EUR/USD Triple Bottom Reversal | Bullish Breakout SetupChart Overview

This is a EUR/USD 1-hour chart showing a classic Triple Bottom Reversal Pattern, a strong bullish reversal signal. The price has tested a key support level multiple times, forming three distinct bottoms, indicating that sellers are losing momentum while buyers are stepping in.

This setup suggests an upcoming breakout, with well-defined entry, take profit, and stop-loss levels to capitalize on the potential upward move.

Technical Breakdown

1. Support & Resistance Zones

Support Zone (Highlighted in Beige)

The price has tested this zone multiple times without breaking below, confirming strong buying interest.

Each time the price touched this level, it rebounded, indicating accumulation by buyers.

Resistance Zone (Highlighted in Beige)

The price previously reversed from this level, making it a key area to watch for a breakout.

A confirmed breakout above this resistance could trigger strong upward momentum.

2. Triple Bottom Formation

A Triple Bottom is a strong bullish reversal pattern. It consists of:

Bottom 1: First rejection from support.

Bottom 2: A retest of support with buyers defending the level.

Bottom 3: The final touch before an upward move, confirming the pattern.

This pattern signals that selling pressure is diminishing and buyers are preparing for a strong breakout.

3. Bullish Reversal & Breakout Zone

A breakout above the neckline resistance (around 1.0843) will confirm the pattern.

Traders should wait for a confirmed candle close above the resistance before entering a long position.

A retest of the breakout zone can provide an additional entry opportunity.

Trade Setup & Key Levels

🔹 Entry Strategy

Aggressive Entry: Enter at the breakout level (above 1.0843) with volume confirmation.

Conservative Entry: Wait for a breakout retest before entering long.

🎯 Take Profit Targets

TP1: 1.08868 (First resistance zone)

TP2: 1.09642 (Major resistance zone, strong price reaction expected)

❌ Stop Loss Placement

Stop Loss: Below 1.06786, under the support zone.

This ensures that if the price breaks below the key level, the trade is invalidated.

Market Sentiment & Expected Move

If the price breaks the resistance → Expect a strong bullish move toward TP1 and TP2.

If the price fails to break out → It may consolidate further or retest support.

Watch for increased volume on the breakout to confirm strength.

📌 Final Thoughts

This is a high-probability bullish setup based on a well-formed Triple Bottom Reversal pattern. Traders should monitor price action near the breakout zone and manage risk effectively with proper stop-loss placement.

Eurusdlong

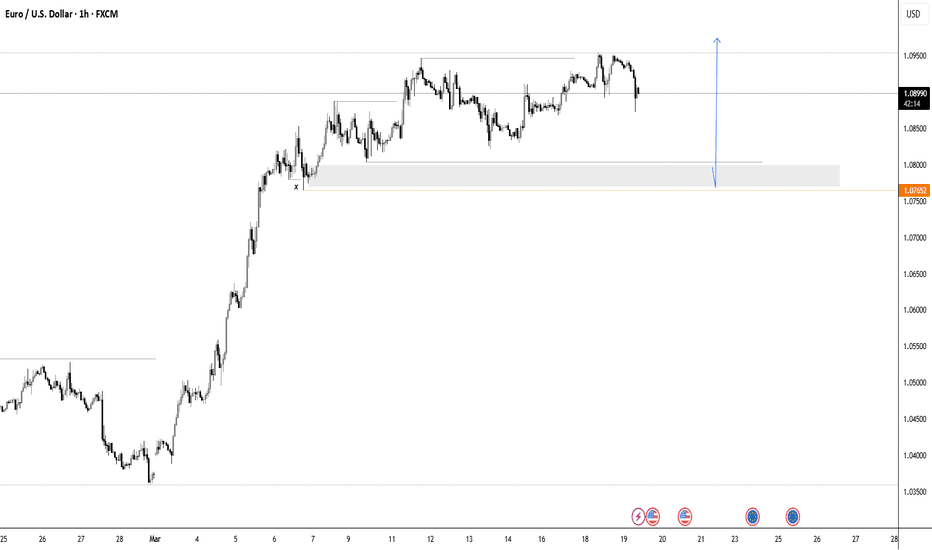

Attention! Key Signals in the EUR/USD Exchange Rate TrendThe EUR/USD pair has traded with a soft tone for five consecutive trading days, and the decline has expanded to 1.0776, the lowest level since March 6. However, the broad weakness of the US dollar in the middle of the European session pushed the currency pair to turn upward.

