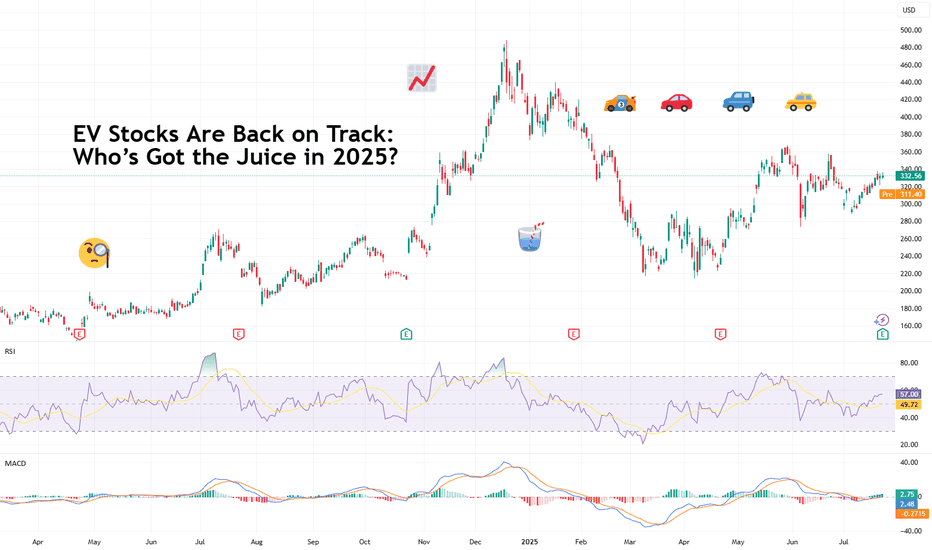

EV Stocks Are Back on Track: Who’s Got the Juice in 2025?This year is big for the EV sector so we figured let’s do a piece on it and bring you up to speed on who’s making moves and getting traction — both in the charts and on the road.

What we’ve got here is a lean, mean lineup of real contenders. Let’s go for a ride.

🚗 Tesla: Still King of the Road (for Now)

Tesla NASDAQ:TSLA isn’t just an EV company. It’s a tech firm, an AI shop, a robotaxi rollout machine, and an Elon-flavored media event every quarter. Even so, when it comes to margins, global volume, and name recognition, Tesla is still the benchmark everyone else is chasing.

In 2025, Tesla’s bounceback is fueled not just by EV hype but by its push into autonomous driving and different plays into the AI space.

The stock is down about 13% year-to-date. But investors love a narrative turnaround. Apparently, the earnings update didn't help the situation as shares slipped roughly 5%. Well, there's always another quarter — make sure to keep an eye on the Earnings Calendar .

🐉 BYD: The Dragon in the Fast Lane

BYD 1211 is calmly racking up sales, expanding across continents, and stealing global market share without breaking a sweat. The Chinese behemoth is outselling Tesla globally and doing it with less drama and more charge… literally .

Vertical integration is BYD’s secret weapon — they make their own batteries, chips, and even semiconductors. The West might not be in love with BYD’s designs, but fleet operators and emerging-market governments are. And that’s where the real growth is.

⛰️ Rivian: Built for Trails, Not Earnings (Yet)

Rivian NASDAQ:RIVN still feels like the Patagonia of EV makers — rugged, outdoorsy, aspirational. Its R1T pickup truck has cult status, but the company had to tone down its ambitions and revised its guidance for 2025 deliveries to between 40,000 and 46,000. Early 2025 projections floated around 50,000 .

The good news? Rivian is improving on cost control, production pace, and market fit. The bad news? It’s still burning cash faster than it builds trucks. But for investors betting on a post-rate-cut growth stock rally, Rivian may be the comeback kid to watch. It just needs a few solid quarters.

🛋️ Lucid: Luxury Dreams, Reality Checks

Lucid NASDAQ:LCID , the one that’ll either go under or make it big. The luxury carmaker, worth about $8 billion, came into the EV game promising to out-Tesla Tesla — with longer range, more appeal, and a price tag to match.

But here’s the rub: rich people aren’t lining up for boutique sedans, especially when Mercedes and BMW now offer their own electric gliders with badge power and a dealer network.

Lucid’s challenge in 2025 is existential. The cars are sleek, the tech is strong, but the cash runway is shrinking and demand isn’t scaling like the pitch deck promised.

Unless it nails a strategic partnership (Saudi backing only goes so far), Lucid could end up as a cautionary tale — a beautifully engineered one, but a cautionary tale nonetheless. Thankfully, Uber NYSE:UBER showed up to the rescue ?

💪 NIO : Battling to Stay in the Race

Remember when NIO NYSE:NIO was dubbed the “Tesla of China”? Fast forward, and it’s still swinging — but now the narrative is more about survival than supremacy. NIO's battery-swap stations remain a unique selling point, but delivery volumes and profitability are still trailing.

The company’s leaning into smart-tech partnerships and next-gen vehicle platforms. The stock, meanwhile, needs more than just optimism to get moving again — it’s virtually flat on the year.

✈️ XPeng: Flying Cars, Literally

XPeng’s NYSE:XPEV claim to fame used to be its semi-autonomous driving suite. Now? It's working on literal flying vehicles with its Land Aircraft Carrier. Innovation isn’t the problem — it's execution and scale.

XPeng is beloved by futurists and punished by spreadsheets. It’s still getting government love, but without a clear margin path, the stock might stay grounded.

🏁 Li Auto: The Surprise Front-Runner

Li Auto NASDAQ:LI doesn’t get the headlines, but it’s quietly killing it with its range-extended EVs — hybrids that let you plug in or gas up. A smart move in a country still building out its charging infrastructure.

Li is delivering big numbers, posting improving margins, and seems laser-focused on practicality over hype. Of all the Chinese EV stocks, this one might be the most mature.

🧠 Nvidia: The Brains of the Operation

Okay, not an EV stock per se, but Nvidia NASDAQ:NVDA deserves a spot on any EV watchlist. Its AI chips are running the show inside Tesla’s Full Self-Driving computers, powering sensor fusion in dozens of autonomous pilot programs, and quietly taking over the brains of modern mobility.

As self-driving becomes less sci-fi and more of a supply-chain item, Nvidia's value-add grows with every mile driven by data-hungry EVs.

🔋 ChargePoint & EVgo: Picks and Shovels

If you can’t sell the cars, sell the cables.

EV charging companies were once seen as the “safe bet” on electrification. Now they’re just seen as massively underperforming.

ChargePoint BOATS:CHPT : Still the leader in US charging stations but struggling with profitability and adoption pacing. Stock’s down bad from its peak in 2021 (like, 98% bad).

EVgo NASDAQ:EVGO : Focused on fast-charging and partnerships (hello, GM), but scale and margin pressures remain.

Both stocks are beaten down hard. But with billions in infrastructure funding still flowing, who knows, maybe there’s potential for a second act.

👉 Off to you : are you plugged into any of these EV plays? Share your EV investment picks in the comments!

Evstocks

Tesla Inc. (TSLA) Technical Analysis and ForecastTSLA has demonstrated strong upward momentum since the market opened today, reaching a resistance level around the $362 zone.

From a technical perspective, there is potential for a short-term pullback to the $354 area, which aligns with the top of the support zone, also known as the "right shoulder" of the prevailing pattern.

Should this support level hold, we may anticipate a continued upward move, targeting higher price levels.

Key Levels to Watch:

Support Levels:

Primary Support: $354 zone

Secondary Support: $321 zone (as a deeper stop loss level)

Resistance/Take Profit Levels:

Target 1 (Take Profit): $440

Target 2 (Take Profit): $480 (previous all-time high)

Traders should approach this setup with caution, as always, adhering to sound risk management principles.

Market conditions can shift rapidly, and price action around these levels should be monitored closely.

If you find this analysis helpful, please consider supporting the channel by liking, commenting, and sharing this post.

Stay disciplined and trade with care.

Tesla (TSLA) Weekly Chart Analysis – Key Levels & Market OutlookTesla (TSLA) Weekly Chart Analysis – Key Levels & Market Outlook 🚀

1️⃣ Overall Trend:

✅ Long-Term Uptrend (2019-2021): Tesla experienced a massive rally, reaching all-time highs.

🔻 Correction Phase (2022): A significant pullback led to a strong downtrend.

📈 Recovery Mode (2023-Present): The stock started forming higher highs and higher lows, indicating a bullish structure.

📉 Recent Pullback: The price is now retracing from recent highs, showing potential short-term downside momentum.

2️⃣ Key Support & Resistance Levels:

📌 Support Zones:

$300: A critical level—if it breaks, Tesla could drop further.

$260 - $280: The next demand zone if selling pressure continues.

$240 - $250: Strong historical support, previous swing low.

$180 - $200: A major long-term base where Tesla found strong demand before a rally.

📌 Resistance Zones:

$380 - $400: A strong rejection zone—Tesla recently pulled back from here.

Above $400: A breakout could send TSLA toward $500+ (previous cycle highs).

3️⃣ Candlestick & Price Action Observations:

📉 Bearish Momentum:

The latest weekly candle is red, indicating strong selling pressure.

If Tesla fails to hold $300, expect a move toward $260-$280.

📊 Potential Bounce Area:

If buyers step in, Tesla might consolidate before another leg higher.

4️⃣ Market Context & Indicators:

🚗 EV Sector & Nasdaq Trends: Tesla follows macroeconomic conditions and overall tech sector movements.

📆 Earnings & News Catalysts: Watch for updates on deliveries, margins, and macro sentiment.

📊 Technical Indicators:

✅ Moving Averages:

50-Week MA: A close below this could signal weakening momentum.

200-Week MA: A crucial long-term dynamic support.

✅ RSI (Relative Strength Index):

Not oversold yet—watch for levels near 30 for potential reversals.

✅ MACD (Moving Average Convergence Divergence):

Bearish crossover forming? A confirmation could indicate further downside momentum.

✅ Fibonacci Retracement:

Retracement levels align with $260 - $280 as a possible bounce zone.

5️⃣ What’s Next?

📌 Bullish Scenario: If Tesla holds $300, expect a potential rebound toward $350-$380.

📌 Bearish Scenario: A break below $300 could lead to a test of $260-$280, with downside risk toward $240 - $250 in extreme cases.

🚀 Key Question: Will Tesla hold support and bounce back, or will sellers push it lower?

💬 Drop your thoughts below! 🔥📉📈

The Ultimate Golden Zone to Close Shorts and flip Long TESLA Must Watch Analysis on TSLA revealing the ultimate golden zone to fill your Longs and close your shorts.

In this video I pinpoint a high probability zone of where to take the next long .

I have used a suite of Fibonacci tools to include TR Pocket , Trend based fib, pitch fan , 0.618, VWAP and volume profile to determine the best Long.

LITM a lithium penny stock gets momentum LONGLITM is a lithium mining company with operations is Western USA and Canada now getting a

lift as lithium prices are rising. It popped 16% today and hit a screener on volume yesterday.

This is a junior miner compared with LAC and SGML. As such it is more reactive to price. All

indicators confirm the move including the extent of the trend, relative volume spiking and the

RS lines. This is a low float low volume stock.

Accumulation of a low float could precipitate more price action upward quite easily.

As a volatile penny stock LITM is risky. Right now, I see a long trade in a

small position ( < 0.001 of account balance) for the potential gain despite the obvious risk

SL at 10% Targets at 10% 20% (red line pivots to the left-1.2o December to Feb) then 70% (

pivot low March 23) and finally 250% for the runners ( January and July 23 high pivots). Time

will tell. I expect great profit in this swing trade with stratified partial profits and less time

effort in the trend using alerts and notifications. A trailing loss will be employed at 10%

once the trade is over 20% profit.

TESLA starting an aggressive bullish reversal to $380.Since July and the bullish break-out above the ATH Lower Highs trend-line, Tesla (TSLA) confirmed the transition to a new long-term bullish pattern. For the time being, that is a Channel Up.

The recent pull-back is part of the wider market correction of the past 3 weeks but last week's green 1W candle, is evidence that the price has found a bottom. In fact this is a Higher Low on the new Bullish Leg similar to the previous one on the week of April 24 2023.

That was the first Bullish Leg since the 2022 Inflation Crisis bottom and the symmetry is evident even on the 1W MACD, which is showing a squeeze, similar to April - May 2023. As long as this doesn't cross, we expect the market to stabilize in August and start rallying aggressively as early as September.

An earlier break above the 1W MA200 (orange trend-line) again, would confirm that, as it is acting as a long-term Pivot. Since the previous Bullish Leg peaked at +194.87%, we see no reason to expect otherwise, thus keeping our long-term Target on Tesla at $380.00, which would not only be a +194.87% rise but also reach just below the April 05 2022 High.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

TSLA basing on its volume profile for a trade LONGTSLA on the highly reliable weekly chart is at the bottom of its volume profile in the lower

part of the high volume area. The TTM Squeeze Indicator ( TTM = Trade the Market John Carter)

has printed a signal for four weeks. The RSI faster and slower lines are near to the 50 level.

The mean relative volatility has steadily decreased and this is in an increasing squeeze state.

This is a setup for a patient trader to take a position in a swing trade. I am looking for a trade

into the upper part of the high volume area and so to the 240-280 range. I will get some shares

as well as a few call options for November (ITM). TSLA will be subjected to a number of

variables making the trade a bit risky including the Musk compensation battle, the China

economy, competition with Chinese EVs in Europe, federal rate actions and the presidential

elections as well as the evolution of self-driving. It is TSLA's volatility that makes it a great

trade. My entry signal here is a TTM indicator going black to white.

WKHS will it rally 50% or fall below its ATL WKHS has been sideways or down since the bullrun in late February. Another EV small cap

is nearing bankruptcy unless it finds a suitor ( FSR trying to attract Nissan) WKHS has a niche

with its delivery trucks ( like for Amazon Prime and USPS). Is the concept to production

hangups and slow downs going to cause its demise? Trader confidence is lacking or are

traders simply waiting for the best possible price? Price is now about to match the all-imte lows

of mid February. Will there be support or will it fall.? Dould WKHS dead cat bounce to rise

to recent high pivots? This may be interesting and potentially profitable.

Rivian Makes the Right Moves & the Stock Rebounds to Key TechRivian had a tough couple of years, as unprofitable startups are more vulnerable to the adverse external environment from high interest rates and lingering inflation. This has softened EV demand and deliveries have been disappointing in recent quarters. Highlighting the challenges, executives believe 2024 production will not surpass that the last year. But the large output-delivery gap of Q2 shows that Rivian is offloading its inventory.

Rivian is making the right moves to turn things around and it will be launching two smaller EVs, starting in 2026. These are crucial for its future, as they will help it increase its customer base, stop the cash burn and eventually make money. The recently announced cash injection from auto giant Volkswagen can help it whether the storm and accelerate its progress.

These developments have helped the stock to relief rally from the April record lows, bringing it to a critical technical juncture. RIVN tries to take out the 38.2% Fibonacci of the slump for the end of 2023 and the EM200 (black line). Surpassing them would shift momentum to the upside and facilitate further gains.

Despite the turnaround plan and promising developments recently, the off-road EV maker is not out of the woods yet. On the technical front, a rejection of the aforementioned critical resistance cluster would reaffirm the bearish bias and enhance risk of lower lows.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (trading as “FXCM” or “FXCM EU”), previously FXCM EU Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763). Please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this video are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed via FXCM`s website:

Stratos Markets Limited clients please see: www.fxcm.com

Stratos Europe Ltd clients please see: www.fxcm.com

Stratos Trading Pty. Limited clients please see: www.fxcm.com

Stratos Global LLC clients please see: www.fxcm.com

Past Performance is not an indicator of future results.

75: Identifying Support around €13.36 Amidst Selling PressureCurrently, we are witnessing selling pressure on the Fastned stock without significant buying interest. However, by examining historical data, we can identify a point of interest around the €13.36 level. This area has previously acted as a support zone, making it a potential accumulation point.

Recent developments support this analysis. Fastned recently raised €32.9 million through the issuance of new bonds, with €12.3 million coming from existing investors extending their bond maturities. This successful fundraising indicates a growing interest and confidence from private investors in Fastned’s long-term potential.

Given this backdrop, we anticipate that the €13.36 level could attract accumulation as investors recognize the company's ongoing investments in the fast-charging infrastructure for electric vehicles. As more motorists transition to electric vehicles, the demand for Fastned's services is expected to increase, potentially driving the stock's recovery.

Monitor the €13.36 level closely for signs of accumulation and potential buying opportunities, considering the growing interest and financial backing Fastned is receiving.

MBLY manufactures autonomous driving components LONGMobileye Global Inc. (MBLY) operates in the Automotive - Original Equipment sector1. The company specializes in developing and deploying advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide They offer a range of products, including safety features for real-time detection of road users, cloud-enhanced driver assist solutions, and self-driving systems for various road types

MBLY on a 180 minute chart shows up and down trending in the past 3-4 months. A support level

is identified in the $24-25 range. Price is currently rising above support with an increase in

relative volume similar to that of late February and Early March.

The Awesome oscillator is green and positive at this time.

The volume profile shows a low volume overhead demonstrating little volume resistance to an

overhead move higher.

I will take a long trade here seeking those targets in the upcoming 1-2 months.

I have identified targets of 41 and 45 based on pivots in 2023.

I will take a long trade here

NIO ? Are traders ready to love it again LONGNIO on the daily is 95% below its ATH Winter of 2021 and 50% lower YTD. In China NIO is

competing well with XPEV, LI , BYD and TSLA while it makes further penetrative into the

EU market. Its unique concept in action is battery leasing and battery swapping making

charging time no longer relevant. Apparently, the battery swapping time from a depleted

battery to one carrying a charge is 15-20 minutes. Being a bottom-seeking bargain hunter quite

often, I will take a long trade here with a planned duration of two earnings periods.

Is FFIE running to earnings early ? Maybe yes. LONGFFIE is a penny stock of interest as it is also in the EV sector. Earnings are coming. In the past

two days it jumped 82%. The stock is trading 99.9% ( no exaggeration ) down from its all-time

high. On the 15-minute chart, price has jumped above its EMA cloud which inflected upward.

A massive volume inflow peaked the price action in keeping with Wychoff's theory. 42 million

shares traded yesterday morning. The EMA cloud settings are periods are 14/56/140 ( long story

multiples of 7). The slow and fast RSI lines had a golden cross of fast over slow and

both over the 50 are quite demonstrative of bullish momentum. ( settings 3 hrs and 1

week). I will play this long until earnings- adding 100 to 1000 shares per day at the low

of the day on a 5-15 minute chart. I will also look at the options chain for March 15th.

Given that WKHS did the same thing and reports the same time, something behind the

stage curtains is underway. Penny stocks are always risky. My analysis has the risk diminished

here.

LCID has another falling wedge breakout LONGLCID is making its move while Fisker got halted and will be delisted. LCID has a rich uncle, a

Saudi billionaire running the national wealth fund there. Fisker lost its suitor in Nissan and tried

to raise cash by selling cars under cost. I would be afraid to buy a car from a company about

to head into bankruptcy. Anyway, time to buy LCID for now, it has a vaccine against the

contagion. I happen to be very fond of falling wedges especially when they repeat. My skills

in Elliott Wave analysis are nil but this is one to analysis. In the meanwhile, it's a buy ( no

I am not a fan of Jim Cramer.)

LCID's vwap bounced after pullback LONGLCID trended up 40% from late June and then over 2-3 days completed a standard

Fib 0.5 retracement before bouncing off a longterm anchored mean VWAP and

reversing. The reversal is supported by the two time frame RSI indicator showing

the lower TF RSI crossing above the higher TF RSI and both of them approaching

the 50 level. The zero lag MACD shows the lines crossed under the histogram and

are now approaching the horizontal zero line. The relative rigor indicator shows

a line cross while the values were negative and now approach to the horizontal

zero line in parallel. Overall I conclude that LCID is set up for a long entry.

WKHS a risky penny EV StockWorkhorse could start working again as the 50 minute chart is showing a suggestion of a reversal

after a long trend down. Price has passed over the longest moving average which is a SMA20.

The EMA cloud ( 100, 200, 300) is starting to turn up and price has crossed over it. All in all,

there are some golden crosses here. Blue buying volume spikes are seen on the relative

volume indicator and they are about six times the running mean. In a bit of divergence the

price volume trend has oscillated up. Overall, this is a penny stock with a price under $ 1.00

It appears to be starting a trend up. I will zoom into a lower time frame and find a optimal

entry. I amy get call options as well. The risk in the trade should be limited by a stop loss

wide enough to allow for a true range or even twice that. My target is about 1.15 the price level

at the time of the last good earnings report. This is about 300% upside. It will probably never

get there but hay you never know. Stranger things have happened.

TSLA continues its downtrend toward Apirl earnings SHORTOn a TSLA chart, TSLA has been trending cown since last May. On the anchored VWAP lines,

it topped out crossing above the second upper VWAP about the first week of January '23 then

crossing under the same line on January 20, 23 Between August and October price tested and

consolidated about the first upper VWAP line. It then fell to the mean VWAP line and returned

in a retracement to the first upper VWAP line by December. paradoxically, price rose

after an earnings miss in October. From December through early February price fell through the

mean VWAP and received support with the first lower VWAP band. The faster EMA in black

crossed under the slower green EMA in early January. TSLA is last significant uptrend or

correction was a month before that. At present a continued trend direction of down

is predicted by the optimized EMA20/65 lines now diverging from a compression with the EMA

20 in black under the green EMA 65 line. A predictive modeling indicator by Lux-Algo

forecasts the persistent downtrend. TLSA could pick up support at the level of the pivot during

the April '23 earnings report or lower still at the second lower VWAP line at about 141.

Fundamentals can trump technicals but things out there are not looking great for TSLA

RIVN reverses to upside LONGIn my previous idea, RIVN was short from the highs. That position was closed today as RIVN

fell below the target. I now based on this idea have a long position. RIVN's move the second

half of today's session was supported by a strong bullish move in the general market from the

federal financial data principally the jobs report.

On the 15-minute chart, RIVN formed a head and shoulders from January 29-31. The previous

trade was from the top of the right shoulder until this morning when RIVN was progressing

through a double bottom which intraday formed a " W" or " reverse cowgirl " pattern.

The bearish ( selling only ) volume profile shows high-volume nodes at 15.8 and 16.0 so

these are my targets. Price is above the POC line of the volume profile which is a bullish bias.

Price is currently near to the level of a standard Fibonacci retracement of the previous

downtrend I will take a long trade with targets as mentioned. The ideal entry is at 15.62

above a bearish high-volume node.

Additionally, I will take a call option striking 16 for February 9th.

As an aside, FSR is presenting a similar chart pattern and set up at a much lower price point .

However, as a penny stock FSR has higher volatilities and may represent a lower probability

overall. A trader may want to take a small position in each and see how they do.

RIVN rises with LCID while FSR fails LONGRIVN popped today while FSR got halted and will be delisted. The 4H chart with BB and a

predictive algo added suggest it has room to 13.25. The indicators are supportive of that

forecast. I will take a long position here with a stop loss under the lower BB line. As to

my FSR put options I will watch them rise until expiration time. No hurry. No worry there.

RIVN's new models and FSR's demise should help for some bullish momentum until RIVN

catches a bit of FSR''s issues.

NKLA can move higher from a support level LONGNKLA had news this week with the litigation over the Badger brand. The news is over and the

real trend is hydrogen stations in California and perhaps Western Canada impacting the

buildout of infrastructure with the help of Biden administration handouts. NKLA has corrected

and fallen into the support of the Fib retracement. Zig and zag I look to enter a long trade

here and target the recent pivot high with an initial target of half way there as a retrace of

a retrace. This would be about 1.02 but I will round it down to 0.99 to be below the

psychological level. This is a risky penny stock trade. With FSR falling off the exchange,

NKLA is getting some extra trader interest which may help carry it higher. This is a 30 minute

chart and meant to be appropriate for intraday or short duration swing traders.

NKLA can this EV penny stock stop the cash burn/ News LONGNKLA on the 120 minute chart has been in a falling wedge pattern and had the news of

hydrogen stations ready to go in the all important California market and now printed a

countertrend breakout over the wedge. Can Nikola stop the cash burn? Can it prevent further

shareholder dilution? Is the board protecting the interests of shareholders ? While this gets

figured out can price rise to the anchored mean VWAP and put in a 10% jump in the short term?

I intend to find out.

GM may be pivoting down SHORTGM on the weekly chart has ascended to the top of the high volume area of the long term

volume profile. The predictive algorithm forecasts a bounce down from that level. The

MACD indicator shows lines crossing over the histogram while the RSI lines are in the 60s

about the same level as the market pivot in 2022. The Supply / Demand indicator has the lines

with zero slopes ( flat) and ready for a reversal. Fundamentally, GM is challenged by the

dynamic between EVs and hybrids moving foward and federal mandates on fleet production

efficiency quota. I will take a short trade here along with Ford.