OPENING: EWZ JUNE 19TH 37/50 SHORT STRANGLE... for a 1.26 credit.

Metrics:

Max Profit: $126

Max Loss/Buying Power Effect: Undefined/$440

Credit Received/Buying Power Effect Ratio: 28.6%

Delta/Theta: -1.53/1.32

Notes: Selling a directionally neutral short strangle in the first expiry in which the at-the-money short straddle pays greater than 10% of the stock price with the intention to delta under hedge to maintain net delta < theta if possible.

EWZ

THE WEEK AHEAD: ROKU EARNINGS; USO, SMH, EWZ, GDXJEARNINGS:

ROKU (64/83) announces earnings on the 13th (Thursday) after market close and looks to be the best play out of earnings announcements occurring next week from a volatility contraction standpoint.

Pictured here is a fairly straightforward short strangle camped out around the 17 delta in the March cycle, paying 5.62 on buying power effect of around 12.50 (45% credit received/effect ratio) on margin. For those looking to define their risk, consider the 90/100/150/160 iron condor, paying 3.37 on buying power effect of 6.63 (50.8% credit received/effect ratio) or some iteration of that where you look to receive one-third the width of the widest wing in credit. There is some call side skew here which you may to consider accommodating via a ratio'd short strangle or a "double double."*

EXCHANGE-TRADED FUNDS WITH EXPIRY IN WHICH AT-THE-MONEY SHORT STRADDLE IS PAYING GREATER THAN 10% OF STOCK PRICE:

XLE (59/22), July

FXI (54/24), August

SMH (51/27), May

USO (48/39), April

XOP (45/36), June

EWW (43/19), September

EWZ (33/27), May

GDXJ (15/27), May

GDX (10/24), June

My general tendency here has been to go with the shortest duration that's paying first (assuming that I'm not already in a play), and then consider longer-dated thereafter. Here, the shortest duration that's paying is in USO (April), followed by SMH, EWZ, and GDXJ (May), and then XOP and GDX (June).

BROAD MARKET FUNDS WITH EXPIRY IN WHICH THE AT-THE-MONEY SHORT STRADDLE IS PAYING GREATER THAN 10% OF STOCK PRICE:

EFA (45/13), December

EEM (42/20), September

QQQ (37/19), September

IWM (34/18), September

SPY (30/15), November

I've been working SPY longer-dated for quite some time now just to have something on in a constant state of theta burn where shorter duration isn't paying. Just for comparison's sake, the EEM September 37/49 is paying 1.14 on a buying power effect of 4.35 (26.2%); the QQQ September 195/257, 5.77 on a buying power effect of 22.94 (25.2%); and the IWM September 142/183, 3.78 on a buying power effect of 16.50 (22.9%) versus the SPY November 280/367, 8.23 on a buying power effect of 33.24 (24.8%).

FUTURES (EXCLUDING CURRENCY/TREASURIES):

/CL (52/40)

/ES (51/16)

/NG (30/39)

/SI (30/18)

/ZC (29/18)

/GC (24/11)

/ZS (15/18)

/ZW (8/37)

VIX/VIX DERIVATIVES:

VIX finished the week at 15.47, with the February, March, and April /VX contracts going for 16.07, 16.27, and 16.70, respectively. The term structure has lost a good deal of the steepness we were enjoying just a few weeks ago when M1-2 contango was at a whopping 19.16% and M4-7 at 6.24% (it's currently 1.25 and 3.45%, respectively) and my tendency would be to probably wait until the February contract drops off to see if a term structure trade is in the offing. They're not exactly paying me huge to go, for example, with an April setup over a March one, with the differential being a scant .43.

* -- E.g., the 2x90/2x95/155/165 iron condor paying 2.91.

OPENING: EWZ JUNE 19TH 39/54 SHORT STRANGLE... for a 1.46 credit.

