EUR/NZD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

EUR-NZD uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 1.885 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the EUR/NZD pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR (Euro)

Bearish revrsal off pullback resistance?EUR/CAD is rising towards the pivot and could reverse to the 1st support which is a pullback support.

Pivot: 1.5629

1st Support: 1.5420

1st Resistance: 1.5731

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

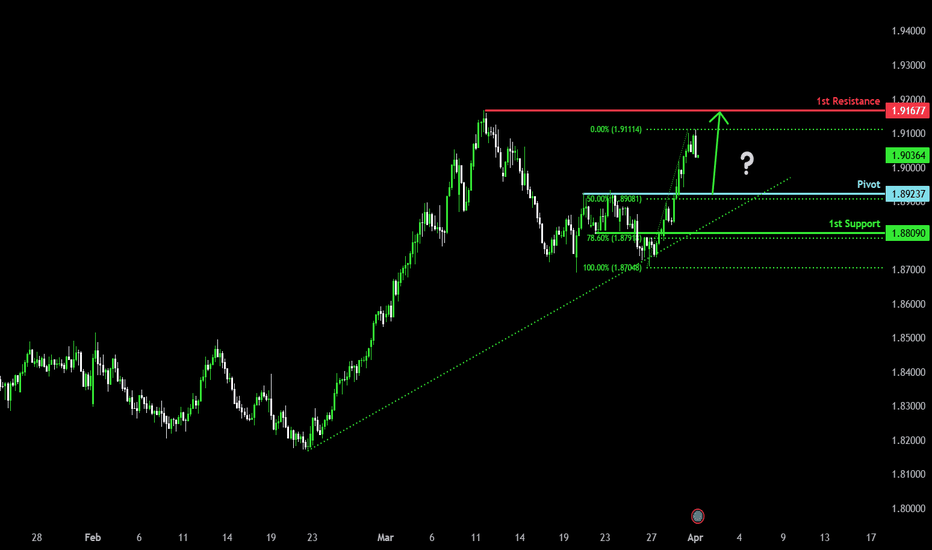

Falling towards 50% Fibonacci support?EUR/NZD is falling towards the pivot which has been identified as a pullback support and could bounce to the pullback resistance.

Pivot: 1.89237

1st Support: 1.88090

1st Resistance: 1.91677

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURAUD forming a top?EURAUD - 24h expiry

Trading has been mixed and volatile.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

Bearish divergence is expected to cap gains.

Bespoke resistance is located at 1.7360.

We look to Sell at 1.7360 (stop at 1.7420)

Our profit targets will be 1.7120 and 1.7080

Resistance: 1.7360 / 1.7420 / 1.7470

Support: 1.7275 / 1.7185 / 1.7090

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Bullish bounce?EUR/USD is falling towards the support level which is a pullback support that lines up with the 78.6% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.0765

Why we like it:

There is a pullback support level that line sup with the 78.6% Fibonacci retracement.

Stop loss: 1.0732

Why we like it:

There is a pullback support level.

Take profit: 1.0836

Why we like it:

There is an overlap resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EUR-NZD Strong Resistance Ahead! Sell!

Hello,Traders!

EUR-NZD keeps growing

In a strong uptrend but a

Wide horizontal supply

Area is above around 1.9170

So after the pair retests

This level we will be expecting

A local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/CAD LONG Investment OpportunityHello, I am Forex Trader Andrea Russo and today I want to talk to you about an interesting trade on EUR/CAD.

In the world of Forex, every trade is a combination of analysis, strategy and intuition. Today I decided to open a buy position (BUY) on EUR/CAD based on the 4-hour timeframe. This choice comes from technical and fundamental signals that indicate potential favorable movements.

The details of my trade:

Entry Price (Entry Point): 1.53771

Stop Loss (SL): 1.52444

Take Profit (TP): 1.55621

I set the Stop Loss at 1.52444 to manage the risk effectively. It is essential to protect the capital, especially in a volatile market like the currency market. At the same time, the Take Profit is set at 1.55621, aiming to capture a significant positive movement.