In the short term, according to the 4-hour chart, although the possibility of further upward movement is low, the downside potential also seems limited. The EUR/USD found buying support around the bullish 100-day moving average but failed to break through the bearish 20-day moving average. Finally, although technical indicators show an upward trend, they remain in negative territory.

EURUSD Trading Strategy:

buy@1.08200-1.08500

tp:1.08900-1.09300

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EUR USD Entry Setup 30M Timeframe🔹 Pattern: Double Bottom

🔹 Entry Condition: Wait for a clean break and retest of the neckline before entering.

No confirmation = No trade.

🔹 Higher Timeframe Context: Overall trend is bearish: this is just a pullback to the Lower High before a potential continuation of the downtrend.

⚠️ Patience is key let’s see how it plays out!

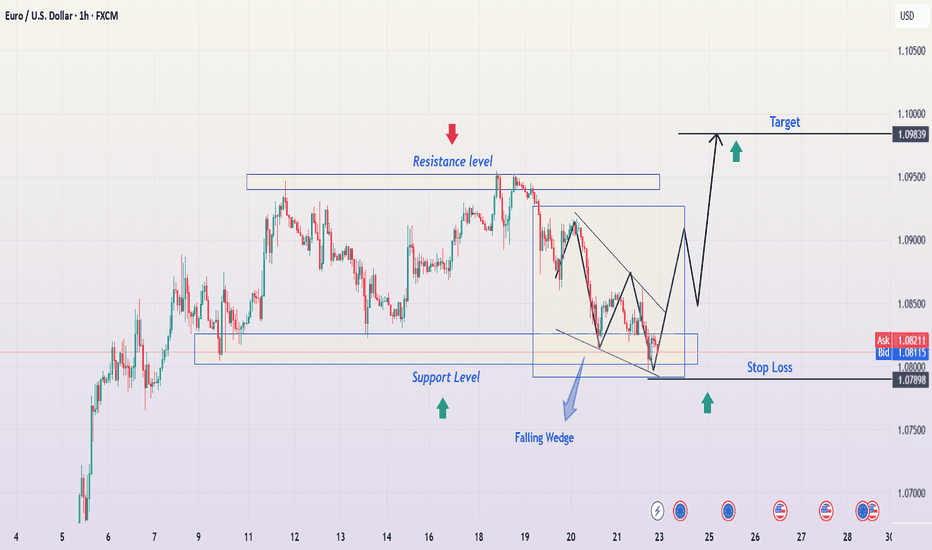

EUR/USD 1H Chart Analysis – Falling Wedge Breakout StrategyOverview of the Chart

The EUR/USD 1-hour chart is forming a falling wedge pattern, which is a bullish reversal setup. This indicates that although the price has been trending downward, the selling pressure is weakening, and a breakout to the upside is becoming more likely.

Currently, the price has broken above the wedge, signaling potential trend reversal. However, traders should watch for a retest of the breakout level to confirm whether the price holds above the resistance-turned-support area before further upward movement.

Key Components of the Chart

1️⃣ Falling Wedge Pattern (Bullish Reversal Signal)

A falling wedge consists of two downward-sloping trendlines that converge, showing a narrowing price range. This pattern is formed when:

The price makes lower highs and lower lows, indicating a downtrend.

The slope of the lower trendline is less steep than the upper one, meaning sellers are losing momentum.

Eventually, the price breaks out above the upper trendline, confirming a bullish reversal.

2️⃣ Support & Resistance Levels

✅ Support Zone (Key Demand Area)

The price recently tested a strong support level (highlighted in beige), where buyers aggressively entered the market.

This level has held multiple times, indicating that buyers are stepping in whenever the price reaches this zone.

The green upward arrow suggests that this is a key accumulation area, where demand is stronger than supply.

🚫 Resistance Zone (Profit Target)

The resistance zone near 1.09450 is the first major target for bulls.

Historically, price action has struggled to break through this level, making it a logical place to take profits.

3️⃣ Breakout Confirmation & Retest

The price has successfully broken out above the falling wedge, which is a strong buy signal.

However, a retest of the breakout level (marked by the yellow circle) might occur before further bullish continuation.

If the price retests and holds above the previous resistance (now support), this will confirm the breakout and provide an additional buying opportunity.

Trade Execution Strategy

📌 Entry Point:

Enter a long trade after the breakout confirmation.

For conservative traders, waiting for a successful retest before entering can reduce risk.

📌 Stop-Loss Placement:

Place a stop loss just below the recent swing low at 1.07541 to limit downside risk.

This ensures that if the breakout fails, the trade is exited with minimal loss.

📌 Profit Target:

The first take-profit target is at 1.09450, the key resistance level.

