ETH/USD Breakout – Long Position Activated!Hi Traders ! Ethereum on the 1H chart has been trading within a descending channel and is now testing the upper boundary. I’ve placed a long entry expecting a breakout, targeting the $2,061 - $2,070 zone. Stop-loss set in case of a false breakout. RSI is showing signs of recovery. Let’s see how it plays out! 🔥👀

Disclaimer: This is not financial advice. Trade at your own risk. 🚨

Ethreum

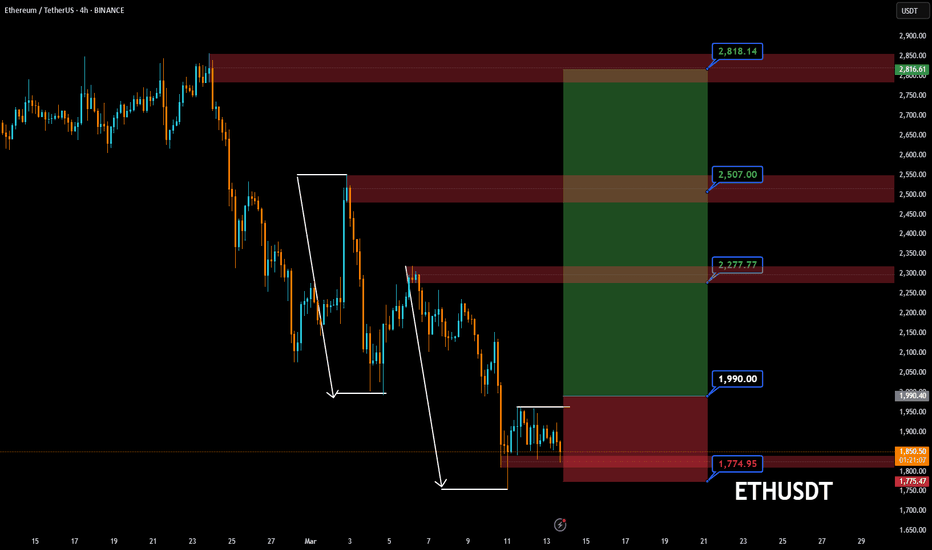

ETHUSDT, I love pattern in chart ...Hello everyone

We backed after a long time by one the powerful analysis on Ethereum.

According to the chart you can see the price movement is sideway, the reason of that for proving this reason is the parallel channel.

At first, the price show us a downward triangle and because of that we expect the price should break the triangle and rising up , the second reason is the price and candle encounter to the one of the important dynamic supporter from the past , and third reason for the rising is the price is near to the below of the channel and the market is so weak and this is what our want and THIS TIME IS TO BUY , ok ??

JUST BUY BUY BUY BUY guys , TRUST US

If you have any question or need help

send us messages

Thank you

AA

ETHUSD Bearish continuation pattern forming?The ETH/USD pair is exhibiting a bearish sentiment, reinforced by the ongoing downtrend. The key trading level to watch is at 2,140, which represents the current intraday swing high and the falling resistance trendline level.

In the short term, an oversold rally from current levels, followed by a bearish rejection at the 2,140 resistance, could lead to a downside move targeting support at 1,723, with further potential declines to 1,545 and 1,375 over a longer timeframe.

On the other hand, a confirmed breakout above the 2,140 resistance level and a daily close above that mark would invalidate the bearish outlook. This scenario could pave the way for a continuation of the rally, aiming to retest the 2,344 resistance, with a potential extension to 2,537 and 2,620 levels.

Conclusion:

Currently, the ETH/USD sentiment remains bearish, with the 2,140 level acting as a pivotal resistance. Traders should watch for either a bearish rejection at this level or a breakout and daily close above it to determine the next directional move. Caution is advised until the price action confirms a clear break or rejection.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

ETH Eyeing Bullish Targets: $2,244 & $2,380On the 4‑hour chart, ETH appears to be carving out a descending wedge pattern (often a bullish formation) while the RSI is trending upward from oversold territory. Here are the key points to watch:

1.Descending Wedge:

- Price has bounced near the lower boundary of the wedge around the mid‑$1,900s.

A break above wedge resistance (roughly in the $2,000–$2,050 zone) could trigger accelerated upside.

2.Fibonacci & Price Targets:

- Expect 1 (~$2,244): First target aligns with a measured move out of the wedge and a key Fib extension zone.

