Eur_usd

USD Direction For The WeekPotential for price action to head back to 1.13500 for a retest of this area where we saw buying momentum fail to break through. On the other side price action may re-test this area and head back down to the 1.11500 area where it is likely to range before advancing up or down.

US Dollar Index at an important junctureWe are at a level of supply as indicated by the 200 day MA, plus upward trending support, plus long term resistance turned support.

Could the level be broken? Possibly. The reasons according to many analysts is that the USD is not considered a safe haven currency. However I wonder if its because the dumping of risky assets in Europe turning the euro into safe haven - is just temporary until the dumping of risky assets in the USA. Remember up until now, the US equities although dropping significantly has not created the level of panic seen in other jurisdictions as indicated by the VIX.

Ultimately, the ECB is likely to ease while the Fed is not likely to go back to square one.

I tend to think there might be consolidation at this level and a sharp move up however a drop below, and I'd be considering closing all my long USD positions.

EUR/USD Short at top of range 1.144xEUR/USD is in a mess.

But downtrend on monthly remains intact and price is ahead of a key level.

Ranging on the weekly chart + uptrend on daily -> potential reversal trade from key monthly level.

Look for price to spike into 1.144x region and reverse for a short.

Tier 2 because of monthly trend + monthly level.

Trade of the day. Breakout Downwards likely on EURUSD. A few things to notice about this chart.

1. Price bounces down from 100 MA. Before November it was bouncing above from it. This line is key.

2. MACD shows price doesn't have a direction and has been consolidating since December. When the market decides EUR is going up or down, large orders will be placed in that direction.

3. There have been a serious of breaks downwards from upward trending lines indicating a downwards bias for about a year now. With EU presenting further QE, there is huge pressure to push the EUR lower and this is likely to continue.

4. Bollinger Band the tightest its been for years. A huge move is coming. It could go either way, but see point 3.

5. Price is dropping to converging supports in both upwards trend support and long-term horizontal support.

Monday will be big. A spike down and we are likely to see the price possibly go to parity. It is possible that we have a few more days of consolidation however I still favour downwards bias.

EUR/USD MAY BE IN A WAVE 2 TRIANGLE - WILL IT BREAK 1.1050The price action on the EUR/USD this week suggests a possible wave 2 "Triangle". Although more common in the wave 4 position they can form in wave 2 as well. It usually means the price is coiled up quite a bit and thrusts out quite strongly. The break of 1.1050 will be telling. If this does hold true then the chances are wave 4 will be a ZigZag ABC. Time will tell.

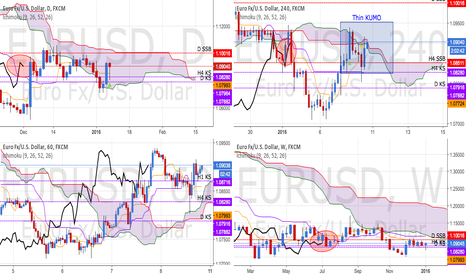

EUR/USD Our setup seems to confirm !We've been bullish for some days now on the pair, check-out our previous analysis.

We think the pair should not close below the extension of H4 SSB @ 1.09311. Stop should be placed at this level.

The upside is seen on extensions of H4 SSB @ 1.09821, 1.10054, 1.10563.

Check out all our setups on www.ichimokuforex.com

Thanks to like and comment if you think this analysis is interesting!