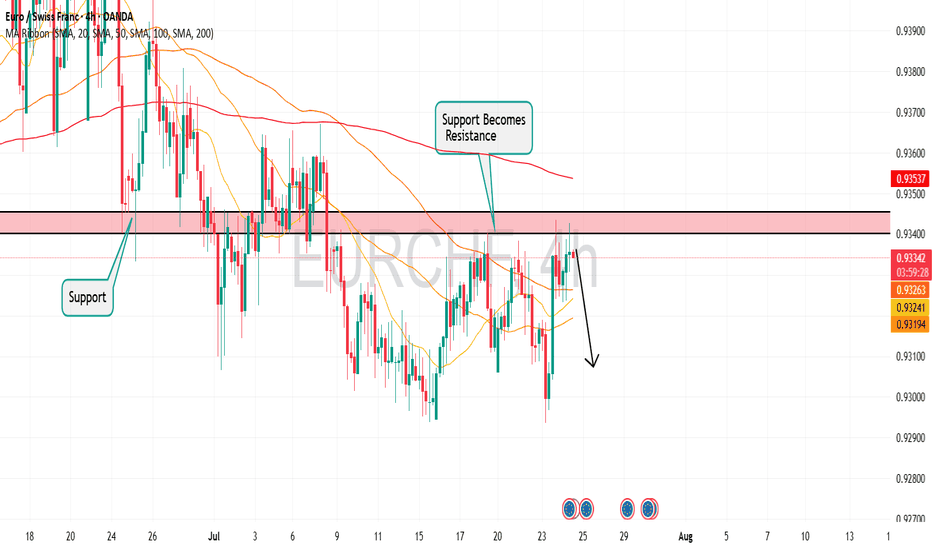

EURCHF Is in The Selling Direction Hello Traders

In This Chart EURCHF HOURLY Forex Forecast By FOREX PLANET

today EURCHF analysis 👆

🟢This Chart includes_ (EURCHF market update)

🟢What is The Next Opportunity on EURCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Eurchfforecast

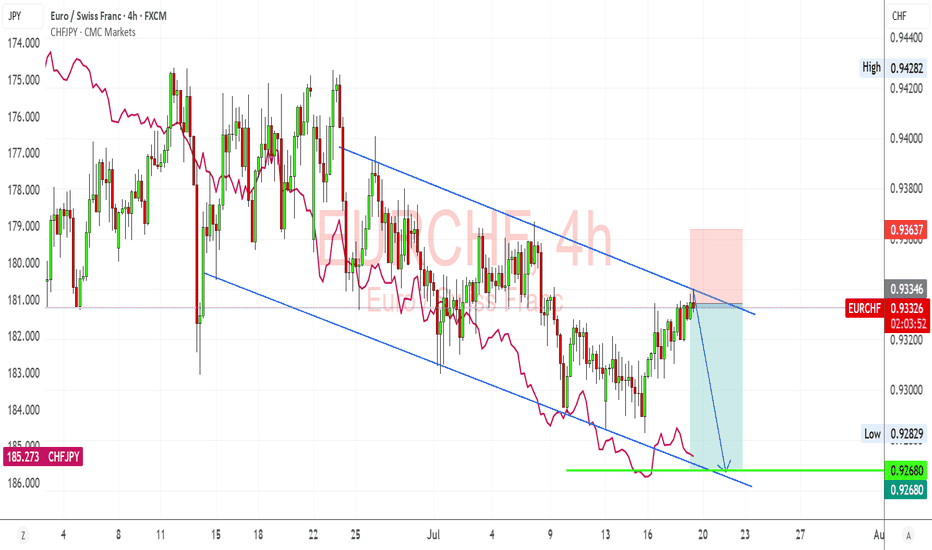

EURCHF – Bearish Channel Holds Firm, CHF Strength Set to ResumeEURCHF just tapped into the descending channel resistance again and is showing signs of rejecting. I'm expecting a bearish continuation here, especially given the strong CHF momentum recently, supported by safe-haven flows and Swiss inflation stability. If the pair fails to break above 0.9340, I’m watching for a downside push back toward 0.9270–0.9265, completing another leg within the structure.

🔍 Technical Setup (4H):

Channel Structure: EURCHF remains firmly within a downward-sloping parallel channel since mid-June.

Resistance Rejection: Price recently tested upper channel resistance (~0.9335–0.9340 zone), aligning with trendline rejection.

Target Support: 0.9270–0.9265 (channel base and key horizontal level).

Confluence: CHFJPY overlay (pink line) is rising again, suggesting renewed CHF strength—this usually weighs on EURCHF.

💡 Fundamental Insight:

EUR Side:

ECB officials remain cautious, but with recent EU data showing weaker growth (especially PMIs and sentiment), euro upside is capped.

The ECB is likely to pause further tightening, while other central banks like SNB remain firm on inflation risks.

CHF Strength:

The Swiss National Bank (SNB) still leans hawkish, with stable inflation giving room to hold rates steady or tighten if needed.

CHF benefits from risk-off flows amid global tariff headlines, China slowdown, and Middle East tensions.

Rising CHFJPY = clear CHF strength across the board.

⚠️ Risks:

If eurozone data surprises to the upside (e.g., inflation rebounds), EURCHF could break out of the channel.

A sudden drop in geopolitical tension or strong risk-on rally could weaken CHF as safe-haven demand falls.

SNB jawboning or FX intervention is always a wildcard.

🧭 Summary:

I’m bearish on EURCHF while it respects this well-defined descending channel. The technicals show consistent lower highs and lower lows, while the fundamentals continue to support CHF strength due to risk aversion, stable inflation, and a resilient SNB. My short bias is valid as long as price remains below 0.9340, with downside targets at 0.9270–0.9265. CHFJPY rising confirms franc leadership across FX markets, and EURCHF is likely a lagger following broader CHF strength.

Symmetrical Triangle in EURCHF —Fundamental & Technical AnalysisToday, I want to examine the EURCHF ( FX:EURCHF ) Short position opportunity from both a Fundamental and Technical perspective.

First, let’s examine the EURCHF pair from a fundamental perspective:

The ECB’s dovish policy stance and weakening Eurozone data contrast sharply with the Swiss Franc’s safe-haven appeal and economic stability. With geopolitical tensions in the background, EURCHF may continue to slide lower, supporting short positions.

In terms of technical analysis , EURCHF is moving near a Heavy Resistance zone(0.967 CHF-0.940 CHF) .

In terms of Classical Technical Analysis , EURCHF is moving inside a Symmetrical Triangle Pattern . The point to note about this example is that every time EURCHF approaches the upper lines of the symmetrical triangle , it starts to decline with a lot of momentum . And considering the previous movement of EURCHF, which was bearish, it is better to look for short positions from inside the symmetrical triangle.

Based on the above explanation , I expect EURCHF to move back towards the lower lines of the symmetrical triangle pattern .

Note: Stop Loss(SL): 0.94120 CHF

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/Swiss Franc Analyze (EURCHF), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EURCHF Analysis – “Euro Inches Higher, But Safe-Haven CHF LurksEURCHF is breaking out from a symmetrical triangle, indicating potential bullish momentum.

Key resistances to watch:

0.9445 – local swing high

0.9498 – potential measured target from the triangle breakout

Entry on retest of the triangle may offer a favorable risk-reward opportunity.

However, upside could be capped if CHF regains strength.

Structure Bias: Bullish breakout, confirmation needed with a clean retest and sustained move above 0.9440

📊 Current Bias: Cautiously Bullish

🧩 Key Fundamentals Driving EURCHF

EUR Side (Neutral to Slightly Bearish):

ECB remains cautious: June’s Economic Bulletin showed soft patches in core inflation and weak consumer activity.

German & French PMIs are mixed; services weaker than expected.

Political uncertainty (France snap elections) weighs on EUR sentiment in the medium term.

CHF Side (Fundamentally Stronger):

SNB is cautious but hawkish: Monetary policy assessment showed a steady hand, maintaining rates with no clear signal of easing.

Safe-haven flows persist due to:

Middle East risk (Israel–Iran escalation)

Russia–Ukraine tensions

Weak equity sentiment

CHF remains supported on global risk aversion, even with SNB standing pat.

⚠️ Risks That May Reverse or Accelerate Trend

Breakout fails to hold → Bearish fakeout leads to drop toward 0.9290 again

Renewed CHF strength from geopolitical shocks

Eurozone political turbulence (especially France & ECB doves)

🗓️ Important News to Watch

🇨🇭 Swiss CPI, SNB statements

🇪🇺 Eurozone PMI Flash (June 21), CPI (June 28), and political updates

Global market risk sentiment (VIX, bonds, oil, Iran/Israel news)

🏁 Which Asset Might Lead the Broader Move?

EURCHF is lagging behind EURUSD and USDCHF, but provides clean geopolitical risk signals. If markets stabilize, this pair has upside potential. However, if fear returns, CHF may quickly regain control, trapping long trades.

EURCHF SHORT FORECAST Q2 W25 D20 Y25EURCHF SHORT FORECAST Q2 W25 D20 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50EMA Rejection

✅15' Order block

✅1H Order Block

✅4H Highs

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF SHORT FORECAST Q2 W23 D2 Y25EURCHF SHORT FORECAST Q2 W23 D2 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4 hour order block

✅4 hour 50 EMA rejection

✅Intraday 15' order block to be identified

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF SHORT FORECAST Q2 W22 D29 Y25EURCHF SHORT FORECAST Q2 W22 D29 Y25

😎PLAN OF ACTION - Correct, no higher time frame order blocks, we get in, we get out. we collect our money & we move on !

NOTE - ✅Intraday 15' order block to be identified. Sit on your hands until this materialises.

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily 50 EMA rejection

✅Weekly 50 EMA rejection

✅Intraday 15' order block to be identified

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EUR/CHF Technical Outlook – Potential Bullish Reversal Setup📈 Pair: EUR/CHF

📆 Date: May 27, 2025

📊 Timeframe: Daily (D1)

📌 Technical Highlights:

🔹 Current Price: 0.93456

🔹 Key Indicators:

50 EMA (Red): 0.93824

200 EMA (Blue): 0.94342

🧠 Chart Analysis:

🔻 Downtrend Resistance Line: A clear descending trendline is pressing price lower, reinforcing a bearish structure since March.

🟣 Reversal Zone (Support Area):

Price is currently hovering just above the marked Reversal Point, a demand zone between 0.93000–0.93400. Historically, this zone has acted as a launch pad for upward momentum.

🟪 Resistance Level:

Located around 0.94300–0.94600, this zone is reinforced by the 200 EMA, making it a critical breakout area. A strong bullish close above this region could invalidate the downtrend.

🔄 Two Scenarios to Watch:

✅ Bullish Breakout Scenario:

Price may bounce from the reversal zone.

A break and retest above the resistance level could lead to bullish continuation toward 0.9500–0.9550.

Confirmation above the 200 EMA will add confidence to the breakout.

📈 Potential Buy Entry: On breakout and retest of 0.9450

🎯 Target: 0.9550

🛡️ Stop Loss: Below 0.9320

❌ Bearish Continuation Scenario:

If price fails to hold above the reversal point, sellers may regain control.

A breakdown below 0.9300 could trigger further downside toward 0.9200 or lower.

📉 Sell Setup Invalid Until: Price closes below 0.9300 on strong volume.

🧭 Conclusion:

This chart suggests a critical decision point for EUR/CHF. A bounce from the reversal zone followed by a confirmed break above resistance could signal the start of a medium-term uptrend. Traders should monitor price action closely for confirmation signals near the trendline and EMA zones.

🚦 Bias: Neutral to Bullish, awaiting confirmation

🧠 Tip: Watch for candlestick patterns (like bullish engulfing or pin bars) near the support zone for early entries.

EUR/CHF Thief’s Jackpot: Swipe Profits with This Slick Strategy!Ultimate EUR/CHF Heist Plan: Snag Profits with the Thief Trading Strategy! 🚀💰

🌍 Greetings, Wealth Raiders! Ciao, Hello, Bonjour, Hola! 🌟

Fellow profit hunters, get ready to crack the EUR/CHF "Euro vs Swiss" Forex vault with our slick Thief Trading Strategy! 🤑💸 This plan blends razor-sharp technicals and fundamentals to loot the market. Follow the chart’s long-entry blueprint to strike at high-risk zones like the Red Zone Resistance It’s a wild ride—overbought conditions, consolidation, and potential trend reversals mean bears are lurking! 🐻 Stay sharp, grab your profits, and treat yourself—you’ve earned it! 🎉💪.

📈 Entry: Storm the Vault!

"The heist is on! Wait for the breakout (0.94000) then make your move - Bullish profits await!"

The market’s ripe for a bullish grab! 💥 Place buy limit orders within the most recent 15 or 30-minute swing low/high levels. Set alerts on your chart to stay locked in. 🔔

🛑 Stop Loss: Guard Your Loot!

Set your Thief SL at the nearest swing low on the 4H timeframe for day/swing trades. Adjust based on your risk tolerance, lot size, and number of orders. Safety first! 🔒

🎯 Targets: Claim Your Prize!

🏴☠️ Short-Term Target: 0.95300

👀 Scalpers, Listen Up!

Stick to long-side scalps. Got deep pockets? Jump in now! Otherwise, join swing traders for the heist. Use trailing stop-loss to lock in gains and protect your stash. 💰

🐂 Why EUR/CHF is Hot!

The Fiber’s bullish surge is fueled by key fundamentals. Dive into Macro, COT Reports, Quantitative Analysis, Sentiment, Intermarket trends, and future targets via the linkss below for the full scoop. 👉🔗. Stay informed to stay ahead! 📰

⚠️ Trading Alert: News & Position Management

News releases can shake the market like a heist gone wrong! 🗞️ To protect your profits:

🚫 Avoid new trades during news events.

🛡️ Use trailing stops to secure running positions.

💥 Boost the Heist!

Hit the Boost Button to supercharge our Thief Trading Strategy! 💪 Every click strengthens our crew, making it easier to swipe profits daily. Join the squad, trade smart, and let’s make money rain! 🌧️💵

EURCHF SHORT FORECAST Q2 W20 D16 Y25EURCHF SHORT FORECAST Q2 W20 D16 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4 Hour order block rejection

✅4 Hour 50 EMA rejection

✅Intraday 15' order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF SHORT FORECAST Q2 W20 D12 Y25EURCHF SHORT FORECAST Q2 W20 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4 Hour order block rejection

✅4 Hour 50 EMA rejection

✅Intraday 15' order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EUR/CHF "Euro vs Swissy" Forex Bullish Heist (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/CHF "Euro vs Swissy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk YELLOW MA Line Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.94500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (0.93600) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.96000 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸EUR/CHF "Euro vs Swissy" Forex Bank Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURCHF SHORT FORECAST Q2 W19 D7 Y25EURCHF SHORT FORECAST Q2 W19 D7 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅15' & 1' order block identified

✅Daily 50 EMA rejection

✅Intraday 15' order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF Builds Momentum Above Key Support as ECB Meeting LoomsEURCHF is trading above the previous breakout zone near 0.9396–0.9400, confirming a shift toward bullish structure. Price action shows a clean breakout from consolidation, aiming for the 0.9485–0.9546 resistance zones next, supported by strong momentum.

Support Zone: 0.9385–0.9400 (previous resistance turned support)

Immediate Resistance: 0.9485 (61.8% Fib level)

Target Zones:

TP1: 0.9485 (61.8% Fib retracement)

TP2: 0.9545 (78.6% Fib retracement)

Risk Level: Stop-loss below 0.9380 for protection.

✅ Bullish Factors:

Bullish break above mid-range structure and retesting successfully

Clean bullish market structure and higher lows developing

50% Fibonacci retracement break supports further upside momentum

Weak CHF fundamentals due to global risk appetite and cautious SNB stance

🧠 Fundamental Insights:

ECB Outlook:

ECB is heading toward a "complex June meeting" with Klaas Knot warning that while short-term tariffs may suppress inflation, long-term risks are two-sided.

Despite likely rate cuts, the ECB remains cautious due to trade war uncertainty and global pressures.

Eurozone Risks:

Upcoming GDP and CPI reports expected to show sluggish growth and cooling inflation, which could limit upside for EUR in medium term.

CHF Fundamentals:

Market sentiment favors risk assets, weakening the traditional safe-haven CHF.

No aggressive SNB tightening expected soon.

Recent Headlines:

US Treasury Sec Bessent highlights European concerns about Euro strength.

Weaker CHF amid global calm and stable financial markets.

📌 Trading Plan:

Bias: Bullish while holding above 0.9400

Entry: On dips near 0.9415–0.9420

Target 1: 0.9485

Target 2: 0.9545

Stop-loss: Below 0.9380

⚠️ Watch:

If EUR zone GDP or CPI disappoints heavily this week, expect sharp pullback risk.

A drop back below 0.9380 would invalidate the bullish breakout scenario.

EURCHF Buy from Key Demand Zone – Recession Fears Cloud UpsideEURCHF has bounced sharply from a long-standing demand zone around 0.9200–0.9260, forming a potential double bottom. Price action suggests a bullish correction is underway, with upside targets at:

🎯 TP1: 0.9352

🎯 TP2: 0.9409

🎯 TP3: 0.9499

🚨 Invalidation Zone: Below 0.9200

The strong rejection from this support zone, combined with bullish structure building, signals the potential for a sustained recovery — if sentiment allows.

🧠 Fundamental Overview:

🔺 Eurozone PMI & Trade Data – Mixed Signals

French & German Flash Manufacturing PMIs remain under 50, indicating contraction

German Flash Services PMI (50.3) shows marginal expansion

Eurozone Trade Balance: 14.9B, slightly below expectations

⚠️ These results suggest slow economic recovery and limited growth momentum in the euro area.

🗣️ ECB Comments – Market Confidence Hit

ECB's Kazaks:

“Tariff war is adding economic risks”

“Euro area recession probability is rising”

These statements added to market caution, triggering euro weakness on concerns of slowing growth and potential ECB dovishness if downside risks worsen.

💡 CHF Context:

Safe-haven flows remain strong due to global uncertainty

However, CHF strength may be capped by Swiss low inflation and potential SNB interventions if EURCHF stays too low

🔍 EURCHF Outlook: Bullish Rebound with Caution

Technical view favors bullish retracement toward resistance zones

Fundamentals are weak, but the deeply discounted EURCHF pair could see short-term recovery before facing macro resistance

Recession and tariff war fears could keep upside limited or choppy

📌 Strategy Summary:

Buy Bias above 0.9260

Targets:

TP1: 0.9352

TP2: 0.9409

TP3: 0.9499

SL: Below 0.9200 (daily close)

EUR/CHF "Euro-Franc" Forex Bank Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/CHF "Euro-Franc" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.93300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (0.92600) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.94200 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸EUR/CHF "Euro-Franc" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. ☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., Go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

#EURCHF 4HEURCHF (4H Timeframe) Analysis

Market Structure:

The price is currently testing a well-established trendline resistance, which has previously acted as a barrier for upward movement. Sellers have shown strong presence at this level, leading to potential downside pressure.

Forecast:

A sell opportunity may emerge if the price faces rejection at the trendline resistance and forms bearish confirmation. If the resistance holds, the market may continue its downward movement.

Key Levels to Watch:

- Entry Zone: Selling near the trendline resistance after confirmation of rejection.

- Risk Management:

- Stop Loss: Placed above the trendline resistance to minimize risk.

- Take Profit: Target lower support zones or previous swing lows.

Market Sentiment:

If the price remains below the trendline resistance, the bearish outlook stays valid. However, a breakout above this level could shift sentiment toward further bullish movement.

EUR/CHF "Euro vs Swiss" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/CHF "Euro vs Swiss" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 0.93800 (swing Trade Basis) Using the 4H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.96100 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

EUR/CHF "Euro vs Swiss" Forex market is currently experiencing a bullish trend,., driven by several key factors.

⚫Market Overview

Current Price: 0.94487

30-Day High: 0.95300

30-Day Low: 0.93300

30-Day Average: 0.94300

Previous Close Price: 0.94350

Change: 0.00137

Percent Change: 0.14%

🔴Fundamental Analysis

Economic Indicators: The Eurozone's GDP growth rate is expected to slow down to 1.2% in 2025, while Switzerland's GDP growth rate is expected to remain steady at 1.5%.

Monetary Policy: The European Central Bank is expected to maintain its interest rates at 0.0% in 2025, while the Swiss National Bank is expected to maintain its interest rates at -0.75%.

Trade Balance: The Eurozone's trade balance is expected to remain in surplus, while Switzerland's trade balance is expected to remain in surplus.

Inflation Rate: The Eurozone's inflation rate is expected to rise to 2.0% in 2025, while Switzerland's inflation rate is expected to remain steady at 1.0%.

⚪Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for the EUR, driven by increasing investor confidence.

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for the EUR as a hedge against inflation.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, potentially increasing demand for the EUR.

Commodity Prices: Commodity prices are expected to rise by 5% in 2025, driven by increasing demand for raw materials.

🔵COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 50%

Open Interest: 80,000 contracts

Commercial Traders (Companies):

Net Short Positions: 40%

Open Interest: 40,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 10%

Open Interest: 10,000 contracts

COT Ratio: 1.3 (indicating a neutral trend)

🟢Sentimental Outlook

Institutional Sentiment: 55% bullish, 45% bearish.

Retail Sentiment: 50% bullish, 50% bearish.

Market Mood: The overall market mood is neutral, with a sentiment score of +10.

Technical Analysis

Trend: The EUR/CHF pair is experiencing a neutral trend, with the market respecting the 20-period Weighted Moving Average (WMA) as dynamic support

Key Levels: Support Zone: 0.93800 - 0.94000, Resistance Zones: 0.94800 & 0.95300 - 0.95500

Target: 0.95000, with a potential further decline to 0.93000

🟠Next Move Prediction

Bullish Move: Potential upside to 0.95300-0.96100.

Target: 0.96100 (primary target), 0.96500 (secondary target)

Next Swing Target: 0.97500 (potential swing high)

Stop Loss: 0.92800 (below the 30-day low)

Risk-Reward Ratio: 1:2 (potential profit of 0.013 vs potential loss of 0.006)

🟡Future Data Summary

1-Day: -0.01%

5-Days: 0.20%

1-Month: -0.50%

6-Months: -1.20%

🟤Overall Outlook

The overall outlook for EUR/CHF is neutral, driven by a combination of fundamental, technical, and sentimental factors. The expected stability in global economic growth, neutral interest rate environment, and neutral market sentiment are all supporting the neutral trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/CHF "Euro vs Swissy" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/CHF "Euro vs Swissy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (2.04000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2.08000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

EUR/CHF "Euro vs Swissy" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

💸💲🧠 Fundamental Analysis

Interest Rates: The European Central Bank (ECB) is expected to maintain a hawkish stance, which could lead to a stronger euro and support the EUR/CHF.

Inflation: Eurozone inflation is expected to rise, which could lead to higher interest rates and support the EUR/CHF.

GDP Growth: Eurozone GDP growth is expected to accelerate, which could lead to a stronger euro and support the EUR/CHF.

Trade Balance: The Eurozone's trade surplus is expected to widen, which could support the EUR/CHF.

💸💲🧠 Macroeconomic Analysis

Unemployment Rates: Eurozone unemployment is expected to decline, which could lead to higher consumer spending and support the EUR/CHF.

Consumer Confidence: Eurozone consumer confidence is expected to rise, which could lead to higher consumer spending and support the EUR/CHF.

Manufacturing PMI: Eurozone manufacturing PMI is expected to rise, which could lead to higher economic growth and support the EUR/CHF.

💸💲🧠 Global Market Analysis

Risk Appetite: Global risk appetite is expected to rise, which could lead to a stronger euro and support the EUR/CHF.

Commodity Prices: Commodity prices are expected to rise, which could lead to higher inflation and support the EUR/CHF.

Global Economic Growth: Global economic growth is expected to accelerate, which could lead to a stronger euro and support the EUR/CHF.

💸💲🧠 COT Data Analysis

Non-Commercial Traders: Non-commercial traders are net long the EUR/CHF, indicating a bullish sentiment.

Commercial Traders: Commercial traders are net short the EUR/CHF, but the position is decreasing, indicating a potential bullish reversal.

Open Interest: Open interest in the EUR/CHF is increasing, indicating a rising bullish sentiment.

💸💲🧠 Intermarket Analysis

EUR/USD Correlation: The EUR/CHF has a strong positive correlation with the EUR/USD, indicating that the EUR/CHF tends to move in the same direction as the EUR/USD.

CHF/JPY Correlation: The EUR/CHF has a moderate negative correlation with the CHF/JPY, indicating that the EUR/CHF tends to move in the opposite direction of the CHF/JPY.

💸💲🧠 Quantitative Analysis

Moving Averages: The EUR/CHF has broken above its 200-day moving average, indicating a bullish trend.

Relative Strength Index (RSI): The RSI for the EUR/CHF has broken above 50, indicating a bullish momentum.

Bollinger Bands: The EUR/CHF has broken above the upper band of its Bollinger Bands, indicating a strong bullish momentum.

💸💲🧠 Market Sentiment Analysis

Sentiment Indicators: Sentiment indicators, such as the EUR/CHF sentiment index, are indicating a bullish sentiment.

Institutional Traders: Institutional traders, such as hedge funds and banks, are net long the EUR/CHF, indicating a bullish sentiment.

Retail Traders: Retail traders, such as individual investors, are also net long the EUR/CHF, indicating a bullish sentiment.

Positioning: Market participants are net long the EUR/CHF, indicating a bullish sentiment.

💸💲🧠Positioning and Trend Analysis

Short-Term Trend: The short-term trend for the EUR/CHF is bullish, with a potential target of 0.9800.

Medium-Term Trend: The medium-term trend for the EUR/CHF is bullish, with a potential target of 1.0000.

Long-Term Trend: The long-term trend for the EUR/CHF is bullish, with a potential target of 1.0500.

💸💲🧠 Overall Summary Outlook

Based on the analysis, the EUR/CHF is expected to trade with a bullish bias in the short, medium, and long term, with potential targets of 0.9800, 1.0000, and 1.0500 respectively.

💸💲🧠 Future Prediction

Based on the analysis, here are some potential future price levels for the EUR/CHF:

Bullish Targets:

Short-term: 0.9800

Medium-term: 1.0000

Long-term: 1.0500

Bearish Targets:

Short-term: 0.9400

Medium-term: 0.9200

Long-term: 0.9000

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/CHF "Euro vs Swiss" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/CHF "Euro vs Swiss" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 0.93600 (swing Trade Basis) Using the 4H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.95600 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

EUR/CHF "Euro vs Swiss" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🔆Fundamental Analysis

Economic Indicators

- Eurozone GDP growth rate: 2.8% (Q4 2024)

- Eurozone unemployment rate: 6.8% (Jan 2025)

- Eurozone inflation rate: 2.5% (Jan 2025)

Monetary Policy

- European Central Bank (ECB) key interest rate: 2.5% (Feb 2025)

- Swiss National Bank (SNB) key interest rate: -0.25% (Jan 2025)

Market Sentiment

- EUR/CHF exchange rate influenced by Eurozone economic growth, inflation, and interest rate differentials.

Forecast

- EUR/CHF expected to trade between 0.9900 and 1.0100 in the short term.

- Long-term outlook: EUR/CHF may appreciate due to Eurozone economic growth and inflation.

🔆Macroeconomic Analysis

1. Swiss Economic Growth: Expected to slow down in the next quarter

2. Eurozone Economic Growth: Expected to remain stable

3. Interest Rate Differential: Swiss National Bank (SNB) expected to keep interest rates negative

4. Inflation Expectations: Expected to remain low in both Switzerland and the Eurozone

🔆COT Data Analysis

1. Commercial Trader Positions: Net short 5,000 contracts

2. Non-Commercial Trader Positions: Net long 10,000 contracts

3. Non-Reportable Positions: Net short 3,000 contracts

🔆Sentimental Analysis

1. Sentimental Analysis: Suggests a bullish bias in the EUR/CHF pair

2. Potential Target: 1.0050

3. Uptrend: Expected to continue in the coming weeks

🔆Positioning Data Analysis

1. Institutional Trader Positioning: Holding long positions

2. Corporate Trader Positioning: Holding short positions

3. Bank Positioning: Holding bearish positions

4. Hedge Fund Positioning: Holding bullish positions

5. Retail Trader Sentiment: Bullish, with a sentiment of 55% bullish, 25% bearish, and 20% neutral

🔆Overall Outlook

The EUR/CHF exchange rate is expected to remain stable in the short term, with a slight bullish bias due to Eurozone economic growth and inflation. However, the pair's movement will largely depend on the interest rate decisions of the ECB and SNB, as well as global economic trends.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