ETHUSDT

ETH - TUG OF WAR! WILL IT REACH $2300?PLLLLLEAAASEE new structure for the market as cited below! Observe and take stances! For nerds , Look at this

Ethereum has experienced a significant breakdown from its previously established value area between $2,060 and $2,100, as seen clearly in the 4H Volume Profile. The price sharply rejected the upper range and fell through low-volume nodes with little resistance, indicating aggressive selling and a clear lack of buyer support at higher levels. Currently, ETH is trading near $1,890, where the new Point of Control (POC) has formed, suggesting that the market is starting to accept this lower price region. However, the volume at these lower levels is still relatively thin, which means that the structure is not yet fully balanced, and volatility may continue. If ETH fails to reclaim the $1,920–$1,950 zone, we could see continued downside movement toward $1,850 or even $1,800, where a new high-volume base might establish. On the other hand, if bulls manage to push the price back above the recent breakdown point and sustain it, there could be a short-term recovery attempt.

Ethereum targetting 1,912$ or 1,776$I see here 2 possibilities.

First look at the uptrend break and retested. Therefore, it may drop to a lower Fibonacci level which is 1,912$

The other option is the triple top formation target which is around 1,776$

* What i share here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose all your money.

Valuation iMe Messenger: Reach 5-20% of Telegram's $30B ?Valuation Potential of iMe Messenger: Why It Has the Prospect to Reach 5-20% of Telegram's $30 Billion Valuation?

Authors: SanTi Li, Naxida, Feng Yu, Li Feiyu

Abstract:

In the Web3 era, the functionality of messaging applications is no longer limited to information transmission. Many failures of Web3 social applications (SocialFi) stem from a lack of sustained user engagement and long-term foundation, or their core functionality merely copying existing platforms (such as borrowing from Twitter). Additionally, the integration of tokens into these platforms often lacks depth and practical utility. Social applications, once adopted by users, establish strong defensive moats, and further integrating Web3 elements such as multi-domain payments, multi-chain interaction, financial services, and decentralized applications can significantly enhance their intrinsic value.

iMe Messenger (LIME), as an extension of Telegram's ecosystem, enhances and optimizes its functionality while maintaining a unique market position. This has attracted growing attention from users, investors, and institutional clients.

By analyzing market trends, user demands, and the synergies between Telegram, its public blockchain TON, and iMe Messenger, this paper explores why iMe Messenger has the potential to reach 5-20% of Telegram's valuation and how it fits within the triad of TON, Telegram, and iMe to mutually enhance value.

1. Market Positioning and User Value of iMe Messenger

1.1 Compatibility with Telegram: Lowering User Migration and Learning Costs

iMe Messenger ( GATEIO:LIMEUSDT LIME) is not only a standalone social application but also a Pro-version developed on top of Telegram, allowing seamless synchronization of chat history, contacts, and channels. This drastically reduces migration costs, enabling iMe to inherit Telegram's ecosystem rather than building an entirely new application from scratch.

Essentially, every Telegram user can also be an iMe user, and all iMe users are inherently Telegram users.

1.2 Enhanced Features for Greater User Engagement and Experience

Building upon Telegram's core, iMe offers additional features such as:

●Integrated Wallets: Supporting multi-chain payments and fund transfers among Telegram friends, including BSC, Solana BINANCE:SOLUSDT , ETH, and TON.

●Translation & Content Organization: Enabling translation for personal and group chats without requiring Telegram's Star VIP subscription.

●Payment and Exchange Integration: Supports Binance Pay and Uniswap's DEX functionalities.

●Improved Group Features: Introduces Crypto Box, similar to WeChat's red packet and gifting features.

●AI Assistant & Antivirus Protection: Enhances user experience with AI-driven features.

●Latest AI Integrations: Users can directly utilize AI models like Gemini and GPT for multi-format content creation and image generation.

●Enhanced Privacy: Strengthened encryption and privacy protection.

●Customizable UI: More personalized interface options than Telegram, appealing to specific user demographics.

These enhancements make iMe a superior choice for certain use cases compared to Telegram's native experience.

Feature Telegram iMe Messenger

Core Messaging ✅ ✅ + Premium Antivirus

Cross-Platform Sync ✅ ✅

AI Translation & Speech-to-Text ✅ (VIP only) ✅ (Free via Lime token)

Multi-Chain Transfers ❌ ✅ (Supports Sol, BSC,

ETH, etc.)

