EUR/USD 4H | Bearish Retest Before Drop? The EUR/USD pair has broken below an ascending channel, signaling a potential bearish trend. After the breakdown, price is now retesting the previous support as new resistance, creating a sell opportunity.

🔎 Key Observations:

✅ Resistance Zone: The 1.08392 - 1.08411 level is acting as a strong resistance after the breakdown.

✅ Sell Confirmation: A rejection from this resistance level will confirm the bearish move, with 1.06773 as the next target.

✅ Bearish Expectation: If price fails to reclaim the broken trendline, further downside momentum is expected.

📌 Trading Plan:

🔻 Look for bearish price action signals (e.g., rejections, bearish engulfing candles) at the retest area.

🔻 A confirmed sell setup can target 1.06773 as the next support zone.

🚨 Risk Management Tip: Use stop-loss above 1.08500 to protect against invalidation.

💬 What are your thoughts on this setup? Are you looking for shorts or waiting for more confirmation?

Eurusd-chart

EURUSD - INTRADAY IDEAThis EURUSD chart is according to the H1 timeframe - GOLDEN FIB ZONE ALONG WITH THE DEMAND.

Execute the price at the exact price mentioned, NO FOMO.

💡KEEP IN MIND💡

I am not a financial advisor and do not contribute to any of your losses or profits. To be safe, I recommend that you risk only 0.1 - 0.2% for the first week or 10 days, as no one can predict the market.

🚀Follow, I will drop daily 2-5 Intraday Charts🚀

EUR/USD Market Trends: Insights and ForecastsRecent Movement: The price has been relatively volatile in the recent period, with several ups and downs. Currently, the price is trading slightly above the key support level around 1.0825.

Support and Resistance: The horizontal lines drawn on the chart suggest potential support and resistance levels. A break above the nearest resistance level around 1.0850 could signal further upward momentum, while a break below the support level around 1.0825 could indicate potential weakness.

Trend: It is difficult to definitively identify a clear trend based on this timeframe. The price has been fluctuating between support and resistance levels, suggesting a potential sideways or ranging market.

Short-Term (Next Few Days): The price is currently near a key support level. If it holds above this level, we might see a retest of the resistance level around 1.0850. However, a break below the support could lead to further downside.

Medium-Term (Next Week): The overall trend remains unclear. A sustained move above the resistance level could signal a bullish bias, while a sustained move below the support level could indicate a bearish bias

EURUSD H4 27 March 2024🇪🇺 EUR/USD, H4 🇺🇸 27 March 2024

The EUR/USD pair experienced a modest retracement after bouncing back from its recent low around 1.0800. This retracement was driven by a strengthening of the dollar yesterday, supported by upbeat U.S. economic data. In contrast, the euro lacked significant catalysts for further gains. Moreover, with the euro's Consumer Price Index (CPI) being lower than that of the U.S. and UK, market expectations of a potential rate cut by the European Central Bank (ECB) have been growing, adding downward pressure on the euro.

EUR/USD retraced from its technical rebound, suggesting the pair remain trading with its long-term bearish trajectory. Suggests the pair remain trading with bearish momentum.

Resistance level: 1.0866, 1.0955📉

Support level: 1.0780, 1.0700📈

Eurusd sell confirm signal EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles. Confirm signal sell

EURUSD BUY NOW EUR/USD stays on the back foot and trades in negative territory below 1.0950 early Friday. Eurozone inflation data and the US jobs report for December, which will inlcude Nonfarm Payrolls and wage inflation figures, will be watched closely by investors.

EURUSD BUY NOW 1.09165

CONFIRM TARGET 1.09973

EURUSD-bearish outlook in daily chart EURUSD has started this month with positive pips because of the relative weakness of US dollar , historically November and December was bearish for the dollar. As comparing with euro dollar is performing well. EURUSD is struggling to get bullish momentum after breaking up the upper side of the trend line briefly reached 1.07500 and currently trading around 1.06880. Technically both 100,200 EMA making golden cross. Ichimoku cloud is still red and the price line is within the cloud. The downside target will be 1.05850.

EURUSD breaks resistanceThe EURUSD pair crossed the resistance of the descending channel and settled above it, providing signals of an attempt to start an upward correction in the intraday term, but we notice that the price is returning to providing negative trades, affected by the negativity of the Stochastic indicator, heading towards testing the breached resistance,

Pivot Price:1.05750

Resistance Price: 1.06202 & 1.06595 & 1.06940

support price: 1.05191 & 1.04782 & 1.04092

The general expected tendency for today: neutral

meframe: 4H

EURUSD pair tried to break down channel resistanceThe EUR/USD pair made an attempt to break through the resistance of the descending channel, but it returns to trading below it again, so that the downward trend scenario remains valid and effective for today, supported by the negativity of the Stochastic indicator, waiting to visit the levels of 1.0519 and then 1.0478 , which represent our next main targets, remembering that stability below 1.0575 represents A prerequisite for the expected decline to continue.

