EUR TRY

The Turkish lira is struggling to defend itself against the euroThe Turkish lira is struggling to defend itself against the euro but in recent sessions, its seen slightly rebounding. The reason for the rebound was the recently rolled out stimulus measures to cushion the blow of COVID-19 to the Turkish economy. The number of coronavirus cases in Turkey recently saw a big spike, recording more than 500 new cases just yesterday. The massive surges raise the number of infections to about 2,433 as of writing. While the death toll in Turkey reaches 59. Turkish Health Minister Fahrenttin Koca said that among the 5,000 plus tests that were conducted, it was found that about 561 people were infected by the deadly virus. While in Europe, leaders from the region ditches austerity to help fight the pandemic with full force in terms of cash. A French official said that the countries in Europe are failing to communicate through the response measures, this leaves space for vulnerability for the single currency.

EURTRY - DAILY TECHNICAL ANALYSIS - FOREX - EUR TRY EURTRY has seen a very long and very nice up trend. Not long ago we saw some break down in that up trend. As I see it, price action looks to give a 'failure to continue trend' signal as it attempted a short up trend here recently. Red line was the optimal entry, I doubt we will see that level again but we may and in my opinion its still not too late to find a short position. If I were short I would take profits at lines bellow entry with stop at previous high.

Clearly not financial advice.

Bullish breakout for EUR/TRY.Hi traders,

wanted to share with you my chart Analysis. The whole first week of February saw EUR/TRY in a down trend, creating a triangle where at the base we have an area of confluence with the trendline formed in the begining of the year (9th of Jan). Week wise and day wise pair is in a long uptrend.

At the beginning of a Friday session (Europe) we saw tweezers bottom/chopsticks candle pattern (on 30min chart) at the area of confluence giving a clear signal of a change in direction of the trend,eating all the shorts on the way - resulting in catapulting of the price up with a text book example of a bullish breakout.

Perfectly following the description of a bullish breakout out of a triangle, price ascended the same amount as the height of the triangle. Price then pulled back to the broken trendline that became the support.

I closed my longs on top of the chart, and will initiate longs for the following weeks, with a good entry. In my opinion we have a begining of a longer term uptrend.

Thank you for reading.

Lukas

Watch for downside consolidation breakout in EURTRY and USDTRYThere is a potential to trade a downside breakout of the consolidation (lira continues to increase) into wedge/triangle support.

The price target is the rising trendline on both the USD/TRY (near 5.75) and EUR/TRY (just above 6.4). A stop loss goes above the consolidation.

The reward:risk is 1.25:1 to 1.5:1, but over a week or two the rollover would add to the potential profit.

The Turkish lira interest rate is 11.25%. The US rate is 1.75% and the EUR rate is 0%. The short trade picks up the interest rate differential. A long trade pays the interest rate differential. I am not interested in the long, only the short, if it materializes.

EUR/TRY trend turning upwardSuddenly, the Turkish lira is experiencing accelerating weakness. EUR/TRY, for example, has been spinning higher lows and higher highs include this week's fresh breakout. These runs usually continue until some dramatic flourish with the Turkish lira losing a LOT within minutes. I won't be surprised to see a 10%+ move in the coming weeks. Note that those climactic moves are often fadeable.

Analysis of EURTRY 17.10.2019The price above 200 MA, indicating a growing trend.

The MACD histogram is above the zero lines.

The oscillator Force Index is above the zero lines.

If the level of resistance is broken, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Long Position

• Entry Level: Long Position 6.5500

• Take Profit Level: 6.0000 (500 pips)

If the price rebound from resistance level, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Short Position

• Entry Level: Short Position 6.4800

• Take Profit Level: 6.4600 (200 pips)

USDJPY

A possible long position at the breakout of the level 108.90

GOLD

A possible short position in the breakdown of the level 1476.00

USDCHF

A possible long position at the breakout of the level 0.9910

EURUSD

A possible long position at the breakout of the level 1.1095

EURTRY Ausbruch verliert etwas an DynamikNach dem Ausbruch aus dem Abwärtsdreieck pendelt der Kurs leider seit mehreren Tagen um die 6.50 herum.

Die fehlende Dynamik lässt meine "Conviction" etwas schmelzen.

Dennoch bleibt bis auf weiteres das Long Szenario weiter aktuell.

Die politische Lage ist weiter sehr undurchsichtig. So unangenehm es klingt aber der erste Impuls, dass der angezettelte Krieg schlecht für Wirtschaft und Währung ist, könnte sich als übertrieben herausstellen und gegebenenfalls sogar ins Gegenteil umschlagen.

Bullishes Szenario definitv beendet bei Kursen um 6.20

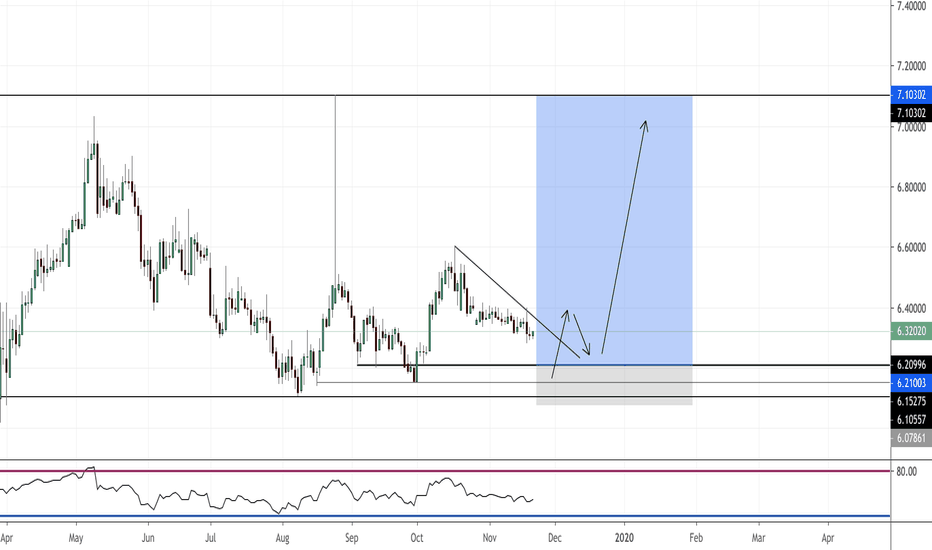

EURTRY breakout happenedRoughly one month ago I pondered about a breakout of the turkish lira.

Now it seems this scenario might happen.

Breakout of downward trending line is clearly visible. Move is probably backed by geopolitical tensions directly involving Turkey and economic threats being issued by the US against the country.

In the most optimistic case, we could see prices of 8 and above again.

Timeframe 3 months.

If price dips again under 6.20, the scenario clearly didn't play out.

This is also where I would put my stop

EUR/TRY - Bullish Setup in a yearly symmetrical triangleFX:EURTRY

*** DISCLAIMER ***

Any and all commentary, research, analyses, or other information published by me on this website are provided as general market commentary, and do not constitute investment advice nor a solicitation and there are no guarantees associated with them. I am not liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

****************************

The price did a false breakout just yesterday and then re-entered in the symmetrical pattern (11 months old) with a long 4H candlestick.

In my opinion the plan is to wait a retracement on the lower base of the triangle and wait for an engulfing or pin bar pattern, just to have a confirmation of the bullish pressure.