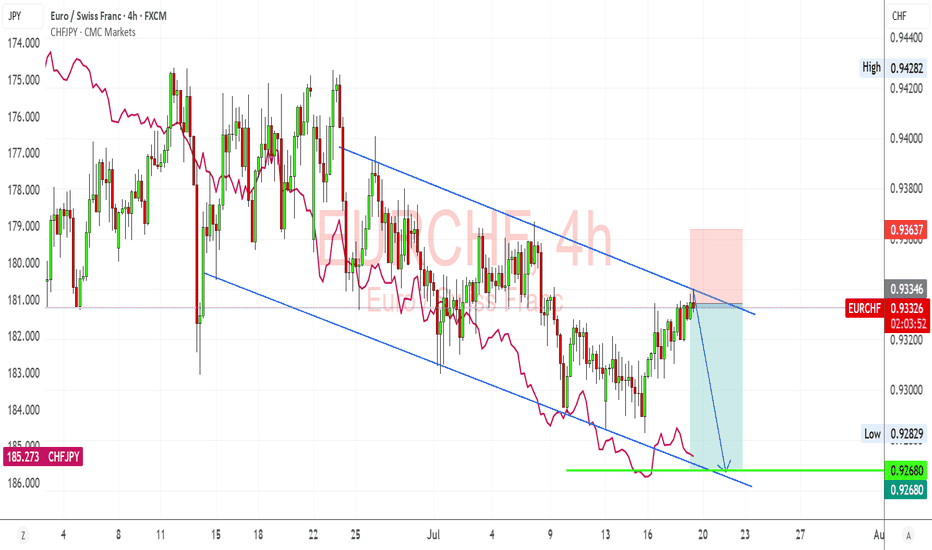

EURCHF – Bearish Channel Holds Firm, CHF Strength Set to ResumeEURCHF just tapped into the descending channel resistance again and is showing signs of rejecting. I'm expecting a bearish continuation here, especially given the strong CHF momentum recently, supported by safe-haven flows and Swiss inflation stability. If the pair fails to break above 0.9340, I’m watching for a downside push back toward 0.9270–0.9265, completing another leg within the structure.

🔍 Technical Setup (4H):

Channel Structure: EURCHF remains firmly within a downward-sloping parallel channel since mid-June.

Resistance Rejection: Price recently tested upper channel resistance (~0.9335–0.9340 zone), aligning with trendline rejection.

Target Support: 0.9270–0.9265 (channel base and key horizontal level).

Confluence: CHFJPY overlay (pink line) is rising again, suggesting renewed CHF strength—this usually weighs on EURCHF.

💡 Fundamental Insight:

EUR Side:

ECB officials remain cautious, but with recent EU data showing weaker growth (especially PMIs and sentiment), euro upside is capped.

The ECB is likely to pause further tightening, while other central banks like SNB remain firm on inflation risks.

CHF Strength:

The Swiss National Bank (SNB) still leans hawkish, with stable inflation giving room to hold rates steady or tighten if needed.

CHF benefits from risk-off flows amid global tariff headlines, China slowdown, and Middle East tensions.

Rising CHFJPY = clear CHF strength across the board.

⚠️ Risks:

If eurozone data surprises to the upside (e.g., inflation rebounds), EURCHF could break out of the channel.

A sudden drop in geopolitical tension or strong risk-on rally could weaken CHF as safe-haven demand falls.

SNB jawboning or FX intervention is always a wildcard.

🧭 Summary:

I’m bearish on EURCHF while it respects this well-defined descending channel. The technicals show consistent lower highs and lower lows, while the fundamentals continue to support CHF strength due to risk aversion, stable inflation, and a resilient SNB. My short bias is valid as long as price remains below 0.9340, with downside targets at 0.9270–0.9265. CHFJPY rising confirms franc leadership across FX markets, and EURCHF is likely a lagger following broader CHF strength.

Eurchfsell

EURCHF Analysis – “Euro Inches Higher, But Safe-Haven CHF LurksEURCHF is breaking out from a symmetrical triangle, indicating potential bullish momentum.

