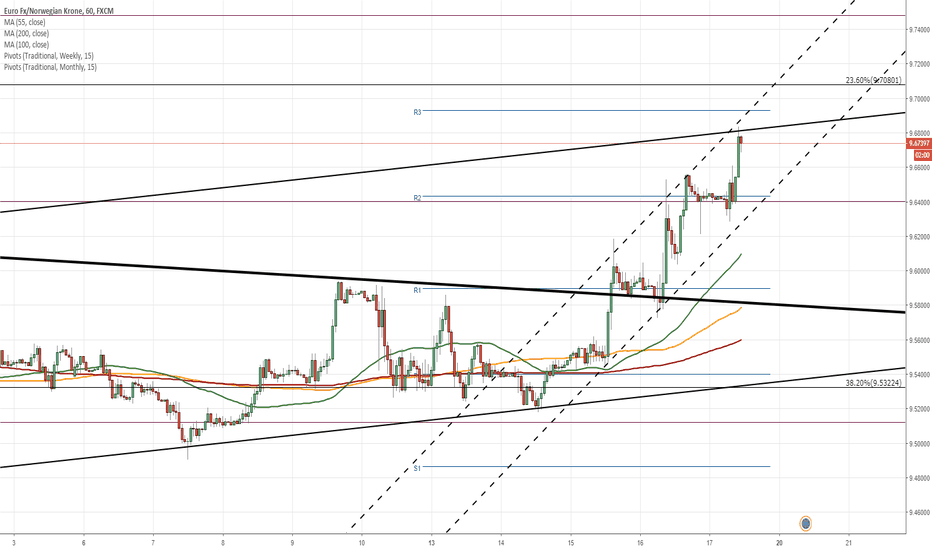

EUR/NOK 1H Chart: Pair shows signs of reversalThe most recent development of the EUR/NOK exchange rate is a breakout from the senior channel which occurred near 9.59 on August 16. This move has extended the pair’s three-day gain to 1.65%.

As a result, the Euro reached the upper boundary of a ten-week ascending channel at 9.68. Even though the price still continues to edge higher today, technical indicators are starting to point to a possible change in sentiment.

It is likely that a reversal south occurs soon, as the current three-day surge cannot be sustainable for long. It is likely that the pair makes a U-turn near the channel line and the 23.60% Fibonacci retracement somewhere in the 9.70 area. A possible downside target for the following sessions is the 55– and 100-period (4H) SMAs and the monthly PP at 9.50.

EURNOK

1W Channel Down. Long-term short.EURNOK has just posted a Lower High on the long term 1W Channel Down (RSI = 48.488, MACD = -0.015, ROC = -1.366). 9.500 is an important 1D support level and will be tested shortly to confirm the new bearish leg on 1D (now on neutral RSI, Highs/Lows). We are taking this opportunity to open a medium term short with TP = 9.38806.

EURNOK, 4H, AB=CDA really nice 1:1 AB=CD pattern was just completed on EURNOK 4h.

The only "warning" is the "fast" fall down to the D-point = Tight SL.

RSI is oversold as well but the more restrictive can wait for it to break up over 20 (or 30 for those who use that).

The risk is that you miss a large part of the movement. As always - your plan and what you have tested is what determines how you should

take a trade.

For that reason, that is according to My plan in these conditions, I only place 1 position in this case - ie. half the risk of a "normal" trade with 2 positions.

EURNOK 4HR SHORT OPPORTUNITYTrade what we see:

Price is following a bearish channel with lower highs forming.

We have two support lines to work off, one formed on the 4hr chart and the second formed on the daily time frame.

A pin bar is forming now and I am waiting to setup this short position which has a great risk / reward ratio.

If this pair breaks out and we see a successful retest, then there will be a good long bias.

EUR/NOK 1H Chart: Long-term triangle dominatesThe EUR/NOK exchange rate has been constrained by a descending triangle which was formed in November, 2017. After testing the upper boundary of this long-term pattern early in May, the common European currency began depreciating against its Norwegian counterpart, thus reaching its bottom boundary at 9.47, likewise reinforced by the monthly S2, mid-yesterday.

It is likely that some downward pressure still prevails during the remaining part of this week, given that the pair might be pressured lower by the combined resistance of the 55-, 100– and 200-day SMAs near 9.60. However, the general price direction should nevertheless remain upwards in line with the prevailing triangle pattern, with its upper boundary being located at 9.65.

EUR/NOK 1H Chart: Bounded in bearish patternsThe movement of EUR/NOK has been bounded in several patterns. Following a two-week period of appreciation, the pair bounced off the upper boundary of the senior channel and the 38.20% Fibonacci retracement at 9.70 and formed a new wave downwards. This movement has been relatively flat, as the Euro has since remained trading near the senior channel.

By mid-today, the pair was testing the combined support of the 55– and 100-hour SMAs and the 50.0% Fibo line at 9.61. The current positioning of the pair suggests that it should decline both in the short and medium term. The nearest target is the bottom boundary of the junior channel and the 61.8% Fibo at 9.52, while a downward-sloping trend-line circa 9.42 could be targeted within the following two weeks. The 9.60 area still needs to be breached to confirm this scenario.

Conversely, a breakout of the weekly PP and the 200-hour SMA at 9.63 is likely to result in a re-test of the senior channel circa 9.68.

EUR/NOK 1H Chart: Bullish in medium termAfter bouncing off the senior channel on January 29, the common European currency began a new up-wave and formed an ascending channel along the way. The rate tested this junior pattern two weeks ago prior to edging lower down to the 6.68 area where it is trading today.

A closer look at the pair’s previous movement demonstrates that the Euro has been successful at respecting channels. Thus, it is likely that the aforementioned junior channel is able to constrain the rate next week, as well. A possible target for the following sessions could be the upper boundary of a three-month channel in the 9.76/78 territory. The rate’s subsequent movement is likewise expected northwards in line with the senior channel.

On the other hand, if the 55– and 100-hour SMAs near 9.6710 do not hold, the pair might be poised for a fall down to the senior channel circa 9.60/62.

EUR/NOK 4H Chart: Surge in sight The Euro began weakening against the Norwegian Krone after reaching the upper boundary of a long-term ascending channel located at the nine-year high of 9.9880. The pair reached a one-year up-trend marked with the dotted line late in January and subsequently began surging in a steep upward movement. The pair was testing the 23.60% Fibo retracement (low and high at 8.7883 and 9.9949, respectively) and the 200-period SMA circa 9.70 today.

The current positioning of the pair suggests that the Euro might be due for a slight decline down to the 55– and 100-period SMAs and the trend-line during the following trading sessions prior to breaching the upper boundary of the aforementioned resistance area and accelerating towards the 9.90 mark.

EUR/NOK 1H Chart: Pair likely to breach triangle soonFollowing a southern breakout of a three-month ascending channel, the Euro started to weaken against the Norwegian Krone, thus resulting in a formation of an opposing channel. This pattern was likewise breached on Friday, thus leaving the rate in a symmetrical triangle—a pattern that has already reached its maturity.

Currently, the pair is stranded between the 200-hour SMA from above and the 55– and 100-hour SMAs and the weekly PP from below. Given the strength of the southern barrier, it is more likely that the former is breached. In order to confirm a surge, the pair should also breach the monthly S1 and the weekly R1 circa 9.7050. A possible upside target in this scenario could be the monthly PP circa 9.85.

On the other hand, the 9.56 area should limit further losses in case bears take the upper hand.

Target in aim EUR start to lose power and the cross want to go directly on the target delimited by the two supports in chart

A long term market pressure of - 11.7 confirm the downtrend

This analysis is based on market pressure.

On my twitter profile twitter.com you can find everyday the market pressure value for all crosses.

Have a nice trading !

EURNOK longIdea: Possible support and return long.

DISCLAIMER:

This is where I practice ideas and work on my trading techniques. Please note I am only providing my own trading information for insight to my trading techniques, you should do your own due diligence and not take this information as a trade signal. Trade at your own risk.

Update idea

EUR/NOK 1H Chart: Euro points to weaknessThe common European currency has been appreciating against the Norwegian Krone in an ascending since late September. This pattern has guided the pair up to the 9.9156 mark—its highest level during the past several years.

Apart from this channel, the pair is likewise trading in a junior one valid since November 21. Its slope is relatively steep; however, as apparent on the chart, the Euro has failed to initiate a solid wave up.

This suggests that a change in the bullish sentiment might occur soon. This assumption is likewise supported by technical indicators.

In terms of support, the pair might hinder near the 9.75 area near where the monthly PP, the 200-hour SMA and the weekly S1 are located.

EURNOK shortTwo target prices (blue lines), first is on bullish trendline, on which we must see to add more short or wait for another retest of highs.

If first support fails, we could see further weakness in EUR, before correction and retesting of now broken bullish trendline, on which I plan to add more shorts.

EUR/NOK 1H Chart: Pair tests triangleThe common European currency is trading against the Norwegian Krone in a channel up valid since mid-July. The latest test of its upper line occurred on October 31.

Along the way, the rate entered another patter—a descending triangle. The general characteristics of this pair suggest that the rate should break out to the upside.

The rate hindering near the upper triangle boundary might serve as an early indication of such a move. This scenario would set the Euro towards the upper boundary of a junior channel circa 9.56.

However, the rate has been stranded between the 55– and 200-hour SMAs for two sessions. A breach of one of these lines is likely to set the tone for the subsequent movement. In case the 200-hour SMA is breached, the aforementioned scenario should occur.

Conversely, a breach of the former should guide the pair towards the 9.43 mark in the short-term and possibly even lower.

EUR/NOK 1H Chart: Euro tests three-month highThe common European currency is trading in two ascending channels against the Norwegian Krone. The senior pattern formed around mid-August and has since stranded the rate in a slight upward momentum. The junior one, on the other hand, has been valid for two weeks, having provided two confirmations on each side.

Following a surge mid-Wednesday, the Euro is consequently trading with low volatility along the upper boundary of the senior channel circa 9.48. This level that is likewise a three-month high is supported by the monthly R1.

Given that the rate has shown reluctance to move past the given area, the pair might respect the boundaries of the senior pattern and move lower. However, the steepness of the junior channel suggests that this decline might actually be sideways until 9.42 is reached.

In case the pair reverses near this mark, it is likely that the Euro breaches the senior channel and surges up to 9.56 where the monthly R2 is located.