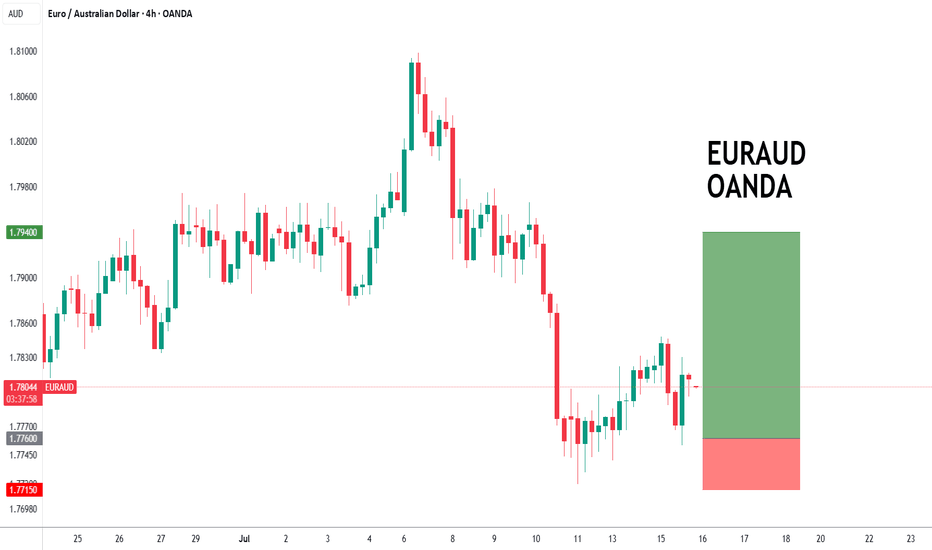

EURAUD Ready to Bounce? Key Support & Fundamentals Aligned!Today I want to share a Long position idea on EURAUD ( OANDA:EURAUD ) with you.

From a fundamental perspective , both the Euro (EUR) and Australian Dollar (AUD) are currently under pressure. However, the Aussie appears fundamentally weaker in the short term, making the EURAUD Long setup more favorable at this stage.

AUD Weakness :

The Reserve Bank of Australia (RBA) has held rates steady at 3.85%, but recent inflation data has dropped to 2.7%, the lowest in over 3 years.

Most economists now expect the RBA to cut rates in its next meeting in August, possibly by 25 basis points.

Slowing economic growth and dovish forward guidance from the central bank are weighing heavily on AUD sentiment.

EUR Outlook :

The European Central Bank (ECB) is also facing weak economic data, but is taking a more cautious approach toward cutting rates.

Despite softer PMIs and sluggish growth in countries like Germany and France, the ECB has not confirmed a near-term rate cut, keeping EUR relatively stable.

This divergence between the RBA’s dovish stance and the ECB’s pause is supportive of EUR strength against AUD.

Summary :

With the RBA likely to ease policy soon and the ECB holding ground for now, the interest rate differential favors EURAUD upside. Fundamentals point toward further weakness in AUD, making the EURAUD Long a strategically sound trade idea for the coming days.

