EUR/JPY Chart Analysis - Falling Wedge Target with Bullish SetupThis EUR/JPY 1-hour chart reveals a well-defined falling wedge pattern, which is a bullish reversal formation. Additionally, we see key support and resistance levels, a double bottom, and a breakout potential that traders can use to plan an entry. Let’s dissect this chart in a professional and detailed manner to understand the trade setup and market psychology.

🔹 Market Trend & Structure Analysis

The market was previously in an uptrend, making higher highs and higher lows, until it faced strong resistance at the 163.500 level. Upon reaching this zone, the price reversed downward, forming a series of lower highs and lower lows, which resulted in a falling wedge pattern.

This downward movement was accompanied by a trendline break, signaling a shift in momentum. The price has since reached a strong support level and is showing signs of potential bullish reversal.

🔹 Key Technical Patterns & Indicators

1️⃣ Falling Wedge Pattern (Bullish Reversal Signal)

A falling wedge is a pattern characterized by two downward-sloping trendlines that converge, indicating that selling pressure is weakening. This pattern is considered a bullish signal because:

✔️ The declining price movement shows exhaustion of sellers.

✔️ Volume typically decreases as the wedge forms, indicating a breakout is coming.

✔️ Once price breaks out of the wedge, a strong bullish move often follows.

The key here is to wait for a breakout above the upper trendline, which will confirm the bullish momentum.

2️⃣ Double Bottom Formation at Support (Reversal Confirmation)

The price tested the 160.500 support level twice, forming a double bottom pattern. This is another bullish sign, as it indicates:

✔️ Buyers are actively defending this level.

✔️ There’s strong demand around this price zone.

✔️ If price breaks above the wedge resistance, it could trigger a significant rally.

🔹 Key Support & Resistance Levels

Identifying support and resistance is crucial for defining entry and exit points.

✅ Support Levels:

160.500 – Strong horizontal support (Price tested this twice).

158.982 – Stop-loss level (Below this, the bullish setup is invalid).

✅ Resistance Levels:

163.500 – Major resistance (Previous high and supply zone).

165.090 – Final target (Key breakout level).

If the price successfully breaks out of the wedge, it has room to rise significantly, with 163.500 as the first target and 165.090 as the ultimate goal.

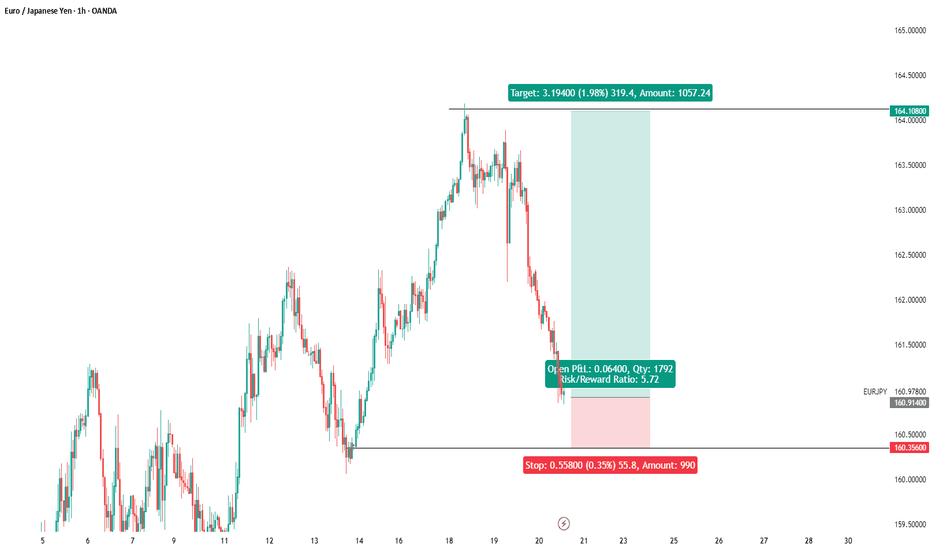

🔹 Trade Setup & Execution Plan

🎯 Bullish Breakout Trade Strategy

Since this setup signals a potential reversal, here’s how traders can execute a high-probability trade:

🔹 Entry Points:

✅ Aggressive Entry: Enter as soon as price breaks above the wedge resistance.

