EUR/USD Hits Highest Level in Over Three YearsEUR/USD Hits Highest Level in Over Three Years

This morning, the euro surged above the 1.1300 mark against the US dollar for the first time since February 2022.

Throughout this week, the EUR/USD pair has broken through the highs of both 2023 and 2024.

Why Is EUR/USD Rising?

Amid the whirlwind of news surrounding the imposition and suspension of tariffs in US–EU trade, one dominant factor stands out — the sell-off of US bonds.

According to Reuters, long-term US Treasury bonds are being heavily sold this week. The yield on 10-year notes has jumped from 3.9% to around 4.4%, marking the steepest increase in yields since 2001. This may reflect a reaction by foreign holders of US debt to sanctions imposed by the White House, combined with growing uncertainty about the US economy — especially as recession fears gain more media attention.

As a result, the US dollar is showing weakness against a range of currencies, including the Japanese yen, Swiss franc, and the euro.

Technical Analysis of EUR/USD

The chart reveals a clear ascending channel (marked in blue), with the price repeatedly interacting with its upper, lower, and median boundaries — highlighted with markers and arrows.

Current bullish sentiment has pushed the pair towards the upper boundary of this channel. It’s possible this resistance line could halt further gains, potentially leading to a correction — perhaps down to the 1.11 level, which previously acted as a strong resistance point.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Eurodollar

Fundamental Market Analysis for April 11, 2025 EURUSDEUR/USD hit its highest levels in nearly two years on Thursday, breaking through and closing above 1.1200 for the first time in 21 months. Market tensions continue to ease after the Trump administration dropped its own tariffs at the last minute, causing a general weakening in US Dollar flows.

US consumer price index (CPI) inflation fell significantly short of forecasts in March. The core CPI fell to 2.8 per cent year-on-year, a four-year low after nearly eight months above 3.0 per cent. Core CPI inflation also fell to 2.4 per cent year-on-year. Investment markets will face a major challenge if the tariffs reverse the Federal Reserve's (Fed) multi-year efforts to curb inflation.

On Friday, the week will conclude with the release of the University of Michigan (UoM) Consumer Sentiment Index survey. The University of Michigan's consumer sentiment index is expected to decline again in April as consumers feel the pressure of the Trump administration's tariff and trade policies, and is likely to fall to a near three-year low of 54.5. In addition, expected consumer inflation data will be released on Friday, with UoM's 1-year and 5-year expected consumer inflation previously standing at 5% and 4.1% respectively.

Trade recommendation: SELL 1.1305, SL 1.1380, TP 1.1150

EU Tariff Relief Drives Euro Above $1.13The euro climbed above $1.13, its highest since September 2024, after the EU suspended new U.S. tariffs for 90 days to allow trade talks. This followed President Trump’s move to cut tariffs to 10% for non-retaliating countries while raising Chinese duties to 125%. While easing global slowdown fears, the mixed signals fueled uncertainty. Money markets adjusted ECB expectations, pricing the deposit rate at 1.8% by December, up from 1.65%, and lowered the probability of an April cut to 90%.

Key resistance is at 1.1390, followed by 1.1425 and 1.1500. Support lies at 1.1260, then 1.1180, and 1.1100.

FX Liquidity 'Worse Than Covid' Amid Tariff Shock. Long EUR/USD?Liquidity Seizes Up: Dealers Report Conditions 'Worse Than Covid' Amid Tariff Turmoil

The intricate plumbing of the global foreign exchange market, typically the world's deepest and most liquid financial arena, experienced a severe blockage in recent days, with dealers reporting liquidity conditions even more challenging than during the peak of the Covid-19 crisis in early 2020. Triggered by the sudden announcement of potential sweeping tariffs by former US President Donald Trump, the ability to execute large trades without significantly moving prices evaporated, creating treacherous conditions for market participants before a temporary pause on the tariff implementation offered a brief respite.

Reports indicate that available liquidity for a single transaction, or "clip," in major currency pairs plummeted to lows around $20 million. While this figure might still sound substantial, it represents a dramatic reduction from the norms in the multi-trillion dollar-a-day spot FX market, where clips of $50 million, $100 million, or even more could typically be absorbed with minimal market impact, especially in benchmark pairs like EUR/USD.

