ETH | Either OR Scenario | ALTSEASONThe previous update was on the current low that ETH hit a couple of days ago, and what happened the previous time we hit that price:

POTUS Donald Trump signed a bill that exempts DeFi platforms from reporting on their clients' taxes, unlike traditional brokers. This may explain the bullish sentiment we're observing across the market currently.

💥 ALTS Part 1 and 2 below, stay tuned for Part 3 ! 💥

____________

BINANCE:ETHUSDT

ETHUSDT

Triple Tap, Then Boom: ETH Breakout Brewing?We're looking at a classic ascending triangle setup on ETH. Price has tapped the resistance zone around $1676 three times already — the next attempt could lead to a breakout. Market structure is clean: higher lows with strong bullish momentum squeezing price toward the horizontal resistance.

This pattern usually ends with a strong impulse up, and considering the overall sentiment, this could be the beginning of a new local rally.

Entry: $1630-1650

SL: $1582

TP: $1820

Risk/Reward: 4.0

More thoughts in my profile @93balaclava

Personally I trade on a platform that offers low fees and strong execution. DM me if you're interested.

Ethereum’s Next Move – What’s the Target? (12H)Before anything else, it’s important to note that Ethereum has reached a significant demand zone where institutional orders have likely been collected. This zone has previously shown strong reactions and is marked as a key level for bullish activity.

Looking ahead, price is approaching a fresh and untouched flip zone, which is expected to contain heavy sell orders. A potential rejection from this area is likely, and the type of rejection we get will be crucial in determining Ethereum’s next move.

If ETH manages to hold the upper green box (support zone), there’s a strong chance it could target the red resistance box above.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

eth drops into februarygm,

what if i told you that ethereum is about to plunge by as much as 50%,

just as everyone is expecting the start of alt season?

what if i told you that the entire structure over the past few months has been corrective, setting the stage for a major liquidity grab below 2k?

you probably wouldn’t believe me.

---

here’s my theory:

the structure from the may 2024 peak (which i’ve labeled as a truncated 5th) down to the upcoming low in february 2025 which i expect to be just beneath 2k, is actually an expanded flat.

---

watching closely for a flush-out into feb,

with a downside target just beneath 2k.

Can $1900 be Ethereum’s next stop after brutal dip?Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Ethereum 🔍📈.

Ethereum is currently trading within a descending channel and has undergone a significant, seemingly unbounded decline. However, it is approaching a key support zone that could potentially trigger a reversal. While the next major move remains uncertain, I am anticipating a potential upward correction of approximately 18%, targeting the $1,900 level—warranting a fresh evaluation of the market landscape.📚🙌

🧨 Our team's main opinion is: 🧨

Ethereum’s been sliding in a downtrend, but with strong support nearby, I’m eyeing a possible 18% bounce toward $1900—time to reassess the market.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

ETH ANALYSIS🔮 #ETH Analysis

🌟🚀 #ETH is trading in an Ascending Triangle Pattern in 1hr timefram and there is a breakdown of the pattern. Ascending trendline works as a resistance line and #ETH is moving towards the ascending trendline. There are 2 scenario in #ETH; either it will again come in the pattern and move upward and it will retest the major support zone first.

🔖 Current Price: $1589

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀

#ETH #Cryptocurrency #Breakout #DYOR

DOGEUSDT UPDATEDOGEUSDT is a cryptocurrency trading at $0.16485, with a target price of $0.30000. This represents a potential gain of over 90%. The technical pattern observed is a Bullish Falling Wedge, indicating a possible trend reversal. This pattern suggests that the downward trend may be coming to an end. A breakout from the wedge could lead to a significant upward movement in price. The Bullish Falling Wedge is a positive indicator, signaling a potential price surge. Investors are showing optimism about DOGEUSDT's future performance. The current price may present a buying opportunity. Reaching the target price would result in substantial returns for investors. DOGEUSDT is positioned for a potential breakout and significant gains.