-------------------------------------------

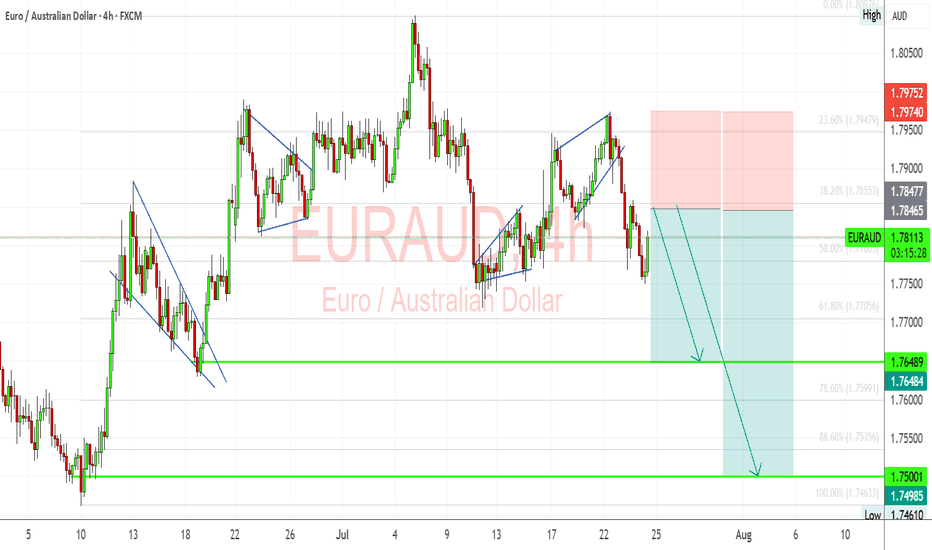

Now let's analyze the conditions of the EURAUD chart on the 4-hour time frame .

EURAUD is currently trading near the Support zone(1.772 AUD-1.763 AUD) , Potential Reversal Zone(PRZ) , and near the lower line of the descending channel .

According to Elliott Wave theory , EURAUD appears to have completed a Zigzag Correction(ABC/5-3-5) .

Also, we can see the Regular Divergence(RD+) between Consecutive Valleys .

I expect EURAUD to rise to at least 1.784 AUD .

Second Target: 1.792 AUD

Note: Stop Loss(SL): 1.762 AUD

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/Australian Dollar Analyze (EURAUD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Euraudlong

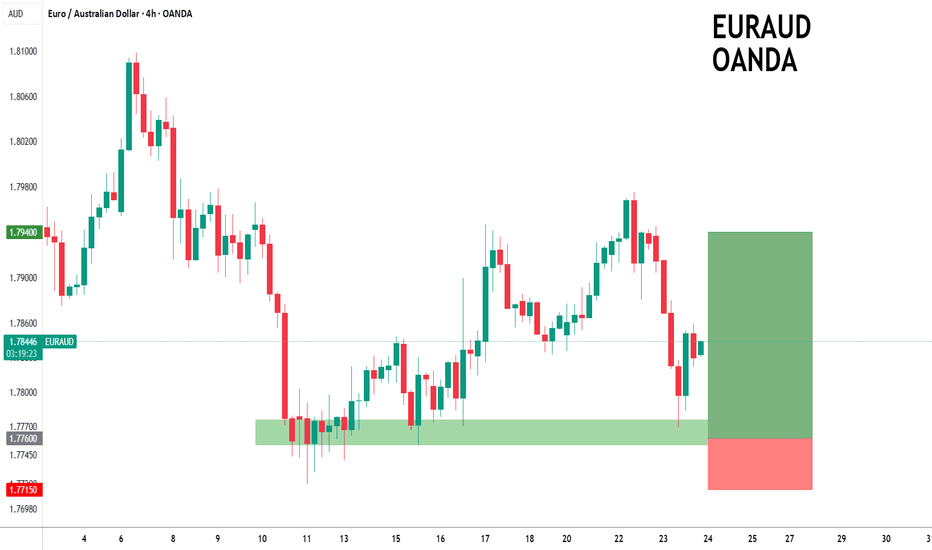

EURAUD to see a temporary move lower?EURAUD - 24h expiry

The primary trend remains bullish.

The selloff is close to an exhaustion count on the daily chart.

Preferred trade is to buy on dips.

Risk/Reward would be poor to call a buy from current levels.

Bespoke support is located at 1.7685.

