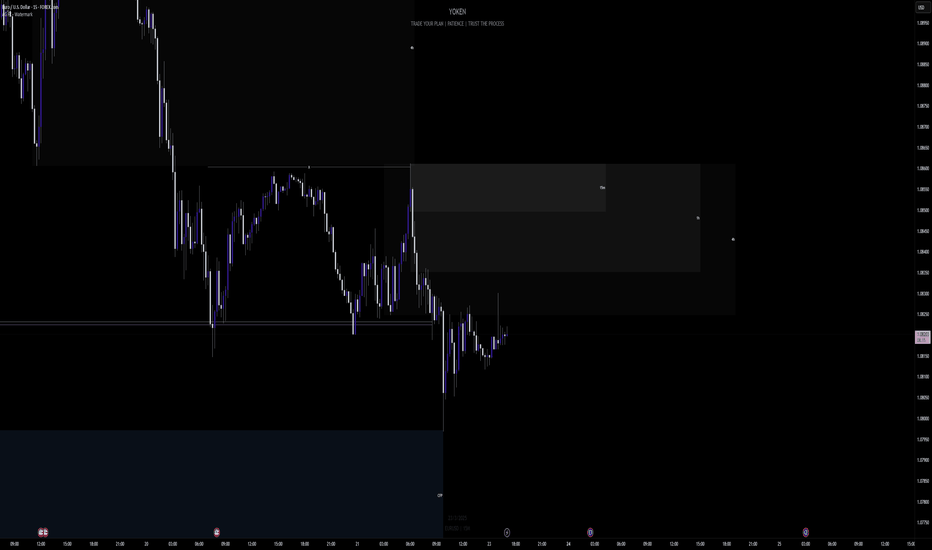

EURUSD Weekly Candle RangeTrading is hard but it's simple.

On the 1W, EURUSD traded into a key zone and ended with a long wick, indicating a strong rejection. I'm looking to find entries in the wick area and targeting CRH for the rest of the week. Do have a lovely weekend. For me, I'd be looking at ETHUSDT 😅

Eurusdoutlook

EUR/USD: Uncertain Trajectory Amid Tariff - Induced JittersThe EUR/USD is trading at 1.0796. After a Thursday rebound from 1.0733 due to a weakening USD, it's now pressured at the intraday high of 1.0799.

US President Donald Trump's new 25% import taxes on cars and car parts, with potential additional levies on the eurozone and Canada, have stoked risk - off sentiment. This has led to a temporary dip in the US dollar's appeal.

On the daily chart, it's found buyers near the non - directional 200 - day SMA, with 1.0730 as dynamic support. It's attempting to break the bullish 20 - day SMA, while the 100 - day SMA is non - directional below the current level. The momentum indicator is flat below 100, and the RSI at 56 hints at upward risk, yet unconfirmed. Bulls should be cautious short - term.

In the 4 - hour chart, technicals are rising but below the mid - line. EUR/USD is fighting a bearish 20 - day SMA, and the 100 - day SMA has lost upward steam around 1.0840. A break above 1.0840 could bring back the bulls.

EURUSD

buy@1.08200-1.08500

tp:1.08900-1.09300

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EurUsd- The "big" move is down, not upLast week, TRADENATION:EURUSD reached a high of around 1.09 and has been consolidating ever since, now for the fifth consecutive trading day. Despite some weak upward spikes, the pair remains in a range-bound phase.

From a technical perspective, multiple resistance levels lie ahead, with the psychological 1.10 mark acting as a key barrier. Given the current price action, I believe this consolidation is more likely to result in a downside breakout rather than a continuation of the uptrend.

There is a strong possibility that EUR/USD will correct the impressive rally that began in early March.

With this outlook in mind, I see more downside potential than upside and I am considering selling into rallies, targeting a move toward 1.07.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Attention! Key Signals in the EUR/USD Exchange Rate TrendThe EUR/USD pair has traded with a soft tone for five consecutive trading days, and the decline has expanded to 1.0776, the lowest level since March 6. However, the broad weakness of the US dollar in the middle of the European session pushed the currency pair to turn upward.