Key resistances to watch:

0.9445 – local swing high

0.9498 – potential measured target from the triangle breakout

Entry on retest of the triangle may offer a favorable risk-reward opportunity.

However, upside could be capped if CHF regains strength.

Structure Bias: Bullish breakout, confirmation needed with a clean retest and sustained move above 0.9440

📊 Current Bias: Cautiously Bullish

🧩 Key Fundamentals Driving EURCHF

EUR Side (Neutral to Slightly Bearish):

ECB remains cautious: June’s Economic Bulletin showed soft patches in core inflation and weak consumer activity.

German & French PMIs are mixed; services weaker than expected.

Political uncertainty (France snap elections) weighs on EUR sentiment in the medium term.

CHF Side (Fundamentally Stronger):

SNB is cautious but hawkish: Monetary policy assessment showed a steady hand, maintaining rates with no clear signal of easing.

Safe-haven flows persist due to:

Middle East risk (Israel–Iran escalation)

Russia–Ukraine tensions

Weak equity sentiment

CHF remains supported on global risk aversion, even with SNB standing pat.

⚠️ Risks That May Reverse or Accelerate Trend

Breakout fails to hold → Bearish fakeout leads to drop toward 0.9290 again

Renewed CHF strength from geopolitical shocks

Eurozone political turbulence (especially France & ECB doves)

🗓️ Important News to Watch

🇨🇭 Swiss CPI, SNB statements

🇪🇺 Eurozone PMI Flash (June 21), CPI (June 28), and political updates

Global market risk sentiment (VIX, bonds, oil, Iran/Israel news)

🏁 Which Asset Might Lead the Broader Move?

EURCHF is lagging behind EURUSD and USDCHF, but provides clean geopolitical risk signals. If markets stabilize, this pair has upside potential. However, if fear returns, CHF may quickly regain control, trapping long trades.

EURCHF SHORT FORECAST Q2 W25 D20 Y25EURCHF SHORT FORECAST Q2 W25 D20 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50EMA Rejection

✅15' Order block

✅1H Order Block

✅4H Highs

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

QUICK PLAY - EURCHF SHORT FORECAST Q2 W23 D3 Y25EURCHF SHORT FORECAST Q2 W23 D3 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4 hour order block

✅4 hour 50 EMA rejection

✅Intraday 15' order block to be identified

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF SHORT FORECAST Q2 W20 D16 Y25EURCHF SHORT FORECAST Q2 W20 D16 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4 Hour order block rejection

✅4 Hour 50 EMA rejection

✅Intraday 15' order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF SHORT FORECAST Q2 W20 D14 Y25EURCHF SHORT FORECAST Q2 W20 D14 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4 Hour order block rejection

✅4 Hour 50 EMA rejection

✅Intraday 15' order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF SHORT FORECAST Q2 W20 D12 Y25EURCHF SHORT FORECAST Q2 W20 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4 Hour order block rejection

✅4 Hour 50 EMA rejection

✅Intraday 15' order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF SHORT FORECAST Q2 W19 D7 Y25EURCHF SHORT FORECAST Q2 W19 D7 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅15' & 1' order block identified

✅Daily 50 EMA rejection

✅Intraday 15' order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF Builds Momentum Above Key Support as ECB Meeting LoomsEURCHF is trading above the previous breakout zone near 0.9396–0.9400, confirming a shift toward bullish structure. Price action shows a clean breakout from consolidation, aiming for the 0.9485–0.9546 resistance zones next, supported by strong momentum.

Support Zone: 0.9385–0.9400 (previous resistance turned support)

Immediate Resistance: 0.9485 (61.8% Fib level)

Target Zones:

TP1: 0.9485 (61.8% Fib retracement)

TP2: 0.9545 (78.6% Fib retracement)

Risk Level: Stop-loss below 0.9380 for protection.