Notes: Going out to the first expiry in which the at-the-money short straddle pays greater than 10% of the stock price and selling the 16's with the intent to potentially do additive delta adjustments over time.

From a portfolio-wide perspective, I have a good sprinkling of longer-dated core exchange-traded fund positions to start out the year: some SPY, SMH, XBI, and XOP, around which I'll play single name from time to time, as well as my standard short volatility stuff in VIX, VXX, and UVXY.

THE WEEK AHEAD: USO, EWZ, XLF; VIX/VIX DERIVATIVESEARNINGS:

Earnings kick off in earnest this week with a bevy of financials (WFC, GS, JPM, C, BAC, MS).

Generally speaking, I haven't played these in the past due to low background implied, and nothing has changed in that regard this go-around from a premium selling standpoint: WFC (30/21), GS (27/24), JPM (20/21), C (16/23), BAC (0/22), MS (0/24).

That being said, it looks like the financial sector exchange-traded fund XLF (5/16) has put in a multi-year double-top, so I could see taking a bearish assumption directional shot on the notion that earnings in this sector may disappoint in a low interest rate environment. For example, the XLF February 21st 30/32 long put vertical costs 1.04/contract to put on, has a max loss metric of .96 and a break even of 30.96 versus a Friday close of 30.69, which are the kind of the risk one to make one/break even at/near where the underlying is currently trading metrics I like to see out of these.

EXCHANGE-TRADED FUNDS WITH THE FIRST EXPIRY IN WHICH THE AT-THE-MONEY SHORT STRADDLE PAYS >10% OF STOCK PRICE:

