Eurjpy!

EUR/JPY "The Yuppy" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "The Yuppy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (164.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (161.000) Day / swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 167.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

EUR/JPY "The Yuppy" Forex Market Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURJPY: Top formation, sell opportunity.EURJPY is neutral on its 1D technical outlook (RSI = 53.515, MACD = 0.340, ADX = 26.005) as it ranges between its 1D MA50 and 1D MA200. This is a peak formation on the LH trendline of the 5 month Channel Down identical to January. At least a -6.20% bearish wave is to be expected. Today's spike gives an even better sell entry for a TP = 154.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

EJ, Massive correction is in order - and thats an understatementEURJPY has been resilient last year, goin parabolic and hitting highs at 175.0 levels. As with any parabolic behavior -- weighty trim downs has followed thereafter. Slashing as much as 1500 pips from its last years price peak.

Based on recent long term metrics -- more trim downs is expected that may linger for quite a bit. Color of the year will likely stay red for the next few seasons ahead.

Our diagram depicts a major long term shift -- with a ultra wide time spectrum double top resistance that spans 17 years from July 2008 to April 2025. This solid head bump zone is historically a hard roof to crack and its already showing rejection based on latest price behavior.

As economic uncertainty lingers, with all markets in red recently -- JPY status as a safe haven pair is currently manifesting hence the recent surge in strength (and weakness on all paired).

The resurfaced black bar on the last monthly closing represents the first of many incoming series of descending price levels.

Expect more price decay from this top zone.

Spotted at 161.0

Mid/Long term target 150, 140 areas.

TAYOR

Trade safely.

EUR/JPY Falling Wedge Breakout | Bullish Potential Ahead🔍 Chart Overview: EUR/JPY – Daily Timeframe

This chart illustrates the price action of the Euro against the Japanese Yen and highlights a Falling Wedge Pattern developing over several months. This is a classic bullish continuation/reversal setup, supported by key technical levels.

📐 1. Chart Pattern: Falling Wedge

A falling wedge is a bullish chart pattern that occurs when the market consolidates between two downward-sloping trendlines.

Characteristics Seen in the Chart:

Converging Trendlines: The upper (resistance) and lower (support) boundaries are both sloping downward, indicating a narrowing price range.

Volume (not shown) usually decreases during the formation, followed by a surge on breakout.

Multiple Touch Points: The price action respects both boundaries multiple times, confirming the pattern's validity.

🏛️ 2. Key Levels

✅ Support Level (Demand Zone):

Marked around 156.000 – 158.000

Multiple bounces from this area, indicating strong buying interest.

Aligned with the lower wedge trendline and historical price reaction zones.

🚫 Resistance Level (Supply Zone / Breakout Zone):

Around 164.500 – 166.000

Price repeatedly failed to break this level, confirming it as a strong supply area.

Confluence of horizontal resistance and the upper wedge boundary.

📊 3. Trade Setup

💼 Entry Strategy:

Confirmation Buy: Enter a long position upon a daily candle close above the wedge resistance (around 166.000).

Aggressive traders may consider an earlier entry near the wedge’s support with a tight stop.

🎯 Target:

The projected target is 172.962, calculated based on the height of the wedge pattern added to the breakout point.

This aligns with a previous swing high area, serving as a logical profit-taking zone.

🛑 Stop Loss:

Positioned at 155.576, just below the key support zone.

This allows the trade room to breathe while protecting against a full pattern failure.

⚖️ 4. Risk Management

Risk-to-Reward Ratio (RRR): Target around 172.962 and Stop Loss at 155.576 offer a favorable RRR of approximately 2.5:1 or more, depending on entry.

Position Sizing: Use appropriate lot size based on your account risk tolerance (e.g., 1-2% of equity per trade).

📅 5. Timeframe Outlook

Medium to Long-Term Setup: Since this is a daily chart, the trade may take weeks to months to fully play out.

Patience and proper trade management are essential.

🔎 6. Additional Notes

Retest Opportunity: If price breaks out, look for a retest of the resistance zone as new support before continuation to the upside.

Fundamental Factors: Keep an eye on EUR and JPY economic data, ECB and BoJ policy announcements, and global risk sentiment, which can influence the pair.

🧭 Professional Takeaway

This is a textbook bullish falling wedge pattern within a well-defined technical structure. The chart provides:

A clear pattern breakout level,

Strong historical support/resistance zones,

A defined risk management plan,

And a realistic price target based on technical projection.

If you are a swing trader or position trader, this setup offers a high-probability opportunity with favorable risk-reward dynamics—provided a breakout is confirmed.

