Warning: Low Ethereum Target LoomsThe Unthinkable Target: Is $1,000 ETH Really in Play?

Suggesting Ethereum could fall back to $1,000 might seem hyperbolic to those who remember its peak near $5,000. However, the crypto market is notorious for its brutal volatility and deep drawdowns. Bitcoin itself has experienced multiple corrections exceeding 80% from its all-time highs throughout its history. While Ethereum has matured significantly, it's not immune to severe market downturns or shifts in narrative dominance.

A $1,000 price target represents a roughly 65-70% decline from prices seen in early-to-mid 2024 (assuming a starting point around $3,000-$3,500) and an approximate 80% drop from its all-time high. While drastic, such a move could become plausible under a confluence of negative circumstances:

1. Severe Macroeconomic Downturn: A deep global recession, coupled with sustained high interest rates or a major credit event, could trigger a massive risk-off wave across all assets, hitting speculative investments like crypto particularly hard.

2. Regulatory Crackdown: Punitive regulations targeting DeFi, staking, or specific aspects of Ethereum's ecosystem could severely damage sentiment and utility.

3. Technological Stagnation or Failure: Major setbacks in Ethereum's scaling roadmap or the discovery of a critical vulnerability could erode confidence.

4. Sustained Loss of Narrative: If competing blockchains definitively capture the dominant narrative for innovation, speed, and cost-effectiveness, ETH could lose its premium valuation.

5. Technical Breakdown: A decisive break below key long-term support levels (like the previous cycle highs around $1,400 or psychological levels like $2,000) could trigger cascading liquidations and stop-loss orders, accelerating the decline towards lower supports, including the $1,000 vicinity which acted as significant resistance/support in previous cycles.

While not a base-case prediction for many, the $1,000 target serves as a stark reminder of the potential downside if the current negative pressures persist and intensify, particularly within a broader bear market context. The factors currently driving ETH's weakness provide fuel for this bearish contemplation.

Reason 1: The Underwhelming Arrival of Spot Ethereum ETFs

Following the monumental success of Spot Bitcoin ETFs in the US, which attracted tens of billions in net inflows within months of launch, expectations were sky-high for their Ethereum counterparts. The narrative was compelling: regulated, accessible vehicles would unlock a floodgate of institutional capital, mirroring Bitcoin's ETF-driven price surge.

However, the reality has been starkly different and deeply disappointing for ETH bulls. Since their launch, Spot Ethereum ETFs have witnessed tepid demand, characterized by weak inflows and, at times, even net outflows. The initial excitement quickly fizzled out, failing to provide the anticipated buying pressure.

Several factors contribute to this underwhelming debut:

• Pre-Launch Regulatory Uncertainty: The SEC's approval process for ETH ETFs was far less certain and more contentious than for Bitcoin. This lingering ambiguity, particularly around Ethereum's classification (commodity vs. security) and the handling of staking, may have made some large institutions cautious.

• Lack of Staking Yield: Unlike holding ETH directly or through certain other investment products, the approved US Spot ETH ETFs do not currently offer holders exposure to staking yields – a core component of Ethereum's tokenomics and a significant draw for long-term investors. This makes the ETF product inherently less attractive compared to direct ownership for yield-seeking capital.

• Existing Exposure Channels: Institutional players interested in Ethereum already had established avenues for gaining exposure, including futures markets (CME ETH futures), Grayscale's Ethereum Trust (ETHE, although less efficient pre-conversion), and direct custody solutions. The incremental demand unlocked by the spot ETFs may have been smaller than anticipated.

• Market Timing and Sentiment: The ETH ETFs launched into a more challenging macroeconomic environment and a period of cooling sentiment in the broader crypto market compared to the Bitcoin ETF launch window. The initial risk-on euphoria had faded, replaced by concerns about inflation, interest rates, and geopolitical tensions.

• "Sell the News" Event: As often happens in markets, the period leading up to the ETF approval saw significant price appreciation. The actual launch may have triggered profit-taking by traders who had bought in anticipation of the event.

The impact of these weak ETF flows is significant. It signals a lack of immediate, large-scale institutional appetite for ETH through this specific channel, removing a key bullish catalyst that many had banked on. It also contributes to negative market sentiment, reinforcing the narrative that Ethereum is currently out of favor compared to Bitcoin or other trending assets. Without this expected wave of ETF-driven buying, the price is more susceptible to selling pressure from other sources.

Reason 2: Derivatives Market Flashing Red - Low Interest, Negative Funding

The derivatives market, particularly perpetual futures, provides crucial insights into trader sentiment and positioning. Two key metrics are currently painting a bearish picture for Ethereum: Open Interest (OI) and Funding Rates.

• Low Open Interest (OI): Open Interest represents the total number of outstanding derivative contracts (longs and shorts) that have not been settled. While OI naturally fluctuates, consistently low OI relative to historical peaks or compared to Bitcoin's OI suggests a lack of strong conviction and reduced speculative interest in Ethereum. When traders are uncertain or bearish, they are less likely to open large, leveraged positions, leading to subdued OI. This indicates that fewer market participants are willing to bet aggressively on ETH's future price direction, especially on the long side.

