Eurusdprediction

EURUSD Sell and Buy Trading PlanH4 - We had a strong bullish move with the price creating a series of higher highs, higher lows structure

This strong bullish move ended with a bearish Divergence

While measuring this strong bullish move using the Fibonacci retracement tool we have two key support zones that has formed (marked in green)

So based on this I expect potential short term bearish moves now towards the key support zones and then potential continuation higher.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

---------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.-

EUR/USD – Bullish Breakout Setup 🔹 Overview:

EUR/USD remains in an ascending channel and is currently near the support zone. A bullish move is anticipated toward the 1.12150 - 1.12382 resistance zone, aligning with the overall trend.

🔹 Technical Analysis:

✅ Support Zone: Holding at 1.07916, acting as a key demand area.

✅ Ascending Channel: Price structure remains bullish, with higher highs and higher lows.

✅ Target: Resistance around 1.12382 aligns with a possible breakout.

🔹 Trade Idea:

📌 Long Entry: Around the support zone if bullish confirmation appears.

📌 Target: 1.12150 - 1.12382 resistance zone.

📌 Invalidation: Break below 1.07916 could shift momentum bearish.

📊 Sentiment: Bullish bias, waiting for confirmation.

📢 Will EUR/USD hit the target? Let’s discuss! 👇

EUR/USD Continued strength or FOMC Fallout?In this analysis I go over the EUR/USD and it's potential for further gains or a weakening bull and drop.

I expect a volatile week considering it's FOMC on Wednesday and ECB speaking on Friday.

Additionally, I share my outlook on ETF's I'm involved in. Currently in QQQE Put Option and closed my TQQQ Put for 30% gains last week.

As always, Good Luck and Trade Safe.

EURUSD analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

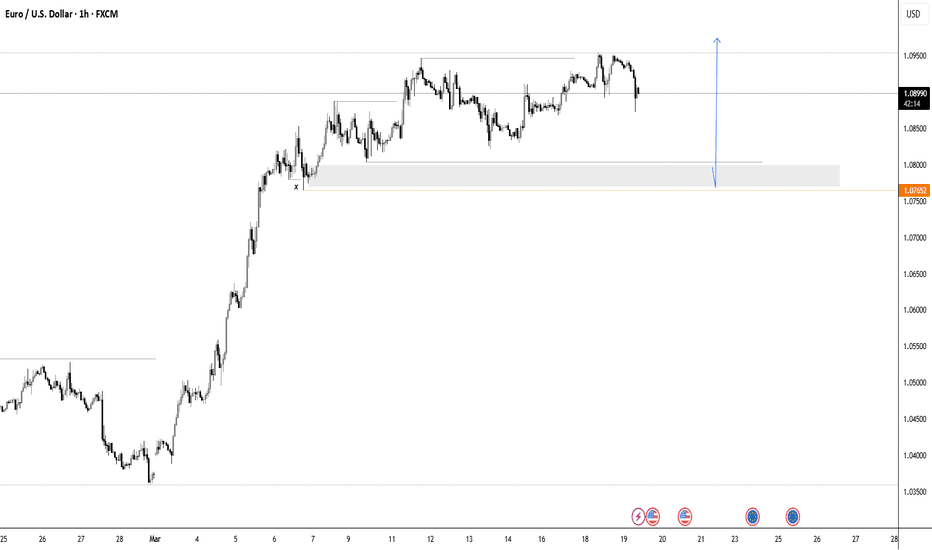

EURUSD Will be in bearish directionHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EUR/USD "The Fiber" Forex Market Bank Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Fiber" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (1.04000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 1.06700 (or) Escape Before the Target

Secondary Target - 1.08000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

EUR/USD "The Fiber" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

⭐🌟⭐Fundamental Analysis

Fundamental analysis evaluates the economic indicators of the Eurozone and the United States, which directly influence the EUR/USD pair.

🌟Eurozone Economic Indicators:

GDP growth is reported at 0.5% for Q4 2024, with recent data suggesting an expected increase to 0.8% for Q1 2025, indicating a potential recovery Euro Area Indicators.

Inflation rate is at 3.0% for February 2025, expected to decrease to 2.2% by year-end, reflecting easing price pressures Euro Area Inflation Rate.

Interest rates are at 2.5%, with the European Central Bank (ECB) likely to hold steady, given mixed inflation signals Euro Area Interest Rate.

Trade balance shows a surplus of €10 billion in January 2025, driven by exports, though not sufficient to offset economic challenges Euro Area Balance of Trade.

🌟United States Economic Indicators:

GDP growth is strong at 2.5% for Q4 2024, though recent projections suggest a slowdown to 2.0% for Q1 2025 United States Indicators.

Inflation is stable at 2.0% for February 2025, within target ranges, but recent data shows slight upward pressure United States Inflation Rate.