If bullish momentum continues, traders can look for higher targets based on price action.

📌 Risk-to-Reward Ratio:

This setup provides a favorable risk-to-reward ratio, meaning that potential profits outweigh the risk taken on the trade.

Technical Indicators Supporting the Trade

📈 Trend Reversal Signals

The market has been in a downtrend, but the falling wedge signals a potential reversal.

A higher low after the breakout would further confirm the uptrend.

📊 Volume Confirmation

Ideally, a breakout should be accompanied by increased volume, showing strong buying pressure.

If volume is low, a false breakout could occur, requiring careful trade management.

🔍 Retest & Price Action

A retest of the breakout level should hold above the wedge to confirm bullish momentum.

If the price fails to hold and falls back below, the breakout may have been a fakeout, meaning traders should exit or wait for re-entry.

Risk Management & Trade Considerations

Always use a stop-loss to manage risk.

If the price fails to stay above the breakout level, consider exiting early.

Watch for external market factors such as news events or economic data releases, which can impact EUR/USD volatility.

Conclusion: Bullish Momentum is Building 🚀

This falling wedge breakout on the EUR/USD chart provides a high-probability long trade setup. As long as price holds above the breakout level, bullish continuation toward 1.09450 is expected. Traders should monitor price action carefully and adjust their positions accordingly to maximize gains while managing risks.

EURUSD Trading: Unveiling the Precise Strategy GuideAfter last week's decline, the euro against the US dollar started to recover at the beginning of this week and is currently trading within the positive range around 1.0850.

According to the Wall Street Journal, the White House is adjusting its tariff policy set to take effect on April 2nd. It may cancel a series of tariffs targeting specific industries and instead impose reciprocal tariffs on countries with significant trade relations with the US. Affected by this news, during the European morning session, US stock index futures rose by 0.8% to 1.0%.

On the 4 - hour chart in the European morning session on Monday, the Relative Strength Index (RSI) indicator climbed to 50, indicating that the recent bearish momentum has dissipated to some extent.

In terms of the upward direction, the 50 - period Simple Moving Average (SMA) forms an interim resistance level at 1.0880, followed by 1.0900. If the euro - US dollar pair can firmly stand above this level, the next resistance level may be at 1.0950.

EURUSD Trading Strategy:

buy@1.08200-1.08500

tp:1.08900-1.09300

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EURUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EUR/USD Falling Wedge Breakout – Professional Chart AnalysisOverview of the Chart

The EUR/USD 1-hour chart presents a bullish trading setup, featuring a well-defined falling wedge pattern, a trendline breakout, and a retest phase, signaling a potential upward move. The chart is marked with key technical elements such as support and resistance zones, breakout confirmation, and risk management parameters.

This analysis will break down each component of the chart, explaining the logic behind the setup and how traders can approach this opportunity.

1. Identified Chart Patterns

Falling Wedge Formation (Bullish Reversal Signal)

The price action formed a falling wedge, characterized by lower highs and lower lows, creating a narrowing price channel.

This pattern is typically a bullish reversal structure, as it indicates weakening selling pressure before an expected breakout.

The wedge’s downward movement ended with a strong breakout to the upside, signaling buyers regaining control.

2. Key Technical Levels

Support & Resistance Zones

Support Level (Buyers’ Stronghold)

The horizontal support level is a price area where buyers have previously stepped in, preventing further declines.

This level has been tested multiple times, reinforcing its strength as a key demand zone.

Resistance Zone (Profit Target Area)

The highlighted resistance zone represents a supply area where the price has struggled to move past in previous sessions.

The target price level aligns with this resistance, making it a realistic profit target for the long position.

3. Trendline Breakout Confirmation

Before forming the wedge, the chart shows an uptrend with a breakout above a trendline.

This trendline breakout was an early signal of bullish strength, aligning with the later wedge breakout.

After the breakout, the price came back for a retest, which is a key confirmation before further upward movement.

4. Retesting Phase Before the Upward Move

After breaking out of the wedge, the price returned to the breakout level to confirm support.

Retesting is a crucial validation step—if the price holds above this level, it increases the probability of a continued bullish move.

This retesting action provides a potential entry point for traders looking to go long.

5. Trade Setup & Risk Management Strategy

Trade Entry:

A buy entry is considered after the retest is confirmed (price holding above the breakout level).

Stop Loss Placement (Risk Control):

The stop loss is placed below the previous low at 1.07790, ensuring protection against fake breakouts or unexpected reversals.

Take Profit Target (Projected Price Move):

The target price is set at 1.09698, which aligns with previous resistance levels and the measured move from the wedge breakout.