AI BOT Integration ✅ ✅ (Advanced AI models)

Functional Optimization ❌ ✅ (More user-friendly UI)

Payment System ❌ ✅ (Binance Pay, CryptoBox)

Staking Services ❌ (Requires third-party access) ✅ (Directly accessible

in Wallet module)

Telegram API Requirement ✅ (Native API) ❌ (Requires external

API access)

Independent App Download ✅ (App Store) ✅ (App Store)

2. Valuation Comparison: iMe vs. Telegram

2.1 Telegram's Valuation Logic

Telegram is currently valued at approximately $30 billion, primarily due to:

1.A massive user base of 900 million to 1 billion with rapid growth.

2.A deep ecosystem including groups, channels, Bot economy, ad revenue, and potential Web3 applications.

3.TON blockchain integration, enhancing payment and application functionalities.

4.An expected IPO and its role in the broader blockchain and AI landscape.

Telegram's valuation is based on user scale × monetization potential × technology moat × IPO expectations, with some influence from its blockchain interactions with TON.

2.2 iMe's Growth Potential

Currently, iMe's Fully Diluted Valuation (FDV) is around $20 million, with 18 million users. While this is significantly lower than Telegram's 900+ million users, its interoperability with Telegram provides substantial user growth potential.

Considering Web3 applications with over 10 million real registered users are rare, iMe's niche appeal could further bolster its valuation. With a 600% growth over 3.5 years, iMe has promising expansion potential.

Factors contributing to iMe’s ability to achieve 5-20% of Telegram’s valuation:

1.User Growth: If iMe captures 5-10% of Telegram's user base (45M-90M users), its market valuation would rise accordingly.

2.Monetization Potential: Ad revenue, VIP subscriptions, Binance Pay integration, and staking services expand its financial ecosystem.

3.Token Utility & Burning Mechanism: Increased usage of Lime token for payments and transactions enhances its long-term value.

4.Multi-Chain Support: Since Telegram prioritizes TON, other blockchain tokens need a third-party solution—iMe fills this gap.

5.TON Ecosystem Integration: iMe strengthens its value by serving as a gateway for blockchain applications within Telegram’s ecosystem.

2.3 Other Reasons for the Valuation Growth Potential of iMe Messenger

There are many projects in the market with overestimated and inflated values, but it is indeed difficult to find undervalued Web3 projects. The core reasons for this mostly relate to the operational strategies of project teams over a period of time, project management styles, and the experiences and habits of personnel. There are even intricate connections with partner institutions, investors, and other stakeholders.

Apart from the valuation growth potential points compared in sections 2.1 and 2.2, the hidden value and potential of the iMe project are also related to the following factors:

1.iMe’s operational model primarily exists within its internal ecosystem and lacks sufficient collaboration with media, rating agencies, and third-party content platforms. This has resulted in valuable updates and the five advantages we mentioned earlier being largely unknown to many investors and enthusiasts.

2.Limited collaboration with KOLs (Key Opinion Leaders) in value-driven or hype-driven streams. In fact, this project was discovered as early as the end of 2021, but we waited to see if others would also identify its value and write about it. However, we found that very few people had actually created content on it. Later, after communicating with the project team, we discovered that they indeed lacked deep collaboration with content institutions and KOLs. Unlike 2018, when PR agencies were of relatively high quality—such as Block72 and Winkrypto, which had at least dozens of team members providing comprehensive support—by 2025, many so-called PR agencies consisted of just one or two individuals. This has significantly increased the difficulty for project teams in making the right choices and the probability of encountering pitfalls. This situation is as challenging as distinguishing between Dogecoin in 2020 and the tens of thousands of meme tokens emerging daily today.

3.Since 2024, Lime has only gradually been listed on new exchanges. Previously, it was primarily listed on Gate, which is known for its extensive range of trading pairs but lacks significant independent AMA (Ask Me Anything) sessions or media promotion through research reports. From 2023 onwards, many major exchanges adopted a strategy of listing only entirely new projects. This strategy undoubtedly impacted a group of high-quality projects that were listed around 2021 and had successfully endured the bear market. With the recent wave of meme token promotion and the market adjustments of 2024-2025, exchange operators and traders have begun to recognize the underlying issues in purely new projects and meme-based projects.