Interest rates are at 4.5%, with expectations of a 0.25% rate cut in September 2025, reflecting a dovish shift United States Interest Rate.

Trade balance shows a deficit of $50 billion in January 2025, a persistent challenge but manageable with strong economic growth United States Balance of Trade.

The narrowing interest rate differential, with potential Fed rate cuts and stable ECB policy, could support EUR strength, though US economic resilience remains a counterforce.

⭐🌟⭐Macroeconomics

Macroeconomics encompasses broader economic factors influencing the pair:

Global GDP growth is projected at 3.0% for 2025, according to recent forecasts, with mixed regional performances World Economic Outlook.

Commodity prices are stable, with oil at $80 per barrel, impacting EUR due to the Eurozone's energy import reliance Commodity Markets Outlook.

Stock markets show positive performance, with the S&P 500 up 5% YTD and Euro Stoxx 50 up 3% YTD, supporting risk-sensitive currencies like the EUR Global Stock Market Performance.

Bond yields are declining, with the US 10-year yield at 3.5%, down from 4.0% earlier, suggesting lower USD appeal Global Economic Outlook.

⭐🌟⭐Global Market Analysis

Global economic conditions play a significant role in currency movements:

Geopolitical events, such as potential tensions, could boost USD as a safe-haven currency, though no major events are currently noted.

Central bank policies are diverging, with the Fed expected to cut rates and the ECB holding steady, narrowing the interest rate differential Central Bank Policies.

Commodity trends, with stable oil prices, have a muted direct impact, though energy costs affect Eurozone inflation.

Stock market performance, with global indices up, suggests risk-on sentiment, potentially supporting EUR over USD Market Performance Analysis.

⭐🌟⭐COT Data and Positioning

COT data provides insights into large trader positions, with recent reports showing:

For euro futures, large speculators are net short, but recent data indicates a reduction in short positions, suggesting emerging bullish sentiment CFTC COT Report.

Positioning shows that institutional traders are cautiously optimistic, with some covering shorts as the price approaches support levels.

Key Insight: Reducing short positions in euro futures align with potential bullish momentum, supporting an upward move.

⭐🌟⭐Intermarket Analysis

Intermarket relationships influence currency valuation:

EUR/USD is positively correlated with stock markets; with global indices performing well, the EUR could benefit from risk-on sentiment Intermarket Correlations.

Gold, trading at $1900 per ounce, slightly up, suggests a weaker USD, supporting EUR strength Gold Price Trends.

Bond yields, with declining US yields, indicate lower USD appeal, potentially boosting EUR/USD Bond Market Insights.

Key Insight: Positive correlations with stocks and gold suggest EUR could strengthen, while declining US yields support this trend.

⭐🌟⭐Quantitative Analysis

Technical analysis provides insights into price trends:

At 1.05000, EUR/USD is approaching key support at 1.0450, with resistance at 1.0600, based on recent charts EUR/USD Technical Analysis.

Moving averages show the 50-day MA at 1.0550 and the 200-day MA at 1.0700, with the price below both, indicating a downtrend TradingView Analysis.

RSI (Relative Strength Index) is at 45, neutral, suggesting potential for a bounce if support holds Technical Indicators Guide.

Key Insight: The pair is at a crucial support level, with technicals suggesting a possible upward reversal.

⭐🌟⭐Market Sentimental Analysis

Market sentiment reflects trader positioning and expectations:

Recent data shows mixed sentiment, with some traders expecting USD strength to continue, while others see potential for EUR recovery due to improving fundamentals Forex Sentiment EURUSD.

Bank forecasts predict EUR/USD rising to 1.08 by year-end, citing Eurozone recovery and expected Fed rate cuts Currency Forecasts.

Key Insight: Emerging optimism about the euro supports a bullish outlook, though caution remains due to recent USD strength.

⭐🌟⭐Next Trend Move

Combining all factors, the next trend move for EUR/USD is likely upward:

The pair is at a key support level (1.0450), and if it holds, could bounce back to test resistance at 1.0800.

Potential catalysts include better-than-expected Eurozone data and Fed rate cut expectations, supporting EUR strength.

Key Insight: The next move favors an upward continuation, with risks of further downside if support breaks.

⭐🌟⭐Overall Summary Outlook

The EUR/USD pair, at 1.05000 on March 4, 2025, exhibits a cautiously bullish outlook. Key drivers include improving Eurozone fundamentals, with GDP growth expected to rise to 0.8% in Q1 2025 and declining inflation, narrowing the interest rate differential as the Fed is expected to cut rates by 0.25% in September 2025. Technical indicators suggest the pair is at a crucial support level, with potential for a bounce, supported by reducing short positions in euro futures and positive intermarket correlations with stocks and gold. Risks include persistent USD strength if US data remains robust or global risk-off sentiment boosts the USD. However, the prevailing trend points to a potential EUR appreciation in the near term.

⭐🌟⭐Future Prediction

Trend: Bullish

Details: The pair is likely to see an upward move, testing resistance at 1.0800 in the near term, driven by Eurozone recovery and expected Fed rate cuts. Risks include stronger-than-expected US data maintaining USD dominance, but current indicators suggest a reversal is imminent.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/USD "The Dollar Crusher" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Dollar Crusher" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (1.04500) then make your move - Bullish profits await!"

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 1.03500(swing Trade) Using the 2H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.07000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

EUR/USD "The Dollar Crusher" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🔴Fundamental Analysis

- The Eurozone's economic growth is expected to slow down, while the US economy is expected to grow at a moderate pace.

- The European Central Bank (ECB) is expected to keep interest rates steady, while the Federal Reserve is expected to maintain its accommodative monetary policy.

🟤Macro Analysis

- The Eurozone's inflation rate is expected to remain low, while the US inflation rate is expected to remain above the Federal Reserve's target.

- The Eurozone's trade balance is expected to remain in surplus, while the US trade balance is expected to remain in deficit.

🟠Sentimental Analysis

- Institutional investors have a bullish sentiment towards the EUR/USD pair, with 55% of investors being bullish.

- Hedge funds have increased their long positions in the EUR/USD pair, with a net long exposure of 12%.

🟣COT Analysis

- The Commitments of Traders (COT) report shows that commercial traders have increased their long positions in the EUR/USD pair, with a net long exposure of 10%.

- Non-commercial traders have also increased their long positions, with a net long exposure of 15%.

🟡Trader Sentiment

- Retail traders have a bullish sentiment towards the EUR/USD pair, with 52% of traders being bullish.

- Commercial banks have increased their EUR/USD holdings, with a growth rate of 5%.

🔵Bullish and Bearish Data:

- Bullish Sentiment: Institutional investors have a bullish sentiment towards the EUR/USD pair, with 55% being bullish. Hedge funds have increased their long positions, with a net long exposure of 12%

- Bearish Sentiment: Asset managers are trimming their long exposure, and gross shorts are trending higher for large specs and asset managers since Q4

🟢Based on this analysis, the EUR/USD pair is expected to move in a bullish trend, with a 55% chance of an uptrend and a 35% chance of a downtrend. However, please note that market predictions can be unpredictable and influenced by various factors

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURUSD Faces Resistance zone – Will Bears Take Over?The EURUSD ( FX:EURUSD ) has reached the Resistance zone($1.0983-$1.0916) as I expected in my previous post . Can the EURUSD break the Resistance zone($1.0983-$1.0916) ?

EURUSD is moving near the Resistance zone($1.0983-$1.0916) , the Resistance line , and Yearly Resistance(1) .

According to the Elliott Wave theory , EURUSD seems to have completed 5 impulse waves and we can expect Corrective Waves .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks .

I expect the EURUSD to decline to at least the Support zone($1.0817-$1.0760) in the coming hours after breaking the lower line of the ascending channel . One of the EURUSD targets could be as wide as the ascending channel .

Note: If EURUSD breaks the Resistance zone($1.0983-$1.0916), we can expect more pumps.

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S. Dollar Analyze (EURUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EURUSDEURUSD has gotten to the Daily OB where we are looking for possible reversal confirmations. And here on the 15mins - price has Changed Character and also confirmed with a new BOS, before the BOS, we can see how price has reacted, creating even more liquidity - equal highs close to our entry zone which is above 50% fib retracement. I am looking to short price from the 1.09048 zone targeting the 1.08416 zone where we have a possible roadblock for price to stop and continue the buys on the 1H TF, or sell all the way to the 1.06068 zone to facilitate a new buys.

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EUR/USD: The Euro Stays in Overbought TerritoryThe pair has been rising for the last five sessions, gaining approximately 1.4% , as expansionary policies in European countries have restored confidence in the euro. In contrast, the U.S. dollar continues to struggle with maintaining consistent demand due to the ongoing tariff battle led by the White House.

Accelerated Movement:

Since March 3rd, EUR/USD has experienced growth of over 5%, driven by strong short-term bullish momentum. Currently, the price is slowly approaching a key resistance zone, but recent price oscillations suggest that bullish momentum is fading, which could lead to short-term bearish corrections.

RSI Indicator:

The RSI line has started oscillating above the 70 level, which is the official overbought zone of the indicator. This suggests that the balance between buying and selling pressure has been lost, with bullish momentum fully dominating the market. The increasing speed of demand for EUR/USD may indicate a potential emergence of bearish corrections in the short term.

MACD Indicator:

The MACD histogram remains at its highest levels of the year, suggesting that buying pressure may be entering a phase of constant exhaustion. In the long run, this could also open the possibility of selling corrections in the upcoming sessions.

Key Levels:

1.1000 – Tentative Resistance: A potential psychological barrier that the price may face in its prolonged bullish streak. Oscillations above this level could confirm sustained buying pressure and signal the beginning of stronger upward movements in the chart.

1.07944 – Near-term Support: A neutral zone where the price has shown stability in the short term. This level may be important for potential selling corrections in the next trading sessions.

1.06173 – Distant Support: A key level corresponding to the highs reached in December 2024. Bearish oscillations reaching this level could jeopardize the current strong bullish trend.

By Julian Pineda, CFA – Market Analyst

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EUR/USD – Bullish, But Time to Breathe!🚀 EUR/USD – Bullish, But Time to Breathe! 🚀

“Momentum is strong, but even the best trends need to take a breath before the next leg up.”

🔥 Key Insights:

✅ Bullish Structure Intact – No reason to fight the trend.

✅ Overextended Move – Markets don’t go up in a straight line; pullbacks create better entries.

✅ Healthy Retracement = Stronger Continuation – Chasing here is risky, waiting for a dip is smart.

💡 The Plan:

Wait for a Pullback Before Longs – Let price reset, don’t rush in.

Watch Volume Profile & CDV for Buyer Confirmation – Smart money leaves clues.

Ideal Entry = Lower Support Levels Holding – We want a strong base for the next move up.

“Patience is key. Let the market give you the perfect entry—not every green candle is a buy!” 🚀💶

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

EurUsd ShortEUR/USD Short Idea

The EUR/USD pair is approaching the 1.09700--1.09940--1.10204 resistance level, which aligns with a significant supply zone and a potential area for bearish reversal.

Key Analysis:

Resistance Zone:

The 1.09700--1.09940--1.10204 levels marks a critical resistance where selling pressure has previously emerged.

Technical Indicators:

RSI is approaching overbought conditions, indicating limited upside potential.

Bearish divergence may form if momentum weakens near this level.

Fundamental Context:

A stronger USD due to hawkish Fed sentiment or economic data could pressure EUR/USD downward.

Eurozone economic uncertainties may add to bearish bias.

Entry: Short positions around 1.09700--1.09940--1.10204

This setup offers a favorable risk-reward opportunity in a high-probability reversal zone.

EURUSD Going To ShortThe EUR/USD currency pair is likely to experience a short movement due to the presence of a clear hidden bearish divergence. This divergence suggests that despite the price making lower highs and RSI making Higher High, the momentum behind these movements is weakening, indicating potential for a downward reversal. Additionally, the price is approaching an unmitigated order block around the 1.098xx region. An unmitigated order block represents an area where price has previously reversed and not yet been revisited, increasing the likelihood of a reaction when price reaches this zone.

Furthermore, the Fibonacci retracement level of 0.786 aligns closely with this order block, strengthening the case for a bearish reversal. Fibonacci retracement levels are commonly used to predict potential areas of support and resistance, and the 0.786 level is often a key point for reversals in trends. This combination of technical factors suggests that a significant fall is anticipated from the 1.098xx level.

You should watch for confirmation signals, such as a clear break of support or bearish candlestick patterns, to solidify the bearish outlook. Given the confluence of these technical indicators, the probability of a substantial decline is high.

1st TP: 1.075x

2nd TP: 1.065x

Technical Analysis: EUR/USD Bullish SetupThe EUR/USD chart shows a textbook setup with the EMA Trading System providing a high-probability long entry.

System Signals

EMA System Status: Bullish Signal with Bullish Trend

Alignment: Confirmed (optimal confluence)

Chart Pattern: Bullish reversal after pullback to dynamic support

Key Technical Elements

The price action shows a clear bullish reversal pattern with an uptrend resuming after testing the 21 EMA support

Background coloring is green, confirming the 21 EMA > 55 EMA relationship (bullish trend)

A green triangle entry signal is visible where the 8 EMA crossed above the 55 EMA

All EMAs are properly aligned in a bullish stack formation (8 > 13 > 21 > 55)

MACD indicators (bottom of chart) show positive momentum with blue line crossing above orange line

Trade Parameters

Entry: 1.08901

Price Target: 1.10028 (1127 ticks/pips gain)

Stop Loss: 1.08356 (545 ticks/pips protection)

Risk-Reward Ratio: 1:2

Market Context

The EUR/USD is showing strength in an established uptrend. The recent pullback created an ideal entry point as price found support at key EMA levels before resuming its upward trajectory. Volume is supporting the move as indicated by the rising histogram bars below the chart.

This setup aligns perfectly with our MACR strategy parameters, offering a high-probability trade with excellent risk-reward characteristics.

The Confirmed alignment status and clear bullish trend provide strong confluence factors supporting this long position.