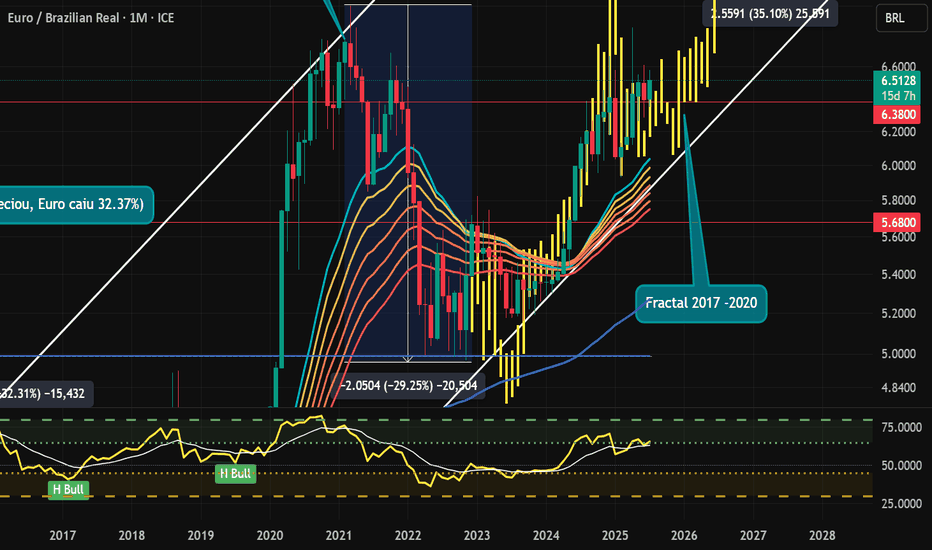

EUR/BRL expectations for 2027Although my primary focus is on the crypto market, here is a brief analysis of the EUR/BRL exchange rate. Since 2011, the pair has shown a strong upward trend, moving within a well-defined ascending channel.

During Brazil's monetary tightening cycles—specifically with the Selic rate hikes in 2016 and 2021—the Brazilian real appreciated significantly, leading to a roughly 30% decline in the EUR/BRL exchange rate in both instances.

Analyzing the price action from 2017 to 2020, a recurring technical pattern (fractal) emerges, which appears to have resumed since 2023. If this structure continues to play out, the euro could reach the R$9.00 level by 2027.

