ETH/USD 1DAY UPDATE BY CRYPTO SANDERS !!Hello, welcome to this ETH /USD 1DAY chart update by CRYPTOSANDERS.

I have tried to bring the best possible outcome to this chart.

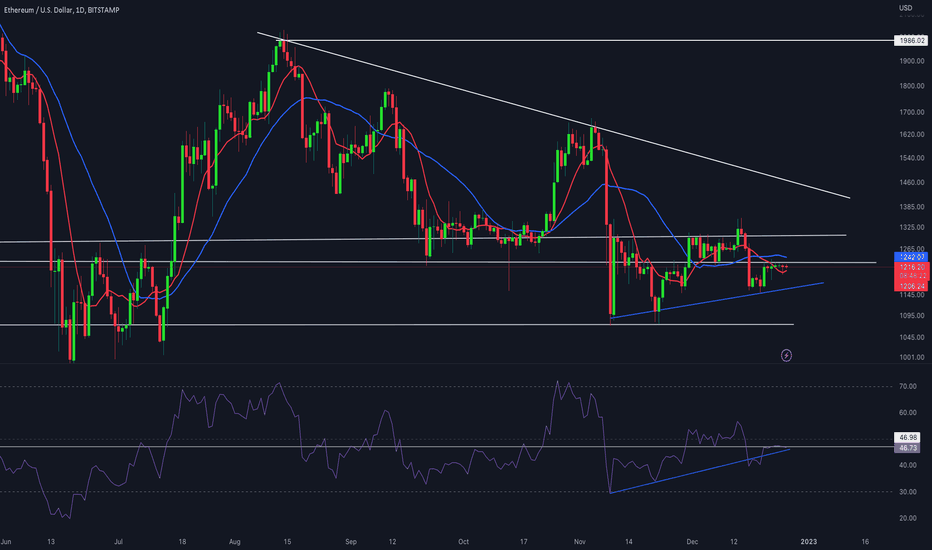

CHART ANALYSIS:-Ethereum (ETH) was also marginally higher in today’s session, with prices continuing to trade below a long-term ceiling

ETH/USD hit a high of $1,342.76 earlier in the day, less than 24 hours after trading at a low of $1,324.97.

Overall, ethereum remains below a resistance point of $1,350, with many expecting prices to move after the release of U.S. inflation figures tomorrow.

As can be seen from the chart, the consolidation below this price ceiling comes as the RSI continues to trade under a hurdle of its own.

Price strength is now tracking at the 68.73 level, which is under a point of resistance at the 70.00 mark.

ETH bulls are likely still targeting a move beyond $1,400, however, in order for this to happen, the RSI level of 70.00 must first be overcome.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you

Ethshort

ETH/USD 1DAY UPDATE BY CRYPTO SANDERS !!Hello, welcome to this ETH /USD 1DAY chart update by CRYPTOSANDERS.

I have tried to bring the best possible outcome to this chart.

CHART ANALYSIS:-Ethereum (ETH) also rallied to a multiple-week high on Monday, with prices climbing above a recent ceiling at $1,300.

ETH/USD raced to an intraday high of $1,324.01 earlier in today’s session, which comes less than 24 hours after trading at a low of $1,261.95.

Similar to bitcoin, today’s rally pushed ethereum to its highest point since mid-December, when the coin was above $1,350.

As can be seen from the chart, an upwards crossover of moving averages has also occurred here, with the RSI gaining momentum as well.

Currently, the index is tracking at 66.81, which is its strongest point since October 29, when ETH was trading upwards of $1,500.

Should bullish sentiment remain throughout the week, ethereum will likely climb past the $1,400 level.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you

BTC & ETH Comparison where the rally will stop ?Hello Everyone,

Welcome Back, Well We anticipated the region for Ethereum to short around 1350 1370 but now as per the Footprints and Positive Delta,

we come to know that Ethereum might stay in this range and try to flip it into support for further continuation towards 1500$

having said that there is high possibilities that BTC might do the same as Ethereum did.

So far so good no sign of weakness has been spotted in both charts, so becarefull while you shorting an uptrend

patience is the name of the game

Disclaimer :

All information is only for educational and entertainment purpose , do paper trades only.

ETH/USD 1DAY UPDATE BY CRYPTO SANDERS Ethereum / U.S. Dollar (BIHello, welcome to this ETH /USD 1DAY chart update by CRYPTOSANDERS.

I have tried to bring the best possible outcome to this chart.

CHART ANALYSIS:-Ethereum (ETH) also consolidated in today’s session, with momentum marginally shifting on Thursday.

ETH/USD dropped to a bottom of $1,246.21 earlier in the day, which comes less than 24 hours after hitting a high of $1,264.81.

Despite the drop, sentiment remains somewhat bullish, as ETH continues to trade above its long-term resistance level at $1,230.

From the chart, the 10-day (red) and 25-day (blue) moving averages also remain close in proximity, maintaining chances of an upwards crossover.

This seems to be one of the factors in place that is keeping bullish sentiment alive. However, with the RSI now falling lower, this could begin to change.

