EWT Will Melt Faces: Why This Time Is DifferentThe crypto market is maturing. The era of pure speculation is giving way to real-world value. In this new paradigm, where major institutions are now involved, UTILITY will be king. One project is perfectly positioned to dominate this new age: Energy Web Token (EWT). As the world scrambles for sustainable energy solutions and the energy transition accelerates, Energy Web is building the digital backbone to make it all happen.

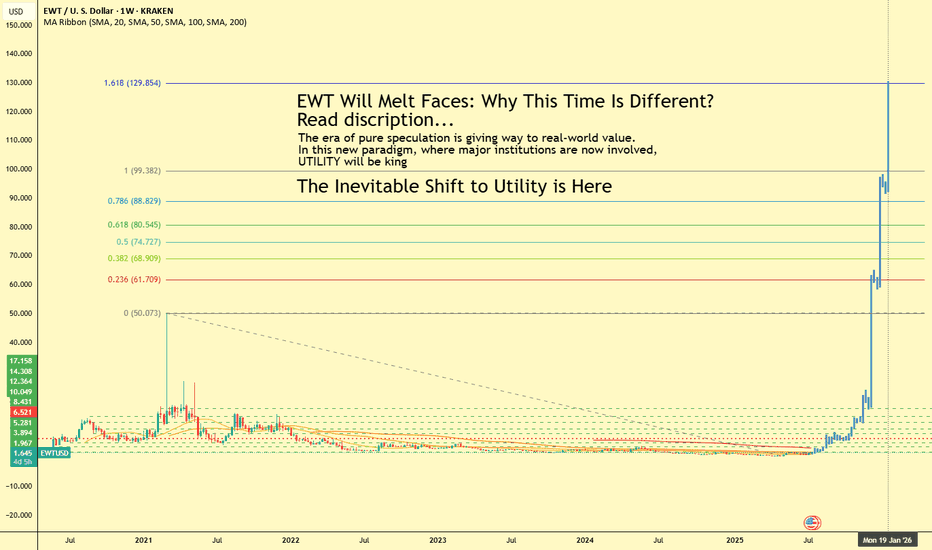

The attached chart isn't wishful thinking; it's a visualization of an inevitable shift. The accumulation phase is over. The explosive, utility-driven growth is about to begin.

The Indispensable Role in the Energy Transition

The urgency of the energy transition is undeniable. We face rising energy needs and the critical imperative to reduce our environmental footprint. Energy Web is at the forefront, offering an open-source, decentralized technology stack to fast-track the move to a low-carbon, customer-centric energy system.

Their mission is to decarbonize the global electricity system using blockchain. They achieve this by enabling distributed energy resources—from rooftop solar panels to electric vehicles and large-scale batteries—to be managed on the grid in a decentralized way. This creates a more flexible, participatory energy market where every user can be both a producer and a consumer.

An Ecosystem of Heavyweights

What truly sets Energy Web apart is its staggering ecosystem of over 100 partners, including titans of industry like Shell, Vodafone, Volkswagen, and Siemens. These aren't just names on a website; they are active collaborators, including major grid operators like Elia in Belgium and Stedin in the Netherlands, all working to implement and accelerate the commercial adoption of Energy Web's technology. These global partnerships underscore the immense trust and conviction that the biggest players in the energy market have in Energy Web's solutions.

Live Products with Real-World Impact

Energy Web isn't selling a dream; it's delivering live products that form the core of its ecosystem:

Energy Web Chain (EWC): An enterprise-grade public blockchain tailored for the energy sector. Since its launch in 2019, it has processed millions of transactions for groundbreaking applications.

Energy Web Decentralized Operating System (EW-DOS): A full stack of open-source software and standards designed to connect and manage the billions of low-carbon assets that will make up the grid of the future.

Green Proofs and Data Exchange: Solutions that bring deep transparency and verifiability to emerging green product supply chains, such as Sustainable Aviation Fuel (SAF). Companies like United Airlines and Amazon are already using this technology.

Energy Web X (EWX): Leveraging Polkadot's powerful and flexible infrastructure, EWX is the next generation of Energy Web's technology. This migration enables customized, enterprise-grade solutions with enhanced security and interoperability, allowing partners to accelerate their decarbonization strategies.

The Numbers: Market Cap and Price Roadmap

As of July 16, 2025, Energy Web Token (EWT) has a market capitalization of approximately $49.7 million USD, with a price of around $1.65 USD. The circulating supply is about 30 million EWT out of a maximum of 100 million.

While no price forecast is a guarantee, the outlook is incredibly bullish. Some analyses suggest potential prices of 40.63 or even more.

These predictions are rooted in the fundamental growth of the network. The 2025 roadmap is packed with milestones, including the rollout of fiat payment integration, the launch of SmartFlow 2.0 and 3.0, the implementation of EVM support on EWX, and the execution of numerous customer and EU-level projects.