EURBRL

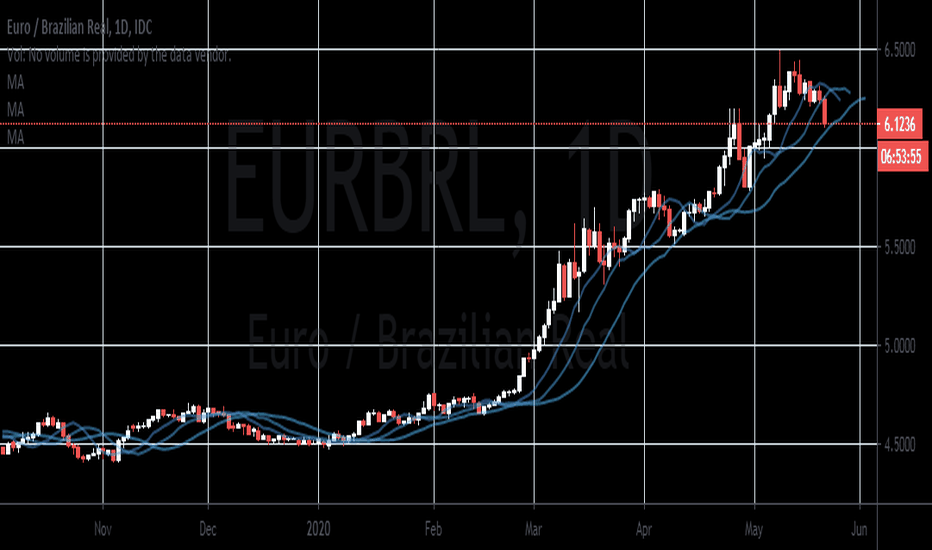

The Brazilian real and the number of coronavirus casesIt’s evident that the Brazilian real’s value continues to plummet against the eurozone’s single currency. The EUR/BRL trading pair has been very bullish in recent days, climbing to record heights. Unfortunately for the Brazilian real, it’s not expected to recover yet although today, prices are seen steady due to the slight weakness faced by the euro. Looking at it, the Brazilian real’s appeal won’t work on investors as the number of coronavirus cases in the country continues to climb drastically. Just recently, the country’s health ministry reported more than 23,000 new confirmed coronavirus cases in the country on Sunday. The Latin American powerhouse now has more than 3.6 million confirmed cases since the pandemic began and the death toll is now over 114,000 according to official reports. Based on those figures, Brazil has the world’s second-worst coronavirus outbreak after the United States and the number is sadly closing in.

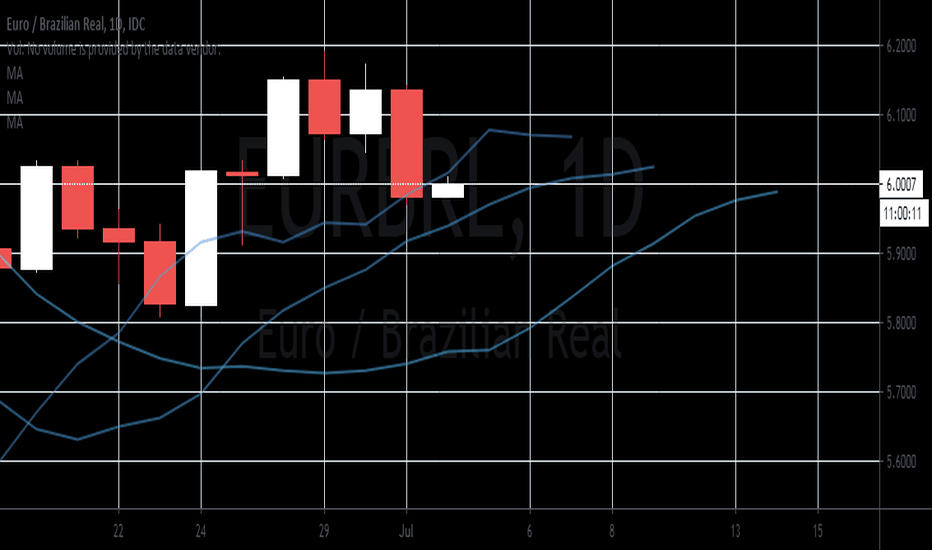

Bearish investors are hoping to have their luck against the tideThe euro to the Brazilian real exchange rate has the potential to go down towards its support level as the euro slows down momentarily. Bearish investors are hoping to have their luck against the tides, possibly pulling the prices lower towards their support in the coming days. However, the move will mostly have a minimal dent on the momentum of bulls as it will not be enough to push the 50-day moving average lower against the 200-day moving average. As of today, the pair has been trading neutrally as both sides wait for further guidance that could tip favors into their ends. The deal between the leaders of the European Union is the main factor that contributed to the prowess and strength of the euro now. And the Brazilian real is weighed down by the struggling country whose economy has been greatly battered by the pandemic. The number of COVID19 cases in Brazil makes it difficult for the real to fully recover against other major currencies.

The Brazilian real appears that it lost its recovery momentumThe Brazilian real appears that it lost its recovery momentum since early June, not just against the euro, but also against other currencies. The EURBRL’s prices have been flirting with a critical resistance, and yesterday, prices bounced off aggressively from that level. However, the pair is widely projected to climb higher and break it, ultimately reaching its higher resistance level in the first half of the month. That should continue to buoy the 50-day moving average against the 200-day moving average, suggesting that the market is still bullish. The Brazilian real is in danger against the euro as bullish investors want to continue their strong performance. In fact, the euro seeks to extend its best run in more than two months against most currencies as it rides on the wave of coronavirus and economic hopes. Bearish investors will have a tough time as more biopharmaceuticals get more positive news from their coronavirus vaccine which helps the euro.

