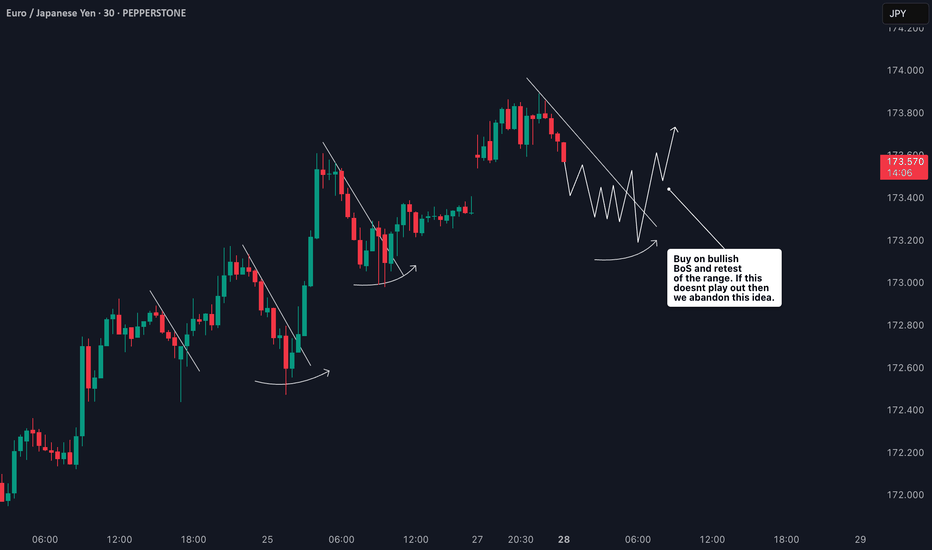

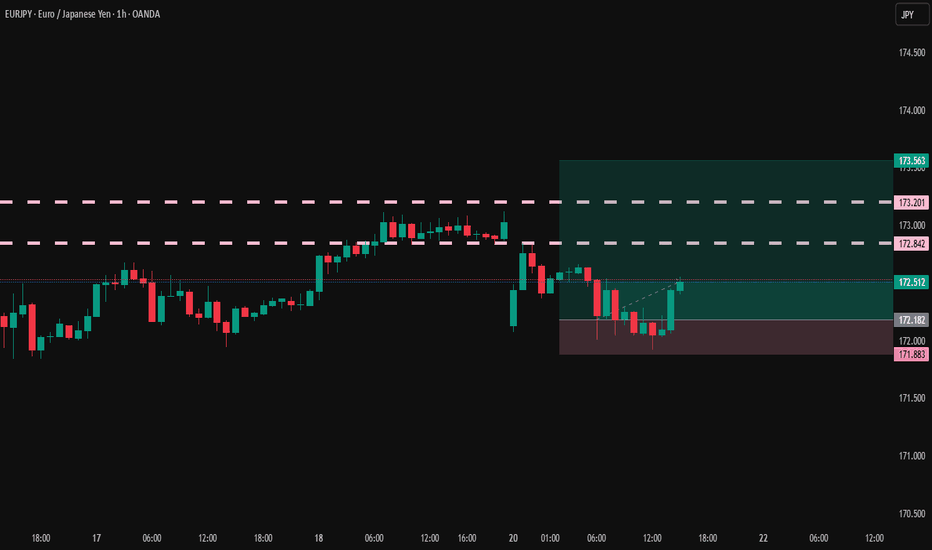

How I’m Trading the EURJPY Break of Structure Setup📈 EURJPY Analysis Update 🔍

I'm currently watching EURJPY closely. On the weekly timeframe, the pair is clearly in a strong bullish trend 🚀. Price has recently tapped into a previous daily bullish order block 🧱 — a key zone of interest.

Now, I’m watching for a break of structure (BoS) 📉 followed by a bullish continuation, especially if price pulls back into the fair value gap (FVG) 📊 near the current low.

As always, this setup — along with all key details and trade considerations — is fully broken down in the 🎥 video.

⚠️ This is for educational purposes only and not financial advice.