Since failing to break out of a ceiling at the 57.00 level, price strength is now tracking at 55.40.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you

ETHSHORT SETUPOn ETHUSDT there is a rising wedge and a bear flag. I am keeping this setup in mind for the next days. There is also a value line on the 1216.98 level and also on the 1202.36 level. A expansion range was also formed and the price is currently at the top of the expansion, and on the top of the bear flag channel. I will be keeping this chart in mind for a short and currently am scalping the small wedge range.

ETH SHORT SETUP FROM RETRACEMENTDay's Bias: Bearish

Plot:

Previously a strong drop from a rising wedge pattern made a strong bearish impulse move leaving huge amount of gaps along the way.

Price recently shows bullish momentum on the lower TF signals the retracement within 50 to 61.8% to take out some of the gaps.

Price momentarily consolidates exactly at the retracement area.

Price created liquidity pools and has been taken out.

Today Asian Range has the highest probability of no longer being revisited to continue another bearish impulse move.

After price revisits 50% of the Asian Range multiple times, then creating a displacement leaving small gaps to be revisited before it continues towards the expected direction.

SHORT ETH After loosing our last entry for this whole long we would've caught by 70 cents I'm sad. Welcome to the game of trading what can I say LOL. I am looking for a short at buyoff exhaustion at 1271.04. My hard Stop LOSS is at 1283.8. GOING IN AT 100X LEVERAGE

TP1 is at 1258.28 once TP HITS SET SL TO ENTRY

TP2 is at 1230.8.

ETH/USD 1DAY UPDATE BY CRYPTO SANDERSHello, welcome to this ETH /USD 1DAY chart update by CRYPTOSANDERS.

I have tried to bring the best possible outcome to this chart.

CHART ANALYSIS:-Ethereum (ETH) mostly consolidated on Tuesday, with prices continuing to trade above the $1,200 point.

Following a low of $1,212.49 to start the year, ETH/USD hit a peak of $1,219.86 earlier in today’s session.

As a result of today’s move, ethereum moved closer to a resistance level of $1,230, which has been in place since December 16.

Looking at the chart, ethereum was unable to recapture this ceiling, as the RSI of 14 days failed to break out of resistance at 49.00.

As of writing, the index is tracking at 48.90, with bulls remaining close to this point ahead of tomorrow’s FOMC report, which could be the trigger to a potential price surge.

After tomorrow’s report, attention will turn to Friday’s U.S. nonfarm payrolls (NFP), which could also be a catalyst for market moves.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you

ETH/USDT 4 HOUR UPDATEHello, welcome to this ETH/USDT chart update by CRYPTO SANDERS.

I have tried to bring the best possible outcome to this chart.

CHART ANALYSIS:-ETH continues the sideways movement. The market is loading for a big impulsive move. The trading range major support is the $1160-$1170 area and major resistance is the $1230-$1240 area. Plan your trades accordingly.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you

ETH/USDT 1DAY UPDATE BY CRYPTO SANDERSHello, welcome to this ETH /USD 1DAY chart update by CRYPTOSANDERS.

I have tried to bring the best possible outcome to this chart.

CHART ANALYSIS:- Ethereum (ETH)

Another week has passed with little excitement for Ethereum investors as volatility was low – likely due to the Christmas holidays. However, ETH’s price did fall by 2% in the past seven days. This is a negligible move in the price, which still remains in a flat trend.

This cryptocurrency remains stuck between the key support at $1,160 and the resistance at $1,240. This channel is intact for the second half of December, and it is unlikely to be broken with the New Year celebrations around the corner.

Looking ahead, the volatility is more likely to return in January 2023. So long as the support levels above $1,000 hold, Ethereum has a chance to break away and attempt to make a higher high. The alternative would see it fall to a three-digit price.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you

ETH Stuck at 1200! Will it Break? Looking at the 4h chart on ETH, we can see it's maintained its tight range around 1200 while also sitting just below horizontal resistance and our 50, 100, and 200 EMAs between 1200-1230.

Based on the above resistance levels, I'm still biased towards the downside short-term. My first long target will be 1150, followed by 1100 if we get there. The RSI is still curving upward along with the MACD which gives me some hope, but until we definitively close above 1230, I'm not convinced.

If you enjoyed my TA, please send a boost my way and comment below :)

ETH Broke Through Support! What's Next?Looking at ETH on the 4h, we can see it rejected off of our 50 and 100 EMAs as predicted and broke through our 1200 support.

Right now I'm look for ETH to retest the 1150 level and will be placing longs there to DCA. If you're looking to short, you could place one here with a stop at 1210 or wait for ETH to reach a more substantial resistance of 1300 before placing a short.

If you enjoyed my TA, please send a boost my way and comment below :)

Daily review of ETH interval 1HHello everyone, let's look at the ETH to USDT chart on a 1-hour time frame. As you can see, the price is moving in the marked channel.

Let's start with the support line and as you can see the first support in the near future is $1209, if the support is broken then the next support is $1202 and $1193.

Now let's go to the resistance line, as you can see the first resistance is $1216, if you manage to break it, the next resistance will be $1220, $1223 and $1227.

Looking at the CHOP indicator, we see that in the 1-hour interval, the energy slowly starts to rise, the MACD indicates a local downtrend, while the RSI is close to the low, we can see a small correction and price rebound.

ETH/USD 1DAY UPDATE BY CRYPTO SANDERSHello, welcome to this ETH /USD 1DAY chart update by CRYPTOSANDERS.

I have tried to bring the best possible outcome to this chart.

CHART ANALYSIS:-Ethereum (ETH) mostly consolidated on Monday, with prices continuing to trade below the $1,230 point.

Following a low of $1,203.72 on Christmas Day, ETH/USD raced to a peak of $1,222.61 earlier in today’s session.

As a result of today’s move, ethereum continued to trade below its key resistance level of $1,230 for a sixth straight day.

Looking at the chart, the failure to break out of this point comes as the RSI continued to hover near a resistance of its own at 48.00

As of writing, the index is tracking at 47.33, which comes after two weeks of residing under the 48.00 mark.

Despite this, the 10-day (red) moving average (MA) has begun to move closer to its 25-day (blue) counterpart, which could mean an upward cross is pending in the coming days.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you

ETH Fell Below 3 EMAs on the 4h!Looking at the ETH chart on the 4h, we can see it fell below all 3 EMAs (50, 100, 200 EMAs) which is definitely a bearish sign.

The RSI is curving sharply downwards along with the MACD. It's bottomed out on lower timeframes but still has more room to decline on the 4h. With that said, we are at micro support at 1200 so we may find some relief here temporarily. If we fall below the 1200 support, there's a high likelihood 1150 is next. It's not looking good for ETH until we can break and close above the 1240 level (all 3 EMAs). Until then, I would looking to place a long here with a tight stop at 1185 or a long at 1150, or a short at 1300. Do not trade the middle ranges.

If enjoyed my TA or have any questions about getting access to my indicators, please send a boost my way, PM me, or comment below :)

ETH/USD 1DAY UPDATE BY CRYPTO SANDERSHello, welcome to this ETH /USD 1DAY chart update by CRYPTOSANDERS.

I have tried to bring the best possible outcome to this chart.

CHART ANALYSIS:-Ethereum (ETH) was marginally higher at the end of the week, as prices moved closer to a key resistance level earlier today.

ETH/USD raced to an intraday peak of $1,224.21 in Friday’s session, less than 24 hours after hovering at $1,187.13.

Today’s move sees ETH bulls once again try to break out of the long-term resistance level of $1,230.

Looking at the chart, the 14-day RSI is now rallying above a resistance point at 47.00, and tracking at 47.92, with the next visible ceiling at 52.00

In order for bulls to continue to push ethereum higher, price strength will likely need to surge toward this upcoming resistance of 52.00.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you

$ETH - WHAT'S NEXT? BIG DROP..?$ETH - WHAT'S NEXT?

We hit the target of this 'beautiful' head and shoulders and are now in between a supply and resistance zone.

The next demand zone is at $665 and with the $BTC chart in mind, I expect us to reach this level.

Invalidation = break of the black trendline.

ETH - trade rekapDisclaimer: If you think this chart is a mess, you are wrong. Here, we are dealing with lots of fibonacci lines to find confluence at specific zones we want to trade. As we want to maximize our profits, we want to trade at highest possible risk reward ratio. As this is a game of possibilities, our job is to find specific zone with highets probability to make price reaction.

Scalp trade. This is how we catch the trades, because we are traders, not gamblers. Why this trade works? Because we have mutiple confluences at the same place. Its yellow trend line of few wick highs. Its blue EMA 233 which is very important EMA. Next, there is 1 fibonacci extension. Enough to think of taking a trade. Now, there is already 1:3 profit taken. You can drive this all the way down if possible, or moving the stop loss in profit level by level.

Happy trading :))

Tools:

- Fibonacci retreacement

- Fibonacci extension

- Pitchfork (All types)

- Trend lines

- RSI

- EMA fibonacci numbers

If you take closer look, you can see how price respects the lines. If the trade analys is good, we can find a place where the top/bottom of the wick will happen, therefore place an entry buy/sell order and let the magic happen :)

ETH/USD 1DAY UPDATE BY CRYPTO SANDERSHello, welcome to this ETH /USD 1DAY chart update by CRYPTOSANDERS.

I have tried to bring the best possible outcome to this chart.

CHART ANALYSIS:-Ethereum (ETH)also consolidated in today’s session, with bulls managing to keep prices above the $1,200 level.

Following a low of $1,208.03 in Tuesday’s session, ETH/USD was marginally higher on Thursday, as it rose to a peak of $1,219.61.

The move sees the world’s second-largest cryptocurrency continue to be a stone’s throw away from a ceiling at $1,230.

Despite the prospect of higher highs, overall momentum seems relatively bearish, with the 10-day (red) moving average extending a crossover with its 25-day (blue) counterpart.

As can be deduced from the chart, the RSI also looks set for a downtrend, as it failed to break out of its current ceiling at 47.00

In order for bullish sentiment to return, it is likely that a move beyond this resistance will need to take place.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you