EURUSD LONG while other majors weaker than DollarEuro and Swissi are currently the only majors against US Dollar that are strong.

EUR/USD climbs above 1.0820 after soft US PPI data

EUR/USD shoots to near 1.0820 as US PPI deflated wider than anticipated

UR/USD has jumped strongly to near 1.0820 as US PPI has softened significantly inspired by lower gasoline prices.

US monthly headline PPI has registered deflation while core PPI has maintained its pace at 0.2%.

The ECB is expected to raise interest rates by 25bps to 4% in order to sharpen its quantitative tools in the battle above 6% inflation.

The EUR/USD pair has accelerated dramatically to near 1.0820 after the United States Producer Price Index (PPI) data shows wider-than-expectations deflation. Monthly headline PPI contracted by 0.3% in May while the street was anticipating a 0.1% contraction. Investors should note that the economic data reported a pace of 0.2% in April. Annualized headline PPI has softened to 1.1% vs. the consensus of 1.5% and the prior release of 2.3%.

Contrary to that, US monthly core PPI has maintained its pace at 0.2% as expected by the market participants. The annualized core PPI has decelerated to 2.8% against the expectations of 2.9% and the former release of 3.1%.

The impact of weak oil prices is clearly visible in extremely soft PPI figures. Firms have passed on the impact of the sheer decline in gasoline prices to the end consumers as the street has not recognized any sign of a slowdown in the overall demand yet.

It looks like in the list of soft inflation, easing labor market conditions, and weak economic activities, decelerated PPI has been added, which would propel the need of skipping interest rate hikes by the Federal Reserve (Fed). The US Dollar Index (DXY) has attracted significant offers after softer-than-anticipated and has dropped below the crucial support of 103.00.

On the Eurozone front, investors are awaiting the interest rate decision by the European Central Bank (ECB). ECB President Christine Lagarde is expected to raise interest rates by 25 basis points (bps) to 4% in order to sharpen its quantitative tools in the battle above 6% inflation.

Economists at Danske Bank expect a pause by the Fed could pose near-term upside risks to EUR/USD, but we still maintain a bearish view on the cross towards the second half of CY2023.

The cautious optimism, however, continues as the US Federal Reserve (Fed) and the European Central Bank (ECB) will announce their decisions on monetary policy in the next 24 hours. In the upcoming American session, it will be the Fed’s turn, with the central bank also releasing the Summary of Economic Projections, the so-called dot plot- Additionally, the Federal Open Market Committee (FOMC) Chairman Jerome Powell will offer a press conference.

Big Picture

EUR BULLISH

Continued Eurozone growth over time, and much slower pace of rate cuts from the ECB relative to the Fed

Policy rates are unlikely to have peaked at 3.00%

Further ECB tightening supporting outlook for medium term strength

ECB will likely stay on the path possibly for a while longer

ECB may have another 150 bps of rates hikes to go to get to a terminal rate of 4%

Growth and monetary policy trends to support Euro

Declining inflation in the US ,reopening of China, and cheaper gas prices to avoid a significant economic slowdown

The rate hikes will continue and that’s positive for the Euro

An improving outlook for the eurozone economy and currency

Buying Euro on every ray of sunlight

Improving investor sentiment in Europe

Euro should show an increasingly solid recovery as the US outlook dims

ECB hawks are waking up

USD BEARISH

The hurdle for raising rates this month is higher, implying fresh US Dollar falls

Dollar weakness will pick up pace during 2024 as market attention turns toward Fed rate cuts

Fed feels more comfortable with receding inflation

US Dollar's position as the primary global reserve currency is being challenged

America on verge of losing petrodollar privilege

Other regions may need to continue their crusade for inflation, reducing spreads of debt securities yields

Combination of lower Fed rate expectations and improved risk sentiment is quintessentially negative

No more Fed hikes, potentially lethal to the US Dollar

US economy to slip into recession, Fed eventually cut rates quicker than peer institutions

Sticky inflation? What is sticky is the downtrend

EUR/USD BEARISH THEMES

EUR BEARISH

Russia is going to get rid of the Euros in their wealth fund

European Commission expects the eurozone economy to decline in Q4 2022 and Q1 2023

Italy’s debt could be a worry for the Eurozone

Inflation risks are to the upside, while growth risks are on the downside

ECB is moving from fighting inflation to worrying about inflation

Europe is in a great stress

Bracing for a tough winter

Underwhelming Eurozone growth should see ECB lag well behind the Fed

Europe is the biggest loser in the Russian-Ukrainian war

Recession seems likely in Germany

Energy crunch could last years

The route of the energy plan could drive to a lengthy, messy and choppy period

The war is still a huge drag on the European economy

USD BULLISH

When the dust settles, the Fed is set to continue raising rates

US to have permanently higher rates than elsewhere

Re-acceleration of inflation and its win over the Fed will continue to catch the market by surprise

