Eurusdprediction

Attention! Key Signals in the EUR/USD Exchange Rate TrendThe EUR/USD pair has traded with a soft tone for five consecutive trading days, and the decline has expanded to 1.0776, the lowest level since March 6. However, the broad weakness of the US dollar in the middle of the European session pushed the currency pair to turn upward.

In the short term, according to the 4-hour chart, although the possibility of further upward movement is low, the downside potential also seems limited. The EUR/USD found buying support around the bullish 100-day moving average but failed to break through the bearish 20-day moving average. Finally, although technical indicators show an upward trend, they remain in negative territory.

EURUSD Trading Strategy:

buy@1.08200-1.08500

tp:1.08900-1.09300

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

EUR USD Entry Setup 30M Timeframe🔹 Pattern: Double Bottom

🔹 Entry Condition: Wait for a clean break and retest of the neckline before entering.

No confirmation = No trade.

🔹 Higher Timeframe Context: Overall trend is bearish: this is just a pullback to the Lower High before a potential continuation of the downtrend.

⚠️ Patience is key let’s see how it plays out!

EURUSD - Will Bears Keep Pushing Lower?Overview of Market Structure

The EUR/USD pair has been experiencing strong bullish momentum over the past few weeks, leading to the creation of an extended bullish leg. However, as with most impulsive moves, the market has left behind imbalances—price inefficiencies where the market moved too quickly without sufficient pullbacks to ensure order fulfillment.

Recently, we have observed a break in bullish structure, signaling a potential shift in momentum. This break suggests that the market may now be in a phase where it seeks to rebalance inefficiencies before deciding its next directional move.

My expectation is that price will first retrace to fill the imbalance zone above, which acts as a supply area, before reversing and targeting the imbalance zones left behind in the bullish rally.

Key Resistance and Market Rejections

A crucial area in this setup is the strong resistance zone (marked in red), which has been rejected twice. Each time price attempted to break through, sellers stepped in, pushing price lower. This level serves as a significant supply zone where institutions may have unfilled sell orders.

With this in mind, the most logical movement for price would be to return to this area, collect liquidity, and then initiate a bearish move.

Imbalance Zones and Market Efficiency

Imbalance zones are areas on the chart where price has moved too quickly, leaving behind inefficiencies. These areas often get revisited later as price seeks to rebalance liquidity.

There are two key imbalance zones in this setup:

The imbalance zone above the current price (first target) – This is the area where price is expected to retrace before reversing.

The imbalance zone below the current price (final target) – Created during the rapid bullish rally, this area remains untested and is likely to be filled once bearish momentum takes over.

These zones are high-probability areas where price is expected to react due to unfulfilled institutional orders.

Break of Bullish Structure & Shift in Momentum

A key element of this trade idea is the break in bullish structure. This break was confirmed when a bearish candle closed below the previous higher low, invalidating the uptrend.

This structural shift suggests that bulls may be losing control, and a deeper retracement is likely before any potential continuation of the overall trend. The break also increases the probability of the lower imbalance zone getting filled before the market makes its next major move.

Trade Execution Plan

Step 1: Identify the Optimal Short Entry

Wait for price to fill the imbalance zone above.

Once confirmation is seen, a short position can be entered.

Step 2: Bearish Move to Lower Imbalance Zone

After rejection from the supply zone, expect price to break lower.

The target for this move will be the imbalance left behind in the bullish rally.

Trailing stop-loss can be used to maximize profits while reducing risk.

Why This Trade Has High Probability

Market Favors Liquidity Grabs – The imbalance zone above is a likely liquidity grab area before the bearish move.

Break in Market Structure – The recent bearish structure break increases the probability of downside continuation.

Historical Resistance Rejection – The resistance zone above has already rejected price twice, indicating strong selling pressure.

Imbalance Fill Below – Price tends to fill inefficiencies left behind in fast-moving markets, making the lower imbalance zone a logical target.

Risk Management Considerations

Stop-loss should be placed slightly above the imbalance zone above to protect against unexpected breakouts.

Take-profit should be set at the lower imbalance zone, allowing for a strong risk-to-reward ratio.

If price breaks past the resistance zone above without rejection, it would invalidate this bearish setup, signaling a reevaluation of market conditions.