✅ Conservative Entry: Wait for a breakout and a retest of the resistance-turned-support before entering.

🔹 Target Levels:

🎯 First target: 163.500 (Previous resistance level).

🎯 Final target: 165.090 (Major resistance zone).

🔹 Stop-Loss Placement:

❌ Place the stop loss below 158.982, as a break below this level would invalidate the bullish setup.

🔹 Risk-Reward Ratio & Trade Justification

📈 Why This Trade Has a High Potential Reward?

Low-risk, high-reward: The stop loss is tight, while the upside potential is large.

Confluence of bullish signals: Falling wedge + Double bottom + Strong support.

Institutional interest likely: Buyers are stepping in at key levels.

A proper risk-to-reward ratio (RRR) for this trade would be at least 1:3, meaning for every 1% risk, there’s a 3% profit potential. This makes it a great swing trading setup.

🔹 Market Psychology Behind the Setup

The falling wedge represents a market correction after a strong bullish trend.

The double bottom shows that sellers are exhausted and buyers are gaining control.

If price breaks out, many traders will enter, triggering a strong upward rally.

This bullish breakout setup aligns with the smart money concept, where institutions accumulate positions before a big move.

🔹 Final Thoughts & Trade Outlook

This EUR/JPY setup presents a high-probability trade opportunity with a bullish breakout scenario. The combination of:

✅ Falling Wedge Pattern (Bullish reversal)

✅ Double Bottom at Support (Buyers stepping in)

✅ Key Resistance Targets (Clear trade exit points)

…creates a great trading setup.

📌 Trading Plan Summary:

✔️ Buy on breakout above the falling wedge.

✔️ Target 163.500 & 165.090 for profits.

✔️ Stop-loss below 158.982 for risk management.

🚀 If executed correctly, this trade has the potential for strong bullish momentum. Would you like a real-time update once the price confirms the breakout? Let’s keep an eye on this trade! 📊🔥

Eurjpylong

EUR/JPY Trading Setup – Falling Wedge Breakout Potential1. Overview of the Market Structure

The EUR/JPY daily chart presents a falling wedge pattern, which is a classic bullish reversal setup. This pattern has been forming for several months, indicating that the price has been consolidating within a narrowing range. The falling wedge typically suggests that selling pressure is weakening, and a potential breakout to the upside could follow.

The chart also highlights key support and resistance zones, along with a well-defined trading setup based on technical confluences.

2. Key Technical Levels

Support Level: ~ 155.819 (Marked as Stop Loss)

This level has acted as strong support multiple times.

A break below this level would invalidate the bullish bias.

Resistance Level: ~ 163-164

The price has previously struggled to break above this region.

Currently, it is retesting this level after a breakout attempt.

Target Levels:

175.246 – This aligns with a previous all-time high zone and a strong resistance level.

179.562 – Marked as the ultimate target, indicating a full breakout potential.

3. Falling Wedge Formation & Breakout Analysis

A falling wedge is a bullish pattern that indicates a decrease in selling pressure over time.

The price has tested the lower trendline multiple times, showing strong demand at support.

Recently, the price broke above the upper wedge trendline, suggesting that a breakout is in progress.

However, the breakout needs confirmation in the form of a successful retest at the previous resistance level (~163-164).

4. Retest Confirmation & Trade Setup

Retest Scenario: If the price holds above the previous resistance and confirms it as support, the probability of continuation towards 175-179 increases.

Entry Strategy: A buy entry can be considered after a successful retest with bullish price action confirmation.

Stop-Loss Placement: Below 155.819 (previous strong support).

Risk-Reward Ratio: The target offers a strong risk-reward ratio if the breakout holds.

