EUR/GBP Analysis – Symmetrical Triangle Breakdown & Bearish MoveThis EUR/GBP chart on the 1-hour timeframe showcases a well-defined symmetrical triangle formation, a widely recognized pattern in technical analysis that signals potential breakout opportunities. The price action has respected the converging trendlines, indicating consolidation before a decisive move. Recently, the market has broken below the support zone, confirming a bearish breakdown and providing a strong signal for potential downside movement.

This analysis will cover pattern formation, key technical levels, trading strategy, risk management, and future market outlook to provide a comprehensive professional breakdown of this setup.

1. Chart Pattern Analysis – Symmetrical Triangle Formation

A symmetrical triangle consists of two converging trendlines that squeeze price action into a narrowing range, reflecting market indecision. This pattern is considered a continuation pattern, meaning that the price is likely to continue in the direction of the prevailing trend after the breakout.

Pattern Characteristics in This Chart:

✅ Lower Highs: Price fails to break previous peaks, indicating weakening bullish momentum.

✅ Higher Lows: Buyers step in at higher points, preventing aggressive declines.

✅ Volume Decrease: Typical of consolidation within a symmetrical triangle.

✅ Breakout Confirmation: A strong bearish candle broke below the support level, signaling further downside potential.

2. Key Technical Levels & Zones

📌 Resistance Level + All-Time High (ATH) – 0.8421

This level represents the highest point in the pattern, where price faced repeated rejections.

It aligns with a historical resistance zone, indicating a strong supply area.

A breakout above this level would shift the market to a bullish bias.

📌 Support Level – 0.8379 (Now Acting as Resistance)

Previously a key demand zone where buyers defended the price.

Price has now broken below this level, confirming it as new resistance in a bearish scenario.

A successful retest followed by rejection increases downside confirmation.

📌 Stop-Loss Placement – 0.8421

Located above the upper trendline and recent highs to avoid false breakouts.

If price regains this level, the bearish scenario will be invalidated.

📌 Target Zone – 0.82926 (Major Support Area)

This is the next strong support level, acting as a potential take-profit zone for short positions.

It aligns with a previous price reaction area, making it a logical target for sellers.

3. Trading Setup & Strategy – Bearish Trade Plan

The breakdown from the symmetrical triangle structure presents an opportunity to short the pair with a defined risk-to-reward setup.

📌 Entry Strategy:

Enter short positions after price breaks and retests the 0.8379 support level as resistance.

Confirmation should come from bearish candlestick patterns like engulfing candles or pin bars.

📌 Stop Loss:

Placed above 0.8421, above the last swing high, to protect against potential false breakouts.

📌 Take Profit (TP) Target:

First TP: 0.8325 (Intermediate support)

Final TP: 0.82926 (Major support and key structure level)

Alternative Scenario – Bullish Reversal Possibility

If price reclaims 0.8379 and closes above it consistently, the bearish breakdown might be a false move.

A move above 0.8421 would invalidate the bearish setup, leading to potential bullish momentum.

4. Risk Management & Trade Confirmation

✅ Volume Analysis

A significant increase in volume on the breakdown strengthens the bearish outlook.

Low volume retests may indicate a weak reversal attempt, favoring continuation downward.

✅ Bearish Price Action Confirmation

Lower highs and consistent lower lows reinforce a bearish sentiment.

Rejections from the broken support (now resistance) validate the trade setup.

✅ Risk-to-Reward Ratio (RRR)

The Stop-Loss (SL) is tight, and the profit target is significantly larger, making this a high RRR trade.

Ideally, a RRR of at least 2:1 or 3:1 should be maintained for proper risk control.

5. Market Sentiment & Future Outlook

Bearish Bias Strengths:

Trendline break indicates strong downside pressure.

Failed attempts to break resistance suggest weakening bulls.

Global macroeconomic factors and fundamental catalysts may favor GBP strength over EUR in the near term.

Reversal Risks:

A strong bullish breakout above 0.8421 would shift momentum to the upside.

Fundamental news events (e.g., ECB or BoE statements) can impact market direction unexpectedly.

6. Summary & Conclusion

🔹 The EUR/GBP 1-hour chart has broken below a symmetrical triangle pattern, confirming a bearish breakout.

🔹 Key levels to watch: Resistance at 0.8421, support at 0.82926.

🔹 Trading strategy favors short positions, with a target at 0.82926 and a stop loss at 0.8421.