Conclusion

This trade idea is based on a smart money concept (SMC) approach, focusing on liquidity grabs, imbalance fills, and structural shifts. If the market follows the expected path, we could see price first push up to fill the imbalance above, reject from that level, and then begin a bearish move to fill the imbalance left in the previous bullish rally.

By patiently waiting for price to reach key areas and confirming rejections, this trade setup provides a high-probability opportunity with a strong risk-to-reward ratio.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

EUR/USD Short Trade Setup – Key Resistance Rejection & Bearish TEntry Zone:

The entry for the short trade is around 1.08405 - 1.08412.

The price is expected to rise into this area before reversing downward.

Stop Loss:

Positioned at 1.08760 - 1.08770, above the resistance zone marked in purple.

This ensures the trade is invalidated if price moves too high.

Take Profit Levels (TP):

TP1: 1.07987

TP2: 1.07620

TP3: 1.07107

Final Target: 1.06604

Indicators Used:

200 EMA (Blue Line): At 1.08405, acting as resistance.

30 EMA (Red Line): At 1.08086, showing short-term trend direction.

Overall Trade Idea:

Price is expected to reject the 1.08412 resistance zone and move downward.

If the price respects the resistance, a strong bearish move toward the 1.06604 target is anticipated.

Potential Trade Plan:

Sell at: ~1.08405

Stop Loss: ~1.08760

Take Profit: Staggered at TP1, TP2, TP3, or full exit at 1.06604.

Break or Bounce? EUR/USD OpportunityHi Traders! The price is in a descending channel and is testing the lower boundary.

🔹 Scenarios:

Buy if it breaks above 1.0845, with a stop loss at 1.0790 and targets at 1.0870, 1.0900, and 1.0950.

Sell if it breaks below 1.0780, with a stop loss at 1.0830 and targets at 1.0750, 1.0720, and 1.0700.

📊 RSI is in the oversold zone—a potential bounce is possible! Watch the price action closely.

📢 Stay updated with live market movements!

🔥 Smash that like button and show some energy! Let’s trade like pros!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trade at your own risk.

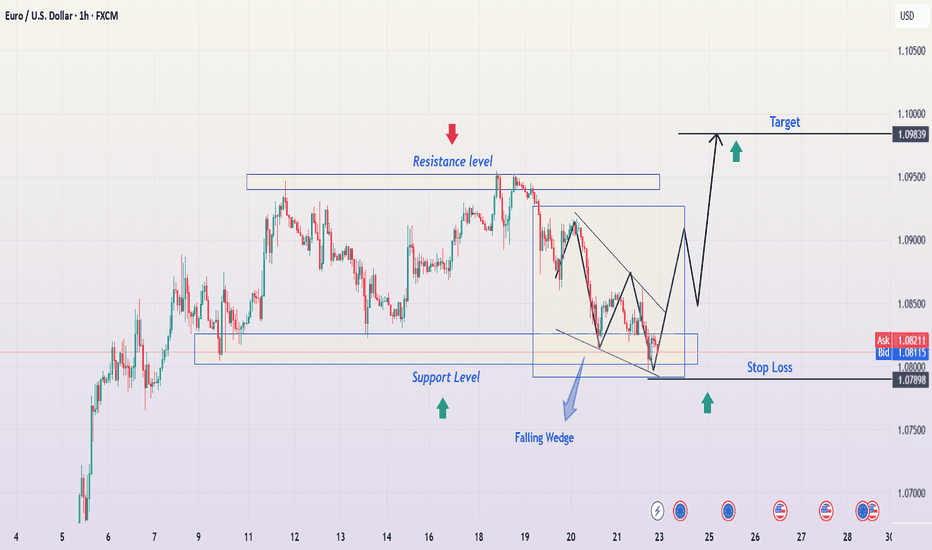

EUR/USD Falling Wedge Breakout – Professional Chart AnalysisOverview of the Chart

The EUR/USD 1-hour chart presents a bullish trading setup, featuring a well-defined falling wedge pattern, a trendline breakout, and a retest phase, signaling a potential upward move. The chart is marked with key technical elements such as support and resistance zones, breakout confirmation, and risk management parameters.

This analysis will break down each component of the chart, explaining the logic behind the setup and how traders can approach this opportunity.

1. Identified Chart Patterns

Falling Wedge Formation (Bullish Reversal Signal)

The price action formed a falling wedge, characterized by lower highs and lower lows, creating a narrowing price channel.

This pattern is typically a bullish reversal structure, as it indicates weakening selling pressure before an expected breakout.