UNG (36/40), February

SLV (33/20), July

USO (32/32), April

EWZ (29/26), June

GLD (26/12), January '21

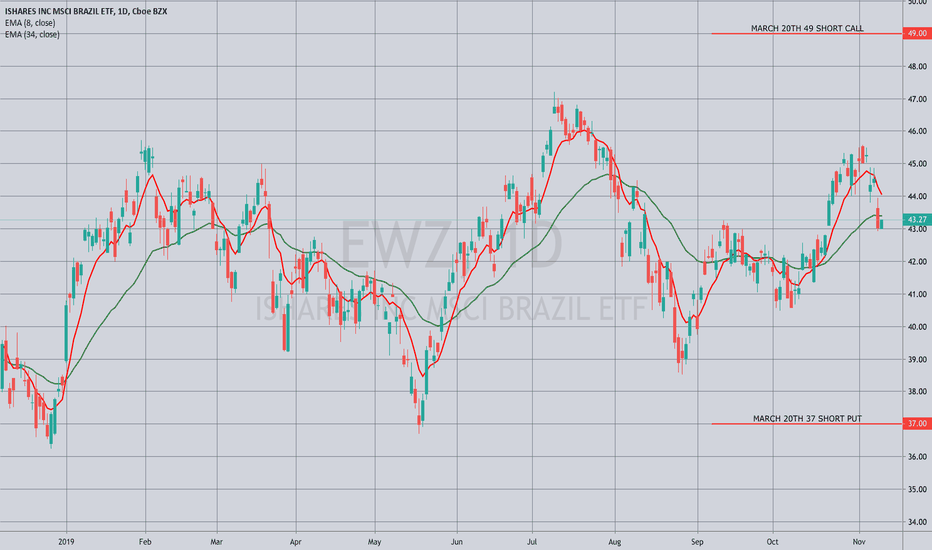

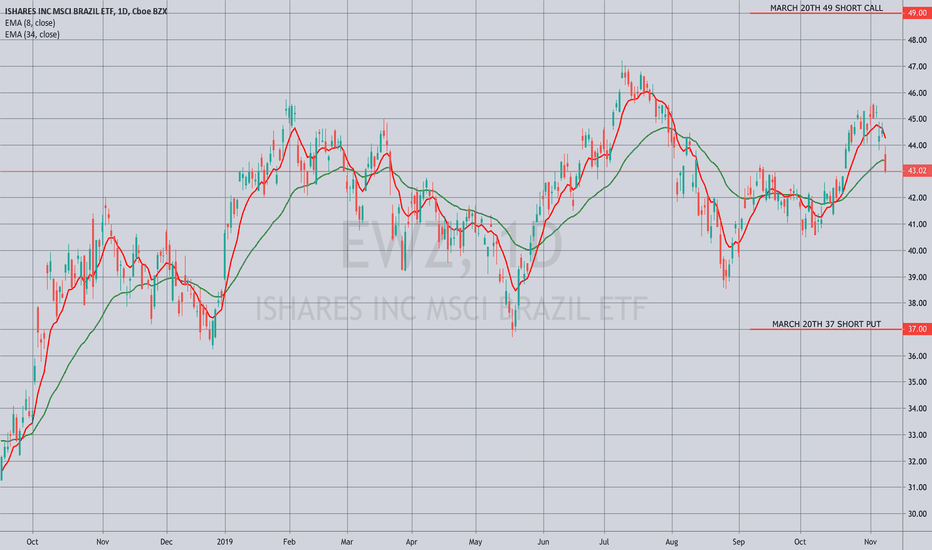

Pictured here is an EWZ 20-delta short strangle set up in the first expiry in which the at-the-money short straddle is paying greater than 10% of the stock price, 1.91 credit, delta/theta 0/1.41.

Although I would ordinarily go with the underlying paying in the shortest duration, we will start to run into seasonality issues with UNG in the February or March cycles (depending, of course, on Mother Nature), so would rather not hit that underlying non directionally here. And USO can be somewhat of a pain to trade due to its smallness.

BROAD MARKET WITH THE FIRST EXPIRY IN WHICH THE AT-THE-MONEY SHORT STRADDLE PAYS >10% OF STOCK PRICE:

EEM (66/16), September

EFA (20/11), December

SPY (14/12), November

QQQ (9/17), September

IWM (0/15), September

Well, we're in a volatility lull here, so this comes as no surprise that shorter duration isn't paying.

VIX/VIX DERIVATIVES:

VIX finished the week at 12.56, with the March, April, and May /VX contracts trading at 16.04, 16.56, and 16.80, respectively, so term structure trades remain viable in those months.

VXX and UVXY -- my go-to derivatives instruments -- both hit new 52 week lows last week, and VXX finished the week at 14.12, UVXY at 11.59. Although VIX has room to trundle lower from here, it probably wouldn't be a bad thing to pull off a few units in profit put on higher up the ladder and then wait for the next >25% pop in VIX (which would be a modest pop at 16 or so) to start legging back in.

EWZ, iShares Inc. MSCI Brazil ETF - Breakout on Bullish PatternAMEX:EWZ

Bullish set up and resistance breakout on the ETF representing the Brazilian market.

As always the ascending triangles are among our most common traded patterns because they have a profit realization degree of 50% with an average Profit/Loss Ratio of 3:1.

finance.yahoo.com

THE WEEK AHEAD: GDX, EWZ, EEMEARNINGS:

You can literally count the number of announcements next week on one had, and they aren't in options liquid underlyings.

EXCHANGE-TRADED FUNDS:

GLD (36/12)

SLV (30/19)

GDX (30/25)

TLT (29/11)

GDXJ (28/29)

EWZ (25/26)

First Expiry in Which At-The-Money Short Straddle Pays Greater than 10% of Share Price:

GLD: January '21

SLV: July

GDX: March

TLT: January '22

GDXJ: May

EWZ: June

Pictured here is an EWZ short strangle in the June expiry paying 1.43 (.71 at 50% max) with break evens wide of one standard deviation for that expiry and delta/theta of .05/1.16.

Of shorter duration, the GDX March 20th 26/33 short strangle is paying .78 (.39 at 50% max; not very compelling) with the shorts camped out around the 18's; the 29 short straddle, 3.00 (.75 at 25% max).