Eurjpylong

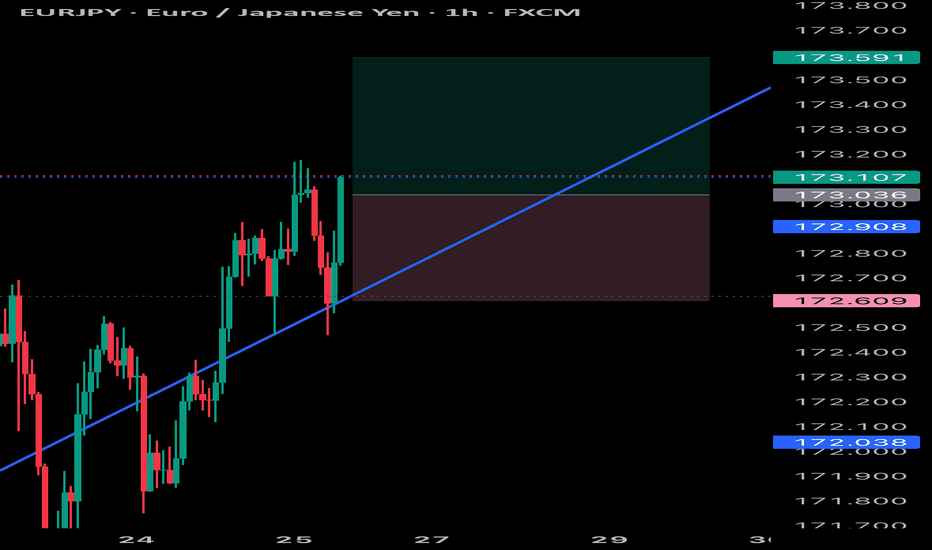

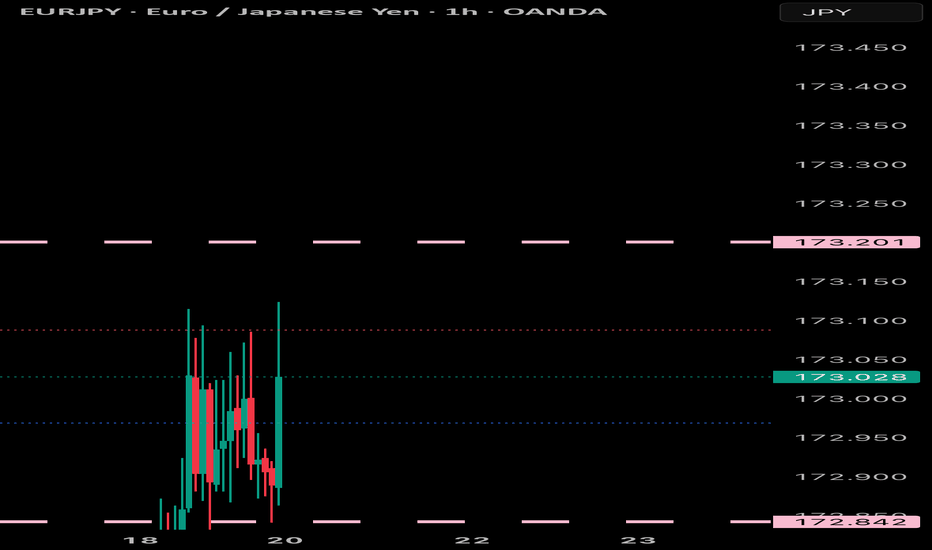

Trading the Pullback on EURJPY My Trade PlanThe EURJPY is clearly in a strong bullish trend 📈, as shown by a consistent pattern of higher highs and higher lows on the 1H timeframe ⏱️. In this video, I’m looking to capitalize on a pullback as a potential buy opportunity 🎯.

We dive into my entry strategy, explore how to align with the prevailing trend, and break down key concepts such as price action, market structure, and smart pullback zones 🧠📊.

⚠️ As always, this is for educational purposes only — not financial advice.

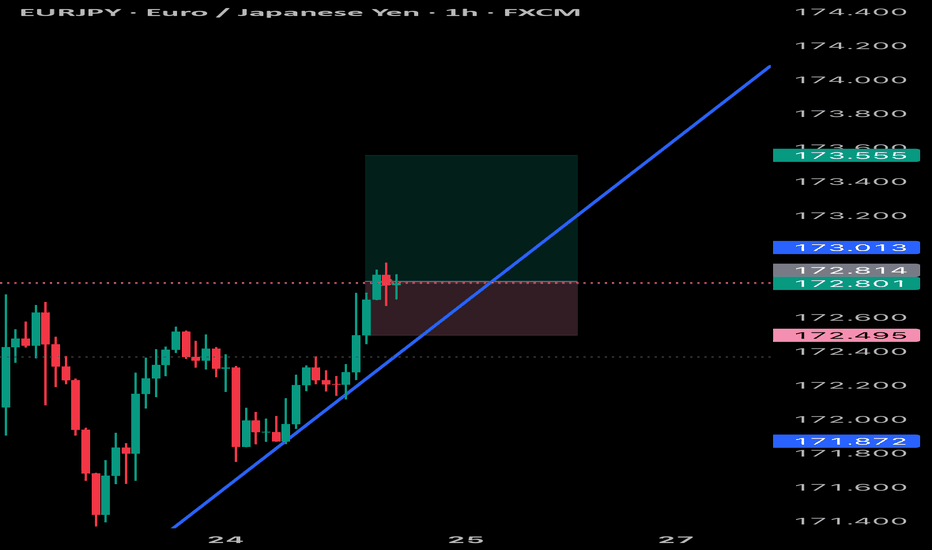

EURJPY Bullish Setup: Waiting for the Optimal Retrace EntryThe EURJPY is currently in a strong bullish trend 📈🔥. I’m anticipating a retracement into the Fibonacci 50–61.8% zone 🔄, which aligns with the equilibrium of the current price swing ⚖️. This potential pullback could present an optimal entry 🎯 — provided we see a bullish break of market structure 🔓📊 during the move down.

🛑 Stops and targets, as discussed in the video, are shared for educational purposes only — this is not financial advice 📚🚫. Please ensure you do your own analysis and risk assessment 🧠📉.

EURJPY: Bullish Trend ContinuationPrice remains in a strong uptrend, now trading above the 172.00 psychological level, targeting new liquidity above.

D1 Key Levels:

Support: 170.50 – 171.00 (daily demand zone + origin of breakout)

Resistance: Hasn't found a ceiling yet. Next key levels are psychological round numbers (173.00, 174.00).

H4 Demand Zone (Pullback Area): 171.20 – 171.50

Watch for retracement into this zone for a high-probability buy setup.

H1 OB: 171.30 – 171.50 (clean mitigation zone)

Monitor M15 for bullish BOS after price taps into this zone for confirmation.

M15 Optimal Plan:

Wait for pullback into 171.30–171.50

Confirm entry with M15 bullish BOS + displacement

🟢Entry Zone: 171.30 – 171.50 (after confirmation)

SL: 170.90

TP1: 172.80

TP2: 173.50

TP3: 174.20

Breakout Alternative: If price rallies above 172.80 early in the week, look for a breakout entry on retest.

Invalidation: H4 closes below 170.50

EURJPY–trend continuation, engulfing candle .. the week of 14/07Friday’s candle engulfed 2 previous days of price action. I interpret this as strongly bullish, especially since this happened in an already nicely bullish trend. However, the room to the upside it not unlimited - the ATH is at 175.421. We are likely to see sideways price action there due to some profit taking and maybe even some selling. IMO there are 2 possible options to get a 2R return:

- we may get a pullback before the bullish trend resumes.

- we drop down to the H1 chart and look for an opportunity to go long.

Either way, in my opinion, the trade should be closed before the ATH.

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk so carefully managing your capital and risk is important. If you like my idea, please give a “boost” and follow me to get even more.

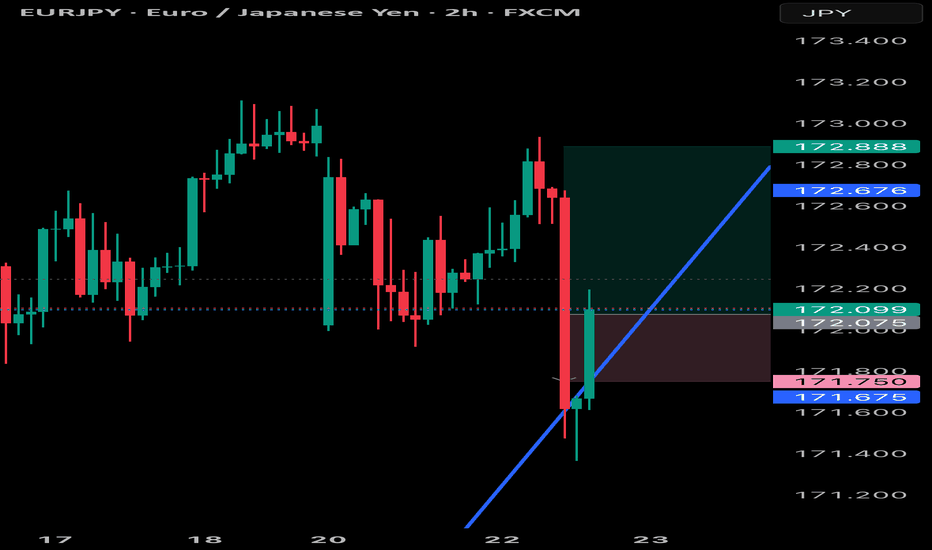

EURJPY: Trading Above Major QP 170. Strong Bullish Trend EJ broke above the key psychological level of 170.00, and has not found major resistance yet. Expecting a bullish trend continuation as long as price stays above 169.

* M30 Bullish Choch

* Creating new HHs and HLs

* M30/H1 Bearish Break Block

* M30/H1 Bullish FVG (50% filled)

🟢Entry: 168.40 – 168.60

Stop Loss: 168.00

TP1: 169.80

TP2: 170.50

TP3: 171.20

Breakout Option: If price pushes above 170.50 early in the week, consider breakout entry on retest.

Invalidation: Bias shifts to neutral if H4 closes below 169.00.

EUR/JPY – Morning Star Reversal with RSI/MA Bullish ConfirmationTechnical Snapshot (1H Timeframe):

✅ Morning Star pattern at key support/resistance zone (169.90–170.00), indicating potential bullish reversal.

📈 Price holds above 55 EMA, confirming structure support and sustained uptrend.

💥 MACD Bullish Crossover signaling renewed upward momentum.

🔄 RSI crossover above its MA from the 50 level – a classic sign of buyer strength resuming.

Bias: Bullish

As long as price sustains above the EMA cluster and doesn’t close below the 170.00 zone, bulls are in control. Watch for a retest + push scenario for low-risk entries.

This idea is for educational purposes only – not financial advice.