✅ Bullish Factors:

Bullish break above mid-range structure and retesting successfully

Clean bullish market structure and higher lows developing

50% Fibonacci retracement break supports further upside momentum

Weak CHF fundamentals due to global risk appetite and cautious SNB stance

🧠 Fundamental Insights:

ECB Outlook:

ECB is heading toward a "complex June meeting" with Klaas Knot warning that while short-term tariffs may suppress inflation, long-term risks are two-sided.

Despite likely rate cuts, the ECB remains cautious due to trade war uncertainty and global pressures.

Eurozone Risks:

Upcoming GDP and CPI reports expected to show sluggish growth and cooling inflation, which could limit upside for EUR in medium term.

CHF Fundamentals:

Market sentiment favors risk assets, weakening the traditional safe-haven CHF.

No aggressive SNB tightening expected soon.

Recent Headlines:

US Treasury Sec Bessent highlights European concerns about Euro strength.

Weaker CHF amid global calm and stable financial markets.

📌 Trading Plan:

Bias: Bullish while holding above 0.9400

Entry: On dips near 0.9415–0.9420

Target 1: 0.9485

Target 2: 0.9545

Stop-loss: Below 0.9380

⚠️ Watch:

If EUR zone GDP or CPI disappoints heavily this week, expect sharp pullback risk.

A drop back below 0.9380 would invalidate the bullish breakout scenario.

EURCHF Buy from Key Demand Zone – Recession Fears Cloud UpsideEURCHF has bounced sharply from a long-standing demand zone around 0.9200–0.9260, forming a potential double bottom. Price action suggests a bullish correction is underway, with upside targets at:

🎯 TP1: 0.9352

🎯 TP2: 0.9409

🎯 TP3: 0.9499

🚨 Invalidation Zone: Below 0.9200

The strong rejection from this support zone, combined with bullish structure building, signals the potential for a sustained recovery — if sentiment allows.

🧠 Fundamental Overview:

🔺 Eurozone PMI & Trade Data – Mixed Signals

French & German Flash Manufacturing PMIs remain under 50, indicating contraction

German Flash Services PMI (50.3) shows marginal expansion

Eurozone Trade Balance: 14.9B, slightly below expectations

⚠️ These results suggest slow economic recovery and limited growth momentum in the euro area.

🗣️ ECB Comments – Market Confidence Hit

ECB's Kazaks:

“Tariff war is adding economic risks”

“Euro area recession probability is rising”

These statements added to market caution, triggering euro weakness on concerns of slowing growth and potential ECB dovishness if downside risks worsen.

💡 CHF Context:

Safe-haven flows remain strong due to global uncertainty

However, CHF strength may be capped by Swiss low inflation and potential SNB interventions if EURCHF stays too low

🔍 EURCHF Outlook: Bullish Rebound with Caution

Technical view favors bullish retracement toward resistance zones

Fundamentals are weak, but the deeply discounted EURCHF pair could see short-term recovery before facing macro resistance

Recession and tariff war fears could keep upside limited or choppy

📌 Strategy Summary:

Buy Bias above 0.9260

Targets:

TP1: 0.9352

TP2: 0.9409

TP3: 0.9499

SL: Below 0.9200 (daily close)

SHORT ON EUR/CHFEUR/CHF is currently at a major resistance level and his recently mitigated a FVG sitting in the same zone.

Price has been rising in what seems like forever on this pair, we finally have gotten our change of character (choc) to the downside with sweeps of liquidity and fvg's now balanced out.

I expect price to fall to the next demand level where plenty of liquidity sits.

I am selling EUR/CHF now looking to make over 200 pips to the downside.

EURCHF at Key Resistance Zone - Potential Drop to 0.95000OANDA:EURCHF has reached a significant resistance zone, marked by prior price rejections, suggesting strong selling interest. This area has previously acted as a key supply zone, increasing the likelihood of a bearish reversal if sellers regain control.

If the price confirms resistance within this zone through bearish price action (e.g., wicks or rejection candles), we could see a move toward 0.95000, which represents a logical target based on recent structure.

However, if the price breaks and holds above this resistance area, the bearish outlook may be invalidated, potentially opening the door for further upside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

0.92 In Focus: Imminent Reversal or New Lows Ahead?Are we about to see a double bottom reversal, or will price break down again?

Going back to my idea posted in December 2023 (see related post), we had a great buying opportunity on the dip below 0.94, followed by a strong rally towards parity, falling just 80 pips short.

That upward move ended in May, and since then, the price has broken down again, with last month taking out last year's low, hitting a new all-time low at 0.921. So, what’s next?

Will the price continue to break down, or are we seeing signs of a double bottom reversal on the weekly charts? Let’s break it down.

On the weekly charts, after hitting the new low last month, we saw a strong reaction with a nearly 360-pip rally before the price broke down again. Zooming into the daily charts (image below), it looks like we could see a move back down under 0.93 into the marked buy zone.

Looking more closely at the daily chart with the MACD indicator, there are signs of a double bottom pattern forming, along with bullish divergence, signaling a potential buying opportunity on dips below 0.93.

Supporting this further, divergence signals are also forming on the 4-hour charts (see image below), with the price slowly grinding down while the MACD moves higher. This is clear evidence that momentum is slowing as we approach a key higher-timeframe area of interest.

Given these signals, I expect one final breakdown under 0.93, followed by a strong rally. However, I won’t be blindly entering buy trades here.

Instead, I’ll wait for the final push down and look for BUY signals on my TRFX indicator from the 4-hour to daily timeframes, with the strongest signal likely appearing on the daily.

If this setup plays out, I fully expect a move back up to test parity, with my first target being last month’s high at 0.958, where we could encounter some resistance. The second target will be the 2024 high at 0.992.

For this setup to be invalidated, we would need to see a clear weekly break and close below 0.925.

Let me know your thoughts below! :)

7 Dimension Sell Setup for EURCHFCORE Analysis Method: Smart Money Concepts

😇 7 Dimension Analysis

Time Frame: H1

1️⃣ Swing Structure: Bearish with CHoCH

🟢 Structure Behavior: After a proper CHoCH, price reaches its extreme POI and previous high level, sweeping swing liquidity. Given the already bearish character, there is a high chance of further downside movement.

🟢 Internal Structure: Shows weakness with consolidation formation.

🟢 POI: Since liquidity is always swept at the extreme high, this is a high-probability sell area.

2️⃣ Pattern

🟢 CHART PATTERNS:

Reversal: Rounding Patterns, Double top.

🟢 CANDLE PATTERNS:

Momentum: BUY Side FOMO appeared, followed by strong bearish candles at this point.

3️⃣ Volume

🟢 Volume on Breakout: Indicates no significant volume on the bullish side; bears are more in control at this point.

🟢 Volume: Increases whenever bearish candles are observed.

4️⃣ Momentum RSI

🟢 Range Shift: From bullish to sideways, with a preceding divergence and a loud move indicating loss of momentum.

5️⃣ Volatility Bollinger Bands

🟢 Squeeze Breakout: With walking on the band, forming on the bearish side.

6️⃣ Strength: Bears are taking control.

7️⃣ Sentiment: Highly bearish.

✔️ Entry Time Frame: H1

✅ Entry TF Structure: Bearish, with liquidity sweep at extreme POI.

💡 Decision: Sell at opening.

🚀 Entry: 0.9749

✋ Stop Loss: 0.9762

🎯 Take Profit: 0.9604

😊 Risk to Reward Ratio: 11RR

🕛 Expected Duration: 5 days

SUMMARY

The analysis identifies a bearish swing structure on the H1 time frame, marked by a Change of Character (CHoCH) and a move towards an extreme Point of Interest (POI). The price has swept swing liquidity, and with an already bearish character, there's a high probability of continued downside. Internal structure shows weakness with consolidation, indicating bearish control.

Reversal chart patterns such as rounding patterns and double tops are noted, along with significant bearish candle patterns following initial BUY side FOMO. Volume analysis indicates increased bearish volume compared to bullish, suggesting bears are gaining control. Momentum indicators, including RSI, show a range shift from bullish to sideways with preceding divergence and loss of momentum.

Bollinger Bands indicate a bearish squeeze breakout, with strength favoring the bears. Sentiment is highly bearish, leading to a decision to sell at opening. Entry is planned at 0.9749 with a stop loss at 0.9762 and a take profit target at 0.9604, providing an 11:1 risk to reward ratio. The expected duration for this trade setup is 5 days, contingent on continued bearish momentum and price behavior as outlined.

EUR/CHF - Bearish Bat Harmonic Pattern Signals Bearish TrendThe EUR/CHF currency pair is currently exhibiting a Bearish Bat Harmonic Pattern (XABCD) on the 4-hour chart. Point D, identified as the Potential Reversal Zone (PRZ), aligns with a critical Key Resistance area and intersects with a significant 4-hour Trend Line. This confluence of factors strengthens our bearish bias and suggests a potential bullish trend reversal from Point D.

Bearish Bat Harmonic Pattern:

The Bearish Bat Harmonic Pattern is a reliable technical indicator that signals potential reversal points in the market. In this case, the pattern's completion at Point D indicates a high probability of a trend reversal from bearish to bullish. This is supported by the alignment of Point D with a Key Resistance area and a 4-hour Trend Line, providing additional validation for this setup.

Confluence Factors:

Key Resistance Area: Point D coincides with a significant resistance level that has historically impeded upward price movement.

4-hour Trend Line: The intersection of Point D with the 4-hour Trend Line further confirms the likelihood of a bearish-to-bullish reversal.

Trade Setup:

Entry Point: 0.98030

Stop Loss: 0.98400

Take Profit Levels

TP-1: 0.97655

TP-2: 0.97280

TP-3: 0.96900

Conclusion:

The confluence of the Bearish Bat Harmonic Pattern, Key Resistance area, and 4-hour Trend Line suggests a high probability of a bullish trend reversal from Point D. Traders should consider entering at 0.98030, with a stop loss at 0.98400, and aim for the specified take profit levels. This setup offers a strategic opportunity to capitalize on the anticipated market reversal.

#EURCHF: 400+ PIPS SELLING OPPORTUNITY Dear Traders,

EURCHF, we have witness a strong change of character in the price, now we expect price to do small correction and reject from our entry point, we also have added stop loss and our take profit areas to make it more clear to all of you. Please keep in mind that tomorrow is NFP and market will likely to remain extremely bullish.

We wish you a great weekend, and we expect all of your support to continued.

Good luck.

EUR/CHF Harmonic Pattern Analysis: Anticipating Bearish Reversal___________________ Technical Analysis of EUR/CHF __________________________

Harmonic Pattern Analysis:

EUR/CHF has recently formed an XABCD harmonic pattern, indicating a potential reversal in the current trend. This pattern has manifested itself alongside the key resistance area, suggesting a significant level where bearish pressure may intensify.

Entry Strategy:

Considering the formation of the harmonic pattern and the positioning of the price at the key resistance area, it is advisable to initiate a short position near 0.98010. This entry point aligns with the anticipated bearish move from point D of the harmonic pattern.

Risk Management:

To effectively manage risk, a stop-loss order should be placed near 0.98370. This level is strategically chosen to mitigate potential losses in case of adverse price movements beyond our anticipated entry point.

Profit Targets:

Profit-taking objectives are set as follows:

- TP-1: 0.97650

- TP-2: 0.97295

- TP-3: 0.96918

These profit targets are based on technical analysis and aim to capitalize on potential downward price movements in EUR/CHF.

Conclusion:

In conclusion, the technical analysis of EUR/CHF suggests a bearish outlook, with the formation of a harmonic pattern and price action near a key resistance area. By adhering to the outlined entry, risk management, and profit-taking strategies, traders can position themselves to potentially capitalize on the anticipated bearish move in the currency pair.