EURCHF – Waiting for the Signal, Not the MiracleWe are currently in a great area for a potential short, and the marked zone looks ideal for an entry—but only if a valid signal confirms it.

We’re not upset if the level gets broken.

We don’t say “this strategy doesn’t work.”

Why? Because we know the market is not under our control.

If price breaks above and gives a clean pullback, we’ll go long.

Simple. No ego. No bias.

Also, the lower level marked on the chart seems to be a great zone for either taking profit from shorts or initiating fresh longs.

🎯 We follow the market, not fight it.

Eurchfidea

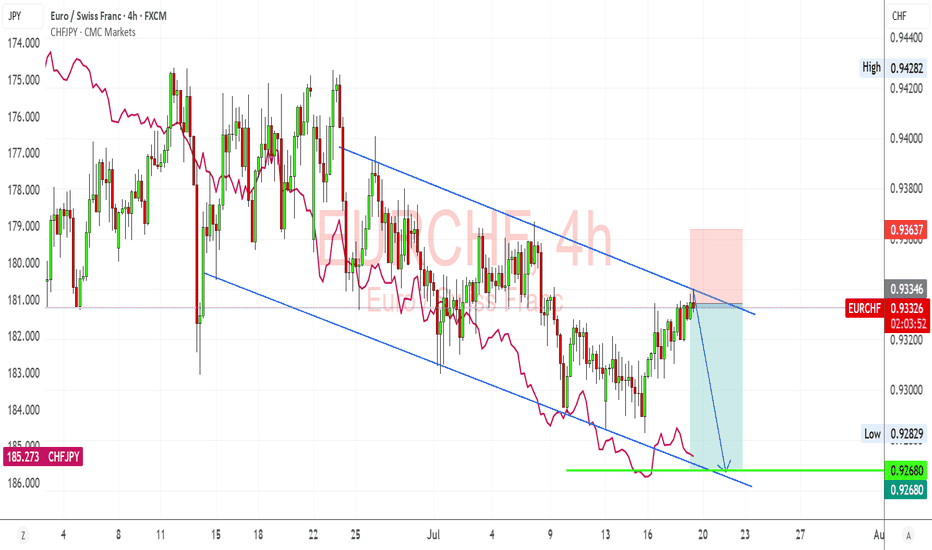

EURCHF – Bearish Channel Holds Firm, CHF Strength Set to ResumeEURCHF just tapped into the descending channel resistance again and is showing signs of rejecting. I'm expecting a bearish continuation here, especially given the strong CHF momentum recently, supported by safe-haven flows and Swiss inflation stability. If the pair fails to break above 0.9340, I’m watching for a downside push back toward 0.9270–0.9265, completing another leg within the structure.

🔍 Technical Setup (4H):

Channel Structure: EURCHF remains firmly within a downward-sloping parallel channel since mid-June.

Resistance Rejection: Price recently tested upper channel resistance (~0.9335–0.9340 zone), aligning with trendline rejection.

Target Support: 0.9270–0.9265 (channel base and key horizontal level).

Confluence: CHFJPY overlay (pink line) is rising again, suggesting renewed CHF strength—this usually weighs on EURCHF.

💡 Fundamental Insight:

EUR Side:

ECB officials remain cautious, but with recent EU data showing weaker growth (especially PMIs and sentiment), euro upside is capped.

The ECB is likely to pause further tightening, while other central banks like SNB remain firm on inflation risks.

CHF Strength:

The Swiss National Bank (SNB) still leans hawkish, with stable inflation giving room to hold rates steady or tighten if needed.

CHF benefits from risk-off flows amid global tariff headlines, China slowdown, and Middle East tensions.

Rising CHFJPY = clear CHF strength across the board.

⚠️ Risks:

If eurozone data surprises to the upside (e.g., inflation rebounds), EURCHF could break out of the channel.

A sudden drop in geopolitical tension or strong risk-on rally could weaken CHF as safe-haven demand falls.

SNB jawboning or FX intervention is always a wildcard.

🧭 Summary:

I’m bearish on EURCHF while it respects this well-defined descending channel. The technicals show consistent lower highs and lower lows, while the fundamentals continue to support CHF strength due to risk aversion, stable inflation, and a resilient SNB. My short bias is valid as long as price remains below 0.9340, with downside targets at 0.9270–0.9265. CHFJPY rising confirms franc leadership across FX markets, and EURCHF is likely a lagger following broader CHF strength.

EURCHF Analysis – “Euro Inches Higher, But Safe-Haven CHF LurksEURCHF is breaking out from a symmetrical triangle, indicating potential bullish momentum.