We look to Buy at 1.7685 (stop at 1.7635)

Our profit targets will be 1.7885 and 1.7910

Resistance: 1.7850 / 1.7910 / 1.7950

Support: 1.7700 / 1.7680 / 1.7630

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

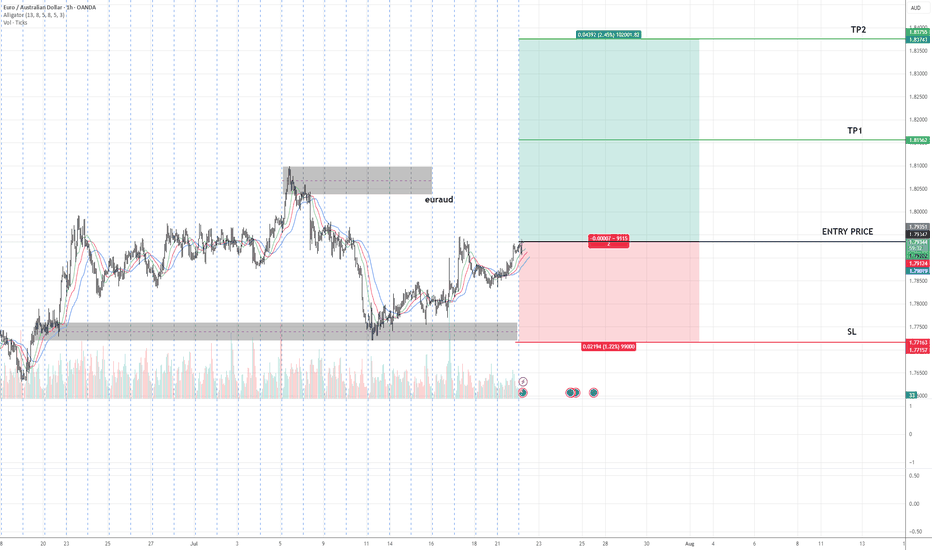

EURAUD Breakdown: Bearish Continuation Ahead of ECBEURAUD is showing signs of renewed downside pressure as fundamental and technical forces align in favor of Australian dollar strength. With the European Central Bank expected to hold rates steady and provide a cautious growth outlook, the euro remains vulnerable. Meanwhile, upside surprises in Australian inflation and supportive commodity dynamics continue to boost AUD sentiment. Technically, the pair has broken down from a rising wedge, confirming bearish momentum and setting the stage for further declines toward key support near 1.7648 and potentially 1.7500.

🟢 Current Bias: Bearish

🔑 Key Fundamentals:

ECB: Markets expect the ECB to hold rates steady this week. While this ends a 7-year streak of cuts, the bank has turned cautiously neutral, with no clear signal of future tightening. Core inflation remains subdued, and growth momentum across Germany and the euro area is weak.

RBA & Australia: The RBA faces persistent inflation risks after the June CPI surprised to the upside, putting rate hikes back on the table. The Aussie dollar is drawing strength from this, especially with rising commodity prices and China's potential fiscal stimulus aiding demand-side confidence.

Macro Divergence: Australia’s macro picture is improving vs. the eurozone. AUD has tailwinds; EUR is under pressure from stagnant growth and tepid inflation outlook.

⚠️ Risks to Bias:

ECB Surprise: A sudden hawkish tone from the ECB (e.g., lifting forecasts or emphasizing wage-driven inflation risk) could spark short-term EUR upside.

RBA Softness: A dovish RBA pivot or weak Aussie data could weaken AUD strength and slow EURAUD downside.

Geopolitical Risk: Broader global volatility (e.g., US-China, oil disruptions) could cause flows into euro as a semi-safe haven.

📅 Key News/Events to Watch:

ECB Rate Decision & Press Conference – July 25

Eurozone Flash GDP + CPI – Next week

China industrial data (AUD-sensitive)

RBA August Meeting Statement (early Aug)

📉 Technical Breakdown (4H Chart):

Price broke bearish from a wedge consolidation.

Minor bullish pullbacks are being sold into, confirming a distribution phase.

Targets:

1st Target: 1.76480 (support & fib confluence)

2nd Target: 1.7500–1.7460 zone (major swing low)

Resistance: 1.7855–1.7975 zone is key invalidation area.

Structure favors lower highs & continuation patterns until support zones break.

🧭 Leader/Lagger Behavior:

AUD is leading the move. Strong CPI and China demand backdrop are fueling bullish AUD momentum.

EUR is lagging, tracking broader USD risk tone and internal Eurozone data weakness.