In the short term, according to the 4-hour chart, although the possibility of further upward movement is low, the downside potential also seems limited. The EUR/USD found buying support around the bullish 100-day moving average but failed to break through the bearish 20-day moving average. Finally, although technical indicators show an upward trend, they remain in negative territory.

EURUSD Trading Strategy:

buy@1.08200-1.08500

tp:1.08900-1.09300

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EUR USD Entry Setup 30M Timeframe🔹 Pattern: Double Bottom

🔹 Entry Condition: Wait for a clean break and retest of the neckline before entering.

No confirmation = No trade.

🔹 Higher Timeframe Context: Overall trend is bearish: this is just a pullback to the Lower High before a potential continuation of the downtrend.

⚠️ Patience is key let’s see how it plays out!

EURUSD Trading: Unveiling the Precise Strategy GuideAfter last week's decline, the euro against the US dollar started to recover at the beginning of this week and is currently trading within the positive range around 1.0850.

According to the Wall Street Journal, the White House is adjusting its tariff policy set to take effect on April 2nd. It may cancel a series of tariffs targeting specific industries and instead impose reciprocal tariffs on countries with significant trade relations with the US. Affected by this news, during the European morning session, US stock index futures rose by 0.8% to 1.0%.

On the 4 - hour chart in the European morning session on Monday, the Relative Strength Index (RSI) indicator climbed to 50, indicating that the recent bearish momentum has dissipated to some extent.

In terms of the upward direction, the 50 - period Simple Moving Average (SMA) forms an interim resistance level at 1.0880, followed by 1.0900. If the euro - US dollar pair can firmly stand above this level, the next resistance level may be at 1.0950.

EURUSD Trading Strategy:

buy@1.08200-1.08500

tp:1.08900-1.09300

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EUR/USD Weekly Bias technical analysis appears well-reasoned. EUR/USD Weekly Bias Analysis

Technical analysis appears well-reasoned:

1. Short-term bearish bias: You anticipate a decline towards the previous week's low, indicating a potential short-term downtrend.

2. Bullish reversal zone: You've identified a critical area, marked by the weekly Fibonacci Volume Zone (FVG), where a potential bullish reversal could occur.

3. Upside target: Your analysis suggests a move towards the weekly high, offering a clear profit target.

# Key Confirmation Factors:

To validate your bias and adjust your strategy, consider the following:

- Candlestick patterns: Monitor for bullish reversal patterns, such as hammer or engulfing candles, to confirm a potential trend change.

- Momentum indicators: Keep an eye on the Relative Strength Index (RSI) and other momentum indicators to gauge the strength of the potential reversal.

- Volume analysis: Analyze trading volumes to ensure they support your bias, with increasing volumes on up days and decreasing volumes on down days.

By carefully monitoring these factors, you'll be well-positioned to adjust your strategy and capitalize on potential trading opportunities in the EUR/USD market.

Week of 3/23/25: EU AnalysisWeekly analysis of EU, my analysis shows bearish signals and where I am looking to trade from.

The chart looks very healthy for a daily retracement with the medium time frames aligning to it.

Only volatile news this week for me to watch out for is:

Unemployment Claims - Thursday

Let me know your thoughts, analysis, or what you'd like to see!

Thanks for watching, good luck this week, let's kill it.

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Matador the EUR/USD Bull? - Bears about to jump in?After the previous 3 weeks of bullish havoc, the bears may have finally decided to pump the breaks on EUR/USD buyers.

As price continued to push higher, I held on to short positions that I began building up at 1.0851 & 1.0909 as I wanted to wait and see if the Pivot level R1 area (1.0935) was going to provide the wall to begin declining back down.

Once I saw the lack of advancement, I opened another strong short position at 1.0912 and now sitting at an overall average price of 1.0891.

I like this trade, however I am still staying cautious on that 1.0800 level. I want to see this price point clearly broken and trading below it, otherwise I will keep my stop at a close break-even point for risk protection. Overall, so far so good but we need to break through 1.0800.