Key resistances to watch:

0.9445 – local swing high

0.9498 – potential measured target from the triangle breakout

Entry on retest of the triangle may offer a favorable risk-reward opportunity.

However, upside could be capped if CHF regains strength.

Structure Bias: Bullish breakout, confirmation needed with a clean retest and sustained move above 0.9440

📊 Current Bias: Cautiously Bullish

🧩 Key Fundamentals Driving EURCHF

EUR Side (Neutral to Slightly Bearish):

ECB remains cautious: June’s Economic Bulletin showed soft patches in core inflation and weak consumer activity.

German & French PMIs are mixed; services weaker than expected.

Political uncertainty (France snap elections) weighs on EUR sentiment in the medium term.

CHF Side (Fundamentally Stronger):

SNB is cautious but hawkish: Monetary policy assessment showed a steady hand, maintaining rates with no clear signal of easing.

Safe-haven flows persist due to:

Middle East risk (Israel–Iran escalation)

Russia–Ukraine tensions

Weak equity sentiment

CHF remains supported on global risk aversion, even with SNB standing pat.

⚠️ Risks That May Reverse or Accelerate Trend

Breakout fails to hold → Bearish fakeout leads to drop toward 0.9290 again

Renewed CHF strength from geopolitical shocks

Eurozone political turbulence (especially France & ECB doves)

🗓️ Important News to Watch

🇨🇭 Swiss CPI, SNB statements

🇪🇺 Eurozone PMI Flash (June 21), CPI (June 28), and political updates

Global market risk sentiment (VIX, bonds, oil, Iran/Israel news)

🏁 Which Asset Might Lead the Broader Move?

EURCHF is lagging behind EURUSD and USDCHF, but provides clean geopolitical risk signals. If markets stabilize, this pair has upside potential. However, if fear returns, CHF may quickly regain control, trapping long trades.

EUR/CHF Thief’s Jackpot: Swipe Profits with This Slick Strategy!Ultimate EUR/CHF Heist Plan: Snag Profits with the Thief Trading Strategy! 🚀💰

🌍 Greetings, Wealth Raiders! Ciao, Hello, Bonjour, Hola! 🌟

Fellow profit hunters, get ready to crack the EUR/CHF "Euro vs Swiss" Forex vault with our slick Thief Trading Strategy! 🤑💸 This plan blends razor-sharp technicals and fundamentals to loot the market. Follow the chart’s long-entry blueprint to strike at high-risk zones like the Red Zone Resistance It’s a wild ride—overbought conditions, consolidation, and potential trend reversals mean bears are lurking! 🐻 Stay sharp, grab your profits, and treat yourself—you’ve earned it! 🎉💪.

📈 Entry: Storm the Vault!

"The heist is on! Wait for the breakout (0.94000) then make your move - Bullish profits await!"

The market’s ripe for a bullish grab! 💥 Place buy limit orders within the most recent 15 or 30-minute swing low/high levels. Set alerts on your chart to stay locked in. 🔔

🛑 Stop Loss: Guard Your Loot!

Set your Thief SL at the nearest swing low on the 4H timeframe for day/swing trades. Adjust based on your risk tolerance, lot size, and number of orders. Safety first! 🔒

🎯 Targets: Claim Your Prize!

🏴☠️ Short-Term Target: 0.95300

👀 Scalpers, Listen Up!

Stick to long-side scalps. Got deep pockets? Jump in now! Otherwise, join swing traders for the heist. Use trailing stop-loss to lock in gains and protect your stash. 💰

🐂 Why EUR/CHF is Hot!

The Fiber’s bullish surge is fueled by key fundamentals. Dive into Macro, COT Reports, Quantitative Analysis, Sentiment, Intermarket trends, and future targets via the linkss below for the full scoop. 👉🔗. Stay informed to stay ahead! 📰

⚠️ Trading Alert: News & Position Management

News releases can shake the market like a heist gone wrong! 🗞️ To protect your profits:

🚫 Avoid new trades during news events.

🛡️ Use trailing stops to secure running positions.

💥 Boost the Heist!