EUR/BRL should go down to its support level this month The exchange rate slightly steadies this Monday, but bears are widely expected to come out triumphant in the coming sessions. The pair should go down to its support level this month as the Brazilian real makes an astonishing come back. The news about the European Central Bank’s decision to expand its stimulus program even more than expected failed to support the euro last week. The ECB opted to widen its stimulus program to support the badly injured economies in the region which is currently facing its worst recession since the Second World War. The decision of the ECB also supported the risk sentiment in the market which ultimately boosted the Brazilian real as well. According to reports, the central bank ramped up its emergency bond-buying scheme by about €600 billion to €1.35 trillion. Aside from that, ECB head Christine Lagarde is set to testify later today, to update the bloc about the stimulus programs which delighted bulls.

The Euro and the Brazilian real aren’t seeing good trajectoriesIt looks like both the Euro and the Brazilian real aren’t seeing good trajectories this week as both economies show negative news and figures. Brazil’s national economy shrank 1.5% in the first three months this year, which was down from a revised 0.4% jump during the previous quarter in 2019. The drop was the first contraction since 2016, as well as the biggest decline since early 2015. Several sectors like finance, mining, manufacturing, construction, and public administration all met significant slumps throughout the period. Although the HIS Markit manufacturing purchasing managers index saw a higher-than-estimated figure on Monday, which came in at 38.3 in May against April’s 36 low. Meanwhile, conflicts with Britain continues to affect the already failing economy in Europe. Nonetheless, Brazil’s new status as a coronavirus epicenter is expected to push its economy down against the single currency.

The Brazilian real gets a chance to recoverThe Brazilian real gets a chance to recover thanks to the recently reported recession in German, the bloc’s biggest economy. The single currency steadies this Tuesday but is widely expected to contract in the coming sessions as investors worry about possible measures from the eurozone to save its powerhouse. Yesterday, the German statistics office reported that the country’s economy dropped from -0.1% to just -2.2% in the first quarter of the year thanks to the lockdown measures that closed businesses. The euro will continue to struggle as Berlin is also expected to see a deeper economic slump in the second quarter of the year. The news gives a much-needed opening for the Brazilian real who has also been struggling against most major currencies in the market, Bearish investors of the euro to Brazilian real exchange rate are hoping to force the 50-day moving average to make a downward reversal in efforts of minimizing prior losses.

EUR/BRL will continue to move higher in the following daysThe pair will continue to move higher in the following days towards its all-time high. The EU’s economic powerhouses, Germany and France, posted their lowest Manufacturing and Services Purchasing Managers Index (PMI) reports in the first week of May. The bimonthly report saw its figure dropping to the lowest level since the 2008 Global Finance Crisis. In addition to that, the European Union also suffered the same fate. Analysts, however, are optimistic that these reports have already hit their bottom and are projected to post higher figures compared to their previous reports. The positive sentiments from analysts came as most EU member states continue to ease their restrictions. Spain, the EU’s most affected member state from the coronavirus pandemic, is now only the 6th on the list of countries with the biggest cases of COVID-19. Brazil, on the other hand, is preparing to become the second most infected country in the world.

Brazilian real crumbles against the euroAs the Brazilian president downplays the novel coronavirus, the Brazilian real crumbles against the euro. Despite being struck by the paralyzing virus, the eurozone’s single currency holds the upper hand in the EURBRL pair. The far-right president of Brazil, Jair Bolsonaro, defied his own government’s social distancing policies against the coronavirus. Bolsonaro joined and interacted with his supporters on the streets of Brasilia as he urges them to continue living normally and keep the economy going. It appears that the economic activity comes first than prioritizing safety and health, leaving a rather distasteful trace to investors. Meanwhile, the current weakness of the euro is attributed to the dwindling confidence over the economic sentiment of the bloc. Also, Berlin’s council of economic advisers said that the economy could contract as much as 5.4% this year courtesy of nonother than the novel coronavirus.

