EURGBP Buyers In Panic! SELL!

My dear subscribers,

My technical analysis for EURGBP is below:

The price is coiling around a solid key level - 0.8417

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 0.8356

My Stop Loss - 0.8444

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

Eurgbp!

Market Analysis: EUR/GBP Gains StrengthMarket Analysis: EUR/GBP Gains Strength

EUR/GBP is gaining pace and might extend its upward move above the 0.8445 zone.

Important Takeaways for EUR/GBP Analysis Today

- EUR/GBP started a fresh increase above the 0.8360 resistance zone.

- There is a major bullish trend line forming with support at 0.8402 on the hourly chart at FXOpen.

EUR/GBP Technical Analysis

On the hourly chart of EUR/GBP at FXOpen, the pair started a fresh increase from the 0.8240 zone. The Euro traded above the 0.8360 level to move into a positive zone against the British Pound.

The EUR/GBP chart suggests that the pair settled above the 50-hour simple moving average and 0.8400. Immediate resistance is near 0.8445. The next major resistance for the bulls is near the 0.8460 zone.

A close above the 0.8460 level might accelerate gains. In the stated case, the bulls may perhaps aim for a test of 0.8500. Any more gains might send the pair toward the 0.8550 level in the coming days.

Immediate support sits near the 23.6% Fib retracement level of the upward move from the 0.8359 swing low to the 0.8447 high. The next major support is near a major bullish trend line at 0.8402.

The 61.8% Fib retracement level of the upward move from the 0.8359 swing low to the 0.8447 high is also at 0.8402. A downside break below the 0.8402 support might call for more downsides.

In the stated case, the pair could drop toward the 0.8360 support level. Any more losses might send the pair toward the 0.8265 level in the near term.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Bullish continuation?EUR/GBP is falling towards the pivot which has been identified as an overlap support and could bounce to the 1st resistance.

Pivot: 0.8403

1st Support: 0.8367

1st Resistance: 0.8442

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish reversal off overlap resistance?EUR/GBP is reacting off the resistance level which is an overlap resistance and could drop from this level to our take profit.

Entry: 0.8441

Why we like it:

There is an overlap resistance level.

Stop loss: 0.8473

Why we like it:

There is a pullback resistance level.

Take profit: 0.8403

Why we like it:

There is an overlap support level that aligns with the 23.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EUR-GBP Resistance Ahead! Sell!

Hello,Traders!

EUR-GBP keeps growing in

A strong uptrend but the pair

Is already overbought so after

It hits a horizontal support

Level of 0.8473 we will be

Expecting a local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Believe or Not follow the blue prediction for the futureEURGBP- It's really highest highs and now headed to the lowest lows. You can see the prediction in blue. Follow me and I will make you a millionaire. Trading is not for the weak and takes a lot patience.

The best way to make money in this industry is to first get a whole life insurance policy from me. Then once it is active drop some money in it. Called paid in advance. The the policy is function in paid in advance bringing the account to cash value. The account will then begin to be your infinite bank. Next 30 days later borrow against your own account and take these funds and place them into your trading account.

So the infinite account will be building 9-15% guaranteed interest each month despite you borrowing from it and the policy provide life insurance in case you get sick or disabled like me. Then trade your balance of $.01 per $100 dollars and copy and paste trades.

If you want to learn how to trade binary first before forex you should join Brandon Boyd and Dr. Josh's class.

EUR/GBP BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

EUR/GBP pair is in the uptrend because previous week’s candle is green, while the price is obviously rising on the 8H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 0.831 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURGBP H4 | Bearish Drop Based on the H4 chart analysis, we can see that the price is currently at our sell entry at 0.8427, a pullback resistance close to the 78.6% Fibonacci retracement.

Our take profit will be at 0.8386, a pullback support.

The stop loss will be placed at 0.8463, which is a multi-swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (fxcm.com/uk):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Stratos Global LLC (fxcm.com/markets):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

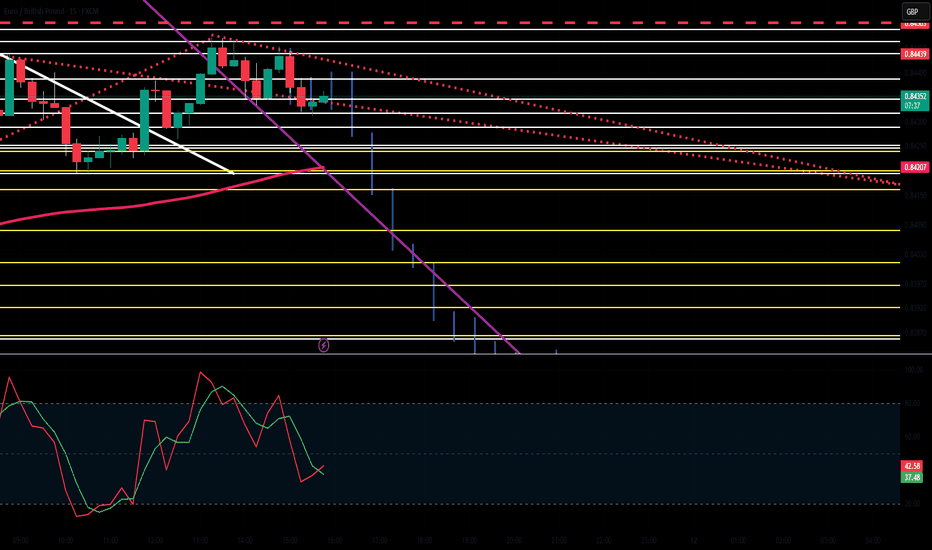

EURGBP 15 Min INTRADAY overbought sideways consolidationBullish Scenario:

The EURGBP pair maintains a bullish intraday sentiment, supported by the longer-term uptrend. The key level to watch is 0.8420, which acts as a critical resistance zone. If the price rallies above 0.8420, the uptrend could resume, targeting 0.8440, with further resistance levels at 0.8460 and 0.8500 over the longer timeframe.

Bearish Scenario:

A confirmed break below 0.8380, especially with a daily close beneath this level, would invalidate the bullish outlook. This could lead to further downside movement, with immediate support at 0.8360, followed by 0.8340 and 0.8327, signaling a deeper corrective pullback.

Conclusion:

The overall intraday trend remains bullish, with 0.8420 as the key pivot level. Holding above this support reinforces the upside potential, while a confirmed breakdown below it could shift momentum toward a deeper retracement. Traders should monitor price action around this critical level for confirmation of the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DeGRAM | EURGBP correction in the channelEURGBP is in an ascending channel between the trend lines.

The price has reached the dynamic resistance.

Indicators have formed a bearish divergence on the 4H Timeframe.

The chart has formed a harmonic pattern.

We expect a correction.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EUR/GBP Trade Analysis & Key LevelsEUR/GBP Trade Analysis & Key Levels

📈 **Current Price:** 0.83800

🔹 **Resistance:** 0.83900

🔹 **Support:** 0.83700

💡 **Market Outlook:**

- Strong **bullish momentum** observed, supported by the **EMA50** trend.

- If the price **breaks resistance**, the next target is **0.84600**.

- If the price **breaks support**, a bearish move may follow.

🎯 **Trade Plan:**

✅ **Entry:** Monitor for breakout confirmation.

✅ **Stop Loss:** 0.83600 (to manage risk effectively).

✅ **Risk Management:** Essential for capital protection.

📊 **Stay updated & trade wisely!** 🚀

EURGBP INTRADAY higher, German debt reforms and ECB rate policyBullish Scenario:

The EURGBP pair maintains a bullish intraday sentiment, supported by the longer-term uptrend. The key level to watch is 0.8400, which acts as a critical resistance zone. If the price rallies above 0.8400, the uptrend could resume, targeting 0.8420, with further resistance levels at 0.8430 and 0.8450 over the longer timeframe.

Bearish Scenario:

A confirmed break below 0.8360, especially with a daily close beneath this level, would invalidate the bullish outlook. This could lead to further downside movement, with immediate support at 0.8328, followed by 0.8310 and 0.8300, signaling a deeper corrective pullback.

Conclusion:

The overall intraday trend remains bullish, with 0.8400 as the key pivot level. Holding above this support reinforces the upside potential, while a confirmed breakdown below it could shift momentum toward a deeper retracement. Traders should monitor price action around this critical level for confirmation of the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURGBP at major support zone: Bullish Rebound ExpectedOANDA:EURGBP is approaching a significant support zone, highlighted by previous price reactions and strong buying interest. This area has historically acted as a key demand zone, increasing the likelihood of a bounce if buyers step in.

The current market structure suggests that if the price confirms support within this zone, we could see a bullish reversal. A successful rebound could push the pair toward the 0.83350 level, a logical target based on past price behavior and structural confluence.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

EURGBP: Bearish Continuation & Short Signal

EURGBP

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell EURGBP

Entry Level - 0.8346

Sl - 0.8364

Tp - 0.8306

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

DeGRAM | EURGBP retest of the support levelEURGBP is in an ascending channel between the trend lines.

The price is moving from the lower boundary of the channel as well as the support level, which coincides with the 88.6% retracement level.

The chart is forming an ascending structure.

On the 1H Timeframe, the indicators indicate a bullish convergence formation.

We expect growth in the channel after consolidation above the support.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EUR/GBP BUYERS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

The BB lower band is nearby so EUR-GBP is in the oversold territory. Thus, despite the downtrend on the 1W timeframe I think that we will see a bullish reaction from the support line below and a move up towards the target at around 0.836.

✅LIKE AND COMMENT MY IDEAS✅

EURGBP The Target Is DOWN! SELL!

My dear friends,

EURGBP looks like it will make a good move, and here are the details:

The market is trading on 0.8274 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 0.8263

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

———————————

WISH YOU ALL LUCK

Bearish drop off pullback resistance?EUR/GBP is reacting off the pivot which has been identified as a pullback resistance and could drop to the pullback support.

Pivot: 0.8265

1st Support: 0.8224

1st Resistance: 0.8292

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURGBP Bearish trend continuationThe EUR/GBP currency pair remains in a bearish trend, with price action aligning with the longer-term prevailing downtrend. However, short-term moves could see a corrective bounce before resuming the dominant trend.

Bearish Scenario:

The key level to watch is 0.8274, which serves as a crucial resistance zone.

A potential oversold rally toward 0.8274 may result in a bearish rejection, reinforcing the downside trend.

If selling pressure resumes from this level, the next targets are 0.8240, followed by 0.8225, with 0.8200 acting as a longer-term support.

Bullish Scenario:

A confirmed breakout above 0.8274 on a daily close would challenge the bearish outlook.

This could trigger further upside momentum, leading to a test of 0.8290, followed by 0.8305 if bullish momentum strengthens.

A sustained move above 0.8305 could signal a broader shift in trend dynamics.

Conclusion:

The overall sentiment remains bearish, but an oversold bounce toward 0.8274 could provide a fresh shorting opportunity if rejection occurs. However, a break above 0.8274 and a daily close beyond this level would open the door for further upside. Traders should watch price action around this key resistance zone to confirm the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.