Why EUR/CAD?

EUR/CAD has an interesting market dynamic influenced by European and Canadian economic factors. At the moment, technical indicators such as support and resistance, along with trend analysis and candlestick patterns, suggest a possible growth opportunity for the Euro against the Canadian Dollar.

Conclusion

Every trade is a step towards knowledge and experience. Although the outcome may vary, disciplined approach and risk management are always at the heart of every decision. I will update you on the results of this trade and continue to share my trading strategies and ideas.

EURJPY remains mixed and volatile.EURJPY - 24h expiry

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

Price action looks to be forming a top.

Preferred trade is to sell into rallies.

A lower correction is expected.

Bespoke resistance is located at 162.35.

We look to Sell at 162.35 (stop at 162.75)

Our profit targets will be 160.75 and 160.50

Resistance: 162.00 / 162.70 / 163.20

Support: 160.75 / 160.20 / 159.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

EURUSD 4H Bearish Cross starting the peak formation.The EURUSD pair posted a strong rebound last week, which is along the lines of our long-term bearish structure estimate, similar to the September 2024 Top.

The 4H MA50/100 Bearish Cross that was formed on Thursday, simply confirms that the pattern goes according to plan as on September 06 2024, the price got rejected after its completion and then rebounded to test Resistance 1 before the ultimate market peak.

We still expect a similar development, with our ultimate long-term Target being 1.03650, just above Support 1.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EURUSD - what’s next?Here is our in-depth view and update on EURUSD . Potential opportunities and what to look out for. This is a long-term overview on the pair sharing possible entries and important Key Levels .

Alright first, let’s take a step back and take a look at EURUSD from a bigger perspective.

After making such a huge upside move, we are expecting EURUSD to have some sort of a correction or a pullback to the downside. After that we got a sell off on EURUSD and just today we hit the 50% correction level at around 1.08442 . After failing to break to the upside we can expect more sells to be in play. Any breaks to the downside from the current price will confirm this. Although TVC:DXY is not as strong at the moment, it still is a global reserve currency . We seen that in play last week when we saw massive upside on OANDA:XAUUSD and on TVC:DXY . We must understand that investors are also pouring their money into DXY as it is a global reserve currency. I still personally believe TVC:DXY holds more strength against TVC:EXY hence why I am still looking to short the pair.

Scenario 1: SELLS from current price

With the instant sell, we are risking a possible pullback and continuations to the upside however, DXY is looking like it will reverse. Failing to break to the upside can also be taken as a confirmation for potential sells.

Scenario 2: BUYS at the break of the Key Level (around 1.085)

With the break to the upside, we can expect more buys to come in play possibly targeting previous highs on EURUSD at around 1.09444.

KEY NOTES

- DXY possible reversal to the upside.

- Breaks above the KL and to the upside would confirm higher highs.

- EURUSD has completed the 50% correction to the upside.

- DXY is the global reserve currency.

Happy trading!

FxPocket

Bullish bounce?EUR/NOK is reacting off the pivot which has been idetified as a pullback support and a bounce from this level could indicate a double bottom pattern which might lead to a potential price rise to the 1st resistance.

Pivot: 11.28684

1st Support: 11.18417

1st Resistance: 11.18417

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Potential bearish reversal?EUR/USD is rising towards the resistance level which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.0876

Why we like it:

There is a pullback resistance that lines up with the 61.8% Fibonacci retracement.

Stop loss: 1.0948

Why we like it:

There is a pullback resistance.

Take profit: 1.0799

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Skeptic | EURCHF: Trend Strength or Weakness? Trade SetupsWelcome back, guys! 👋I'm Skeptic.

Today, I’m bringing you a multi-time frame analysis of EURCHF , including both long and short triggers, along with a few educational tips. Let's dive in!