- Expect 2 (~$2,380): Second target corresponds to a higher Fib extension (2.0–2.272), marking a stronger bullish continuation if momentum holds.

3.RSI Confirmation:

- The 4‑hour RSI is turning upward, suggesting improving bullish momentum. A sustained move above 50–55 on the RSI would strengthen the case for further upside.

4.Pullback Risk:

- If ETH fails to break wedge resistance, it may retest support in the $1,900 area. A close below that could delay or invalidate the bullish setup.

Overall, ETH’s structure and momentum suggest a potential move toward $2,244 initially, with a push to $2,380 if buyers maintain control. A break above the wedge and sustained bullish RSI would be the clearest signals for continuation to these higher levels.

ETHEREUM -Weekly forecast,Technical Analysis & Trading IdeasMidterm forecast:

While the price is above the support 1521.00, beginning of uptrend is expected.

We make sure when the resistance at 2090.33 breaks.

If the support at 1521.00 is broken, the short-term forecast -beginning of uptrend- will be invalid.

BITSTAMP:ETHUSD MARKETSCOM:ETHEREUM

Technical analysis:

A trough is formed in daily chart at 1750.30 on 03/11/2025, so more gains maximum to Major Resistance (2090.33) is expected.

Take Profits:

2362.31

2546.73

2801.10

3042.75

3516.43

3741.60

4107.80

4500.00

4868.00

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

ETH1! (Ethereum Futures - CME) Analysis Based on Gap Filling📉📈 ETH1! (Ethereum Futures - CME) Analysis Based on Gap Filling

On the daily chart of Ethereum Futures (ETH1!) on the CME, three significant price gaps can be observed. Historically, these gaps tend to get filled over time. Based on market cycles, we estimate that around 200 days remain until the end of the crypto bull cycle, after which the bear cycle may begin.

🔹 Key CME Gap Levels:

🔸 Lower Gap: $1450 - $1550 (Largest Gap)

🔸 Mid Gap: $2550 - $2625

🔸 Upper Gap: $2900 - $3200

📌 Trade Setup Suggestion:

✅ Entry: $1480

⛔ Stop Loss: $1300

🎯 Target: $3200

🔥 Risk management and confirmation signals using price action are recommended. If the price reacts at the $2550 - $2625 level, partial profit-taking could be a good strategy.

🧐 What do you think about this analysis? Do you also expect these gaps to be filled? 🤔👇

#Ethereum #ETH #CME #Crypto #Futures #TechnicalAnalysis #TradingView

Ethereum Set to Drop 15%: $1,750 Target Ahead, Stay Alert!Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Ethereum 🔍📈.

Ethereum is currently navigating within a downward channel, with the possibility of establishing a parallel channel. Based on technical indicators, there is a projected 15% decline toward the identified support level on the chart. This forecast aligns with prevailing market trends and resistance points. The primary target for Ethereum in this scenario is $1,750, and it’s crucial for investors to remain vigilant and adjust their strategies as market conditions evolve.📚🙌

🧨 Our team's main opinion is: 🧨

Ethereum is in a downward channel, and I’m expecting at least a 15% drop to the support level, with a target of $1,750, so investors should stay alert and adjust accordingly. 📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

ETHUSD ICTETH/USD Analysis: Potential Drop from the 2047 OB to 1760

Ethereum (ETH) is currently approaching a key Order Block (OB) at the 2047 level. Based on price action analysis and market structure, there is a high probability that ETH will face strong resistance at this level, leading to a potential bearish move towards the 1760 level.

Key Observations:

Order Block (OB) at 2047:

This level represents a significant supply zone where institutional traders might initiate sell positions.

Historical price reactions at this level indicate strong resistance.

Market Structure:

ETH is currently in an uptrend but approaching a key resistance zone.

If price rejects 2047, it could signal the beginning of a short-term bearish correction.

Liquidity & Stop Hunt:

Many traders might have stop-loss orders above 2047, making it an attractive zone for liquidity grabs before a potential reversal.

A fake breakout above this level could trigger a sharp sell-off.

Target Zone at 1760:

This level aligns with a previous demand zone and a key Fibonacci retracement level.

If ETH fails to maintain bullish momentum, 1760 could act as a strong support where buyers may re-enter the market.

Trading Plan:

Short Entry: Around 2047 (Confirmation with bearish price action, e.g., rejection wicks, bearish engulfing candles).

