SOL/USDT:BUY...Hello friends

Due to the heavy price drop we had, the market fell into fear and at the specified support, buyers supported the price, which is a good sign that we should buy within the support ranges with capital and risk management and move with it to the specified targets.

Always buy in fear and sell in greed.

*Trade safely with us*

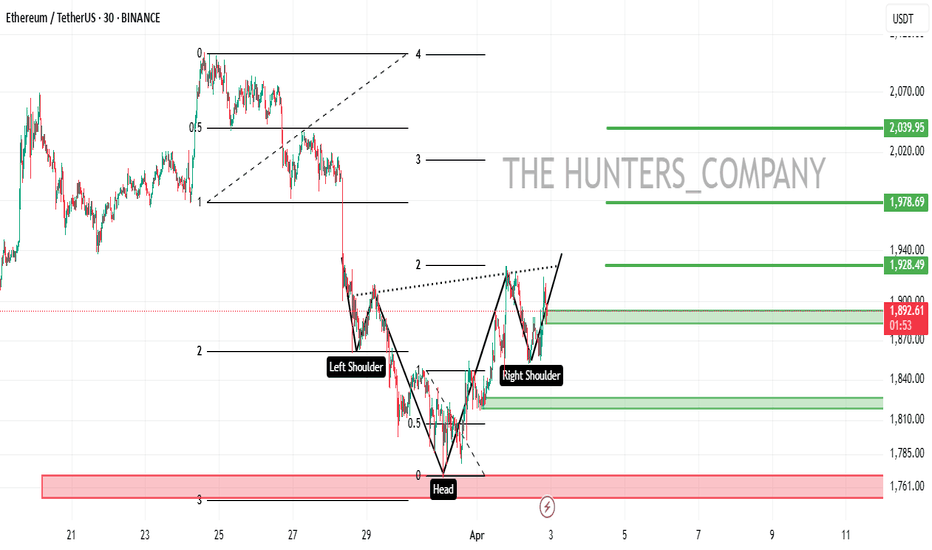

Ethlong

EHT/USDT:BUY...Hello friends

Due to the heavy price drop we had, the market fell into fear and at the specified support, buyers supported the price, which is a good sign that we should buy within the support ranges with capital management and move with it to the specified targets.

(Always buy in fear and sell in greed)

*Trade safely with us*

3k before august, is it real?Looking at history, ETH corrections of 65–75% have often been followed by sharp rallies. I believe we’re in a similar situation right now. With the upcoming Pectra upgrade on the horizon, there’s a strong chance we could see this pattern repeat.

At the same time, ETH is currently undervalued — not just against BTC, but also compared to many altcoins.

In my opinion, ETH is the most undervalued asset in the market right now.

ETH | Ethereum Hits 2 YEAR LOW - What's Next?Could it be that ETH bottoms out here?

Low from March 2023:

Interestingly enough, it could be said that it was the previous cycle's accumulation zone. Considering the previous cycle's price action, this isn't a ad zone to load up - for the longer term.

From here, although the price bounced high, and low, it was the 8-month price action before the next bullish cycle started. This gives us perspective in terms of time

___________________

BINANCE:ETHUSDT

Ethereum Failing against BITCION ? Here is a valid reason why.

In a world being thrown upside down and sideways and Markets Rising and falling and Rising again on a few words and actions, there is one Shining Light in the world of Crypto

Ethereum - And its constant DROP when compared to BITCOIN

It is possibly the Only coin in the top 10 that has failed to rally at least once, to any significant degree since 2023, when nearly everything else took off.

It currently sits at the same price it was in May 2020 !

It reached its ATH in Nov 2021 and ever since then, has fallen in what is becoming a parabolic reverse curve;

All this despite coins like BASE, Coinbases Crypto, being based on that ETH Layer.

This is pretty well ALL down to the adoption of BITCOIN by corporate ventures, keeping the Bitcoin Dominance high.

I mentioned in a post back in 2023 ( maybe here but certainly on X) how BTC could be used in the "Financial Wars" to come, as a means to weaken and scupper ALT coins.

They tried to Destroy crypto, they failed and so, by allowing Bitcoin ETF's etc, BTC dominance remains High and ALTS Fail

And that is EXACTLY what we have seen so far. As Corporations continue to Buy Bitcoin, Dominance remains high..... It isd as simple as that.

And this ETH BTC chart shows that very clearly.

The REAL question is why the ETH ETF's failed so much.

Maybe that is because MANY people realised the "energy behind Ethereum" - The American crypto , Protected by Gensler and predecessors. The Not really Descentralised structure and power if you hoold a LOT, something not many independants can do

Ethereum Surges Past Resistance as Trump Halts Tariff Plans..!🚨 **Market Update** 🚨

President Donald Trump has announced a 90-day pause on the full effect of new tariffs for certain countries, and the markets are reacting strongly! 📈 Both the stock and crypto markets are surging as a result.

Right now, Ethereum is testing the $1600 resistance level on the 1-hour timeframe. 💥 Our trading strategy is to let it break the resistance and sustain above it, then look for a solid entry on the pullback.

Stay tuned and trade wisely! 🚀💰

Ethereum Weekly Analysis: Double Top BreakdownHello guys!

Ethereum has formed a clear double top pattern on the weekly timeframe — a strong bearish reversal signal. The pattern is confirmed by:

🔹 A break of the ascending trendline

🔹 Strong rejection from the $3,200–$3,400 resistance zone

🔹 Current price action hovering near $1,780

🧭 Target of the double top pattern lies in the $1,350–$1,450 zone — aligned with a low-volume area on the volume profile, which could act as a magnet for price.

Key Takeaways:

If ETH fails to reclaim the $2,000 zone, more downside pressure is likely.

A bounce may occur in the target zone, providing a possible mid-term long opportunity.

📌 Stay cautious and watch for reaction zones, especially if ETH reaches the $1,400 region.

You can buy it at $1400!

US100 Bullish SideUS100 show clear bullish momentum and many indicators shows that US100 in uptrend which are given below:

RSI daily timeframe bullish divergence

Descending parallel channel which show that US100 in a strong uptrend

Strong support zone

All these indicator indicators shows us that US100 in a clear bullish momentum

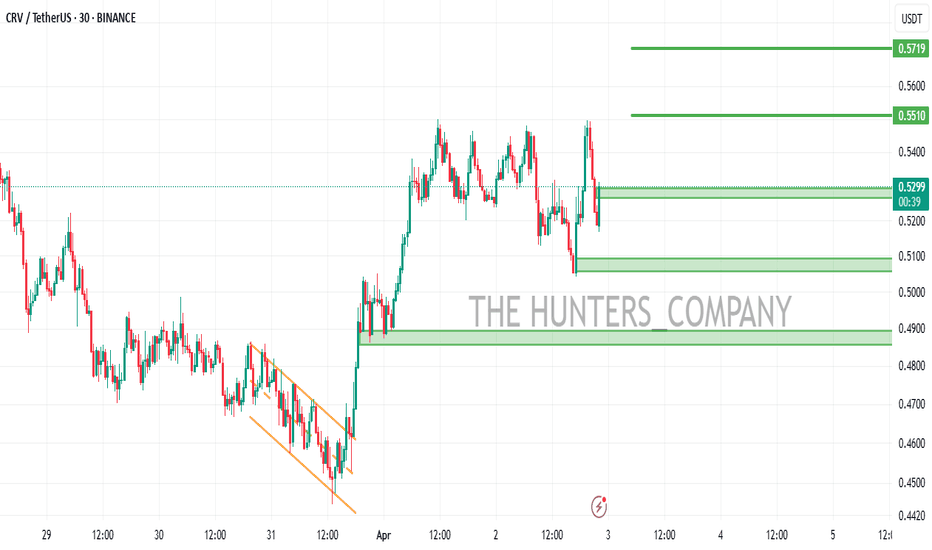

PEPE/USDT:FREE SIGNALHello dear friends

Given the price drop we had in the specified support range, a double bottom pattern has formed, indicating the entry of buyers.

Now, given the good support of buyers for the price, we can buy in steps with capital and risk management and move to the specified targets.

*Trade safely with us*

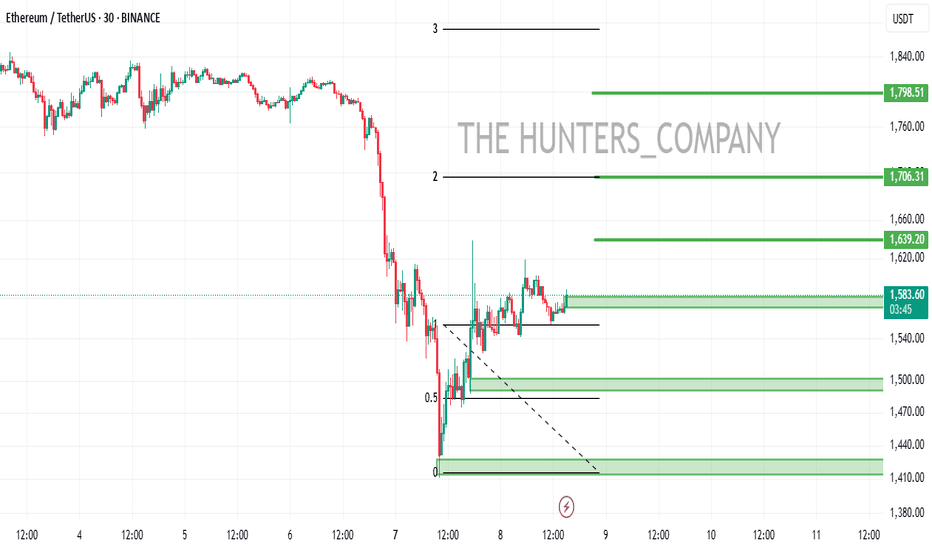

ETH/USDT:UPDATEHello dear friends

Given the price drop we had, a head and shoulders pattern has formed within the specified support range, indicating the entry of buyers.

Now, given the good support of buyers for the price, we can buy in steps with capital and risk management and move towards the specified targets.

*Trade safely with us*

SEI/USDT:BUY LIMITHello dear friends

Given the price drop we had in the specified support range, the price has been able to create higher ceilings and floors.

Now, given the good support of buyers for the price, we can buy in steps with capital and risk management and move towards the specified goals.

*Trade safely with us*

LONG ON ETHEREUM (ETH/USD)Ethereum has given a change of character (choc) to the upside on the 4 hour timeframe...

followed by a nice sweep of engineered liquidity!

Its currently respecting a key demand are and I believe it will now rise for 300-500 points this week.

I am buying Eth to the next level of resistance.