#ETH/USDT#ETH

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a rebound from the lower limit of the descending channel, this support is at a price of 2000

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 2117

First target 2211

Second target 2304

Third target 2433

Ethshort

#ETH is hitting a major resistance next target $4000! Here's Why#ETH is back inside the legendary 1,883-day trendline, a massive bullish signal for altcoins.

Meanwhile, BTC Dominance is getting rejected from the top, adding fuel to the altcoin momentum.

But there's one key confirmation still needed before we talk about new ATHs for ETH, BTC, and the broader altcoin market:

The 200-Week EMA.

Currently sitting around $2,237, this level needs to be claimed with a strong weekly close. ETH is trading above it right now, but the next 2 days and 4 hours are crucial.

A confirmed breakout here would signal a major shift in ETH's 200-week momentum a structural change that could trigger the next big leg up.

I believe it’s only a matter of time before ETH closes above this level. Once that happens, the next target for CRYPTOCAP:ETH would be $2980, $3488 and $4000!

What do you think?

Drop your thoughts in the comments and hit the like button if you found this valuable.

#PEACE ✌️

BUY MARKET!!!Hello dears

If you are risk-averse, this analysis is for you...

Given the decline we had, you can see that the price was supported within the specified support range and a range was formed that can be purchased with risk and capital management and moved to the specified ranges...

*Trade safely with us*

AI Prediction ETH/USD for 24 hour! Intraday trading!May 5, 2025 6:36 pm. ETH/USD. ETH/USD Trading Plan

Long Scenario

- Entry: $1,815 (confirmed by Supertrend long + RSI rising above 40).

- Stop-Loss (SL): $1,790 (below $1,800 support).

- Take-Profit (TP): $1,840 (below $1,850 resistance).

- Trailing Stop: 13 points (2x ATR).

Short Scenario

- Entry: $1,795 (confirmed by breakdown below $1,800 + MACD bearish crossover).

- Stop-Loss (SL): $1,820 (above $1,810–$1,820 resistance).

- Take-Profit (TP): $1,750 (above $1,780 support).

- Trailing Stop: 13 points (2x ATR).

AI ETH Prediction for Next 6–24 Hours!May 4, 2025 4:21 pm. ETH/USD Trading Strategy

Timeframe: Short-Term (Next 6–24 Hours)

Long Scenario

- Entry: Break above 1833.50 (confirmed bullish momentum).

- Confirmation: MACD bullish crossover + RSI > 50.

- Stop-Loss (SL): 1818.00 (below support zone 1820–1825).

- Take-Profit (TP): 1838.00 (below resistance 1840).

- Trailing Stop: Activate at 1835.00, trail by 0.5%.

Short Scenario

- Entry : Drop below 1825.00 (bearish breakdown).

- Confirmation: Supertrend remains short + Stochastic RSI reversal.

- Stop-Loss (SL): 1836.00 (above resistance 1833.50).

- Take-Profit (TP): 1815.00 (above support 1815).

- Trailing Stop: Activate at 1820.00, trail by 0.5%.

#ETH/USDT#ETH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 1815.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 1840

First target: 1860

Second target: 1876

Third target: 1890

Ethereum's $2k Crossroads: Squeeze Up or Crash Down?Ethereum at a Crossroads: Eyeing $2,000 Amidst Short Squeeze Hopes, Crash Warnings, and Existential Questions

Ethereum (ETH), the bedrock of decentralized finance (DeFi) and the engine behind countless non-fungible tokens (NFTs), finds itself ensnared in a complex web of conflicting market signals and divergent analyst opinions. On one hand, recent price action shows resilience, with ETH powering through previous resistance levels and setting its sights on the psychologically significant $2,000 mark. This move is potentially bolstered by intriguing on-chain data, such as declining supply on major exchanges like Binance, sparking whispers of an impending short squeeze. Yet, casting a long shadow over this optimism are stark warnings: technical analysts point to rare, potentially bearish patterns forming, prominent trading firms question its fundamental value proposition compared to Bitcoin (BTC), highlighting its staggering year-to-date losses, and some even provocatively label it more akin to a "memecoin."

This cacophony of bullish hopes and bearish alerts places Ethereum at a critical juncture. Is the recent surge the beginning of a sustained recovery, fueled by tightening supply and renewed developer activity? Or is it merely a deceptive bounce within a larger downtrend, vulnerable to a potential crash as underlying weaknesses and unfavorable comparisons to Bitcoin take hold? Dissecting these opposing narratives is crucial for understanding the intense battleground Ethereum's price chart has become.

The Bullish Ascent: Powering Through Resistance, Eyeing $2,000

The immediate catalyst for renewed optimism stems from Ethereum's recent price performance. After a period of consolidation and, at times, significant downward pressure, ETH has demonstrated notable strength. Headlines proclaiming "Ethereum Price Powers Through Resistance — Eyes on $2,000?" capture this sentiment. Breaking through previously established resistance levels (potentially building on support found around the $1,800 mark) is a technically significant event. It suggests buyers are stepping in with enough conviction to overcome selling pressure that had previously capped advances.

Successfully reclaiming and holding levels above former resistance transforms these zones into potential new support floors, providing a base for further upward movement. The $2,000 level looms large, not just as a round number, but often as a key area of historical price interaction – a zone where significant buying or selling interest has previously materialized. A decisive break above $2,000 could inject further confidence into the market, potentially attracting momentum traders and reinforcing the bullish narrative.

The Binance Supply Drop and Short Squeeze Speculation

Adding intrigue to the bullish case is the observation of declining Ether supply on major exchanges, specifically Binance. Exchange supply is a closely watched metric. When the amount of ETH held on exchanges decreases, it generally implies that investors are withdrawing their coins to private wallets, often for longer-term holding ("HODLing") or for use within the DeFi ecosystem (staking, lending, etc.). This reduction in readily available supply on exchanges can, in theory, create a tighter market.

This dynamic fuels speculation about a potential "short squeeze." A short squeeze occurs when the price of an asset starts to rise rapidly, forcing traders who had bet against it (short sellers) to buy back the asset to close their positions and cut their losses. This forced buying adds further upward pressure on the price, creating a rapid, cascading effect. If a significant number of traders have shorted ETH, anticipating further price declines, a sustained move upwards coupled with shrinking exchange supply could create the conditions for such a squeeze, dramatically accelerating the price towards and potentially beyond the $2,000 target. While short squeezes are relatively rare and difficult to predict accurately, the declining supply on a major platform like Binance certainly adds a compelling element to the bullish thesis.

Underlying Strengths: The Long-Term Vision

Beyond short-term price action and supply dynamics, Ethereum's bulls point to its fundamental strengths. The successful transition to Proof-of-Stake (PoS) via "The Merge" was a monumental technical achievement, drastically reducing the network's energy consumption and changing its tokenomics by potentially making ETH a deflationary asset under certain conditions (where more ETH is "burned" via transaction fees than is issued as staking rewards). Ongoing scalability upgrades, often referred to under the umbrella of Ethereum 2.0 developments (like proto-danksharding via EIP-4844), aim to reduce transaction fees and increase throughput, making the network more efficient and attractive for developers and users.

Ethereum remains the dominant platform for smart contracts, DeFi applications, and NFT marketplaces. Its vast developer community, established network effects, and continuous innovation pipeline are often cited as core long-term value drivers that short-term price volatility cannot erase. For believers in Ethereum's vision, the current price levels, even after the recent bounce, might represent an opportunity to accumulate an asset with significant future potential.