This liquidity drought occurred paradoxically alongside a spike in overall trading volumes. Both algorithmic trading systems and human traders on principal desks were highly active, reacting to the news flow and heightened volatility. However, this surge in activity masked a fundamental deterioration in market quality. High volume accompanied by low liquidity signifies frantic, often smaller, trades occurring across widening bid-ask spreads, with market makers unwilling or unable to provide firm quotes for substantial sizes. It's the market equivalent of a crowded room where everyone is shouting, but no one is willing to make a firm commitment.

Why 'Worse Than Covid'? Unpacking Dealer Sentiment

The comparison to the Covid-19 crisis is stark and revealing. The initial wave of the pandemic in March 2020 caused unprecedented volatility across all asset classes as the world grappled with lockdowns and economic shutdowns. FX liquidity certainly suffered then, with spreads widening dramatically. However, dealers suggest the current environment, driven by tariff uncertainty, felt different, and arguably worse, for several reasons:

1. Nature of the Shock: Covid-19, while devastating, was primarily a health crisis with economic consequences. Central banks globally responded with massive, coordinated liquidity injections and policy easing, providing a clear backstop (even if the initial shock was severe). The tariff announcement, however, represents a political and policy shock. Its potential impact is multifaceted – affecting inflation, growth, supply chains, corporate earnings, and international relations – and far harder to model. The policy path forward, including potential retaliation from other countries, is deeply uncertain.

2. Central Bank Reaction Function: During Covid, the playbook for central banks was relatively clear: provide liquidity and ease financial conditions. In response to potential tariffs, the central bank reaction is much less certain. Tariffs could be inflationary (raising import costs), potentially pushing central banks towards tighter policy, while simultaneously being negative for growth, which might argue for easing. This ambiguity makes it harder for markets to price in a predictable policy response, adding another layer of uncertainty that dampens risk appetite and liquidity provision.

3. Fundamental Uncertainty vs. Panic: While Covid induced panic, the underlying driver was identifiable. The tariff threat introduces deep uncertainty about the fundamental rules of global trade. This makes it exceptionally difficult for market makers, who provide liquidity, to price risk accurately. When risk becomes unquantifiable, the natural reaction is to withdraw, reduce quote sizes, and widen spreads significantly to avoid being caught on the wrong side of a large, unhedged position.

The Tariff Trigger: A Wrench in the Works

Donald Trump's proposal for a "reciprocal" or blanket tariff system, potentially starting at 10% on all imports with higher rates for specific countries, fundamentally challenges the existing global trade framework. The announcement immediately forced market participants to reassess:

• Inflation Outlook: Tariffs directly increase the cost of imported goods, potentially fueling inflation and impacting interest rate expectations.

• Economic Growth: Trade wars can disrupt supply chains, raise business costs, reduce export competitiveness (due to retaliation), and dampen consumer and business confidence, weighing on growth.

• Currency Valuations: Currencies of countries heavily reliant on exports to the US, or those potentially facing steep retaliatory tariffs, came under pressure. The US dollar itself experienced volatility as markets weighed the inflationary impact against the potential growth slowdown and risk-aversion flows.

This complex interplay of factors, combined with the political uncertainty surrounding the implementation and potential scope of such policies, created a perfect storm for volatility. Algorithmic systems, programmed based on historical correlations and data, struggled to navigate a potential regime shift driven by policy pronouncements. Human traders, facing heightened risk and uncertainty, became more cautious. Liquidity providers, facing the risk of being adversely selected (i.e., only trading when the market is about to move sharply against them), drastically reduced their exposure.

The Impact: Beyond the Trading Desks

The evaporation of liquidity has real-world consequences:

• Increased Transaction Costs: Corporates needing to hedge currency exposure for international trade face higher costs (wider spreads).

• Execution Risk: Asset managers rebalancing global portfolios find it harder and more expensive to execute large trades, potentially suffering significant slippage (the difference between the expected execution price and the actual price).