The wedge’s downward movement ended with a strong breakout to the upside, signaling buyers regaining control.

2. Key Technical Levels

Support & Resistance Zones

Support Level (Buyers’ Stronghold)

The horizontal support level is a price area where buyers have previously stepped in, preventing further declines.

This level has been tested multiple times, reinforcing its strength as a key demand zone.

Resistance Zone (Profit Target Area)

The highlighted resistance zone represents a supply area where the price has struggled to move past in previous sessions.

The target price level aligns with this resistance, making it a realistic profit target for the long position.

3. Trendline Breakout Confirmation

Before forming the wedge, the chart shows an uptrend with a breakout above a trendline.

This trendline breakout was an early signal of bullish strength, aligning with the later wedge breakout.

After the breakout, the price came back for a retest, which is a key confirmation before further upward movement.

4. Retesting Phase Before the Upward Move

After breaking out of the wedge, the price returned to the breakout level to confirm support.

Retesting is a crucial validation step—if the price holds above this level, it increases the probability of a continued bullish move.

This retesting action provides a potential entry point for traders looking to go long.

5. Trade Setup & Risk Management Strategy

Trade Entry:

A buy entry is considered after the retest is confirmed (price holding above the breakout level).

Stop Loss Placement (Risk Control):

The stop loss is placed below the previous low at 1.07790, ensuring protection against fake breakouts or unexpected reversals.

Take Profit Target (Projected Price Move):

The target price is set at 1.09698, which aligns with previous resistance levels and the measured move from the wedge breakout.

This provides a strong risk-to-reward ratio, making the setup favorable for bullish traders.

6. Risk-Reward Ratio & Trade Viability

Risk: The distance between the entry point and the stop loss is relatively small, making it a low-risk trade.

Reward: The potential upside move is significantly higher than the risk, creating a high reward-to-risk ratio trade.

This type of technical confluence increases the probability of a successful trade, making it an attractive opportunity.

7. Conclusion & Trading Strategy

📌 Key Takeaways:

✅ The falling wedge breakout signals a bullish reversal.

✅ The trendline breakout and retest add further confirmation to the trade setup.

✅ The support and resistance zones provide a clear risk management strategy.

✅ The risk-reward ratio makes this an attractive long trade setup.

💡 Trading Plan:

🔹 Enter Long after retest confirmation above the breakout level.

🔹 Stop Loss: 1.07790 (below previous low).

🔹 Take Profit: 1.09698 (previous resistance zone).

Final Thoughts

This EUR/USD setup is a textbook example of a bullish reversal following a falling wedge breakout. Traders who patiently wait for a confirmed retest can capitalize on this high-probability trade setup, aiming for a strong bullish continuation.

🔹 Tags: #EURUSD #ForexTrading #TechnicalAnalysis #Breakout #PriceAction #TradingSetup #SupportResistance

EURUSD NEXT POSSIBLE MOVEVANTAGE:EURUSD

EUR/USD Intraday Analysis – Key Zones to Watch

The market structure for EUR/USD on the 15-minute chart presents a well-defined range with key trading zones.

🔸 Sell Zone – The price is currently trading near this zone, indicating potential short opportunities if bearish pressure increases.

🔸 Buy Zone – A key support level where buying interest may emerge, leading to possible bullish movements.

🔸 Target & Stop Levels:

Buy TP and Sell SL: Upper resistance level where buying targets align and sell stop-losses are triggered.

Sell TP and Buy SL: Lower support level acting as a sell target and buy stop-loss zone.

Traders should monitor price action around these zones for confirmations before entering trades.

📅 Date: March 24, 2025

📊 Chart: 15-Minute (EUR/USD)

💹 Broker: VANTAGE

#EURUSD #ForexTrading #IntradayAnalysis #PriceAction #TradingStrategy

EURUSD(20250324) Today's AnalysisToday's buying and selling boundaries:

1.0824

Support and resistance levels:

1.0887

1.0863

1.0848

1.0799

1.0784

1.0760

Trading strategy:

If the price breaks through 1.0824, consider buying, the first target price is 1.0848

If the price breaks through 1.0799, consider selling, the first target price is 1.0784

EURUSD Will be in bearish directionHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EUR/USD Trading Analysis – Falling Wedge Breakout StrategyChart Overview

The EUR/USD 1-hour chart presents a classic falling wedge pattern, which is a bullish reversal setup indicating that selling momentum is weakening and a breakout to the upside is imminent. This chart provides a structured trading plan, highlighting support and resistance levels, entry points, stop-loss placement, and a target price.

