Eurjpydaily

EUR/JPY "The Yuppy" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

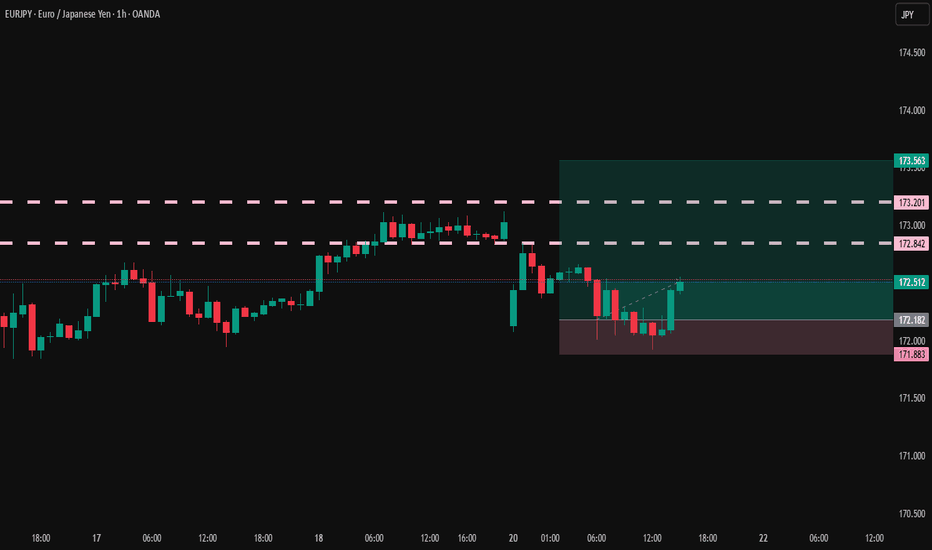

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "The Yuppy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 30min period, the recent / nearest low or high level.

Goal 🎯: 165.000

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Based on the fundamental analysis, I would conclude that the EUR/JPY (Euro/Japanese Yen) pair is: Bullish

Reasons:

Interest rate differential: The European Central Bank's (ECB) interest rate (2.50%) is higher than the Bank of Japan's (BoJ) interest rate (0.10%), making the EUR more attractive to investors.

Economic growth: The Eurozone's economy is expected to grow at a faster pace than Japan's, driven by the strong labor market and increasing business investment.

Monetary policy: The ECB's hawkish stance and potential interest rate hikes are expected to support the EUR, while the BoJ's dovish stance and potential monetary policy easing could weaken the JPY.

Trade balance: The Eurozone's trade balance is expected to remain in surplus, driven by the strong demand for European exports, which could support the EUR.

Japanese economic slowdown: Japan's economy is expected to slow down, driven by the aging population and decreasing labor force, which could lead to a decline in the JPY.

However, it's essential to consider the following risks:

Global economic slowdown: A slowdown in global economic growth could reduce demand for the EUR and drive down prices.

Eurozone debt crisis: The Eurozone's debt crisis could resurface, potentially weakening the EUR and driving down prices.

Trade tensions: Escalating trade tensions between the Eurozone and other countries could negatively impact the EUR and drive down prices.

Bullish Scenario:

Interest rate differential, economic growth, and monetary policy support the EUR

Japanese economic slowdown and trade balance support the bullish case

Key Fundamental Indicators:

Eurozone GDP growth: 1.5% (2023 estimate)

Japan GDP growth: 0.5% (2023 estimate)

ECB interest rate: 2.50%

BoJ interest rate: 0.10%

Eurozone trade balance: €20 billion (2023 estimate)

Japan trade balance: ¥500 billion (2023 estimate)

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

#EURJPY 1 DAYEURJPY (Euro / Japanese Yen)

Timeframe: Daily (1D)

Pattern: Downtrend

The daily chart of EURJPY reveals a pronounced downtrend, characterized by a series of lower highs and lower lows. This pattern indicates that sellers have maintained control over the market, leading to consistent price declines over time. The downtrend reflects a bearish sentiment among traders, as the currency pair struggles to regain upward momentum.

Forecast: Sell

Given the established downtrend, the forecast suggests a selling opportunity. The likelihood of continued bearish movement remains strong, as the pair has not shown any significant signs of reversal or stabilization at this point.

Technical Outlook:

Resistance Level: The recent lower high points, which may serve as potential entry points for sellers.

Support Level: Key support zones below the current price, where a breakdown could trigger further selling pressure.

Key Levels to Watch: A sustained move below recent support levels would reinforce the bearish outlook, potentially leading to further declines.

Traders should be vigilant for confirmation signals, such as bearish candlestick formations or increased volume during price drops, to validate their entry strategies.

Keep an eye on economic news and geopolitical factors that could influence the Euro and Japanese Yen, as these may impact price dynamics in this pair.

EURJPY - FUNDAMENTAL AND TECHNICAL VIEW#EURJPY

- Currently there is an UP SIDE BIAS for EURJPY. XXXJPY CURRENCIES BUY very fast in previous weeks with JPY WEAK after BOJ MEETING. Somehow it is being RECOVERED again. MARKET RISK is still ON. VIX is going DOWN, XXXJPY CURRENCIES SHOULD BE BUY FAST NOW.

- Some NEWS coming for the USD will help strengthen the EURO. Because the reason for that is because the NEWS related to USD is quite weak and USD has got a weak SENTIMENT. But in the future, if the RATE HIKE SENTIMENT is PRICED by the ECB, EURO may be BUY more.

