EUROUSD TRADING POINT UPDATE > READ THE CHAPTIAN Buddy'S dear friend

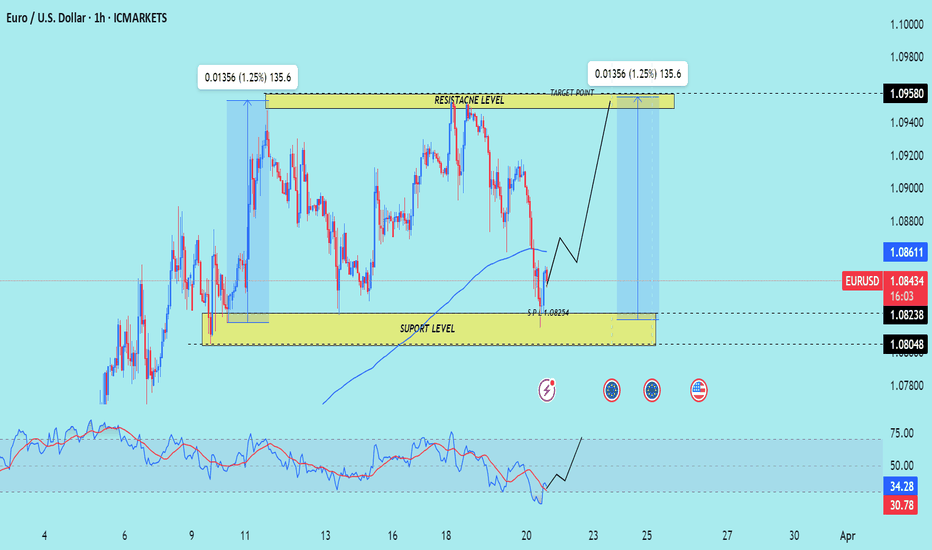

SMC Trading Signals Update 🗾🗺️ Euro USD Traders SMC-Trading Point update you on New technical analysis setup for Euro USD ) Euro USD Technical patterns support level pullback up trend 📈🚀 1.08254 strong 🪨 support level target 🎯 point Resistance level 1.09580 good luck 💯💯

Key Resistance level 1.09580

Key Support 1.08254

Mr SMC Trading point

Palee support boost 🚀 analysis follow)

Eurousd

EURUSD Bulls Eyeing FOMC–Will Powell’s Dovish Tone Fuel a Rally?As we approach the much-anticipated FOMC rate decision and Powell’s press conference , market sentiment is shifting, and EURUSD ( FX:EURUSD ) traders are closely watching for clues on the Federal Reserve’s next move . With recent economic data pointing to signs of slowing growth and cooling inflation, the Fed might adopt a more dovish tone , fueling further upside for EURUSD .

Key Factors Driving the Bullish Outlook :

Inflation & Economic Data : CPI and PPI data indicate a gradual cooling of inflation, which strengthens the case for a potential rate cut later this year. If Powell acknowledges this shift, it could weigh on the dollar.

Market Pricing of Rate Cuts : Investors are already pricing in multiple Fed rate cuts for 2024. A dovish Powell could accelerate these expectations, weakening USD and pushing the EURUSD higher.

------------------------------------------------------------------

Now let's take a look at the EURUSD chart on the 2-hour time frame .

EURUSD is moving near the Resistance zone($1.0983-$1.0916) and Yearly Resistance(1) .

Regarding Elliott Wave theory , it seems that EURUSD has managed to complete the main wave 4 . The structure of the main wave 4 is the Double Three Correction(WXY) .

The main wave 5 is likely to complete near the upper line of the ascending channel(possible) and Monthly Resistance(4) .

I expect EURUSD to rise in the coming hours to the targets I have indicated on the chart, although the Federal Reserve Conference could create long shadows , but I think the supply and demand zones will still work but still pay more attention to money management today .

Note: If EURUSD can break below the Potential Reversal Zone(PRZ) , there is a possibility of further decline in EURUSD.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S. Dollar Analyze (EURUSD), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EUROUSD TRADING PINT UPDATE >READ THE CHPATIAN Buddy'S dear friend

SMC Trading Signals Update 🗾🗺️ SMC-Trading Point update you on New technical analysis setup for Euro USD) Euro USD) Technical patterns choch looking for Bullish patterns support level 1.0866 Resistance level 1.09361 ) good luck guys 🤝

Key Resistance level 1.09361+ 1.09483

Key Support level 1.08802 - 1.08666

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

EUROUSD 4H LONG (ALL Targets DONE)This position worked perfectly.