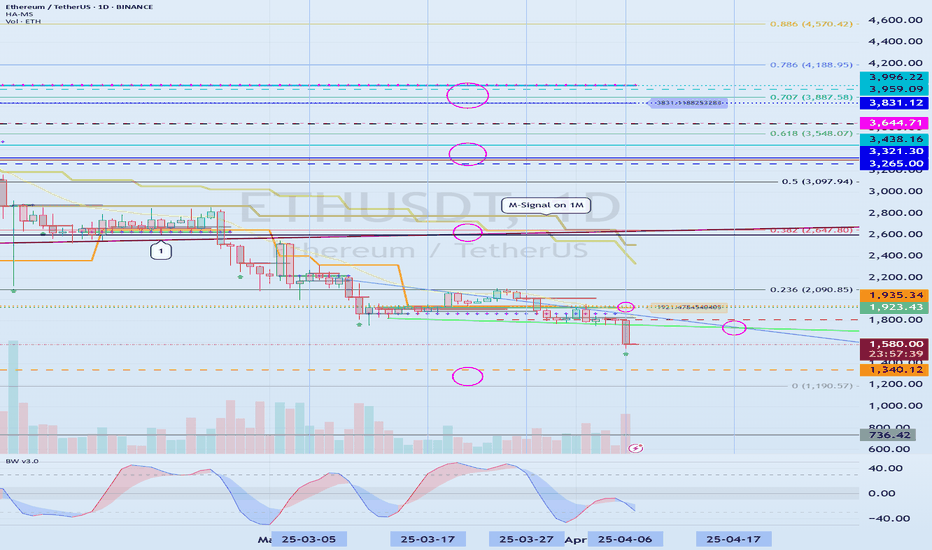

Support zone: 1340.12-1935.34

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(ETHUSDT 12M chart)

I can't get on the plane and it's falling.

The maximum decline zone is expected to be around the Fibonacci ratio 0 (1190.57).

-

(1M chart)

Since it has fallen below the support and resistance zones, I think it's a good idea to check the turn with a relaxed mind.

In order to continue the uptrend, it must rise above the M-Signal indicator on the 1M chart.

If it falls to around 736.47, it is better to buy without thinking from a long-term investment perspective.

The minimum holding period is 1 year.

-

(1W chart)

When looking at the 1W chart, the HA-Low indicator on the 1W chart is formed at the 1340.12 point.

Therefore, if it shows support around this area, it is a time to buy.

If it falls below 1340.12, it is a time to buy when it rises again and support is confirmed.

In the explanation of the 1M chart, I said to buy unconditionally if it falls to around 736.42.

This is a condition for holding for at least 1 year, so if not, it is recommended to buy when it is confirmed to be supported by rising near 1340.12.

-

(1D chart)

ETH's volatility period is from April 5 to 7.

ETH's next volatility period is around April 17 (April 16 to 18).

-

The most important thing on the ETH chart is the rising trend line (1).

Therefore, volatility is likely to occur when it passes the rising trend line (1).

-

Let's look at the chart from a short-term perspective.

Currently, the HA-Low indicator on the 1D chart is formed at the 1935.34 point.

Therefore, from a short-term perspective, when it is confirmed to be supported by rising near 1935.34, it is the time to buy.

Therefore, you should think about the average purchase price of the coins you currently own and think about how to respond.

-

The best method is to increase the number of coins (tokens) corresponding to the profit.

This method is most efficient when used during a downward trend.

You write down the purchase price and amount separately, and if the purchase price rises more than the purchase price and a profit is generated, you sell the purchase amount within the purchase amount range to leave the number of coins (tokens) corresponding to the profit.

The reason why this method is explained from a short-term perspective is because you have to conduct day trading or short-term trading.

If you continue to trade until the upward trend turns like this, you will make a large profit when the upward trend turns.

In addition, since the pressure on funds has decreased, you will also have the opportunity to seize the opportunity to make a full-fledged purchase.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

To check the entire range of BTC, I used TradingView's INDEX chart.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year upward trend and faces a 1-year downward trend.

Accordingly, the upward trend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

ETH/USD Bearish Reversal Setup – Targeting $1,470 After ResistanPair: Ethereum / U.S. Dollar (ETH/USD)

Exchange: Coinbase

Timeframe: 15 minutes

Indicators:

EMA 30 (red line): ~1635.82

EMA 200 (blue line): ~1585.79

🟣 Key Levels & Zones

Resistance Zone (Purple Rectangle Top): Around $1,647 – previously tested and rejected.

Support Zone (Purple Rectangle Bottom): Around $1,470 – marked as the "EATARGET POINT".

Current Price: ~$1,645

📉 Bearish Breakdown Setup

Chart Pattern: There’s a potential double top or distribution zone forming near the resistance.

Projection: The price is expected to break below the smaller support zone and drop to the target zone around $1,470.67, representing an 11.13% drop.

Measured Move Tool: Indicates a bearish price target if the price breaks down from the current consolidation.

✅ Confluence

Price is currently hovering under resistance.

EMAs show short-term bullish momentum but could flatten if breakdown confirms.

Support near $1,635 is being tested – a break below could trigger the expected drop.

⚠️ Trading Implications

Short Setup: A trader might look to enter short around $1,647 if breakdown confirmation occurs.

Stop Loss: Just above the resistance zone (~$1,650+).

Take Profit: Near $1,470 zone.

$ETH update, are we at the bottom?We’re getting close.

If you’re still holding AMEX:ETH , you might just need a bit more patience — in a month, we could be heading back up.

Let’s break down the chart, because this is a fascinating setup:

1️⃣ Two similar patterns with three tops and three MACD resets.

2️⃣ AMEX:ETH is in a consolidation zone between $1950 and $1075, right where past rallies have started.

3️⃣ MACD on the weekly is near reset — a bullish reversal could kick in within 2 weeks and last 6+ months.

4️⃣ RSI is at the bottom, aligning perfectly with the MACD: this often signals a bounce.

📉 Yes, one last dip is possible — maybe $1150–$1250 — but I personally think AMEX:ETH will bounce above the previous low.

🚫 Don’t sell the bottom. Capitulating now could mean missing out on the reversal.

📅 Timeline? January was the time to exit. If you’re still in, just hold tight — things might look very different by May and beyond.

⚠️ Disclaimer: This is a chart-based analysis. Macro factors (👋 tariffs!) can shift everything, so stay alert and manage risk.

SUPERUSDT UPDATESUPERUSDT is a cryptocurrency trading at $0.5519, with a target price of $1.2000. This represents a potential gain of over 170%. The technical pattern observed is a Bullish Falling Wedge, indicating a possible trend reversal. This pattern suggests that the downward trend may be coming to an end. A breakout from the wedge could lead to a significant upward movement in price. The Bullish Falling Wedge is a positive indicator, signaling a potential price surge. Investors are showing optimism about SUPERUSDT's future performance. The current price may present a buying opportunity. Reaching the target price would result in substantial returns for investors. SUPERUSDT is positioned for a potential breakout and significant gains.