• Negative Funding Rates: Funding rates are periodic payments exchanged between long and short position holders in perpetual futures contracts. They are designed to keep the futures price tethered to the underlying spot price.

o Positive Funding: When the futures price trades at a premium to spot (contango) and bullish sentiment dominates, longs typically pay shorts. This incentivizes shorting and disincentivizes longing, helping to pull the prices back together.

o Negative Funding: When the futures price trades at a discount to spot (backwardation) and bearish sentiment prevails, shorts pay longs. This indicates a higher demand for short positions (either speculative shorting or hedging long spot holdings). Consistently negative funding rates, as observed for ETH during periods of weakness, are a strong bearish signal. It means traders are actively paying a premium to maintain short exposure, reflecting widespread pessimism about the price outlook.

•

The combination of low Open Interest and negative Funding Rates creates a negative feedback loop. It shows reduced speculative appetite, a dominance of short positioning, and a lack of leveraged longs willing to drive the price higher. While extremely negative funding can sometimes precede a "short squeeze" (where rising prices force shorts to cover, accelerating the rally), the persistent nature of these conditions recently suggests underlying weakness rather than an imminent explosive reversal. This bearish derivatives landscape acts as a significant headwind, absorbing buying pressure and making sustained rallies difficult.

Reason 3: The Relentless Rise of Competing Layer-1s

Ethereum's primary value proposition has long been its status as the dominant, most secure, and most decentralized platform for smart contracts and decentralized applications (DApps). However, its reign is facing its most significant challenge yet from a growing cohort of alternative Layer-1 (L1) blockchains, often dubbed "ETH Killers."

While Ethereum still dominates in terms of Total Value Locked (TVL) in DeFi and overall network value, competing L1s like Solana, Avalanche, Cardano, and newer entrants are rapidly gaining ground in crucial areas of network activity:

• Transaction Throughput and Fees: Many competitors offer significantly higher transaction speeds (transactions per second) and dramatically lower fees compared to Ethereum's mainnet. While Ethereum's Layer-2 scaling solutions aim to address this, the user experience on some alternative L1s can feel faster and cheaper for certain applications, attracting users and developers.

• Active Users and Daily Transactions: Chains like Solana have, at times, surpassed Ethereum in metrics like daily active addresses and transaction counts, particularly fueled by specific niches like meme coins, high-frequency DeFi, or certain NFT projects. This indicates a migration of user activity seeking lower costs or specific functionalities.

• Developer Activity and Ecosystem Growth: While Ethereum retains a vast developer community, alternative L1s are aggressively courting developers with grants, simpler tooling (in some cases), and the allure of building on the "next big thing." This leads to vibrant DApp ecosystems growing outside of Ethereum.

• Technological Differentiation: Competitors often employ different consensus mechanisms (e.g., Proof-of-History, Avalanche Consensus) or architectural designs that offer trade-offs favoring speed or specific use cases over Ethereum's current approach (though Ethereum's roadmap aims to incorporate many advancements).

The impact of this intensifying competition is multifaceted. It fragments liquidity and user attention across multiple platforms. It challenges the narrative of Ethereum's unassailable network effect. Crucially, it reduces the relative demand for ETH itself, which is needed for gas fees and staking on the Ethereum network. If users and developers increasingly opt for alternative platforms, the fundamental demand drivers for ETH weaken, putting downward pressure on its price relative to these competitors and the market overall. Ethereum is no longer the only viable option for building or using decentralized applications, and this increased competition is clearly impacting its market position and price performance.

The Path to Reversal: What Needs to Change for Ethereum?

Despite the current headwinds and the looming shadow of lower price targets, Ethereum is far from dead. It possesses a resilient community, the largest developer base, significant first-mover advantages, and a comprehensive roadmap for future upgrades. However, a sustainable trend reversal requires tangible progress and shifts across several fronts:

1. ETF Flows Must Materialize: The narrative needs to shift from disappointment to tangible success. This requires sustained, significant net inflows into the Spot ETH ETFs, potentially driven by broader institutional adoption, clearer regulatory frameworks globally, or perhaps future ETF iterations that incorporate staking yields (though regulatory hurdles for this are high).

2. Derivatives Sentiment Needs to Flip: Open Interest needs to build substantially, indicating renewed speculative conviction. More importantly, funding rates need to turn consistently positive, signaling a shift towards bullish positioning and leveraged longs re-entering the market.

3. Successful Execution of Ethereum's Roadmap: Continued progress and successful implementation of Ethereum's scaling solutions are paramount. Wider adoption and tangible impact from upgrades like Proto-Danksharding (EIP-4844) reducing Layer-2 fees, and clear progress towards future milestones like Verkle Trees and Statelessness, are needed to demonstrate Ethereum can overcome its scalability challenges and maintain its technological edge.

4. Reigniting Network Activity and Demand: Ethereum needs compelling new applications or upgrades to existing protocols that drive genuine user demand and increase the consumption of ETH for gas. This could come from innovations in DeFi, NFTs, GameFi, decentralized identity, or other unforeseen areas. The narrative needs to shift back towards Ethereum as the primary hub of valuable on-chain activity.