Now it is important to wait for the correction structure, as it was indicated in the previous update post:

Considering the current formations on the 1D TF, the probability of price growth to the current maximum increases multiple times. Locally, I expect to see a price correction (a rollback next week) and preferably with a depiction of a bullish imbalance. After which, you can work long for a whole month until 1.12758

EUR/USD – Bullish, But Time to Breathe!🚀 EUR/USD – Bullish, But Time to Breathe! 🚀

“Momentum is strong, but even the best trends need to take a breath before the next leg up.”

🔥 Key Insights:

✅ Bullish Structure Intact – No reason to fight the trend.

✅ Overextended Move – Markets don’t go up in a straight line; pullbacks create better entries.

✅ Healthy Retracement = Stronger Continuation – Chasing here is risky, waiting for a dip is smart.

💡 The Plan:

Wait for a Pullback Before Longs – Let price reset, don’t rush in.

Watch Volume Profile & CDV for Buyer Confirmation – Smart money leaves clues.

Ideal Entry = Lower Support Levels Holding – We want a strong base for the next move up.

“Patience is key. Let the market give you the perfect entry—not every green candle is a buy!” 🚀💶

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

EUROUSD 4H LONG (3 Targets DONE)Re-opening in the specified block after confirmation of the level of $1.03744 brings 3 targets for the position.

Considering the current formations on the 1D TF, the probability of price growth to the current maximum increases multiple times. Locally, I expect to see a price correction (a rollback next week) and preferably with a depiction of a bullish imbalance. After which, you can work long for a whole month until 1.12758

EUR/USD: Ascending Triangle Formation Points to Liftoff!● The EUR/USD pair tried to climb above 1.0530 but got pushed back, slipping lower.

● However, the charts are hinting at a potential breakout with an Ascending Triangle pattern forming.

● If the pair can finally break through 1.0530, it could spark a rally toward 1.0600.

● Stay tuned; the next move could be explosive! 🚀

Will We See the Euro Trading Below Par?CME: Micro EUR/USD Futures ( CME_MINI:M6E1! ) #Microfutures

Since the US election last November, the Euro currency has lost ground against the US dollar, with the EUR/USD exchange rate sliding from 1.08 to as low as 1.02.

A combination of new policies from the Trump administration aims to strengthen the dollar. Recent efforts to end the geopolitical crisis will not support the euro. On the contrary, they could push the European common currency below the critical 1-dollar level.

Quick Review of the EUR/USD Price Trend

The euro has swung widely against central bank policies and geopolitical events:

• 2020: The Fed implemented massive stimulus measures in response to the pandemic. Lowering interest rates and increasing money supply reduced the value of the USD

• 2021: The faster vaccine rollout and quicker reopening of the US economy boosted economic growth and investor sentiment towards the USD

• 2022: (1) The Fed raised interest rates to combat inflation, making the USD more attractive to investors compared to the Euro. (2) Europe faced an energy crisis due to its dependence on Russian gas. This crisis led to economic uncertainty and weakened the euro. (3) Ongoing geopolitical tensions created economic instability in Europe, further weakening the euro against the USD

• Q4 2022 and 2023: European Central Bank abandoned its long-held zero-rate policy in September 2022. It raised rates eight times to 4.00%. These actions narrowed the interest rate differentials between the US and Europe, and helped the euro rebound

• 2024: The EUR/USD moved mainly sideways in the range of 1.06 and 1.12. Fed easing and rebounds of US inflation contributed to the mild volatility.

• Q4 2024 to Current. Dollar ascended quickly after the election win of Donald Trump. Investors expect strong dollar with the support of the new America First policies

Ukraine Peace Talks and Possible Outcomes

On February 12th, Presidents Trump and Putin agreed to immediately start negotiations to end the ongoing conflict in Ukraine. On February 18th, US and Russian officials held peace talks in Saudi Arabia. The two sides agreed to create a high-level team to lead the Ukraine peace talks. Neither Ukraine nor the EU participated in the meeting.

How the peace talks would progress remain highly uncertain. Using Game Theory, we could break them down into two mutually exclusive and collectively inclusive outcomes:

• Peace: US, Russia, Ukraine and the EU sign a peace agreement to end the conflict and ensure long-lasting peace. Whether it will be a fair treaty is a hotly debated topic.

• No-Peace: Peace talks break down. The 3-year-long conflict continues. This could last for years but eventually will lead to a win/loss outcome or a draw.

From an investing perspective, “No-Peace” is equivalent to “Risk On”. It may imply higher gold prices, higher energy costs and lower equity value. Meanwhile, “Peace” means “Risk Off”. We may see declining gold, lower oil and gas, and rising stock prices.

However, it would be difficult to pick the price direction if we can’t predict the outcome.

Peace or No Peace – A Steep Cost for Europe

For better or worse, the recent events are a wakeup call to European countries.

The US had defense spending totaling $967 billion in 2024, which is 3.49% of its GDP. For a comparison, the total defense spending for EU member states reached $358 billion in 2024. This represents around 1.9% of the EU's GDP

• The US accounted for 73% of the defense spending in the 32 countries in NATO

• Since 2022, the US contributed to 2/3 of all the financial aids sending to Ukraine

The US administration intends to cut its financial support. Europe will have to increase defense spending dramatically. In a worst case, a complete breakdown in Cross-Atlantic relations could see the US exiting NATO and all US troops withdrawing from Europe.

How much is the spending gap? In 2024, Russia had defense budget of $462 billion, or 6.7% of its GDP. Ukraine had defense budget of $40 billion, or 22% of its GDP.

• EU plus Ukraine spent $64 billion less than Russia in defense budget.

In my opinion, in a Peace scenario and with reduced US involvement, the EU defense budget must surpass that of Russia to ensure Ukraine to stay on top. I find this to be 2.5% of GDP. This means a 32% increase or $471 billion in total defense spending.

For No-Peace, the EU will be fighting an active war. NATO will need to maintain a standing army of 1 million troops and rebuild an entire defense industry. In this scenario, I feel that the defense budget needs to double 5% of GDP. budget to raise a large army and rebuild an entire defense industry. This means a 163% increase or $942 billion in total defense spending.

If the above numbers sound outrageous, Israel, a country constantly fighting for its survival, will serve as a good refence point. In 2024, Israel's defense spending amounted to 117.5 billion Israeli shekels (around $32.5 billion USD), which is 6.7% of its GDP.

The EU has an estimated GDP growth at 0.9% in 2024 and a forecast growth of 1.5% in 2025. The defense budget increase will cause mandatory cuts in non-defense spending. The combined effect will be negative, pushing GDP growth into a negative territory.

In my opinion, re-arming Europe is critical to its survival. However, defense buildup comes at a steep cost. The expectations of lower GDP growth will push the value of Euro currency lower, likely below the 1-dollar critical level.

Commitment of Traders shows diminishing bullish sentiment

The CFTC Commitments of Traders report shows that on February 11th, total Open Interest (OI) for CME Euro FX Futures is 622,873 contracts. “Asset Manager” (i.e., hedge funds) own 338,182 in Long, 177,937 in Short and 35,597 in Spreading.

• While they maintain a long-short ratio of 1.9:1, hedge funds have reduced long positions by 1,014 while increasing short positions by 2,249.

• This indicates that “Smart Money” is becoming less bullish on the Euro.

Trade Setup with Micro Euro/USD Futures

If a trader shares a similar view, he could express his opinion by shorting the CME Micro Euro/USD Futures ($M6E).

M6E contracts have a notional value of 12,500 euro. With February 19th settlement price of 1.0435, each March contract (M6EH5) has a notional value of $13,044. Buying or selling one contract requires an initial margin of $260.

Hypothetically, a trader shorts March M6E contract and the euro drops to $0.99. A short futures position would gain $668.75 (= (1.0435 – 0.99) x $12500). Using the initial margin as a cost base, a theoretical return would be +257% (= 668.75 / 260).

The risk of shorting euro futures is rising euro. Investors could lose part of or all their initial margin. A trader could set a stop loss while establishing his short position. In the above example, the trader could set a stop-loss at 1.06 when entering the short order at 1.0435. If euro rebounds, the maximum loss would be $206.25 ( = (1.06 – 1.0435) *12500).

To learn more about all the Micro futures and options contracts traded on CME Group platform, you can check out the following site:

www.cmegroup.com

The Leap trading competition, #TheFuturesLeap, sponsored by CME Group, is currently running at TradingView. I encourage you to join The Leap to sharpen your trading skills and put your trading strategies at test, competing with your peers in this paper trading challenge sponsored by CME Group.

www.tradingview.com

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

DXY - Looking to Big PictureWhen we look back, when Trump first came, Dxy showed a 5.5% increase, Dxy goes to 103.5. And Trump Dxy is too expensive, the dollar is too expensive, it should fall, the statements started. Then Dxy's 14% decrease went to 88.5. Now Dxy is around 102.

I bought it directly as a fractal from August 15, 2016. If Dxy comes to around 104 until the election, the rapid increase with Trump's arrival corresponds to 110s. It has been an expected area for a long time and when Trump Dxy is at 110s, similarly, if the decrease starts with him saying the dollar is too expensive, it goes to 94s, fractal.

Here, my hopes begin and I say that it is still expensive at those levels, we will go down to 86s. This means a 4-year never-ending mega bull.

I applied the same fractal to the euro, and the much-anticipated 1.02s are here again. If I can get a fund, I will look for swing shorts at 1.12s. The fractal and events looked pretty good to me. It also fit the channel nicely.

FX:EURUSD

EUR/JPY Tests Key Resistance: Breakout or Pullback?EUR/JPY Analysis

Key Resistance Zone:

The price is currently testing a key resistance zone near the 164 level, which has previously acted as a strong barrier. A successful breakout above this zone could signal further bullish momentum.

Rising Trendline Support:

The price has consistently found strong support from the ascending trendline, confirming the overall bullish structure of the market.

EURO/USD Analysis UpdateI hope you are well.

Based on the previous analysis that was done and as expected, the 4H high was broken and now the 4H trend is bullish which will facilitate the daily pullback.

The 4H swing high has broken through the candle body and has been confirmed.

The 15-minute trend that caused this impulsive price move on the 4-hour timeframe is in an uptrend and continues to maintain its uptrend.

We should not look for entry opportunities now, if you are a swing trader and are looking for high risk/reward we should wait for the 15 minute trend to turn down until the 4 hour structure has a pullback.

In the pullback of the 4 hour structure we can look for entry opportunities in the areas marked in the discount area, of course, on the condition that the 15 minute trend turns bullish again in that area.

Regards ❤️

Market Analysis: EUR/USD Starts IncreaseMarket Analysis: EUR/USD Starts Increase

EUR/USD started a decent upward move above the 1.0350 resistance.

Important Takeaways for EUR/USD Analysis Today

- The Euro found support and started a recovery wave above the 1.0360 resistance zone.

- There is a key bullish trend line forming with support near 1.0395 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair started a fresh increase from the 1.0265 zone. The Euro climbed above the 1.0310 resistance zone against the US Dollar.

The pair even settled above the 1.0350 resistance and the 50-hour simple moving average. Finally, it tested the 1.0435 resistance. A high is formed near 1.0434 and the pair is now consolidating gains. There was a minor decline below the 23.6% Fib retracement level of the upward move from the 1.0266 swing low to the 1.0434 high.

Immediate support is near the 1.0395 level. There is also a key bullish trend line forming with support near 1.0395. The next major support is at 1.0350 and the 50% Fib retracement level of the upward move from the 1.0266 swing low to the 1.0434 high.

If there is a downside break below 1.0350, the pair could drop toward the 1.0310 support. The main support on the EUR/USD chart is near 1.0265, below which the pair could start a major decline.

On the upside, the pair is now facing resistance near 1.0435. The next major resistance is near the 1.0450 level. An upside break above 1.0450 could set the pace for another increase. In the stated case, the pair might rise toward 1.0550.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURO/USD multi timeframe analysis

The monthly trend for EUR/USD remains bullish.

However, with the weekly timeframe trending downward, the market has entered a pullback phase on the monthly timeframe. While the weekly highs remain protected, it’s important to note that the deeper the weekly pullback penetrates into the monthly bullish structure, the higher the likelihood that the pullback will conclude.

Identifying the End of the Weekly Pullback

The weekly pullback is considered over when the daily timeframe structure shifts to bullish and successfully breaks above the weekly high. In this case, however, the daily structure turned bullish only to facilitate the weekly pullback toward the protected high. When the daily structure subsequently turns bearish again, it aligns with the primary bearish trend of the weekly timeframe.

Current Market Outlook

At present, the daily structure is bearish. The 4-hour structure, however, has turned bullish, which supports the expectation of a daily pullback. For this scenario to remain valid, the 15-minute structure must continue to hold a bullish trend and eventually break through the protected 4-hour high, thereby confirming the bullish shift in the 4-hour structure.

Let's get closer:

Trade Bias and Triggers

As long as the 15-minute structure stays bullish and successfully breaks the protected 4-hour high, the bias remains in favor of taking buy trades during the daily pullback. The ideal trigger for this bias is a sustained bullish 15-minute structure that leads to a confirmed breakout of the 4-hour high, making the 4-hour structure fully bullish.

Regards ❤️

#EURUSDEUR/USD Update, The pair continues its upward trajectory, driven by improving Eurozone sentiment and USD softness. Bulls are eyeing a key breakout above , potentially targeting . Support holds firm near , offering a solid risk-reward setup. Keep an eye on macro data for further momentum. #EURUSD #ForexAnalysis #Trading

EUR/USD Short term short to long idea pending...This week, my focus for EUR/USD is on the supply zone near 1.05800. I anticipate a reaction from this level, making it a key area for potential sells at the start of the week. Following this initial move, I expect a bullish rally to develop midweek.

If the price drops to 1.05200, aligning with my 11-hour demand zone, I’ll shift my focus to potential buys. After receiving valid lower-timeframe confirmations, I plan to target the nearest liquidity pool to the upside as the price resumes its bullish trend.

Confluences for EUR/USD Sells:

Shift in Market Character: Price has shown signs of a downside reversal, suggesting a potential sell-off.

Unmitigated Supply Zone: A clean 2-hour supply zone remains untapped.

Liquidity Below: There’s significant liquidity to the downside that price may target.

Trend Recalibration: Despite the overall bullish trend, a pullback is necessary for continuation.

Note: If the supply zone at 1.05800 fails to hold, it will further confirm bullish momentum. In this case, I’ll wait for a nearby demand zone to form, providing an opportunity to capitalize on the move to the upside. Patience will be key in this scenario.

EUROUSD CHART LOOKOUTThe Euro might experience brief upward corrections in the near term, driven by temporary factors such as market sentiment or short-term economic data. However, the broader outlook suggests a downward trajectory, reflecting underlying challenges such as weaker growth prospects, policy divergences, or geopolitical pressures. While volatility is expected, the dominant trend leans toward a decline.

EURUSD: Will It Retrace to POI?Our philosophy focuses on simplicity and precision, avoiding cognitive overload.

On the daily chart, EURUSD is trading within Range Zone.

If another daily candle closes bullish above $1.086 (the Daily Range Bottom), it could push the price up to the Range Top at $1.1, which is our Daily Point of Interest (Daily POI).

The Mid Daily Range may act as minor resistance on this move.

If EURUSD falls below the Daily Range Bottom, it enters a bearish zone, with the next target around Key Daily Level 1↓ at $1.066.

Alternatively, a bullish breakout above the Daily Range Top could extend gains to the Minor Daily Level at $1.112.

Though, this scenario is secondary as long as EURUSD remains within the Daily Range Zone.

EURUSD Analysis==>>Ascending Broadening Wedge Reversal Pattern!EURUSD ( FX:EURUSD )has managed to form an Ascending Broadening Wedge Reversal Pattern near the Resistance zone($1.0980-$1.0912) and Yearly Pivot Point .

Also, Regular Divergence (RD-) between Consecutive Peaks .

I expect the EURUSD to attack the Support zone($1.0816-$1.0775) again in the coming hours.

Euro/U.S.Dollar Analyze (EURUSD), 1-hour Time frame ⏰.

🔔Be sure to follow the updated ideas.🔔

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Euro Declines Slightly - What Direction for Investors?Hello everyone,

Today, the Euro/USD exchange rate is recorded at approximately 1.05 USD for each Euro. On this day, the exchange rate has seen a slight decline of about 0.09% compared to the previous trading session.

The ECB has maintained a tight monetary policy to combat inflation, but I believe the bank may adjust its policy if economic data does not show positive trends. This creates pressure on the Euro. Additionally, recent economic data from the Eurozone indicates a sluggish recovery, particularly in the manufacturing and services sectors. This has diminished investors' confidence in the recovery potential of the European economy.

In the near future, the fluctuations in the Euro exchange rate may depend on new policies from the ECB and the economic developments in Europe. If the USD strengthens, the Euro will face downward pressure in the upcoming period.

EURUSD Analysis==>>Inverted Head and Shoulders Pattern!!!EURUSD ( FX:EURUSD ) is moving near the Upper line of the Descending Channel , Support zone($1.0816-$1.0775) , and Support lines .

Regarding Classic Technical Analysis , EURUSD has already broken the Neckline of the Inverted Head and Shoulders Pattern ( Bullish Reversal Pattern ).

Also, Regular Divergence (RD+) between Consecutive Valleys .

I expect EURUSD to rise to at least the width of the descending channel after breaking the upper line of the descending channel and SMA(100) and then attacking the Resistance lines .

⚠️Note: If EURUSD goes below $1.075, we must wait for more dumps to at least $1.069⚠️

Euro/U.S.Dollar Analyze (EURUSD), 1-hour Time frame ⏰.

🔔Be sure to follow the updated ideas.🔔

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EUR/USD Pauses After Four-Day Slide as USD Rally EasesThe EUR/USD pair takes a breather on Friday, following a prolonged four-day losing streak, as the US Dollar's (USD) strong rally shows signs of slowing. The Euro attempts to stabilize after a tough week, with the pair hovering slightly higher, supported by a momentary pause in the USD’s upward momentum. Despite this pause, the outlook for the Greenback remains positive, particularly after Thursday’s encouraging US economic data, which continues to reinforce the idea of a resilient American economy.

USD Momentum Eases After Strong Economic Data

The US Dollar has experienced a robust run in recent weeks, driven by a strong economy and expectations of higher interest rates from the Federal Reserve. However, the rally took a pause on Friday, despite the release of better-than-expected US economic data. September’s Retail Sales increased by 0.4%, surpassing market forecasts, while the Initial Jobless Claims for the week ending October 11 came in lower than anticipated at 241,000, compared to an expected 260,000. These figures underscored the strength of the US labor market and consumer spending, further bolstering the Federal Reserve’s stance on maintaining elevated interest rates.

Even though the positive data continues to favor the USD, the currency’s upward trajectory has temporarily slowed, allowing the EUR/USD pair to consolidate after a sharp decline earlier in the week. This pause in the Greenback's rally offers the Euro some relief, though the broader trend remains USD-favorable in the near term.

Technical Outlook: EUR/USD Prepares for a Potential Rebound

From a technical standpoint, the EUR/USD pair is showing early signs of a potential bullish rebound. The pair has bounced from a critical demand area, suggesting that buying interest is emerging at these lower price levels. Furthermore, the Commitment of Traders (COT) report reveals a significant divergence between retail and institutional sentiment. While retail traders remain predominantly bearish, large institutional investors—commonly referred to as "smart money"—have begun to increase their long positions on the Euro. This discrepancy in positioning could signal a reversal in market direction, potentially favoring the Euro in the near term.

Seasonality patterns also support a possible recovery in the EUR/USD, as historical data suggests that the Euro tends to perform well during this period of the year. Taken together, the technical indicators and seasonal trends point toward a possible bullish setup, where traders might look to enter long positions, anticipating further upside movement.

Conclusion: EUR/USD Seeks Stability as USD Rally Temporarily Stalls

The EUR/USD pair has found some much-needed support after several days of losses, as the relentless USD rally slows down following strong US economic data. Despite the positive fundamentals supporting the Greenback, technical indicators hint that the Euro may be on the verge of a recovery. The rebound from key demand levels, coupled with institutional long positioning and supportive seasonality, suggests that the EUR/USD could be setting up for a bullish move. Traders should remain vigilant, as the pair’s next move will depend on evolving market conditions and the upcoming data releases that could further influence the direction of both currencies.

✅ Please share your thoughts about EUR/USD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.