• Systemic Risk: In highly leveraged markets, poor liquidity can exacerbate sell-offs. Margin calls, as reportedly seen alongside the tariff news, can force leveraged players to liquidate positions rapidly into an illiquid market, potentially triggering a domino effect.

The temporary pause in the tariff implementation announced subsequently provided some relief, likely allowing liquidity to recover partially from the extreme lows. However, the underlying uncertainty hasn't disappeared. Until there is greater clarity on the future direction of US trade policy, the FX market is likely to remain susceptible to bouts of nervousness and reduced liquidity.

Should You Long EUR/USD Based on This? A Cautious No.

While the liquidity situation is dire and reflects significant market stress, using poor FX liquidity itself as a primary reason to take a directional view, such as longing EUR/USD, is generally flawed logic.

Here's why:

1. Liquidity is Not Direction: Market liquidity reflects the ease and cost of transacting, not necessarily the fundamental direction of an asset price. Poor liquidity is a symptom of high volatility, uncertainty, and risk aversion. While these factors can influence currency direction (e.g., risk aversion often benefits perceived safe-haven currencies), the liquidity state itself isn't the driver. Both buyers and sellers face the same poor liquidity.

2. Universal Impact: The reported liquidity crunch affected the global spot FX market. While specific pairs might have been hit harder at times, the underlying issue was broad-based risk aversion and dealer pullback, impacting EUR/USD, USD/JPY, GBP/USD, and others. It doesn't inherently favor the Euro over the Dollar.

3. Focus on Fundamentals and Sentiment: A decision to long EUR/USD should be based on a broader analysis of:

o Relative Monetary Policy: Expectations for the European Central Bank (ECB) versus the US Federal Reserve (Fed).

o Economic Outlook: Growth prospects in the Eurozone versus the United States.

o Risk Sentiment: Is the broader market mood risk-on (often favoring EUR) or risk-off (which can sometimes favor USD, though the tariff news complicated this)?

o Tariff Impact Analysis: How would the proposed tariffs, if implemented, differentially impact the Eurozone and US economies? Would potential EU retaliation harm the US more, or vice-versa?

4. Increased Trading Risk: Poor liquidity makes any trade riskier and more expensive. Spreads are wider, meaning entry and exit costs are higher. Slippage on stop-loss orders or take-profit orders is more likely. Executing large sizes is challenging. Therefore, even if you have a strong fundamental view to long EUR/USD, the current liquidity environment makes executing and managing that trade significantly more difficult and costly.

Conclusion

The recent seizure in FX liquidity, reportedly surpassing the severity seen during the Covid crisis onset, underscores the market's extreme sensitivity to geopolitical and policy uncertainty. The threat of sweeping tariffs injected a level of unpredictability that forced liquidity providers to retreat, even amidst high trading volumes. While the temporary pause offers breathing room, the fragility remains. For traders, this environment demands heightened caution, smaller position sizes, and wider stop-losses. Critically, basing directional trades like longing EUR/USD solely on the state of market liquidity is misguided. Such decisions must stem from a thorough analysis of economic fundamentals, policy outlooks, and risk sentiment, while acknowledging that poor liquidity significantly raises the cost and risk of executing any strategy.

Euro Steady as EU Retaliates on TariffsThe euro hovered around 1.0980 on Thursday, supported by rising trade tensions and renewed political stability in the Eurozone. Sentiment favored the currency after China raised tariffs on all U.S. goods to 84% from 34%, retaliating against Washington’s hike to 104% on Chinese imports. The European Commission also approved retaliatory tariffs on €21 billion worth of U.S. goods, including soybeans, motorcycles, and orange juice. The escalation pushed investors away from typical safe havens like the dollar and Treasuries. Political stability in Germany further supported the euro, as the CDU/CSU and SPD finalized a coalition, clearing the way for Friedrich Merz to become Chancellor next month. The ECB is also expected to cut rates by 25 basis points later this month.

Key resistance is at 1.1020, followed by 1.1100 and 1.1150. Support lies at 1.0880, then 1.0810 and 1.0730.