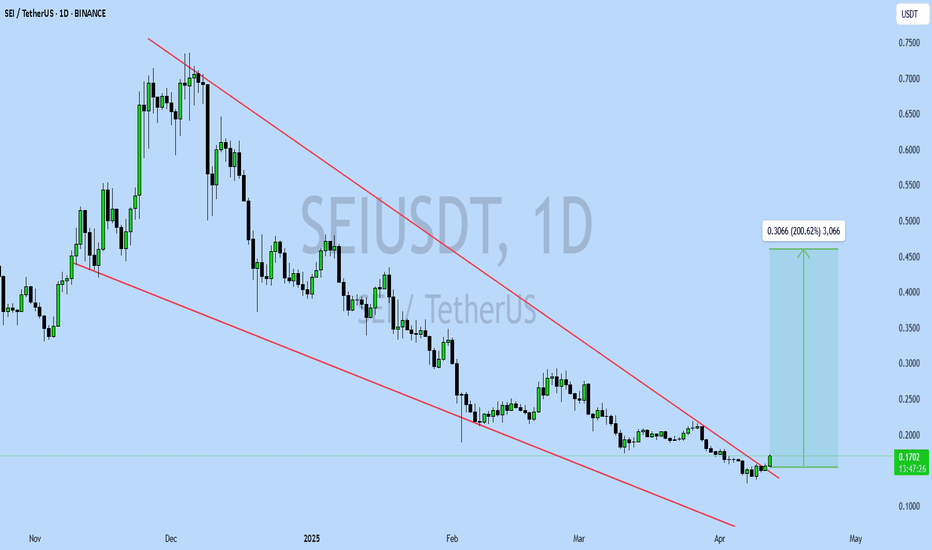

SEIUSDT UPDATESEIUSDT is a cryptocurrency trading at $0.1700, with a target price of $0.4500. This represents a potential gain of over 200%. The technical pattern observed is a Bullish Falling Wedge, indicating a possible trend reversal. This pattern suggests that the downward trend may be coming to an end. A breakout from the wedge could lead to a significant upward movement in price. The Bullish Falling Wedge is a positive indicator, signaling a potential price surge. Investors are showing optimism about SEIUSDT's future performance. The current price may present a buying opportunity. Reaching the target price would result in substantial returns for investors. SEIUSDT is positioned for a potential breakout and significant gains.

Bitcoin TA 25.4.12Bitcoin is currently correcting towards the range of 87 to 90 thousand dollars, and after that, we will enter a short position if we see a valid setup. The target levels are 74 thousand dollars, 70 thousand dollars, and lower targets can also be observed in this view. We will wait for the valid setup before entering the short position.

⚠️ This Analysis will be updated ...

👤 Sadegh Ahmadi: @GPTradersHub

📅 25.Apr.12

⚠️(DYOR)

❤️ If you apperciate my work , Please like and comment , It Keeps me motivated to do better

Ethereum Breakdown in Progress – Will the Next Support Hold?Ethereum (ETH) is currently breaking below the ascending trendline, signaling a potential further downside. The price is testing the first blue support zone, and if this level fails to hold, ETH is likely to drop towards the next major support area around $1,400.

Key Levels to Watch:

🔹 First blue area (~$2,100–$2,300): ETH is currently breaking below this zone. If confirmed, the downtrend will likely accelerate.

🔹 Next blue area (~$1,350–$1,450): If the first support breaks, ETH could decline further to this key historical level.

Bearish Confirmation:

Trendline Breakdown: ETH has already fallen below the long-term ascending trendline, indicating a shift in structure.

Break & Retest: A failed recovery above $2,300 would confirm a further downside.

Traders should watch for a weekly close below $2,100 to confirm the breakdown. If buyers step in and reclaim $2,300, a relief bounce could occur.

ETH | Ethereum Hits 2 YEAR LOW - What's Next?Could it be that ETH bottoms out here?

Low from March 2023:

Interestingly enough, it could be said that it was the previous cycle's accumulation zone. Considering the previous cycle's price action, this isn't a ad zone to load up - for the longer term.

From here, although the price bounced high, and low, it was the 8-month price action before the next bullish cycle started. This gives us perspective in terms of time

___________________

BINANCE:ETHUSDT

Opportunity for a Profitable Ethereum Long Position (30M)Before anything else, you must stick to the entry zone and stop-loss.

Otherwise, the risk-to-reward ratio gets ruined and the trade loses its value.

There's a bullish QM pattern on the chart.

We're looking for a Buy/Long opportunity around the support zone.

Take partial profit at the first target and move the stop to break-even

If the stop-loss gets hit, the position will be closed.

ETH Long Term Prediction - Ethereum Game Plan ETH broke the bullish weekly structure and is currently retracing lower. I don’t see any signs of strength on the chart yet.

I expect the price to first hit $1250 and see a rejection there a possible bounce.

However, the real target is $870 (2022 low). That level holds significant liquidity, so I expect it to be taken out, triggering a potential capitulation. I’ll be looking for spot buys and long-term long setups in anticipation of another possible bull run.