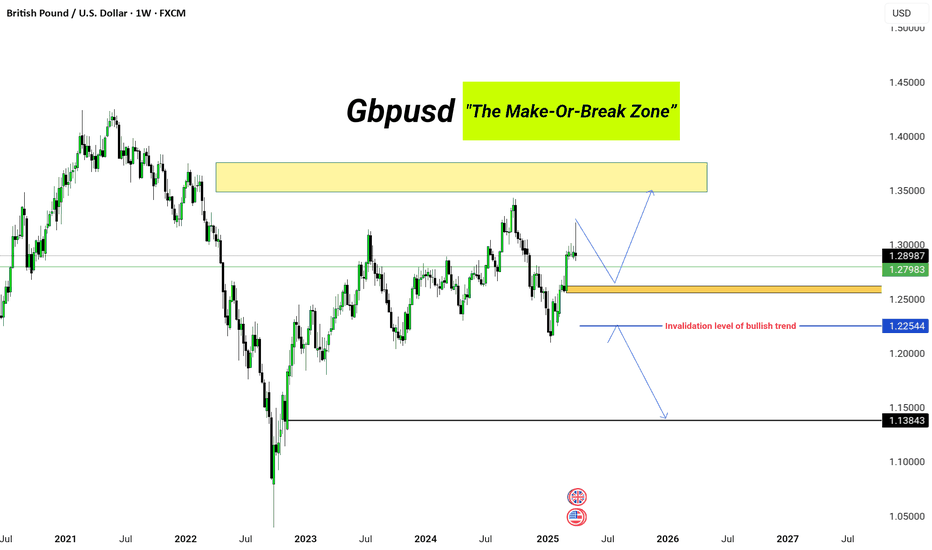

GBP/USD: The Make-Or-Break Zone”GBP/USD is showing strong bullish momentum, pushing toward the key resistance zone between 1.33000–1.36000. However, a short-term correction may occur before the next leg higher.

Key Levels:

Support Zone: 1.27983

Resistance Zone (Target): 1.33000–1.36000

Invalidation Level of Bullish Trend: 1.22544

Bearish Scenario: If 1.22544 breaks, eyes on 1.13843

The structure supports bullish continuation unless price breaks below 1.22544. Stay patient and look for clean entries post-correction.

EUR/JPY "The Yuppy" Forex Bank Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "The Yuppy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (163.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 30 mins timeframe (161.500) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 166.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

EUR/JPY "The Yuppy" Forex Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/JPY – Bearish Setup with Elliott Wave AnalysisThis EUR/JPY daily chart shows an Elliott Wave analysis, suggesting a possible bearish continuation. The current wave structure indicates the pair is moving through the final phase of a five-wave impulsive sequence.

The market has completed three waves of a larger impulsive cycle, with Wave (4)

The price movement between Wave (2) and Wave (4) shows a pause or slowdown after going up. This means the buyers are losing strength, and the price may soon start to fall

If the price gets rejected near 162.900 , it could confirm further downside.

If it breaks below the 159.674 level, it may speed up the decline, with a possible target around 155.526 level.

EURJPY Is Going Up! Buy!

Here is our detailed technical review for EURJPY.

Time Frame: 6h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 161.112.

The above observations make me that the market will inevitably achieve 162.396 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURJPY on the Edge of Collapse: Ready for the Drop? Hi Traders ! The price has formed a Head and Shoulders (H&S) pattern on the daily (1D) chart and is approaching the neckline. If it breaks this level with strong momentum, we could see a significant decline, targeting the 135.000 - 140.000 zone.

Key Levels:

✅ Confirmation: Clear break of the trendline.

❌ Stop-loss: Above the right shoulder 165.000.

🎯 Bearish target: 135.000 - 140.000.

We’ll wait for confirmation before taking action. Stay tuned!

Disclaimer: This is not financial advice. Do your own research before making any trading decisions.

EURJPY Double Top - Bearish Reversal Ahead Toward Target!🔍 Chart Analysis: Identifying the Double Top Pattern

The EURJPY (Euro/Japanese Yen) 1-hour chart shows a classic Double Top pattern, which is a strong bearish reversal formation. This pattern occurs when the price reaches a significant resistance level twice but fails to break above it, indicating a potential shift from bullish momentum to bearish control.

1️⃣ Top 1: The first peak formed as buyers pushed the price higher, but strong resistance forced a pullback.

2️⃣ Top 2: The price attempted to break the same resistance level again but failed, forming a second peak at approximately 164.165, confirming that sellers are overpowering buyers.

3️⃣ Neckline (Support Level): The critical support level around 160.000 acted as a trigger for the bearish move. Once this level broke, the double top pattern was confirmed.

📌 Key Levels and Market Structure

🔹 Resistance (164.165): The highest level where sellers dominated, preventing further upward movement.

🔹 Support/Neckline (160.000): This level acted as a crucial pivot. Once broken, it signaled a trend reversal.

🔹 Take Profit Levels:

TP1 – 159.036: This serves as the first profit target, aligning with a prior demand zone.

TP2 – 157.200: The full projected downside move based on the double top pattern.

🔹 Stop Loss (SL): Above 164.165, ensuring a risk-managed approach in case of trend invalidation.

📉 Trading Strategy: How to Trade This Setup?

1️⃣ Entry Confirmation:

The ideal entry was after the price broke the neckline at 160.000 and retested it as resistance.

A breakdown candle with high volume confirmed seller dominance.

2️⃣ Stop-Loss Placement:

A stop-loss above 164.165 provides room for price fluctuations while protecting against false breakouts.

3️⃣ Profit Targets:

TP1: 159.036, securing partial profits.

TP2: 157.200, completing the double top measured move.

📊 Market Psychology & Price Action Insights

The double top pattern reflects a shift in market sentiment from bullish to bearish.

The repeated rejection at 164.165 signals a lack of buying strength, increasing the probability of a downward move.

The breakdown of the 160.000 neckline confirms that sellers have taken control.

The price action also shows a lower-high formation, reinforcing bearish momentum.

✅ Conclusion: Bearish Bias Until 157.200

This setup strongly favors short positions, as long as the price stays below 162.500.

A break above 164.165 invalidates the bearish setup, signaling a potential reversal.

Until then, the market remains bearish, with TP1 & TP2 as achievable downside targets.

💬 What’s your outlook on EURJPY? Drop your analysis below! 👇

EURJPY: Will Start Growing! Here is Why:

Balance of buyers and sellers on the EURJPY pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the buyers, therefore is it only natural that we go long on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURJPYHello Traders! 👋

What are your thoughts on EURJPY?

This pair is currently trading below a key resistance zone and has also broken its ascending trendline.

The price is now in the process of pulling back to the broken trendline, consolidating around that area.

We expect that after completing the pullback and some consolidation, the pair will decline at least toward the specified support levels.

Don’t forget to like and share your thoughts in the comments! ❤️

EUR_JPY GROWTH AHEAD|LONG|

✅EUR_JPY has retested a key support level of 160.600

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 163.000 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURJPY Approaching Key Resistance — Potential Sell SetupOANDA:EURJPY is approaching a key resistance level, an area that has been a key point of interest where sellers have regained control, leading to notable reversals in the past. Given this, there is potential for a bearish reaction if price action confirms rejection, such as a bearish engulfing candle, long upper wicks or increased selling volume.

If the resistance level holds, I anticipate a downward move toward 161.20, which represents a logical target based on previous price behavior and market structure.

However, if the price breaks above this zone and sustains above it, the bearish outlook may be invalidated, opening the door for further upside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

EURJPY remains mixed and volatile.EURJPY - 24h expiry

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

Price action looks to be forming a top.

Preferred trade is to sell into rallies.

A lower correction is expected.

Bespoke resistance is located at 162.35.

We look to Sell at 162.35 (stop at 162.75)

Our profit targets will be 160.75 and 160.50

Resistance: 162.00 / 162.70 / 163.20

Support: 160.75 / 160.20 / 159.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

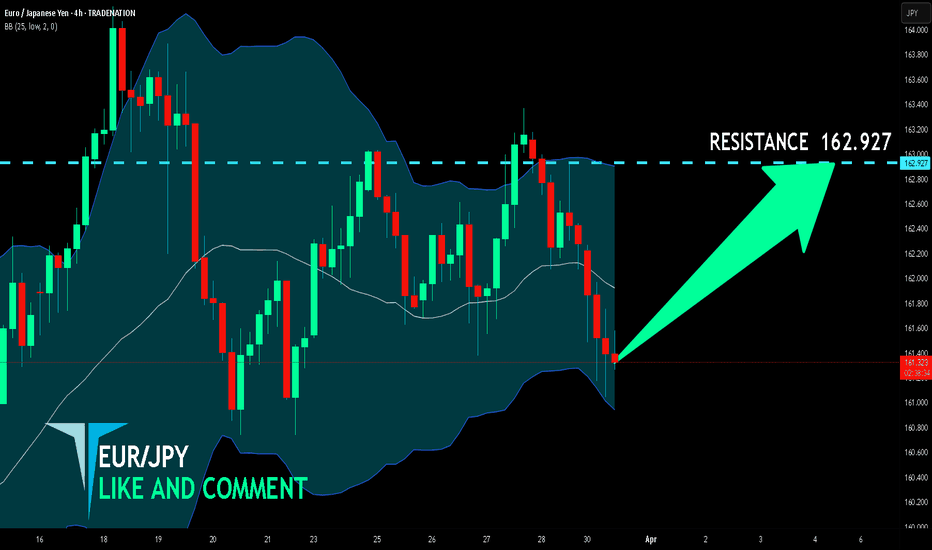

EUR/JPY BEST PLACE TO BUY FROM|LONG

Hello, Friends!