BROAD MARKET:

EEM (24/16)

IWM (11/16)

QQQ (10/16)

SPY (3/13)

First Expiry in Which At-The-Money Short Straddle Pays Greater than 10% of Share Price:

EEM: September

IWM: August

QQQ: September

SPY: September

The EEM September 18th 39/51 short strangle is paying 1.48 at the mid (.74 at 50% max). As before, I'm somewhat reluctant to go that far out in time to get paid, but have been putting on some longer-dated setups and managing them somewhat short of 50% max as I wait for shorter duration expiries to be more productive.

FUTURES:

/NG (43/48)

/GC (36/11)

/SI (30/25)

/6C (28/6)

/6B (25/8)

Natural gas remains frisky due to seasonality, but I was hoping for more of a seasonal bounce to pull on the short end of the stick; Mother Nature hasn't cooperated on that end of things, unfortunately.

EWZ Equilibrium Equilibrium underway on EWZ. POC currently set on support. Will be watching for a push past POC, 50 EMA and 200 SMA to the top of the EQ. If price can do so, i will reevaluate volume profile once closer to resistance and watch for the inevitable break to either side. If price cannot push past, we may break bearish and work to 36.66 support.

THE WEEK AHEAD: ANF, BBY EARNINGS; XOP, EWZ, GDX, SMHIt's a short market week here, but this is what we've got ... .

EARNINGS:

HPE (43/33): Announces Monday after market close.

ANF (85/80): Announces Tuesday before market open.

BBY (70/42): Announces Tuesday before market open.

HPQ (50/36): Announces Tuesday after market close

DE (34/29): Announces Wednesday before market open.

Of these, ANF and BBY appear most appealing from a volatility contract standpoint.

The setup pictured here is an ANF 16 short straddle in the December 20th month, paying 2.87 (.72 at 25% max) versus 15.93 spot (18.0%), with the defined risk 11/16/16/21 iron fly paying 2.60 with a buying power effect of 2.40 (.65 at 25% max).

The BBY December 20th 65/80 short strangle is paying 1.75 (.88 at 50% max), with the correspondent 60/65/80/85 iron condor in the same cycle paying 1.60 (.80 at 50% max).

EXCHANGE-TRADED FUNDS:

TLT (36/12)

SLV (29/20)

GLD (23/11)

USO (21/33)

XLE (19/20)

As with last week, short duration premium selling remains less than ideal here, so either hand sit, keeping powder dry, or look to deploy in longer duration setups. Here's what's on my list for longer duration setups in which at background implied volatility is higher:

XOP: January, where the at-the-money short straddle is paying 2.20 versus 21.05 spot (10.5%)

EWZ: March, where the at-the-money short straddle is paying 5.12 versus 43.16 spot (11.9%)

GDX: March, where the at-the-money short straddle is paying 3.14 versus 26.76 spot (11.7%)

SMH: May, where the at-the-money short straddle is paying 17.95 versus 130.92 spot (13.7%)

BROAD MARKET:

SPY 10/13

IWM (7/16)

QQQ (7/16)

As with the exchange-traded funds, you're looking at either hand sitting on shorter duration setups or going out farther in time to get paid, with the expiries in which the at-the-money short straddle is paying greater than 10% in September for SPY and June for both IWM and QQQ (ugh).

FUTURES:

/6B (67/12)

/NG (41/60)

/6C (30/5)

/SI (29/18)

/GC (23/11)

Cable I get, but what's with the Loonie?

VIX/VIX DERIVATIVES:

With the January, February, and March contracts trading at 16.68, 17.76, and 18.05 respectively as of Friday close, VIX term structure trades in those expiries remain viable. For all other short volatility trades, I'd wait for a VIX pop above 20 to consider starting to add short position, as well as consider taking off some risk if we see another drop back into the 2019 lows at 12. It finished Friday at 12.34 ... .

THE WEEK AHEAD: CRON, TLRY, CGC EARNINGS; EWZ; VIXHIGH RANK/IMPLIED EARNINGS:

CRON (32/82) (Tuesday Before Open)

TLRY (50/97) (Tuesday After Close)

CSCO (44/27) (Tuesday After Close)

WMT (48/23) (Thursday Before Open)

NVDA (24/43) (Thursday After Close)

AMAT (17/34) (Thursday After Close)

CGC (95/87) (Thursday Before Open)

JC (30/43) (Friday Before Open)

Notes: Looks like it's the "Week of Weed" with CRON, TLRY, CGC announcing and all in states of high implied/high rank ... . If you're hesitant to go into single name here, MJ (47/51) has decent rank/implied metrics, although it's less liquid than I would like.

EXCHANGE-TRADED FUNDS:

TLT (56/12)

EWZ (47/28)

SLV (44/22)

GDXJ (37/31)

GLD (34/11)

EEM (33/16)

First Expiries In Which At-the-Money Short Straddle Pays >10% of Stock Price:

TLT: January of '21

EWZ: March: 5.64 verus 43.02 (13.11%)

SLV: April: 1.72 versus 15.70 (11.0%)

GDXJ: January: 3.99 versus 36.33 (11.0%)

GLD: January of '21

EEM: June: 4.97 versus 43.68 (11.4%)

Notes: Pictured here is an EWZ delta-neutral short strangle camped out at the 20 delta in the first expiry in which the at-the-money short straddle pays greater than 10% of the value of the underlying. Paying 1.61, it has break evens of 35.39/50.61 with delta/theta metrics of -.36/1.49; .40 at 25% maximum; .80 at 50%.

BROAD MARKET:

Broad market premium selling simply isn't paying here in short duration (an understatement).

FUTURES:

/6B (72/9)

/NG (74/60)

/SI (44/21)

/GC (34/12)

/ZS (32/20)

Notes: Natty is frisking up, which should be no surprise. Having put on a bullish assumption seasonality play in UNG way back in August at lows, I'm just waiting for things to top out in January or February before doing something in the other direction.

VIX/VIX DERIVATIVES:

Term structure trades* in VIX remain viable for the December, January, and February expiries with the correspondent futures contracts trading at 16.05, 17.33, and 18.07 respectively.

On the other end of the stick, continue to consider a VXX Super Bull or similar setup to potentially catch a modest volatility expansion running into the end of the year without sticking your entire pickle in the grinder, particularly if VIX continues to trundle along at 2019 lows: the December 20th 16P/-18P/18C/-20C pays a small credit (.17), has a 17.83 break even versus spot of 18.64, and max profit/max loss metrics of 2.17/1.87, with max being realized on a finish above 20, which does not exactly require a massive pop from here.

* -- Generally short call verticals with break even near where the correspondent /VX futures contract is trading (e.g., the December 20th 15/18, paying .90, with a 15.90 break even versus the December /VX contract trading at 16.05; the January 22nd 16/19, 1.00, with a 17.00 break even versus 17.33; February 19th 17/20, with an 18.00 break even versus 18.07).

THE MONTH AHEAD (IRA): EX. CANADA/U.S. ETF'S FOR DIVIDENDSIt shouldn't come as a massive shocker to anyone that the U.S. market has been and has gotten even more expensive. For an investor that is just starting out, it is enormously frustrating, since virtually everything is at the top of a very long term trajectory with the broad market yet again knocking at the door of all-time-highs.

Here are a few acquisition ideas for ex. U.S./Canada exchange-traded funds that pay in excess of SPY (1.90%), IWM (1.33%), QQQ (.84%), and DIA (2.21%) and TLT (average 20-year maturity treasuries) (2.22%). To put things in some additional context: HYG (High Yield Corporate Bonds) is paying 5.29% (paid monthly), EMB (Emerging Market Bonds) -- 5.45%, XLU (Utilities) -- 2.93% (paid quarterly), and IYR (REIT) -- 2.63%.*

EEM: Emerging Market. It gets huge volume (79 million 90-day) and is extremely liquid on the options side of things. The downside is that you get about TLT is currently paying in yield -- 2.22%, paid out quarterly, and fund managers had to muck it up by sticking a whole bunch of China in there. If I wanted to play a Chinese exchange-traded fund, I'd play one (e.g., FXI).

EFA: Behind the funky acronym (MSCI EAFE), this is basically a world excluding the U.S. and Canada exchange-traded fund. Sporting a 3.18% yield, it pays dividends every six months, trades healthy share volume (90-day average 18.3 million), and has good options expiry availability and liquidity, a must for investors looking to go short put/acquire/cover.

EWA: Australia. Granted, the share volume isn't great (1.7 million 90-day), but the yield is 5.54%. Expiry availability isn't fantastic and neither is option liquidity. Dividends pay out twice a year. 21.82/share as of Friday close.

EWG: Germany. 90-day 1.98 million shares average. 2.83% paid once a year. Decent expiry availability/liquidity. 26.44/share as of Friday close.

EWI: Italy. 90-day 1.90 million shares on average. 4.63% paid out once every six months. Expiry availability/liquidity isn't great, with the general solution being to be "fill picky." 26.95 as of Friday close.

EWW: Mexico. 90-day 3.20 million shares traded on average. 4.17% paid out twice a year. Good expiry availability and option liquidity. 43.64 as of Friday close.

EWT: Taiwan. 90-day 5.80 million shares traded. 2.74% paid out once a year. Expiry availability isn't great and neither is options liquidity. 36.71 as of Friday close.

EWZ: Brazil. 90-day 21.58 million shares traded. 2.71% paid out every six months. Excellent expiry availability/options liquidity. 42.11 as of Friday close.

RSX: Russia. 90-day 5.58 million shares traded. 4.31% yield paid out once a year. Expiry availability/options liquidity decent and decent. 22.51 as of Friday close.

The general play on these would be short put, acquire, then cover. Naturally, you'll probably want to drill into the charts on each of these to determine which ones might be trading at a discount.

* -- IYR, XLU, and EMB have ripped higher recently, so are kind of out of range of prices at which I'd like to acquire. Forever the optimist, however, I've got a couple "not a penny more" short puts hanging out there in XLU and HYG. (See Posts Below).

EWZ, iShares Inc. MSCI Brazil ETF - Ascending TriangleAMEX:EWZ

Potential ascending triangle of continuation of an inverted trend at the beginning of 2016 in the Brazilian market.

In this case a breakout of the resistance could lead to interesting profits, and ETFs are volatile assets that have intense price changes in tight time frames, and a liquidity necessary to allow immediate trading in the trade.

finance.yahoo.com

EWZ: Viking is back in townI've been working for 5 hours to estimate the trend turns for the next six months. To gain the knowledge to do those five hours are countless.

Now, it will not be 100 % accurate in timing. I still have a lot of cycle work to be completed to fine-tune. But it will be quite accurate as I have gone back in time and checked out what EWZ has done in the past. And since the past tells us about the future as history repeats, confidence level is high. Please allow a day or two on each side of the green bars.

Price is a different story. I have no clue how to deal with that. But its better to know when price can turn than how high it can go, if you catch my drift?

$EWZ $BVSP $IBOV Brazilian Stocks Under PressureWith market volatility back in the global markets with a vengeance, and the US Dollar remaining strong, one EM equity market that has been hit particularly hard this year has been the Brazilian Stocks (EWZ). Sluggish growth forecasts, combined with waning support for the Brazilian President, has sent Brazilian Stocks to its lowest level of the year so far, down -2.94%.