🔹 Confirmation comes from trendline breaks, volume analysis, and lower highs/lows structure.

📌 Final Verdict:

The setup is bearish unless price reclaims 0.8379 and invalidates the structure.

Traders should monitor price action, volume, and news events for further confirmations.

🔥 Potential Profit Target: 80-90 Pips 📉

⚠️ Risk Management is Crucial – Always Use Stop Loss & Proper Position Sizing

EURGBP

EURGBP: Rectangle Top rejection. Sell opportunity.EURGBP is neutral on its 1D technical outlook (RSI = 52.272, MACD = 0.002, ADX = 25.202), going from an almost overbought RSI to neutral as it got rejected on the R1 Zone. That is the top of the 6 month Rectangle pattern, where the last rejection pulled the price all the way down to the S1 Zone. This time the presence of both the LH and HL trendlines makes us consider a slightly tighter trading range. The trade is short, TP = 0.82600.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

EUR/GBP Technical Analysis – Triangle Breakdown & Bearish MoveChart Overview

This EUR/GBP 1-hour chart highlights a symmetrical triangle pattern that has recently broken to the downside, signaling a potential bearish move. The chart includes key technical levels such as resistance, support, trendlines, and a projected price target. Let’s analyze each component in detail.

1. Formation of a Symmetrical Triangle

A symmetrical triangle is a continuation pattern, meaning it typically precedes a breakout in the direction of the prevailing trend. In this case:

The pair initially rallied sharply, forming a strong uptrend.

A consolidation phase followed, where price started forming lower highs and higher lows, creating a contracting triangle.

The triangle’s resistance and support levels were tested multiple times, confirming their significance.

Key takeaway: The more times price tests support and resistance without breaking through, the stronger the eventual breakout.

2. Breakdown from the Triangle – Bearish Signal

The price broke below the support level, triggering a breakdown from the symmetrical triangle.

This breakdown was accompanied by a strong bearish candlestick, indicating a decisive move to the downside.

The previous support is now acting as resistance, meaning any pullback to this zone could provide a shorting opportunity.

Why is this important?

A breakdown from a triangle often results in a sharp directional move, especially if it aligns with the broader market trend.

3. Trendline Analysis – Uptrend Reversal

The rising trendline that supported the price action has been broken, further confirming trend exhaustion and a shift to bearish momentum.

Before the breakdown, the price had been respecting the trendline as support.

After the breakdown, the trendline is invalidated, reinforcing the bearish outlook.

Technical Insight:

Trendlines act as dynamic support/resistance, and once broken, they often lead to strong directional movements.

4. Key Support & Resistance Levels

Resistance Level (Former Support Zone):

This level was previously a strong demand zone where buyers stepped in.

Now that price has fallen below it, this area could act as a resistance if price retests it.

Traders should watch for bearish rejections or reversal patterns (such as shooting stars or bearish engulfing candlesticks) before entering short positions.

Support Level & Bearish Target (0.829):

The chart highlights 0.829 as the next significant support area.

This level aligns with historical price action and provides a logical take-profit zone for short traders.

5. Expected Price Action – Bearish Continuation Scenario

Given the breakdown from the triangle, the expected movement is as follows:

A short-term pullback to the broken support (now resistance).

Rejection from this zone, leading to further downside momentum.

Price reaching the projected target near 0.829, where traders may look to take profits or reassess market conditions.

6. Trading Strategy & Risk Management

✅ Bearish Trade Setup

Entry: On a pullback to the broken support level (preferably with bearish confirmation signals).

Stop-Loss: Above the previous resistance level to avoid false breakouts.

Take-Profit: Around the 0.829 target or lower if momentum continues.

⚠ Risk Considerations

If price closes back above the broken support, it may indicate a false breakout, invalidating the bearish trade setup.

Fundamental news events (such as central bank decisions or economic data) could impact price movement unexpectedly.

Conclusion – Bearish Outlook with Defined Target

This chart presents a textbook triangle breakdown, reinforcing the bearish bias for EUR/GBP. The structure suggests that price will continue lower toward the 0.829 target, unless invalidated by a strong reversal. Traders should watch for pullbacks and rejection signals before entering short positions.