5. Favorable Macroeconomic Conditions: Like all risk assets, Ethereum would benefit significantly from a broader shift towards risk-on sentiment, potentially fueled by central bank easing (lower interest rates), controlled inflation, and stable global growth.

6. A Renewed, Compelling Narrative: Ethereum needs a clear and powerful story that resonates beyond its existing user base. Whether it's focusing on its superior security and decentralization, its role as the foundational "settlement layer" for the digital economy, or a new killer application, a refreshed narrative is needed to recapture investor imagination and justify a premium valuation.

Conclusion: Ethereum at a Critical Juncture

Ethereum's recent price struggles are not arbitrary; they are rooted in tangible factors: the lackluster performance of its spot ETFs, bearish signals from the derivatives market, and the undeniable pressure from faster, cheaper Layer-1 competitors. These elements combine to create an environment where contemplating a fall towards $1,000, while bearish, is a reflection of the significant challenges the network faces.

However, Ethereum's history is one of resilience and adaptation. It has weathered bear markets, technical hurdles, and competitive threats before. The path back to sustained growth and potentially new all-time highs is challenging but not impossible. It hinges on reigniting institutional interest via ETFs, flipping derivatives sentiment, successfully executing its ambitious technological roadmap to counter competitors, and benefiting from a supportive macro environment. Until these positive catalysts materialize convincingly, Ethereum may continue to lag, and the possibility of further downside, even towards the $1,000 mark in a severe downturn, will remain a topic of discussion among market participants navigating the crypto giant's uncertain future.

Ethreum

ETH-----Sell around 1640, target 1540 areaTechnical analysis of ETH contract on April 8:

Today, the large-cycle daily level closed with a small negative line yesterday. The K-line pattern continued to fall, the price was below the moving average, and it was currently deviated from the moving average, so here we have to pay attention to one issue, which is to prevent the price from rebounding and correcting to the moving average pressure position, and the moving average pressure is near the 1670 area. The attached chart indicator is dead cross running, and the big trend is no problem, it is very clear; the short-cycle hourly chart has continued to rebound since yesterday's European session, and the high point has touched the 1640 area. The current K-line pattern is continuous positive, and the attached chart indicator is golden cross running, so wait and see during the day. From the current trend, the trend of rebound correction will still be in the day, and wait for the signal of pressure before selling.

Therefore, today's ETH short-term contract trading strategy: sell at the rebound 1640 area, stop loss at the 1670 area, and target the 1540 area;

ETH ANALYSIS🔮 #ETH Analysis :: Support & Resistance Trading

💲💲 #ETH is trading between support and resistance area. If #ETH sustains above major support area then we will a bullish move and if not then we will see more bearish move in #ETH then could expect a pullback.

💸Current Price -- $1564

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

#ETH #Cryptocurrency #DYOR

ETH CHART: I FOUND THE BOTTOM!HERE IS MY FUNDA REASON OR NEWS WHY I THINK THIS IS THE LAST DROP~! BEFORE WE RECOVER AND START THE BUILDING OF CRYPTO!

Price Decline and Market Sentiment: Ethereum's price has dropped below $1,800, marking a significant decline of over 45% since the start of the year. This has raised concerns about its market stability, with some analysts predicting further drops to $1,550 if key resistance levels aren't reclaimed.

Investor Sentiment and FUD: Fear, uncertainty, and doubt (FUD) have led to increased selling pressure. Retail traders have been offloading ETH holdings, resulting in reduced trading volumes and network activity. Active addresses and transaction volumes have also declined, signaling lower demand!

Technical Challenges and Resistance Levels: Ethereum has struggled to break past critical resistance levels, such as $1,900. Its failure to reclaim these levels has validated bearish patterns, with some analysts warning of a potential drop to 17-month lows!

Macroeconomic Factors: Broader economic uncertainties, including geopolitical events like tariffs, have contributed to Ethereum's struggles. These factors have added to the negative sentiment in both the financial and crypto markets.

Network Activity and Whale Behavior: While some large investors (whales) are accumulating ETH, the overall network activity has seen a decline. This mixed behavior has created uncertainty about the asset's short-term trajectory