5. Market Sentiment & Volume Analysis

The previous downward move showed declining bearish momentum, further confirming the validity of the falling wedge.

A volume increase on the breakout would provide additional confirmation.

If the price consolidates near the breakout zone with low volatility, a strong move upward could follow.

Final Conclusion: Bullish Breakout in Progress

The falling wedge breakout suggests that EUR/JPY is poised for further upside.

A successful retest at 163-164 could push the price towards 175.246 and ultimately 179.562.

Risk management is crucial, and a stop-loss below 155.819 is recommended to avoid invalidation of the setup.

This setup presents a high-probability trading opportunity, but confirmation through price action and volume analysis remains key.

Key Trading Plan Summary:

📌 Pattern: Falling Wedge (Bullish)

📌 Breakout Confirmation: Yes, but retesting is ongoing

📌 Entry Point: Above 163-164 after successful retest

📌 Stop Loss: Below 155.819

📌 Target Levels: 175.246, then 179.562

📌 Risk-Reward: Favorable if breakout sustains

Would you like any refinements or a more concise version for your TradingView post? 🚀📈

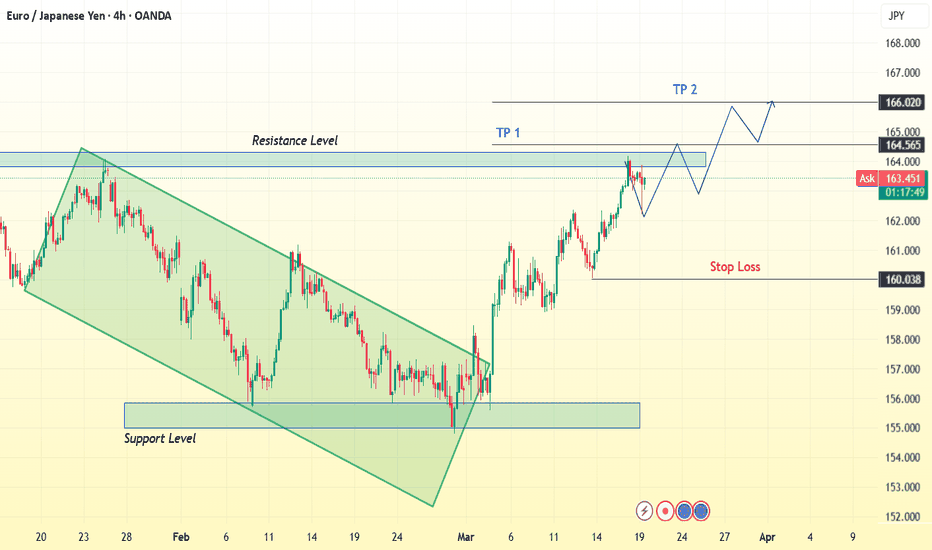

EURJPY Breakout Analysis: Falling Wedge & Key LevelsChart Pattern Breakdown

The chart presents a 4-hour timeframe for EUR/JPY, revealing a strong technical setup with multiple key patterns in play. The price action has been forming a falling wedge, a bullish reversal pattern, followed by a breakout.

Falling Wedge Formation

A falling wedge pattern is characterized by a narrowing range, where both highs and lows trend downward but converge towards a breakout point. This setup indicates a loss of bearish momentum and the potential for a strong bullish move once the price breaks out.

The wedge began forming in early February, with price making lower highs and lower lows within the structure.

The support level remained stable, while the resistance trendline kept the price within a tightening range.

Around early March, the price successfully broke above the wedge resistance, confirming the bullish breakout.

Key Resistance & Support Levels

Resistance Level (Marked on the chart)

Around 163.500 - 164.000, where the price faced rejection multiple times.

The market tested this level but struggled to break through immediately, confirming its importance.

Support Level (Marked on the chart)

Around 158.500 - 159.000, acting as a strong demand zone.

This area provided multiple bounces before the final wedge breakout.

Current Price Action & Trading Setup

Breakout Confirmation: The price successfully broke the wedge and moved higher, testing the resistance zone.