Key Levels to Watch:

✅ Resistance: 0.835 - 0.837 (Former Support Zone, Now Resistance)

✅ Target: 0.829 (Projected Price Target)

📉 Bias: Bearish

Final Thought

This setup provides a high-probability trade idea for traders looking to capitalize on momentum. As always, implementing proper risk management is crucial to navigate market uncertainties. 🚀

EURGBP: Bullish Continuation is Highly Probable! Here is Why:

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy EURGBP.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURGBP INTRADAY Bearish continuation The EUR/GBP pair continues to exhibit bearish sentiment, reinforced by the prevailing downtrend. The key intraday resistance level is at 0.8420, marking the current swing high.

Bearish Scenario:

An oversold rally from current levels, followed by a bearish rejection at 0.8420, would likely target downside support at 0.8353. A break below this level would open the door for further declines toward 0.8335 and 0.8300 in the longer timeframe.

Bullish Scenario:

Alternatively, a confirmed breakout above the 0.8420 resistance, accompanied by a daily close above this level, would invalidate the bearish outlook. This would pave the way for further rallies, with the next resistance levels at 0.8450 and 0.8490.

Conclusion:

The prevailing sentiment remains bearish as long as 0.8420 holds as resistance. Traders should watch for rejection at this level to confirm downside momentum. Conversely, a decisive breakout above 0.8420 would signal a potential shift to a bullish bias, targeting higher resistance levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EUR/GBP BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

We are targeting the 0.841 level area with our long trade on EUR/GBP which is based on the fact that the pair is oversold on the BB band scale and is also approaching a support line below thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Bearish reversal?EUR/GBP is rising towards the pivot and could reveres to the 1st support.

Pivot: 0.8401

1st Support: 0.8356

1st Resistance: 0.8444

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR-GBP Will Grow! Buy!

Hello,Traders!

EUR-GBP is going down

To retest the horizontal

Support of 0.8369 one

More time and as it is

A strong support level

We will be expecting a

Local bullish rebound

And a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP Bearish Continuation Setup Potential Drop to Key Support📌 Overview:

The EUR/GBP pair is showing signs of bearish continuation after failing to break above key resistance levels. Price action indicates a potential downward move towards a major support zone, aligning with the overall market structure.

🔎 Technical Analysis:

The pair has formed a lower high, indicating weakness in bullish momentum.

A breakdown from the recent consolidation zone suggests sellers are in control.

Price has breached a key support level, turning it into a resistance zone.

The market structure indicates a potential drop towards 0.82773, which aligns with a previous support area.

📊 Key Price Levels:

✔ Resistance: 0.84000 - 0.84200 (previous support turned resistance)

✔ Current Price: 0.83876

✔ Target: 0.82773 (major support and liquidity zone)

✔ Stop Loss: Above 0.84000, invalidating the bearish setup

📉 Trade Plan & Execution:

🔹 Entry Strategy:

Traders can look for a retest of broken support (now resistance) near 0.84000 to confirm selling pressure.

A bearish rejection candle (such as a shooting star, bearish engulfing, or pin bar) could confirm the continuation of the downward trend.

🔹 Profit Target:

The primary target is 0.82773, which acts as a strong demand zone from previous price action.

🔹 Risk Management:

A stop loss should be placed above 0.84000, as a break above this level would invalidate the bearish setup.

Maintaining a favorable risk-to-reward ratio (1:2 or better) is advisable for optimal trade execution.

📢 Market Outlook & Considerations:

✅ Bearish Confirmation: Sustained rejection from resistance and lower highs strengthen the bearish outlook towards 0.82773.

🚨 Bullish Reversal Risk: A break above 0.84000 could invalidate the setup, signaling a potential return to bullish momentum.

📊 Fundamental Factors: Keep an eye on GBP and EUR-related economic data, central bank policies, and risk sentiment, which could impact price movements.

EUR/GBP Bearish Trading Setup | Resistance Rejection & BreakdownMarket Context & Overview

The EUR/GBP currency pair is currently showing signs of bearish momentum, as illustrated in this 1-hour trading chart. The price is facing a strong resistance zone while forming a descending trendline, indicating that sellers are gaining control over the market. Given this technical setup, traders can anticipate a potential breakdown leading to further downside movement.

This analysis highlights key price levels, technical indicators, and potential trade opportunities based on current price action. The bearish outlook is supported by the market structure, which is displaying signs of a potential trend reversal from the resistance zone.

🔹 Key Technical Levels

1️⃣ Resistance Zone (0.84200 - 0.84300)

This area has acted as a strong selling zone in previous price action.