This provides a strong risk-to-reward ratio, making the setup favorable for bullish traders.

6. Risk-Reward Ratio & Trade Viability

Risk: The distance between the entry point and the stop loss is relatively small, making it a low-risk trade.

Reward: The potential upside move is significantly higher than the risk, creating a high reward-to-risk ratio trade.

This type of technical confluence increases the probability of a successful trade, making it an attractive opportunity.

7. Conclusion & Trading Strategy

📌 Key Takeaways:

✅ The falling wedge breakout signals a bullish reversal.

✅ The trendline breakout and retest add further confirmation to the trade setup.

✅ The support and resistance zones provide a clear risk management strategy.

✅ The risk-reward ratio makes this an attractive long trade setup.

💡 Trading Plan:

🔹 Enter Long after retest confirmation above the breakout level.

🔹 Stop Loss: 1.07790 (below previous low).

🔹 Take Profit: 1.09698 (previous resistance zone).

Final Thoughts

This EUR/USD setup is a textbook example of a bullish reversal following a falling wedge breakout. Traders who patiently wait for a confirmed retest can capitalize on this high-probability trade setup, aiming for a strong bullish continuation.

🔹 Tags: #EURUSD #ForexTrading #TechnicalAnalysis #Breakout #PriceAction #TradingSetup #SupportResistance

EURUSDMy Trade Idea

My trade idea was simple:

If EUR/USD breaks above a key level, I will look for a retest and enter a long position after confirming the entry with candlestick confirmation.

If it breaks below, I will wait for a retest, confirm with a candlestick pattern, and enter a short position.

This is a very short-term trade, so I’ll skip if the setup doesn’t align. Follow for faster updates! 🚀

EURUSD(20250324) Today's AnalysisToday's buying and selling boundaries:

1.0824

Support and resistance levels:

1.0887

1.0863

1.0848

1.0799

1.0784

1.0760

Trading strategy:

If the price breaks through 1.0824, consider buying, the first target price is 1.0848

If the price breaks through 1.0799, consider selling, the first target price is 1.0784

EURUSD Will be in bearish directionHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EUR/USD Trading Analysis – Falling Wedge Breakout StrategyChart Overview

The EUR/USD 1-hour chart presents a classic falling wedge pattern, which is a bullish reversal setup indicating that selling momentum is weakening and a breakout to the upside is imminent. This chart provides a structured trading plan, highlighting support and resistance levels, entry points, stop-loss placement, and a target price.

Traders can use this setup to capitalize on the potential bullish move while effectively managing risk. Let’s break it down step by step.

1. Understanding the Falling Wedge Pattern

A falling wedge is formed when price action moves within two downward-sloping trendlines that converge. It signals decreasing bearish pressure, as the price forms lower highs and lower lows within a narrowing range. The decreasing range indicates that sellers are losing control, and an upside breakout is likely.

In this chart, we observe the following key characteristics of a falling wedge:

✅ Two converging downward trendlines that contain price movement.

✅ Lower highs and lower lows showing seller exhaustion.

✅ Decreasing volume as the price approaches the breakout zone.

✅ Support near 1.08000, which has held price several times before.

A breakout above the wedge signals a shift from bearish to bullish sentiment, making this a strong trade setup.

2. Key Support & Resistance Levels

🔹 Support Level (Demand Zone)

The horizontal blue zone at 1.07898 – 1.08000 is a critical support level.

This level has been tested multiple times, making it a strong demand zone where buyers step in.

The falling wedge bottom aligns with this area, reinforcing its importance.

If price stays above this zone, it confirms the potential for a bullish breakout.

🔹 Resistance Level (Supply Zone)

The resistance zone at 1.09300 - 1.09839 has acted as a barrier to upward movement.

Price previously reversed from this zone, making it a logical take-profit area.

If the breakout happens, this level will be tested again.

A break above 1.09839 would signal further bullish momentum.

3. Trading Strategy – Step-by-Step Execution

📌 Entry Confirmation

To enter this trade with confidence, traders should wait for a confirmed breakout above the wedge.

A strong bullish candle breaking above the wedge’s upper trendline signals entry.

Ideally, a pullback and retest of the breakout level would provide additional confirmation before entering long.

📌 Stop-Loss Placement

Risk management is key, and stop-loss placement should be strategic to avoid unnecessary losses.

A stop-loss is set just below 1.07898, slightly under the recent low.

This placement ensures protection against false breakouts.

📌 Take-Profit Target

The take-profit target is set at 1.09839, aligning with key resistance and the projected wedge breakout distance.

This level has historically acted as resistance, making it an ideal zone to exit profits.