EUR/BRL failed to breakout from a major resistance lineThe pair failed to breakout from a major resistance line, sending the pair lower towards a key support line. Brazil is seeking a Mercosur-UK trade deal, which will be the same agreement with the European Union. This was after thethen second-largest economy in the EU withdraw from the bloc last January 31. Brazil is among the growing number of non-EU countries seeking ties with Britain. On the global ranking, Britain placed fifth on the largest economy in the world next to Germany, the EU’s economic powerhouse. The ECB will also hold several press briefings today, February 06, to discuss the current economic climate within the bloc. Analysts are worried that the press briefings will be negative with the recent slump in Germany’s Factory Orders report. On January 08, Germany posted a negative growth in factory orders which increases fears that Germany might enter a recession. With this is mind, the euro will fall in coming sessions.

Brazilian Real to trade higherLooking at the recent changes in Brazil the technicals and fundamentals are lining up for a stronger BRL.

BRL may open stronger Thursday, as the central bank delivered an expected 50bp rate cut, but notably removed the following

sentences from the statement.

“In the Copom evaluation, the evolution of the basic scenario and the balance of risks

prescribes an adjustment in the degree of monetary stimulus, with a reduction of the Selic

rate by 0.50 percentage points. The Committee considers that the consolidation of the benign scenario for prospective inflation should allow an additional adjustment of equal

magnitude."

It also took out the phrase "in any further adjustments in the degree of stimulus" from the

following line in the October statement: “The Copom understands that the current stage of

the economic cycle recommends caution in any further adjustments in the degree of

stimulus.”

- S&P followed the rate decision by upgrading Brazil’s outlook from stable to positive.

Looking at the technicals the EUR/BRL is currently at the Monthly Pivot and is making lower highs and lower lows - finding resistance above.

There is a lot of possible liquidity below the Yearly Pivot as this acted as strong support from the summer.

EUR/BRL News and Charts for August 12, 2019The pair failed to breakout from a key resistance line, which will send the pair lower towards a major support line. Unpredictability was seen to be playing its game on the EU-Mercosur trade negotiations. The 20 years negotiation between the European Union and Brazil had finally come into an end after the two (2) economies agreed to draft deal which will open the market of the largest trading bloc in the world and the largest trading bloc in South America. However, negotiations to finalize the deal was still rough as the election of Brazilian President Jair Bolsonaro had caused Brazil’s deforestation to soar, an event that violates the agreed terms between the two (2) economies. Aside from this, Bolsonaro, also dubbed as “South America’s Trump”, had inherited U.S. President Donald Trump’s eccentric attitude after he cancelled a meeting with French Foreign Minister Jean-Yves Le Drian for a haircut.

Falha de topo EUR/BRL e USD/BRLAcredito que esta falha de topo no mensal do EUR e USD com o BRL nos levará pelo menos até a metade dessa perna de alta para de lá definir se o Real volta a apreciar indo testar o fundo ou retoma a alta. Mais provável na minha opinião é o fortalecimento do Real daqui em diante.

EURBRL November 2016EURBRL November 2016

the bear roar from march 2016 and break 0.618 suport level. Are this pair are hopeless for bullish?

at daily chart, we can see euro vs brazillian real already break channel down at november 11

and failed to break support level at october 25

this level also a good support for brazillian real at july 2015

so this breakout are a very good sign for bullish, but we need more reason to take this price movement as reversal, since it was a very strong bearish perform at EURBRL chart daily

If we look for bigger timeframe EURBRL analysis (weekly), this level also as resistance at black friday 2008

and it's 0.5 fibonacci from september 2010. So this strong support will be our basic forex outlook at EURBRL trading strategies

and this is also a good sign that the big correction already over at EURBRL

4 hour timeframe, EURBRL perform channel up, after success break the big correction

to take a good setup, we need to wait some retracement around .618, and we may calculate a setup timing using a time cycle, time cycle are a good forex forecast technical analysis tool . If EURBRL made a correction for this week, the best bullish position at 61.8 fibonacci support,

this level also a very good support line that hold bearish movement at Aug/Oct. 3.6030 are best long position for this month at brazillian real

to analyze target and stop level, we need to look at bigger timeframe at daily EURBRL chart, and combine with fibonacci target

as we see the 1.168 are CSR level at November 2015 and April/June strong support, 3.9209 are best target for bullish at EURBRL

with stoploss below last low at 3.4739

this trading plan R/r ratio : 2.44