Dollar Under Pressure from Recessionary SignalsEUR/USD climbed about 80 pips to 1.1040 on Wednesday as the dollar index slipped below 105.5, marking a second day of losses. The U.S. dollar weakened amid growing fears of recession, triggered by President Trump's sweeping tariffs. China now faces a 104% levy, with Beijing vowing to "fight to the end." Market sentiment remained cautious as trade negotiations stalled, despite Trump’s outreach to major partners. Concerns that the escalating trade war may tip the U.S. into recession have increased expectations of further Fed rate cuts, weighing on the dollar.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.0900, then 1.0850 and 1.0730.

Market Analysis: EUR/USD Resumes IncreaseMarket Analysis: EUR/USD Resumes Increase

EUR/USD started a fresh increase above the 1.0950 resistance.

Important Takeaways for EUR/USD Analysis Today

- The Euro started a decent upward move from the 1.0880 zone against the US Dollar.

- There was a break above a key bearish trend line with resistance at 1.0955 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair started a fresh increase from the 1.0775 zone. The Euro cleared the 1.0950 resistance to move into a bullish zone against the US Dollar, as mentioned in the last analysis.

The bulls pushed the pair above the 50-hour simple moving average and 1.1000. Finally, the pair tested the 1.1150 resistance. A high was formed near 1.1146 before the pair corrected gains. It dipped below 1.1000 and tested 1.0880.

The pair is again rising from the 1.0880 zone. There was a break above a key bearish trend line with resistance at 1.0955. The pair climbed above the 50% Fib retracement level of the downward move from the 1.1146 swing high to the 1.0880 low.

Immediate resistance on the EUR/USD chart is near the 1.1045 zone and the 61.8% Fib retracement level of the downward move from the 1.1146 swing high to the 1.0880 low.

The first major resistance is near the 1.1080 level. An upside break above the 1.1080 level might send the pair toward the 1.1145 resistance. The next major resistance is near the 1.1165 level. Any more gains might open the doors for a move toward the 1.1200 level.

Immediate support on the downside is near the 1.0955 level. The next major support is the 1.0880 level. A downside break below the 1.0880 support could send the pair toward the 1.0830 level. Any more losses might send the pair into a bearish zone toward 1.0775.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Euro Firms as U.S.-China-EU Trade Rift WidensThe euro hovered near $1.10, its highest since October 2024, as the dollar weakened and trade tensions escalated. China plans to impose 34% tariffs on all U.S. goods from April 10, following Trump’s 10% tariff on all imports, including 20% on EU and 34% on Chinese goods. France urged firms to halt U.S. investments, and the EU is preparing countermeasures. Markets now price in a 90% chance of an ECB rate cut in April, with the deposit rate seen falling to 1.65% by December from 2.5%.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.0900, then 1.0850 and 1.0730.

Fundamental Market Analysis for April 8, 2025 EURUSDAfter a tense week in which the US fully adopted a protectionist trade policy - despite lacking the necessary industrial infrastructure - tariffs on imports were imposed. The US now applies a general 10 per cent import tax on all goods from each country, as well as various ‘reciprocal’ tariffs calculated by dividing US imports by exports. After imposing a 34 per cent tariff on Chinese products, China responded with its own 34 per cent tariff on all goods imported from the US. Unable to find alternative solutions, the Trump administration threatened to impose an additional 50 per cent tariff on all Chinese goods, which is set to take effect on April 8.

US data takes centre stage again this week, with the release of Consumer Price Index (CPI) data on Thursday. On Friday, producer price index (PPI) data and the University of Michigan (UoM) consumer sentiment survey are expected.

Investors are raising bets that the Federal Reserve (Fed) will begin cutting interest rates to reduce recession risks. Markets are factoring in nearly 200 basis points of rate cuts through the end of 2025, despite the Fed issuing cautious policy statements indicating that trade uncertainty complicates any potential rate cut.

