#EURUSD: Last Bullish Price Extension! Get Ready! EURUSD is approaching our buying zone, a key level, which suggests a smooth bullish reversal. As this is a swing trade, we advise keeping stop losses larger. There are two targets to keep an eye on. Remember, this is not a guaranteed move, and this is just our overview. Good luck and trade safely.

Team Setupsfx_

Eurusdtrend

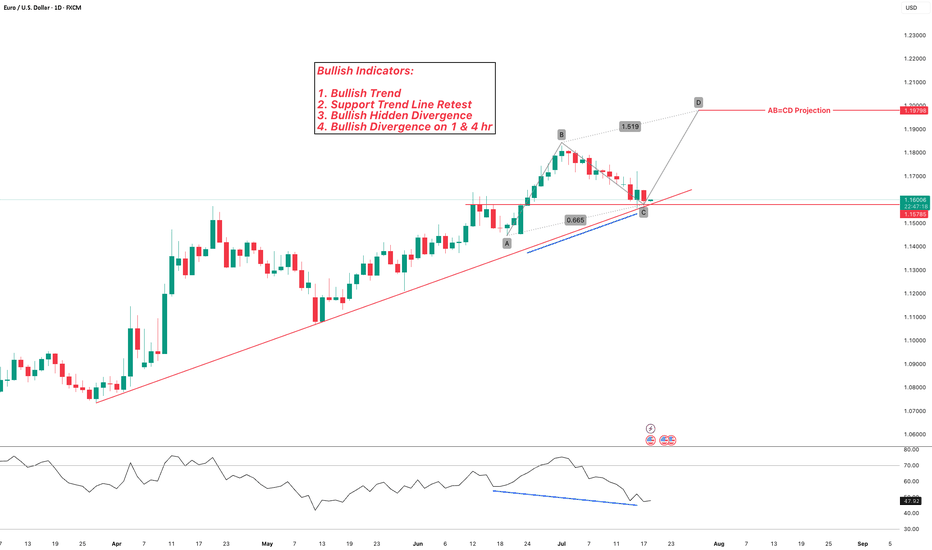

EURUSD Bullish Continuation OutlookFX:EURUSD has been trading in a bullish trend. Currently price is retesting the previous resistance level, as well as 0.618 fib. Hidden bullish divergence can be observed on the chart, in addition to regular bullish divergence on lower timeframes (1 & 4 hour).

I am expecting bullish continuation from here to complete the price projections!

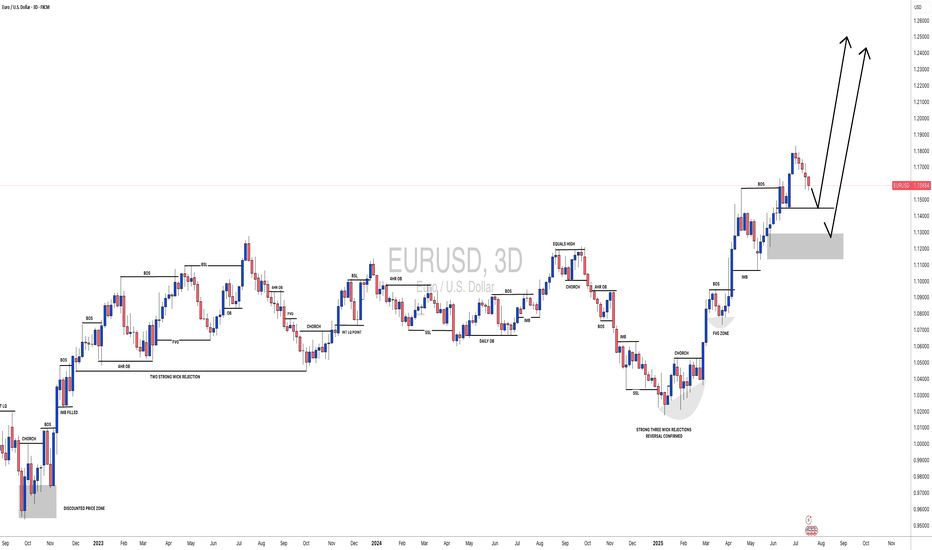

#EURUSD: Still Extremely Bullish! Let's see how it goes! EURUSD is currently making minor correction and it is likely to reverse in coming days. We have to area from where price could reverse from. we advise you to read the chart and also do your analysis before making any decision.

Like and Comment For More!

Team Setupsfx_

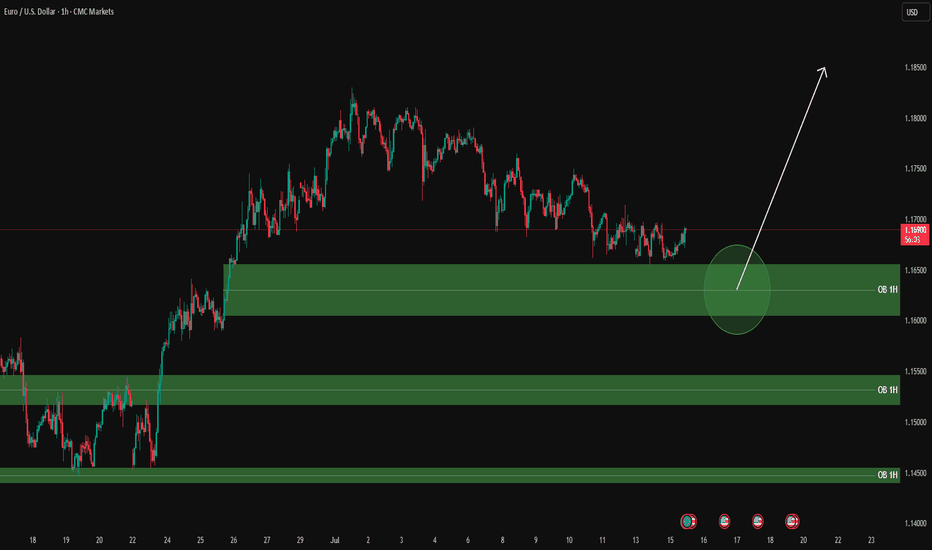

EURUSD analysis – 1H OB Setup

✅ Green zones = 1H Buy Order Blocks

Clean plan:

Wait for price to reach the green circle zone (1.1600 – 1.1650 OB).

Once there:

✅ Drop to LTF (5M / 3M) and wait for:

Price reaction to the OB zone

BOS / CHoCH structure confirmation

Strong bullish candle for clean entry

Then, enter with stop below the OB zone.

🎯 Targets:

First TP: 1.1690 – 1.1700

Second TP: higher previous highs if momentum continues

⚠️ Let price enter your zone, get your LTF confirmations, and then take your entry with discipline.

📊 ProfitaminFX | Gold, BTC & EUR/USD

📚 Daily setups & educational trades

EUR/USD Retracement Into Demand ZoneHello guys!

EUR/USD is currently undergoing a healthy retracement after an extended bullish trend within the ascending channel. The price is now approaching a key demand zone, which aligns perfectly with the mid-line of the channel structure.

This zone previously acted as a strong resistance area and is now expected to serve as support, confirming a classic flip in market structure. The reaction around the 1.16288 - 1.15774 area will be crucial.

If buyers step in here, the bullish momentum is likely to resume with the next major target being the upper resistance zone near 1.20000 , as projected by the upward arrow. The overall structure remains bullish as long as the price holds above the channel support and doesn't close below the last demand zone.

Market Analysis: EUR/USD Pares GainsMarket Analysis: EUR/USD Pares Gains

EUR/USD declined from the 1.1750 resistance and traded below 1.1650.

Important Takeaways for EUR/USD Analysis Today

- The Euro started a fresh decline after a strong surge above the 1.1720 zone.

- There is a connecting bearish trend line forming with resistance at 1.1660 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair rallied above the 1.1720 resistance zone before the bears appeared, as discussed in the previous analysis. The Euro started a fresh decline and traded below the 1.1660 support zone against the US Dollar.

The pair declined below 1.1620 and tested 1.1590. A low was formed near 1.1592 and the pair started a consolidation phase. There was a minor recovery wave above the 1.1610 level.

EUR/USD is now trading below the 50-hour simple moving average. On the upside, it is now facing resistance near the 1.1630 level. It is close to the 23.6% Fib retracement level of the downward move from the 1.1749 swing high to the 1.1592 low.

The next key resistance is at 1.1660 and the 50% Fib retracement level. There is also a connecting bearish trend line forming with resistance at 1.1660.

The main resistance is near the 1.1690 level. A clear move above it could send the pair toward the 1.1720 resistance. An upside break above 1.1720 could set the pace for another increase. In the stated case, the pair might rise toward 1.1750.

If not, the pair might resume its decline. The first major support on the EUR/USD chart is near 1.1590. The next key support is at 1.1550. If there is a downside break below 1.1550, the pair could drop toward 1.1520. The next support is near 1.1485, below which the pair could start a major decline.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EUR/USD : US Dollar Strengthens Following Inflation ReportEUR/USD Analysis: US Dollar Strengthens Following Inflation Report

Yesterday, the US Consumer Price Index (CPI) report was released, showing an increase in consumer prices. According to Forex Factory, annual CPI rose from 2.4% to 2.7%, exceeding analysts' expectations of a 2.6% rise.

As reported by Reuters, the data supports the stance of Federal Reserve Chair Jerome Powell, who has repeatedly stated that the anticipated inflationary pressure—driven in part by tariffs—is a reason to refrain from further interest rate cuts.

However, President Donald Trump interpreted the data differently. On his Truth Social platform, he posted that consumer prices remain low and called for an immediate rate cut.

The market responded with a stronger US dollar—indicating that participants believe interest rates are likely to remain at current levels in the near term. Notably, the EUR/USD exchange rate fell to the 1.1600 level for the first time since late June (as indicated by the arrow).

Technical Analysis of the EUR/USD Chart

Analysing the EUR/USD chart as of 7 July, we identified:

→ A long-term ascending channel

→ A potential downward trajectory (marked by red lines)

Since then, the pair has followed the outlined path and declined by more than 1%.

It is worth noting that today, the EUR/USD price is near the lower boundary of a key trend channel, which may offer significant support — traders may look for a technical rebound from this level.

Additionally, attention should be paid to the upcoming release of the US Producer Price Index (PPI) at 15:30 GMT+3. These figures carry particular weight in light of potential renewed inflationary pressures. This and other upcoming data may prove decisive for the near-term direction of EUR/USD.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

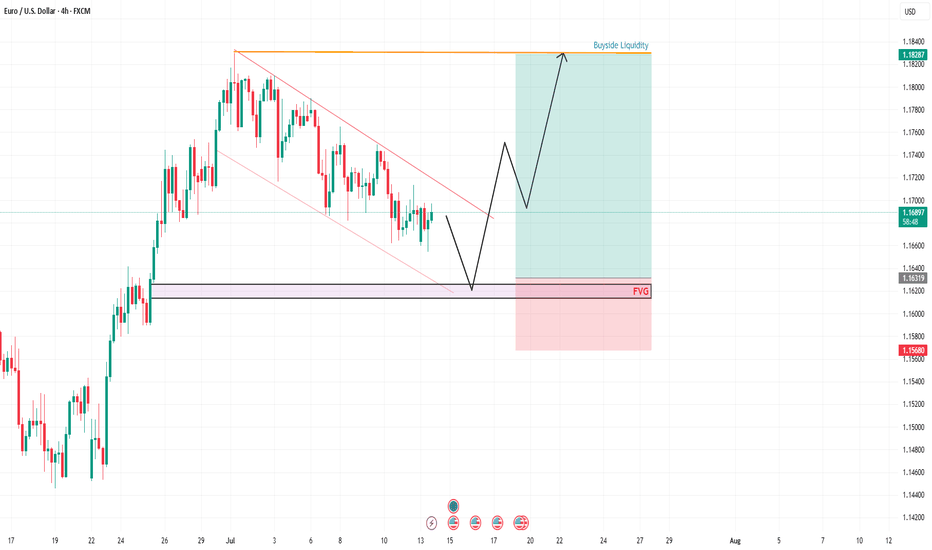

EURUSD POTENTIAL BUY SETUP 4HLooking at EURUSD, Price is moving in a descending channel. EU on the high timeframe is bullish as Dollar is weak. I am expecting EU to fall into the marked FVG to clear the lows and take internal liquidity from the marked FVG before moving higher and take the Buyside Liquidity as marked.

Potential Entry= 1.6350

Stop loss= 1.15650

Take Profit = 1.18250

Please wait for price to come into the marked potential area to take this trade and manage your risk accordingly. Follow me for more updates and trades.

Ready to Swipe the Pips? | EUR/USD Heist Blueprint Unlocked🏴☠️💸 EUR/USD "Fiber Heist Plan" – Thief Trader Style 💸🏴☠️

The Vault is Open – Swipe the Bullish Bags! 🚀📈💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Welcome, Money Makers & Market Robbers! 🤑✨

Here’s the latest masterstroke based on our Thief Trading Style™—a tactical breakdown of EUR/USD primed for a bullish breakout robbery. We’re targeting the red zone 🎯—where the weak hands panic, and the real players win.

🔓 Entry Plan (Buy Setup):

🟢 "The vault is wide open!" — We’re planning bullish entries using 15m–30m timeframe swing levels.

✅ Buy Limit Orders: Plot them smartly around most recent swing lows/highs.

⚠️ Chart Alert Suggested: Eyes on the prize, don’t miss the break-in.

🛑 Risk Guard (SL Setup):

💼 Stop-Loss: Set at nearest 30-min swing low (based on your risk appetite).

Remember, it’s about preserving your loot, not just grabbing it.

🎯 Target Area:

🎯 Primary Target: 1.19000

🎯 Optional Trailing SL: Ride the wave, lock the profits as price moves.

🧲 Scalpers' Notice:

Only scalp long. Got big pockets? Jump in. Smaller bags? Swing along.

💡 Trailing stop advised—don’t let the market steal your gains.

💹 Current Market Outlook:

EUR/USD is moving bullish—supported by technical signals, macro news, COT insights, and intermarket vibes.

🧠 Use all tools: Fundamental 📊 + Sentiment 🧭 + Quant + Bias Score 📈.

📎 Want the full breakdown? Check the 👉.Liinkk.🔗

(Keep updated, conditions shift fast!)

⚠️ News Risk Alert:

🚨 Stay alert during news drops—avoid fresh trades then.

Use trailing SLs to lock profits & guard against reversal raids.

💖 Support the Robbery Plan!

💥 Hit that Boost Button 💥 if you're riding with the Thief Team!

We steal smart, we trade sharp — every day’s a new heist in this market.

See you on the next plan! Stay legendary 🐱👤💸🤑🔥

What Are Bollinger Bands? How to use it.✅ What Are Bollinger Bands?

Bollinger Bands are a volatility-based technical analysis tool developed by John Bollinger. They consist of three lines:

1. Middle Band: 20-period Simple Moving Average (SMA)

2. Upper Band: Middle Band + 2 standard deviations

3. Lower Band: Middle Band - 2 standard deviations

The bands expand and contract based on price volatility.

📊 What Bollinger Bands Tell You

Contraction (Squeeze): Low volatility, possible breakout coming

Expansion: High volatility, breakout in progress or exhausted

Price Touches Band: Doesn’t mean reversal—it's a sign of strength or weakness

🎯 Mastering Strategies with Bollinger Bands

1. Bollinger Band Squeeze (Breakout Strategy)

Setup: Bands are very close together (low volatility)

Signal: Wait for breakout and volume spike

Action: Enter in direction of breakout

Tip: Combine with MACD or RSI for confirmation

> 🔍 Example: If the price breaks above the upper band with strong volume after a squeeze → potential long entry.

2. Mean Reversion (Reversal Strategy)

Setup: Price touches or exceeds upper/lower band

Signal: Look for RSI divergence, candlestick reversal patterns

Action: Fade the move back to the 20 SMA (mean reversion)

Tip: Works best in ranging markets

> ⚠️ Warning: Don’t short just because price touches the upper band. Look for confluence.

3. Trend Riding with Bands

Setup: Price rides upper/lower band

Signal: Pullbacks to the 20 SMA in a strong trend

Action: Enter on bounce near SMA if the trend is strong

Tip: Use higher timeframes to confirm the trend

> 🟢 In an uptrend, buy near the 20 SMA when price pulls back but doesn’t break lower band.

📌 Key Tips for Mastery

1. Adjust settings for asset/timeframe (e.g., crypto might need a 10 or 14 SMA)

2. Never use Bollinger Bands alone – combine with:

RSI (for overbought/oversold confirmation)

MACD (trend confirmation)

Volume (for breakout confirmation)

3. Use multiple timeframes – e.g., 4H for trend, 15m for entry

4. Avoid chasing band breakouts without confirmation

5. Backtest strategies with your preferred asset

🧠 Advanced Concepts

Double Bottoms Outside Band: When price forms a W-bottom with the second low outside the lower band bullish reversal setup.

Walking the Band: In strong trends, price can "walk" along the band don’t fade too early.

Band Width: Track the width of bands to detect upcoming breakouts.

⚠️ Disclaimer

This guide is for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Always do your own research (DYOR) and consult with a financial advisor before making any investment decisions.

EURUSD Bearish SMC Setup | Premium Supply Rejection + CHoCH +FVGPair: EUR/USD

Timeframe: 4H

Price reacted strongly from a Premium Selling Zone, forming multiple CHoCH (Change of Character) and BOS (Break of Structure) confirmations.

🔻 Red Zones indicate strong institutional selling

🔺 Weak High is now likely to remain protected

Market structure has shifted bearish, and price is targeting imbalances (IMB) and Fair Value Gaps (FVG) below.

⸻

✅ Entry: Taken from the premium supply rejection

🎯 Target 1: 1.16000 – Minor imbalance fill

🎯 Target 2: 1.15000 – Mid-level demand

🎯 Final Target: 1.14500 – Major liquidity zone

❌ Invalidation: Clean break above 1.18000

⸻

📉 Smart Money Confirmation Setup:

• Premium Supply

• CHoCH

• BOS

• FVG & IMB below

🔄 Missed the entry? Wait for a pullback into lower OB or supply zone.

#EURUSD #SmartMoney #SMC #CHoCH #BOS #FVG #OrderBlock #Forex #LiquiditySweep #SupplyDemand

EURUSD Will Keep Growing!

HI,Traders !

#EURUSD is trading in an

Uptrend and the pair broke

The key horizontal level

Of 1.16370 and the breakout

Is confirmed so after a potential

Retest of the support cluster

Of the rising and horizontal

Support lines below we will

Be expecting a bullish continuation !

Comment and subscribe to help us grow !

EurUsd - This is the deadly breakout!EurUsd - FX:EURUSD - is about to fly:

(click chart above to see the in depth analysis👆🏻)

EurUsd has been rallying about +15% over the past couple of months. Additionally the breakout at the current resistance trendline is about to be confirmed. Subsequently EurUsd is setting up for another major move higher, which will be painful for all European traders.

Levels to watch: $1.23, $1.11

Keep your long term vision🙏🙏

Philip (BasicTrading)

EURUSD I Technical & Fundamental Forecast Welcome back! Let me know your thoughts in the comments!

** EURUSD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

EUR/USD Analysis: US Dollar Strengthens at the Start of the WeekEUR/USD Analysis: US Dollar Strengthens at the Start of the Week

On 2 July, on the EUR/USD chart, we noted that the rally—during which the pair had gained more than 6% since mid-May—was under threat, citing several technical signals, including:

→ proximity of the price to the upper boundary of the ascending channel;

→ overbought conditions on the RSI indicator;

→ nearby resistance from the Fibonacci Extension levels, around 1.18500.

Trading at the start of the week points to renewed US dollar strength. This became particularly evident with the opening of the European session, which triggered a decline in EUR/USD to the 1.17500 area.

It is reasonable to assume that the dollar’s strength against the euro is linked to early-week positioning by traders, who are anticipating news regarding US trade agreements.

According to Reuters, the United States is close to finalising several trade deals in the coming days and is expected to notify 12 other countries today about higher tariffs.

EUR/USD Technical Chart Analysis

The ascending channel established last week remains in play, with the following developments:

→ a dashed midline within the upper half of the channel has been breached by bearish pressure (as indicated by the arrow);

→ a series of lower highs in recent sessions suggests the formation of a downward trajectory, within which the price could move towards the channel median—or potentially test its lower boundary.

P.S. In the longer term, analysts at Morgan Stanley maintain a bullish outlook, forecasting that EUR/USD could rise to 1.2700 by the end of 2027.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EUR/USD breakout awaiting EUR/USD has not provided a clear structure over the past week or two. The pair appears to be in consolidation, building liquidity on both sides of the current range. At the moment, I’m waiting for a decisive breakout, ideally followed by distribution within the monthly supply zone, although that zone is still some distance away.

This week, my focus will be on whether a new supply zone forms, closer to current price. If price sweeps the nearby equal highs and then shows signs of reversal, this could give us a fresh supply area to work from. Alternatively, if price moves lower, I’ll be looking at the 8-hour demand zone around 1.16000 for a possible long setup.

Confluences for EUR/USD:

- Although price has been slightly bullish, the current consolidation phase suggests a potential reversal could be on the horizon.

- Liquidity is building on both sides of the range, making a reaction from the monthly supply zone increasingly probable.

- There’s significant downside liquidity still untapped, such as Asia session lows, which could serve as short-term targets.

- For clearer confirmation, we still need a decisive break in market structure to the downside.

P.S. If price sweeps the lower liquidity and moves into the 8-hour demand zone near 1.16000, I will be watching for accumulation to form and signs of bullish intent from there.

EURUSD Bullish Setup: Watching for a Break and Retest📈 Looking at EURUSD right now, we’re in a strong bullish structure 🔼 — but it’s clearly overextended 🚀

As we head into the end of the week, there’s still potential for more upside today ⬆️ — but ⚠️ be cautious, since Fridays often bring retracements as we move into the weekly close 🕒📉

🔍 I’m watching for a bullish opportunity if we get a break above the current equal highs, followed by a retest and failure to break back below 🧠📊

If that setup doesn’t materialize, we’ll simply step aside and abandon the idea 🚫

💬 Not financial advice — always trade at your own risk.

EUR/USD Rallies on Broad Dollar WeaknessEUR/USD Rallies on Broad Dollar Weakness

EUR/USD started a fresh increase above the 1.1750 resistance.

Important Takeaways for EUR/USD Analysis Today

- The Euro started a decent increase from the 1.1600 zone against the US Dollar.

- There is a connecting bullish trend line forming with support near 1.1770 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair started a fresh increase from the 1.1600 zone. The Euro cleared the 1.1650 resistance to move into a bullish zone against the US Dollar.

The bulls pushed the pair above the 50-hour simple moving average and 1.1750. Finally, the pair tested the 1.1830 resistance. A high was formed near 1.1829 and the pair is now consolidating gains above the 23.6% Fib retracement level of the upward wave from the 1.1590 swing low to the 1.1830 high.

Immediate support on the downside is near a connecting bullish trend line at 1.1770. The next major support is the 1.1710 level. A downside break below the 1.1710 support could send the pair toward the 1.1680 level and the 61.8% Fib retracement level of the upward wave from the 1.1590 swing low to the 1.1830 high.

Any more losses might send the pair into a bearish zone toward 1.1645. Immediate resistance on the EUR/USD chart is near the 1.1830 zone. The first major resistance is near the 1.1850 level. An upside break above the 1.1850 level might send the pair toward the 1.1920 resistance.

The next major resistance is near the 1.1950 level. Any more gains might open the doors for a move toward the 1.2000 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EUR/USD Analysis: Rally May Be Under ThreatEUR/USD Analysis: Rally May Be Under Threat

The euro has appreciated by approximately 15% against the US dollar this year, as confidence in the United States continues to wane. As ECB Chief Economist Philip Lane noted in an interview at CNBC: “There is a degree of reorientation by global investors towards the euro.”

At the same time, officials at the European Central Bank have expressed concern that the rapid strengthening of the euro could undermine efforts to stabilise inflation at 2%. They warn that a move above $1.20 may pose risks for inflation and the competitiveness of export-oriented firms — an issue raised during the ECB’s ongoing ECB Forum on Central Banking in Portugal.

Could EUR/USD Reach the $1.20 Level?

From a technical analysis perspective, EUR/USD is showing bearish signals:

→ If the early April rally (coinciding with Trump’s announcement of new tariffs) is taken as the initial impulse wave A→B, and the May low is interpreted as the end of the B→C corrective move, then, according to Fibonacci Extensions, the pair has now risen to a key resistance zone around 1.1850 (as indicated by the arrow on the chart).

→ In addition, the RSI indicator signals strong overbought conditions, while the price is hovering near the upper boundary of the ascending channel — a level that typically acts as resistance.

Given these factors, we could assume that EUR/USD may be in a vulnerable position, potentially facing a short-term correction — possibly towards the lower boundary of the channel, reinforced by support at the 1.1620 level. However, this does not negate the longer-term bullish outlook for the euro amid prevailing fundamental conditions.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EUR/USD Weekly – Two Long Setups Hello guys!

It is my perspective on eurusd!

Before we even reach the major resistance zone around 1.2050–1.2100, I’ve highlighted two long-term opportunities that may unfold as the price continues to climb.

✔ First Long Position:

It looks like a more conservative entry. The price is already above it. You can set a pending position!

It was likely aiming to catch the momentum as the price broke above the previous structure.

TP is near the descending trendline, around 1.2050–1.2100. a smart place to exit before major resistance hits.

✔ Second Long Position:

Positioned slightly lower. probably in case of a pullback or retest into the broken zone.

This one offers better risk-reward, but requires patience and a cleaner retracement.

Both longs are short-to mid-term swing ideas, aiming to ride the bullish leg into the bigger trendline rejection zone, where I’d personally be more cautious or even look for reversal setups.