Hit the Boost Button to supercharge our Thief Trading Strategy! 💪 Every click strengthens our crew, making it easier to swipe profits daily. Join the squad, trade smart, and let’s make money rain! 🌧️💵

EURCHF SHORT FORECAST Q2 W20 D12 Y25EURCHF SHORT FORECAST Q2 W20 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4 Hour order block rejection

✅4 Hour 50 EMA rejection

✅Intraday 15' order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EUR/CHF "Euro vs Swissy" Forex Bullish Heist (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/CHF "Euro vs Swissy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk YELLOW MA Line Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.94500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (0.93600) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.96000 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸EUR/CHF "Euro vs Swissy" Forex Bank Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURCHF Builds Momentum Above Key Support as ECB Meeting LoomsEURCHF is trading above the previous breakout zone near 0.9396–0.9400, confirming a shift toward bullish structure. Price action shows a clean breakout from consolidation, aiming for the 0.9485–0.9546 resistance zones next, supported by strong momentum.

Support Zone: 0.9385–0.9400 (previous resistance turned support)

Immediate Resistance: 0.9485 (61.8% Fib level)

Target Zones:

TP1: 0.9485 (61.8% Fib retracement)

TP2: 0.9545 (78.6% Fib retracement)

Risk Level: Stop-loss below 0.9380 for protection.

✅ Bullish Factors:

Bullish break above mid-range structure and retesting successfully

Clean bullish market structure and higher lows developing

50% Fibonacci retracement break supports further upside momentum

Weak CHF fundamentals due to global risk appetite and cautious SNB stance

🧠 Fundamental Insights:

ECB Outlook:

ECB is heading toward a "complex June meeting" with Klaas Knot warning that while short-term tariffs may suppress inflation, long-term risks are two-sided.

Despite likely rate cuts, the ECB remains cautious due to trade war uncertainty and global pressures.

Eurozone Risks:

Upcoming GDP and CPI reports expected to show sluggish growth and cooling inflation, which could limit upside for EUR in medium term.

CHF Fundamentals:

Market sentiment favors risk assets, weakening the traditional safe-haven CHF.

No aggressive SNB tightening expected soon.

Recent Headlines:

US Treasury Sec Bessent highlights European concerns about Euro strength.

Weaker CHF amid global calm and stable financial markets.

📌 Trading Plan:

Bias: Bullish while holding above 0.9400

Entry: On dips near 0.9415–0.9420

Target 1: 0.9485

Target 2: 0.9545

Stop-loss: Below 0.9380

⚠️ Watch:

If EUR zone GDP or CPI disappoints heavily this week, expect sharp pullback risk.

A drop back below 0.9380 would invalidate the bullish breakout scenario.

EURCHF Buy from Key Demand Zone – Recession Fears Cloud UpsideEURCHF has bounced sharply from a long-standing demand zone around 0.9200–0.9260, forming a potential double bottom. Price action suggests a bullish correction is underway, with upside targets at:

🎯 TP1: 0.9352

🎯 TP2: 0.9409

🎯 TP3: 0.9499

🚨 Invalidation Zone: Below 0.9200

The strong rejection from this support zone, combined with bullish structure building, signals the potential for a sustained recovery — if sentiment allows.

🧠 Fundamental Overview:

🔺 Eurozone PMI & Trade Data – Mixed Signals

French & German Flash Manufacturing PMIs remain under 50, indicating contraction

German Flash Services PMI (50.3) shows marginal expansion

Eurozone Trade Balance: 14.9B, slightly below expectations

⚠️ These results suggest slow economic recovery and limited growth momentum in the euro area.

🗣️ ECB Comments – Market Confidence Hit

ECB's Kazaks:

“Tariff war is adding economic risks”

“Euro area recession probability is rising”

These statements added to market caution, triggering euro weakness on concerns of slowing growth and potential ECB dovishness if downside risks worsen.

💡 CHF Context:

Safe-haven flows remain strong due to global uncertainty

However, CHF strength may be capped by Swiss low inflation and potential SNB interventions if EURCHF stays too low

🔍 EURCHF Outlook: Bullish Rebound with Caution

Technical view favors bullish retracement toward resistance zones

Fundamentals are weak, but the deeply discounted EURCHF pair could see short-term recovery before facing macro resistance

Recession and tariff war fears could keep upside limited or choppy

📌 Strategy Summary:

Buy Bias above 0.9260

Targets:

TP1: 0.9352

TP2: 0.9409

TP3: 0.9499

SL: Below 0.9200 (daily close)

EUR/CHF "Euro-Franc" Forex Bank Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/CHF "Euro-Franc" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.93300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (0.92600) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.94200 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸EUR/CHF "Euro-Franc" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. ☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., Go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

#EURCHF 4HEURCHF (4H Timeframe) Analysis

Market Structure:

The price is currently testing a well-established trendline resistance, which has previously acted as a barrier for upward movement. Sellers have shown strong presence at this level, leading to potential downside pressure.