Stop Loss: Above 2080 (To avoid stop hunts and fake breakouts).

Take Profit: 1760 (Key demand zone and potential reversal area).

Conclusion:

ETHUSD is showing signs of potential rejection at the 2047 OB level, which could lead to a move towards 1760. Traders should monitor price action closely for confirmation before entering short positions. Risk management is essential, as breakouts above 2047 could invalidate the bearish scenario.

Ethereum ETH price analysis CRYPTOCAP:ETH price has dropped to the most critical point, where the upward trend is still in place and the structure is not broken.

Below $1700, personally, we will lose the desire to look towards #Ethereum

📈 In the meantime, we stick to positive thinking and expect the OKX:ETHUSDT price to move along the blue route: $3800 - $2600 - $6200 - $4200 - $7700 - $9700

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

"ETH/USDT 1H: Bullish Reversal in Play – Targeting $2,280?ETH/USDT 1H: Bullish Reversal in Play – Targeting $2,280?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Market Structure (Confidence Level: 8/10):

Bullish reversal forming after testing $1,800 support.

RSI confirms hidden bullish divergence, with higher lows on RSI while price made lower lows.

Smart Money Analysis:

Strong order block formed at $1,880, reinforcing demand.

Break of market structure at $1,950, confirming a shift in trend.

Institutional accumulation visible in the volume profile, suggesting Smart Money positioning.

Trade Setup:

Entry: $1,953 - $1,960 (current retest).

Targets:

T1: $2,120 (Fair Value Gap fill).

T2: $2,280 (high-timeframe resistance).

Stop Loss: $1,880 (below recent swing low).

Risk Score:

7/10 – Favorable risk-to-reward, but a stoprun below $1,900 remains a risk.

Market Maker Activity:

Currently engineering a stoprun below $1,900, likely before a continued move higher.

Volume increasing on bullish moves, confirming institutional buying interest.

Key Levels:

Support: $1,880, $1,800.

Resistance: $2,120, $2,280.

Recommendation:

Long positions remain favorable at the $1,953 - $1,960 entry zone.

Monitor for a stoprun below $1,900 as liquidity is being engineered before continuation.

Manage risk tightly, as Smart Money is accumulating ahead of a potential breakout.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

ETH(based on NEo wave)This supercycle is a nice nature triangle which E wave is ending and its look like a diamon diametrical.

so I will update it for the confirmation, I think ALTseason is so close and we can see that happening soon but this season take about 400 to 450 days and after that there is a huge CRASH!

Ethereum will move to the upside1. Current Price and Context

The current price of ETHUSD is $1,848.22, as indicated by the red label at the bottom right of the chart.

This price represents a significant decline from earlier highs, suggesting a corrective phase following a prior uptrend.

2. Price Movement and Trend

The chart shows a sharp upward movement starting in early 2024, with the price reaching a high near $4,000 (orange horizontal line).

After this peak, the price entered a correction phase, dropping steadily. The downward movement is marked by a descending triangle pattern, a bearish continuation pattern characterized by lower highs and a flat or slightly declining lower trendline.

The upper trendline of the descending triangle slopes downward, while the lower support level was initially around $2,100 (orange horizontal line labeled "Correction").

3. Breakdown and Support Levels

The price has recently broken below the $2,100 support level, which could indicate a continuation of the bearish trend or a potential exhaustion point.

The current price of $1,848.22 is near a significant low, with the chart suggesting this as an "Opportunity to go for long" (yellow annotation). This implies that some traders might see this as a potential reversal point to enter a long position, anticipating an upward move.

4. Potential Targets and Resistance

The chart projects a potential upside target near the previous high of $4,000 if the price reverses and breaks out of the descending triangle pattern.

The vertical orange line at $4,071 suggests a psychological or technical resistance level that the price approached earlier in the trend.

5. Technical Observations

Descending Triangle: This pattern often signals a continuation of a downtrend unless a strong bullish reversal occurs. The breakdown below $2,100 supports the bearish case, but the current low at $1,848.22 could act as a support zone if buying interest emerges.

Volume (not shown): Without volume data, it’s hard to confirm the strength of the breakdown or potential reversal. Typically, a breakout with high volume would carry more significance.

Timeframe: The 12-hour chart suggests this is a medium-term analysis, suitable for swing traders looking for opportunities over days or weeks.