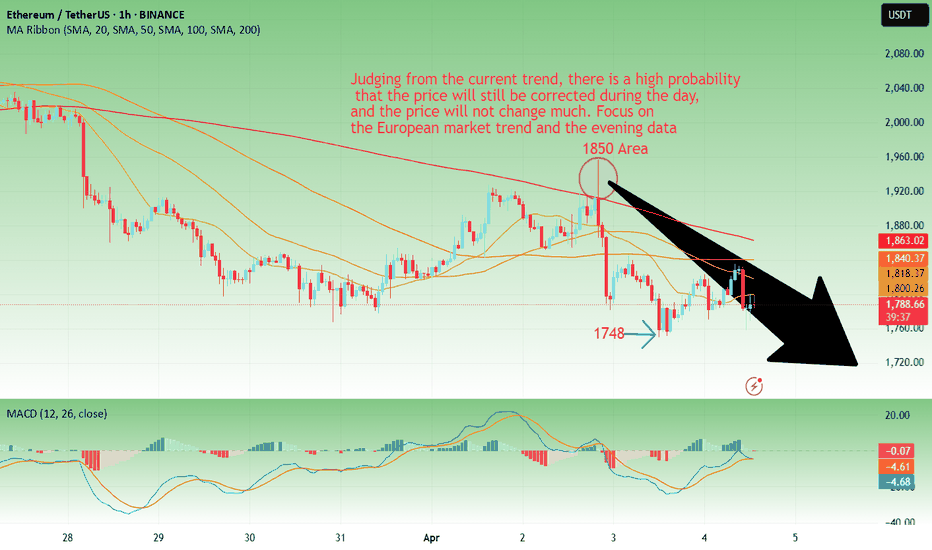

ETH-----Sell around 1810, target 1750 areaTechnical analysis of ETH contract on April 5: Today, the large-cycle daily line level closed with a small negative line yesterday, and the K-line pattern continued to fall. The price was below the moving average. The fast and slow lines of the attached indicator were glued together and flattened. From this point of view, the time happened to be on the weekend, and the weekend was mainly focused on corrections. So can we predict whether the trend of the second big drop will continue next week? Let's wait and see; the short-cycle hourly chart was under pressure in the early morning, and the K-line pattern showed continuous negative lines. The attached indicator was dead cross running, and the high point of the correction was near the 1836 area. From the perspective of various technical indicators, the current decline will continue, but the strength will not be very large.

Therefore, today's ETH short-term contract trading strategy: sell directly at the current price of 1813 area, stop loss in the 1843 area, and target the 1750 area;

ETH-----Sell around 1825, target 1750 areaTechnical analysis of ETH contract on April 4: Today, the daily level of the large cycle closed with a small positive line yesterday, and the K-line pattern was a single positive line with continuous negative lines. The price is still below the moving average and is obviously suppressed. The fast and slow lines of the attached indicator continue to close negative today, so the pattern will cross downward. Therefore, the general trend remains unchanged and continues to be bearish. Trading remains short-term and risk control is done well; the short-term price decline yesterday broke the previous low of 1750, but did not continue. The current price fluctuates within the range and there is not much movement. From the perspective of various technical indicators, the four-hour chart is a continuous negative line, and the intraday price is suppressed, so the trend is still bearish, and the previous correction high is near 1850.

Today's ETH short-term contract trading strategy: sell at the 1825 area, stop loss at the 1855 area, and target the 1750 area;

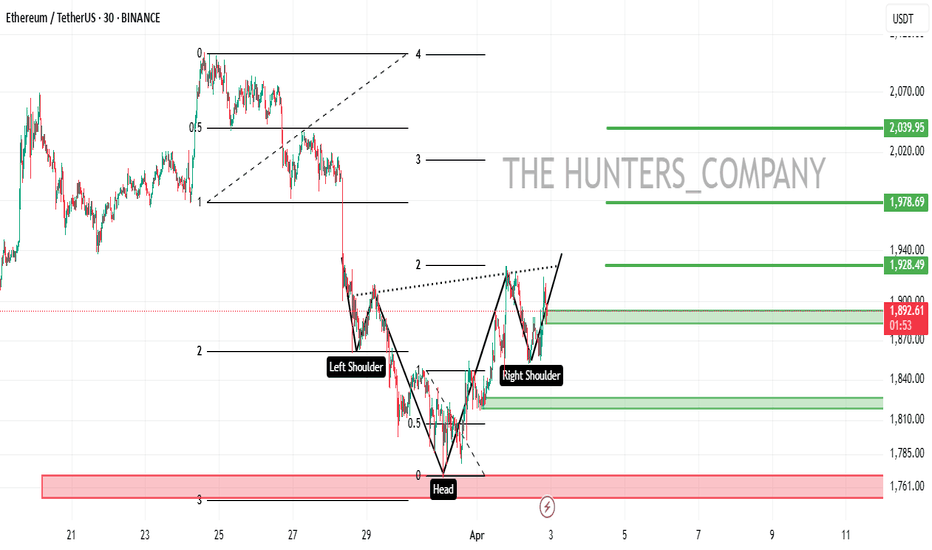

ETH/USDT:UPDATEHello dear friends

Given the price drop we had, a head and shoulders pattern has formed within the specified support range, indicating the entry of buyers.

Now, given the good support of buyers for the price, we can buy in steps with capital and risk management and move towards the specified targets.

*Trade safely with us*

ETH-----Sell around 1840, target 1770-1750 areaTechnical analysis of ETH contract on April 3: Today, the large-cycle daily line level closed with a medium-yin line yesterday, the K-line pattern was a continuous Yin and a single Yang, the price was below the moving average, and the attached indicator was dead cross, so there was no problem with the trend and it was still falling significantly, but the trend this week was more volatile, and it was greatly stimulated by the news and data. The rhythm of trading is very important; the four-hour chart is the focus, the current K-line pattern is a continuous Yin, the attached indicator is dead cross, the morning fell, and the correction was made during the day. It was just corrected to the 1845 area near the moving average pressure position, so we still have to focus on the price continuing to break in the European session. In addition, the same anti-pull strength cannot be large, otherwise it will still fluctuate.