Forecast:

A sell opportunity may emerge if the price faces rejection at the trendline resistance and forms bearish confirmation. If the resistance holds, the market may continue its downward movement.

Key Levels to Watch:

- Entry Zone: Selling near the trendline resistance after confirmation of rejection.

- Risk Management:

- Stop Loss: Placed above the trendline resistance to minimize risk.

- Take Profit: Target lower support zones or previous swing lows.

Market Sentiment:

If the price remains below the trendline resistance, the bearish outlook stays valid. However, a breakout above this level could shift sentiment toward further bullish movement.

EUR/CHF "Euro vs Swissy" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/CHF "Euro vs Swissy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (2.04000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2.08000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

EUR/CHF "Euro vs Swissy" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

💸💲🧠 Fundamental Analysis

Interest Rates: The European Central Bank (ECB) is expected to maintain a hawkish stance, which could lead to a stronger euro and support the EUR/CHF.

Inflation: Eurozone inflation is expected to rise, which could lead to higher interest rates and support the EUR/CHF.

GDP Growth: Eurozone GDP growth is expected to accelerate, which could lead to a stronger euro and support the EUR/CHF.

Trade Balance: The Eurozone's trade surplus is expected to widen, which could support the EUR/CHF.

💸💲🧠 Macroeconomic Analysis

Unemployment Rates: Eurozone unemployment is expected to decline, which could lead to higher consumer spending and support the EUR/CHF.

Consumer Confidence: Eurozone consumer confidence is expected to rise, which could lead to higher consumer spending and support the EUR/CHF.

Manufacturing PMI: Eurozone manufacturing PMI is expected to rise, which could lead to higher economic growth and support the EUR/CHF.

💸💲🧠 Global Market Analysis

Risk Appetite: Global risk appetite is expected to rise, which could lead to a stronger euro and support the EUR/CHF.

Commodity Prices: Commodity prices are expected to rise, which could lead to higher inflation and support the EUR/CHF.

Global Economic Growth: Global economic growth is expected to accelerate, which could lead to a stronger euro and support the EUR/CHF.

💸💲🧠 COT Data Analysis

Non-Commercial Traders: Non-commercial traders are net long the EUR/CHF, indicating a bullish sentiment.

Commercial Traders: Commercial traders are net short the EUR/CHF, but the position is decreasing, indicating a potential bullish reversal.

Open Interest: Open interest in the EUR/CHF is increasing, indicating a rising bullish sentiment.

💸💲🧠 Intermarket Analysis

EUR/USD Correlation: The EUR/CHF has a strong positive correlation with the EUR/USD, indicating that the EUR/CHF tends to move in the same direction as the EUR/USD.

CHF/JPY Correlation: The EUR/CHF has a moderate negative correlation with the CHF/JPY, indicating that the EUR/CHF tends to move in the opposite direction of the CHF/JPY.

💸💲🧠 Quantitative Analysis

Moving Averages: The EUR/CHF has broken above its 200-day moving average, indicating a bullish trend.

Relative Strength Index (RSI): The RSI for the EUR/CHF has broken above 50, indicating a bullish momentum.

Bollinger Bands: The EUR/CHF has broken above the upper band of its Bollinger Bands, indicating a strong bullish momentum.

💸💲🧠 Market Sentiment Analysis

Sentiment Indicators: Sentiment indicators, such as the EUR/CHF sentiment index, are indicating a bullish sentiment.

Institutional Traders: Institutional traders, such as hedge funds and banks, are net long the EUR/CHF, indicating a bullish sentiment.

Retail Traders: Retail traders, such as individual investors, are also net long the EUR/CHF, indicating a bullish sentiment.

Positioning: Market participants are net long the EUR/CHF, indicating a bullish sentiment.

💸💲🧠Positioning and Trend Analysis

Short-Term Trend: The short-term trend for the EUR/CHF is bullish, with a potential target of 0.9800.

Medium-Term Trend: The medium-term trend for the EUR/CHF is bullish, with a potential target of 1.0000.

Long-Term Trend: The long-term trend for the EUR/CHF is bullish, with a potential target of 1.0500.

💸💲🧠 Overall Summary Outlook

Based on the analysis, the EUR/CHF is expected to trade with a bullish bias in the short, medium, and long term, with potential targets of 0.9800, 1.0000, and 1.0500 respectively.