From a purely technical analysis point of view, I see a small scale rising broadening pattern and this usually indicates a drop to the starting point of the pattern will take place however, If we drop aggressively, I may eye that 1.0600 level again which will lock in almost 300 pips but as I just said, these patterns usually return to their starting point so 1.0300 or below is not out of the question. I guess it depends on how the price action is looking whether I'd close or hold.

1.0600 is around the yearly pivot point so that is a good marker to shoot for IMO. Interestingly, the MACD and RSI show a rising broadening pattern as well so that gives me a little bit more conviction in this trade.

I see some other markers for this trade as well but I will share that in my next upcoming market preview video since it'd be too much to type.

As always, Good Luck & Trade Safe

EUR/USD: Key Levels and Short-Term OutlookRecently, although inflation data in the United States has declined, it remains elevated, and the labour market continues to be tight. The Federal Reserve may maintain a hawkish stance, which is supportive of the US dollar. Meanwhile, the economic recovery in the eurozone has slowed. Weak manufacturing PMI data has dampened business and consumer confidence, exerting downward pressure on the euro.

From the 4-hour candlestick chart, EUR/USD is currently in a triangular consolidation pattern, with the price hovering around 1.08343. The resistance zone lies between 1.08760 and 1.09090, whilst the first support level is at 1.08067 and the second at 1.07528. In this context, EUR/USD is more likely to test the support levels in the short term.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EURUSD THEORY : BIG SHORT (W.B.: 24/03/25)Price has confirmed the change - not a strong confirmation but one nonetheless. For that reason, wait for price to retrace back into one of the drawn up POIs in order to decide where to sell from - If I get further signals that a sell will occur.

It should sell all the way to the bottom..

Next week should be interesting

N.B.: This is not financial advice. Trade safely and with caution.

EUR/USD Outlook – Potential Downtrend After Channel BreakdownOverview:

Pair: EUR/USD

Timeframe: 4-Hour (4H)

Broker: OANDA

Current Price: 1.08436

Trend: Potential Reversal

Technical Analysis:

The EUR/USD pair has been trading within a rising channel, indicating a bullish trend. However, recent price action shows a breakout to the downside, suggesting a potential bearish reversal.

The price failed to sustain above resistance and is now heading lower.

Breakdown confirmation suggests further downside movement.

Target: 1.06166, which aligns with a previous consolidation zone.

Trading Strategy:

📉 Bias: Bearish below the channel breakdown

🎯 Target: 1.06166 (Key Support)

🔍 Confirmation: Additional bearish momentum with lower highs and lower lows

EURUSD Sell and Buy Trading PlanH4 - We had a strong bullish move with the price creating a series of higher highs, higher lows structure

This strong bullish move ended with a bearish Divergence

While measuring this strong bullish move using the Fibonacci retracement tool we have two key support zones that has formed (marked in green)

So based on this I expect potential short term bearish moves now towards the key support zones and then potential continuation higher.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

---------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.-

EUR/USD Continued strength or FOMC Fallout?In this analysis I go over the EUR/USD and it's potential for further gains or a weakening bull and drop.

I expect a volatile week considering it's FOMC on Wednesday and ECB speaking on Friday.

Additionally, I share my outlook on ETF's I'm involved in. Currently in QQQE Put Option and closed my TQQQ Put for 30% gains last week.

As always, Good Luck and Trade Safe.

EURUSD analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EUR/USD "The Dollar Crusher" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Dollar Crusher" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (1.04500) then make your move - Bullish profits await!"

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 1.03500(swing Trade) Using the 2H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.07000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

EUR/USD "The Dollar Crusher" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🔴Fundamental Analysis

- The Eurozone's economic growth is expected to slow down, while the US economy is expected to grow at a moderate pace.

- The European Central Bank (ECB) is expected to keep interest rates steady, while the Federal Reserve is expected to maintain its accommodative monetary policy.