---

🕰️ Daily Time Frame Analysis:

After a solid accumulation phase and breaking above resistance, we've successfully shifted the trend to uptrend . Given the major trend direction, it's better to focus on long positions .

---

⏳ 4-Hour Time Frame Analysis:

Following the uptrend, we've formed a bullish ascending triangle, indicating a potential continuation. You might think that the RSI downtrend signals trend weakness, but here’s the key point:

- Lack of follow-through on the downside shows trend strengt h. If it was genuine weakness, we’d have seen a sharp downward move already.

This makes the bias towards long positions stronger .

---

🚀 Long Setup:

After breaking the resistance at 0.9649 7, we can consider a long position. A breakout of the RSI trendline to the upside would be an extra confirmation.

📉 Short Setup:

To go short, we first need a breakdown from the ascending triangle, followed by a break below the key support at 0.95726.

---

🎯 Target Setting:

You can use the height of the triangle or your own support/resistance levels to set targets. I’m not here to tell you where to place your stop loss or take profit since that heavily depends on your strategy, stop size, and R/R ratio.

---

💬 Final Thoughts:

I always provide the key levels and setups, but it's up to you to adapt them to your own strategy.

Thanks for sticking around until the end of this analysis.

See you on the next one!💪🔥

EUR_CHF LONG SIGNAL|

✅EUR_CHF made a retest

Of the horizontal support level

Of 0.9500 and we are already

Seeing a bullish rebound so

We can enter a long trade

With the TP of 0.9567

And the SL of 0.9488

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Check out my Week 14 Trade Analysis for 2025!Hello fellow traders , my regular and new friends!

How was your trading this week?

For me i did a couple of trades, namely on the EurNzd, Usdjpy and snp500.

Took a lost on snp500.

Usdjpy was so so

Eurnzd was not bad :)

Which are the pairs you have traded?

NFP for this week, do take note. What should we keep an eye on?

Do check out my recorded video for more insights!

Do Like and Boost if you have learnt something and enjoyed the content, thank you!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

EUR-CHF Potential Long! Buy!

Hello,Traders!

EUR-CHF is already making

A bullish rebound after the

Retest of the horizontal

Support of 0.9500 so we

Are locally bullish biased

And we will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

HelenP. I Euro drops to $1.0650 points, breaking support levelHi folks today I'm prepared for you Euro analytics. After analyzing this chart, we can see that the price spent some time within a consolidation range. During this period, the price tested the lower support zone and made a strong reaction from this level, moving upwards. This move showed strong buying pressure as the price quickly reversed from the support zone, signaling that buyers were ready to push higher. The price then broke above the trend line, continuing to rise and establishing a bullish momentum. It reached the upper resistance zone before encountering resistance and starting to consolidate. This consolidation happened within a narrow range, confirming that the market was unsure about the next move but still held above the important support 1. Now, the price is trading near the trend line and is testing the support zone. A reaction from this support will be crucial for determining the next move. Given the current price action, I expect a potential continuation of the move towards my goal at 1.0650, where the price may encounter further support and the previous price action. If you like my analytics you may support me with your like/comment ❤️

Bullish bounce?EUR/GBP is reacting off the pivot and could bounce to the 1st resistance.

Pivot: 0.8337

1st Support: 0.8310

1st Resistance: 0.8377

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop off 38.2% Fibonacci resistance?EUR/USD is rising towards the resistance level which is a pullback resistance that line sup with the 38.2% Fibonacci retracement and could drop from this level to our take profit.

Entry: 1.0833

Why we like it:

There is a pullback resistance level that lines up with the 38.2% Fibonacci retracement.

Stop loss: 1.0884

Why we like it:

There is a pullback resistance level that lines up with the 61.8% Fibonacci retracement.

Take profit: 1.0706

Why we like it:

There is a pullback support level that lines up with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.