Eurusdtradesignal

EURUSD LONG TERM UPEURUSD Live Trading Session/ EURUSD analysis #forex #forextraining #forexHello Traders

In This Video EURUSD HOURLY Forecast By World of Forex

today EURUSD Analysis

This Video includes_ (EURUSD market update)

EURUSD Analysis today | Technical and Order Flow

#usdjpy #usdchftechnicalanalysis #usdjpytoday #gold

What is The Next Opportunity on EURUSD Market

how to Enter to the Valid Entry With Assurance Profit?

This Video is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts.

Disclaimer: Financial Trading Has Large Potential Rewards, But Also Large Potential Risk. You must be aware of the Risk and Be Welling to Accept Them in order to Trade the Financial Market . Please be Carefully With Your Money.

We are talking about future market, anything can Happen,Markets are Always like that.dnt Risky more Than 2% of your account

Now you can join with our "vip premium" service

Join us and let's make trading together

EUR/USD Holding the Line: Bullish Channel Setup!Hi traders! Analyzing EUR/USD on the 30-min timeframe, price is currently reacting near the bottom of a well-defined ascending channel, signaling a potential bullish continuation within the trend:

🔹 Entry: 1.17071

🔹 Take Profit: 1.17423

🔹 Stop Loss: 1.16825

After a corrective move downwards, price tapped into a key trendline support, aligning with prior structure and psychological level near 1.1700. The RSI is showing a bullish divergence near oversold levels, adding confluence to a possible reversal.

As long as price holds above the lower boundary of the channel, bulls may look to target the mid-to-upper region of the range, aligning with previous highs and dynamic resistance.

🟢 The trend remains intact as long as higher lows are respected.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for managing their own risk and strategy.

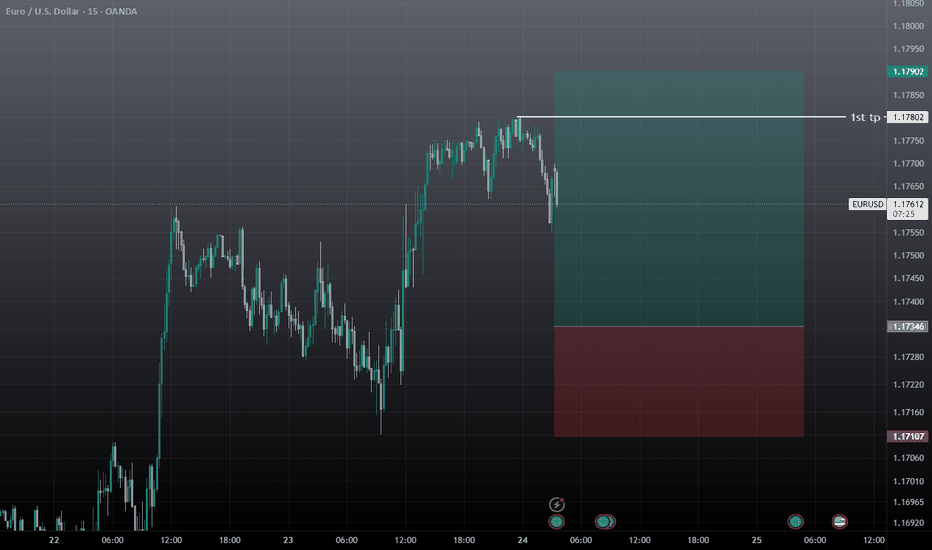

EUR/USD Could Take Off From Here! Strategic SetupHi traders! , Analyzing EUR/USD on the 30 minute timeframe, price is currently reacting from a strong support zone near 1.1696, showing potential for a bullish rebound after a sharp drop.

🔹 Entry: 1.1696

🔹 Take Profit (TP): 1.1770

🔹 Stop Loss (SL): 1.1621

After a strong downside move, EUR/USD is attempting a recovery from a key intraday support area. The RSI is bouncing from oversold conditions (around 34), indicating a possible short-term shift in momentum.

Price is also approaching the 200 EMA from below, and a break above could confirm bullish continuation toward the 1.1770 resistance zone. The setup offers a solid risk-reward ratio and aligns with mean reversion expectations.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for their own decisions and risk management.

EURUSD on 3rd May 2025By looking at EURUSD in 4h timeframe, it is trading on very strong zone as it became support now due to yesterday breakout. Also there is uptrend trendline which is acting as strong support, if it breaks our next target will be down to 1.12490 and 1.12930. if this support holds then price may surge in upward direction. Need to wait till breakout in downward.

Key point.

Support - 1.14190, 1.13600, 1.13152

Resistance - 1.14906, 1.15440

If you like it do follow and share.

Any Query Reach Us or comment down.

Follow for more updates.

Rudra Vasaikar Wishes You A Great And Very Amazing Trading Life. Trade Safe, Trade Right.

RISK WARNING 🔴 🔴 🔴

There is high risk of loss in Trading Forex, Crypto, Indices, CFDs, Features and Stocks. Choose your trade wisely and confidently, please see if such trading is appropriate for you or not. Past performance is not indicative of future results. Highly recommended - Information provided by Pro Trading Point are for Educational purpose only. Do your investment according to your own risk. Any type of loss is not our responsibility.

HAPPY TRADING.

EUR/USD "The Fiber" Forex Bank Money Heist Plan (Bearish)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Fiber" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk GREEN Zone. It's a Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Neutral Level breakout then make your move at (1.12600) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 (or) 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 3H timeframe (1.14200) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.10800

💰💵💸EUR/USD "The Fiber" Forex Market Heist Plan (Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Inventory and Storage Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it. go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/USD remains capped below 1.1400, bullish bias prevailsEUR/USD's near-term outlook is neutral. The pair oscillates below a flat 20 SMA, while longer-term (100/200) SMAs maintain upward slopes. Momentum is flat around 100, and the RSI is only slightly higher near 45, suggesting limited upward potential.

#EURUSD: 1545+ PIPS Swing Sell Idea Concept! Comment Your Views!Hey there everyone! 👋

I’ve got some insights into the EURUSD currency pair. It’s been on a wild ride lately, with the USD taking a nosedive. But guess what? The EURUSD is on a bullish streak and it’s not stopping anytime soon, and it is very likely it will reach our entry point.

Now, I know what you’re thinking. “Is this a good time to jump in?” Well, let me tell you, it’s all about your risk tolerance. We’ve identified three potential entry points for the EURUSD pair, so you can decide if it’s time to make a move. 📈

Remember, trading involves risks, so it’s important to be cautious and stick to your risk management plan. 🛡️

Good luck with your trading journey 😊

Much Love❤️

Team Setupsfx_

EURUSD SHORT FORECAST Q2 W16 D17 Y25EURUSD SHORT FORECAST Q2 W16 D17 Y25

GM GM!

SUMMARY

- Weekly order block short

- Unconvincing bearish move via the order block therefore 15' break of structure required. MINIMUM

- Tap entry via the 15' order block only valid if major 15' structure levels broken. In turn we will see a turn around in higher time frame price action support the short from the weekly order block

- A + short would be to await all of the above prior short

Trade well.

FRGNT X

EURUSD:The euro is facing a "battle at key resistance levels"The EURUSD exchange rate continues its rebound momentum. Although the weak inflation data in the eurozone has strengthened the market's expectation of an interest rate cut by the ECB, the US dollar has weakened due to the risk - off sentiment triggered by Trump's tariff remarks, which has become a key factor supporting the short - term upward movement of the euro.

We can focus on the initial resistance level of 1.0880 above. If this level is not breached, one can attempt to short at high levels.

Trading strategy:

Sell@1.0880

TP:1.0780

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

EURUSD:Analysis of the Profit-making Strategies for Next WeekThe euro against the US dollar once retraced to around 1.0765. Subsequently, it stabilized slightly after the release of the US core Personal Consumption Expenditures (PCE) inflation data for February. Since the year-on-year growth rate of this data exceeded expectations, the market's expectation that the Federal Reserve will maintain the current interest rate range of 4.25%-4.50% for a longer time has intensified. Moreover, the United States is set to impose an additional 25% tariff on imported automobiles starting from April 2nd, which adds more uncertainties to the outlook of the euro.

We can focus on the initial resistance level of 1.0850 above. If this level is not breached, one can attempt to short at high levels.

Trading strategy:

Sell@1.0850

TP:1.0750

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

EURUSD:Today's trading strategyThe EUR/USD is fluctuating and consolidating around 1.0790, having weakened for six consecutive trading days previously. US President Trump's announcement of imposing a 25% tariff on imported automobiles and their components starting from April 2nd has made the market worried that the economic and trade relations between the US and major economies are facing more uncertainties.

As can be seen from the chart, the EUR/USD has continuously declined. After hitting a low of 1.0732 at the lowest, it stabilized and rebounded. Currently, it is trading within the range of 1.0780-1.0790. If the exchange rate can break through the resistance level of 1.0830 above, it is expected to test the 1.09 mark. If it is blocked and pulls back, one should be vigilant about retesting the support area of 1.0732 again. In the short term, the EUR/USD may continue to have a wide range of fluctuations within the range of 1.0700-1.0830.

Trading strategy:

Sell@1.0830

TP:1.0730

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

EURUSD:Beware of the retest of the daily chart resistanceYesterday, the price of EUR/USD generally declined as expected. The intraday price dropped to a minimum of 1.0776, rose to a maximum of 1.0829, and closed at 1.0789.

Currently, the overall EUR/USD remains below the daily chart resistance level of 1.0860. Therefore, for the time being, a bearish stance is still appropriate for the medium-term trend. From the perspective of the four-hour chart, the price is in a fluctuating decline and is supported at the 1.0770 area, while the resistance of the four-hour chart is at the 1.0805 area. For now, it is advisable to be cautious about chasing short positions, and beware of an upward price correction. In terms of price levels, pay attention to the daily chart resistance to observe further performance of downward pressure.

Trading strategy:

Sell@1.0850-1.0860

TP:1.0810-1.0770

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

The trend of the EURUSD fluctuates and declines downwardOn Monday, as expected, the EUR/USD pair generally trended downwards. The price dropped to a low of 1.0781 and climbed to a high of 1.0857 on that day, closing at 1.0800.

Looking back at Monday's market performance, the price made a short - term upward correction right after the morning opening. Then, as anticipated, it reached the resistance levels on the four - hour chart and within the daily resistance range before halting its ascent. The price came under renewed pressure and declined during the pre - US session and the US trading session, ultimately closing with a large bearish candlestick on the daily chart.

Currently, on the daily chart, special attention should be paid to the resistance area around 1.0860. As long as the price stays below this level, a downward - pressured trend can be expected for the swing trading. Meanwhile, from the perspective of the four - hour chart in the short term, the area around 1.0770 needs to be closely watched. Once it is broken below, the focus should shift to the area around 1.0720.

Trading strategy:

Sell@1.0820-1.0830

TP:1.0770-1.0720

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

EUR/USD "The Fiber" Forex Market Bank Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Fiber" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (1.04000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 1.06700 (or) Escape Before the Target

Secondary Target - 1.08000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

EUR/USD "The Fiber" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

⭐🌟⭐Fundamental Analysis

Fundamental analysis evaluates the economic indicators of the Eurozone and the United States, which directly influence the EUR/USD pair.

🌟Eurozone Economic Indicators:

GDP growth is reported at 0.5% for Q4 2024, with recent data suggesting an expected increase to 0.8% for Q1 2025, indicating a potential recovery Euro Area Indicators.

Inflation rate is at 3.0% for February 2025, expected to decrease to 2.2% by year-end, reflecting easing price pressures Euro Area Inflation Rate.

Interest rates are at 2.5%, with the European Central Bank (ECB) likely to hold steady, given mixed inflation signals Euro Area Interest Rate.

Trade balance shows a surplus of €10 billion in January 2025, driven by exports, though not sufficient to offset economic challenges Euro Area Balance of Trade.

🌟United States Economic Indicators:

GDP growth is strong at 2.5% for Q4 2024, though recent projections suggest a slowdown to 2.0% for Q1 2025 United States Indicators.

Inflation is stable at 2.0% for February 2025, within target ranges, but recent data shows slight upward pressure United States Inflation Rate.

Interest rates are at 4.5%, with expectations of a 0.25% rate cut in September 2025, reflecting a dovish shift United States Interest Rate.

Trade balance shows a deficit of $50 billion in January 2025, a persistent challenge but manageable with strong economic growth United States Balance of Trade.

The narrowing interest rate differential, with potential Fed rate cuts and stable ECB policy, could support EUR strength, though US economic resilience remains a counterforce.

⭐🌟⭐Macroeconomics

Macroeconomics encompasses broader economic factors influencing the pair:

Global GDP growth is projected at 3.0% for 2025, according to recent forecasts, with mixed regional performances World Economic Outlook.

Commodity prices are stable, with oil at $80 per barrel, impacting EUR due to the Eurozone's energy import reliance Commodity Markets Outlook.

Stock markets show positive performance, with the S&P 500 up 5% YTD and Euro Stoxx 50 up 3% YTD, supporting risk-sensitive currencies like the EUR Global Stock Market Performance.

Bond yields are declining, with the US 10-year yield at 3.5%, down from 4.0% earlier, suggesting lower USD appeal Global Economic Outlook.

⭐🌟⭐Global Market Analysis

Global economic conditions play a significant role in currency movements:

Geopolitical events, such as potential tensions, could boost USD as a safe-haven currency, though no major events are currently noted.

Central bank policies are diverging, with the Fed expected to cut rates and the ECB holding steady, narrowing the interest rate differential Central Bank Policies.

Commodity trends, with stable oil prices, have a muted direct impact, though energy costs affect Eurozone inflation.

Stock market performance, with global indices up, suggests risk-on sentiment, potentially supporting EUR over USD Market Performance Analysis.

⭐🌟⭐COT Data and Positioning

COT data provides insights into large trader positions, with recent reports showing:

For euro futures, large speculators are net short, but recent data indicates a reduction in short positions, suggesting emerging bullish sentiment CFTC COT Report.

Positioning shows that institutional traders are cautiously optimistic, with some covering shorts as the price approaches support levels.

Key Insight: Reducing short positions in euro futures align with potential bullish momentum, supporting an upward move.

⭐🌟⭐Intermarket Analysis

Intermarket relationships influence currency valuation:

EUR/USD is positively correlated with stock markets; with global indices performing well, the EUR could benefit from risk-on sentiment Intermarket Correlations.

Gold, trading at $1900 per ounce, slightly up, suggests a weaker USD, supporting EUR strength Gold Price Trends.

Bond yields, with declining US yields, indicate lower USD appeal, potentially boosting EUR/USD Bond Market Insights.

Key Insight: Positive correlations with stocks and gold suggest EUR could strengthen, while declining US yields support this trend.

⭐🌟⭐Quantitative Analysis

Technical analysis provides insights into price trends:

At 1.05000, EUR/USD is approaching key support at 1.0450, with resistance at 1.0600, based on recent charts EUR/USD Technical Analysis.

Moving averages show the 50-day MA at 1.0550 and the 200-day MA at 1.0700, with the price below both, indicating a downtrend TradingView Analysis.

RSI (Relative Strength Index) is at 45, neutral, suggesting potential for a bounce if support holds Technical Indicators Guide.

Key Insight: The pair is at a crucial support level, with technicals suggesting a possible upward reversal.

⭐🌟⭐Market Sentimental Analysis

Market sentiment reflects trader positioning and expectations:

Recent data shows mixed sentiment, with some traders expecting USD strength to continue, while others see potential for EUR recovery due to improving fundamentals Forex Sentiment EURUSD.

Bank forecasts predict EUR/USD rising to 1.08 by year-end, citing Eurozone recovery and expected Fed rate cuts Currency Forecasts.

Key Insight: Emerging optimism about the euro supports a bullish outlook, though caution remains due to recent USD strength.

⭐🌟⭐Next Trend Move

Combining all factors, the next trend move for EUR/USD is likely upward:

The pair is at a key support level (1.0450), and if it holds, could bounce back to test resistance at 1.0800.

Potential catalysts include better-than-expected Eurozone data and Fed rate cut expectations, supporting EUR strength.

Key Insight: The next move favors an upward continuation, with risks of further downside if support breaks.

⭐🌟⭐Overall Summary Outlook

The EUR/USD pair, at 1.05000 on March 4, 2025, exhibits a cautiously bullish outlook. Key drivers include improving Eurozone fundamentals, with GDP growth expected to rise to 0.8% in Q1 2025 and declining inflation, narrowing the interest rate differential as the Fed is expected to cut rates by 0.25% in September 2025. Technical indicators suggest the pair is at a crucial support level, with potential for a bounce, supported by reducing short positions in euro futures and positive intermarket correlations with stocks and gold. Risks include persistent USD strength if US data remains robust or global risk-off sentiment boosts the USD. However, the prevailing trend points to a potential EUR appreciation in the near term.

⭐🌟⭐Future Prediction

Trend: Bullish

Details: The pair is likely to see an upward move, testing resistance at 1.0800 in the near term, driven by Eurozone recovery and expected Fed rate cuts. Risks include stronger-than-expected US data maintaining USD dominance, but current indicators suggest a reversal is imminent.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/USD "The Dollar Crusher" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Dollar Crusher" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (1.04500) then make your move - Bullish profits await!"

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 1.03500(swing Trade) Using the 2H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.07000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

EUR/USD "The Dollar Crusher" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🔴Fundamental Analysis

- The Eurozone's economic growth is expected to slow down, while the US economy is expected to grow at a moderate pace.

- The European Central Bank (ECB) is expected to keep interest rates steady, while the Federal Reserve is expected to maintain its accommodative monetary policy.

🟤Macro Analysis

- The Eurozone's inflation rate is expected to remain low, while the US inflation rate is expected to remain above the Federal Reserve's target.

- The Eurozone's trade balance is expected to remain in surplus, while the US trade balance is expected to remain in deficit.

🟠Sentimental Analysis

- Institutional investors have a bullish sentiment towards the EUR/USD pair, with 55% of investors being bullish.

- Hedge funds have increased their long positions in the EUR/USD pair, with a net long exposure of 12%.

🟣COT Analysis

- The Commitments of Traders (COT) report shows that commercial traders have increased their long positions in the EUR/USD pair, with a net long exposure of 10%.

- Non-commercial traders have also increased their long positions, with a net long exposure of 15%.

🟡Trader Sentiment

- Retail traders have a bullish sentiment towards the EUR/USD pair, with 52% of traders being bullish.

- Commercial banks have increased their EUR/USD holdings, with a growth rate of 5%.

🔵Bullish and Bearish Data:

- Bullish Sentiment: Institutional investors have a bullish sentiment towards the EUR/USD pair, with 55% being bullish. Hedge funds have increased their long positions, with a net long exposure of 12%

- Bearish Sentiment: Asset managers are trimming their long exposure, and gross shorts are trending higher for large specs and asset managers since Q4

🟢Based on this analysis, the EUR/USD pair is expected to move in a bullish trend, with a 55% chance of an uptrend and a 35% chance of a downtrend. However, please note that market predictions can be unpredictable and influenced by various factors

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