EURAUD is currently reactive to external forces rather than setting direction for other pairs.

✅ Summary: Bias and Watchpoints

Bias: Bearish

Fundamentals: Weak Eurozone growth vs. hotter Aussie inflation and hawkish RBA tone.

Risk: ECB hawkish tilt or a dovish shift from the RBA.

Event to Watch: ECB press conference and Aussie CPI commentary from policymakers.

Leader/Lagger: Lagger — following AUD strength rather than leading.

EURAUD – Planning Ahead, Not PredictingAs usual, I have marked my level.

🎯 I’m waiting for the price to reach it and if a valid sell signal appears, I will enter a short position.

If the level is broken cleanly,

I’ll wait for a pullback and enter a buy trade.

We are just traders, not predictors.

We have no impact on the market —

we are just a tiny part of a huge system.

🧠 So I never say: “Price will come here, then must fall.”

That’s not my mindset.

My belief is simple:

Manage risk, be prepared for everything.

One trade won’t make me rich,

and I won’t let one trade destroy me.

📌 Stop-loss is the first and last rule.

Trading without a stop-loss is just gambling.

EURAUD to find buyers at previous support?EURAUD - 24h expiry

The primary trend remains bullish.

We are trading at oversold extremes.

Preferred trade is to buy on dips.

Risk/Reward would be poor to call a buy from current levels.

Bespoke support is located at 1.7760.

We look to Buy at 1.7760 (stop at 1.7715)

Our profit targets will be 1.7940 and 1.7960

Resistance: 1.7840 / 1.7900 / 1.7950

Support: 1.7750 / 1.7720 / 1.7700

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

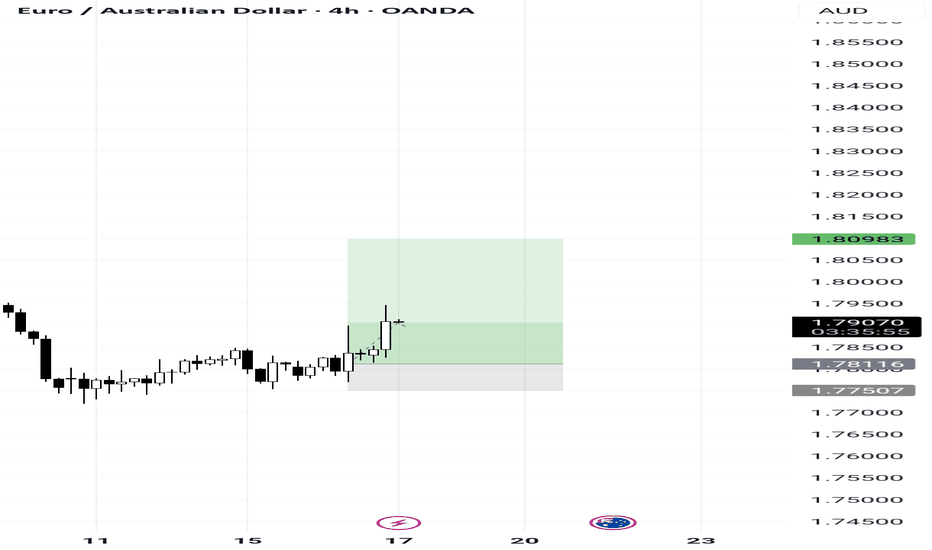

EURAUD Buy Setup – Advanced Analysis Entry: As marked on chart

🎯 TP1: As highlighted on chart

🎯 TP2: As highlighted on chart

🛑 SL: As defined on chart

📊 Technical Insight:

Price has completed a higher low formation, indicating the potential start of a new uptrend phase.

The market has shown an accumulation phase followed by a breakout above minor resistance, suggesting strong demand at current levels.

Volume analysis supports the breakout, with increased participation on bullish pushes and decreasing volume on retracements, confirming healthy trend dynamics.

📍 As long as price holds above the stop loss zone, we expect continuation towards TP1 and TP2 in line with the primary trend.