Multiple rejection points indicate that buyers are struggling to push beyond this level.

This resistance aligns with the descending trendline, further strengthening the bearish bias.

2️⃣ Support Level (0.84000)

The current support level has provided temporary demand, preventing immediate downside movement.

If the price breaks below this support, it will confirm a bearish continuation.

3️⃣ Major Resistance Zone (0.84495)

This is the all-time high resistance zone in the short-term structure.

A break above this level would invalidate the bearish setup and could lead to bullish momentum.

4️⃣ Target Level (0.83735)

If the price successfully breaks below 0.84000, the next target would be 0.83735.

This level aligns with previous swing lows, making it a realistic downside target for short positions.

5️⃣ Stop Loss Placement (Above 0.84201)

A stop-loss above 0.84201 ensures protection against false breakouts.

If price breaks above this level, it could signal a shift in market structure.

🔹 Technical Insights & Market Sentiment

1️⃣ Descending Trendline: The price is respecting a descending trendline, indicating a bearish bias.

2️⃣ Multiple Resistance Rejections: Price has tested the resistance zone multiple times without breaking through.

3️⃣ Bearish Price Action: The recent candles show lower highs, reinforcing the downtrend.

4️⃣ Volume Analysis: A drop in buying pressure at resistance signals potential weakness among buyers.

5️⃣ Fundamental Factors : GBP strength due to macroeconomic factors could add further pressure on EUR/GBP.

🔹 Trade Plan & Strategy

📌 Entry Criteria

Ideal entry near 0.84150 - 0.84200 if price shows rejection at resistance.

Alternatively, enter after a confirmed breakdown below 0.84000 for safer confirmation.

🎯 Profit Target

First target: 0.83735

If bearish momentum continues, price could extend towards 0.83600 as an extended target.

🛑 Stop Loss Placement

Above 0.84201 to minimize risk.

This ensures the trade remains valid while avoiding market noise.

🔹 Risk-Reward Ratio & Trade Management

✅ Risk-Reward Ratio (RRR): Approximately 2:1, making this a favorable setup.

✅ Trade Management:

If price starts reversing before hitting the target, consider trailing stop-loss to secure profits.

If price consolidates around support, watch for breakout confirmations before entering.

🔹 Final Thoughts & Market Sentiment

This trading setup suggests a strong bearish opportunity based on price action, resistance rejection, and trendline confluence. The break below 0.84000 will be the key trigger for further downside movement. If price remains below resistance, a sell position with a stop-loss above 0.84201 and a target of 0.83735 offers a high-probability trade setup.

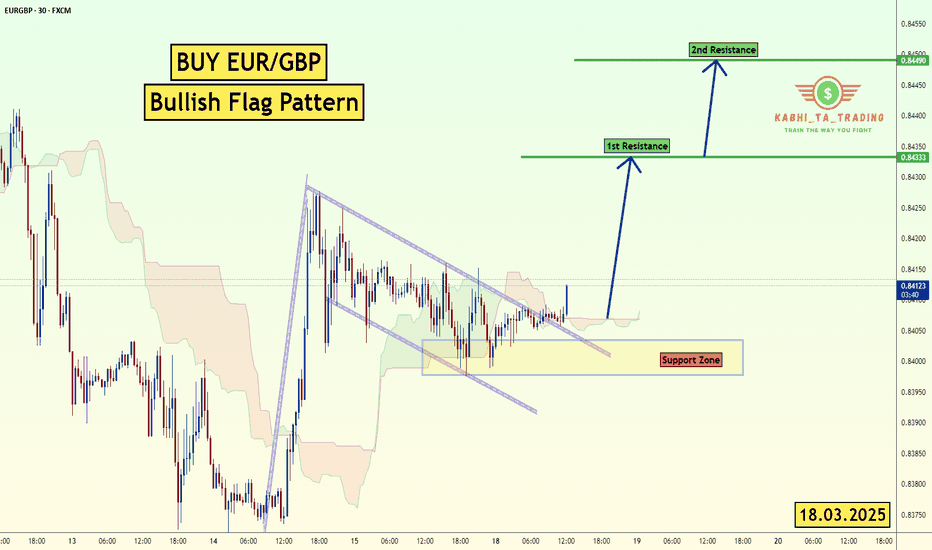

EUR/GBP Bullish Flag (18.3.25)The EUR/GBP pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Bullish Flag Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 0.8433

2nd Resistance – 0.8448

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

EURGBP INTRADAY OutlookBullish Scenario:

The EURGBP pair maintains a bullish intraday sentiment, supported by the longer-term uptrend. The key level to watch is 0.8420, which acts as a critical resistance zone. If the price rallies above 0.8420, the uptrend could resume, targeting 0.8440, with further resistance levels at 0.8460 and 0.8500 over the longer timeframe.