EURJPY can be SELL at 143.80 level before BUY. After that you can BUY at 148.00 LEVEL. If the MAIN STRUCTURES BREAK somehow, EURJPY price can definitely be BUY at 146.61 LEVELS.

EURJPY - FUNDAMENTAL AND TECHNICAL VIEW#EURJPY

- Currently there is an UP SIDE BIAS for EURJPY. XXXJPY CURRENCIES BUY very fast in previous weeks with JPY WEAK after BOJ MEETING. Somehow it is being RECOVERED again. MARKET RISK is still ON. VIX is going DOWN, XXXJPY CURRENCIES SHOULD BE BUY FAST NOW.

- Some NEWS coming for the USD will help strengthen the EURO. Because the reason for that is because the NEWS related to USD is quite weak and USD has got a weak SENTIMENT. But in the future, if the RATE HIKE SENTIMENT is PRICED by the ECB, EURO may be BUY more.

For that, the support of EURO STOCKS and VIX must be received. We have no more confirmation that the EURO is likely to be WEAK.

EURJPY can be SELL at 140.104 level before BUY. After that you can BUY at 147.15 LEVEL. If the MAIN STRUCTURES BREAK anyway, the EURJPY price can definitely be BUY at 147.15 LEVELS.

EURJPY - FUNDAMENTAL AND TECHNICAL VIEW

⚠️ EUR DATA OUTLOOK IN THIS WEEK

⛔️ ZEW ECONOMIC SENTIMENT DATA, a very important DATA for the EURO, is scheduled to be released on Tuesday. Also, GERMANY CPI DATA is scheduled to be released. Be careful about that DATA.

⛔️ EUR CPI DATA to be released on Wednesday. Depending on the nature of that DATA, it will definitely affect the EURO on Friday's speech by the ECB PRESIDENT. CPI DATA POSITIVE WILL IMPACT EURO VERY STRONGLY.

⛔️ The ECB PRESIDENT is scheduled to deliver two speeches on Thursday and Friday. Pay attention to it.

⛔️ Pay attention to what he says about EURO INFLATION and INTEREST RATES. You can get SHORT TERM ENTRIES. If those COMMENTS are POSITIVE, they will definitely affect the EURO in a POSITIVE way.

⛔️ Also keep an eye on GERMANY PPI DATA on Friday with CPI DATA and ECB PRESIDENT's speech likely.

⚠️ JPY DATA OUTLOOK IN THIS WEEK.

⛔️ PPI DATA is scheduled to be released on Monday. It will provide some support for the BOJ MEETING on Wednesday.

⛔️ Very important for JPY on Wednesday this week. The BOJ MONETARY POLICY STATEMENT is scheduled to be released. There you should pay attention to whether there is any mention of whether the BOJ is coming out of NEGATIVE INTEREST DATA.

⛔️ CORE CPI Y/Y DATA TO JPY TO BE RELEASED ON FRIDAY. If the BOJ OUTLOOK becomes POSITIVE and the DATA supports it, the JPY may go up slightly for that day.

🔰 Most likely, the PRICE can fall to the 135 LEVEL. After that, the PRICE can move up to 143 LEVEL. 🔰

EURJPY Ascending Channel Pattern#EURJPY Hello trader, I hope are good and safe. Today I opened the chart of #EURJPY for 15 Min and analyzed it then I see that this chart has made a ASCENDING CHANNEL, So I hope #EURJPY will go downside,

Now Nice opportunity for short.

If you have any query then leave a COMMENT, LIKE and FOLLOW.

Keep Supporting And Thank You..

EURJPYHello everyone, and welcome to my TradingView profile, my name is TRADiNG_Club_ and today I am going to analyze XAU/USD, a full technical analysis on different time frames using a translation of market information While doing so, let me give you a personal opinion about it. The next most likely market movement and helps you find and manage market opportunities.

My thoughts are for those who are interested in improving their financial education.

Thank you..

EURJPY: Bearish PennantEJ is currently at the top of a bearish pennant (Monthly/Weekly T.f) the pattern is also visible on the RSI on the Mly T.f

The next target is 126.800 .

the target after that is 117.740 .

We're currently at a fib level. If price is ever to pick up, it'll do so at this level. But i would wait for a break to the upside, then a restest and continuation before buying ( break and retest of pennant or at least 133.100 level.) the next target if that happens will be 137.400.

EURJPY Analysis This analysis includes the monthly, weekly, daily and four hour charts.

On the monthly chart:

It has crossed a downtrend, which is the upper leg of a continuation triangle

It is currently heading to exceed 130.924, and in case it is exceeded, the purchasing objectives will be:

(131.605 - 132.254 - 133.825 - 135.270 - 137.128 - 138.208 - 140.421 - 144.175 - 147.612 - 154.486 - 160.882 - 167.590)

provided the area is not broken 129,300 - 127,531

_____________

But if he breaks the area 129.300 - 127.531, he has two selling goals:

122.620 - 121.472

_____________

My personal opinion: It is in a strong bullish trend and I am buying.

Note: I hope no one accuses me of insane, as this analysis is basically insane.

EURJPY - SHORT; SELL the Monthly Resistance here! ......despite the heavy docket next week. (BoJ rate decision, EU data dump, etc.) The upcoming data has a virtually zero chance to fundamentally alter the overall picture, either for the EU or for the BoJ.

Much more importantly, technically this is a solid SHORT Entry here with low risk. (Despite the likely volatility.) If the trade is wrong, you'll know it right away.

Note: This post also serves as a replacement/update for the previous EURJPY post which was erroneously updated, earlier last week. (See attached)