Therefore, today's ETH short-term contract trading strategy: sell directly at the current price of 1840, stop loss in the 1870 area, and target the 1770-1750 area

Ethereum Price Analysis: Is a Drop to $1,550 Imminent This Week?As of April 3, 2025, Ethereum (ETH) is trading at approximately $1,838 (based on recent market data), reflecting a precarious position in the crypto market. After a volatile start to the year, ETH has shed over 44% year-to-date and is now testing critical support levels. This analysis explores the potential for an 11% drop to the $1,550 range within the next few days (by the end of this week, April 6), driven by technical breakdowns, bearish on-chain signals, and broader market pressures.

Technical Analysis: Bearish Signals Mounting

On the daily chart, ETH has been struggling to maintain momentum above the $1,800 psychological level. After a brief bounce from its yearly low of $1,760 on March 11, the price has failed to reclaim the $2,000 mark—a key resistance zone that previously acted as support in late 2024. Here’s a breakdown of the technical setup:

Key Support Breach: The $1,800–$1,877 range has been a critical support zone, aligning with the 61.8% Fibonacci retracement level from the December 2024 high of $4,106 to the March 2025 low of $1,759. A close below $1,770 this week would confirm a breakdown, opening the door to the next major support at $1,550–$1,600, a level last tested in October 2023.

Bearish Pattern Confirmation: The 2-hour chart shows ETH completing a corrective structure (likely an A-B-C wave) after its March 19 peak at $2,070. If wave C mirrors wave A in length—a common Elliott Wave scenario—the target aligns near $1,550, coinciding with the 1.61 external Fibonacci retracement of the recent bounce.

Moving Averages: ETH is trading below both its 50-day SMA ($2,321) and 200-day SMA ($3,010), signaling a sustained bearish trend. The 50-day SMA, now sloping downward, acts as dynamic resistance, capping any relief rallies. A failure to reclaim this level soon reinforces the downside risk.

RSI Oversold but Weak : The 14-day Relative Strength Index (RSI) sits near 30, indicating oversold conditions. However, in strong downtrends, RSI can remain oversold for extended periods, as seen during ETH’s 2022 bear market. Momentum remains weak, with no bullish divergence to suggest an imminent reversal.

Target Projection : A drop from $1,838 to $1,550 represents an 11% decline, achievable within 2–3 days if selling pressure accelerates. The $1,550 level aligns with historical support and the long-term 78.6% Fibonacci retracement, making it a plausible target.

On-Chain Data: Selling Pressure Intensifies

On-chain metrics paint a grim picture, supporting the bearish technical outlook:

Exchange Reserves Rising: Ethereum’s exchange reserve has ticked up from 18.3 million ETH, reversing a multi-month decline. This suggests long-term holders or institutions are moving assets from cold storage to exchanges, potentially preparing to sell.

Whale Activity: Recent data shows significant whale sell-offs, with large transactions (over 100 ETH) spiking in the past 48 hours. This aligns with posts on X noting whale distribution near current levels, adding downward pressure.

DeFi Weakness: Ethereum’s dominance in decentralized finance (DeFi) is waning, with total value locked (TVL) dropping as competing Layer-1 chains gain traction. Reduced network activity undermines ETH’s utility-driven demand, a key pillar of its value proposition.

Staking Dynamics: While staking activity increased post-Shapella upgrade, the anticipated selling pressure from unstaked ETH continues to linger, especially as macroeconomic uncertainty prompts profit-taking.

Market Sentiment: Fear Dominates

The broader crypto market is reeling from macroeconomic headwinds. The U.S. Core PCE Index rose to 2.8% in February, exceeding the Federal Reserve’s 2% target, signaling persistent inflation. Higher interest rates for longer dampen risk-on assets like cryptocurrencies. Posts on X reflect growing pessimism, with some traders eyeing sub-$1,000 levels if $1,760 fails—a sentiment echoed by Ethereum’s 7% drop this week alone.

Bitcoin (BTC), trading near $82,000, has also faltered, dragging altcoins lower. ETH’s correlation with BTC remains high (around 0.9), and a failure to hold $80,000 for BTC could amplify ETH’s decline. Additionally, the lack of immediate catalysts—such as ETF approvals or major network upgrades—leaves ETH vulnerable to further capitulation.

Price Scenarios and Key Levels

Bearish Case (Base Scenario): A daily close below $1,770 triggers a swift move to $1,550–$1,600 by April 6. Volume spikes and panic selling could push it lower, though $1,550 offers strong historical support.

Bullish Rejection: A reclaim of $2,070 (the March 19 high) invalidates the bearish setup, potentially sparking a relief rally to $2,250. This seems unlikely without a significant BTC breakout or positive news.

Invalidation: A close above $2,120 this week would negate the short-term bearish thesis, though resistance at the 50-day SMA ($2,321) caps upside potential.

Trading Strategy

Entry: Short ETH below $1,770 with confirmation of increased volume.

Target: $1,550 (11% drop), with a stretch goal of $1,500 if momentum persists.

Stop Loss: $1,911 (intraday high from April 2), limiting risk to 4–5%.

Risk/Reward: Approximately 2.5:1, assuming a $1,550 target.

