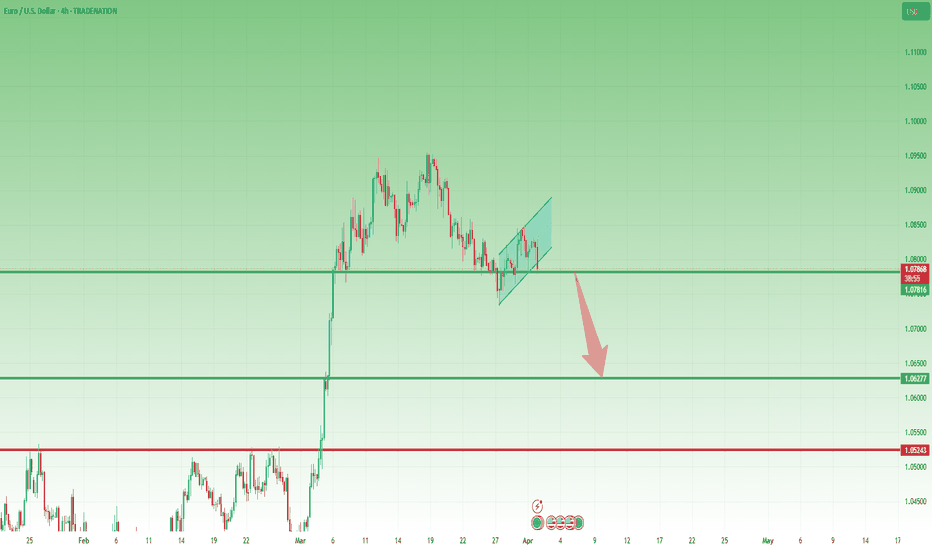

EurUsd could continue to the downsideTwo weeks ago, I mentioned that while a new high was possible, the bigger move in EUR/USD should be to the downside.

Indeed, the pair dropped from above 1.0900 and recently found support around the 1.0730 zone.

The recent recovery appears corrective, unfolding in a flag pattern, and I expect another leg down toward 1.0600.

Bearish confirmation comes with a daily close below 1.0750, and my preferred strategy is to sell rallies.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Eurusdanalysis

EUR/USD Double Top Analysis - Bearish Reversal Trade Setup This analysis highlights a Double Top pattern forming on the EUR/USD 4-hour timeframe, which is a classic bearish reversal pattern. The pattern signals a potential shift from a bullish trend to a downtrend, providing traders with a well-defined entry, stop loss, and target levels.

1. Understanding the Double Top Pattern

A Double Top is a trend reversal pattern that forms after an extended uptrend. It consists of two peaks (Top 1 and Top 2) at approximately the same resistance level, followed by a break below the neckline (support level), confirming the pattern.

Pattern Breakdown:

Top 1 & Top 2: These peaks represent failed attempts to break higher, showing strong selling pressure at resistance.

Support (Neckline): The price found support at a key level, where buyers initially stepped in, but eventually, this level was broken, triggering a potential downtrend.

2. Key Levels & Trading Setup

📌 Resistance Level (Bearish Rejection Zone)

The resistance level is marked in the 1.09500 - 1.09600 range.

Price action tested this zone twice (Top 1 & Top 2) but failed to sustain above it.

The repeated rejection indicates that sellers are dominant in this zone.

📌 Support Level (Neckline Breakout Confirmation)

The support level is marked in the 1.07700 - 1.07800 zone.

The price bounced off this area initially, but later broke below it, confirming a bearish move.

The breakout suggests selling momentum is increasing.

3. Trading Strategy – Bearish Setup

🔴 Entry Point (Sell Trigger)

A short trade is confirmed when the price breaks below the neckline (support level) after forming the Double Top.

The breakout confirms seller dominance and signals potential downside movement.

🚨 Stop Loss Placement

Stop Loss is placed slightly above the resistance level at 1.09575.

This ensures protection against false breakouts or price retracements.

🎯 Target (Take Profit Projection)

The price target is calculated based on the height of the Double Top pattern.

Target Level: 1.06639, aligning with the measured move from the resistance to the neckline.

4. Market Outlook & Risk Management

📉 Bearish Scenario (High Probability Move)

✔️ The market structure shows a strong bearish reversal with price failing to break above resistance.

✔️ The confirmed neckline break indicates sellers have taken control.

✔️ If the price continues lower, we can expect a move toward 1.06639.

📈 Bullish Scenario (Invalidation of Trade)

❌ If price closes back above resistance (1.09575), it would invalidate the bearish setup.