Bearish Scenario:

A confirmed break below 0.8380, especially with a daily close beneath this level, would invalidate the bullish outlook. This could lead to further downside movement, with immediate support at 0.8360, followed by 0.8340 and 0.8327, signaling a deeper corrective pullback.

Conclusion:

The overall intraday trend remains bullish, with 0.8420 as the key pivot level. Holding above this support reinforces the upside potential, while a confirmed breakdown below it could shift momentum toward a deeper retracement. Traders should monitor price action around this critical level for confirmation of the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURGBP nearing resistance – Drop toward 0.8370 next?OANDA:EURGBP is getting close to a key resistance level that has previously acted as a strong barrier, triggering bearish momentum in the past -

This zone is once again a potential point of interest for those looking for short opportunities. Given this, how price reacts here could set the tone for the next move.

If signs of rejection appear: such as long upper wicks, bearish candlestick formations, or a slowdown in bullish momentum, a move toward the 0.83700 is highly possible . However, a decisive breakout above this resistance may invalidate the bearish bias and lead to further upside. Price action at this level will be critical in determining the next move.

Just my perspective on key levels, always confirm setups and maintain solid risk management.

EUR/GBP "The Chunnel" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/GBP "The Chunnel"Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.83400) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (0.83000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 0.84200 (or) Escape Before the Target

Secondary Target - 0.85000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

EUR/GBP "The Chunnel" Forex Market market is currently experiencing a neutral trend,., driven by several key factors.

🔱Fundamental Analysis

Interest Rates: The European Central Bank (ECB) has maintained its interest rates at 3.50%, while the Bank of England (BoE) has kept its rates at 4.50%. The interest rate differential is slightly in favor of the GBP.

Inflation: Eurozone inflation is at 5.3% (Jan 2025), while UK inflation is at 3.2% (Jan 2025). The higher inflation in the Eurozone might lead to a rate hike by the ECB.

GDP Growth: Eurozone GDP growth is expected to be around 1.2% in 2025, while the UK's GDP growth is expected to be around 1.5% in 2025.

Trade Balance: The Eurozone has a trade surplus, while the UK has a trade deficit.

🔱Macroeconomic Factors

Unemployment Rates: Eurozone unemployment is at 6.4% (Jan 2025), while UK unemployment is at 3.7% (Jan 2025).

Manufacturing PMI: Eurozone Manufacturing PMI is at 48.5 (Feb 2025), while UK Manufacturing PMI is at 49.3 (Feb 2025).

Services PMI: Eurozone Services PMI is at 52.3 (Feb 2025), while UK Services PMI is at 50.2 (Feb 2025).

🔱Global Market Analysis

Risk Appetite: Global risk appetite is moderate, with investors seeking safe-haven assets amid concerns over inflation and economic growth.

Commodity Prices: Oil prices are stable, while gold prices are rising due to safe-haven demand.

🔱COT Data

Non-Commercial Traders (Large Speculators)

Net Positions: EUR/GBP net positions are slightly bearish, with 55% of traders holding short positions.

Long Positions: Long positions are moderate, with 45% of traders holding long positions.

Short Positions: Short positions are slightly higher, with 55% of traders holding short positions.

Commercial Traders (Hedgers)

Net Positions: EUR/GBP net positions are slightly bullish, with 52% of traders holding long positions.

Long Positions: Long positions are moderate, with 52% of traders holding long positions.

Short Positions: Short positions are slightly lower, with 48% of traders holding short positions.

🔱Intermarket Analysis

Correlation: EUR/GBP is negatively correlated with EUR/USD and positively correlated with GBP/JPY.

Cross-Rates: EUR/JPY and GBP/JPY are trading in a range, indicating a balanced market.

🔱Quantitative Analysis

Trend Analysis: The EUR/GBP is trading in a downtrend, with a bearish bias.

Momentum Indicators: RSI (14) is at 40, indicating a neutral market. MACD (12, 26) is bearish, with a signal line crossover.