4.The team has a strong technical mindset, focusing on R&D while lacking market operation experience. This issue is not unique to iMe’s team. Even a project as robust as Algorand, which had an MIT-backed “king bomb” team, later faced operational chaos due to blind hiring of Web2 product managers who lacked experience and made misguided decisions.

5.Insufficient utilization of traffic and promotional platforms. During due diligence, we found that the iMe team produces high-quality animations and content. However, these materials are often only published within their own community and Twitter. Many high-quality users are not necessarily effective disseminators—just as in real life, many exceptionally talented individuals are not good at expressing themselves or spreading information. Therefore, leveraging high-quality third-party platforms and engaging in interactive campaigns (such as writing contests) is also key to furthering brand building.

In summary, the fundamental prerequisite for a project to have sufficient growth potential is that its core technology is strong and its sector and market trends are favorable. However, a lack of brand promotion and groundwork is one of the primary reasons why high-quality content goes undiscovered. This issue can be mitigated with the support of large institutions, major exchanges, or influential figures. This is also one of the main reasons why undervalued projects have room for valuation growth.

3. The Impact of the BINANCE:TONUSDT TON Ecosystem on IME’s Valuation

3.1 Growth Potential of the TON Ecosystem

TONUSDT

TON, as the decentralized blockchain platform officially supported by Telegram, encompasses multiple application scenarios, including DeFi and GameFi. Telegram is actively promoting the TON ecosystem.

1.TON’s growth potential: TON currently has a market valuation exceeding $10 billion, and with its integration into the Telegram ecosystem, its value could potentially double in the future.

2.Potential of TON payments: IME has a built-in TON wallet, gradually making it one of the most important payment and transaction gateways within the TON ecosystem. This undeniably enhances IME’s long-term product value. Although the Lime token has not yet been launched on the TON chain, this development is likely imminent.

3.Binding effect between TON and Telegram: TON is poised to become the Web3 core of Telegram’s economic system. As a Telegram-compatible all-in-one development application, IME is naturally positioned to benefit from this ecosystem’s growth.

3.2 Direct Impact of TON on IME’s Valuation

The expansion of the TON ecosystem means that IME is no longer just a messaging app—it is becoming a Web3 gateway. If TON’s overall valuation grows to $20 billion or beyond, then iMe, as an important Web3 entry point, will also see an increase in its valuation. TON’s decentralized payment services and smart contract capabilities, combined with iMe’s built-in multi-chain wallet, provide strong support for Telegram-based iMe users. This transforms iMe from a mere communication tool into a cross-chain financial and social platform.

(This also applies to native iMe users—i.e., institutional users who directly use the iMe software without relying on the Telegram client—bringing new users to Telegram’s ecosystem and creating potential TON adopters.)

Risks and Challenges

Of course, the development of iMe Messenger is not without risks. As a platform based on decentralization and blockchain technology, it faces multiple challenges similar to those of Telegram, including technical security, user privacy protection, and regulatory policies. There is also the systemic risk of Telegram suddenly ceasing API development (although such a move would be self-sabotaging for Telegram itself). Additionally, the Web3 market is highly competitive, with new products continuously emerging, exerting competitive pressure on iMe. How to ensure user privacy and security while continuously optimizing product features and enhancing user experience will be key to iMe Messenger’s future development.

4. Comprehensive Summary: Factors Affecting iMe’s Valuation

Based on the above analysis, iMe’s development trajectory and speed suggest that it has the potential to reach 5-10% of Telegram’s user base. The expansion and growth of iMe also contribute to the overall expansion and development of Telegram. At the same time, by leveraging the mutual benefits of the Telegram and TON ecosystems, iMe can create additional value. This enables iMe to benefit from Telegram’s strong user retention moat while positioning itself as a potential Web3 or secondary version of Telegram.

From the perspectives of user base, business model, TON enablement, integrated wallet, and Lime token functionalities, IME has the potential to achieve a valuation of 5%-20% of Telegram’s estimated value, equating to a valuation of over $1.5 billion. As the Telegram ecosystem matures and the TON network further develops, iMe’s market value may continue to grow, with potential for further valuation increases.

Overall, iMe

LIMEUSDT

Lime is not merely a secondary development software utilizing Telegram’s API. Instead, it is a Web3 social communication and payment tool with significantly stronger utility. Its valuation model is closer to a combination of Wallet + Telegram + TON + AI, making it more akin to a Web3 version of WeChat. It holds the potential to become a fully realized Web3 social application. Hopefully, it will ultimately succeed alongside Telegram.