❌ This would indicate that buyers are regaining control, and the trade setup should be re-evaluated.

5. Final Thoughts & TradingView Tags

Summary of Trading Setup:

✅ Pattern: Double Top (Bearish Reversal)

✅ Sell Entry: Below the support neckline

✅ Stop Loss: Above 1.09575

✅ Target: 1.06639

✅ Risk-Reward Ratio: Favorable

📌 Tags for TradingView Idea:

#EURUSD #DoubleTop #ForexTrading #BearishReversal #SupportResistance #PriceAction #TechnicalAnalysis #ForexSetup #TradingStrategy

Strong GDP, Weak USD – How Will EURUSD React!?Today's U.S. data showed strong GDP growth (2.4%) , but lower inflation ( 2.3% Final GDP Price Index ) and a weaker trade balance ( -147.9B ) suggest the Fed may remain cautious on rate hikes. This limits USD's strength , supporting a potential EURUSD rebound .

EURUSD ( FX:EURUSD ) is moving in the Support zone($1.08180-$1.0745) and has also managed to break the Downtrend line . 50_SMA(Weekly) plays a good role of support for EURUSD .

In terms of Classic Technical Analysis and Price Action , there is also a possibility that EURUSD will return to an uptrend with Inverse Head and Shoulders and Bullish Quasimodo Patterns .

Regarding Elliott Wave theory , it seems that EURUSD has managed to complete the main wave 4 . The main wave 4 structure is an Expanding Flat Correction(ABC/3-3-5) .

I expect EURUSD to trend higher in the coming hour s and rise to at least $1.0855 , and if the Resistance zone($1.0867-$1.0850) is broken, we should expect more pumping .

Note: If EURUSD breaks below the 50_SMA(Weekly), we expect further declines. The worst Stop Loss(SL) could be $1.072.

Please respect each other's ideas and express them politely if you agree or disagree .

Euro/U.S. Dollar Analyze (EURUSD), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EUR/USD Triple Bottom Reversal | Bullish Breakout SetupChart Overview

This is a EUR/USD 1-hour chart showing a classic Triple Bottom Reversal Pattern, a strong bullish reversal signal. The price has tested a key support level multiple times, forming three distinct bottoms, indicating that sellers are losing momentum while buyers are stepping in.

This setup suggests an upcoming breakout, with well-defined entry, take profit, and stop-loss levels to capitalize on the potential upward move.

Technical Breakdown

1. Support & Resistance Zones

Support Zone (Highlighted in Beige)

The price has tested this zone multiple times without breaking below, confirming strong buying interest.

Each time the price touched this level, it rebounded, indicating accumulation by buyers.

Resistance Zone (Highlighted in Beige)

The price previously reversed from this level, making it a key area to watch for a breakout.

A confirmed breakout above this resistance could trigger strong upward momentum.

2. Triple Bottom Formation

A Triple Bottom is a strong bullish reversal pattern. It consists of:

Bottom 1: First rejection from support.

Bottom 2: A retest of support with buyers defending the level.

Bottom 3: The final touch before an upward move, confirming the pattern.

This pattern signals that selling pressure is diminishing and buyers are preparing for a strong breakout.

3. Bullish Reversal & Breakout Zone

A breakout above the neckline resistance (around 1.0843) will confirm the pattern.

Traders should wait for a confirmed candle close above the resistance before entering a long position.

A retest of the breakout zone can provide an additional entry opportunity.

Trade Setup & Key Levels

🔹 Entry Strategy

Aggressive Entry: Enter at the breakout level (above 1.0843) with volume confirmation.

Conservative Entry: Wait for a breakout retest before entering long.

🎯 Take Profit Targets

TP1: 1.08868 (First resistance zone)

TP2: 1.09642 (Major resistance zone, strong price reaction expected)

❌ Stop Loss Placement

Stop Loss: Below 1.06786, under the support zone.

This ensures that if the price breaks below the key level, the trade is invalidated.

Market Sentiment & Expected Move

If the price breaks the resistance → Expect a strong bullish move toward TP1 and TP2.

If the price fails to break out → It may consolidate further or retest support.

Watch for increased volume on the breakout to confirm strength.

📌 Final Thoughts

This is a high-probability bullish setup based on a well-formed Triple Bottom Reversal pattern. Traders should monitor price action near the breakout zone and manage risk effectively with proper stop-loss placement.

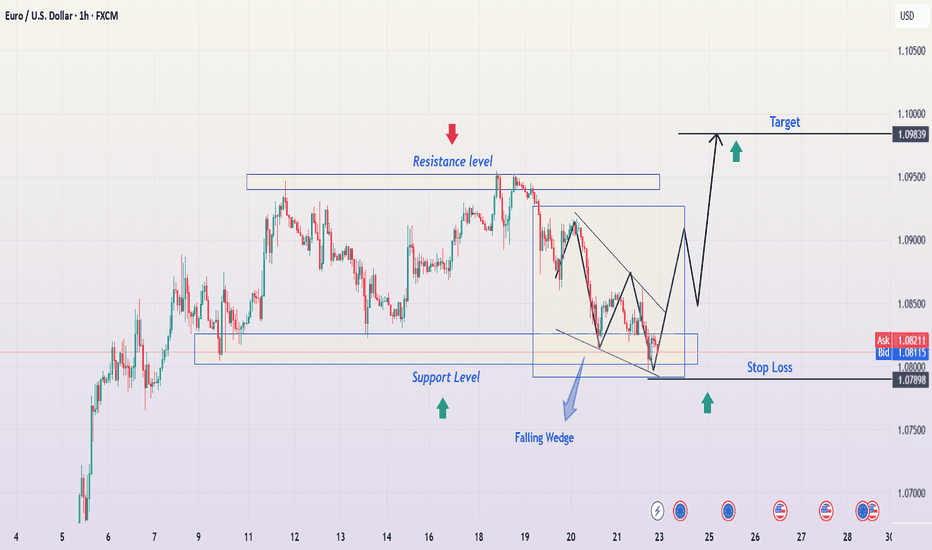

EUR/USD 1H Chart Analysis – Falling Wedge Breakout StrategyOverview of the Chart

The EUR/USD 1-hour chart is forming a falling wedge pattern, which is a bullish reversal setup. This indicates that although the price has been trending downward, the selling pressure is weakening, and a breakout to the upside is becoming more likely.

Currently, the price has broken above the wedge, signaling potential trend reversal. However, traders should watch for a retest of the breakout level to confirm whether the price holds above the resistance-turned-support area before further upward movement.

Key Components of the Chart

1️⃣ Falling Wedge Pattern (Bullish Reversal Signal)

A falling wedge consists of two downward-sloping trendlines that converge, showing a narrowing price range. This pattern is formed when:

The price makes lower highs and lower lows, indicating a downtrend.

The slope of the lower trendline is less steep than the upper one, meaning sellers are losing momentum.

Eventually, the price breaks out above the upper trendline, confirming a bullish reversal.

2️⃣ Support & Resistance Levels

✅ Support Zone (Key Demand Area)

The price recently tested a strong support level (highlighted in beige), where buyers aggressively entered the market.

This level has held multiple times, indicating that buyers are stepping in whenever the price reaches this zone.

The green upward arrow suggests that this is a key accumulation area, where demand is stronger than supply.

🚫 Resistance Zone (Profit Target)

The resistance zone near 1.09450 is the first major target for bulls.

Historically, price action has struggled to break through this level, making it a logical place to take profits.

3️⃣ Breakout Confirmation & Retest

The price has successfully broken out above the falling wedge, which is a strong buy signal.

However, a retest of the breakout level (marked by the yellow circle) might occur before further bullish continuation.

If the price retests and holds above the previous resistance (now support), this will confirm the breakout and provide an additional buying opportunity.

Trade Execution Strategy

📌 Entry Point:

Enter a long trade after the breakout confirmation.

For conservative traders, waiting for a successful retest before entering can reduce risk.

📌 Stop-Loss Placement:

Place a stop loss just below the recent swing low at 1.07541 to limit downside risk.

This ensures that if the breakout fails, the trade is exited with minimal loss.

📌 Profit Target:

The first take-profit target is at 1.09450, the key resistance level.

If bullish momentum continues, traders can look for higher targets based on price action.

📌 Risk-to-Reward Ratio:

This setup provides a favorable risk-to-reward ratio, meaning that potential profits outweigh the risk taken on the trade.

Technical Indicators Supporting the Trade

📈 Trend Reversal Signals

The market has been in a downtrend, but the falling wedge signals a potential reversal.

A higher low after the breakout would further confirm the uptrend.

📊 Volume Confirmation

Ideally, a breakout should be accompanied by increased volume, showing strong buying pressure.

If volume is low, a false breakout could occur, requiring careful trade management.

🔍 Retest & Price Action

A retest of the breakout level should hold above the wedge to confirm bullish momentum.

If the price fails to hold and falls back below, the breakout may have been a fakeout, meaning traders should exit or wait for re-entry.

Risk Management & Trade Considerations

Always use a stop-loss to manage risk.

If the price fails to stay above the breakout level, consider exiting early.

Watch for external market factors such as news events or economic data releases, which can impact EUR/USD volatility.

Conclusion: Bullish Momentum is Building 🚀

This falling wedge breakout on the EUR/USD chart provides a high-probability long trade setup. As long as price holds above the breakout level, bullish continuation toward 1.09450 is expected. Traders should monitor price action carefully and adjust their positions accordingly to maximize gains while managing risks.

EUR/USD Technical Analysis – Potential Reversal SetupThe EUR/USD 1-hour chart displays a recent downtrend with a series of lower highs and lower lows, forming a bearish market structure. The Harmonic patterns such as the Bat suggest potential areas of reversal, aligning with Fibonacci retracement levels.

A Change of Character (ChoCh) at the latest low (XA 0.7872) signals a possible shift in trend. The presence of bullish reaction points, marked by green triangles and yellow circles, suggests buying pressure is increasing. Additionally, the projected upward trendlines indicate possible price targets at 1.08476 (T1) and 1.08885 (T2) .

The oscillators at the bottom indicate oversold conditions, reinforcing the likelihood of a bullish correction. However, confirmation via price action and volume is necessary before entering long positions. A break above key resistance levels would further validate the upside potential.

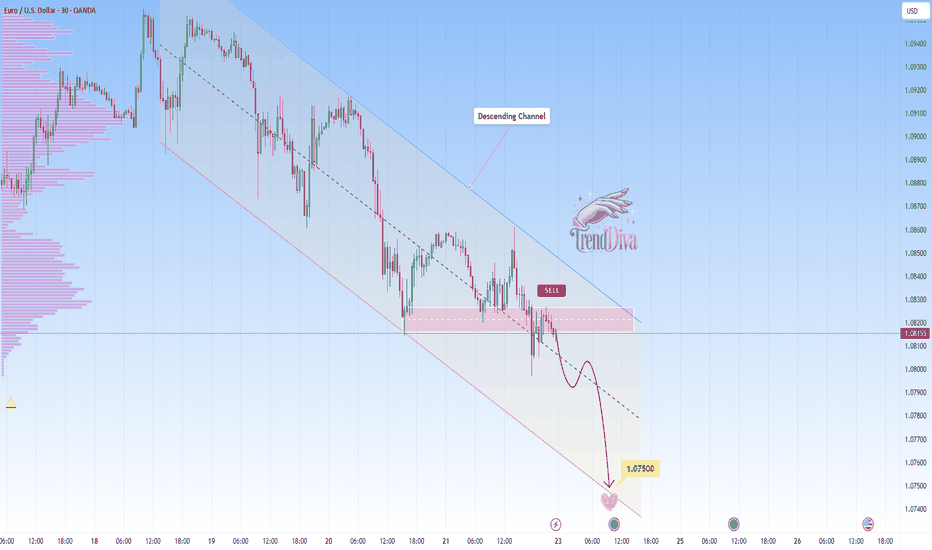

EURUSD Maintains Bearish Momentum - Is 1.07500 the Next Target?OANDA:EURUSD is trading within a well-defined descending channel, with price action consistently respecting both the upper and lower boundaries. Recently, the price rejected a key resistance zone, reinforcing bearish momentum and signaling a potential continuation toward lower levels.

The current price action suggests that if price continues to respect this resistance, we could see further downside toward 1.07500, aligning with the lower boundary of the channel. However, if price breaks above the channel and sustains above it, the bearish outlook may be invalidated, potentially signaling a shift in momentum. Monitoring price action and volume at this level will be essential for confirmation.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

EUR/USD Trading Analysis – Falling Wedge Breakout StrategyChart Overview

The EUR/USD 1-hour chart presents a classic falling wedge pattern, which is a bullish reversal setup indicating that selling momentum is weakening and a breakout to the upside is imminent. This chart provides a structured trading plan, highlighting support and resistance levels, entry points, stop-loss placement, and a target price.

Traders can use this setup to capitalize on the potential bullish move while effectively managing risk. Let’s break it down step by step.

1. Understanding the Falling Wedge Pattern

A falling wedge is formed when price action moves within two downward-sloping trendlines that converge. It signals decreasing bearish pressure, as the price forms lower highs and lower lows within a narrowing range. The decreasing range indicates that sellers are losing control, and an upside breakout is likely.

In this chart, we observe the following key characteristics of a falling wedge:

✅ Two converging downward trendlines that contain price movement.

✅ Lower highs and lower lows showing seller exhaustion.

✅ Decreasing volume as the price approaches the breakout zone.

✅ Support near 1.08000, which has held price several times before.

A breakout above the wedge signals a shift from bearish to bullish sentiment, making this a strong trade setup.

2. Key Support & Resistance Levels

🔹 Support Level (Demand Zone)

The horizontal blue zone at 1.07898 – 1.08000 is a critical support level.

This level has been tested multiple times, making it a strong demand zone where buyers step in.

The falling wedge bottom aligns with this area, reinforcing its importance.

If price stays above this zone, it confirms the potential for a bullish breakout.

🔹 Resistance Level (Supply Zone)

The resistance zone at 1.09300 - 1.09839 has acted as a barrier to upward movement.

Price previously reversed from this zone, making it a logical take-profit area.

If the breakout happens, this level will be tested again.

A break above 1.09839 would signal further bullish momentum.

3. Trading Strategy – Step-by-Step Execution

📌 Entry Confirmation

To enter this trade with confidence, traders should wait for a confirmed breakout above the wedge.

A strong bullish candle breaking above the wedge’s upper trendline signals entry.

Ideally, a pullback and retest of the breakout level would provide additional confirmation before entering long.

📌 Stop-Loss Placement

Risk management is key, and stop-loss placement should be strategic to avoid unnecessary losses.

A stop-loss is set just below 1.07898, slightly under the recent low.

This placement ensures protection against false breakouts.

📌 Take-Profit Target

The take-profit target is set at 1.09839, aligning with key resistance and the projected wedge breakout distance.

This level has historically acted as resistance, making it an ideal zone to exit profits.

Partial profit-taking can be considered near 1.09300, before the final target.

📌 Risk-to-Reward Ratio

With a tight stop-loss and a higher profit target, this trade offers a favorable risk-reward ratio (RRR).

A minimum RRR of 1:3 is recommended, meaning potential reward is three times the risk taken.

4. Expected Market Behavior & Possible Scenarios

📊 Scenario 1: Bullish Breakout Confirmation 🚀

If price breaks and closes above the wedge, we expect a rally towards 1.09300 - 1.09839.

Pullback to retest the breakout zone would further confirm bullish strength.

Strong volume would validate the breakout, leading to a high-probability move.

📉 Scenario 2: Bearish Breakdown (Invalidation) ❌

If price breaks below 1.07898, the bullish setup is invalidated.

A downside move could push the price lower, possibly towards 1.07500 or below.

Traders should exit long positions if this scenario unfolds.

5. Additional Technical Indicators for Confirmation

To strengthen this trade setup, traders can use:

✅ RSI (Relative Strength Index) – Look for RSI divergence or a move above 50, confirming bullish strength.

✅ MACD (Moving Average Convergence Divergence) – A bullish crossover on MACD would reinforce the breakout.

✅ Volume Analysis – A spike in volume at the breakout level adds confidence in the move.

6. Conclusion & Trading Plan

This falling wedge setup suggests a high-probability bullish breakout if the price confirms above the resistance zone.

🔹 Trading Plan Summary:

✅ Wait for a breakout above the wedge before entering.

✅ Confirm breakout with a retest or strong bullish candle.

✅ Set stop-loss below 1.07898 to limit downside risk.

✅ Take profit at 1.09839, securing profits at resistance.

This strategy offers an excellent risk-to-reward ratio, making it a well-structured trade setup. Always manage risk and avoid premature entries without confirmation.

📌 TradingView Tags for Maximum Visibility

#EURUSD #Forex #TechnicalAnalysis #FallingWedge #Breakout #PriceAction #ForexSignals #SupportResistance #TradingSetup #DayTrading #SwingTrading

EURUSD | 4H | WAIT BREAKOUTHey there, Traders,

I’ve put together an analysis for EUR/USD. Right now, I’m watching it like a hunter, waiting for a breakout. As soon as it happens, I’ll drop updates right here under this analysis.

Big thanks to everyone who supports me with likes—you guys are awesome!

God bless you all

EUR/USD Technical Analysis – Double Top Pattern & Bearish MoveThis EUR/USD 1-hour chart presents a clear Double Top pattern, signaling a potential trend reversal. The chart displays key technical elements, including support and resistance levels, trendlines, a stop-loss placement, and a take-profit target. Let’s go through an in-depth professional breakdown of this trading setup.

1. Market Structure and Trend Analysis

Before identifying the pattern, it’s crucial to analyze the market structure:

✔ The price had been in an uptrend initially, making higher highs and higher lows.

✔ However, the trend began to weaken after hitting resistance at the 1.0950 zone.

✔ This failure to break higher created a double top, which is a strong bearish reversal signal.

A double top forms when the price reaches a high twice, fails to break above resistance, and then declines past the neckline (support level), confirming trend reversal.

2. Double Top Pattern Breakdown

🔹 First Peak (Top 1):

The price surged upwards, hitting the resistance zone at 1.0950, but faced selling pressure.

The rejection resulted in a pullback to the neckline (support level at 1.0800-1.0820).

🔹 Second Peak (Top 2):

The price attempted another rally but failed at the same resistance zone, confirming seller dominance.

The second rejection suggests a lack of bullish strength, signaling a potential shift in momentum.

🔹 Neckline (Support Breakdown):

The key support zone around 1.0800 acted as a pivot level.

Once this level was breached, it confirmed bearish continuation.

3. Key Technical Levels & Price Action Signals

🟢 Resistance Level – 1.0950 Zone

This level has acted as a strong supply zone where sellers stepped in to push prices lower. The two failed breakout attempts indicate that buyers lost control.

🔵 Support Level (Neckline) – 1.0800-1.0820 Zone

Initially, this area provided buyer support, but once broken, it became a resistance level (previous support turns into new resistance).

⚡ Stop-Loss Placement – 1.09190

A well-placed stop-loss above the resistance zone protects against false breakouts.

If the price rises above this level, it invalidates the bearish structure.

🎯 Take-Profit Target – 1.06916

The projected target aligns with the measured move (the distance from the resistance to the neckline).

The price may find support at this level, where traders should look for a potential reversal or continuation.

4. Confirmation of Bearish Breakdown

For a high-confidence short trade, multiple confluences support the bearish bias:

✔ Break & Retest of the Neckline – After breaking support, the price attempted a retest and failed, confirming resistance.

✔ Trendline Break – The trendline supporting the previous uptrend has been decisively broken.

✔ Bearish Price Action – The formation of strong red candles and lower highs suggests sustained selling pressure.

✔ Momentum Shift – Increased bearish volume further confirms the reversal strength.

5. Trading Strategy & Execution Plan

✅ Entry Criteria

Sell after the retest rejection at the previous support (now resistance).

Look for a strong bearish candle formation as a confirmation signal.

📉 Risk Management

Stop-Loss: Placed slightly above 1.09190, ensuring the pattern remains valid.

Take-Profit: Target set at 1.06916, aligning with previous structure support.

💰 Risk-Reward Ratio

The setup offers an attractive risk-to-reward ratio, making it a high-probability trade.

6. Alternative Scenarios & Market Considerations

Although the bearish bias is dominant, traders should be prepared for alternative outcomes:

🔸 Fakeout Risk: If price closes above 1.09190, it could indicate a failed breakdown, invalidating the trade.

🔸 Bounce from 1.06916: If the price reaches the target support zone, buyers might step in, leading to a potential reversal.

🔸 Fundamental Influence: News events (such as FOMC, ECB statements, or US inflation data) can increase volatility and impact price direction.

7. Conclusion – A High-Probability Short Trade

This Double Top pattern setup presents a textbook bearish reversal, offering an excellent short-selling opportunity. The combination of technical confirmations, price action signals, and a well-structured risk-reward ratio makes this trade highly reliable.

Final Takeaways:

✔ Bearish Confirmation – Double Top breakdown with a retest rejection.

✔ Sell Setup Validity – Below 1.0800 support.

✔ Stop-Loss & Target Defined – Risk-controlled strategy execution.

📊 Verdict: Bearish trade setup with downside potential toward 1.06916. Traders should monitor price action for further confirmations! 🚀

EUR/USD 4H Analysis – Bearish Breakdown Setup1. Market Structure & Trend

The EUR/USD chart shows a previous uptrend, confirmed by the ascending trendline, where the price made higher highs and higher lows. However, the trendline has now been broken, signaling a potential shift in market direction. The price is currently retracing from a key resistance zone, and a possible bearish continuation is expected.

2. Key Levels & Zones

✅ Resistance Zone (1.09563 - 1.1000):

This blue-shaded area represents a strong resistance level, where sellers have stepped in multiple times.