🔱Market Sentimental Analysis

Trader Sentiment: Trader sentiment is slightly bearish, with 55% of traders expecting a price decline.

Market Positioning: Market positioning is neutral, with a balanced ratio of long to short positions.

🔱Positioning

Long Positions: Long positions are moderate, with traders holding 45% of long positions.

Short Positions: Short positions are slightly higher, with traders holding 55% of short positions.

🔱Overall Summary Outlook

The EUR/GBP is expected to trade lower, driven by a stronger GBP and a weaker EUR. The bearish bias is supported by fundamental, technical, and sentimental analysis. However, traders should be cautious of potential reversals and use proper risk management techniques.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/GBP "The Chunnel" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/NZD "Euro vs Kiwi" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : The heist is on! Wait for the breakout of (0.82650) then make your move - Bearish profits await!"

however I advise placing Sell stop below the support line or Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in swing/retest.

I highly recommend to use alert in your trading platform.

Stop Loss 🛑: Thief SL placed at 1.83000 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.81950 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

The EUR/GBP "The Chunnel" Forex Market is currently experiencing a Bearish trend., driven by several key factors.

⚖️Fundamental Analysis

- The European Central Bank's (ECB) monetary policy decisions significantly impact the EUR/GBP exchange rate. The ECB's interest rate decisions influence the euro's value relative to the pound.

- The UK's economic performance, including GDP growth, inflation, and employment rates, also affects the exchange rate.

- Political developments, such as Brexit negotiations and EU-UK trade agreements, can create market volatility and impact the EUR/GBP exchange rate.

⚖️Macro Economics

- Inflation Rates: The ECB's inflation target is below, but close to, 2%. The UK's inflation rate has been above the Bank of England's 2% target. These differences can influence the exchange rate.

- Interest Rates: The ECB's interest rates are currently lower than the Bank of England's rates. This difference can impact the exchange rate.

- GDP Growth: The EU's GDP growth has been slower than the UK's in recent years. This difference can influence the exchange rate.

⚖️COT Data

- Commitment of Traders (COT): The COT report shows that large speculators, such as hedge funds and institutional investors, are currently net short on the euro. This suggests that they expect the euro to weaken against the pound.

- Non-Commercial Traders: Non-commercial traders, such as individual investors and hedge funds, are currently net long on the euro. This suggests that they expect the euro to strengthen against the pound.

⚖️Market Sentimental Analysis

- Market Sentiment: The market sentiment for EUR/GBP is currently bearish, with many analysts expecting the euro to weaken against the pound.

- Positioning: Many traders and investors are currently short on the euro, expecting it to weaken against the pound.

⚖️Trader Positions

- Institutional Traders: 55% short, 45% long

- Retail Traders: 58% short, 42% long

- Hedge Funds: 60% short, 40% long

- Commercial Traders: 52% short, 48% long

- Banks: 50% short, 50% long

⚖️Next Trend Move

- Based on the current market sentiment and positioning, the next trend move for EUR/GBP is likely to be downward, with the euro weakening against the pound.

- However, it's essential to keep in mind that market trends can change rapidly, and unexpected events can impact the exchange rate.

⚖️Quantitative Analysis

- Moving Averages: The 50-day moving average is currently above the 200-day moving average, indicating a bullish trend. However, the short-term moving averages (10-day and 20-day) are below the longer-term moving averages, indicating a bearish trend.

- Relative Strength Index (RSI): The RSI is currently at 40, indicating that the market is oversold and due for a bounce.

- Bollinger Bands: The Bollinger Bands are currently widening, indicating increased volatility.

⚖️Intermarket Analysis

- Correlation with Other Markets: EUR/GBP is currently positively correlated with the EUR/USD and negatively correlated with the GBP/USD.

- Impact of Other Markets: The EUR/GBP exchange rate is likely to be impacted by the performance of the US dollar, as well as the relative economic performance of the EU and UK.

- Commodity Prices: Changes in commodity prices, such as oil and gold, can also impact the EUR/GBP exchange rate.

⚖️Overall Summary Outlook

The EUR/GBP exchange rate is expected to decline in the short-term, driven by the bearish market sentiment and positioning. The euro's weakness against the pound is likely to continue, with a potential target of 0.8200. However, any unexpected positive developments in the EU or negative developments in the UK could lead to a reversal of the trend. Traders and investors should remain cautious and monitor market developments closely.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURGBP - Approaching Key Resistance: Is 0.8370 the next target?OANDA:EURGBP is nearing a key resistance level that has previously acted as a strong barrier, triggering bearish momentum in the past. This zone also aligns with prior supply areas where sellers have stepped in, making it a potential point of interest for those looking for short opportunities. Given its historical significance, how price reacts here could set the tone for the next move.