🟤Macro Analysis

- The Eurozone's inflation rate is expected to remain low, while the US inflation rate is expected to remain above the Federal Reserve's target.

- The Eurozone's trade balance is expected to remain in surplus, while the US trade balance is expected to remain in deficit.

🟠Sentimental Analysis

- Institutional investors have a bullish sentiment towards the EUR/USD pair, with 55% of investors being bullish.

- Hedge funds have increased their long positions in the EUR/USD pair, with a net long exposure of 12%.

🟣COT Analysis

- The Commitments of Traders (COT) report shows that commercial traders have increased their long positions in the EUR/USD pair, with a net long exposure of 10%.

- Non-commercial traders have also increased their long positions, with a net long exposure of 15%.

🟡Trader Sentiment

- Retail traders have a bullish sentiment towards the EUR/USD pair, with 52% of traders being bullish.

- Commercial banks have increased their EUR/USD holdings, with a growth rate of 5%.

🔵Bullish and Bearish Data:

- Bullish Sentiment: Institutional investors have a bullish sentiment towards the EUR/USD pair, with 55% being bullish. Hedge funds have increased their long positions, with a net long exposure of 12%

- Bearish Sentiment: Asset managers are trimming their long exposure, and gross shorts are trending higher for large specs and asset managers since Q4

🟢Based on this analysis, the EUR/USD pair is expected to move in a bullish trend, with a 55% chance of an uptrend and a 35% chance of a downtrend. However, please note that market predictions can be unpredictable and influenced by various factors

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/USD: The Euro Stays in Overbought TerritoryThe pair has been rising for the last five sessions, gaining approximately 1.4% , as expansionary policies in European countries have restored confidence in the euro. In contrast, the U.S. dollar continues to struggle with maintaining consistent demand due to the ongoing tariff battle led by the White House.

Accelerated Movement:

Since March 3rd, EUR/USD has experienced growth of over 5%, driven by strong short-term bullish momentum. Currently, the price is slowly approaching a key resistance zone, but recent price oscillations suggest that bullish momentum is fading, which could lead to short-term bearish corrections.

RSI Indicator:

The RSI line has started oscillating above the 70 level, which is the official overbought zone of the indicator. This suggests that the balance between buying and selling pressure has been lost, with bullish momentum fully dominating the market. The increasing speed of demand for EUR/USD may indicate a potential emergence of bearish corrections in the short term.

MACD Indicator:

The MACD histogram remains at its highest levels of the year, suggesting that buying pressure may be entering a phase of constant exhaustion. In the long run, this could also open the possibility of selling corrections in the upcoming sessions.

Key Levels:

1.1000 – Tentative Resistance: A potential psychological barrier that the price may face in its prolonged bullish streak. Oscillations above this level could confirm sustained buying pressure and signal the beginning of stronger upward movements in the chart.

1.07944 – Near-term Support: A neutral zone where the price has shown stability in the short term. This level may be important for potential selling corrections in the next trading sessions.

1.06173 – Distant Support: A key level corresponding to the highs reached in December 2024. Bearish oscillations reaching this level could jeopardize the current strong bullish trend.

By Julian Pineda, CFA – Market Analyst

EUR/USD – Bullish, But Time to Breathe!🚀 EUR/USD – Bullish, But Time to Breathe! 🚀

“Momentum is strong, but even the best trends need to take a breath before the next leg up.”

🔥 Key Insights:

✅ Bullish Structure Intact – No reason to fight the trend.

✅ Overextended Move – Markets don’t go up in a straight line; pullbacks create better entries.

✅ Healthy Retracement = Stronger Continuation – Chasing here is risky, waiting for a dip is smart.

💡 The Plan:

Wait for a Pullback Before Longs – Let price reset, don’t rush in.

Watch Volume Profile & CDV for Buyer Confirmation – Smart money leaves clues.

Ideal Entry = Lower Support Levels Holding – We want a strong base for the next move up.

“Patience is key. Let the market give you the perfect entry—not every green candle is a buy!” 🚀💶

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..