Trade recommendation: SELL 1.0950, SL 1.1030, TP 1.0830

FXAN & Heikin Ashi Trade IdeaOANDA:EURUSD

In this video, I’ll be sharing my analysis of EURUSD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

"STOXX50 / EURO 50" Indices Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "STOXX50 / EURO 50" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑: (5450) Thief SL placed at the recent/swing high or low level Using the 2H timeframe swing / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 5200 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"STOXX50 / EURO 50" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 🔎👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/USD Daily Chart Analysis For Week of April 4, 2025Technical Analysis and Outlook:

The Euro has experienced a notable increase, surpassing resistance levels at 1.086 and 1.095 in the current trading session, thereby completing the Inner Currency Rally of 1.114. However, an intermediate price reversal has been observed, suggesting that the Eurodollar will continue to decline towards the support level at 1.090, with a potential extension down to 1.075. An upward momentum could emerge from either of these support levels.

EUR/USD Holds Neutral Bias After NFPThe U.S. dollar has managed to regain some ground in the short term after several sessions of gains in EUR/USD. Currently, the pair is showing a downward move of just over 1%, following the NFP report, which showed 228,000 new jobs versus the 137,000 expected. This has slightly increased demand for the U.S. dollar in recent hours, as the market anticipates the possibility of higher inflation and, consequently, more restrictive Fed policy in upcoming decisions.

Uptrend

Since February 28, a strong upward trend has been in place, showing a clear buying bias in EUR/USD. So far, selling corrections have not been strong enough to break key trendline levels, making this the dominant formation to watch in the short term.

RSI

In the case of the RSI, oscillations have started to approach the overbought zone near the 70 level. Additionally, it is important to note that while EUR/USD has posted higher highs, the RSI has shown lower highs, reflecting a bearish divergence and signaling a potential imbalance driven by strong short-term buying pressure. This could eventually lead to downward corrections in the sessions ahead.

Key Levels:

1.1000 – Major resistance: This level remains the most relevant round-number resistance on the chart. Sustained price action above this level could reinforce bullish momentum in the short term.

1.07911 – Near-term barrier: This level is located near the 200-period moving average and could serve as a tentative zone for future selling corrections.

1.06132 – Distant support: Positioned around the 38.2% Fibonacci retracement, this level marks a key breakpoint that, if reached, could invalidate the current bullish structure.

By Julian Pineda, CFA – Market Analyst

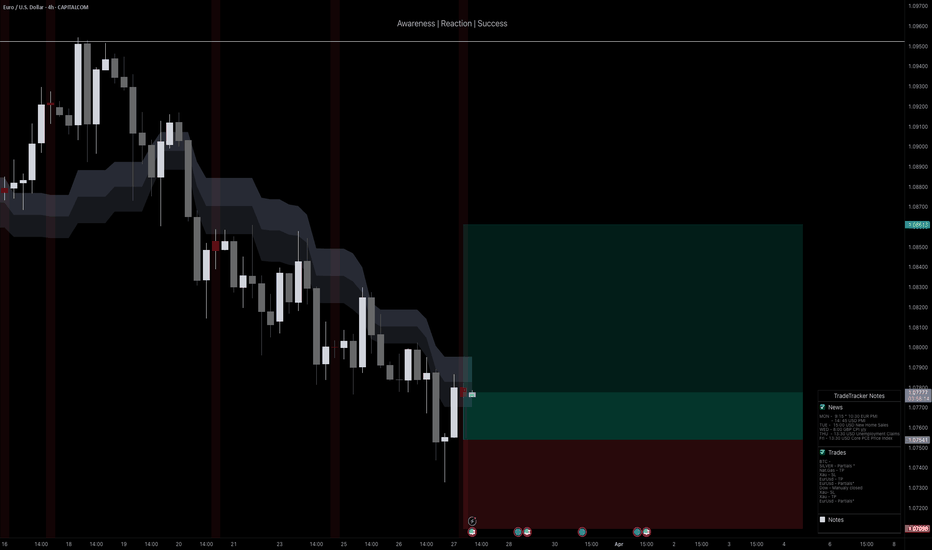

EUR/USD Long to Short idea (1.08500 up to 1.10500)EUR/USD (EU) Analysis – This Week

This week, EUR/USD looks promising, similar to GBP/USD, with multiple key points of interest (POIs) in close proximity.

A clean, unmitigated 2-hour demand zone sits nearby, which could trigger a bullish rally if price reacts from this level. At the same time, price has been bearish over the past few days, forming a valid 9-hour supply zone from the recent downward push. I’ll be watching to see where price slows down and which liquidity level it targets first.