The Bearish Counter-Narrative: Red Alerts and Worrying Comparisons

However, the optimism is heavily tempered by significant bearish signals and critiques. This serves as a stark warning. Technical analysis involves studying chart patterns and indicators to forecast future price movements. While the specific "rare pattern" isn't detailed, the emergence of such signals often causes significant concern among traders. Patterns like head-and-shoulders tops, descending triangles, or bearish divergences on key indicators can suggest that upward momentum is waning and a significant price decline could be imminent. Such technical warnings cannot be easily dismissed, especially when they align with other concerning factors.

The Stark Reality: Underperformance and the "Memecoin" Jab

Perhaps the most damaging critique comes from the direct comparison with Bitcoin and the assessment of Ethereum's recent performance. A large year-to-date drop is a brutal statistic, especially when Bitcoin, while also volatile, may have fared comparatively better during the same period (depending on the exact timeframe and BTC's own fluctuations).

Why the "memecoin" comparison? Memecoins are typically characterized by extreme volatility, price movements driven largely by social media hype and sentiment rather than clear fundamental value, and a lack of a distinct, widely accepted use case beyond speculation. While some calling Ethereum a memecoin is hyperbolic – given its vast ecosystem and utility – the critique likely stems from its recent high volatility and its struggle to maintain value relative to Bitcoin. The trading firm's assertion that Ether's "risk-reward is now unjustifiable compared to Bitcoin" encapsulates this view. They likely argue that Bitcoin's clearer narrative as a potential store of value or "digital gold," potentially bolstered by institutional adoption via ETFs, offers a more compelling investment case with potentially less downside risk compared to Ethereum, which faces ongoing scalability challenges, competition from other Layer 1 blockchains, and perhaps greater regulatory uncertainty regarding its status (security vs. commodity).

This underperformance raises difficult questions. If Ethereum is the backbone of Web3, why has its price struggled so much relative to its peers or even its own potential? Possible contributing factors include:

1. Capital Rotation: The excitement and capital inflows surrounding spot Bitcoin ETFs may have drawn investment away from Ethereum and other altcoins.

2. Regulatory Uncertainty: Ongoing debates, particularly in the US, about whether ETH should be classified as a security could be creating hesitancy among institutional investors.

3. Competition: Numerous alternative Layer 1 blockchains (Solana, Avalanche, etc.) are competing fiercely for developers and users, potentially fragmenting the market share Ethereum once dominated.

4. Post-Merge Narrative Shift: While technically successful, the immediate post-Merge price action was underwhelming for many, and the narrative focus may have shifted elsewhere.

Synthesizing the Dichotomy: A Market Divided

Ethereum's current situation is a textbook example of a market grappling with deeply conflicting data points and narratives.

• Bullish Signals: Price breaking resistance, targeting $2k, falling exchange supply, potential short squeeze, ongoing network development, strong ecosystem.

• Bearish Signals: Severe YTD underperformance, concerning technical patterns ("red alert"), critical comparisons to Bitcoin's risk/reward, being labeled "memecoin-like" by traders, regulatory overhang, Layer 1 competition.

This dichotomy creates significant uncertainty. Is the falling supply on Binance a sign of HODLer conviction paving the way for a short squeeze, or simply users moving assets to DeFi protocols, with little bearing on immediate price direction? Is the push towards $2,000 the start of a real trend reversal, or a bull trap set by bearish technical patterns? Is Ethereum's fundamental value being overlooked amidst short-term noise, or are the critiques about its risk/reward profile relative to Bitcoin valid warnings?

Investor Sentiment and Key Factors to Watch

This environment fosters polarized investor sentiment. Optimists see a buying opportunity, focusing on the recent strength and long-term potential. Pessimists see confirmation of underlying weakness and prepare for further declines. The path forward will likely be determined by several key factors:

1. Bitcoin's Trajectory: As the market leader, Bitcoin's price action heavily influences the broader crypto market, including Ethereum. Continued strength in BTC could provide a tailwind for ETH.

2. Technical Levels: Whether ETH can decisively breach and hold $2,000, or if it gets rejected, will be a critical short-term indicator. Equally important is whether current support levels hold during any pullbacks.

3. Exchange Flows & On-Chain Data: Continued monitoring of exchange supply, staking activity, and transaction volumes will provide clues about investor behavior.

4. Regulatory Developments: Any clarification on Ethereum's regulatory status, particularly in the US, could significantly impact sentiment.

5. Macroeconomic Environment: Broader market risk appetite, influenced by inflation, interest rates, and economic growth prospects, will continue to play a role.

Conclusion: Navigating Ethereum's Uncertain Path

Ethereum stands at a precarious crossroads. The recent climb towards $2,000, supported by encouraging signs like falling exchange supply, offers a glimmer of hope for bulls anticipating a recovery and perhaps even a short squeeze. However, this optimism is aggressively challenged by alarming technical warnings, significant underperformance compared to market expectations and Bitcoin, and pointed critiques questioning its current investment viability.

The "memecoin" comparison, while harsh, reflects a genuine frustration and concern among some market observers about ETH's volatility and perceived lack of decisive direction relative to the "digital gold" narrative solidifying around Bitcoin. The formation of rare bearish patterns adds a layer of technical urgency to these concerns.

Ultimately, the market remains deeply divided on Ethereum's immediate future. The battle between the potential for a supply-driven squeeze towards $2,000 and the risk of a pattern-induced crash is palpable. Investors must weigh the platform's undeniable long-term technological significance and ecosystem strength against the immediate headwinds of poor recent performance, regulatory ambiguity, and concerning technical signals. The coming weeks are likely to be crucial in determining whether Ethereum can overcome the prevailing skepticism and validate the recent bullish momentum, or if the bears will regain control, confirming the warnings of a continued downturn. The price action around the $2,000 level will be a key battleground in this ongoing struggle.

Disclaimer: The information presented in this article is for informational and educational purposes only. It is based on the analysis of the provided headlines and general market knowledge. It does not constitute financial advice. Investing in cryptocurrencies involves significant risk, including the potential loss of principal. Readers should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.

ETH-----Sell around 1838, target 1750 areaTechnical analysis of ETH contract on May 2: Today, the large-cycle daily level closed with a medium-yang line yesterday, and the K-line pattern was single-yin and single-yang. The price is still consolidating at a high level. The attached indicator is running in a golden cross. The high pressure is in the 1885 area, and the low support is in the 1720 area. This is the current high and low point of the range. In addition, the trend over the weekend is likely to be mainly corrected, so try not to hold positions until the weekend for today's trading; the short-cycle hourly chart shows that the European session rose and corrected the day before, and the US session continued to break the previous high position. The current K-line pattern is continuous and negative, and the attached indicator is running in a dead cross. The trend is likely to fall during the day.

Therefore, today's ETH short-term contract trading strategy: sell at the current price of 1838, stop loss in the 1858 area, and target the 1750 area;

ETH-----Sell around 1800, target 1730 areaTechnical analysis of ETH contract on April 30:

Today, the large-cycle daily level closed with a small negative line yesterday. The K-line pattern was a continuous positive single negative, the price was above the moving average, and the attached indicator was a golden cross with a shrinking volume. However, at present, the rise did not break the high and did not continue. The decline also did not see the strength and continuation. It is likely to be a fluctuating trend. Therefore, we should not think too much about trading, just keep short-term; the short-cycle hourly chart was under pressure and retreated in the morning. Yesterday's high point was in the 1842 area, and the previous low point supported the 1722 area; this is the current range of range fluctuations. The current K-line pattern is a continuous negative, and the attached indicator is dead cross running, so there is still a high probability of a downward trend during the day.

Therefore, today's ETH short-term contract trading strategy; sell at the 1800 area, stop loss at the 1830 area, and target the 1730 area;

ETH(20250429) market analysis and operationTechnical analysis of ETH contract on April 29: Today, the large-cycle daily level closed with a small positive line yesterday, and the K-line pattern was a single negative line. The price was consolidating at a high level. The attached indicator was in a golden cross operation. The overall trend of rising is still obvious. However, it should be noted that the price seems strong but the rebound did not break the high and did not continue. Instead, it quickly retreated under pressure after touching the high pressure level. At the same time, the low point moved up. In this way, the price will maintain a range of fluctuations before it breaks through the pressure position and support position; the short-cycle hourly chart was also in a range trend yesterday, with a high of 1850 and a low of 1750. The current price is in correction.

Therefore, today's ETH short-term contract trading strategy: buy in the 1750 area when it retreats, stop loss in the 1720 area, target the 1815 area, sell in the 1815 area when it rebounds, stop loss in the 1845 area, target the 1750 area; give real-time trading strategies based on real-time trends during the session

ETH-----Sell around 1770, target 1700 areaTechnical analysis of ETH contract on April 24: Today, the large-cycle daily level closed with a small positive line yesterday, the K-line pattern continued to rise, the price was at a high level, and the attached indicator was running in a golden cross. The general trend of rising is relatively obvious, but there are two points we should pay attention to. First: After the current four-hour chart is under pressure, the K-line pattern is continuous and negative, the price is below the moving average, and the fast and slow lines of the attached indicator have signs of sticking and dead cross; Second: Yesterday's high did not continue, so a retracement and decline within the day is a high probability event; the short-cycle hourly chart did not continue to break upward after yesterday's price continued to fluctuate at a high level. Today, it began to retreat under pressure. The current price is below the moving average, and the attached indicator is running in a dead cross, so let's take a look at the strength of the decline within the day.

Today's ETH short-term contract trading strategy: Sell directly at the current price of 1770 area, stop loss in the 1800 area, and target the 1700 area;

Risky Scalp Short | $ETH @ CMP 1778 | 5x–7x LeverageHigh-risk scalp short on ETH based on intraday price action and overextension signs.

Trade Plan:

Entry 1: CMP ~1778

Entry 2: 1812

Leverage: 5x to 7x

SL: To be updated (Max 3% risk)

Quick scalp — watch closely for volatility & potential fakeouts.

⚠️ High-risk trade. Not financial advice. For educational purposes only. Use proper risk management.

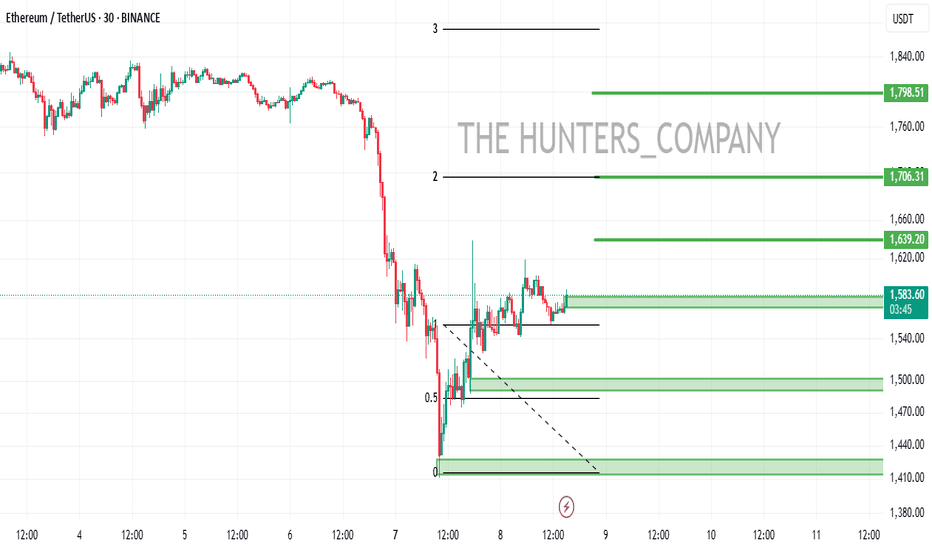

#ETH/USDT#ETH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 1555.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 1591

First target: 1628

Second target: 1658

Third target: 1695

ETHUSDT | One of Today’s Top Volume GainersEthereum has been attracting a lot of attention today, with trading activity picking up noticeably. If you’ve been watching closely, you’ll see that the blue boxes above price are acting as reliable resistance zones. Every test of these areas has been met with selling pressure, suggesting bears remain cautious here.

Key Observations

• Blue Boxes as Resistance

These zones have halted rallies before. Expect price to struggle when it reaches these levels unless strong bullish energy steps in.

• Potential Bullish Shift

Markets can turn quickly. If Ethereum breaks above a blue box with solid volume and then retests it successfully, I will drop my short bias and look for a long entry. Until I see that confirmation, I remain skeptical of further upside.

How to Trade This Setup

Short Entries on Rejection

Wait for price to approach a blue box and show clear signs of weakness on a 5‑ or 15‑minute chart. Once you see a confirmed break down in structure and CDV supports selling pressure, that’s your signal to short.

Switching to Long

If a breakout occurs above the blue box with conviction and price comes back to retest it successfully, shift your bias. Only after a retest holds and lower‑time‑frame confirmations appear will I consider going long.

Patient Execution

Trading isn’t about jumping at every move. We wait to see what the market tells us. When you trade based on confirmation rather than assumption, you avoid the traps that catch so many.

Why Trust This Analysis

I focus on setups that combine volume, structure, and real‑time order flow signals. My track record—verifiable right on my profile—shows a high success rate because I trade with discipline and clear rules. If you want clarity instead of noise, stay tuned and act on confirmed signals.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

ETH-----Sell around 1610, target 1550 areaTechnical analysis of ETH contract on April 16:

Today, the large-cycle daily level closed with a small negative line yesterday, and the K-line pattern was a single negative and a single positive, but the price was still below the moving average. The attached indicator dead crosses and the fast and slow lines are golden crosses, but the pressure is below the zero axis. In this way, the current pullback trend can only be regarded as a correction, because the price has not stood on the moving average and has not broken the previous high. It is easy to fall under pressure for the second time when the indicators are not unified; the current K-line pattern of the four-hour chart has fallen continuously, and the attached indicator dead crosses. The price is below the moving average, and the pressure position of the pullback moving average is near the 1610 area. The short-cycle hourly chart was under pressure in the US market yesterday and was corrected in the Asian time today. The trend pattern is still the same, and the correction pullback cannot be large.

Therefore, today's ETH short-term contract trading strategy: sell at the pullback 1610 area, stop loss at the 1640 area, and target the 1550 area;

EHT/USDT:BUY...Hello friends

Due to the heavy price drop we had, the market fell into fear and at the specified support, buyers supported the price, which is a good sign that we should buy within the support ranges with capital management and move with it to the specified targets.

(Always buy in fear and sell in greed)

*Trade safely with us*

ETH-----Sell around 1600, target 1530-1505 areaTechnical analysis of ETH contract on April 11:

Today, the large-cycle daily level closed with a small negative line yesterday, and the K-line pattern was a single positive line with continuous negative lines. The price was below the moving average, and the attached indicator was dead cross. The downward trend in the big trend is still very obvious. Yesterday, we also explained that the suppression at the weekly level was very obvious, so it is difficult to break the high, continue, and form a trend. This is what we need to clarify first; the short-cycle hourly chart yesterday continued to fall in the European session and the US session, and the price support rebounded in the early morning. This is also expected. The right shoulder pressure of the head and shoulders top pattern is near the 1600 area. Yesterday, it reached the low point and rebounded to the right shoulder peak and then fell to complete the head and shoulders top pattern. Isn’t this very clear?

Therefore, today’s ETH short-term contract trading strategy: sell at the rebound 1600 area, stop loss at the 1630 area, and target the 1530-1505 area;