6. Possible Scenarios

Bullish Scenario: If the price holds above $1,848.22 and starts to recover, it could test the $2,100 level again. A break above $2,100 with strong momentum might signal a return to the $4,000 range, aligning with the "Opportunity to go for long" annotation.

Bearish Scenario: If the price fails to hold $1,848.22 and continues to decline, it could test lower support levels (e.g., $1,500 or below), indicating further correction.

GREAT LONG OPPORTUNITY HAS COME✅ PREVIOUSLY ON ETH

We thought that it could be the bottom at 870.

We were waiting for the long opportunity after 2030.

✅WHERE WE ARE

ETH is at the strong support line. We expect the strong bullish impulse at the moment.

💡The absolute principle for trading💡

LONG- as low as possible

SHORT - as high as possible

PLEASE DO NOT FORGET TO SMASH LIKE👍🏻 AND FOLLOW ME❤ IT MOTIVATES ME TO THE NEXT IDEA! THANK YOU 🎉

*As long as 1073 remains unbroken, this idea is valid.

Positive days coming? ETH Crypto MarketWill Ethereum end its downtrend? Ethereum has been quite weak for a long time and is currently at an important support level. If it breaks down further, a sharp decline may continue, but if it holds the support, the upcoming period could be more positive.

Many cryptocurrency dominance charts, as well as Nasdaq and stock charts too, showing the same pattern. Is the reversal starting?

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

Crypto Markets See $3.8 Billion Outflow, What Does It Mean?Ethereum, Solana, and Toncoin were hit with multi-million outflows; but Bitcoin took the biggest hit with $2.59 billion in funding.

For the third week in a row, digital asset investment products have seen investors siphon off funds. This past week alone marked a historic $2.9 billion outflow, raising the cumulative figure to $3.8 billion in three weeks.

According to the latest edition of the Digital Asset Fund Flows Weekly Report, Bitcoin was hit the hardest by negative sentiment, suffering $2.59 billion in outflows last week, while short coin products attracted $2.3 million in inflows. Ethereum also faced heavy losses and received a record $300 million in outflows.

Toncoin was not immune, with investors siphoning off $22.6 million. Meanwhile, multi-asset products experienced $7.9 million in outflows, while Solana and Cardano saw outflows of $7.4 million and $1.2 million, respectively. Even blockchain stocks fell, losing $25.3 million.

Sui, on the other hand, saw inflows of $15.5 million, followed by XRP, which received $5 million, while Litecoin added $1 million in inflows.

Over the past week, outflows were broad, with the United States leading with $2.87 billion, followed by Switzerland with $73 million and Canada with $16.9 million. Sweden also recorded $14.5 million in outflows, while Brazil and Hong Kong saw $2.6 million and $2.5 million, respectively.

In contrast, Germany trended with $55.3 million in inflows as investors bought into the trend. Australia also recorded a modest inflow of $1 million. BITSTAMP:BTCUSD COINBASE:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSDT CRYPTO:ETHUSD

Is SOL/BTC following the ETH/BTC distribution pattern?

As the big red weekly candle closes for BTC, we should see some volatility this week.

Solana valued in BTC has exited a rectangular distribution topping pattern.

Failure to recapture the rectangular box and enter back into it in a spring like move is looking increasingly unlikely.

Ethereum valued in BTC followed a very similar pattern in Nov 2023, exiting the rectangular distribution rectangle and fell much much lower.

The 50 week (blue line) and 200 week (purple line) moving averages also follow a similar trajectory for both instruments / coins.

If SOL / BTC does not recover into the box, and fast I will be exiting a long term position I hold.

Defensive Strategy based on this chart and the USD chart warrants consideration

PUKA

Ethereum at a Key Level! ¿Rebound or More Drop?Hi traders! 🚀 I'm entering ETH/USD at a key zone. The price is testing support at $2,098, and while the trend is still weak, the RSI at 30 suggests we're in oversold territory. 👀

Trade Details:

🔸 Entry:$2,098 ✨

🔸 SMA 200:$2,213 → strong resistance.

🔸 SMA 20:$2,167 → could act as a barrier.

🔸 TP:$2,256 🟢

🔸 SL:$1,912 🔴

Clear risk management in place—let's see if we get the bounce! What do you think? 📉📈🔥

⚠️ Disclaimer: This is not financial advice. I'm just sharing my analysis and personal experience. Every trader should do their own research and manage their risk. 📢