We are targeting the 162.927 level area with our long trade on EUR/JPY which is based on the fact that the pair is oversold on the BB band scale and is also approaching a support line below thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Strong Confluence Zone – Is EURJPY Ready to Fly?EURJPY is currently respecting a strong ascending trendline that has acted as dynamic support for several years. Price recently rebounded from both the horizontal support zone and the rising trendline, indicating strong buying interest at this confluence area.

Now, the pair is attempting to break above a key resistance zone marked by a descending trendline. A successful breakout above this area could signal a potential continuation of the long-term bullish trend.

The RSI is also showing a bullish divergence, which adds confluence to the bullish bias. However, rejection from resistance could trigger a retest of the support zones.

Found this helpful? Like & follow us for more high-quality market insights.

EURJPY Weekly Forecast: Triple Bottom Breakout & Bullish Target Overview of the Chart & Market Structure

The EUR/JPY daily timeframe chart presents a Triple Bottom Pattern, a powerful bullish reversal formation that suggests a potential shift in market sentiment. This pattern occurs when price tests a key support level three times and fails to break lower, indicating strong buying interest at that zone.

Historically, a Triple Bottom leads to a significant trend reversal as sellers lose strength and buyers gain control. If confirmed by a breakout above resistance, this setup could provide a high-probability trading opportunity for swing traders and position traders.

Key Chart Components & Price Action Analysis

1. Triple Bottom Formation

The three bottoms marked on the chart represent repeated failed attempts by sellers to push the price lower:

Bottom 1 (August 2024): The first rejection from the support zone (~155.000) led to a temporary bounce.

Bottom 2 (October 2024): Price retested the same level, but buyers stepped in again, preventing a breakdown.

Bottom 3 (March 2025): The final test of support confirmed a strong accumulation zone, setting the stage for a potential bullish breakout.

In technical analysis, a Triple Bottom is considered a stronger reversal signal than a Double Bottom, as it represents prolonged buying pressure at key levels.

2. Support & Resistance Levels

Support Zone (~155.086): This level has been tested multiple times and remains a solid demand zone, where buyers have consistently entered the market.

Resistance Zone (~166.000): This level represents the neckline of the pattern, which must be breached to confirm a bullish reversal.

Breakout Target (~179.233): If price breaks out above 166.000, the projected target is set at 179.233, based on the height of the Triple Bottom pattern.

Trading Strategy & Entry Plan

1. Entry Point – Waiting for Confirmation

A buy trade should be initiated ONLY after a confirmed breakout above the resistance level (~166.000). Traders should wait for a daily candle close above this level, preferably with high volume, to confirm the breakout.

2. Stop Loss Placement

A stop-loss should be placed below the third bottom (support level) at 155.086 to minimize risk.

This placement ensures that if price invalidates the pattern by moving below the support level, the trade is exited early.

3. Profit Target Calculation

The measured move technique is applied to estimate the target. The height of the pattern (distance from support to resistance) is projected upward from the breakout point.

Target price: 179.233, aligning with historical resistance.

4. Risk-to-Reward Ratio & Position Sizing

The risk-to-reward ratio (RRR) for this setup is favorable, making it an attractive swing trade opportunity.

Traders should adjust position sizes based on risk tolerance, ensuring proper money management principles are applied.

Additional Confirmation Factors

1. Volume Analysis

A breakout with increasing volume will confirm strong bullish momentum.

Weak volume during breakout could indicate a false breakout, requiring caution.

2. RSI & Momentum Indicators

RSI trending above 50 suggests growing bullish strength.

Bullish divergence on RSI or MACD would add further confidence to the trade.

3. Retest of Resistance as Support

Often, after breaking resistance, price retests the breakout level before moving higher.

This could offer a secondary entry opportunity for traders who miss the initial breakout.

Potential Risks & Market Conditions to Watch

False Breakouts – If price fails to sustain above resistance, the pattern could be invalidated.

Macroeconomic Events – Major news events, such as ECB or BOJ policy decisions, could impact EUR/JPY movement.

Geopolitical Uncertainty – Unexpected events may cause volatility and deviation from technical patterns.

Conclusion – High-Probability Bullish Setup

The Triple Bottom Pattern in EUR/JPY is shaping up as a strong bullish reversal setup. If the price successfully breaks above 166.000, a rally toward 179.233 is expected.

📌 Trading Plan Recap:

✅ Entry: Buy above 166.000 (confirmed breakout).

✅ Target: 179.233 (measured move projection).

✅ Stop Loss: 155.086 (below support).

✅ Risk-Reward Ratio: Favorable for swing traders.

This setup aligns well with technical and price action strategies, making it an attractive trade idea for the upcoming weeks.