Traders can use this setup to capitalize on the potential bullish move while effectively managing risk. Let’s break it down step by step.

1. Understanding the Falling Wedge Pattern

A falling wedge is formed when price action moves within two downward-sloping trendlines that converge. It signals decreasing bearish pressure, as the price forms lower highs and lower lows within a narrowing range. The decreasing range indicates that sellers are losing control, and an upside breakout is likely.

In this chart, we observe the following key characteristics of a falling wedge:

✅ Two converging downward trendlines that contain price movement.

✅ Lower highs and lower lows showing seller exhaustion.

✅ Decreasing volume as the price approaches the breakout zone.

✅ Support near 1.08000, which has held price several times before.

A breakout above the wedge signals a shift from bearish to bullish sentiment, making this a strong trade setup.

2. Key Support & Resistance Levels

🔹 Support Level (Demand Zone)

The horizontal blue zone at 1.07898 – 1.08000 is a critical support level.

This level has been tested multiple times, making it a strong demand zone where buyers step in.

The falling wedge bottom aligns with this area, reinforcing its importance.

If price stays above this zone, it confirms the potential for a bullish breakout.

🔹 Resistance Level (Supply Zone)

The resistance zone at 1.09300 - 1.09839 has acted as a barrier to upward movement.

Price previously reversed from this zone, making it a logical take-profit area.

If the breakout happens, this level will be tested again.

A break above 1.09839 would signal further bullish momentum.

3. Trading Strategy – Step-by-Step Execution

📌 Entry Confirmation

To enter this trade with confidence, traders should wait for a confirmed breakout above the wedge.

A strong bullish candle breaking above the wedge’s upper trendline signals entry.

Ideally, a pullback and retest of the breakout level would provide additional confirmation before entering long.

📌 Stop-Loss Placement

Risk management is key, and stop-loss placement should be strategic to avoid unnecessary losses.

A stop-loss is set just below 1.07898, slightly under the recent low.

This placement ensures protection against false breakouts.

📌 Take-Profit Target

The take-profit target is set at 1.09839, aligning with key resistance and the projected wedge breakout distance.

This level has historically acted as resistance, making it an ideal zone to exit profits.

Partial profit-taking can be considered near 1.09300, before the final target.

📌 Risk-to-Reward Ratio

With a tight stop-loss and a higher profit target, this trade offers a favorable risk-reward ratio (RRR).

A minimum RRR of 1:3 is recommended, meaning potential reward is three times the risk taken.

4. Expected Market Behavior & Possible Scenarios

📊 Scenario 1: Bullish Breakout Confirmation 🚀

If price breaks and closes above the wedge, we expect a rally towards 1.09300 - 1.09839.

Pullback to retest the breakout zone would further confirm bullish strength.

Strong volume would validate the breakout, leading to a high-probability move.

📉 Scenario 2: Bearish Breakdown (Invalidation) ❌

If price breaks below 1.07898, the bullish setup is invalidated.

A downside move could push the price lower, possibly towards 1.07500 or below.

Traders should exit long positions if this scenario unfolds.

5. Additional Technical Indicators for Confirmation

To strengthen this trade setup, traders can use:

✅ RSI (Relative Strength Index) – Look for RSI divergence or a move above 50, confirming bullish strength.

✅ MACD (Moving Average Convergence Divergence) – A bullish crossover on MACD would reinforce the breakout.

✅ Volume Analysis – A spike in volume at the breakout level adds confidence in the move.

6. Conclusion & Trading Plan

This falling wedge setup suggests a high-probability bullish breakout if the price confirms above the resistance zone.

🔹 Trading Plan Summary:

✅ Wait for a breakout above the wedge before entering.

✅ Confirm breakout with a retest or strong bullish candle.

✅ Set stop-loss below 1.07898 to limit downside risk.

✅ Take profit at 1.09839, securing profits at resistance.

This strategy offers an excellent risk-to-reward ratio, making it a well-structured trade setup. Always manage risk and avoid premature entries without confirmation.

📌 TradingView Tags for Maximum Visibility

#EURUSD #Forex #TechnicalAnalysis #FallingWedge #Breakout #PriceAction #ForexSignals #SupportResistance #TradingSetup #DayTrading #SwingTrading

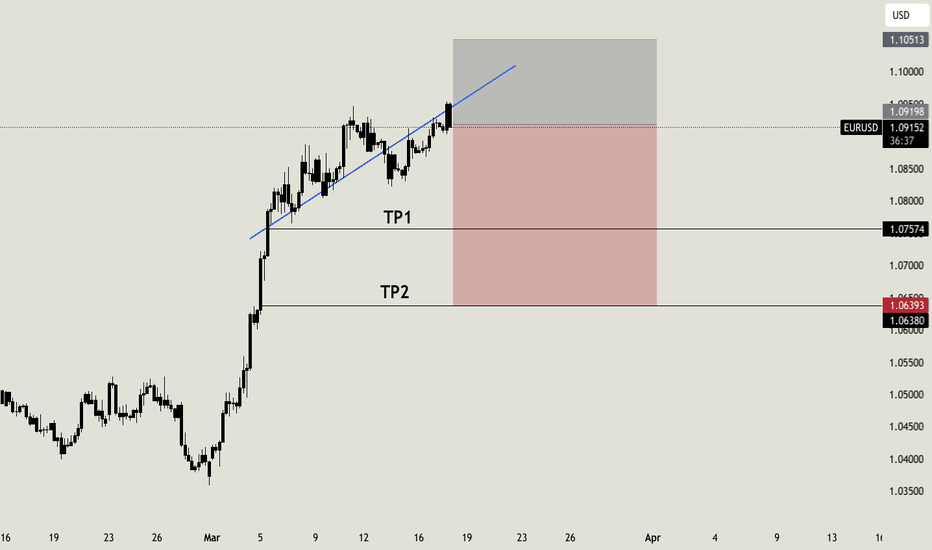

Matador the EUR/USD Bull? - Bears about to jump in?After the previous 3 weeks of bullish havoc, the bears may have finally decided to pump the breaks on EUR/USD buyers.

As price continued to push higher, I held on to short positions that I began building up at 1.0851 & 1.0909 as I wanted to wait and see if the Pivot level R1 area (1.0935) was going to provide the wall to begin declining back down.

Once I saw the lack of advancement, I opened another strong short position at 1.0912 and now sitting at an overall average price of 1.0891.

I like this trade, however I am still staying cautious on that 1.0800 level. I want to see this price point clearly broken and trading below it, otherwise I will keep my stop at a close break-even point for risk protection. Overall, so far so good but we need to break through 1.0800.

From a purely technical analysis point of view, I see a small scale rising broadening pattern and this usually indicates a drop to the starting point of the pattern will take place however, If we drop aggressively, I may eye that 1.0600 level again which will lock in almost 300 pips but as I just said, these patterns usually return to their starting point so 1.0300 or below is not out of the question. I guess it depends on how the price action is looking whether I'd close or hold.

1.0600 is around the yearly pivot point so that is a good marker to shoot for IMO. Interestingly, the MACD and RSI show a rising broadening pattern as well so that gives me a little bit more conviction in this trade.

I see some other markers for this trade as well but I will share that in my next upcoming market preview video since it'd be too much to type.

As always, Good Luck & Trade Safe

EURUSD THEORY : BIG SHORT (W.B.: 24/03/25)Price has confirmed the change - not a strong confirmation but one nonetheless. For that reason, wait for price to retrace back into one of the drawn up POIs in order to decide where to sell from - If I get further signals that a sell will occur.

It should sell all the way to the bottom..

Next week should be interesting

N.B.: This is not financial advice. Trade safely and with caution.

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EURUSD Bulls Eyeing FOMC–Will Powell’s Dovish Tone Fuel a Rally?As we approach the much-anticipated FOMC rate decision and Powell’s press conference , market sentiment is shifting, and EURUSD ( FX:EURUSD ) traders are closely watching for clues on the Federal Reserve’s next move . With recent economic data pointing to signs of slowing growth and cooling inflation, the Fed might adopt a more dovish tone , fueling further upside for EURUSD .

Key Factors Driving the Bullish Outlook :

Inflation & Economic Data : CPI and PPI data indicate a gradual cooling of inflation, which strengthens the case for a potential rate cut later this year. If Powell acknowledges this shift, it could weigh on the dollar.

Market Pricing of Rate Cuts : Investors are already pricing in multiple Fed rate cuts for 2024. A dovish Powell could accelerate these expectations, weakening USD and pushing the EURUSD higher.

------------------------------------------------------------------

Now let's take a look at the EURUSD chart on the 2-hour time frame .

EURUSD is moving near the Resistance zone($1.0983-$1.0916) and Yearly Resistance(1) .

Regarding Elliott Wave theory , it seems that EURUSD has managed to complete the main wave 4 . The structure of the main wave 4 is the Double Three Correction(WXY) .

The main wave 5 is likely to complete near the upper line of the ascending channel(possible) and Monthly Resistance(4) .

I expect EURUSD to rise in the coming hours to the targets I have indicated on the chart, although the Federal Reserve Conference could create long shadows , but I think the supply and demand zones will still work but still pay more attention to money management today .

Note: If EURUSD can break below the Potential Reversal Zone(PRZ) , there is a possibility of further decline in EURUSD.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S. Dollar Analyze (EURUSD), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EUR/USD Outlook – Potential Downtrend After Channel BreakdownOverview:

Pair: EUR/USD

Timeframe: 4-Hour (4H)

Broker: OANDA

Current Price: 1.08436

Trend: Potential Reversal

Technical Analysis:

The EUR/USD pair has been trading within a rising channel, indicating a bullish trend. However, recent price action shows a breakout to the downside, suggesting a potential bearish reversal.

The price failed to sustain above resistance and is now heading lower.

Breakdown confirmation suggests further downside movement.

Target: 1.06166, which aligns with a previous consolidation zone.

Trading Strategy:

📉 Bias: Bearish below the channel breakdown

🎯 Target: 1.06166 (Key Support)

🔍 Confirmation: Additional bearish momentum with lower highs and lower lows

EUR/USD 4H Analysis – Bearish Breakdown Setup1. Market Structure & Trend

The EUR/USD chart shows a previous uptrend, confirmed by the ascending trendline, where the price made higher highs and higher lows. However, the trendline has now been broken, signaling a potential shift in market direction. The price is currently retracing from a key resistance zone, and a possible bearish continuation is expected.

2. Key Levels & Zones

✅ Resistance Zone (1.09563 - 1.1000):

This blue-shaded area represents a strong resistance level, where sellers have stepped in multiple times.

Price previously attempted to break this level but failed, forming a rejection.

This suggests buyers are losing strength, and sellers are likely to dominate.

✅ Support Level (1.0800 - 1.0780):

A critical support zone, which acted as a demand area in the past.

If price breaks below this level with strong bearish momentum, it confirms a trend reversal.

✅ Target Level (1.06870):

The next major downside target aligns with previous market structure and liquidity zones.

This area marks a key demand zone, where buyers might step in again.

3. Trade Setup & Execution Plan

🔹 Entry Strategy

A sell entry is ideal on a confirmed break and retest of the support zone at 1.0800.

If price retests this level and forms bearish rejection candles (such as pin bars or engulfing patterns), it strengthens the bearish bias.

🔹 Stop Loss & Risk Management

A stop loss should be placed above the resistance zone at 1.09563, ensuring a safe exit if the market reverses bullish.

Risk-to-Reward Ratio (RRR):

Entry: Below 1.0800 (after confirmation).

Stop Loss: Above 1.09563 (resistance zone).

Target: 1.06870 (support zone).

RRR: Around 1:3, meaning potential profit is three times the risk.

4. Confirmation Indicators & Confluences

✅ Bearish Trendline Break:

The ascending trendline has been broken, confirming a possible shift in trend.

✅ Support Flip:

If the price breaks support and retests it as resistance, it confirms bearish continuation.

✅ Price Action Candlestick Patterns:

Look for bearish engulfing candles, pin bars, or rejection wicks at key levels.

✅ Volume Analysis:

Increased selling pressure after support break indicates strong bearish momentum.

5. Final Thoughts & Bias

📉 Bias: Bearish (Unless resistance is reclaimed).

💡 Key Watch: Break and retest of 1.0800 support for confirmation.

⚠️ Risk Management: Always use a stop loss to manage risk effectively.

Conclusion

This setup presents a high-probability short trade with a clear entry, stop loss, and target. Traders should wait for confirmation signals before executing the trade. If price breaks above resistance, the bearish outlook is invalidated.

🔔 Stay cautious and trade with discipline! 🚀