The sharp declines have also been fueled by uncertainty over the US-China trade talks on a macro level. The combination of these two forces, the external macro headwinds and weak domestic economy, have both been a perfect storm for the under-performance of Brazilian stocks in 2019 thus far. Furthermore, on a technical basis, the EWZ continues to show deterioration within the equity market, with the 50-day EMA acting as a strong resistance March 2019 and the price action failing to break above since then.

We believe that is these headwinds continue, there will be more downside for Brazilian stocks to come. We caution investors against this equity market.

$USDBRL $EWZ $BVSP - Brazilian Real Under PressureAs market volatility has come back with a vengeance and the US Dollar continues to remain strong, one EM currency that has been hit particularly hard this year has been the Brazilian Real ($USDBRL).

Sluggish growth forecasts, coupled with waning support for the Brazilian President has sent the Brazilian Real to its lowest level of the year thus far. The sharp declines have also been fueled by uncertainty over the US-China trade talks on the macro level. The combination of the two forces, the external macro headwinds and feeble domestic economy, have been a perfect storm for the under-performance of the $USDBRL in 2019.

Further more, on a technical basis, the $USDBRL continues to show deterioration within the Brazilian Real, with the 10-day EMA being a strong support for the currency pair.

We believe if this continues, $USDBRL 4.25 is the next stop.

OPENING: EWZ JUNE 21ST 34.5/37.5/44/47 IRON CONDOR... for a 1.04/contract credit.

With implied volatility fairly low across the board, going small, defined in the exchange-traded fund with the highest background implied volatility on the board (30.9%) to keep powder dry for something sexier to come along ... . Shorts nearest the 25 delta strike, longs nearest the 10 with slightly more than one-third the width of the wings collected. Shooting for that ol' 50% max. Go 37.5/44 short strange in June, and you'll collect 1.60 or so.

Metrics:

Max Profit: 1.04 ($104)/contract

Max Loss: 1.96 ($196/contract)

Break Evens: 36.46/45.04

Delta/Theta: -2.36/1.18

THE WEEK AHEAD: GDXJ, XOP, EWZ PREMIUM SELLINGAlthough there are quite a few earnings announcements up next week, none of them appear particularly attractive from both a volatility metric standpoint as well as a liquidity standpoint.

For instance, MYL (78/46), EA (73/50), and ROKU (65/82) all have the right volatility metrics, but when you go to work setups, you're confronted with non-$1 wide strikes, not something you want to see if you need to roll out in time for duration ... .

Consequently, you're left with looking at either single name with earnings in the rear view mirror or exchange-traded funds.

On the exchange-traded fund end of things, GDXJ (51/28), ASHR (41/26), IYR (38/13), OIH (35/33), and GDX (34/23) round out the top five by rank; OIH (35/33), XOP (30/31), EWZ (15/28), GDXJ (51/28), and ASHR (41/26) round out the top five when sorted by 30-day.

Pictured here is a GDXJ short strangle in the June cycle (47 days 'til expiry) that's paying 1.14 (.57 at 50% max) with break evens of 25.86/31.84 and delta/theta metrics of -3.21/2.12. Alternatively, the June 21st 29 short straddle is paying 2.36 (.59 at 25% max), break evens of 26.64/31.36 and delta/theta metrics of 11.96/2.35.

The XOP June 21st 28/32 short strangle camped out around the 30 delta pays 1.16 (.58 at 50% max) with break evens of 26.84/33.16 and delta/theta metrics of 2.87/2.30.

The EWZ June 21st 38/44 25 delta short strangle is paying 1.30 (.65 at 50% max) with break evens at 36.70/45.30 and delta/theta metrics of -1.42/2.84.

THE WEEK AHEAD: TWTR EARNINGS, EWZTWTR (41/54) announces earnings on Tuesday before market open; pictured here is a May 17th 30/39 short strangle.

Metrics:

Max Loss/Buying Power Effect: Undefined/3.50/contract

Max Profit: 1.09

Break Evens: 28.91/40.09

Delta/Theta: -3.99/4.92

Front Week to May Opex Volatility Differential: 41.5%

Notes: Look to put a play on in the waning hours of the Monday session, adjusting the strikes to reflect any movement in the underlying if necessary.

For those of a defined risk bent, the May 17th 27/31/38/42 iron condor is paying 1.13 with a buying power effect of 2.87, break evens of 29.87/39.13, and delta/theta of -1.24/2.9. It isn't quite what I like to see out of these (one-third the width of the widest wing in credit). By going slightly wider, you give up some credit at the door while increasing probability of profit.

On the exchange-traded fund front, not much is rocking. Moreover, we're still in between cycles for me, with May opex being too short in duration and June being a touch long. As with last week, I'm looking to put something on in EWZ (14/30), since I don't have anything on at the moment, but have really just been waiting for June to get closer in time: the June 21st 36/44.5 short strangle is paying 1.23 with a buying power effect of about 4.10/contract, break evens at 34.77/45.73, and delta/theta metrics of -2.1/2.35. It's a little wider than I usually like to go (~25 deltas), but if I'm going to but it on early in the cycle, I want a little more room to adjust if necessary.

The standard 25/10 iron condor in the June cycle is the 34/37/44/47, which is paying 1.02 with a buying power effect of 1.98, break evens of 35.98/45.02, and delta/theta of -2.05/1.07.

THE WEEK AHEAD: NFLX, IBM EARNINGS; ASHR, GDXJ, XOP, EWZEARNINGS:

NFLX and IBM both announce on Tuesday after market close, so look to put on something in the waning hours of Monday's session if you're going to do a volatility contraction play.

Pictured here is a NFLX (42/46) 25/10 iron condor,* with the short option strikes at the 25 delta; the longs at the 10 (as of Friday close). Metrics: $825 max profit; $1675 max loss; 24.6% return at 50% max; break evens wide of the expected move at 311.75/393.25, delta -.74, theta 16.21. Potential volatility contraction from the nearest weekly (April 18th: 78.6%) to the May expiry (44.2%) appears to be in the neighborhood of 40%. The wings can naturally be narrowed to generate a softer buying power effect (e.g., the 310/320/385/395 pays 4.18 ($418) with a max loss/buying power effect of 5.82 ($582), -.45 delta, 6.48 theta and with break evens still wide of the expected).

IBM (67/29): The May 17th 130/135/155/160 is paying 1.50 at the mid with fairly wide markets and pesky strike availability in the May cycle where you'd ordinarily want to pitch your tent. On check on a similarly delta'd setup in the New York session, I'd pass if you can't filled with a fairly delta neutral setup for at least one-third the width of the wings. Potential volatility contraction from the nearest weekly (April 18th: 53.9%) to the following monthly (May 17th: 28.4%) looks to be fairly decent at around 45%.

THE EXCHANGE-TRADED FUND FRONT

Top of the List: ASHR (53/29), GDXJ (33/28), OIH (27/31), XLV (24/14), GDX (21/22), XOP (20/30), and EWZ (18/32).

We're kind of mid-cycle here with May being a tad short (33 days) and June being a tad long (68 days), so would probably wait to put something on until June comes more into view.

Since I don't have anything on in EWZ currently, I might make an exception there. The May 17th 26 delta 38/43 short strangle is paying 1.19, with break evens wide of the expected move at 36.81/44.19, delta -.16, theta 3.6.

BROAD MARKET

With VIX finishing the week at a penny north of 12, we could be in for a long, dry summer of premium selling (who knows, really). A good time to dry powder out and keep it dry for the next uptick in volatility ... .

* -- There is some research in support of the notion that 25/10's more closely emulate short strangle performance over a large number of occurrences; this is naturally intuitive, since you're paying less for the longs, bringing in more credit, and therefore generating more favorable break evens over a tighter winged setup.