The Inevitable Shift to Utility is Here

The chart attached to this idea shows a classic pattern: a long consolidation period followed by a parabolic rise. This is not a coincidence. The market is maturing. The days of projects with no substance are numbered. Large institutional players, now entering the space, are seeking sustainable, fundamentally sound investments.

EWT is precisely that. It solves a real-world, global problem. It has a working product, an unparalleled network of partners, and a clear vision for the future. The shift to utility is the next great wave in the crypto market, and Energy Web Token is poised to ride it to unprecedented heights.

The great separation is coming. Projects built on hype will fade. Projects that create tangible value, like Energy Web, will not only survive—they will dominate. Get ready, because EWT is poised to melt faces. This time, it's different.

EWTUSDT

Energy Web Token—EWT—Triple Recovery: 1000% PP (TAC-S7)All right, here we are.

I appreciate the insistence and support, I like people who never give up. It is a stressful work but I will always comeback and give you what you want. I hope you enjoy the analysis.

Energy Web Token produced a bearish impulse starting May 2024, it ended in April 2025, almost an entire year. This is the last ABC on the chart. The market was sideways and then we have this correction.

Now that the correction is over, we can expect a change of trend.

Current action for EWTUSDT is happening above the August 2024 low. Also above the November 2024 low.

The correction was strong but even stronger where the last two weeks. EWT recovered almost six months of bearish action in just two weeks. This strong bullish momentum gives us a clue of huge rising potential in 2025.

The week before last, 5-May, EWT started trading around $0.687. It went full blown bullish and broke its November 2024 low resistance. The week that followed, 12-May (last week), started red and this resistance was tested as support and holds. Then again, strong bullish momentum and EWTUSDT moved above its August 2024 low. This is a major, major bullish development.

The current weekly session/candle, while pretty young is also good. It started red and wicked lower. The wick did not reach the August 2024 low support but reversed sooner. This is another strongly bullish development and can signal that there will be additional growth this week, next week, and so on.

Trading volume becomes really high in October and November last year and this is also really good because the action is happening above those prices. So the market went through a final full flush, removing all the stop-loss orders and weak hands and is now ready for long-term growth.

The signals here are very, very strong. We don't need to consider the bottom dynamics, the rounded bottom and such because prices are the same now as back in September 2024, which is exceedingly good.

The market dropping for years on end, it seemed like forever, means that there is no need for this Altcoin to move back down again. Don't get me wrong, there can be corrections and retraces based on the short-term, but, when it comes to the bigger picture, we are going up.

I plotted several targets for you on the chart. The main one goes to 1,000%. If you were to calculate this same target coming from the market low, total growth potential amounts to ~2,900%, really strong.

This is it for now. Thanks again for your continued support.

Namaste.

EWT/USDT Major trend. Channel -93% US Energy Sector 11 2023Logarithm. Time frame 1 week.

Cryptocurrency in coinmarketcap: Energy Web Token.

Of the liquid exchanges, it is traded on KuCoin, Kraken (USA), Gate.io.

Downward channel. At the zone of its meridian a descending wedge has formed in the secondary trend. The percentages to the key zones of support/resistance levels are shown on the chart. It is more rational to work from the average buy/sell price, as we are already in the first capitulation zone.

Decline from the low (liquidity) -93%.

We are in the first so-called capitulation zone.

This is not the maximum value for altcoins of such liquidity.

The range of the maximum capitulation zone is shown on the price chart, which is the range of the downward volatility channel and understanding of market cycles and chart logic, i.e. price movement.

Also shown on the chart are conventionally maximum averaged (from the average price) potential market phase targets (not "one-step" pump/dump due to low liquidity at good times, but specifically trends):

1) "participation" (bullish trend development towards the reset zone, i.e. distribution).

2) distribution. .

Capitalization is low. There is no HYIP (the project and the meaning is different), it is not a one-step profit from nothing. Suitable for investment if you understand "who and for what", will or will not be able to realize the intended (not speculation, because it is easier to simply under the "hamster time" given the liquidity) is another matter.

Fundamental basis . That is, what it is and what it is for.

This is a so-called real project. It is not created for cryptocurrency hype and speculation (money from nothing). Until everything is ready, then the price does not matter. In the project previously invested a large capital not speculative, but more far-sighted direction, which is interested exactly in the development of the project's intent in the field of energy and control in the United States in the first place, and not in speculation.

The Energy Web Token (EWT) is the operating token underlying the Energy Web Chain, a blockchain-based virtual machine designed to support and further develop applications for the energy sector. In times of blackout, it will be relevant.

The Energy Web Token is a joint project between Rocky Mountain Institute (RMI) and Grid Singularity (GSy).

Rocky Mountain Institute (RMI) is a leader in research and development in the energy sector. As a renowned think tank, RMI has been involved in many groundbreaking projects in the energy sector. By creating the Energy Web Chain, RMI wanted to harness the decentralized power of blockchain technology to enable participants in the energy sector to develop new decentralized solutions.

Grid Singularity ( GSy ) brought blockchain expertise to the project. As a blockchain developer, GSy was the driving force behind the creation of the Energy Web Chain. Together with renowned experts, key Ethereum blockchain developers, experienced energy executives and energy regulators, GSy was an integral part of the EWT launch.

Given that the Energy Web Chain network is designed for enterprise use , it supports state-of-the-art scalability and data privacy. The Foundation also recently released a comprehensive technology solution called the Energy Web Decentralized Operating System (EW-DOS). This allows users to monitor and manage their electrical systems online.

Line chart to visualize this downward channel and the logic of the wedges in it.

Secondary trend. Downward wedge zone. Time frame 3 days.

EWT/USDT Secondary trend. Downward wedge zone. 4 11 2023Logarithm. Downward wedge zone. Time frame 3 days.

A descending wedge is forming in the descending channel (the main trend). Almost in the final phase of its formation.

Decrease from the price minimum in the main trend -93%.

We are in the first zone of so-called capitulation.

This is not the maximum value for altcoins of such liquidity.

The range of the maximum capitulation zone is shown on the price chart, which is the range of the downward channel (main trend) of volatility.

Cryptocurrency in coinmarketcap: Energy Web Token.

From liquid exchanges traded on KuCoin, Kraken (USA), Gate.io.

Repeatability of fractal wedge logic (secondary trend) in the downward channel (primary trend).

Local resistance zones in the realization of the figure's goals after breaking through the resistance of the wedge (breaking the downward trend of price movement). Fractal projection on identical zones now.

Main trend (to understand the given zone of the wedge in it).

EWT/USDT Major trend. Channel -93% US Energy Sector 11 2023

EWT - Wyckoff Accumulation + Volume #EWT

This beautiful falling wedge or #bullflag has all the mechanics of a #Wyckoff Accumulation Schematic built into it, which can be seen by #volume tells in all the right places.

After The low was breached note the negligible #volume, then observe the volume on the first solid bullish candle to break through the #wedge. What we want to see after is the follow-through retrace candles reaction, and not just the #volume, but the fact it snatched the stops on the candle a month before it.

Pair that all with my favorite leading indicator, #OBV, which has already breached the last swing.

I like this PA...

This is the literal BOTTOM for Energy Web Token (EWT)EWT has broken out of a 2.5 year downtrend which markt the literal bottom if I know anything about TA.

Focus on Renewable Energy

EWT aims to accelerate the adoption of renewable energy sources by creating a decentralized platform where energy assets can be easily and transparently operated. Given the increasing importance of green energy, this sector-specific focus could give EWT a unique edge.

Strong Partnerships

Energy Web Token has built partnerships with prominent players in the energy sector. This not only provides it with credibility but also helps in real-world adoption, which is a key metric for any cryptocurrency.

Not financial advice.

Energy Web token📈 Bullish scenario for EWT - corporations and green energy

Energy Web Token - helps web2/traditional companies use blockchain technology to access and manage green energy assets, built on EVM (Ethereum Virtual Machine)

The project has partnerships or working together with Vodafone, PayPal, Shell and many others. The project also was mentioned in a press-release of BlackRock.

BlackRock, in its press-release, has highlighted the importance of Energy Web's role in the fight for green energy. Many corporations are "sick" of green energy and this is another advantage for Energy Web.

The prospects for green use of blockchain are significant: Ripple has invested 100 million in carbon markets. And the White House is developing policies to reduce Bitcoin's energy consumption and carbon footprint.

In terms of tokenomics: EWT is capitalized at $120 million with limited emission, the token is used to pay fees in blockchain + for staking. The value is clear.

As a conclusion, Energy Web is a bet on the adoption of cryptocurrency by institutions, corporations and states. Top funds are paying attention to such projects for a reason, it means they have already done the analysis.

From the technical point of view EWT has strength in the moment, we rose and stand without aggressive sells, for me the buying zone of $2.5-3.5 is interesting. Partial sales recomended at $7, $15, $20-22

Presenting alpha... EWTBItcoin recently see a break of trend to move towards the upside? It needs to break 63K with conviction before the we're out of the woods otherwise price will continue to random walk but we're long term bullish on crypto. EWT is a project that have links with major institutions in the energy space and their Github repository suggests that a potential integration with Coinbase is up coming.

BULL CASE

If price breaks out of the channel and holds it as support, we will ride it all the way to $40.

BEAR CASE

If BTC dumps, we will see holds dump even harder along with it, if this happens, we will accumulate heavily as price move towards the bottom of the channel