If bearish signals emerge, such as rejection wicks, bearish candlestick patterns, or signs of weakening bullish pressure, I anticipate a move toward the 0.83700 level. However, a clear breakout above this resistance could challenge the bearish outlook and open the door for further upside. It's a pivotal area where price action will likely provide clearer clues on the next direction.

Just my take on support and resistance zones, not financial advice. Always confirm your setups and trade with a proper risk management.

DeGRAM | EURGBP completes the correctionEURGBP is in an ascending channel between the trend lines.

The price has already reached the support level and approached the lower trend line.

Indicators are forming a bullish convergence on the 1H Timeframe.

We expect the growth to resume.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | EURGBP pullback from the retracement levelEURGBP is in an ascending channel between the trend lines.

The price is moving from the dynamic resistance, which has already acted as a pullback point, and 88.6% retracement level.

The chart formed a harmonic pattern after reaching the upper trend line.

Indicators continue to form a bearish divergence on the 4H Timeframe.

We expect a pullback.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EURGBP INTRADAY upside capped at 0.8420Bullish Scenario:

The EURGBP pair maintains a bullish intraday sentiment, supported by the longer-term uptrend. The key level to watch is 0.8420, which acts as a critical resistance zone. If the price rallies above 0.8420, the uptrend could resume, targeting 0.8440, with further resistance levels at 0.8460 and 0.8500 over the longer timeframe.

Bearish Scenario:

A confirmed break below 0.8380, especially with a daily close beneath this level, would invalidate the bullish outlook. This could lead to further downside movement, with immediate support at 0.8360, followed by 0.8340 and 0.8327, signaling a deeper corrective pullback.

Conclusion:

The overall intraday trend remains bullish, with 0.8420 as the key pivot level. Holding above this support reinforces the upside potential, while a confirmed breakdown below it could shift momentum toward a deeper retracement. Traders should monitor price action around this critical level for confirmation of the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Bullish bounce off overlap support?EUR/GBP is falling towards the support which has been identified as an overlap support and could bounce tot he 1st resistance which is a pullback resistance.

Pivot: 0.8387

1st Support: 0.8355

1st Resistance: 0.8452

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURGBP Buyers In Panic! SELL!

My dear subscribers,

My technical analysis for EURGBP is below:

The price is coiling around a solid key level - 0.8417

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 0.8356

My Stop Loss - 0.8444

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

Market Analysis: EUR/GBP Gains StrengthMarket Analysis: EUR/GBP Gains Strength

EUR/GBP is gaining pace and might extend its upward move above the 0.8445 zone.

Important Takeaways for EUR/GBP Analysis Today

- EUR/GBP started a fresh increase above the 0.8360 resistance zone.

- There is a major bullish trend line forming with support at 0.8402 on the hourly chart at FXOpen.

EUR/GBP Technical Analysis

On the hourly chart of EUR/GBP at FXOpen, the pair started a fresh increase from the 0.8240 zone. The Euro traded above the 0.8360 level to move into a positive zone against the British Pound.

The EUR/GBP chart suggests that the pair settled above the 50-hour simple moving average and 0.8400. Immediate resistance is near 0.8445. The next major resistance for the bulls is near the 0.8460 zone.

A close above the 0.8460 level might accelerate gains. In the stated case, the bulls may perhaps aim for a test of 0.8500. Any more gains might send the pair toward the 0.8550 level in the coming days.

Immediate support sits near the 23.6% Fib retracement level of the upward move from the 0.8359 swing low to the 0.8447 high. The next major support is near a major bullish trend line at 0.8402.

The 61.8% Fib retracement level of the upward move from the 0.8359 swing low to the 0.8447 high is also at 0.8402. A downside break below the 0.8402 support might call for more downsides.

In the stated case, the pair could drop toward the 0.8360 support level. Any more losses might send the pair toward the 0.8265 level in the near term.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Bullish continuation?EUR/GBP is falling towards the pivot which has been identified as an overlap support and could bounce to the 1st resistance.

Pivot: 0.8403

1st Support: 0.8367

1st Resistance: 0.8442

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.