 05 is a flat top triangle.

If you find this analysis useful, please like, comment, or donate

ETHEUR bearish symmetric triangle and flat bottom triangleBad news for those of us who were expecting an immediate rebound. A symmetric triangle (blue triangle) has forming since February 23rd, with base around 1253 EUR and top at 1423 EUR. It's final confirmation would be when rebounding at 1309 - 1314 EUR. Depending on the way you consider its height, the expected drop would be around 1145 EUR.

In addition, a flat bottom triangle that has been forming since February 24th would strengthen the idea of a bearish trend. Projecting its height, we're locating prices at the same level as the symmetric triangle.

Let us also remember that the previous minimum, located at 1115 EUR, is the result of a previously identified ascending wedge, whose height is also projected on this chart, though pushing prices down to 1105 and 1069 EUR respectively.

ETHEUR ascending wedgeAfter a discrete recovery from it's recent correction, ETHEUR formed and confirmed a rising wedge with a tip on 1328 EUR and a confirmation rebound on 1300 EUR. Depending the height of the wedge you'd consider, the drop would reach 1200 to 1140 EUR. It would be reasonable to set a stop loss on 1365 EUR if the figure is wrong!

ETHEUR possible scenariosHello traders, I hope you're doing well.

Apparently a downward channel is being formed, as suggested by the grey polyline. After testing again the resistance at 1381 EUR, we might expect a retracement up to the area signaled by the purple rectangle (Fib 0,618 and 0,50). As you can notice, KDJ signals overbought, momentum is decreasing, and MACD histogram has reached its first threshold (signaled by a green dotted line).

If 1341 EUR is surpassed, my expectation is that the next support would be, naturally, 1314 EUR and 1300 EUR. Now, if that support is trespassed, price would keep sinking up to 1287 EUR, which is a support based on a Fib retracement taken from ATH to 1210 EUR, which is the breaking point from the main support (ie. flat top triangle).

[ETH] - So far, not bad.I was about to publish my ETH idea the other day (red line) although I regretted it and decided to wait to see how the price development happened. Today three days later we can verify that the price, more or less, remains stable within the ascending channel drawn.

What to expect next? Buff, so weekend is ahead and we are also giving way to the last week of April, with a lot of relevant dates in the economic calendar, apart from the fact that not very optimistic data regarding transport or employment in global terms are also accumulating, which we will soon see its effects on the price of ETH and all crypto in general.

Perhaps another new correction for speculation and fear of what this new system brings us and the human need to continue treating fiat money with the zero importance that it has. If not another new wave of adoption will come soon, in a reasonable interval of time of 2 years, apparently there is still a way to go in the development of the system but it is already latent and at these prices we must take advantage.

This idea revolves around the ascending channel, a drawing that in this 4-hour view is not appreciated, although in a larger one it has a steeper inclination. Just an idea, thanks!

ETH at the edge of the main resistanceETH is facing huge resistances into the 220e/240e area before being able to fight the bears at higher space.

Stoch RSI not enough overbought

And the magic indicator shows too that we are not at the bottom of this spring crypto game for ETH.

Waiting a little bit before buying more ETH !

Are we bottomed yet? Don´t think so But. But... EURWell we need to noticed the volume on COINBASE:ETHEUR since 14th november.

So personally as a newbie i think we didn't found the bottom yet regards how markets works. Well but my thoughts are that big short need a better price to reload so lets restore the people confidence to load shorts at higher price.

It's important to notice that the herd (myself included) need to believe in a long bull run put savings and move funds so the market can turn..

For now that are my COINBASE:ETHEUR targets..

So never forget DYOD... Peace..

OwlTraders always awake on the markets movements.

Are we bottomed yet? Don´t think so But. But... EURWell we need to noticed the volume on COINBASE:ETHEUR since 14th november.

So personally as a newbie i think we didn't found the bottom yet regards how markets works. Well but my thoughts are that big short need a better price to reload so lets restore the people confidence to load shorts at higher price.

It's important to notice that the herd (myself included) need to believe in a long bull run put savings and move funds so the market can turn..

For now that are my COINBASE:ETHEUR targets..

So never forget DYOD... Peace..

OwlTraders always awake on the markets movements.

Are we bottomed yet? Don´t think so But. But... EURWell we need to noticed the volume on COINBASE:ETHEUR since 14th november.

So personally as a newbie i think we didn't found the bottom yet regards how markets works. Well but my thoughts are that big short need a better price to reload so lets restore the people confidence to load shorts at higher price.

It's important to notice that the herd (myself included) need to believe in a long bull run put savings and move funds so the market can turn..

For now that are my COINBASE:ETHEUR targets..

So never forget DYOD... Peace..

OwlTraders always awake on the markets movements.

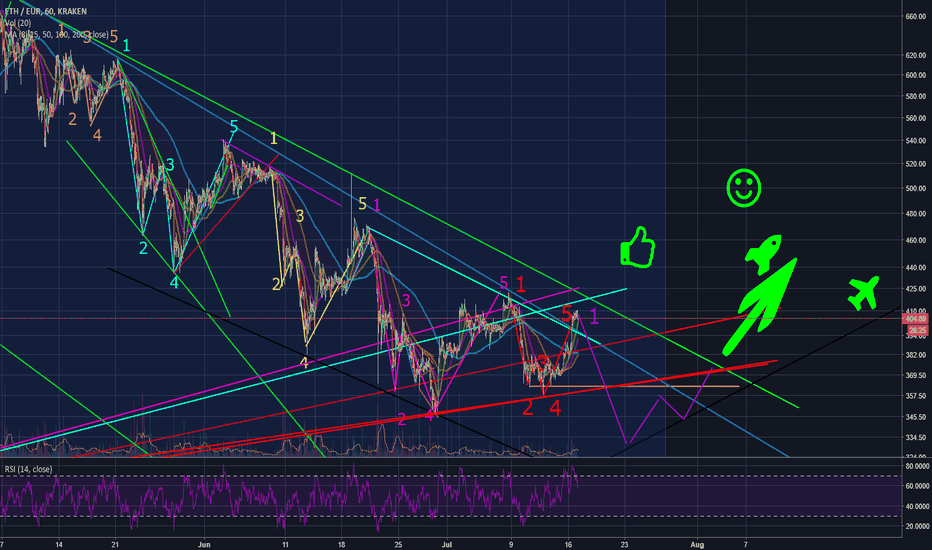

ETH EUR H1 - new fractal cycle incoming before bull runI didn't see that one coming! I thought it would have been the last moves before the last dump, but it seems another cycle is taking place. Previous moves from BTC chart also tends to confirm we're heading to a strong correction before the moment we're waiting for... ;-)

Short ETH/EUR break below daily cloud, TP: 420/ 400/ 375ETH/EUR finds strong support at daily cloud base at 442 levels.

The pair has edged higher from session lows at 442 to currently trade at 461 levels.

Technical indicators are highly bearish. We see scope for further weakness on break below cloud.

Momentum studies are highly bearish. We see -ve DMI dominance and ADX is above 25 and rising supporting the trend lower.

Price action is below major EMAs on the daily chart and upside remains capped at 5-DMA at 493.

Next major bear target lies at 420 (Dec 22 lows) ahead of 371 (78.6% Fib).

On the flipside, break above 5-DMA will see upside till 100-DMA at 524. Violation at 100-DMA negates bearish bias.

Support levels - 442 (cloud base), 440 (61.8% Fib), 420 (Dec 22 lows), 371 (78.6% Fib)

Resistance levels - 488 (50% Fib), 493 (5-DMA), 524 (100-DMA)

Good to go short on break below daily cloud, SL: 490, TP: 420/ 400/ 375

ETH/EUR on track to test 78.6% Fib at 382, stay short Price action rages in 'Symmetric Triangle' pattern and we see scope for test of 'Triangle Base' and 78.2% Fib at 382 levels.

Breach at 'Triangle Base' could see further downside. Scope then for test of 88.6% Fib at 282 levels.

On the flipside, breakout above 5-DMA could see test of 20-DMA at 494. Breakout at 20-DMA invalidates bearish bias.

Support levels - 382 (converged trendline and 78.6% Fib retrace of 168 to 1168 rally), 370 (March 18 low), 334 (Dec 8 low)

Resistance levels - 422 (5-DMA), 493 (20-DMA), 500

Recommendation: Good to short rallies around 400, SL: 422, TP: 382/ 370/ 335

ETH/EUR sell opportunityETH/EUR is extending downside for 3rd consecutive session, trades 5.09% lower on the day.

Upside in the pair remains capped below 5-DMA which is immediate resistance at 859.

Downside in the pair is currently holding support at 38.2% Fib retrace of 115 to 1183 rally at 775.

Break below 38.2% Fib support is likely to see further weakness. Scope then for test of 670 levels.

Technical studies on daily and intraday charts are bearish. Immediate support below 775 lies at 50-DMA at 725 levels.

On the flipside, breakout above 5-DMA could see upside till 20-DMA at 935. Violation at 20-DMA to invalidate bearish bias.

Support levels - 775 (38.2% Fib retrace of 115 to 1183 rally), 725 (50-DMA), 670 (rising trendline)

Resistance levels - 800, 859 (5-DMA), 930 (23.6% Fib)

Good to go short on break below 775, SL: 860, TP: 725/ 700/ 680/ 650