Pullback & Retest: The market is currently pulling back, testing the recent breakout area. This could be an ideal entry point for a long trade.

Bullish Target: The next significant resistance is at 166.754, followed by an extended target at 166.938.

Trade Plan

✅ Long Entry: On a successful retest of support near 160.500 - 161.000

🎯 Target 1: 166.754

🎯 Target 2: 166.938

🔒 Sell Stop (Stop Loss): Below 158.918 to minimize risk

Conclusion

The EURJPY chart is showcasing a strong bullish setup with a confirmed falling wedge breakout. As long as price holds above the key support level, the market is likely to continue its bullish momentum towards the 166+ zone. Traders should watch for confirmations such as bullish candlestick patterns, volume surges, and trendline support before entering a long position.

🚀 Do you agree with this setup? Drop your thoughts in the comments! 🚀

eurjpy buy signal

Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURJPY - Expecting Retraces Before Prior Continuation HigherHi Traders, on March 12th I shared this "EURJPY Short Term Buy Idea"

We expected to see correction prior to the bullish continuation. You can read the full post using the link above.

Price is moving as per the plan!!!

Based on the current scenario my bullish view still remains the same here.

We have bearish divergence in play based on the moving averages and histogram of the MACD and I expect to see retraces now before further continuation higher.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

---------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.-

EURJPY 4H | Bullish Breakout & Retest – Next Big Move?The EUR/JPY 4-hour chart presents a compelling bullish breakout setup following a structured downtrend. The market recently broke through a significant resistance zone, indicating potential further upside movement. This analysis outlines key price levels, market structure, and an actionable trading plan.

📊 Market Structure Overview

🔸 Downtrend Reversal: The price was previously trading within a descending channel (highlighted in green), forming lower highs and lower lows.

🔸 Support Confirmation : The price bounced from a strong support zone around 158.500 - 160.000, confirming buyers' interest in this region.

🔸 Breakout & Retest : A strong bullish impulse broke through the 164.500 - 165.000 resistance zone, suggesting a shift in market sentiment.

📌 Key Trading Levels

🔹 Support Zone: 158.500 - 160.000

This area previously acted as a demand zone where buyers aggressively pushed the price higher.

It now serves as a safety net for long positions.

🔹 Resistance Zone (Now Potential Support): 164.500 - 165.000

Price has broken above this level, but a retest could provide an ideal entry for confirmation.

🔹 Next Major Resistance (Target Levels):

TP1: 165.000 → A psychological level and previous resistance.

TP2: 166.020 → A higher resistance zone where price may struggle to break through.

📈 Trading Plan – Long Setup

✅ Entry Confirmation:

Wait for price to pull back to the 164.500 - 165.000 zone.

Look for bullish candlestick patterns (e.g., pin bars, engulfing candles) to confirm buyers stepping in.

🎯 Take Profit Targets:

TP1: 165.000 (Initial resistance level)

TP2: 166.020 (Potential extended bullish move)

🛑 Stop Loss Strategy:

Below 160.038 (Previous structure low & key support level)

Ensures protection against potential fakeouts or trend reversals.

📢 Risk-Reward Ratio:

Aiming for 2:1 or better risk-reward ratio for an optimal trade setup.

📝 Market Outlook & Conclusion

📌 The recent breakout above resistance suggests bullish momentum is strong. However, traders should be patient and wait for a pullback to enter at a better risk-reward level. If price successfully retests and holds above 164.500, there is a high probability of continuation towards 166.020.

🚀 Trading Bias: Bullish – Until market structure shifts or a major rejection occurs at resistance.

📢 Final Trading Tip

🔹 Patience is key! Don’t rush into a trade immediately after a breakout. Wait for confirmation, as false breakouts are common in volatile markets. A successful retest of the broken resistance will provide a low-risk, high-reward entry opportunity.

EUR/JPY Bullish Continuation in an Ascending Channel

This EUR/JPY 4-hour chart shows a strong bullish trend within an ascending channel, indicating a potential continuation of upward momentum.