EURAUD forming a bottom?EURAUD - 24h expiry

The primary trend remains bullish.

The selloff has posted an exhaustion count on the daily chart.

Preferred trade is to buy on dips.

Risk/Reward would be poor to call a buy from current levels.

Bespoke support is located at 1.7760.

We look to Buy at 1.7760 (stop at 1.7715)

Our profit targets will be 1.7940 and 1.7970

Resistance: 1.7875 / 1.7950 / 1.8000

Support: 1.7750 / 1.7715 / 1.7670

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Brace Yourselves: EURAUD’s Harmonic Storm Is Coming!Good morning, Traders ☀️

I've identified a bullish harmonic Bat pattern on the EURAUD pair.

At this stage, I'm only anticipating a reactional buy from the marked zone.

I'll determine my target level after observing the market's response from that area.

📌 I’ll be sharing the target details under this post once the reaction unfolds.

Your likes and support are what keep me motivated to share these analyses consistently.

Huge thanks to everyone who shows love and appreciation! 🙏

euraud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EUR/AUD Made Perfect Breakout , Long Setup Valid To Get 150 PipsHere is My 2H T.F Chart and if we have a look we will see that we have a very good breakout after this ascending triangle , the price finally closed above neckline for this pattern and we have a good confirmation so i`m waiting the price to go back to retest this broken neckline and then we can enter a buy trade . and if the price closed below my neckline with daily candle then this idea will not be valid anymore .

EURAUDBullish Continuation from a Bull Flag Pattern + Break of Structure

Bull Flag Pattern Formed

After a strong impulsive bullish move, the price forms a consolidation channel (flag), sloping slightly downward.

This is a classic bull flag pattern, indicating bullish continuation.

Break of Structure (BOS) Confirmed

The price broke above the flag, showing a BOS (Break of Structure) to the upside.

This confirms a potential continuation of the uptrend.

Fibonacci Confluence

Price retraced to the 61.8–78.6% Fibonacci zone (golden zone), which often acts as a strong reversal area in trending markets.

This gives a good risk-to-reward (R:R) opportunity.

Higher Highs and Higher Lows (Market Structure)

The market is forming HHs (Higher Highs) and HLs (Higher Lows) – typical of a healthy uptrend.

Demand Zones Below

Several demand zones (blue boxes) support price if it retraces.

The strong low marked adds structure-based support beneath the trade entry.

Risk-to-Reward (R:R) Setup

You’ve set a tight stop loss below structure and a larger take profit aiming at the -61.8% and 100% Fib extensions – a favorable R:R ratio

EUR/AUD 1H – Decision Point Ahead Breakout or Fakeout? Eyes on Confirmation Zone 👁️

EUR/AUD has finally tapped into a critical resistance at 1.79900, a level previously rejected with high volatility. The current price action is testing this ceiling, with signs of strength — but smart money waits for confirmation.

What We’re Seeing:

🔹 Uptrend Intact: All EMAs are aligned in bullish order.

🔹 Bullish Fair Value Gap (FVG) formed below — a potential area of demand.

🔹 Price now hovering inside the Confirmation Zone — marked by previous highs and psychological resistance.

🔹 Volume building gradually — but breakout volume not confirmed yet.

⚖️ Summary:

Trend: Upward

Structure: Breakout under test

Momentum: Bullish

Market Phase: Confirmation / decision point

Key Behavior: Watch for commitment or rejection without predicting it

EURAUD sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

euraud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURAUD to continue in the sequence of higher lows?EURAUD - 24h expiry

The primary trend remains bullish.

Short term RSI is moving lower.

Preferred trade is to buy on dips.

Risk/Reward would be poor to call a buy from current levels.

Bespoke support is located at 1.7840.

We look to Buy at 1.7840 (stop at 1.7805)

Our profit targets will be 1.7980 and 1.8000

Resistance: 1.7920 / 1.7990 / 1.8020

Support: 1.7800 / 1.7750 / 1.7710

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

#EURAUD: Two Swing Bullish Entry Worth Thousands Pips! EURAUD is currently at a critical level, and the price isn’t yet decided for the next move. However, the current price behaviour suggests strong bullish volume presence in the market. There are two areas to buy from. The first is activated, and we think price could just be starting the next bull run from this point. The second entry is a safe point if price does decide to drop further and fill up the daily Fair Value Gap.

We wish you the best in trading.

If you want to support us, you can do the following:

- Like the idea

- Comment on the idea

- Share the idea

If you have any questions or concerns about the analysis or trading in general, please let us know in the comment box.

Team Setupsfx_

❤️🚀

#EURAUD: Daily Timeframe Suggest Major Price Correction! EURAUD is currently implementing a significant correction, which could potentially be advantageous for swing traders like ourselves. This correction presents an opportunity to execute swing trades.

There are two potential entry points for swing trades: a risky trade and a safer trade option.

Best of luck and trade safely!

Warm regards ❤️

Team Setupsfx_

#EURAUD: Two Major Buying Zones|, Which One Are You In? Hey Everyone

Following a substantial bullish candle, the price failed to maintain the bullish momentum and swiftly transitioned into a bearish position, effectively eradicating the bullish gain. Nevertheless, we remain optimistic that the price will retain its bullish trend in the upcoming weeks. We have identified two potential areas where price may reverse from either of the two zones. You are welcome to set take profit and stop loss orders based on your own investment strategy. It is advisable to closely monitor the prices before making any trading decisions.

We extend our sincere best wishes and best of luck in your trading endeavours. Your unwavering support is greatly valued.

If you wish to contribute, we have provided several avenues for your assistance:

- Liking our ideas

- Commenting on our ideas

- Sharing our ideas

Team Setupsfx_🚀❤️

EURAUD – Rejection From Resistance: Bearish Momentum BuildingThe recent rally on EURAUD has met strong rejection near the 1.7980–1.8000 supply zone, signaling exhaustion of bullish momentum. With price forming a clear lower high and pushing away from the upper range, traders may be eyeing short setups targeting deeper fib retracements. Here's how the fundamentals align with the technical picture:

🔻 Bias: Bearish

🔑 Key Fundamentals

Eurozone: While the German Ifo business sentiment has improved, hard data (like industrial output) remains weak. ECB speakers such as Panetta and Knot continue to lean dovish, signaling no urgency for further tightening.

Australia: The AUD is finding strength from a risk-on global environment, falling oil prices (positive for AUD importers), and stability in China-sensitive commodities. The RBA remains relatively hawkish versus the ECB.

Yield Spread: Euro-Australia rate differentials are narrowing, reducing EUR’s relative appeal.

⚠️ Risks to Bias

Unexpected Hawkish ECB Commentary

Risk-Off Event (e.g., equity sell-off or new geopolitical tensions) that could weaken AUD

China PMI Miss dragging AUD if demand outlook sours

📅 News/Events to Watch

June 28: U.S. Core PCE (Fed impact → EURUSD spillover)

June 30: China PMIs (key for AUD demand outlook)

Ongoing: ECB member speeches, Eurozone CPI prelims

🔄 Potential Leader

AUD Crosses (e.g., AUDJPY, AUDUSD) may lead broader moves if China PMI surprises or if commodities rebound further.

This technical rejection from the key resistance zone aligns with the macro shift favoring AUD strength over EUR. As long as price stays below the 1.7980–1.8000 zone, EURAUD may slide toward 1.7730, 1.7595, and even 1.7460 in extension.

🔔 Trade idea: Watch for bearish confirmation on the H4 close below 1.7830 to validate momentum continuation.

EUR/AUD Giving Amazing Bullish P.A , Ready To Get 150 Pips ?Here is my EUR/AUD 2H Chart , if we check the chart we will see that we have a very strong old res that forced the price to respect it may times and finally we have a great breakout and also we have a very good rejection to the area , so it`s the best place to enter a buy trade to go to the high again to see if we can take it also or not . if the price closed below the broken res and new support with daily candle , this mean the idea is not valid anymore .