Confluences for EU Buys:

EU has been bullish for weeks, and this move could be a healthy correction before further upside.

The U.S. dollar remains bearish, aligning with this bullish bias.

A clean 2-hour demand zone has formed, which previously caused a break of structure to the upside.

Imbalances and untapped Asia session highs still need to be taken.

Note: If price breaks below this structural low, I will shift my focus toward sell opportunities. However, if that happens, we’ll know exactly where the ideal entry points for shorts will be.

Euro Rises Above $1.09 Despite Tariff ThreatsThe euro climbed above $1.09, showing unexpected strength after President Trump announced 20% tariffs on all EU imports.

◉ Fundamental Rationale

● The currency got a boost because the U.S. dollar weakened. Trump’s tariffs made trade tensions worse and worried people about slower economic growth.

● Also, new numbers showed Eurozone inflation fell to 2.2% in March, the lowest since November 2024.

● This lower inflation means the European Central Bank doesn’t need to raise interest rates, making the euro more appealing to investors.

◉ Technical Observation

● From a technical perspective, an inverse head and shoulders pattern has formed, hinting at a possible trend reversal.

● A breakout above $1.095 could pave the way for stronger bullish momentum.

Fundamental Market Analysis for April 3, 2025 EURUSDEUR/USD saw a bullish spike on Wednesday after the Trump administration announced tariffs that were less severe than many investors expected given President Donald Trump's flurry of tariff threats over the past 72 days. While the specific tariff proposals are unclear, U.S. consumers should prepare for flat 10 percent tariffs on all imports, significant 25 percent tariffs on all automobiles and auto parts, and “reciprocal” tariffs imposed at different rates depending on the country.

In addition, Trump has reiterated his intention to impose additional tariffs on goods such as copper, microchips, and other important imported consumer goods that are vital to the U.S. economy. As these tariffs are likely to drive up consumer prices in the coming months and there is no obvious alternative in the market to obtain foreign goods without incurring high import duties, inflationary pressures are expected to rise soon and persist longer than desired. According to Federal Reserve (Fed) officials, the uncertainty of the Trump administration's trade policy is likely to keep interest rates elevated for an extended period beyond previous expectations.

European economic indicators are likely to remain moderately light for the rest of the trading week. Meanwhile, new US Non-Farm Payrolls (NFP) data is expected this Friday. The NFP report could have a significant impact on the markets as the US economy moves into a post-tariff phase, and the March labor statistics will be a key indicator of the impact of the Trump administration's tariff strategy.

Trading recommendation: BUY 1.09100, SL 1.08400, TP 1.10300

Euro at Critical Demand – Is the Trend About to Flip?Euro reached an important zone for my setup, triggering a long position. Although it’s still trending below the fibcloud on the 4H timeframe, we’ve seen a solid 0.5% recovery from the recent low. I’m looking for this area to hold as support, with defined risk in case the setup invalidates.

Technicals:

• Price tapped into a major 4H support level where liquidity historically steps in.

• The current move marks a 0.5% bounce from the low, showing early signs of demand.

• Still trading below the fibcloud, but a reclaim of that zone would open the path toward 1.0850.

• Setup includes a stop-loss below the most recent wick low, with a clear structure to build a higher low.

Fundamentals:

EUR-side strength:

• ECB maintains a slower pace of rate cuts compared to the Fed.

• Growth and inflation in the Eurozone are still challenges, but the ECB’s hawkish stance continues to support medium-term EUR strength.

• The ECB may hike another 150 bps to reach a 4% terminal rate, which favors EUR upside.

USD-side risks:

• Trump announced plans to impose a 25% tariff on all car imports, including from the EU-adding geopolitical and trade uncertainty.

• Traders remain cautious around further escalation in US-EU trade tensions.

• US Initial Jobless Claims later today could bring weakness to the dollar if the data disappoints.

In short, while the USD remains resilient, the EUR fundamentals and the current technical zone make this a compelling spot for a bounce.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Euro in trading range awaiting breakoutAs can be seen in the chart, the Euro is fluctuating within the trading range on the 15-minute timeframe. We wait for a breakout with a strong candle from either side and enter the trade in the direction of the breakout with a target equal to the width of the trading range and a stop loss behind the breakout candle.

EUR/USD Long setup from the 3hr demand zoneSimilar to GBP/USD, I’m looking for long opportunities on EU. My key area of interest is the 3-hour demand zone, where I will wait for price to mitigate and accumulate before entering a position.

Price has also changed character to the upside, further validating this demand zone as a strong point of interest. Additionally, there is a significant amount of liquidity to the upside that needs to be taken.

The next major supply zone I have marked out is the 23-hour supply zone, which is further away. For now, my focus remains on the demand zone—unless price breaks below, creating a new supply level.

Confluences for EU Buys:

- Bullish market structure shift, with a clean demand zone left behind.

- Unmitigated 3-hour demand zone, making it a strong area of interest.

- Liquidity resting above, which price is likely to target.

- DXY has been bearish, aligning with a bullish outlook for EU.

Note: If price breaks structure to the upside without tapping my nearby demand zone, I will either wait for a new demand zone to form or look for a sell-to-buy opportunity from supply.

EUR/USD Daily Chart Analysis For Week of March 28, 2025Technical Analysis and Outlook:

The Euro has experienced a downward trend in the current trading session, surpassing the Mean Support level of 1.078, where an intermediate price reversal occurred. The analysis indicates that the Eurodollar is expected to retest the Mean Resistance level at 1.086, with a possible resistance level marked at 1.095. A downward momentum may be initiated from either the Mean Resistance of 1.086 or 1.095.

Eur/Usd Mar/24 Weekly analyzeHello eveyone.

Price reject at W200 ma for 2 weeks and Closed below W 200 MA also this w open below W pivot so i'm gonna sell for this week

..............................

( This is an idea and entry-tp-sl placed for my own trade , you can change entry-tp-sl depends on your risk management )

Eurozone Growth Slows, ECB Leans DovishThe euro hovered near $1.08, its weakest since March 6, as investors digested PMI data and ECB comments. Eurozone private sector activity grew at its fastest pace since August but missed expectations, with manufacturing rebounding and services slowing.

ECB’s Cipollone and Stournaras signaled growing support for a rate cut, possibly in April, citing faster disinflation. Lagarde warned of weaker growth but downplayed inflation risks from EU-U.S. trade tensions, suggesting no rate hikes. De Galhau also noted room for further easing.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0730, with further levels at 1.0660 and 1.0600.

Market Analysis: EUR/USD RetreatsMarket Analysis: EUR/USD Retreats

EUR/USD declined from the 1.0950 resistance and traded below 1.0850.

Important Takeaways for EUR/USD Analysis Today

- The Euro started a fresh decline below the 1.0850 support zone.

- There is a key bearish trend line forming with resistance at 1.0820 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair struggled to clear the 1.0950 resistance zone. The Euro started a fresh decline and traded below the 1.0850 support zone against the US Dollar.

The pair declined below 1.0820 and tested the 1.0775 zone. A low was formed near 1.0776 and the pair started a consolidation phase. There was a minor recovery wave above the 1.0800 level. The pair tested the 23.6% Fib retracement level of the downward move from the 1.0954 swing high to the 1.0776 low.

The pair is now trading below 1.0820 and the 50-hour simple moving average. On the upside, the pair is now facing resistance near the 1.0820 level. There is also a key bearish trend line forming with resistance at 1.0820.

The next key resistance is at 1.0850. The main resistance is near the 1.0865 level or the 50% Fib retracement level of the downward move from the 1.0954 swing high to the 1.0776 low.

A clear move above the 1.0865 level could send the pair toward the 1.0910 resistance. An upside break above 1.0910 could set the pace for another increase. In the stated case, the pair might rise toward 1.0950.

If not, the pair might resume its decline. The first major support on the EUR/USD chart is near 1.0775. The next key support is at 1.0750. If there is a downside break below 1.0725, the pair could drop toward 1.0700. The next support is near 1.0650, below which the pair could start a major decline.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.