Conclusion

Ethereum’s technical setup, coupled with bearish on-chain signals and a fearful market, suggests an 11% drop to $1,550 is plausible by the end of this week (April 6, 2025). The $1,770 level is the line in the sand—watch it closely. While oversold conditions hint at a potential bounce, the lack of buying conviction and macro pressures tilt the odds toward further downside. Traders should monitor BTC’s price action and exchange inflows for confirmation. Stay nimble, and let the charts guide your next move.

Ethereum’s drop is due to market issues, but upgrades may helpEthereum , one of the most popular and widely used blockchain platforms, is going through a rough patch. Since its launch in 2015, the cryptocurrency has drawn attention for its decentralized nature and its capabilities for smart contracts and decentralized applications (DApps). However, despite its early success, Ethereum has experienced significant price fluctuations in recent years. According to analysts, its price has dropped approximately 45.4% in the last quarter alone.

Several key factors are driving Ethereum’s recent price decline. First , increasing competition from faster and cheaper blockchains like Solana and Cardano is drawing in users and developers, reducing demand for Ethereum. Second , high transaction fees — especially during times of network congestion — make the platform less attractive for users who prioritize speed and cost-efficiency. Finally , delays in implementing upgrades such as the full transition to Ethereum 2.0 have eroded investor and user confidence, negatively impacting the token’s price.

Despite the current challenges, Ethereum remains one of the most promising cryptocurrencies. In 2025, its value and adoption may rise significantly due to several critical developments:

Full transition to Ethereum 2.0: The long-awaited move to Ethereum 2.0 — set to improve transaction speed, enhance security, and reduce fees — could serve as a major growth driver. The switch from Proof of Work (PoW) to Proof of Stake (PoS) will improve the network’s energy efficiency, making it more eco-friendly and cost-effective. With these enhancements, Ethereum could better compete with rival blockchains and attract more users and investors.

Boom in Decentralized Finance (DeFi): Ethereum serves as the foundation for many DeFi applications, which continue to gain popularity. In 2025, the growth of DeFi projects and the increasing total value locked in these apps may fuel demand for Ethereum. Ongoing development and integration of new financial instruments in the Ethereum ecosystem will further cement its role in the crypto economy.

Emergence of Layer 2 technologies: Layer 2 solutions like Optimistic Rollups and zk-Rollups could greatly enhance Ethereum’s scalability by reducing the load on the mainnet and lowering transaction fees. These technologies are essential for mass adoption, helping Ethereum scale efficiently while maintaining decentralization.

Growth of NFTs and asset tokenization: As tokenization and NFTs continue to rise in popularity, Ethereum remains the leading platform in this space. By 2025, we could see further expansion in the NFT market and tokenized assets, driving increased demand for Ethereum as the go-to platform for creating and exchanging digital assets.

Global crypto adoption and regulatory clarity: In 2025, regulatory frameworks for cryptocurrencies are expected to become clearer around the world. With growing government acceptance and legal recognition of crypto assets, Ethereum could become a foundational element of future financial systems—attracting fresh investment and pushing its value higher.

Despite the current headwinds, Ethereum has strong potential for recovery and future growth. FreshForex analysts predict a rebound could occur as early as Q3 or Q4 of 2025, driven by upcoming upgrades and network improvements. Don’t miss the chance to get in at the right time!

Exclusive offer for our readers: Get a massive 10% bonus on your balance for every crypto deposit of $202 or more! Just contact support with the promo code 10CRYPTO , fund your account, and trade with extra power. Full bonus terms available here.

At FreshForex, you can open trading accounts in 7 cryptocurrencies and access over 70 crypto pairs with up to 1:100 leverage — trade 24/7.

ETH-----Sell around 1900, target 1820 areaTechnical analysis of ETH contract on April 2: Today, the large-cycle daily level closed with a small positive line yesterday, and the K-line pattern was a single positive line with continuous negatives. The price was at a low level, and the attached indicator was a golden cross with a shrinking volume, but it can be seen that the fast and slow lines are still below the zero axis, which is an obvious price suppression, and the current pullback trend is only a correction performance, which is difficult to continue and difficult to break. This is the signal, so the downward trend remains unchanged; the correction trend of the four-hour chart for two consecutive trading days is also completed. At present, the K-line pattern is continuous negative, and the price is under pressure and retreats. Whether the European session can break down is very critical. The short-cycle hourly chart of the previous day's US session hit a high in the early morning and retreated under pressure in the morning. The current K-line pattern is a continuous negative and the attached indicator is dead cross running. It is still bearish during the day. The starting point is near the 1850 area. The European session depends on the breakout of this position.

Therefore, today's ETH short-term contract trading strategy: sell at the pullback 1900 area, stop loss at the 1930 area, and target the 1820 area;

Why is Eth Falling? ETH/BTC Ratio Hits All-Time Low Since 2020Why is Ethereum Falling? ETH/BTC Ratio Hits All-Time Low Since 2020

The cryptocurrency market is a volatile landscape, constantly shifting and evolving. Recent data has revealed a significant development: the Ethereum to Bitcoin (ETH/BTC) ratio has plummeted to an all-time low since 2020. This stark decline, currently resting at a mere 0.02 has ignited a wave of speculation and concern within the crypto community, raising questions about Ethereum's current standing and future trajectory.

The ETH/BTC ratio serves as a crucial metric for comparing the relative performance of Ethereum against Bitcoin. When the ratio falls, it indicates that Bitcoin is outperforming Ethereum, and conversely, a rising ratio suggests Ethereum's ascendancy. The current dramatic drop highlights a significant divergence in the fortunes of these two leading cryptocurrencies.

The backdrop to this decline is multifaceted. Bitcoin, often seen as the “digital gold” of the crypto world, has exhibited remarkable resilience and strengthened its position. This consolidation is likely driven by several factors, including increased institutional adoption, regulatory clarity in some jurisdictions, and its established reputation as a store of value. These factors have contributed to a sense of stability and confidence in Bitcoin, attracting capital and bolstering its market position.

Ethereum, on the other hand, has faced challenges in maintaining its momentum. While it remains the leading platform for smart contracts and decentralized applications (dApps), it has struggled to keep pace with Bitcoin's surge. Several factors contribute to this relative underperformance.

Firstly, regulatory uncertainty surrounding Ethereum and its classification has cast a shadow over its future prospects. The evolving regulatory landscape, particularly in major economies like the United States, has created a sense of unease among investors. The lack of clear guidelines and the potential for stricter regulations have dampened enthusiasm and limited institutional investment.

Secondly, Ethereum has faced competition from emerging layer-1 blockchains that offer faster transaction speeds and lower fees. These “Ethereum killers,” as they are sometimes called, have attracted developers and users seeking alternatives to Ethereum's perceived limitations. While Ethereum has undergone significant upgrades, such as the transition to proof-of-stake (The Merge), the benefits have not yet translated into a sustained surge in its relative value.

Thirdly, the overall market sentiment has played a role. Bitcoin's narrative as a safe haven and store of value has resonated strongly during periods of economic uncertainty. In contrast, Ethereum, with its focus on innovation and development, is perceived as a riskier asset. When market volatility increases, investors often gravitate towards the perceived safety of Bitcoin.

The decline in the ETH/BTC ratio raises several critical questions. Is Ethereum in trouble? Is this a temporary setback or a sign of a more fundamental shift in the crypto landscape?

While the current situation is concerning, it is essential to consider the long-term potential of Ethereum. Its robust ecosystem, driven by a vibrant community of developers and innovators, remains a significant asset. Ethereum's role in powering decentralized finance (DeFi), non-fungible tokens (NFTs), and other emerging technologies positions it as a crucial player in the future of the internet.

Furthermore, Ethereum's ongoing development efforts, including layer-2 scaling solutions and future upgrades, aim to address its scalability and efficiency challenges. These improvements could potentially revitalize Ethereum's performance and restore its competitive edge.

However, the current market dynamics suggest that Ethereum faces an uphill battle. To regain its footing, it needs to overcome regulatory hurdles, address its scalability issues, and effectively communicate its value proposition to a broader audience.

The cryptocurrency market is notoriously unpredictable, and past performance is not indicative of future results. The ETH/BTC ratio could rebound, or it could continue its downward trajectory. The outcome will depend on a complex interplay of factors, including regulatory developments, technological advancements, and market sentiment.

In the meantime, the low ETH/BTC ratio serves as a stark reminder of the dynamic nature of the cryptocurrency market. It underscores the importance of diversification and the need for investors to consider the risks and potential rewards of each asset carefully.

The current situation also highlights the need for Ethereum developers and community members to focus on the core values of the project, and to continue to innovate and improve the technology. Ultimately, the success of Ethereum will depend on its ability to adapt to the changing landscape and deliver on its promise of a decentralized and equitable future.

In conclusion, while the record low ETH/BTC ratio raises concerns about Ethereum's current standing, it is premature to declare its demise. The cryptocurrency market is constantly evolving, and Ethereum's long-term potential remains significant. However, the current challenges demand a proactive and strategic approach to ensure its continued relevance and success in the years to come.

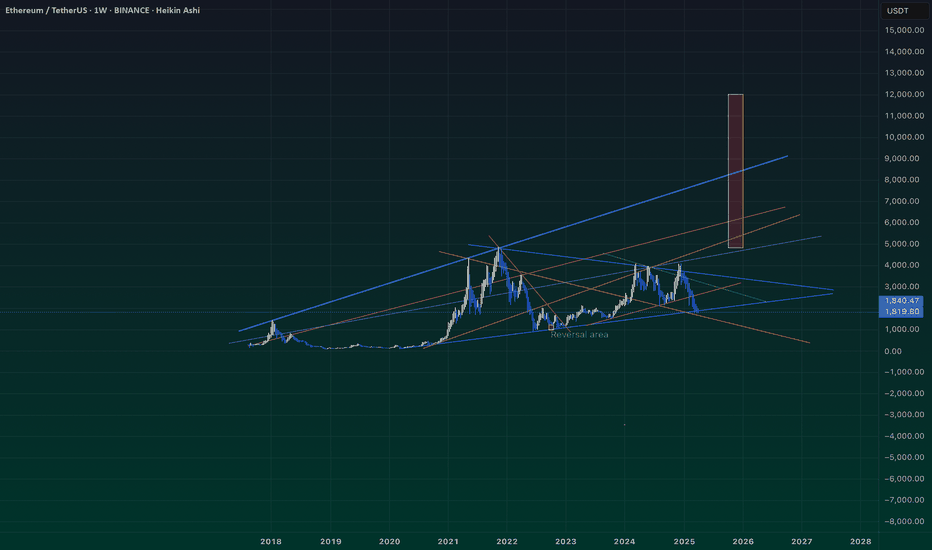

LONG ON ETHEREUM (ETH/USD)Ethereum has given a change of character (choc) to the upside on the 4 hour timeframe...

followed by a nice sweep of engineered liquidity!