The Dollar is higher for longer, alongside the Fed’s narrative

Stagflation to take USD even higher

Hot CPI means the Fed pivot is well beyond the horizon

Ugly inflation promises further flight to safety

US at war means a stronger dollar

Outlook for Fed monetary policy now more hawkish

Powell projects pain, higher rates for longer set to keep the dollar bid

EURUSD | LONG TERM SWINGS TO THE UPSIDE?Hi Traders!

I'm looking at EURUSD and expecting more upside movements on this, possible Bullish rally into 1.16029 / 1.17211, this will be a +800 point move from current price 1.08318 - looking at the lower time frames, weekly, daily, 1hour and 15min there has been multiple confirmations for upside price movements, new HH and HL levels are formed + 61.80% and 38.00% fib corrections, all levels rejected and pushed price into upside direction, on the weekly time frame, after the monthly key level 0.95374 was rejected, we only had 3 Bearish candle formations and the rest are Bullish impulsive pushes, (12) to confirm, in order to see any Bearish plays on the weekly and monthly time frame, we will need to see price take out major key levels + new structure needs to form after taking out previous support and set lows (Key Levels) for now short term targets can be daily key levels as 1.09348 (Daily) and 1.11860 (Daily) this will be a 103.2 point move and 355.2 point move, I will do more technical updates on the weekly and daily time frame later this week when the markets are open.

GBPUSD SHORTGbpusd has been on a short bullish run for some weeks now and that has created a rising wedge pattern on the 4hr tf which mean a bearish move is likely to happen soon so i would advice my followers to only look for sells

if my price forcast has been helpful pls like, follow, share and comment.

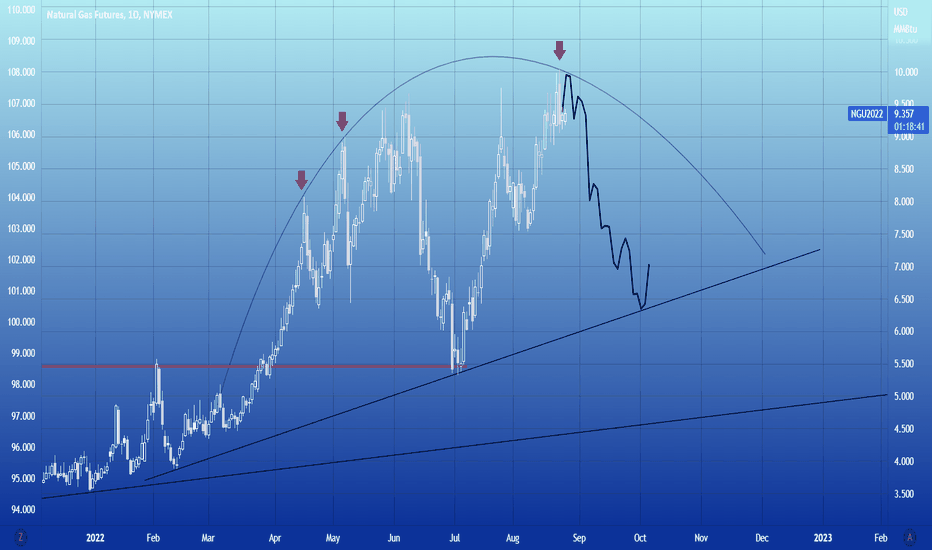

Natural Gas already priced in ? I always think it's great to look at the screen in the evening until you notice the patterns.

In this example, however, I find this not so uninteresting, as gas prices will also fall due to the rising dollar.

Perhaps a brief cooling of inflation.

Definitely not an easy topic.

Your opinions?

EURUSD Assessing great risk and great potentialOn the interest rate front: Market investors believe this conflict, the largest war Europe has faced since World War II, will prevent the ECB from taking any strong tightening moves in the near term. Also, the Fed is expected to have a 95% chance of raising rates by 25 basis points at its March meeting, and the invasion ended market investors' speculation that the Fed would raise rates by 50 basis points.

Economic: As the war is escalating and has not yet eased, there will be a certain degree of impact on the economies of various countries, especially the European economies will inevitably be dragged down by it.

The euro against the U.S. dollar has seen the bottom put up some time ago, when the war had not yet broken out. Conflicts are also stimulated because of the accumulation of long-term disagreements, Russia through the impact of the war to try to change the current unfavorable pattern, perhaps Europe will pay a heavy price of economic losses. In the short to medium term, I am bearish on EURUSD.