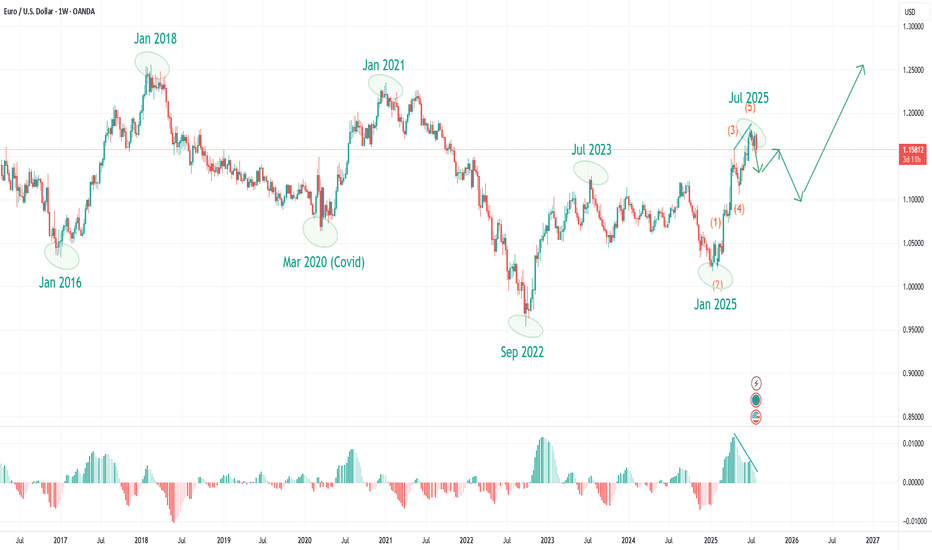

EUR/USD: Is the Next Big Correction Already Underway?EUR/USD: After 120 Days Up, Are We Entering a Year-Long Correction? What Market Cycles Reveal.

As EUR/USD traders digest the stunning 120-day, five-wave rally from the January 2025 lows to the July 2025 highs, the big question now is—what's next? The clues are right in front of us, and they suggest we may be headed into an extended corrective phase, one that could last until the very start of 2026.

What the Current Structure Shows

Motive Wave Complete: The impulsive surge just wrapped up a textbook five-wave move, with each leg unfolding cleanly and culminating in a July top. Motive waves like this are the engines of market trends—fast-moving, decisive, and packed with momentum.

Corrective Phase Incoming: But all trends eventually pause, and here the evidence points to a shift. Corrective waves—unlike their trending counterparts—are time-consuming, choppy, and have a tendency to frustrate impatient traders. The completed motive wave took just 120 days, but corrections often take much longer to play out. According to this chart, the probable timeline for this correction extends into December 2025, or possibly beyond.

Why the Count Is Labelled This Way

Wave Duration Clue: One of the most reliable Elliott Wave principles is that corrective phases outlast the sharp, high-energy motive moves that precede them. With the motive wave spanning four months, a comparable correction stretching into late 2025 makes perfect structural sense.

Cycle Awareness, Major Turning Points, and MACD Divergence:

Flip to the weekly turning points chart, and a deeper pattern emerges: Major EUR/USD direction changes consistently cluster around the start of a new year, with minor tops and bottoms often forming near mid-year. Over the last eight years, six out of seven major pivots have landed at those cycle pivots.

Notably, if you look at the weekly chart’s MACD, there’s now a clear bearish divergence—while price clocked new highs into July, the MACD failed to confirm, rolling over and diverging lower. This kind of momentum divergence at a major turning point is classic for trend exhaustion and aligns perfectly with the idea that a correction is not only likely, but perhaps overdue.

This powerful confluence—timing, price structure, and momentum—underscores just how much “cycle” and structure awareness can add to your trading playbook.

What to Watch Next (Trade Planning)

Timing the Correction: If the correction follows historical precedent, expect sideways or choppy price action well into Q4 2025, with the next big directional opportunity around the calendar turn into 2026.

Cycle-Based Strategies: Recognising these cycles lets you prepare for reversals, especially if price is diverging from the MACD at those major timing windows.

Structure > Prediction: The motive phase is where you ride the trend; cycles, structure, and momentum help you avoid exhaustion traps and see when patience is required.

Eurusdweekly

EUR/USD Update: Bullish Outlook Towards 1.14190 and BeyondHi Everyone,

As we projected in our analysis last week, EUR/USD corrected throughout the week and approached a retest of the 1.12000 level.

We expect the price to potentially retest 1.12000 and confirm it as support before advancing further to challenge the May 26 high of 1.14190. This would further reinforce our outlook for a potential long-term bullish trend.

Of course, the price could also challenge the 1.14190 high without a second retracement, should there be strong buying pressure early in the week. A successful breach of this level would likely drive the price higher towards the 1.15240 level.

We will provide further updates on the expected path for EUR/USD should the price reach this target.

The longer-term outlook remains bullish, with expectations for the rally to extend toward the 1.2000 level, provided the price holds above the key support at 1.10649.

We will continue to update you throughout the week with how we’re managing our active ideas and positions. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for the week ahead. Trade safe.

BluetonaFX

EUR/USD remains capped below 1.1400, bullish bias prevailsEUR/USD's near-term outlook is neutral. The pair oscillates below a flat 20 SMA, while longer-term (100/200) SMAs maintain upward slopes. Momentum is flat around 100, and the RSI is only slightly higher near 45, suggesting limited upward potential.

EURUSD: The range is compressing in the sideway zone. Waiting foThe Relative Strength Index (RSI) indicator on the 4-hour chart stays below 50 and EUR/USD failed to make a 4-hour close above the 20-period and 50-period Simple Moving Averages (SMA), reflecting a lack of buyer interest.

On the downside, 1.1300 (static level) aligns as interim support before 1.1270-1.1260 (Fibonacci 238.2% retracement of the latest uptrend, 100-period SMA) and 1.1180 (Fibonacci 50% retracement).

EUR/USD could face strong resistance at 1.1380, where the Fibonacci 23.6% retracement level converge with the 20-period and 50-period SMAs. In case EUR/USD manages to stabilize above this resistance, 1.1450 (static level) and 1.1500 (static level, round level) could be seen as next hurdles.

EUR USD Weekly Timeframe Outlook EUR USD Trade Setup weekly timeframe

On the weekly timeframe EUR USD has tapped on a strong supply level.

this level has also acted as a strong resistance level in the past.

So we will be looking for selling opportunities from the lower timeframe.

Patterns to watch out for.

1. Double Top

2. Head and shoulders pattern

3. Bearish break and retest + it must align with the 0.50 - 0.618 Fib Retracement level for stronger confirmation.

4. Lower timeframe supply levels.

Check next post to see the pattern i found.

EUR USD Entry Setup 30M Timeframe🔹 Pattern: Double Bottom

🔹 Entry Condition: Wait for a clean break and retest of the neckline before entering.

No confirmation = No trade.

🔹 Higher Timeframe Context: Overall trend is bearish: this is just a pullback to the Lower High before a potential continuation of the downtrend.

⚠️ Patience is key let’s see how it plays out!

EUR/USD "The Fiber" Forex Market Bank Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Fiber" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (1.04000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 1.06700 (or) Escape Before the Target

Secondary Target - 1.08000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

EUR/USD "The Fiber" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

⭐🌟⭐Fundamental Analysis

Fundamental analysis evaluates the economic indicators of the Eurozone and the United States, which directly influence the EUR/USD pair.

🌟Eurozone Economic Indicators:

GDP growth is reported at 0.5% for Q4 2024, with recent data suggesting an expected increase to 0.8% for Q1 2025, indicating a potential recovery Euro Area Indicators.

Inflation rate is at 3.0% for February 2025, expected to decrease to 2.2% by year-end, reflecting easing price pressures Euro Area Inflation Rate.

Interest rates are at 2.5%, with the European Central Bank (ECB) likely to hold steady, given mixed inflation signals Euro Area Interest Rate.

Trade balance shows a surplus of €10 billion in January 2025, driven by exports, though not sufficient to offset economic challenges Euro Area Balance of Trade.

🌟United States Economic Indicators:

GDP growth is strong at 2.5% for Q4 2024, though recent projections suggest a slowdown to 2.0% for Q1 2025 United States Indicators.

Inflation is stable at 2.0% for February 2025, within target ranges, but recent data shows slight upward pressure United States Inflation Rate.

Interest rates are at 4.5%, with expectations of a 0.25% rate cut in September 2025, reflecting a dovish shift United States Interest Rate.

Trade balance shows a deficit of $50 billion in January 2025, a persistent challenge but manageable with strong economic growth United States Balance of Trade.

The narrowing interest rate differential, with potential Fed rate cuts and stable ECB policy, could support EUR strength, though US economic resilience remains a counterforce.

⭐🌟⭐Macroeconomics

Macroeconomics encompasses broader economic factors influencing the pair:

Global GDP growth is projected at 3.0% for 2025, according to recent forecasts, with mixed regional performances World Economic Outlook.

Commodity prices are stable, with oil at $80 per barrel, impacting EUR due to the Eurozone's energy import reliance Commodity Markets Outlook.

Stock markets show positive performance, with the S&P 500 up 5% YTD and Euro Stoxx 50 up 3% YTD, supporting risk-sensitive currencies like the EUR Global Stock Market Performance.

Bond yields are declining, with the US 10-year yield at 3.5%, down from 4.0% earlier, suggesting lower USD appeal Global Economic Outlook.

⭐🌟⭐Global Market Analysis

Global economic conditions play a significant role in currency movements:

Geopolitical events, such as potential tensions, could boost USD as a safe-haven currency, though no major events are currently noted.

Central bank policies are diverging, with the Fed expected to cut rates and the ECB holding steady, narrowing the interest rate differential Central Bank Policies.

Commodity trends, with stable oil prices, have a muted direct impact, though energy costs affect Eurozone inflation.

Stock market performance, with global indices up, suggests risk-on sentiment, potentially supporting EUR over USD Market Performance Analysis.

⭐🌟⭐COT Data and Positioning

COT data provides insights into large trader positions, with recent reports showing:

For euro futures, large speculators are net short, but recent data indicates a reduction in short positions, suggesting emerging bullish sentiment CFTC COT Report.

Positioning shows that institutional traders are cautiously optimistic, with some covering shorts as the price approaches support levels.

Key Insight: Reducing short positions in euro futures align with potential bullish momentum, supporting an upward move.

⭐🌟⭐Intermarket Analysis

Intermarket relationships influence currency valuation:

EUR/USD is positively correlated with stock markets; with global indices performing well, the EUR could benefit from risk-on sentiment Intermarket Correlations.

Gold, trading at $1900 per ounce, slightly up, suggests a weaker USD, supporting EUR strength Gold Price Trends.

Bond yields, with declining US yields, indicate lower USD appeal, potentially boosting EUR/USD Bond Market Insights.

Key Insight: Positive correlations with stocks and gold suggest EUR could strengthen, while declining US yields support this trend.

⭐🌟⭐Quantitative Analysis

Technical analysis provides insights into price trends:

At 1.05000, EUR/USD is approaching key support at 1.0450, with resistance at 1.0600, based on recent charts EUR/USD Technical Analysis.

Moving averages show the 50-day MA at 1.0550 and the 200-day MA at 1.0700, with the price below both, indicating a downtrend TradingView Analysis.

RSI (Relative Strength Index) is at 45, neutral, suggesting potential for a bounce if support holds Technical Indicators Guide.

Key Insight: The pair is at a crucial support level, with technicals suggesting a possible upward reversal.

⭐🌟⭐Market Sentimental Analysis

Market sentiment reflects trader positioning and expectations:

Recent data shows mixed sentiment, with some traders expecting USD strength to continue, while others see potential for EUR recovery due to improving fundamentals Forex Sentiment EURUSD.

Bank forecasts predict EUR/USD rising to 1.08 by year-end, citing Eurozone recovery and expected Fed rate cuts Currency Forecasts.

Key Insight: Emerging optimism about the euro supports a bullish outlook, though caution remains due to recent USD strength.

⭐🌟⭐Next Trend Move

Combining all factors, the next trend move for EUR/USD is likely upward:

The pair is at a key support level (1.0450), and if it holds, could bounce back to test resistance at 1.0800.

Potential catalysts include better-than-expected Eurozone data and Fed rate cut expectations, supporting EUR strength.

Key Insight: The next move favors an upward continuation, with risks of further downside if support breaks.

⭐🌟⭐Overall Summary Outlook

The EUR/USD pair, at 1.05000 on March 4, 2025, exhibits a cautiously bullish outlook. Key drivers include improving Eurozone fundamentals, with GDP growth expected to rise to 0.8% in Q1 2025 and declining inflation, narrowing the interest rate differential as the Fed is expected to cut rates by 0.25% in September 2025. Technical indicators suggest the pair is at a crucial support level, with potential for a bounce, supported by reducing short positions in euro futures and positive intermarket correlations with stocks and gold. Risks include persistent USD strength if US data remains robust or global risk-off sentiment boosts the USD. However, the prevailing trend points to a potential EUR appreciation in the near term.

⭐🌟⭐Future Prediction

Trend: Bullish

Details: The pair is likely to see an upward move, testing resistance at 1.0800 in the near term, driven by Eurozone recovery and expected Fed rate cuts. Risks include stronger-than-expected US data maintaining USD dominance, but current indicators suggest a reversal is imminent.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURUSD -Weekly forecast, Technical Analysis & Trading Ideas💡 Daily Timeframe:

EURUSD has been in a Range Bound recently. It touched and reject from 1.0528 major resistance today.

A peak is formed in daily chart at 1.05285 on 02/26/2025, so more losses to support(s) 1.03570, 1.02920 and minimum to Major Support (1.01779) is expected.

💡 Four-hour Timeframe:

The uptrend is broken, and price is in an impulse wave.

The bearish wave is expected to continue as long as the price is below the strong resistance at 1.0528

A strong bearish divergence has also formed in the RSI.

💡 One-hour Timeframe:

1.0457 support is broken now. It will act as a Resistance now!

Forecast:

1- Correction wave toward the Sell Zone

2- Another Downward Impulse wave toward Lower TPs

SL: Above 1.0528

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

EURUSD - Swing Buy on MidWeek Reversal & USD News (CPI)Reasons for this setup being higher probability:

HTF is bullish because of the doji on Monthly and momentum on Weekly chart.

We've created a protected low, confirmed by Divergence with GBPUSD.

Market created momentum higher.

We're now in a retracement phase.

Looking for the market to flip up with a reversal pattern on the LTF before entering.

Continuing in the bullish HTF idea.

Possible EURUSD movement last week of July 2024Following the concept of the penultimate weekly candle of indecision and considering that the previous candle was bearish, we will look for bearish options. However, it is important to be careful of possible attempts to liquidate and manipulate the market, which may influence purchases before following the natural downward trend.

Trading Rules

Never trade too long - Risk management is essential.

Never trade without confirmation - Wait for clear signals.

Never trust signals blindly - Do your own analysis and research.

If you found this idea useful, please support it by liking and sharing. 👍🙂

✅ Hit the like button, subscribe and share on other trading forums.

✅ Follow me for future ideas, trade setups and updates on this analysis.

✅ Feel free to share your ideas, comments, opinions and questions.

Take care and trade well!

PORTUGUESE-BR

Seguindo o conceito da penúltima vela semanal de indecisão e considerando que a vela anterior apresentou queda, buscaremos opções de baixa. No entanto, é importante ter cuidado com possíveis tentativas de liquidação e manipulação do mercado, que podem influenciar compras antes de seguir a tendência natural de baixa.

Regras de Negociação

Nunca negocie muito - A gestão de risco é essencial.

Nunca negocie sem uma confirmação - Espere por sinais claros.

Nunca confie cegamente em sinais - Faça sua própria análise e pesquisa.

Se você achou esta ideia útil, por favor, apoie curtindo e compartilhando. 👍🙂

✅ Clique no botão curtir, inscreva-se e compartilhe em outros fóruns de negociação.

✅ Siga-me para ideias futuras, configurações de negociação e atualizações sobre esta análise.

✅ Não hesite em compartilhar suas ideias, comentários, opiniões e perguntas.

Tome cuidado e negocie bem!

EUR/USD Shorts to Longs ideaMy EU analysis this week focuses on shorting opportunities. I will look for sells either from the 6-hour supply zone near the current price or, ideally, from the 11-hour supply zone if the price breaches the Asian high and continues upward.

If the price opens lower, I will look for buying opportunities at the 4-hour or 3-hour demand zones. Once the price reaches these demand zones, I plan to buy up toward the supply zone, as we are still in a short-term bullish trend indicated by the recent break of structure to the upside.

Confluences for EU Sells are as follows:

- 11hr supply zone has caused a break of structure to the downside and nearby 6hr supply.

- The overall trend on the higher time frame is bearish and the dollar is also overall bullish.

- Price has already mitigated 4hr supply might be a start of a bearish trend.

- Bullish pressure is getting exhausted after the bullish rallies we saw last week.

- Clean 11hr supply that has an imbalance that we could see a clean reaction from

P.S. Since the price is between liquidity zones, I will approach these nearby areas with caution and may lower my risk until the price reaches more favourable extreme zones where trades will be more worthwhile.

Have a great trading week!

EURUSD WEEKLY BIASEURUSD is bearish till my golden and final zone.

The EUR/USD pair is one of the most widely traded currency pairs in the world. It represents the exchange rate between the euro, the official currency of the Eurozone, and the US dollar, the currency of the United States. Traders and investors closely monitor this pair because it reflects the relative strength of these two major global economies and can be influenced by a wide range of factors, including economic indicators, central bank policies, geopolitical events, and market sentiment

EUR USD PRICE - NEED TO BALANCE THE LIQUIDITY AT RESISTANCE ZONEHELLO TRADERS have a look of EUR USD price need to BALANCE the

LIQUIDITY which is IMBALANCED ZONE in the up ward direction,we can see that at 4h time frame from the past price in the up ward direction all the LIQUIDITY got FILLED, now its time to break the DOWN TREND LINE after that wait for the pullback then 1st target is 1.09134 nd 2nd target is 1.09952 nd 3rd target is 1.10882 , FOLLOW FORE LIVE CONTENTS

eurusd long EUR/USD managed to erase a portion of its daily losses after falling below 1.0800 with the immediate reaction to the US jobs report, which showed an increase of 303,000 in Nonfarm Payrolls in March.

EUR/USD erased its daily gains and closed flat on Thursday after climbing to its highest level since March 21 above 1.0870. The pair fluctuates in a tight channel below 1.0850 in the early European session on Friday as investors gear up for the US labor market data.

Hawkish comments from Federal Reserve (Fed) officials and the negative shift seen in risk mood helped the US Dollar (USD) stage a rebound in the American session on Thursday.

EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles. confirm signal eurusd

Long EUR/USD is the forex ticker that tells traders how many US Dollars are needed to buy a Euro. The Euro-Dollar pair is popular with traders because its constituents represent the two largest and most influential economies in the world. Follow real-time EUR/USD rates and improve your technical analysis with the interactive chart. Discover the factors that can influence the EUR/USD forecast and stay up to date with the latest EUR/USD news and analysis articles.

The Euro's recent move higher against the US dollar has stalled today with further progress being kept in check by the 200-day simple moving average. While this technical indicator was broken yesterday, the pair closed below the longer-dated moving average. A confirmed break higher – a close and open above the 200-dsma – would see the 50-dsma and a cluster of recent highs on either side of 1.0900 come into focus. Support is seen at 1.0787 down to 1.0760

Confirm long