Its currently respecting a key demand are and I believe it will now rise for 300-500 points this week.

I am buying Eth to the next level of resistance.

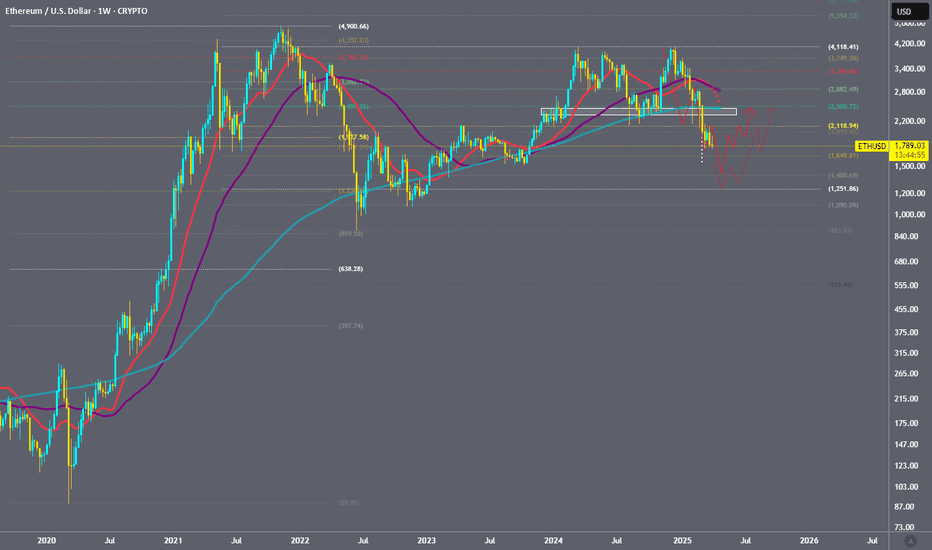

ETH: Possible Scenario!Hello Traders,

Here's a quick update on ETH in the weekly timeframe.

ETH is currently in a downtrend, trading at $1,890. It has already faced a 57% drop, and the trend is likely to continue.

Based on this weekly analysis, I expect ETH to drop to $1,400, where we have a support level. In a worst-case scenario, it could fall to $1,000. A rebound toward $2,200 is possible from the current market price, but it may not sustain for long.

Conclusion:

✅ Potential Accumulation Range: $1,000 - $1,400

✅ Lower Support: $1,000

Note: Always do your own research and analysis before investing.

ETH-----More around 1865 target 1800 areaTechnical analysis of ETH contract on March 30: Today, the large-cycle daily level closed with a small negative line yesterday, the K-line pattern continued to fall, the price was below the moving average, and the attached indicator was running with a golden cross and shrinking volume. The big trend was still very obvious, but I would like to remind you that the current price deviates from the moving average, and if there is a rebound trend in the future, it is also a correction trend. Don't be misled; the short-cycle hourly chart showed that the European market fell and the US market continued to break the low yesterday, and the morning support rebounded and corrected. The current K-line pattern continued to rise, and the attached indicator was running with a golden cross, so it still needs to be corrected within the day, and the high point of the US market correction yesterday was in the 1865 area.

Today's ETH short-term contract trading strategy: sell at the rebound 1865 area, stop loss in the 1895 area, and target the 1800 area;

ETH/USDT | Potential Trend Reversal from Monthly Demand Zone📉 Market Overview:

ETH/USDT is currently holding within a strong monthly demand zone, showing signs of possible accumulation. Price has tested this level and indicating a potential reaction.

🔍 Key Trading Conditions:

✅ Liquidity Sweep: If price sweeps the daily previous low, this could be a liquidity grab to trap sellers.

✅ Market Structure Shift (MSS): If price breaks a key lower high to the upside, it would confirm a short term bullish structure shift, signaling a potential trend reversal.

📊 Trade Plan:

🎯 Bullish Confirmation: Wait for a clear MSS to the upside on lower timeframes (4H/1H).

🔹 Entry: After a successful daily low sweep & bullish confirmation.

🔹 SL: Below the liquidity sweep low.

🔹 TP1: Mid-range supply zone.

🔹 TP2: Previous structural highs.

🚨 Risk Management:

Always wait for confirmation before entering.

Monitor price action around key levels.

Manage risk with proper stop-loss placement.

📌 Conclusion:

If ETH sweeps liquidity and shifts structure bullishly, we can expect a potential reversal. Stay patient and let price confirm the move!

📈 Like & Follow for More Market Updates! 🚀