💸💲🧠 Future Prediction

Based on the analysis, here are some potential future price levels for the EUR/CHF:

Bullish Targets:

Short-term: 0.9800

Medium-term: 1.0000

Long-term: 1.0500

Bearish Targets:

Short-term: 0.9400

Medium-term: 0.9200

Long-term: 0.9000

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

#EURCHF 4HEURCHF (4H Timeframe) Analysis

Market Structure:

The price is forming a rising wedge pattern, which is a bearish reversal setup. This pattern indicates weakening bullish momentum as the price narrows toward the upper boundary. A breakout below the wedge support suggests the potential for a bearish move.

Forecast:

A sell opportunity is anticipated if the price breaks below the rising wedge support, signaling the start of a downtrend.

Key Levels to Watch:

- Entry Zone: After the price breaks below the wedge support and confirms the breakout with a retest.

- Risk Management:

- Stop Loss: Placed above the recent swing high or the upper boundary of the wedge.

- Take Profit: Target key support levels below or Fibonacci retracement levels for potential downside movement.

Market Sentiment:

The rising wedge pattern suggests bearish sentiment as buying momentum weakens. Waiting for a confirmed breakout and retest ensures a more strategic entry aligned with market direction.

#EURCHF 1DAYEURCHF (1D Timeframe) Analysis

Market Structure:

Trendline Resistance Breakout: The price has broken above a key descending trendline resistance, signaling a potential shift towards bullish momentum.

Forecast:

Buy Opportunity: The breakout suggests increased buying interest, with expectations for further upward movement if the price sustains above the broken trendline.

Key Levels to Watch:

Entry Zone: Consider buying after confirmation of the breakout or on a retest of the trendline as new support.

Risk Management:

Stop Loss: Placed below the broken trendline or recent swing low to minimize risk.

Take Profit Zones: Focus on the next resistance levels or Fibonacci extensions for potential targets.

Market Sentiment:

Bullish Bias: The breakout indicates a potential trend reversal, favoring buyers as long as the price remains above the trendline support.

EUR/CHF "Swiss Franc Cross" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the EUR/CHF "Swiss Franc Cross" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Goal 🎯: 0.94800

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

#EURCHF 1DAYEURCHF (1D Timeframe) Analysis

Market Structure:

-Trendline Resistance Breakout: The price has successfully broken above a key trendline resistance, signaling a potential shift in momentum to the upside.

Forecast:

-Buy Opportunity: The breakout suggests bullish momentum, and further upward movement is likely as long as the price stays above the broken resistance.

Key Levels to Watch:

-Entry Zone: After confirmation of the breakout or on a retest of the trendline as new support.

-Risk Management:

- Stop Loss: Placed below the broken trendline or recent swing low to manage risk.

-Take Profit Zones: Target the next resistance levels or Fibonacci projections for potential gains.

Market Sentiment:

Bullish Bias: The breakout above resistance highlights strengthening buying pressure, supporting further upside potential.

#EURCHF 2HEURCHF 2-Hour Analysis

The EURCHF pair has exhibited a bearish trend with a breakdown below the trendline support on the 2-hour chart. Additionally, the head and shoulders pattern reinforces the bearish outlook, indicating a potential continuation of downward momentum. This setup presents a strong sell opportunity.

Technical Outlook:

Pattern: Trendline Support Breakdown & Head and Shoulders

Forecast: Bearish (Sell Opportunity)

Entry Strategy: Enter a sell position after confirming the breakdown and observing bearish price action signals, such as a retest of the broken trendline or the neckline of the head and shoulders pattern.

Traders should watch for further confirmation with indicators like RSI indicating bearish divergence or MACD showing a bearish crossover. Implement effective risk management by setting stop-loss orders above the neckline or trendline and targeting key support zones below for potential take-profit levels.

#EURCHF 1DAYEURCHF Daily Analysis

The EURCHF pair is approaching a key support level on the daily chart, a zone where buying interest has consistently emerged. This support area offers a potential bullish setup, with the likelihood of a price rebound if the level holds.

Technical Outlook:

Pattern: Support

Forecast: Bullish (Buy Opportunity)

Entry Strategy: Look for confirmation of support holding with bullish price action signals before entering a buy position.

Traders should monitor for reversal candlestick patterns, such as bullish engulfing or hammer formations, and supportive indicators like RSI signaling oversold conditions. Employ proper risk management by placing stop-loss orders below the support level and targeting resistance zones for potential profit.

EUR/CHF "Euro-Swiss" Bank Money Heist Plan on Bullish Side.Hola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist EUR/CHF "Euro-Swiss" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 2H timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