Price previously attempted to break this level but failed, forming a rejection.

This suggests buyers are losing strength, and sellers are likely to dominate.

✅ Support Level (1.0800 - 1.0780):

A critical support zone, which acted as a demand area in the past.

If price breaks below this level with strong bearish momentum, it confirms a trend reversal.

✅ Target Level (1.06870):

The next major downside target aligns with previous market structure and liquidity zones.

This area marks a key demand zone, where buyers might step in again.

3. Trade Setup & Execution Plan

🔹 Entry Strategy

A sell entry is ideal on a confirmed break and retest of the support zone at 1.0800.

If price retests this level and forms bearish rejection candles (such as pin bars or engulfing patterns), it strengthens the bearish bias.

🔹 Stop Loss & Risk Management

A stop loss should be placed above the resistance zone at 1.09563, ensuring a safe exit if the market reverses bullish.

Risk-to-Reward Ratio (RRR):

Entry: Below 1.0800 (after confirmation).

Stop Loss: Above 1.09563 (resistance zone).

Target: 1.06870 (support zone).

RRR: Around 1:3, meaning potential profit is three times the risk.

4. Confirmation Indicators & Confluences

✅ Bearish Trendline Break:

The ascending trendline has been broken, confirming a possible shift in trend.

✅ Support Flip:

If the price breaks support and retests it as resistance, it confirms bearish continuation.

✅ Price Action Candlestick Patterns:

Look for bearish engulfing candles, pin bars, or rejection wicks at key levels.

✅ Volume Analysis:

Increased selling pressure after support break indicates strong bearish momentum.

5. Final Thoughts & Bias

📉 Bias: Bearish (Unless resistance is reclaimed).

💡 Key Watch: Break and retest of 1.0800 support for confirmation.

⚠️ Risk Management: Always use a stop loss to manage risk effectively.

Conclusion

This setup presents a high-probability short trade with a clear entry, stop loss, and target. Traders should wait for confirmation signals before executing the trade. If price breaks above resistance, the bearish outlook is invalidated.

🔔 Stay cautious and trade with discipline! 🚀

EURUSD Sell and Buy Trading PlanH4 - We had a strong bullish move with the price creating a series of higher highs, higher lows structure

This strong bullish move ended with a bearish Divergence

While measuring this strong bullish move using the Fibonacci retracement tool we have two key support zones that has formed (marked in green)

So based on this I expect potential short term bearish moves now towards the key support zones and then potential continuation higher.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

---------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.-

EURUSD at Key Resistance Level – Will Sellers Step In?OANDA:EURUSD has reached a key resistance level, marked by prior price rejections, suggesting strong selling interest. This area has previously acted as a key supply zone, increasing the likelihood of a bearish reversal if sellers step in.

If bearish signals emerge, such as rejection wicks, bearish candlestick patterns, or signs of weakening bullish pressure, I anticipate a move toward the 1.07400 level. However, a clear breakout above this resistance could challenge the bearish outlook and open the door for further upside. It's a pivotal area where price action will likely provide clearer clues on the next direction.

Just my take on support and resistance zones, not financial advice. Always confirm your setups and trade with a proper risk management.

Fatigue in EUR/USD: Time to Sell the Rallies?Last week, EUR/USD saw an explosive rise, breaking above my 1.06 target and even surpassing the next resistance at 1.08.

However, signs of fatigue are emerging, and there appears to be significant selling liquidity around the 1.09 level.

With the DXY currently in a support zone and potentially set for an upward reversal, I expect EUR/USD to decline and correct its 500-pip rally.

A break back below 1.08 would confirm this scenario, potentially leading to a test of the 1.06 zone.

Selling rallies near 1.09 could offer a favorable risk-reward opportunity.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

EURUSD $EURUSD | 4% EURUSD BULLISH RALLY Mar09'25EURUSD FX:EURUSD | 4% EURUSD BULLISH RALLY Mar09'25

Sparros Exchange Trend Table:

FX:EURUSD Weekly Trend: Bullish

FX:EURUSD Daily Trend: Bullish

FX:EURUSD 4H Trend: Bullish

FX:EURUSD 1H Trend: Bullish

BUY/LONG ZONE (GREEN): 1.08750 - 1.11100

DO NOT TRADE/DNT ZONE (WHITE): 1.08155 - 1.08750

SELL/SHORT ZONE (RED): 1.05125 - 1.08155

EURUSD has rallied over +4% this past week.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technical indicators, support and resistance, eurusd, eu, eur, usd, currency, currencies, currencytrading, forex, foreignexchange, eurusdtrade, eurusdidea, eurusdanalysis, bullrally, eurusdrally, eurusdrun, eurusdbullrun, eurusdprice,

DeGRAM | EURUSD reached a resistanceEURUSD is in a descending channel between trend lines.

Price is aiming for the upper boundary of the channel and dynamic resistance.

The chart maintains the descending structure and has already approached the dynamic resistance, which was previously a pullback point.

On 1D Timeframe indicators are in overbought zone, and on 1H a bearish divergence is forming.

We expect a pullback.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EUR/USD Surges, but Is a Reversal Coming?After retesting the 1.0360 support during Monday’s Asian session open, EUR/USD reversed to the upside, reaching the 1.05 resistance zone.

The pair then broke above this level, surging higher and reaching the 1.08 zone, surpassing the 1.0780 resistance.

Currently, the pair is consolidating above this level. However, since the DXY is sitting on strong support with a high chance of reversal, this breakout could turn out to be a false one.

If the price drops back below the 1.0780 zone, it would confirm a false breakout, potentially leading to a decline toward the 1.06 support level.

In conclusion, I’m waiting for confirmation to enter short positions.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

DeGRAM | EURUSD reached the upper boundary of the channelEURUSD is above the ascending channel between the trend lines.

The price has already reached the upper boundary of the channel and is now moving from the dynamic resistance, which earlier was the starting point of the correction.

On the 4H Timeframe, the indicators indicate overbought.

We expect a pullback.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

Market Analysis: EUR/USD RalliesMarket Analysis: EUR/USD Rallies

EUR/USD started a fresh increase above the 1.0550 resistance.

Important Takeaways for EUR/USD Analysis Today

- The Euro started a decent recovery wave from the 1.0360 zone against the US Dollar.

- There is a connecting bullish trend line forming with support near 1.0570 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair started a fresh increase from the 1.0360 zone. The Euro cleared the 1.0450 resistance to move into a bullish zone against the US Dollar, as mentioned in the last analysis.

The bulls pushed the pair above the 50-hour simple moving average and 1.0550. Finally, the pair tested the 1.0635 resistance. A high was formed near 1.0637 and the pair is now consolidating gains above the 23.6% Fib retracement level of the upward wave from the 1.0359 swing low to the 1.0637 high.

Immediate support on the downside is near a connecting bullish trend line at 1.0570. The next major support is the 1.0500 level and the 50% Fib retracement level of the upward wave from the 1.0359 swing low to the 1.0637 high.

A downside break below the 1.0500 support could send the pair toward the 1.0465 level. Any more losses might send the pair into a bearish zone toward 1.0425.

Immediate resistance on the EUR/USD chart is near the 1.0635 zone. The first major resistance is near the 1.0665 level. An upside break above the 1.0665 level might send the pair toward the 1.0720 resistance.

The next major resistance is near the 1.0750 level. Any more gains might open the doors for a move toward the 1.0800 level.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURUSD Correcting – Another Fall Ahead?Today I want to analyze EURUSD ( FX:EURUSD ) for a 15-minute time frame and whether EURUSD is ready to fall or not.

EURUSD is moving in a Heavy Resistance zone($1.0537-$1.04500) . It also moves in the descending channel in the 15-minute time frame.

According to the theory of Elliott waves , it seems that EURUSD has completed its 5 downward waves , and we should wait for corrective waves . I expect corrective waves to end either in a descending channel or eventually at a Resistance zone($1.0493-$1.0480) .

I expect EURUSD to attack the Support lines in the coming hours, and if the Support lines break , we should expect a decline to at least 100_SMA(4-hour) .

Note: If EURUSD breaks the Resistance line, we can expect more pumps.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S.Dollar Analyze (EURUSD), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

DeGRAM | EURUSD lower volatilityEURUSD is in an ascending channel between trend lines.

The price is moving from the upper boundary of the channel, resistance level and upper trend line, which has repeatedly acted as a pullback point.

After the chart failed to form an ascending structure, the volatility decreased and after the chart returned under the dynamic resistance level and is currently holding under the important psychological level of $1.05.

We expect the pair to pullback to $1.03430 after consolidating under the supply zone.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | EURUSD will continue to grow in the channelEURUSD is in an ascending channel above the trend lines.

The price is holding the lower boundary of the supply zone.

The chart is still forming an ascending structure.

We expect the growth to continue in the channel, we believe that the chart will soon form an ascending top.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!