Partial profit-taking can be considered near 1.09300, before the final target.

📌 Risk-to-Reward Ratio

With a tight stop-loss and a higher profit target, this trade offers a favorable risk-reward ratio (RRR).

A minimum RRR of 1:3 is recommended, meaning potential reward is three times the risk taken.

4. Expected Market Behavior & Possible Scenarios

📊 Scenario 1: Bullish Breakout Confirmation 🚀

If price breaks and closes above the wedge, we expect a rally towards 1.09300 - 1.09839.

Pullback to retest the breakout zone would further confirm bullish strength.

Strong volume would validate the breakout, leading to a high-probability move.

📉 Scenario 2: Bearish Breakdown (Invalidation) ❌

If price breaks below 1.07898, the bullish setup is invalidated.

A downside move could push the price lower, possibly towards 1.07500 or below.

Traders should exit long positions if this scenario unfolds.

5. Additional Technical Indicators for Confirmation

To strengthen this trade setup, traders can use:

✅ RSI (Relative Strength Index) – Look for RSI divergence or a move above 50, confirming bullish strength.

✅ MACD (Moving Average Convergence Divergence) – A bullish crossover on MACD would reinforce the breakout.

✅ Volume Analysis – A spike in volume at the breakout level adds confidence in the move.

6. Conclusion & Trading Plan

This falling wedge setup suggests a high-probability bullish breakout if the price confirms above the resistance zone.

🔹 Trading Plan Summary:

✅ Wait for a breakout above the wedge before entering.

✅ Confirm breakout with a retest or strong bullish candle.

✅ Set stop-loss below 1.07898 to limit downside risk.

✅ Take profit at 1.09839, securing profits at resistance.

This strategy offers an excellent risk-to-reward ratio, making it a well-structured trade setup. Always manage risk and avoid premature entries without confirmation.

📌 TradingView Tags for Maximum Visibility

#EURUSD #Forex #TechnicalAnalysis #FallingWedge #Breakout #PriceAction #ForexSignals #SupportResistance #TradingSetup #DayTrading #SwingTrading

EURUSD is about to riseThe information of the Federal Reserve is about to be released. We need to get into the market one step ahead.

EURUSD

🎁 Buy@ 1.08500

🎁 SL 1.07500

🎁 TP 1.10000

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

If you also aspire to achieve financial freedom,Follow the link below to get my daily strategy updates

EUR/USD: Key Levels and Short-Term OutlookRecently, although inflation data in the United States has declined, it remains elevated, and the labour market continues to be tight. The Federal Reserve may maintain a hawkish stance, which is supportive of the US dollar. Meanwhile, the economic recovery in the eurozone has slowed. Weak manufacturing PMI data has dampened business and consumer confidence, exerting downward pressure on the euro.

From the 4-hour candlestick chart, EUR/USD is currently in a triangular consolidation pattern, with the price hovering around 1.08343. The resistance zone lies between 1.08760 and 1.09090, whilst the first support level is at 1.08067 and the second at 1.07528. In this context, EUR/USD is more likely to test the support levels in the short term.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Liquidity Grab eurusd Supply & Demand Zones:

🔻 A major supply zone (resistance) is marked above 1.09618, where institutional selling pressure may appear.

🔹 A demand zone (support) is established below 1.09064, providing potential entry opportunities.

📈 Trading Plan & Targets:

✅ Expecting a bullish move from the demand zone as price reacts positively.

🎯 Target 1: 1.09064 – Mid-level liquidity area.

🎯 Target 2: 1.09618 – Major resistance & supply zone.

📌 Smart Money Concept (SMC):

🔹 Price is forming a liquidity sweep before a potential bullish push.

🔹 The structure suggests an accumulation phase, with a breakout confirmation above key levels.

💡 Key Takeaways:

🔹 Bullish bias unless price invalidates the demand zone.

EUR/USD Bullish Continuation Setup📈 Trend Analysis:

The price is trading within a rising channel, suggesting an overall bullish trend.

The market recently pulled back to a key support level, presenting a potential buy opportunity.

🔍 Key Levels:

Buy Zone: Around 1.08680 - 1.08966, marking strong support.

Target: 1.10140, aligning with the upper trendline resistance.

📌 Trade Plan:

Look for buy entries near the lower boundary of the ascending channel.

Confirmation through bullish candlestick patterns (e.g., engulfing, pin bar) strengthens the setup.

⚠ Risk Management:

Stop loss: Below the 1.08680 support level.

Take profit: Gradually scale out at 1.10140 resistance.

EURUSD is Ready for a Bullish Move Hello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts