EUR/USD trades with sizeable gains above 1.1500, at over three-yThe Relative Strength Index (RSI) indicator on the 4-hour chart rose above 70, reflecting overbought conditions for EUR/USD. On the downside, 1.1500 (mid-point of the ascending channel) aligns as first support before 1.1450 (static level) and 1.1400 (20-period Simple Moving Average).

Looking north, first resistance could be spotted at 1.1600 (static level, round level) ahead of 1.1670 (upper limit of the ascending channel).

Eurusdlongsetup

EURUSD: BUY trend continuesEURUSD is taking a breather, but bulls are still in charge. The 2-hour chart shows price well above key moving averages, keeping the uptrend alive. Momentum has cooled slightly, yet indicators stay near highs—no real signs of weakness. Dips toward 1.1500 are likely to draw buyers back in.

How Smart Money is Positioning in EUR/USD – 5 Scenarios UnfoldedLiquidity Maps & Trap Zones: EUR/USD 1H Breakdown

EUR/USD SMC Analysis – Scenarios Overview

1. Case 1 – Immediate Pump:

The market may pump directly from the current market price (CMP) and take out the external range liquidity resting above the current highs.

2. Case 2 – 15-Min Demand Reaction:

The market could react to the 15-minute demand zone , showing a bullish response and pushing higher toward the 1H supply zone .

3. Case 3 – Inducement & Distribution:

Combined with Case 2, the market may first mitigate the 15-minute demand , then take out the inducement (IdM ) near the 1H supply zone . From there, distribution may begin within that supply range, leading to a drop toward the discount zone .

This would likely involve a fake breakout to the upside (liquidity sweep), trapping buyers and hitting the stop-losses of early sellers before reversing sharply.

4. Case 4 – 1H CHoCH and Triangle Breakdown:

A Change of Character (CHoCH) may occur on the 1H timeframe directly from the current price, leading to a downside move. This scenario would also break the rising triangle pattern , triggering entries from price action traders and increasing market volatility as liquidity accelerates the move downward.

5. Case 5 – 1H Supply Rejection & Free Fall:

The market may react from the 1H supply zone and reject aggressively, resulting in a free fall all the way down to the previous CHoCH level , confirming strong bearish intent from premium to discount.

Thanks for your time..

EUR/USD "The Fiber" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Fiber" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 4H timeframe (1.08500) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1.13000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

EUR/USD "The Fiber" Forex Market Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

Detailed Explanation 📝✨

Point 1: Fundamentals = tug-of-war ⚔️; U.S. strength 💪 offset by tariffs 🌧️, Eurozone weakness 🇪🇺 mitigated by ECB stability 🌟.

Point 2: Macro shows U.S. resilience cracking 😟, euro holding ground ⚖️.

Point 3: Global markets mixed 🌐, no clear winner, EUR/USD in range 🔄.

Point 4: COT cautious 📑, speculators less bullish 😐, hedgers bearish 📉.

Point 5: Intermarket neutral ⚖️; dollar-yield link key 📈, equity dips cap extremes 📉.

Point 6: 1.0950 pivot 🎯, breakout or breakdown ahead 🚀📉.

Point 7: Sentiment balanced 😊, retail buys 📈 vs. institutional caution 😐.

Point 8: Trends hinge on 1.0950 🔮; bullish needs breakout 📈, bearish risks below support 📉.

Point 9: Neutral outlook ⚖️, breakout potential either way 🌟📉.

Accurate as of April 7, 2025 ⏰, based on trends & projections. Watch U.S. CPI & Eurozone news 👀!

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURUSD TA: Fibonacci, Bull Flags, and Data-Driven Entry StrategyTechnical Analysis: EURUSD (Euro/US Dollar)

📈 The EURUSD pair is demonstrating strong bullish momentum on the 4-hour timeframe, with price action currently trading at 1.13638, well above the key 50% Fibonacci retracement level drawn from the previous range low to high.

🔍 The chart reveals a series of bull flags forming during the recent uptrend, suggesting continued buying pressure despite the pair trading at premium levels. This pattern typically indicates brief consolidation before further upside movement.

💹 From a Fibonacci perspective, the current price position above the 50% retracement level indicates strength in the Euro against the Dollar. However, this elevated position also creates potential for a healthy pullback to retest support before continuing higher.

⏱️ Today's upcoming US Retail Sales data release represents a significant market catalyst. Interestingly, this high-impact event could trigger a pullback regardless of the outcome:

If actual figures come in below forecast: Dollar weakness could prompt profit-taking after the recent rally

If actual figures exceed forecast: Dollar strength could naturally push EURUSD lower

🎯 Trade Idea: Monitor for a potential retracement toward the 50% Fibonacci level, followed by a bullish break of market structure on the 30-minute timeframe. This would provide a higher-probability entry point for long positions with a more favorable risk-to-reward ratio.

🔄 The presence of multiple bull flags suggests that any pullback may be temporary, potentially offering an excellent opportunity to enter with the prevailing trend at a better price point.

⚠️ DISCLAIMER: This analysis is provided solely for informational purposes and should not be construed as financial advice.

EURUSD Short Term Buy IdeaH4 - Strong bullish momentum

Higher highs on the moving averages of the MACD

No opposite signs

Expecting retraces and further continuation higher until the strong support zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPUSD and EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

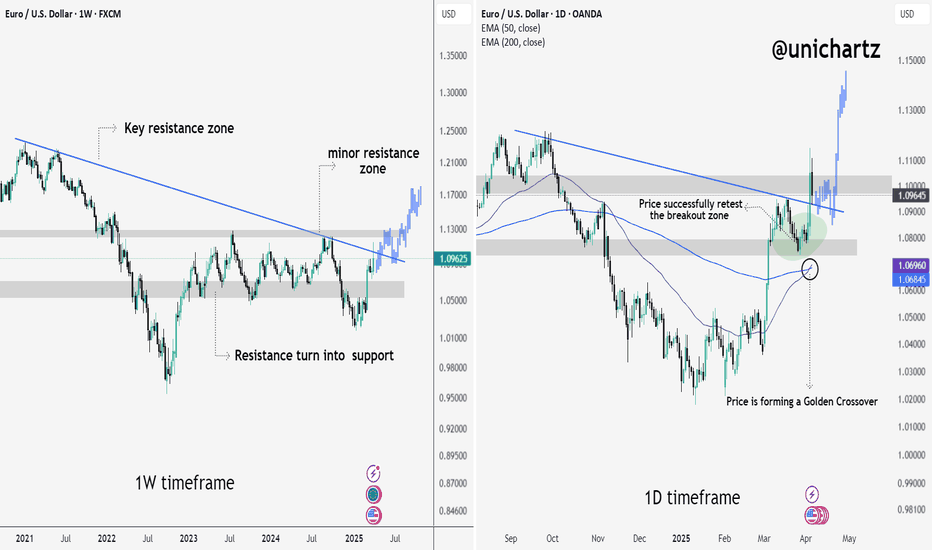

EUR/USD – Golden Crossover & Breakout Confirmation (Multi-T.F)EUR/USD is showing strong bullish signs across both the weekly and daily timeframes, suggesting a potential macro trend reversal in the making. After being trapped below a long-term descending trendline for nearly two years, price has not only broken out but also successfully retested the breakout zone — a key validation for trend continuation.

On the daily chart, a Golden Crossover is now forming, which historically precedes major uptrends in forex pairs. Combined with reclaiming key structural levels and building higher lows, EUR/USD could be positioning for a powerful upside move in Q2 2025.

Let’s dive into the multi-timeframe analysis to understand why this setup could be one of the cleanest trend reversals on the board.

1W Timeframe – Macro Breakout in Progress

EUR/USD has officially broken out of a long-standing descending resistance trendline. This breakout occurred from a structurally important zone that had acted as a ceiling for over 2 years.

📌 Key Observations:

🔹 Price reclaimed and held above the key resistance zone, turning it into strong support.

🔹 Minor resistance zones lie ahead, but structure favors further upside.

🔹 Projection shows potential continuation toward 1.16+ if momentum sustains.

1D Timeframe – Bullish Retest + Golden Cross Forming

Zooming into the daily chart, we see:

✅ A successful retest of the breakout zone, which held as support (bullish confirmation).

✅ Price is now forming a Golden Crossover – where the 50 EMA is crossing above the 200 EMA. This is typically seen as a strong bullish signal in trending markets.

📌 What’s Bullish:

Clean breakout ✔️

Retest with strength ✔️

Momentum crossover ✔️

EUR/USD is now in a strong bullish structure, backed by a confirmed breakout on the weekly and a golden crossover on the daily. If price holds above 1.09, we may see continued upside toward 1.13–1.16 levels in the coming weeks.

Thank you for reading and supporting @unichartz. If you found this analysis helpful, don’t forget to like, follow, and share! 💙

EUR/AUD 4H Trade Setup: Demand Zone Bounce to 1.87500🔵 Key Zones and Levels

🟦 Demand Zone: Strong support area where price has bounced multiple times.

✅ Confluence with the trendline gives extra strength.

🎯 Entry Point: 1.78990

Perfect spot for a potential buy setup.

🛑 Stop Loss: 1.76962

Below the demand zone to protect against false breakouts.

🚀 Target Point: 1.87500

Profit goal with an impressive +4.85% potential (867.4 pips)!

📊 Price Action

📍Current price: 1.80528 (hovering near EMA and close to entry)

🔁 Price has tested the support zone several times — showing signs of accumulation.

⬆️ Potential bullish breakout from this zone.

🔍 Indicators & Patterns

📏 EMA (7): Price is near it, waiting for a clear move above for momentum.

📈 Trendline: Holding well as dynamic support.

🔶 Channel pattern: Higher highs and higher lows indicate uptrend structure.

📌 Summary

🟢 Buy Setup:

🛒 Entry: 1.78990

🛑 Stop Loss: 1.76962

🎯 Target: 1.87500

⚖️ Risk-Reward: Great R:R setup with strong technical backing!

EURUSD is Ready for a Bullish MoveHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EUR/USD Bullish Breakout & Retest Setup – Targeting 1.10955Instrument: EUR/USD

Timeframe: 30-Minute

Indicators Used:

EMA 30 (Red): 1.09821

EMA 200 (Blue): 1.09698

Key Levels Identified:

Entry Point: 1.09695

Stop Loss: Around 1.09067

Resistance Zone: ~1.09911

Target Zone: ~1.10918 to 1.10955

Projected Gain: ~147.3 pips (1.35%)

Price Action Analysis:

Bullish Breakout:

The price broke out from a consolidation zone (marked in purple).

A bullish trend is forming as price moves above the 200 EMA.

EMAs Alignment:

The 30 EMA is currently above the 200 EMA, indicating a potential bullish trend continuation.

However, price is slightly below the 30 EMA now, suggesting some short-term pullback or resistance.

Retest at Entry Zone:

Price retested the entry zone at 1.09695 after the breakout and is now hovering near it.

This retest is healthy for confirming support before another move up.

Trade Setup Insight:

Entry Strategy: A long (buy) entry at or around 1.09695.

Stop Loss Placement: Below the previous support zone near 1.09067 to manage risk.

Target Strategy: Aiming for the resistance zone around 1.10918–1.10955 for profit booking.

Conclusion:

This looks like a bullish continuation setup with a favorable risk-reward ratio. The confluence of:

EMA support,

Price structure (breakout & retest),

and defined resistance/target zone

EURUSD is Ready for a Bullish MoveHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EUR/USD Short Setup – Entry at Resistance, Targeting 1.08942"Entry Point: Around 1.10456

Stop Loss: Around 1.10833

Take Profit (EA Target Point): Around 1.08942

Risk-Reward Ratio: Appears favorable (approximately 1:2)

🔍 Key Observations:

Resistance Zone (Supply Area):

Price hit a strong resistance (marked with a purple zone) and showed signs of rejection with wicks.

The resistance aligns with the entry zone, suggesting a potential reversal area.

Moving Averages:

EMA 30 (Red) ≈ 1.09966 and EMA 200 (Blue) ≈ 1.09607

Price is currently above both EMAs, which is typically bullish, but the setup anticipates a pullback or correction.

Bearish Engulfing Pattern:

A possible bearish engulfing candlestick appears near the entry zone, indicating seller strength.

Break of Minor Support (RESISTANCE POINT):

If price breaks below this level, it would likely confirm the short setup toward the target.

✅ Confirmation Needed:

A clean break and close below the support (resistance point) to confirm entry.

Momentum indicators (RSI, MACD) could provide additional confidence if available.

⚠️ Risk Notes:

Since the price is still above both EMAs, this trade counters the short-term trend, so proper stop management is key.

Watch for news events, especially since this pair reacts strongly to economic data (note the calendar icon at the bottom right).

GBPUSD, EURUSD and AUDUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

#EURUSD: Two Opportunities In One Chart, What do you see? Price has shown bullish behaviour exhaustion, and it's at a point where we see a total meltdown in prices. This is an excellent scenario for traders who trade on what the chart shows us rather than selling or buying only. We can utilise both these entries when prices do show a strong indication at either of our levels.

If you like our work, then do like and comment on the idea, which will boost us to post more such ideas. ❤️🚀