Next, we will explore the long-term value of several public blockchain networks. May the force be with you~

Friendly Reminder: This article is created for research and educational purposes only and does not constitute investment advice. The Web3 space is simultaneously full of opportunities and risks. We encourage readers to conduct their own research (DYOR) on every project or topic.

The key is whether it can rise to 2271.0-2356.31

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

The April TradingView competition is sponsored by PEPPERSTONE.

Accordingly, we will look at the coins (tokens) and items that can be traded in the competition.

I will talk about the ETHUSD chart.

--------------------------------------

(ETHUSD 1W)

If you look at the 1W chart, you can see how important the current price position is.

If it continues to decline this time, it is likely to fall to around 1337.54.

Therefore, the key is whether it can maintain the price by rising near the Fibonacci ratio of 0.236 (2089.91).

In order to turn upward on the 1W chart, it must rise near the Fibonacci ratio of 0.382 (2646.14) and maintain the price.

-

(1D chart)

Since the HA-Low indicator on the 1D chart is formed at the point of 1935.88, the key is whether it can receive support and rise near this area.

If it does not and falls below 1871.55, it is highly likely to fall to around 1626.95.

-

The M-Signal indicator on the 1W and 1M charts is passing near the Fibonacci ratio of 0.382 (2646.14).

Therefore, in order to turn into an uptrend, the price must rise above the M-Signal indicator on the 1W and 1M charts and be maintained.

To do so, we need to see if it can naturally rise above the M-Signal indicator on the 1W and 1M charts while maintaining the price by rising around 2271.0-2356.31.

However, in order to continue the uptrend, it is expected that the price must rise above the Fibonacci ratio of 0.382 (2646.14) and be maintained.

-

If the OBV does not rise above the upper line of the price channel and show an uptrend, it is likely that it will be difficult to sustain even if an uptrend appears.

The StochRSI indicator is showing a downward trend in the overbought zone.

Therefore, if the StochRSI indicator turns upward again and maintains the price around 1935.88, it is expected that it will lead to an attempt to rise to around 2271.0.

Therefore, when the competition started,

- If the StochRSI indicator did not turn upward,

- If the OBV did not rise above the upper line and showed an upward trend,

- If it did not receive support near 1935.88, it is expected that the SHORT position would be advantageous.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems that it has been maintaining an upward trend following a pattern since 2015.

That is, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point of interest is whether they can be supported and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio of 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

ETH Chart - SECRET in the INVERTETH is losing ground quickly after a nasty bearish pattern formed in the weekly.

The bearish M-pattern we're currently observing in the macro timeframe:

We know this is a bearish patter, not only because we've seen it many times before but also because it is the opposite of the W-Bottom. (we can actually confirm this by flipping the chart):

In this case, the bullish confirmation would have been a support retest of the neckline:

And so, if we flip it again back to the original view - the opposite can be true. As we get rejected on the resistance line, an even lower price is likely:

____________________

BINANCE:ETHUSDT

Ethereum ETH Will Crash After Small PumpHello, Skyrexians!

Recently we have already told that potentially BINANCE:ETHUSDT has been finished the correction and is ready to reach $7-10k, but today we recalculated waves and can tell that one more leg down will happen with the high probability.

Let's take a look at the daily chart. Minimum Awesome Oscillator wave tells us that recent dump was only wave 3. Now asset is in wave 4. When AO crosses zero line it means that the min requirement for the wave 4 has been complete. At this point price shall reach the target area at 0.38-0.5 Fibonacci approximately at $2600. There we have to be very careful and if will see the bearish divergent bar the wave 5 will come. The target is $1600.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

ETH ANALYSIS AND NEXT TRADE IDEA.ETHUSDT is trading at 2060$, if we look its previous chart then we can see a clear MS after liquidity sweep which cause bullish structual moves and also did bullish BOS. I have found OB+FVG+SSL setup in the move which caused BOS. And this is our buy zone for next 2200 target.

Ethereum (ETH/USDT) 1D Chart Update ETH is still trading inside a descending channel, showing signs of a possible reversal. The price is bouncing off support levels around $1,750-$1,830, with a possible retest of higher resistance levels. The 50-day moving average (red line) is acting as a dynamic resistance above the price.

Bullish scenario: ETH needs to sustain above $1,830 to confirm a short-term correction. If ETH breaks the $2,200-$2,400 resistance zone, a rally toward $2,800-$3,000 could follow.

Bearish scenario: Rejection at the resistance could push ETH back towards $1,830 and possibly $1,750. A loss of $1,750 could trigger a further decline towards $1,600.

Resistance: $2,200, $2,400, $2,800

Support: $1,830, $1,750, $1,600

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

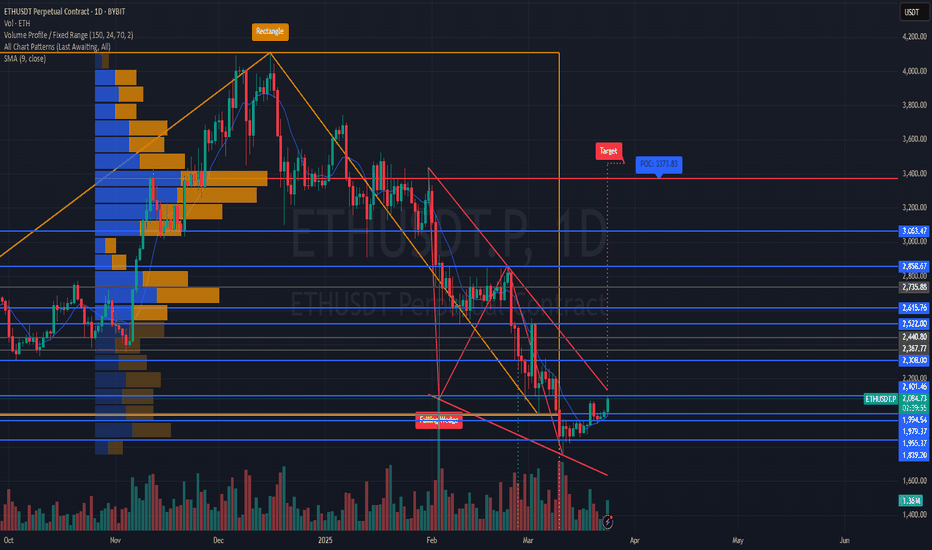

#ETHUSDT is forming a potential mid-term reversal📉 LONG BYBIT:ETHUSDT.P from $2102.90

🛡 Stop loss at $2083.00

🕒 Timeframe: 1D (Mid-term idea)

✅ Overview:

➡️ BYBIT:ETHUSDT.P Falling Wedge breakout confirmed on the daily chart.

➡️ Successful retest of the $1,955–$2,041 zone.

➡️ Holding above $2,101 opens the way to higher levels.

➡️ Volume is increasing post-breakout — confirming buyer interest.

➡️ Next strong resistance block lies between $2,308–$2,522.

🎯 TP Targets:

💎 TP 1: $2112.00 — nearest resistance and key liquidity zone.

💎 TP 2: $2125.00 — a critical daily level, zone of pullback from previous drop.

💎 TP 3: $2134.00 — potential impulse target toward major POC ($3,373).

📢 If price fails to hold above $2,068 and breaks below $2,041 — the setup is invalidated.

📢 A retest of $2,101 from below may be needed before a stronger upward move.

📢 Volume support at $1,955 is critical for the bullish case.

🚀 BYBIT:ETHUSDT.P is forming a potential mid-term reversal — if price holds above $2,101, a move toward $2,200+ and beyond is expected.

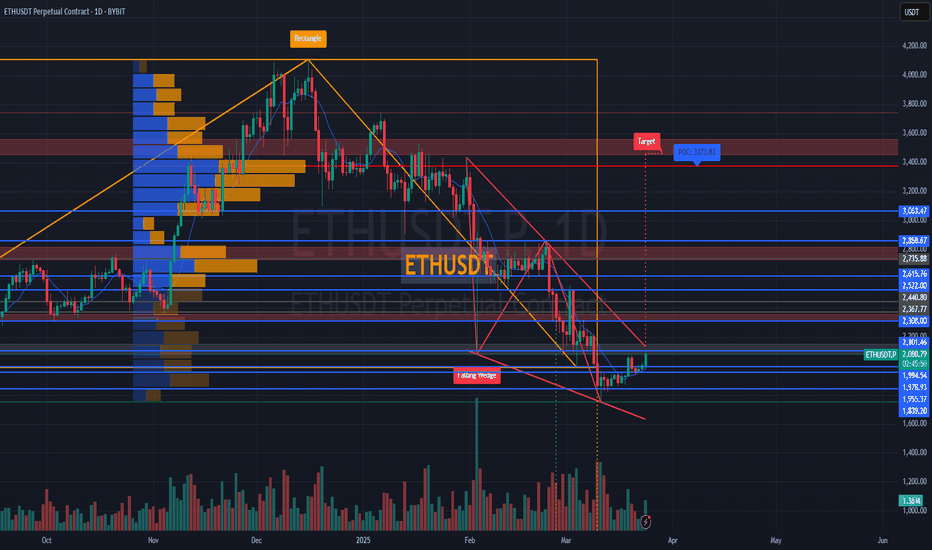

Awakening of #ETH – Return of the Bulls and Wedge Breakout📊 Overview of the BYBIT:ETHUSDT.P Situation on 4H and 1D Timeframes

✅ Trend and Technical Indicators:

➡️ The chart shows a strong downtrend that began in late December 2024, when the price dropped from a peak of around 3400 USDT to 1620 USDT by March 2025.

➡️ A correction followed, with the price recovering to around 2100 USDT, where it is currently consolidating.

✅ Volume: The volume at the bottom of the chart was high during the drop, confirming the strength of the bearish trend. Now, volume is decreasing, which may indicate a weakening momentum.

✅ Patterns: A Rising Wedge pattern is forming on the chart — typically a bearish signal, especially after a strong downtrend. This may suggest a potential reversal to the downside.

➡️ A Falling Wedge pattern appeared earlier, and its breakout upward gave a short-term bullish impulse.

✅ Positive Factors:

➡️ Price bounced from a strong support level at 1620 USDT, which gives bulls hope for recovery.

➡️ Declining volume may indicate seller exhaustion.

➡️ The earlier breakout of the Falling Wedge supports the current correction.

✅ Negative Factors:

➡️ The Rising Wedge now forming is a bearish pattern, and a breakdown could lead to further decline.

➡️ The overall trend remains bearish, and price has yet to break through key resistance levels (e.g., 2400 USDT).

➡️ The crypto market, especially BYBIT:ETHUSDT.P remains volatile, and external factors (news, macroeconomic conditions) could significantly impact movement.

📉 4H Timeframe:

➡️ A Rising Wedge is forming; price is testing the upper boundary of the wedge and a key resistance level at $2,101.

➡️ There's a potential retracement zone targeting $1,839 — aligned with the lower edge of the wedge and a liquidity area.

➡️ Support exists at $2,068 and $2,041, but if the wedge breaks downward, the decline may accelerate.

➡️ Volume is increasing, confirming active participation and the importance of this zone.

📈 1D Timeframe:

➡️ BYBIT:ETHUSDT.P bounced from a demand zone and is currently testing the $2,100 area.

➡️ The next strong resistance lies between $2,308–$2,367, and the previous downtrend hasn’t been fully broken yet.

➡️ There's a glimmer of strength on the daily (a +4.5% candle with notable volume), but the move is not yet confirmed as a sustained uptrend.

➡️ A breakout from the Falling Wedge is confirmed — a bullish pattern that played out.

➡️ Price has broken above the descending channel (orange line), increasing the likelihood of a trend reversal.

➡️ The measured target from the wedge breakout is around POC $3,373, aligning with previous volume accumulation — ambitious but logical.

⚠️ Risks / Limitations:

➡️ If price fails to hold above $2,101 and drops below $2,068, a return to $1,955 or even $1,839 is possible.

➡️ Volume is present but the momentum must be confirmed in the next 1–2 days.

📍Important Note:

👉 On 4H – a bearish setup is forming.

👉 On 1D – a weak recovery attempt, still under pressure.

👉 A reaction from the $2,100 zone is critical: either a rejection downward (per the wedge), or a breakout that invalidates the bearish setup.

👉 This area is a decision zone — a key point for planning potential trades.

📢 Conclusion: A breakout, retest, and confirmation of the structure and volume are visible.

🔵 Bullish Scenario:

➡️ The Falling Wedge breakout confirms a bullish impulse. The target at 3373.83 USDT looks realistic long-term, if price breaks 2100 USDT and holds above 2400 USDT.

➡️ To confirm this scenario, we need volume growth and a breakout of major resistance levels (e.g., 2400 USDT and above).

🔴 Bearish Scenario:

➡️ The Rising Wedge identified earlier remains valid. If this pattern plays out, the price may drop to 1901.73 USDT or even lower, to 1620 USDT.

➡️ The long-term downtrend (marked by a red line) is still intact, supporting the bearish outlook.

📉 LONG BYBIT:ETHUSDT.P from $2102.90

🛡 Stop loss at $2083.00

🕒 Timeframe: 1D (Mid-term idea)

✅ Overview:

➡️ BYBIT:ETHUSDT.P Falling Wedge breakout confirmed on the daily chart.

➡️ Successful retest of the $1,955–$2,041 zone.

➡️ Holding above $2,101 opens the way to higher levels.

➡️ Volume is increasing post-breakout — confirming buyer interest.

➡️ Next strong resistance block lies between $2,308–$2,522.

🎯 TP Targets:

💎 TP 1: $2112.00 — nearest resistance and key liquidity zone.

💎 TP 2: $2125.00 — a critical daily level, zone of pullback from previous drop.

💎 TP 3: $2134.00 — potential impulse target toward major POC ($3,373).

📢 If price fails to hold above $2,068 and breaks below $2,041 — the setup is invalidated.

📢 A retest of $2,101 from below may be needed before a stronger upward move.

📢 Volume support at $1,955 is critical for the bullish case.

🚀 BYBIT:ETHUSDT.P is forming a potential mid-term reversal — if price holds above $2,101, a move toward $2,200+ and beyond is expected.

ETHUSDT, I love pattern in chart ...Hello everyone

We backed after a long time by one the powerful analysis on Ethereum.

According to the chart you can see the price movement is sideway, the reason of that for proving this reason is the parallel channel.

At first, the price show us a downward triangle and because of that we expect the price should break the triangle and rising up , the second reason is the price and candle encounter to the one of the important dynamic supporter from the past , and third reason for the rising is the price is near to the below of the channel and the market is so weak and this is what our want and THIS TIME IS TO BUY , ok ??

JUST BUY BUY BUY BUY guys , TRUST US

If you have any question or need help

send us messages

Thank you

AA

ETH/USDT Weekly Chart – Bullish Bounce!📊 ETH/USDT Weekly Chart – Bullish Bounce!

Ethereum just printed a strong bounce from the macro ascending trendline, holding structure since 2020. This confirms continued bullish strength on the higher timeframe. 🔥

🔹 Key Highlights:

Price is pushing up slowly to hit the major weekly resistance around $2800.

Next bullish target: $2,800 resistance zone, also aligns with the EMA cluster.

📈 A breakout above $2,800 could open the doors for $4,000+ in the coming months.

🧠 Watching for volume + some fundamental catalyst.

Do hit the like button if you like my updates.

#Peace

ETH/USDT 1DAY CHART UPDATE !!ETH is still trading inside a descending channel, with the price close to key support.

Support Zone Holding: The $1,750–$1,830 area has provided a strong support base.

Ichimoku Cloud Resistance: The red Ichimoku Cloud above is acting as a crucial

resistance barrier.

Bullish Scenario:

If ETH breaks out of the descending channel, the first major resistance to watch is $2,400–$2,600 (cloud resistance).

A confirmed breakout could lead to a move towards $4,000+.

Bearish Continuation :

If ETH fails to break out, it could retest the $1,750–$1,830 support area.

A breakdown below $1,750 could open the door to lower levels around $1,600.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

ETHUSD Ethereum Update 21/03/2025We have seen the upward impulse and the correction. I'm waiting for internal liquidity to be reached and for the price to rise to 2200+ in the next 2 weeks.

Best regards, EXCAVO

_____________________

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETH BUY ZONE / ACCUMULATING LEVELBINANCE:ETHUSDT is looking bullish after retracing to 1900-2000 region. It should be noted that the same region was previous resistance which ETH broke in Dec 23' before making a new swing high.

This is a great buying zone technically for someone who does not trade and wants to buy/hold BINANCE:ETHUSDT for the long term!

UNIUSDT UPDATEUNIUSDT is a cryptocurrency trading at $6.780. Its target price is $10.000, indicating a potential 50%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about UNIUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. UNIUSDT is poised for a potential breakout and substantial gains.