Key Highlights:

✅ Ascending Channel – Price is trading within a well-defined upward channel, showing steady bullish movement.

✅ Support Zones – Two key support areas marked, which could act as potential entry zones on a retracement.

✅ Target Level – The projected target is around 165.831, aligning with previous resistance zones.

✅ Price Action Expectation – A pullback to the support level within the channel before another bullish impulse toward the target.

Trading Plan:

📌 Bullish Bias: Wait for a retracement toward the marked support zones for a potential long entry.

📌 Invalidation: A strong break below the channel and support zones would invalidate the bullish setup.

EURJPY Bullish Breakout Technical and Fundamental confluenceEURJPY Trade Analysis

Trade Type: Buy

Technical Analysis:

1. Trendline Breakout: EURJPY has broken above a key trendline, signaling a potential trend reversal or continuation.

2. Zone Breakout: The price has decisively moved past a strong resistance zone, confirming bullish momentum.

3. Double Bottom on 4H: A well-formed double-bottom pattern at a critical support level within the blue zone suggests a strong bullish reversal.

Fundamental Analysis:

Bullish Euro Outlook: Recent economic data and news favor the euro, boosting investor confidence. Positive developments such as stronger-than-expected GDP growth, hawkish ECB comments, or improved inflation outlook contribute to EUR strength.

Risk Sentiment: If global markets favor risk-on assets, JPY (a safe-haven currency) could weaken, further supporting EURJPY’s bullish move.

Trade Details:

Target Price: 163.755

Risk Management: 1% risk per trade

Risk-to-Reward Ratio (RRR): 1:3

With both technical and fundamental factors aligning, this trade setup presents a high-probability opportunity. Proper risk management will be maintained to maximize gains while minimizing exposure.

EUR/JPY Technical AnalysisTrendline Breakout:

EUR/JPY has broken a long-standing descending trendline, which previously acted as dynamic resistance, pushing the price lower. The breakout indicates a potential trend reversal from bearish to bullish.

Retesting Support Zone:

After the breakout, the price has retraced back to a key support zone around 156.000, highlighted in purple. This area has previously acted as a strong demand zone, where buyers have stepped in multiple times. Retesting this zone is a natural price action movement before confirming further upside momentum.

Bullish Projection:

If the support at 156.000 holds, EUR/JPY is expected to resume its bullish movement towards key resistance levels at 158.000 and ultimately 160.000. These levels align with previous price reaction zones, making them crucial take-profit areas for buyers.

EURJPY - Bullish Continuation Toward 160.850OANDA:EURJPY is trading within a well-defined ascending channel, with price action respecting both the upper and lower boundaries. The recent bounce off support suggests buyers are maintaining control, supporting a potential continuation of the uptrend.

As long as the price remains above the support level and the channel's lower boundary holds, the bullish structure remains intact.

A potential upside target is 160.850, aligning with the upper boundary of the channel. A break and close above this level could signal further bullish momentum.

However, a breakdown below the support zone would invalidate the bullish scenario and may open the door for a deeper pullback.

Remember, always confirm your setups and trade with solid risk management.

Best of luck!

eurjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURJPY forming a bottom?EURJPY - 24h expiry

Posted a Bullish Hammer Bottom on the 4 hour chart.

Bullish divergence can be seen on the 4 hour chart (the chart makes a lower low while the oscillator makes a higher low), often a signal of exhausted bearish momentum, or at least a correction higher.

This is positive for short term sentiment and we look to set longs at good risk/reward levels for a further correction higher.

Further upside is expected although we prefer to buy into dips close to the 156.97 level.

Although the anticipated move higher is corrective, it does offer ample risk/reward today.

We look to Buy at 156.75 (stop at 155.72)

Our profit targets will be 159.47 and 160.55

Resistance: 159.10 / 160.55 / 162.00

Support: 154.40 / 151.10 / 149.30

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

EURJPY buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurjpy. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurjpy analysis. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade