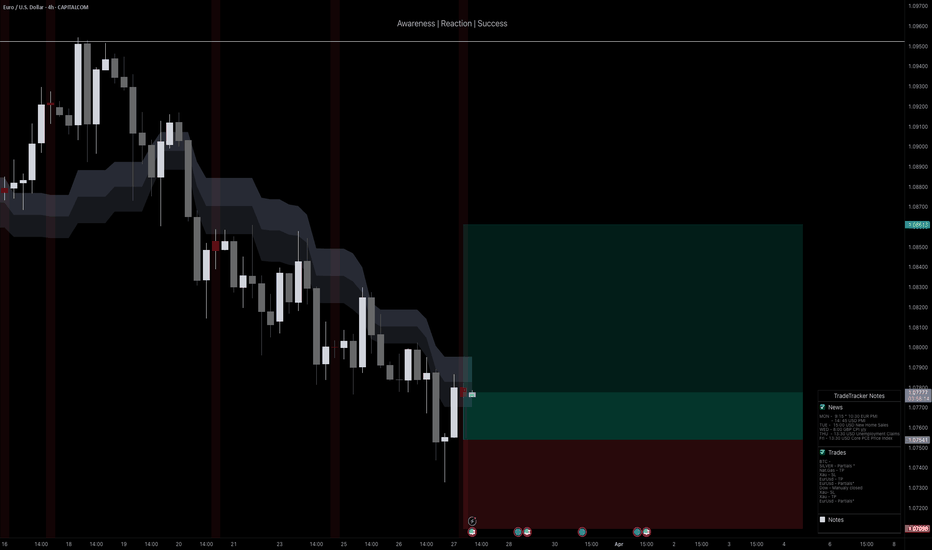

EURUSD SELL (DOWNTREND) H4 SHORT LOOKEUR/USD Market Analysis

Trend: Bearish

Pattern: Strong downward momentum observed after recent highs around 1.1570

Sell Entry Zone: Confirmed with bearish momentum

Target Levels:

1st Target: 1.11000 – Key psychological and technical level

2nd Target: 1.09100 – Near the 55-day SMA, strong historical support

Final Target: 1.07500 – Close to 200-day SMA and March lows

Stop Loss: 1.15500 – Just below the recent high (1.1570), to limit upside risk.

Eurusdupdate

EURUSD SHORT FORECAST Q2 W18 D30 Y25EURUSD SHORT FORECAST Q2 W18 D30 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURUSD SHORT FORECAST Q2 W18 D29 Y25

EURUSD SHORT FORECAST Q2 W18 D29 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EUR/USD W Closure Very Bearish , Best 2 Places For Sell Cleared Here is my opinion on EUR/USD , If we checked weekly time frame , we will see that we have a great bearish price action , and on lower time frames we have avery good bearish price action also , so i think we can sell this pair from the places i mentioned with small sl , and target will be from 100 to 250 pips .

#EURUSD: Our Last Trade Mitigated Early, Now Swing Trade Active?EURUSD, in our previous recommendation, advised everyone to sell swing trades. However, the price was mitigated by a narrow margin. The DXY index suggests further price growth in the coming weeks. Please ensure you manage your risk while trading. This is our concept only and does not guarantee the movements we’ve shown in our analysis. Therefore, please conduct your own analysis before taking any swing entry.

Good luck and trade safely.

Wishing you good luck and safe trading!

Thank you for your support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

EUR/USD trades with sizeable gains above 1.1500, at over three-yThe Relative Strength Index (RSI) indicator on the 4-hour chart rose above 70, reflecting overbought conditions for EUR/USD. On the downside, 1.1500 (mid-point of the ascending channel) aligns as first support before 1.1450 (static level) and 1.1400 (20-period Simple Moving Average).

Looking north, first resistance could be spotted at 1.1600 (static level, round level) ahead of 1.1670 (upper limit of the ascending channel).

EURUSD: BUY trend continuesEURUSD is taking a breather, but bulls are still in charge. The 2-hour chart shows price well above key moving averages, keeping the uptrend alive. Momentum has cooled slightly, yet indicators stay near highs—no real signs of weakness. Dips toward 1.1500 are likely to draw buyers back in.

#EURUSD: 1545+ PIPS Swing Sell Idea Concept! Comment Your Views!Hey there everyone! 👋

I’ve got some insights into the EURUSD currency pair. It’s been on a wild ride lately, with the USD taking a nosedive. But guess what? The EURUSD is on a bullish streak and it’s not stopping anytime soon, and it is very likely it will reach our entry point.

Now, I know what you’re thinking. “Is this a good time to jump in?” Well, let me tell you, it’s all about your risk tolerance. We’ve identified three potential entry points for the EURUSD pair, so you can decide if it’s time to make a move. 📈

Remember, trading involves risks, so it’s important to be cautious and stick to your risk management plan. 🛡️

Good luck with your trading journey 😊

Much Love❤️

Team Setupsfx_

EURUSD SHORT FORECAST Q2 W16 D18 Y25EURUSD SHORT FORECAST Q2 W16 D18 Y25

Fun Coupon Friday.

Summary

- STILL with HTF Order block (weekly)

- All long positions invalid until weekly close above weekly order block

- Short positions charted

- The more breaks of 15' structure the more confluence for bearish pressure

- Lower time frame turn around in price action REQUIRED in all short positions.

FRGNT X

EuroDollar : When Does the Dust Settle? Tariffs 25'Rather quiet to begin the week as the EuroDollar remains unchanged during the Initial 3 sessions of the week. A "Doji" Daily Candle printed, informing us those of us more technically minded to write off the day's price behavior and look to preceding candles for indication of future direction. It is important to note the longer top wick of 38.5 pips versus the 23.5 pips bottom wick. We can observe yet another daily candle wicking into the Weekly level 1.087. This Price remains very important in the short term because it may facilitate a pullback on EurUsd to the downside. This follows a historic Week of volatility for the EuroDollar as Trumps Tariffs shook the markets to say the least.

If we are considering Bullish targets for the week, Daily Level 1.093 , or even Daily Level 1.098 which would be the most generous for buyers. When fundamentals are this strong, it's more difficult to discount those larger, irrational moves that you see in the markets sometimes. So although one could argue how over-extended the EuroDollar is, we must remember the game we are playing.

In Considering Bearish targets, a retest of Daily Support level 1.0786 seems reasonable. A Deeper retracement could see price around 1.0694 , the beginning of Last Tuesdays very clean bullish NY session. A pullback seems technically sound, considering the outlier and extent of last weeks upside move.

Job Openings on Tuesday is the appetizer to the

Inflation CPI data on Wednesday which will surely see some volatility rock these already rattled markets.

CPI/Inflation is forecasted to Cool for the Dollar which technically supports more strength for the Euro and a further upside push for this pair.

Please Leave a rocket or comment if you enjoyed this Analysis. Have a good trading week !

WHY EURUSD IS BULLISH ?? DETAILED ANALYSISEURUSD has officially broken out of a clean bullish pennant pattern on the 4H chart, confirming the bullish momentum that has been building over the past week. After a sharp rally, price consolidated within a contracting range, forming the classic pennant shape. With the breakout now confirmed and price currently trading at 1.106, I’m anticipating a continuation toward the projected target at 1.143 — offering a potential 300+ pip gain in this move.

Technically, the breakout is supported by increasing bullish volume, strong impulse candles, and a clear structure of higher lows. The pennant served as a healthy consolidation zone, allowing buyers to regain control before the next leg up. Price has respected support at 1.096 and is now printing bullish continuation signals with momentum indicators pointing north.

Fundamentally, today’s market sentiment favors EUR strength, especially as the US dollar comes under pressure due to rising expectations of Federal Reserve rate cuts later in the year. Inflation data in the eurozone remains sticky, supporting the ECB’s cautious stance on monetary easing. Meanwhile, weaker US labor market data and softening retail figures are weighing on dollar demand.

With both technicals and fundamentals aligned, I’m expecting further upside on EURUSD. The structure is solid, the breakout is clean, and sentiment supports continued bullish flow. I’ll be holding my bias firmly bullish unless the price falls back below 1.096, which would invalidate the setup. For now, all eyes are on 1.120 short term and eventually 1.143 as the full pennant projection completes.

EUR/USD Long to Short idea (1.08500 up to 1.10500)EUR/USD (EU) Analysis – This Week

This week, EUR/USD looks promising, similar to GBP/USD, with multiple key points of interest (POIs) in close proximity.

A clean, unmitigated 2-hour demand zone sits nearby, which could trigger a bullish rally if price reacts from this level. At the same time, price has been bearish over the past few days, forming a valid 9-hour supply zone from the recent downward push. I’ll be watching to see where price slows down and which liquidity level it targets first.

Confluences for EU Buys:

EU has been bullish for weeks, and this move could be a healthy correction before further upside.

The U.S. dollar remains bearish, aligning with this bullish bias.

A clean 2-hour demand zone has formed, which previously caused a break of structure to the upside.

Imbalances and untapped Asia session highs still need to be taken.

Note: If price breaks below this structural low, I will shift my focus toward sell opportunities. However, if that happens, we’ll know exactly where the ideal entry points for shorts will be.

#EURUSD: Two Opportunities In One Chart, What do you see? Price has shown bullish behaviour exhaustion, and it's at a point where we see a total meltdown in prices. This is an excellent scenario for traders who trade on what the chart shows us rather than selling or buying only. We can utilise both these entries when prices do show a strong indication at either of our levels.

If you like our work, then do like and comment on the idea, which will boost us to post more such ideas. ❤️🚀

Euro at Critical Demand – Is the Trend About to Flip?Euro reached an important zone for my setup, triggering a long position. Although it’s still trending below the fibcloud on the 4H timeframe, we’ve seen a solid 0.5% recovery from the recent low. I’m looking for this area to hold as support, with defined risk in case the setup invalidates.

Technicals:

• Price tapped into a major 4H support level where liquidity historically steps in.

• The current move marks a 0.5% bounce from the low, showing early signs of demand.

• Still trading below the fibcloud, but a reclaim of that zone would open the path toward 1.0850.

• Setup includes a stop-loss below the most recent wick low, with a clear structure to build a higher low.

Fundamentals:

EUR-side strength:

• ECB maintains a slower pace of rate cuts compared to the Fed.

• Growth and inflation in the Eurozone are still challenges, but the ECB’s hawkish stance continues to support medium-term EUR strength.

• The ECB may hike another 150 bps to reach a 4% terminal rate, which favors EUR upside.

USD-side risks:

• Trump announced plans to impose a 25% tariff on all car imports, including from the EU-adding geopolitical and trade uncertainty.

• Traders remain cautious around further escalation in US-EU trade tensions.

• US Initial Jobless Claims later today could bring weakness to the dollar if the data disappoints.

In short, while the USD remains resilient, the EUR fundamentals and the current technical zone make this a compelling spot for a bounce.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

EUR/USD Long setup from the 3hr demand zoneSimilar to GBP/USD, I’m looking for long opportunities on EU. My key area of interest is the 3-hour demand zone, where I will wait for price to mitigate and accumulate before entering a position.

Price has also changed character to the upside, further validating this demand zone as a strong point of interest. Additionally, there is a significant amount of liquidity to the upside that needs to be taken.

The next major supply zone I have marked out is the 23-hour supply zone, which is further away. For now, my focus remains on the demand zone—unless price breaks below, creating a new supply level.

Confluences for EU Buys:

- Bullish market structure shift, with a clean demand zone left behind.

- Unmitigated 3-hour demand zone, making it a strong area of interest.

- Liquidity resting above, which price is likely to target.

- DXY has been bearish, aligning with a bullish outlook for EU.

Note: If price breaks structure to the upside without tapping my nearby demand zone, I will either wait for a new demand zone to form or look for a sell-to-buy opportunity from supply.

EURUSD Weekly Candle RangeTrading is hard but it's simple.

On the 1W, EURUSD traded into a key zone and ended with a long wick, indicating a strong rejection. I'm looking to find entries in the wick area and targeting CRH for the rest of the week. Do have a lovely weekend. For me, I'd be looking at ETHUSDT 😅

EURUSD:Today's trading strategyThe EUR/USD is fluctuating and consolidating around 1.0790, having weakened for six consecutive trading days previously. US President Trump's announcement of imposing a 25% tariff on imported automobiles and their components starting from April 2nd has made the market worried that the economic and trade relations between the US and major economies are facing more uncertainties.

As can be seen from the chart, the EUR/USD has continuously declined. After hitting a low of 1.0732 at the lowest, it stabilized and rebounded. Currently, it is trading within the range of 1.0780-1.0790. If the exchange rate can break through the resistance level of 1.0830 above, it is expected to test the 1.09 mark. If it is blocked and pulls back, one should be vigilant about retesting the support area of 1.0732 again. In the short term, the EUR/USD may continue to have a wide range of fluctuations within the range of 1.0700-1.0830.

Trading strategy:

Sell@1.0830

TP:1.0730

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!